Author: Arthur Hayes

Translation: GaryMa, Wu Shuo Blockchain (note: the article has been edited)

Patience is essential in the financial markets.

Since the outbreak of the U.S. banking crisis this year, I and many others have stated that the U.S. and global legal currency banking system will be saved by a new round of central bank printing (which will push up the prices of risky assets). However, after Bitcoin and gold completed their initial rise, these hard-currency assets have fallen back.

- Ethereum Ecosystem Weekly Report: Cancun Upgrade, EIP-4844 Engine API Version Control, Suggested Addition of Block Blob Target…

- Launch of new policy on virtual assets in Hong Kong: interpreting the “transitional arrangement” for cryptocurrency platforms

- Exclusive Interview with Starknet Founder: ZK Scalability Road is Long and Challenging, Starknet Will Become the Winner of the Next Generation

As far as Bitcoin is concerned, the volatility and trading volume of spot and derivatives have declined. Some people are beginning to wonder why Bitcoin has not continued to rise if we are really in a banking crisis. Similarly, why hasn’t the Fed started cutting interest rates, and why hasn’t the U.S. started yield curve control?

My answer to those skeptics is: be patient. Nothing goes up or down in a straight line, and we will move forward in twists and turns. Remember: the destination is known, but the path is unknown.

Printing, yield curve control, bank bankruptcies, etc. will all happen, starting with the United States and eventually spreading to all major legal currency systems. The goal of this article is to explore why I believe that the real Bitcoin bull market will begin in the late third quarter and early fourth quarter of this year. Before that, calm down. Take a vacation, enjoy nature and the company of friends and family. Because by this fall, you’d better fasten your seat belt and get ready to TO THE MOON.

As I have said many times, the price of Bitcoin is the result of legal currency liquidity and technology. Most of my articles this year have focused on global macro events that affect legal currency liquidity. I hope that during the summer break in the northern hemisphere, I can turn to writing exciting things about the cutting edge of Bitcoin and cryptocurrency technology.

The goal of this article is to give readers a clear roadmap of the evolution of legal currency liquidity and to understand what will happen in the next few months. Once we are satisfied with the expansion of the liquidity of the dollar and legal currency to the end of the year, we can fully focus on which technical aspects of certain currencies are the most exciting. When you combine “the hum of the printing press” with truly innovative technology, your return will far exceed the cost of energy you put in. This is the goal we have always pursued.

Premise

Bureaucrats in charge of central banks and global monetary policy believe they can govern a market of over 8 billion people. Their arrogance is evident in the way they speak about all things deterministic, based on economic theories developed in academia over the past few centuries. But whether they like it or not, they have not solved the three-body problem of monetary versions.

When the equation of “debt and production output” loses balance, the “law” of economics collapses. This is similar to how water changes state at seemingly random temperatures. We can only understand the behavior of water through post-observation and experimentation, not through theoretical speculation in ivory towers. Our monetary rulers refuse to use empirical data to guide their policy adjustments, instead insisting that the theories taught by their esteemed professors are correct, regardless of objective results.

In this article, I will delve into why, contrary to common currency theory, due to current debt and production output conditions, raising interest rates will lead to an increase in the quantity of money and inflation, not a decrease. This will lead to an exacerbation of inflation no matter which path the Fed chooses, whether it is raising or lowering interest rates, and will trigger a widespread withdrawal from the parasitic fiat monetary financial system.

As a true believer in Satoshi Nakamoto, we hope to trade as cautiously as possible based on the timing of this mass exodus. I hope to earn lucrative returns in fiat currency until I must sell dollars and invest in Bitcoin with all my might. Of course, I am also showing a kind of arrogance because I believe I can predict the best exit time without self-destruction. But what can I say? At the end of the day, we are all flawed humans, but at least we must strive to understand what the future may look like.

Having said that, let us continue to explore some (controversial) factual statements.

- Regardless of the position in the economic system, every major fiat currency system faces the same problem. That is, they are all heavily indebted, the working-age population is decreasing, and the assets of their banking systems are mainly low-yield government and corporate bonds/loans. The rise in global inflation has rendered the global fiat currency banking system functionally insolvent.

- Due to the role of the United States as the world’s largest economy and reserve currency issuer, the United States is more severely affected by these problems than any other country and is in the most dire situation.

- Groupthink among central bankers does exist, as all senior officials and staff study at the same “elite” universities that teach different versions of the same economic theory.

- Therefore, no matter what action the Fed takes, all other central banks will eventually follow suit.

- Keeping this in mind, I want to focus on the situation in the United States. Let’s quickly get to know the various roles in this tragedy.

- The Fed exerts influence through its ability to print money and hold assets on its balance sheet.

- The US Treasury influences the situation by issuing debt to raise funds to support the federal government.

- The US banking system exerts influence by absorbing deposits and lending them out to create credit and providing funds for businesses and governments. The solvency of the banking system is ultimately supported by currency printed by the Fed or taxpayer money from the US Treasury.

- The US federal government exerts influence through its ability to tax and spend on various government programs.

- Private businesses and individuals exert influence through their decisions on where and how to save funds, and whether to borrow from the banking system.

- Foreign participants, especially other countries, exert influence by deciding whether to buy, hold, or sell US Treasuries.

At the end of this text, I would like to summarize the main decisions of each stakeholder into a framework to show how we have reached a point where each participant has almost no operational space. This lack of flexibility allows us to confidently predict how they will respond to the current US currency problem. Finally, because the financial crisis is still closely related to the agricultural harvest cycle, we can reasonably predict that the market will wake up and realize the bad situation in September or October of this year.

Takeaways

Please be patient because I have some preliminaries before we get into the details. I will list some basic assumptions that I believe will happen or intensify in the fall.

Inflation will reach a local low this summer and accelerate by the end of the year

