On the evening of June 5th, the US Securities and Exchange Commission (SEC) filed a lawsuit against cryptocurrency exchange Binance and its CEO Changpeng Zhao. This black swan event has attracted huge attention from the entire crypto market, and many KOLs have expressed their support for Binance, with industry cohesion reaching an unprecedented level.

SEC Twitter Account Under Siege

Under the SEC’s tweet announcing the lawsuit against Binance, there was a surge of voices expressing dissatisfaction with the enforcement action, accusing the agency of being a joke. Some people also believe that this lawsuit seems more like a personal grudge, making the SEC look very unprofessional.

Perhaps inspired by the crypto community, Binance CEO Changpeng Zhao launched a poll on Twitter: “Who protects you more? SEC vs. Binance.” As of 4 p.m. on June 6th, in a poll with over 150,000 respondents, a whopping 85.5% chose Binance, while only 14.5% chose the SEC.

- Quickly overview the latest projects and research in the ZK encryption field: besides privacy and scalability, what other applications are there?

- In-depth analysis: The Intentions and Story behind SEC’s Lawsuit against Binance

- How serious are the 13 charges brought by the SEC against Binance for evading regulation and laundering billions of dollars?

Under SEC Chairman Gary Gensler’s tweet, Changpeng Zhao also responded bluntly: “I wonder if Gary Gensler has read the comments on his own speech, which came from the consumers he should be protecting.”

Cardano Founder Charles Hoskinson Calls for Unity in the Crypto Community

“I have read over 130 pages of the SEC’s complaint against Binance and it appears to be version 2.0 of the US trying to stop innovation and only work with a few big banks to have end-to-end control over people’s financial lives. Whether or not the actions taken by US regulators are legal and compliant is up for debate, but the SEC’s lawsuit against Binance seems to be a philosophical disagreement with the existence of cryptocurrency and what it represents. The SEC may be trying to remove concepts such as self-sovereign identity, owning your own wallet, and controlling your own economy from the public consciousness.”

To be honest, what is happening now is not something new, just different participants, technologies, and languages. For the entire crypto industry, this is indeed a great opportunity to set aside decentralized nature and unite to develop a set of common sense rules and guidelines.”

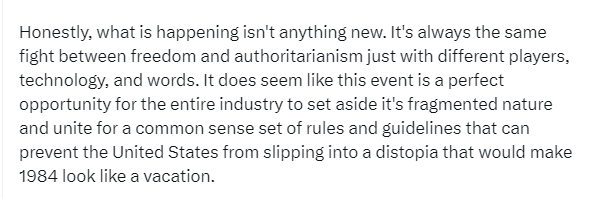

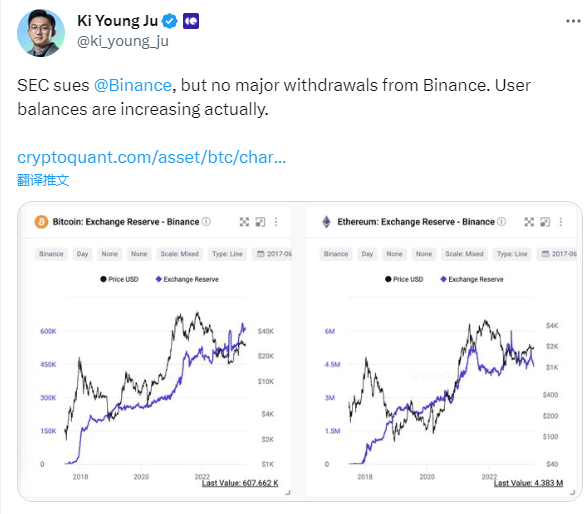

CryptoQuant Founder Ki Young Ju: Enforcement Action Has Not Had a Significant Impact on Binance

“Data shows that the U.S. Securities and Exchange Commission’s lawsuit against Binance did not cause major market fluctuations, and Binance did not experience a large-scale run on withdrawals, and the number of user balances even increased.”

“The BSC ecosystem accounts for only about 10% of Binance’s total reserves, and so far, Binance’s hourly bitcoin reserve outflow is only about 4,000 BTC, which is a normal phenomenon. Compared with the net outflow during the March 2023 lawsuit against Binance by the U.S. Commodity Futures Trading Commission, this impact is relatively small, and so far, Binance’s net outflow is less than what the exchange has experienced during other “pressure” (or regulatory FUD) periods. In addition, these net outflows are relatively small compared to the exchange’s reserve level, and although withdrawal user trading volumes have surged, the overall situation is still at a historically normal level.”

Crypto KOL “Ash Crypto” – US Regulators Want to Kill Cryptocurrency

“Whether you support Zhao Changpeng and Binance or not, one thing that is really happening now is that the crypto industry is under attack, so we all need to unite, we need to stand with Coinbase, XRP, Binance, and all other companies fighting for the survival of cryptocurrencies, US regulators want to kill cryptocurrencies.”

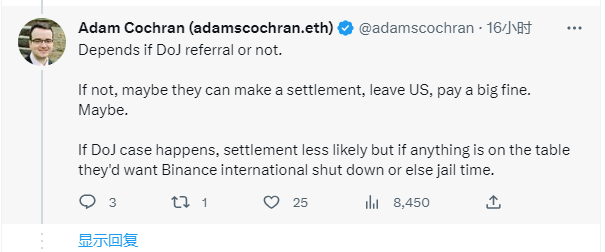

Former The Block Research Director Adam Cochran: US Regulators Want to Fine the “Defendants” to Death

“The US Securities and Exchange Commission is demanding that Binance register in their prosecution, which is debatable because US rules are really clusterfuck, they even try to mix BUSD into BNB, BNB Vault, and improperly include stablecoins in the scope of the prosecution. The US Securities and Exchange Commission even mixes international entities and US entities together. Now everyone knows that the US treats international entities and employees very poorly because they will take more action. The US Securities and Exchange Commission seeks to block anything related to crypto and impose civil fines on the defendants, perhaps they want to fine the defendants to death.”

“Maybe Binance can reach a settlement with the US Securities and Exchange Commission, leave the US, pay a huge fine, but if legal intervention occurs, the likelihood of a settlement is smaller, and Binance International may be closed, and someone may go to jail.”

It is worth noting that the ability of the cryptocurrency industry to deal with black swan events seems to have further improved. Data shows that despite the market fluctuations, there has been no significant volatility, and the entire cryptocurrency market value still remains above $1 trillion. Undoubtedly, the struggle between the US Securities and Exchange Commission and Binance has officially begun, and BlockingNews will continue to follow up on developments.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!