The concept of RWA (Real World Assets) is receiving more and more attention, and in a recent report by Citigroup, it is estimated that as much as $4-5 trillion could flow into this market by 2030.

RWA mainly refers to non-blockchain system asset classes, the most popular of which include cash (USD), metals (gold, silver, etc.), real estate, bonds (mostly US bonds), insurance, consumer goods, and other non-securities assets such as real estate, art, climate assets, and intangible assets (such as carbon credits). Its asset size far exceeds that of Crypto natives. According to traditional market data, the fixed income bond market alone is valued at $127 trillion.

However, in the past decade of development, RWA has progressed slowly due to barriers such as compliance, technology, and cognition. For example, the STO concept that emerged in the second half of 2018 has a long way to go to break through its market size.

Subsequently, leading DeFi protocols such as MakerDAO and Aave successively introduced the RWA market, allowing for the collateralization of real assets, but the RWA concept has still not made a big splash.

- USDT Slightly Unpegged in Data Analysis: Market FUD Leads to Significant Drop in 3Pool Liquidity on Curve

- Analysis of Curve Founder’s “Collateralized Cash-Out” Behavior: From Shorting Costs to Market Impact

- LD Track Observation: Market generally falls, stablecoin market cap down by $950 million, ETH collateralization ratio increases by 1.63% MoM ……

During the market downturn, the yield of on-chain native assets in the DeFi market has dropped significantly, and risk-free yield products in DeFi have been valued. The fixed-income DeFi market represented by on-chain US Treasuries has become a more promising narrative in the RWA category.

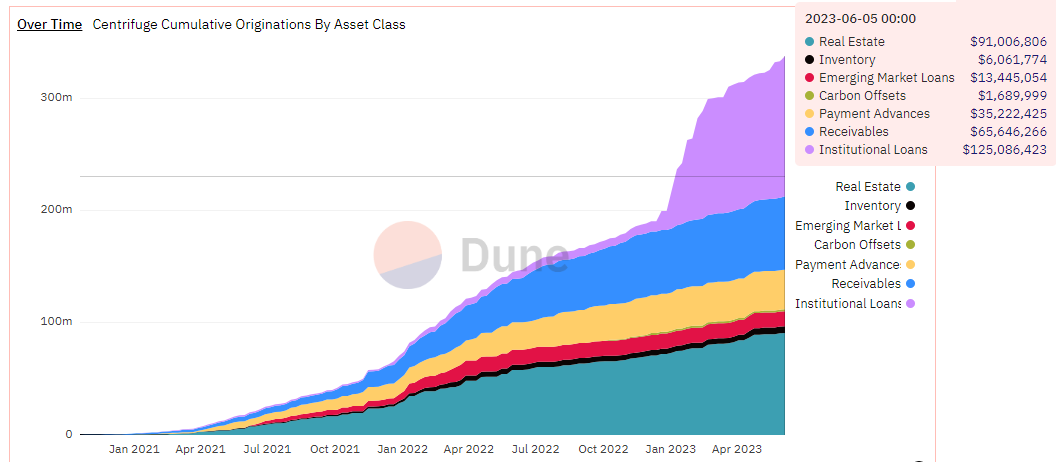

On-chain RWA itself requires prerequisites such as credibility, compliance institutions, and market consensus to support it. From the perspective of asset liquidity demand and DeFi/TradFi demand, short-term national debt is relatively more suitable for starting. We can focus on this segmentation scene in the RWA concept, which is also showing such a trend from the Dune data:

In the DeFi market, the overall TVL has fallen by almost 70% from its high point in November 2021 (about $178.79B) to the current $54.25B, and DeFi yield is also volatile, dropping from its high point to around 3% or lower. By comparison, US Treasury yields, driven by interest rate hikes, have been higher than the more volatile DeFi yields.

With a near 5% risk-free annualized return, stablecoin issuers such as USDC/USDT have attracted attention for their returns on US bond interest. Compared to RWA asset categories such as real estate and traditional funds, on-chain US bonds may be a safer, more compliant, and more liquid option.

If on-chain US bonds are no longer released with stablecoins at a lower cost to increase liquidity in the face of the expectation of a huge bond market, DeFi’s risk-free rate of return will add another layer of expectation. From this perspective, DeFi’s risk-free rate of return should be benchmarked between the 2-year and 5-year periods (4.5%), at least not lower than the 4% 10-year US bond.