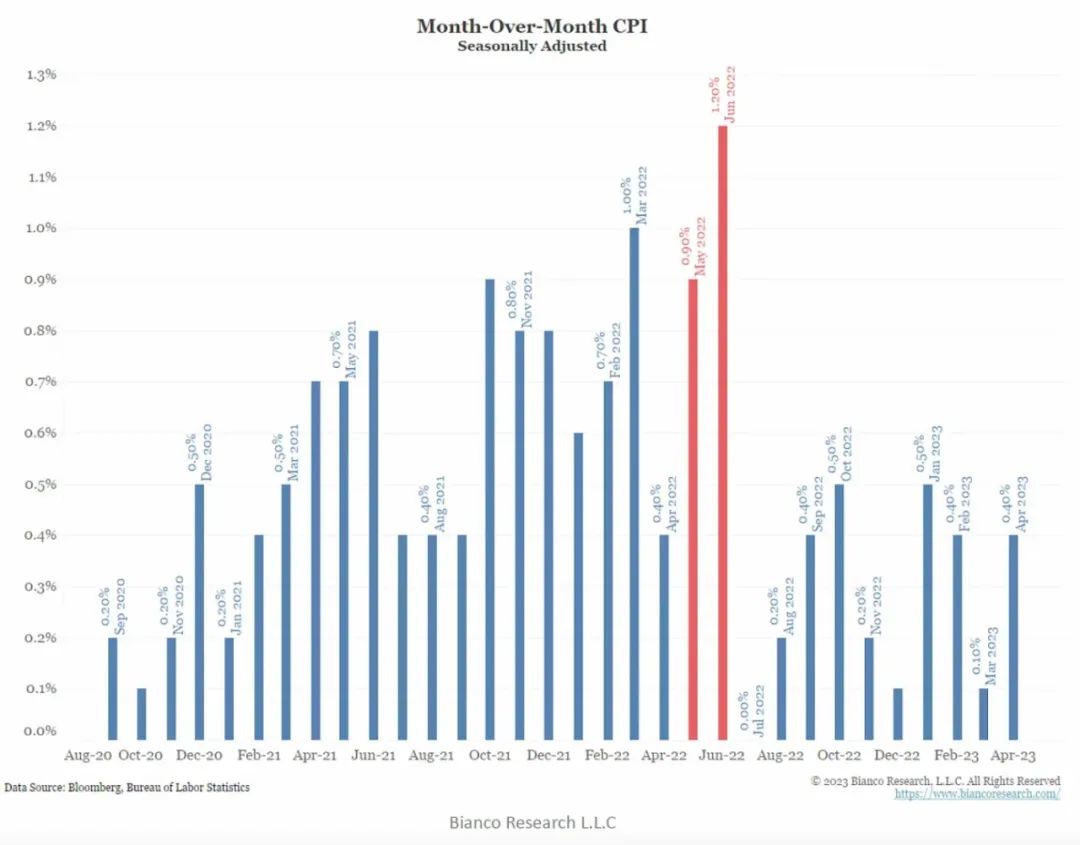

I am specifically referring to the US Consumer Price Index (CPI). Due to a statistical phenomenon called the base effect, the high month-on-month (MoM) inflation data for 2022 will be replaced by lower month-on-month inflation data for the summer of 2023. If the CPI month-on-month inflation rate in June 2022 is 1% and the CPI month-on-month inflation rate in June 2023 is 0.4%, then the year-on-year CPI will decline.

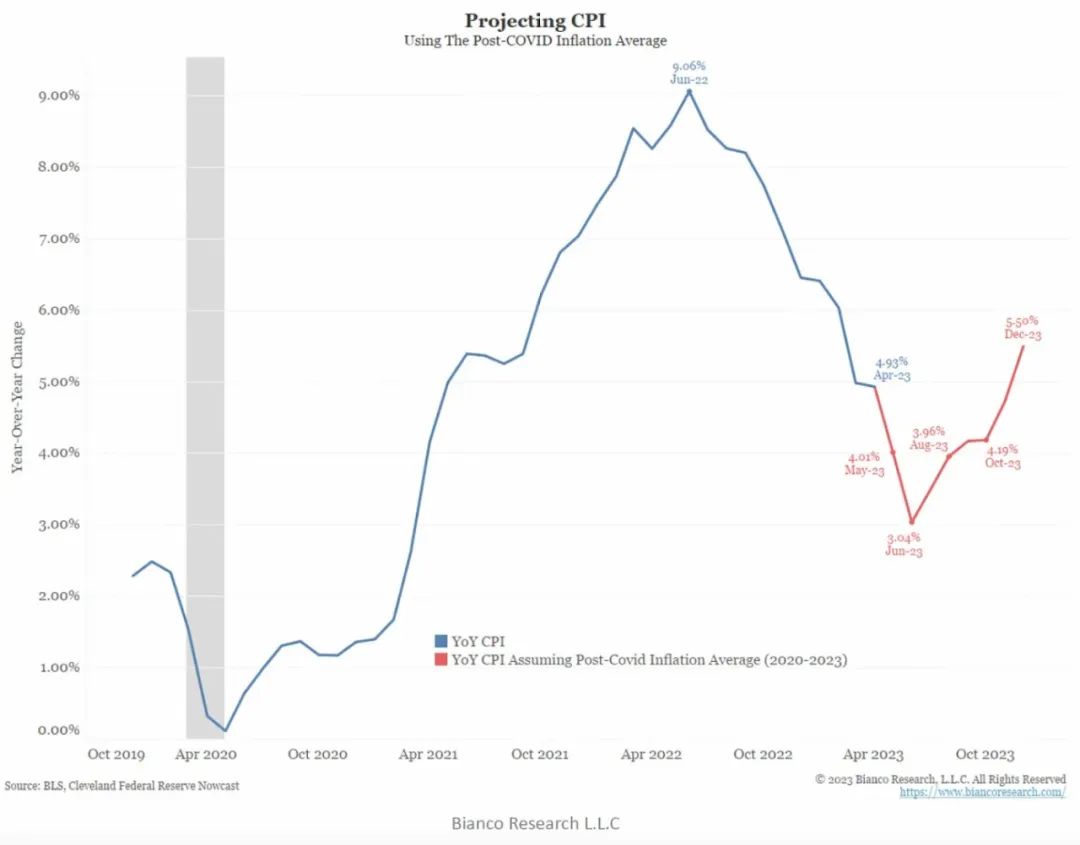

As shown in the above figure, some of the highest month-on-month consumer price index (MoM CPI) data from last year (which is considered in the current year-on-year data) occurred in May and June. For 2023, the average value of month-on-month CPI is 0.4%, which means that if we only take the average value and replace all data from May to December 2022 with 0.4%, we will get the following chart:

