The US Securities and Exchange Commission (SEC) has filed a lawsuit against Binance, its CEO Changpeng Zhao (CZ), and two other subsidiaries, BAM Trading Services (“BAM Trading”) and BAM Management US Holdings Inc. (“BAM Management”), accusing them of violating US securities trading rules. The 136-page lawsuit covers multiple aspects and includes some parts that may be difficult to understand at first glance. This article by Odaily Star Daily will provide an in-depth analysis of the important parts of the document and some easily overlooked points, attempting to analyze the information behind the text and the SEC’s understanding of Binance and the cryptocurrency industry, as well as the true intentions of this regulatory action.

Key points at a glance: (skip the first two parts if you have read the summary of the regulatory document before)

-

The SEC is suing Binance and its CEO Changpeng Zhao, claiming that they “improperly handle customer funds” and “deceive regulators and investors.”

-

In addition, the SEC claims that Binance mixed “billions of dollars” of customer funds and secretly transferred them to an independent company named Merit Peak Limited, which is controlled by Binance founder Changpeng Zhao.

-

The lawsuit mentions that cryptocurrencies listed as securities include but are not limited to BNB, BUSD, and various other cryptocurrencies such as SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI.

SEC’s summary of Binance’s illegal activities, as previously reported by Odaily:

-

Binance ignored federal securities laws and their protections for investors.

-

Binance offered unregistered securities sales.

-

Binance deceived investors and had manipulative trading characteristics.

-

Binance evaded US regulation, with Binance COO quoted as saying, “We never want to be supervised.”

-

Binance and Changpeng Zhao claimed that BAM Trading independently controlled the Binance.US platform, but actually manipulated it behind the scenes.

-

Binance claimed that the Binance entity would not serve US customers, but helped high-net-worth US customers bypass geographic restrictions behind the scenes (the March lawsuit was also based on this reason).

-

Binance mixed billions of dollars of customer funds and secretly transferred them to an independent company named Merit Peak Limited, which is controlled by Binance founder Changpeng Zhao. This is something regulated US exchanges cannot do.

-

Binance used wash trading to intentionally inflate the trading volume of the Binance.US platform.

-

Binance did not disclose relevant assets in accordance with securities law.

Summary of SEC’s demands:

The SEC seeks the following relief:

(a) Permanent injunctions prohibiting Defendants from further violations of the federal securities laws as charged;

(b) Ordering Defendants to disgorge their ill-gotten gains plus prejudgment interest;

(c) Permanent injunctions prohibiting Defendants and their controlled entities, directly or indirectly, from making use of interstate commerce or the mails in connection with:

(i) any unregistered offer or sale of securities, including any securities issued in an Initial Coin Offering (“ICO”);

(ii) any securities transaction made on a non-registered exchange;

(iii) any securities broker or dealer activity by a non-registered entity; and

(iv) any unregistered activity as a clearing agency;

(d) Civil penalties against Defendants; and

(e) Such additional relief as may be necessary or appropriate for the benefit of investors.

SEC misunderstands “Tai Chi” in Chinese and claims Zhao Changpeng executed a “Tai Chi plan” against regulation

The SEC listed several pieces of evidence for Zhao Changpeng and Binance evading U.S. regulation in its lawsuit. Among them, the SEC mentioned that the establishment of Binance.US was to isolate Binance’s primary entity from U.S. regulation risks and claimed this was Zhao Changpeng and Binance advisers’ “Tai Chi plan.” I suspect that this may be because the SEC could not understand the Chinese context of “playing Tai Chi” from some Chinese sources and mistakenly interpreted the name of this entity isolation plan as “Tai Chi.”

The SEC also mentioned that Binance advisers proposed that this “Tai Chi entity” should “release a long and detailed Howey test (a test to determine whether an asset is a security) asset valuation framework… to demonstrate the complexity of the Howey test,” then engage in dialogue with the SEC to discuss “establishing or acquiring a broker/dealer or alternative trading system (ATS), with no expectation of success, just to pre-empt potential enforcement action.”

证 The SEC even bolded a non-official quote from Binance CCO in the litigation document, “Bro, we’re actually operating a TM unregistered trading platform in the US.”

Meanwhile, after the establishment of the US entity Binance.US, the SEC claimed that Zhao and Binance continued to guide high-net-worth US clients to bypass geographical and KYC restrictions in various ways, so that they could trade using the more liquid Binance entity. The SEC also cited Zhao’s words: “We do need to let users know that they can change their KYC information on Binance.com and continue to use the platform. However, this information needs to be written very carefully, because anything we send will be public. We are not responsible for this.” This was also the reason why Binance was sued by the CFTC in March, that the Binance entity should not provide services to US customers.