From the perspective of liquidity and pricing rights, the value of RWA may be that US bond RWA will be a way for institutions and capital to flow freely from traditional markets into the encryption field, and US bonds themselves are liquidity or may introduce new liquidity to the market.

You can pay attention to the following three aspects:

On-chain US bonds and public fixed-income RWAs

- OndoFinance:

OndoFinance targets the issuance of US bonds through tokenized funds and provides investors with four types of bonds: US money market funds (OMMF), US Treasury bonds (OUSG), short-term bonds (OSTB), and high-yield bonds (OHYG). After participating in the KYC/AML process, users can trade fund tokens and use these fund tokens in DeFi protocols. (For example, OUSG holders who have gone through KYC can lend their tokens in the decentralized lending protocol FluxFinance developed by Ondo, leveraging USDC)

*Ondo requires KYC and some personal information, as well as a minimum USDC size requirement.

- Cytus Finance:

Cytus aims to allow investors to obtain returns on US Treasury bonds without cashing out stablecoins in compliance. Cytus Finance’s US bond pool mixes bonds of varying periods, ranging from one year to one month. Currently, two liquid fixed income pools are offered: a real estate debt pool with a yield of 5-6% and a US Treasury bond pool with a yield of 2-3%.

Compared to Robinland, a sister company that only serves US users, Cytus aims to provide services to users outside the US, but users still need to complete the KYC process to comply with SEC regulations.

- T Protocol

T Protocol is a permissionless, on-chain US debt product based on Liquity fork, designed to provide complete DeFi composability for non-permissioned US debt. Users can mint TBT (underlying is Matrixdock’s STBT) through USDC. TBT is always redeemable for $1 USDC, and yields are distributed through rebase.

The protocol also includes other tokens: sTBT, a rebasing token issued by institutions that have passed KYC, serves as collateral for TBT; wTBT is a wrapped interest-bearing asset that allows users to participate in other DeFi activities while earning bond yields. It has liquidity on DEXs such as Velodrome and veSync.

Their website indicates that it cannot be used in the US or other sanctioned areas, but no KYC is required in actual use.

- IPOR

Interest rate derivatives have also emerged on the market, aiming to flatten interest rate fluctuations through interest rate swaps. The IPOR interest rate reflects the benchmark interest rate of the DeFi market and is open source for others to integrate into smart contracts. DeFi users can achieve hedging, arbitrage, and speculation through trading IPOR. Its approach is similar to LIBOR (London Interbank Offered Rate).

Non-full-collateralized lending protocols based on RWA assets

Protocols based on RWA assets can provide undercollateralized loans, allowing DeFi investors to lend funds to different financial institutions (such as bonds, real estate), which often pay higher interest rates because they do not need to provide on-chain asset collateral during protocol lending, allowing DeFi investors to earn higher stablecoin returns and rewards.

There are different ways for such protocols to provide under-collateralized loans to institutions. The progress of mature protocols such as Maple Finance, TrueFi, and Goldfinch on RWA assets can illustrate the latest trend of combining RWA assets with DeFi.

- Maple Finance

Maple Finance introduces a new liquidity pool: the cash management pool, which invests in US Treasury bills through an independent special purpose vehicle (SPV) as the sole borrower of the cash management pool. Maple and the cooperation platform charge management fees, and the remaining income is distributed to depositors.

*Only KYC-ed non-US accredited investors can participate.

Synthetic Assets

Due to the high compliance requirements involved in bringing off-chain assets onto the chain through RWA, development in this area is often constrained (as seen in Mirror, a previous red-hot asset class in the Terra ecosystem, where the stock RWA asset category was excellent, but the compliance difficulty was the highest).

In this context, innovation in DeFi and RWA assets may return to the direction of synthetic assets.

Represented by the Synthetix protocol, synthetic assets can lock collateral such as stocks and commodities to create synthetic assets, which are traded on-chain in the form of derivative products.

In any case, DeFi and off-chain asset yields need an appropriate interface. In the market’s downward range, DeFi needs self-generating capabilities from internal or external sources. RWA assets with stable value and real demand may bring new use cases.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!