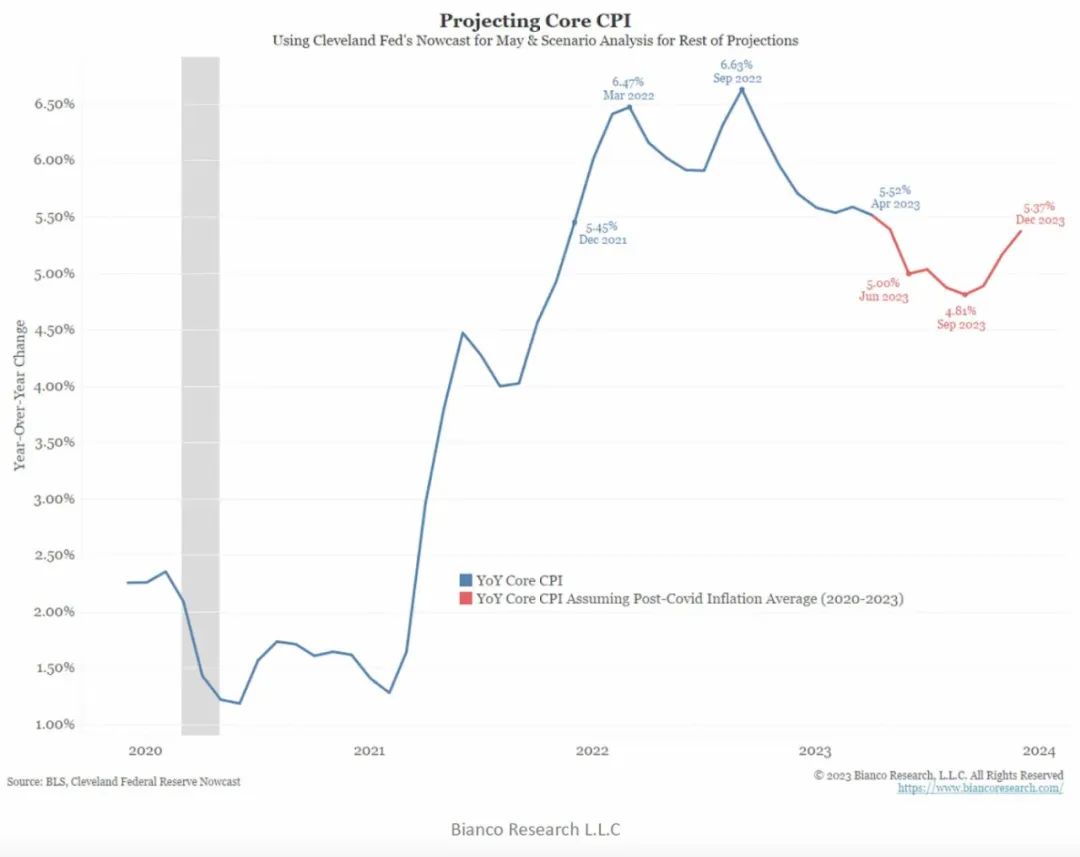

The Federal Reserve does not care about the real inflation situation. They care about the fictional concept of “core inflation”, which removes factors that people actually care about (such as food and energy). The following chart analyzes core Consumer Price Index (CPI) in the same way:

The conclusion is that the Fed will not be able to achieve its 2% core inflation target by 2023. This means that if you believe Powell and other members of the Federal Reserve Board, the Fed will continue to raise interest rates. This is important because it means that the interest rates on funds held in the reverse repurchase (RRP) and interest on excess reserves (IORB) facilities will continue to rise. It will also lead to higher rates on U.S. Treasury short-term bills (<1 year maturity).

Don’t get caught up in why these inflation indicators don’t match the price movements you and your family actually feel. This is not an exercise in intellectual honesty – instead, we just want to understand the indicators that affect how the Fed adjusts policy rates.

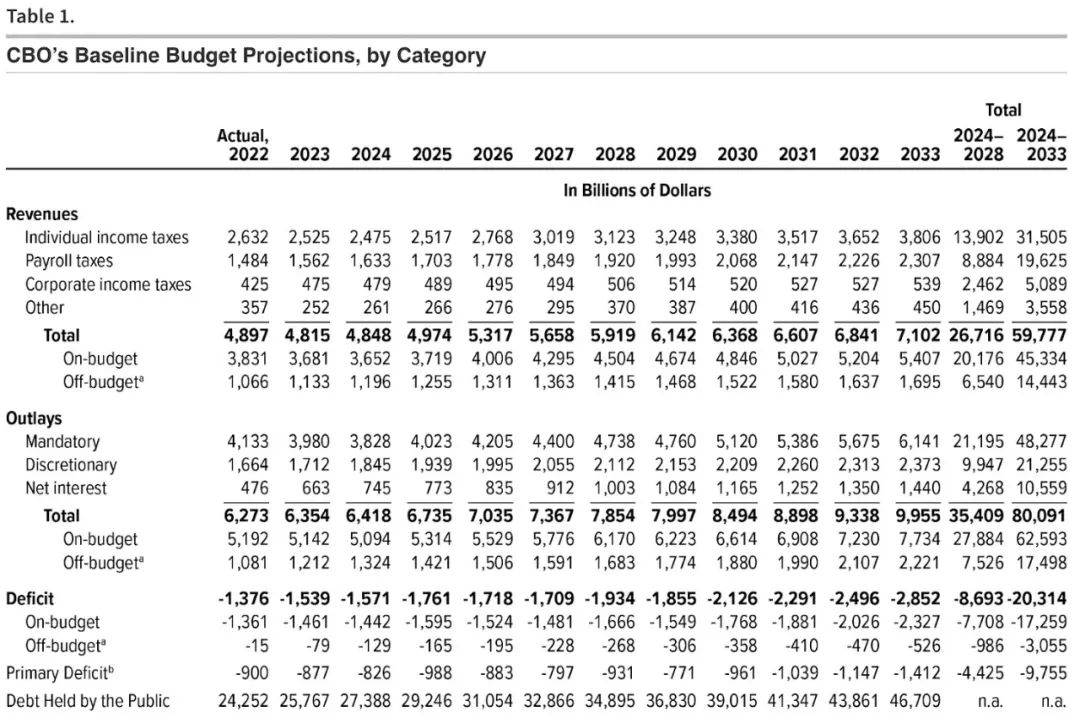

The US federal government cannot reduce the deficit due to Social Security spending

The baby boomer generation is the wealthiest and most powerful segment of the US electorate, and they are also increasingly aging and ill. This means that a politician who runs on a platform of reducing the Social Security and Medicare benefits promised to the baby boomer generation will be digging their own grave.

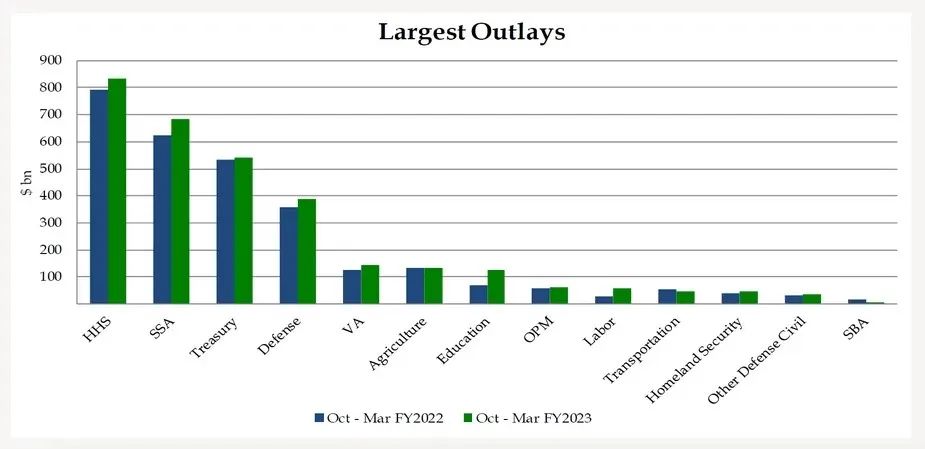

HHS (Department of Health and Human Services) + SSA (Social Security Administration) = Elderly and Medical Welfare

Treasury = Interest payments on outstanding debt

Defense = War

Spending on elderly and medical welfare and defense will only continue to rise. This means that the US government’s fiscal deficit will continue to rise. It is estimated that annual deficits of $1-2 trillion will become the norm over the next decade, unfortunately, neither US political party has the political will to change this trend.