CSRC believes that BAM Trading should not be influenced by the Binance entity and Zhao Changpeng – the budget review for buying company hoodies is not allowed either

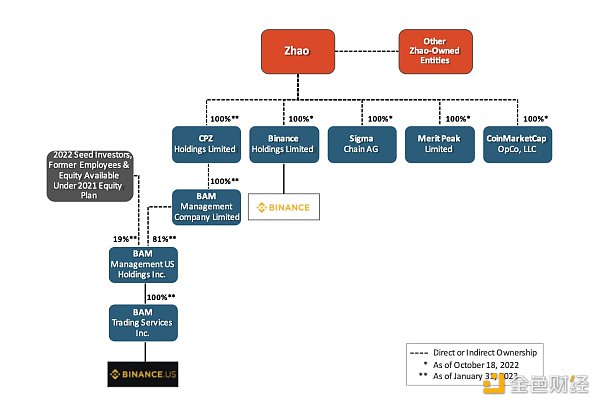

The CSRC document shows that Zhao Changpeng himself controls Binance and Binance.US platforms through various direct or indirect equity structures, despite the platform’s claim to have a considerable degree of independence. The figure is shown below:

The CSRC said that at least for most of 2021, BAM Trading employees could not access certain real-time trading data on the Binance.US platform without Zhao Changpeng’s personal approval. Moreover, Zhao Changpeng and Binance controlled BAM Trading’s bank accounts and financial condition. At least until December 2020, BAM Trading employees could not control BAM Trading’s bank accounts, including accounts used to store and transfer deposits from Binance US platform users.

At the same time, Zhao Changpeng is also responsible for approving various daily business expenses of BAM Trading. The CSRC describes in the document that as of January 30, 2020, all BAM Trading expenses exceeding $30,000 require Zhao Changpeng’s approval. BAM Trading regularly solicits Zhao Changpeng and Binance’s approval for daily business expenses, including rent, franchise tax, legal fees, Amazon Web Services (AWS) fees for hosting Binance US platform customer data, and even an $11,000 expenditure to purchase Binance brand hoodies.

The China Securities Regulatory Commission (CSRC) said that from around December 2020, Binance allowed BAM Trading personnel to take control of certain bank accounts of BAM Trading, but as of May 2023, Zhao Changpeng still has signing authority over BAM Trading accounts that hold custodial funds for Binance US customers.

Within this lawsuit, the CSRC believes that despite having founded BAM Trading, Zhao Changpeng should not have exerted influence over its management.

Implying Misappropriation Without Evidence: Sigma Chain and Merit Peak

The CSRC claims that from the early days of the Binance US platform, Zhao Changpeng instructed BAM Trading to take on two market makers that he owned and controlled: Sigma Chain and Merit Peak. These two entities were operated by several Binance employees working under Zhao Changpeng’s direction, including a Binance logistics manager who at least until December 2020 also had signing authority over BAM Trading’s US dollar account.

Merit Peak traded on the platform from at least November 15, 2019, to June 10, 2021. As of April 2022, Sigma Chain was a frequent spot trader on the Binance US platform and continued to act as a counterparty for some OTC trades and Binance US platform’s Convert and OCBS services. The CSRC alleges that Sigma Chain and Merit Peak’s activities on the Binance US platform and their undisclosed relationships with Zhao Changpeng and Binance involve conflicts between Zhao Changpeng’s financial interests and the interests of Binance US platform customers.

For example, by 2021, at least $145 million had been transferred from BAM Trading to Sigma Chain’s account, and an additional $45 million had been transferred from BAM Trading’s Trust Company B account to Sigma Chain’s account. From that account, Sigma Chain spent $11 million to purchase a yacht.

The CSRC’s description here appears to insinuate that the yacht was purchased with misappropriated funds from Binance US users, although it provides no substantive evidence to support this claim.

Binance US and Binance Proper Allegedly at Odds, Binance Responds

According to the CSRC’s account within this filing, as of January 2020, BAM Trading employees began compiling a “shackles” list of features that required “Binance personnel to answer, visit, approve, or fund,” indicating BAM Trading’s lack of independence and understanding of platform operations. They noted, for example, that BAM Trading’s compliance team lacked “respect and transparency” between Asia and US teams; BAM Trading was “not allowed to expand its finance team domestically in the United States”; and BAM Trading’s legal department needed “a better understanding of BAM Trading’s internal controls/IT infrastructure.”

According to the document, BAM Trading CEO A explained to Binance CFO shortly after the article was published that BAM Trading employees “felt like puppets”.

The SEC document states that on December 3, 2020, BAM Trading CEO A reported to Binance CFO that BAM Trading’s “daily battle” was to ask Binance’s clearing staff to “tell us about their daily work and permissions”, but the Binance back office manager and another Binance employee “refused to share their screens, saying you don’t need to know about our daily work.”