The end result is that the market must absorb a continuous stream of massive debt.

Foreign participants

As I have written in several articles this year, foreign participants have become net sellers of US Treasuries (USTs), for many reasons, here are a few:

- Property rights depend on whether you are a friend or an enemy of American politicians. We have seen the rule of law give way to national interests, with the US freezing Russian state assets in the Western financial system. As a foreign holder of US Treasuries, you cannot be sure that you will be allowed to access your own wealth when you need it.

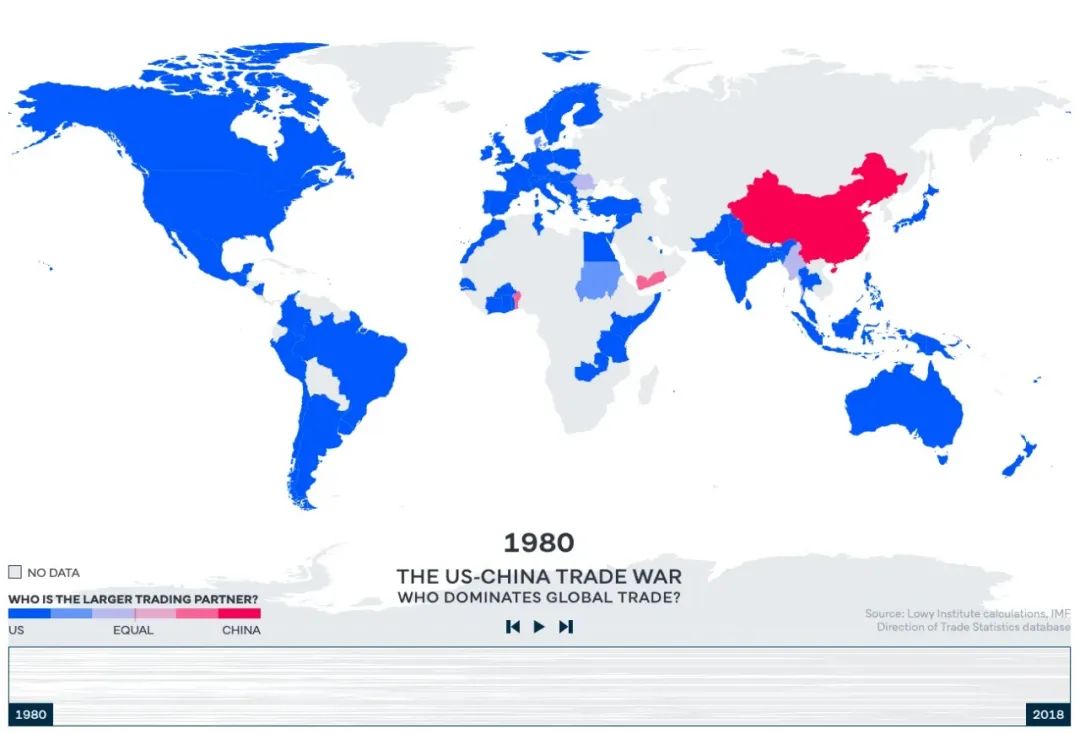

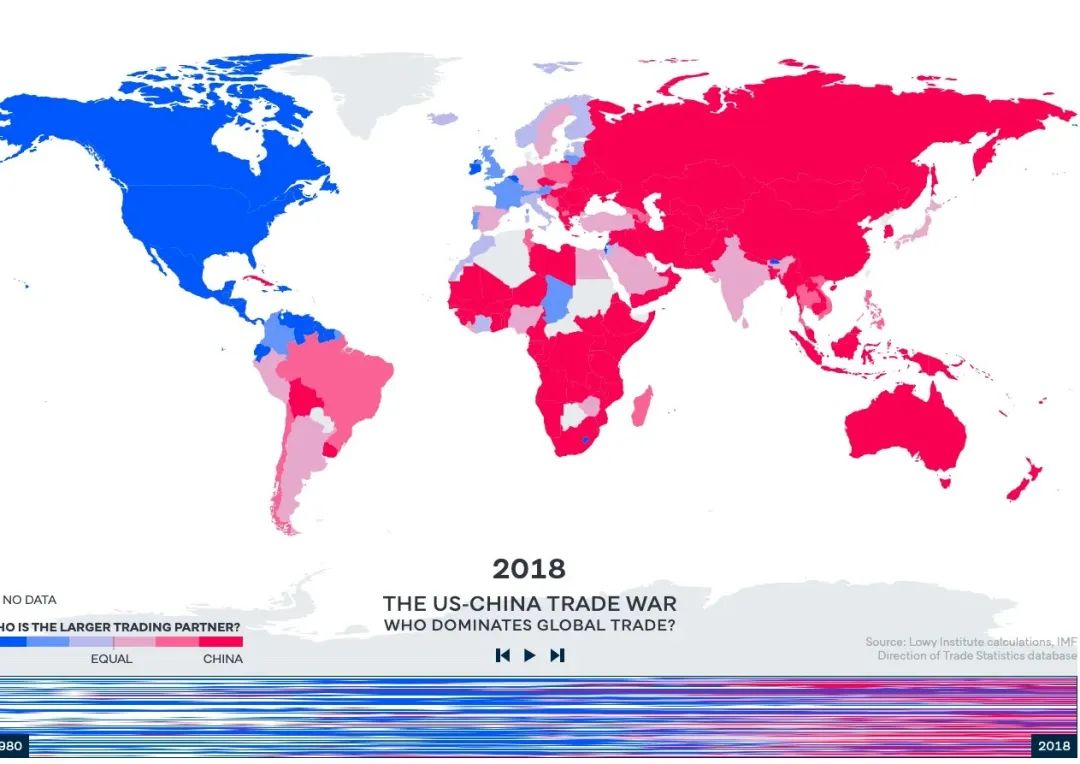

- More countries than the US have the Oriental giant as their largest trading partner. This means that it makes more sense to pay for goods in the legal currency of the Oriental giant than in dollars from a purely trade-driven perspective. As a result, more and more goods are invoiced directly in that legal currency. This has led to a marginal decrease in demand for the dollar and US Treasuries.

- Over the past twenty years, US Treasuries have lost purchasing power in terms of energy. Gold has maintained its purchasing power in terms of energy. Therefore, in a world of energy supply shortages, it is best to save gold on the margin rather than US Treasuries.

TLT ETF (US Treasuries over 20 years) divided by WTI crude oil spot price (white line)

Gold divided by WTI crude oil price (yellow line)

The total return of long-term US Treasuries has been 50% lower than the price of oil. However, since 2002, gold has outperformed the price of oil by 190%.

This has led to a decrease in foreign holdings of US Treasuries. Governments outside the US are no longer buying newly issued Treasuries and are also selling their existing holdings of US Treasuries.

In short, if there is a lot of debt to sell, one cannot rely on foreigners to buy it.

Private companies and individuals in the US – Private sector

What we are most concerned about this group is how they will handle savings. Remember, during the pandemic, the US government provided stimulus funds to everyone. To combat the disastrous economic impact of the lockdown, the stimulus measures offered by the US exceeded those of any other country.

This stimulus money was deposited into the U.S. banking system and since then, the private sector has been spending its free funds on anything it likes.

With deposit, money market fund, and short-term U.S. Treasury yields basically at 0%, the U.S. private sector has been happy to park funds in banks. As a result, deposits in the banking system have surged. But when the Fed decided to combat inflation by accelerating rate hikes, the U.S. private sector suddenly faced a choice:

- Continue to earn basically 0% in banks.

- Or open their mobile banking app and buy a money market fund or U.S. Treasury that pays up to 10 times as much as they used to.

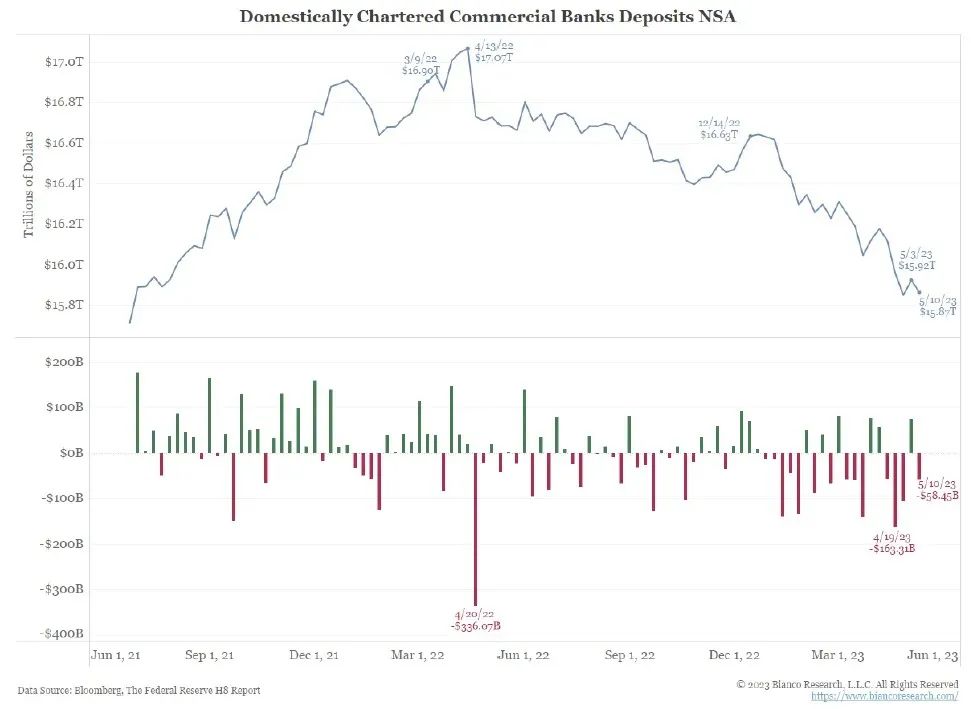

Given how easy it is to move funds from low-to-zero-yielding bank accounts to higher-yielding assets, hundreds of billions of dollars of capital have flowed out of the U.S. banking system since the end of last year.

Over $1 trillion has already been pulled from the U.S. banking system since last year.

The crucial question going forward is whether this outflow of funds will continue. Will businesses and individuals continue to move funds from 0% bank accounts to money market funds yielding 5% or 6%? Logic tells us the answer is obvious, “Of course they will.” If they can increase their interest income 10-fold by spending only a few minutes on their smartphone, why wouldn’t they? The U.S. private sector will continue to extract funds from the U.S. banking system until banks offer rates that are competitive with at least the federal funds rate.

The next question is, if the U.S. Treasury is selling debt, what type of debt (if any) does the public want to buy? This question is easy to answer as well.

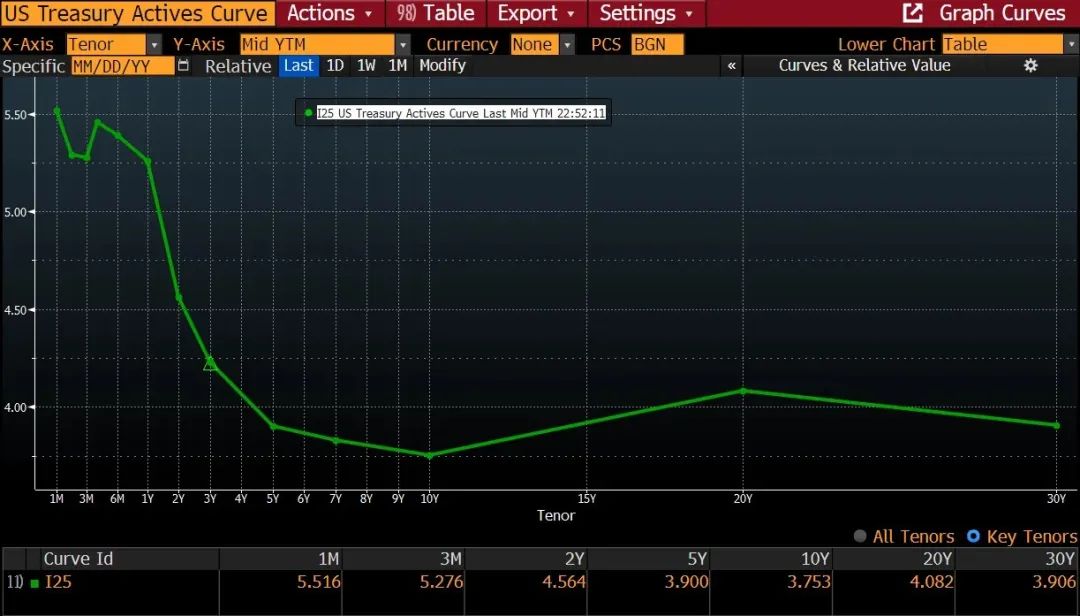

Everyone is feeling the impact of inflation and therefore has a high preference for liquidity. Everyone wants to get their hands on funds immediately because they don’t know where inflation is headed in the future and, given that inflation is already high, they want to buy goods now to avoid them becoming even more expensive in the future. If the U.S. Treasury offered you a one-year note yielding 5% or a 30-year bond yielding 3%, because the yield curve is inverted, which would you choose?