The document also states that around March 2021, Zhao Changpeng decided to replace BAM Trading CEO A with BAM Trading CEO B, who officially took office in May 2021. Upon taking the position, BAM Trading CEO B realized that “there were problems with the relationship between Binance and BAM Trading, and he accepted the role on the condition that he would be able to operate BAM Trading independently of Zhao Changpeng and Binance.” BAM Trading CEO B issued several public statements stating that BAM Trading “is not a substitute for Binance.”

The SEC claims in the document that when BAM Trading CEO B took over as CEO, he quickly realized that Binance was actually exerting considerable control over the operations of BAM Trading and the Binance.US platform, and was unwilling to relinquish that control. As he testified under oath, BAM Trading CEO B “has no firsthand knowledge of the specific situation of [Binance] entities managing [Binance.US platform] servers,” but he knows “it’s not [BAM Trading].” Similarly, he testified that the matching engine “may be owned and managed by some [Binance] entity, but I don’t know which one, and there are other servers that perform other functions.” The conclusion was that the company’s “biggest risk is that we rely heavily on a bunch of technology in Asia.”

(According to Odaily Star Daily analysis, A and B are Catherine Coley and Brian Brooks, respectively. Catherine Coley served as CEO of Binance.US in 2020, and Brian Brooks served as CEO of Binance.US in mid-2021 and was formerly the US National Bank Inspector.)

Binance strongly opposes this claim. In its statement on the lawsuit document, “the SEC’s action here appears to be an attempt to hastily grab jurisdiction from other regulators, and investors do not appear to be the SEC’s priority. Due to our size and global renown, Binance has now become an easy target for attack and is caught in a tug of war between US regulatory agencies.”

It seems that the SEC’s goal here has never been to protect investors; if it were, employees should have engaged in deep conversations based on facts and worked hard to demonstrate the safety of the Binance.US platform. Instead, the SEC’s true intention here seems to be to make headlines.”

Expansion of Jurisdiction over Unregistered Securities Raises Doubts

The issue of whether U.S. exchanges provide unregistered securities or cryptographic assets has been mentioned several times in previous cryptographic-related cases. However, in this legal document, the SEC seems to have expanded its definition of securities.

In the lawsuit, the SEC believes that the issuance of BNB and BUSD falls under the category of securities, attracting investors with the concept of expected returns. The SEC spends a lot of space in the document explaining the concepts of BNB and BUSD, as well as how to recognize related expected returns from Binance WhiteBlockingper. Based on this logic, the SEC believes that related pledging concepts and products such as “Simple Earn” and “BNB Vault” from Binance also fall under the category of securities.

At the same time, unlike previous lawsuits, the SEC believes that another ten tokens, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI, also fall under the category of securities, and it spends considerable space explaining the reasons why each token should be recognized as a security.

It is worth noting that the SEC did not list ETH as a security. In 2018, Gary Gensler himself said that the SEC did not consider Ethereum to be a security. In the April hearing, Gary Gensler also refused to answer whether Ethereum was a security. Although based on the same logic, this lawsuit recognizes that Solana, a public chain token, is a security, and the contradictory logic before and after has led many on Twitter to believe that there is a double standard.

It is also worth mentioning that FTX apparently never received any charges from the SEC for providing unregistered securities before the crash. Today, some in the market are questioning whether the charges against Binance are revenge by the SEC under Gary Gensler’s leadership, based on SBF and Gary Gensler’s relationship, for Binance’s role in the FTX crash.

Real Demand Beyond the Document: Jurisdictional Dispute or Power Assertion?

Some observers believe that the SEC may be suing Binance for the purpose of competing with the Commodity Futures Trading Commission (CFTC) for jurisdiction over cryptocurrency assets. It is worth noting that the CFTC also sued Binance in March of this year, making similar allegations. Many of the allegations in the SEC lawsuit are similar to those in the CFTC’s complaint, which could suggest overlap in the focus areas of the two agencies.

Regulatory responsibility and jurisdiction in the field of cryptocurrency assets has always been a complex issue, and competition and overlap between different agencies may arise. Therefore, some observers believe that the SEC’s lawsuit against Binance may be aimed at consolidating its position in cryptocurrency asset regulation and competing with the CFTC for jurisdiction in this area.

Binance’s official response suggests that because of its global reputation and brand influence, Binance has become an easy target for attack and may become embroiled in a tug-of-war between US regulatory agencies, as this lawsuit may have the purpose of asserting power. Binance wrote in its official response, “Nevertheless, we stand with the US digital asset market participants against the SEC’s overreaching and are prepared to fight against it with our full might.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!