Of course, you would choose a one-year note. Not only can you get a higher yield, but you can also get your funds back faster and only face 1 year of inflation risk instead of 30 years of inflation risk. The US private sector prefers short-term US Treasury bonds. They express this preference by buying money market funds and exchange-traded funds (ETFs) that can only hold short-term debt.

Note: An inverted yield curve means that long-term yields are lower than short-term debt. Naturally, you expect to earn more income for lending money for a longer period of time. But the inverted yield curve is unnatural and indicates a serious dysfunction in the economy.

The Fed

I’ve already mentioned similar themes above, but allow me to expand on the same theme in a more vivid and vivid way.

Imagine there are two politicians.

Oprah Winfrey wants everyone to be happy and live their best life. She makes sure that everyone has food on the table, a car with a full tank of gas in the garage, and the best health care until they die. She also says she won’t raise taxes to pay for these benefits. She will borrow money from elsewhere in the world to achieve this goal, and she believes it can be done because the US is the global reserve currency issuing country.

Scrooge McDuck is a miser who hates debt. He almost doesn’t provide government welfare because he doesn’t want to raise taxes or borrow money to pay for things the government can’t afford. If you have a job that allows you to buy a full refrigerator of food, a pickup truck, and top-notch health care, that’s your business. But if you can’t afford these things, that’s your business too. He doesn’t believe the government has a responsibility to provide these for you. He wants to keep the value of the dollar and ensure that there is no reason for investors to hold other assets.

Imagine that you are in the late stages of an empire where income inequality is rapidly increasing. Mathematically, most people’s incomes are always below average, so who will win? Oprah Winfrey always wins. It’s always a win to use a currency printing press to get free stuff paid for by others.

The primary job of politicians is to win elections. Therefore, regardless of which party they belong to, they will always prioritize spending money they don’t have to win the support of the majority.

Unless severe accusations are made by the long-term debt market or malignant inflation, there is no reason not to adopt a platform based on “free stuff.” This means that from now on, I don’t expect to see any substantial changes in the traditional spending habits of the U.S. federal government. As for this analysis, tens of trillions of dollars will continue to be borrowed every year to pay for these benefits.

The U.S. Banking System

In short, the U.S. banking system, as well as other major banking systems, is in trouble. I’ll quickly review the reasons why.

Asset inflation in the banking system due to stimulus measures provided by governments around the world. Banks lend these deposits to governments and companies as required, with very low interest rates. This works for a while because the interest rate on bank deposits is 0%, but they lend money to others at rates of 2-3% over an extended period of time. But then inflation appears, and all major central banks (with the Fed being the most aggressive) significantly raise the short-term policy rate, far exceeding the yield on government bonds, mortgage loans, corporate loans, and so on. Depositors can now earn higher returns by purchasing repurchase agreements (RRPs) or money market funds that invest in the Fed’s short-term U.S. Treasury bonds. As a result, depositors begin to withdraw funds from banks to earn higher returns. Banks cannot compete with the government because it would undermine their profitability – imagine a bank with a loan rate of 3% but a deposit rate of 5%. One day, the bank will go bankrupt. Therefore, bank shareholders begin to sell bank stocks because they realize that these banks cannot profit mathematically. This has led to a self-fulfilling prophecy, with the solvency of some banks being called into question as their stock prices plummet.

In my recent interview with Zoltan Pozar in Bitcoin Miami, I asked him what he thought of the U.S. banking system. He replied that the system was fundamentally sound, with only a few bad apples. This is consistent with the statements of various Fed chairs and U.S. Treasury Secretaries, including Janet Yellen. I strongly disagree.

Bank of America now faces two choices:

Option 1: sell assets (US Treasuries, mortgage loans, auto loans, commercial real estate loans, etc.) at a huge loss and then raise deposit rates to attract customers back to the bank.

This option means admitting hidden losses on the balance sheet but guarantees the bank cannot sustain profitability. The yield curve is inverted, which means the bank will pay higher short-term deposit rates but cannot lend out these deposits at higher rates for longer-term loans.

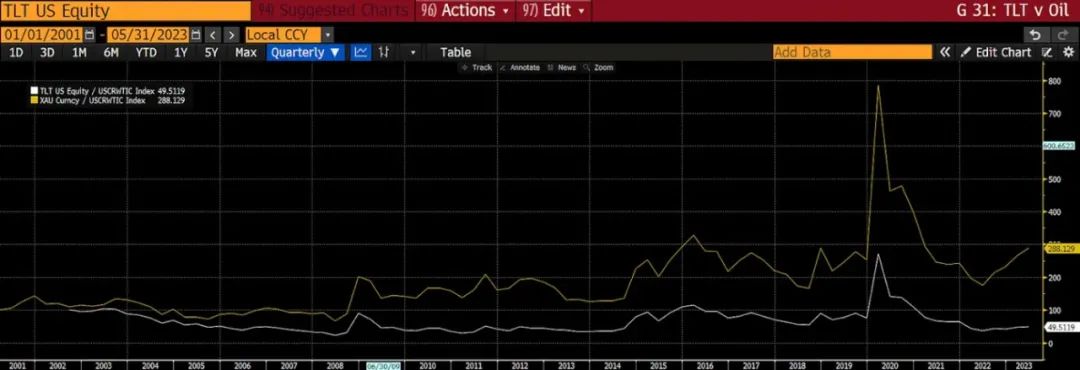

US Treasury 10-year yield minus 2-year yield

The bank cannot buy long-term government bonds because that would cause losses—very important! The only thing the bank can buy is short-term government bonds or place funds with the Fed (IORB) and receive slightly higher interest than deposit payments. With this strategy, the bank is hard-pressed to achieve net interest margins (NIM) of more than 0.5%.

Option 2: do nothing and swap the assets you have on hand with the Fed for freshly printed dollars when depositors flee.

This is essentially the role of the Bank Term Funding Program (BTFP). I discussed this issue in detail in a previous article. Don’t worry about whether the assets the bank holds on the balance sheet meet the eligibility requirements of BTFP—the real problem is that the bank cannot expand its deposit base and then use those deposits to buy long-term government bonds.

US Treasury

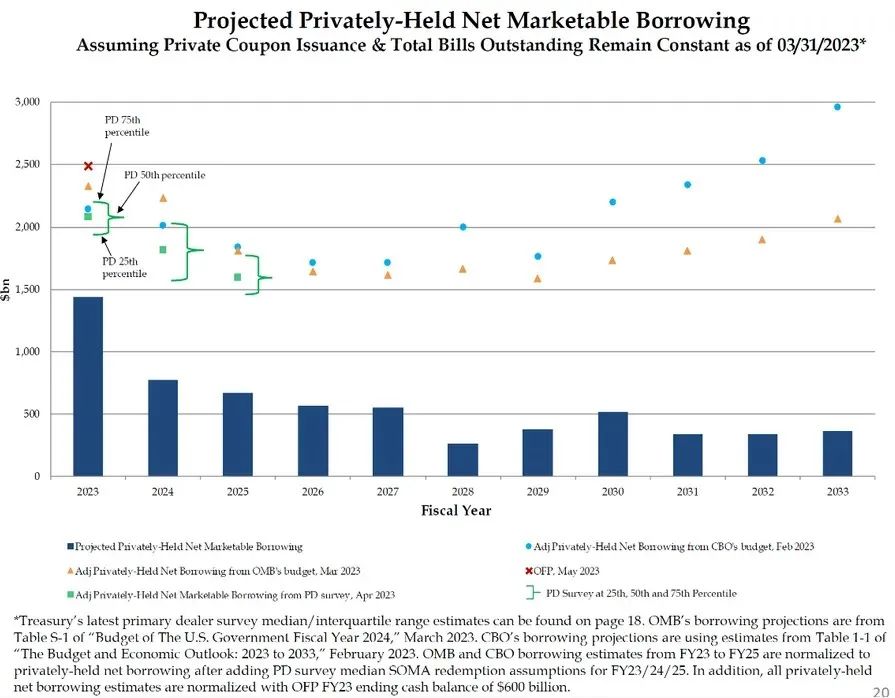

I know the media and markets are focused on when the US debt ceiling will be reached and whether the two parties will find a compromise to raise the ceiling. Ignore the circus—the debt ceiling will be raised (as it has in the past, given more dire alternative scenarios). And when it is raised, sometime this summer, the US Treasury has some work to do.

The US Treasury must issue trillions of dollars of debt to fund the government. It is important to focus on the maturity structure of the debt issued. Obviously, it would be great if the US Treasury could issue trillions of dollars of 30-year bonds because the yields on these bonds are nearly 2% lower than short-term bonds with less than a 1-year maturity. But can the market handle it? Absolutely not!

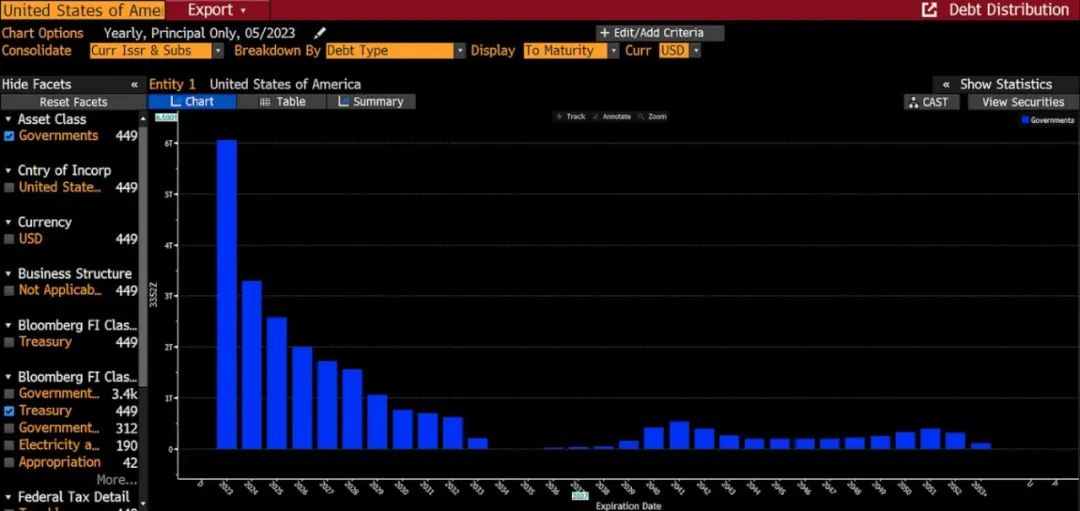

US Treasury debt maturity structure

From now until the end of 2024, the debt that needs to be rolled over is around $9.3 trillion. As you can see, the US Treasury is unwilling or unable to issue a large amount of long-term debt and is instead financing itself with short-term debt. Uh-oh! This is bad news because short-term rates are higher than long-term rates, which increases interest costs.

Let’s take a look.

Here’s a table of the main potential buyers of US Treasuries, bills, and bonds:

None of the major buyers are willing or able to buy long-term US Treasuries. Therefore, if the US Treasury tries to flood the market with tens of trillions of dollars of long-term debt, the market will demand higher yields. Imagine if the 30-year yield rose from 3.5% to 7%, which would cause bond prices to plummet, marking the end of many financial institutions. This is because these financial institutions are encouraged by regulators to use almost unlimited leverage to buy large amounts of long-term debt. That’s sure to end badly!

US Treasury yield curve

Yellen is not stupid. She and her advisers know that issuing the necessary debt at the long end of the yield curve is impossible. Therefore, they are issuing debt where demand is strong: at the short end of the yield curve. Everyone wants the high returns of short-term rates, which could rise further later this year as inflation picks up.

As the US Treasury sells $1-2 trillion in debt, short-term rates will rise. This will further exacerbate the problems of the banking system, as depositors seek better terms from the government instead of borrowing from banks. This in turn ensures that banks cannot profit from buying long-term bonds. The death spiral is rapidly approaching.

Federal Reserve

In this final section, Powell is in a rather messy situation. Each stakeholder is pulling his central bank in different directions.

Rate cut

The Federal Reserve controls/manipulates short-term interest rates by setting rates for RRP and IORB. Money market funds can earn returns in RRP, and banks can earn returns in IORB. Without these two tools, the Federal Reserve would be unable to regulate interest rates as it wishes.

The Federal Reserve can significantly lower the rates for these two tools, which would immediately steepen the yield curve. The benefits would include:

- Banks will be profitable again. They can compete with the rates offered by money market funds, rebuild their deposit base, and begin providing long-term loans to businesses and governments. The U.S. banking crisis will end. The U.S. economy will thrive because everyone will once again have access to cheap credit.

- The U.S. Treasury Department can issue more longer-term debt because the yield curve is positively sloped. Short-term rates will fall, but long-term rates will remain unchanged. This is desirable because it means that interest expenses on long-term debt remain constant, but the debt becomes more attractive as an investment.

The downside is that inflation will accelerate. The price of money will fall, and the prices of things voters care about (such as food and fuel) will continue to rise at a pace higher than wages.

Rate hike

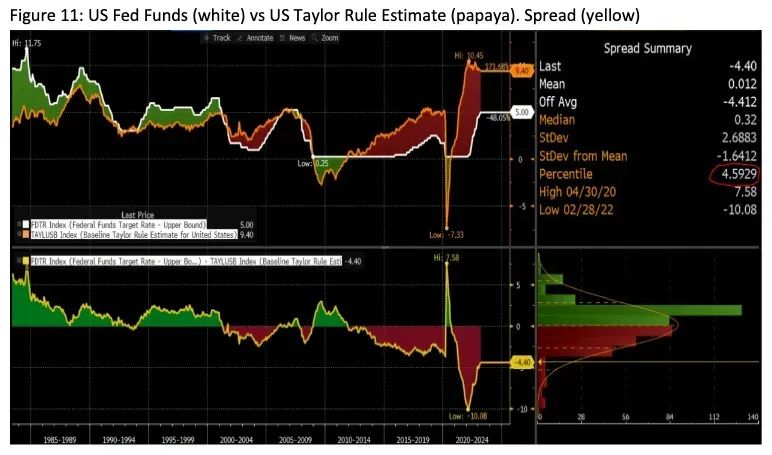

If Powell wants to continue fighting inflation, he must continue to hike rates. According to the Taylor rule, interest rates in the United States are still deeply negative, at least for economic experts.

The following are the negative consequences of continuing to hike rates:

- The private sector continues to be more inclined to borrow from the Federal Reserve using money market funds and RRP, rather than depositing funds in banks. As deposit bases decline, U.S. banks continue to fail and receive bailouts. The Federal Reserve’s balance sheet may not store these bad debts, but the Federal Deposit Insurance Corporation (FDIC) is now full of bad debt loans. Fundamentally, this is still inflationary because depositors will repay in full in the form of printed money, and they will be able to earn more interest income by borrowing from the government rather than the banks.

- The yield curve continues to invert, making it impossible for the U.S. Treasury Department to issue long-term debt at the desired scale.

I want to further explain the point that raising interest rates also leads to inflation. I agree that the quantity of money is more important than the price of money. What I am focusing on here is the amount of dollars injected into the global market.

As interest rates rise, there are three ways for global investors to earn income in printed dollar form. The printed currency can come from the Federal Reserve or the US Treasury. The Federal Reserve pays interest to holders through reverse repurchase agreements and bank deposit reserves. Remember: if the Fed wants to continue manipulating short-term interest rates, it must have these tools.

If the US Treasury issues more debt and/or new debt, as interest rates rise, it will pay more interest to debt holders. Both of these things are happening.

All in all, the interest paid by the Fed through RRP and IORB and the interest paid by the US Treasury on debt have a stimulative effect. But isn’t the Fed supposed to reduce the quantity of money and credit through quantitative tightening (QT)? Yes, that’s correct, but now let’s analyze the net effect and how it will develop in the future.

As we can see, the effect of QT has been fully offset by interest paid through other means. Despite the Fed shrinking its balance sheet and raising interest rates, the amount of currency is still increasing. But will this continue to happen in the future, and to what extent? Here are my thoughts:

1. The private sector and US banks prefer to deposit funds with the Fed, so the balances of RRP and IORB will increase.

2. If the Fed wants to raise interest rates, it must raise the interest rate on funds deposited in RRP and IORB.

3. The US Treasury will soon need to provide financing for $1-2 trillion in deficits in the foreseeable future and must finance it with higher and rising short-term interest rates. Given the maturity of the US debt, we know that actual monetary interest expenditures can only rise mathematically.

Combining these three factors, we know that the net effect of US monetary policy is currently stimulative, and the money printing press is producing more and more fiat currency. Remember, this is because the Fed is raising interest rates to fight inflation. But if raising interest rates actually increases the money supply, it can be inferred that raising interest rates actually increases inflation. Mind-blowing!

Of course, the Fed could accelerate QT to offset these effects, but that would require the Fed to become a direct seller of US Treasuries and mortgage-backed securities (MBS), in addition to foreign investors and the banking system. If the largest creditor (the Fed) is also selling, the dysfunctionality of the US Treasury market will increase. This will cause investors to panic, leading to a surge in long-term yields as everyone rushes to sell their bonds before the Fed starts selling.

Trading-related

If you are a believer in Satoshi Nakamoto, time will be on your side. If you choose to partner with the traditional financial devil, the timing bomb is ticking…

Important things will happen between now and the autumn harvest.

First, the US debt ceiling will be raised this summer. This will cause the US Treasury to begin issuing debt to fund the government. As the US Treasury repays maturing debt and issues new debt, the net effect will be more unpaid debt and higher rates. The debt issuance may temporarily put pressure on dollar liquidity as the Treasury General Account (TGA) increases. But over time, as the Treasury spends money, the TGA declines and dollar liquidity increases.

Second, as I previously outlined, inflation will bottom out and begin to slowly rise. This means that the Fed may pause rate hikes in June, only to reignite the flames at the July meeting, raising rates. By the end of August’s Jackson Hole central banker meeting, the policy rate may be close to 6%. Higher rates will increase the amount paid in interest on RRP and IORB balances.

Finally, depositors will continue to move funds from non-systemically important banks to systemically important banks, or to money market funds. Money market funds deposit funds in RRP while systemically important banks deposit funds in IORB. In both cases, the balances of RRP and/or IORB grow. Systemically important banks have a lot of cash, which is why they pay little or no interest on deposits and store any excess funds in the Federal Reserve System (thus increasing IORB). This increases the amount of currency the Fed issues to pay for funds deposited in these facilities.

In summary, the amount of dollar liquidity injected into the system every day will continue to grow. The rate of change of dollar liquidity injection will also accelerate, as the larger the balance, the more interest paid. Compound interest is a geometric series.

Bitcoin has experienced about a 10% pullback from its peak in April. All of this interest payment is actually a stimulus plan for wealthy asset holders. When they have more funds than they need, wealthy asset holders buy risk assets. Gold, bitcoin, AI tech stocks, and others will be beneficiaries of the “wealth” printed and distributed by governments.

I expect bitcoin to remain stable here. I don’t believe we will retest $20,000 or near that level again. A strong support base will form as funds gradually flow into the global risk asset market. During the northern hemisphere summer, volatility and trading volumes typically disappoint, so I am not surprised that adventurers troubled by boredom have temporarily left cryptocurrency trading. I will use this calm time to gradually increase my bitcoin allocation after TGA is replenished.

As more and more experts start talking about the billions of dollars issued by the Fed and the US Treasury as interest payments, people will once again realize that the currency printing machine is running non-stop. And when the printing press hums, bitcoin will prosper!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!