Author: Leland Lee / Source: galaxy Translation: Plain Blockchain

Who captures MEV? Who should capture MEV?

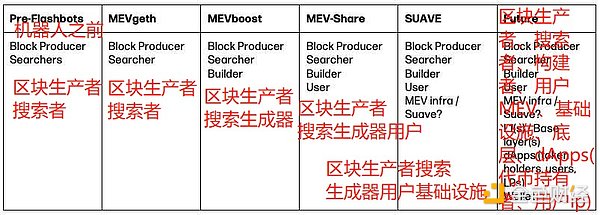

Before Ethereum transitions to proof of stake (PoS), miners can extract value (MEV) mainly by searchers and miners. Today, on Ethereum, network stakeholders known as builders and validators compete with searchers for MEV revenue. In the future, there will be more participants competing for MEV.

- Understanding Gensyn, the AGI computing power market protocol with a $43 million investment led by a16z in one article

- Is the US SEC “hunting down” the CEO of Binance, with a hint of personal grudges?

- What impact will SEC’s consecutive lawsuits against Binance and Coinbase have on the cryptocurrency market?

This raises several questions: How is MEV currently distributed among participants? How big is the total MEV today? What will the entire MEV market and its future distribution look like?

A programmatic view of value direction in transactions.

MEV is a Transaction Disease

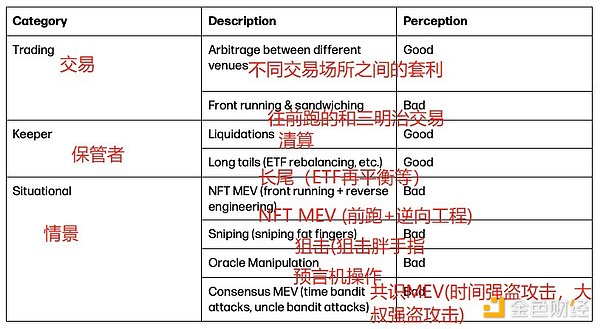

MEV is residual value extracted from a blockchain system. Wherever there is value trading through an unauthorized system, there is MEV. For example, if traders set the slippage too high, searchers may sandwich their trades in the middle. In this case, the searcher obtains MEV at the expense of the trader. To explore the factors that affect MEV, there must be a classification system to understand the growth and decline of different MEV sub-markets.

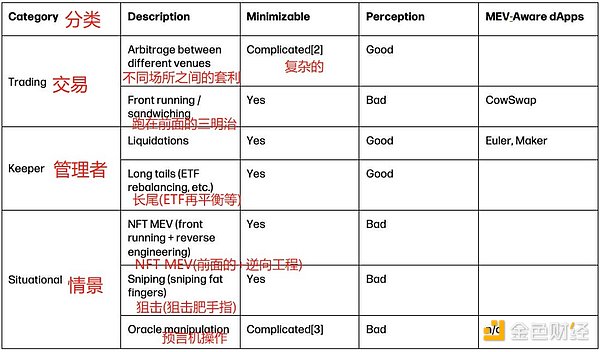

Advanced classification of MEV.

Although MEV often has negative connotations, MEV can promote the healthy development of the ecosystem. MEV can create incentives for participants in the system. For example, if there are no searchers to clear and arbitrage between venues, the protocol will generate bad debts, and users will face greater spreads, making transactions worse on the chain.

Observable MEV is just the Tip of the Iceberg

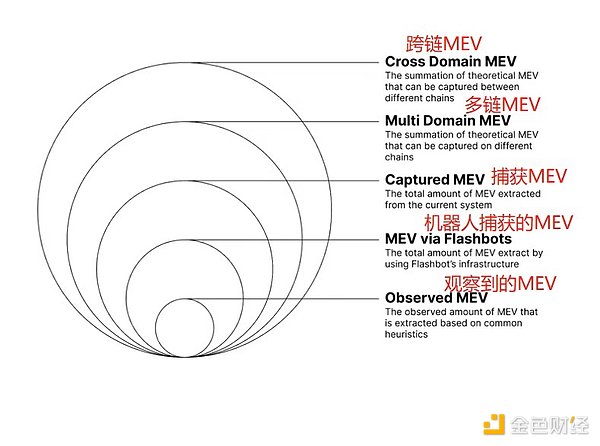

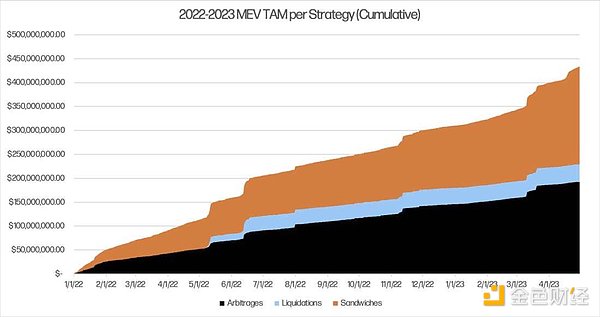

Although calculating the total addressable market (TAM) of MEV is challenging, we estimate that the lower limit of annual MEV extracted from Ethereum is between $300 million and $900 million, based on estimates from various data providers [1].

This MEV TAM is the total value lost to MEV. For example, if a transaction is worth 100 units of value, and the user ultimately only gets 90 units of value, then 10 units of value will leak to MEV. In practice, this is calculated by identifying MEV transactions (such as arbitrage, sandwich, or clearing) and then determining the income of searchers. This number can be further divided into the profit of the searcher, the profit of the builder, and the net new funds of the validator.

The TAM mental model of MEV, not drawn to scale. Source: Flashbots & Leland Lee.

However, we estimate that the real MEV TAM is more than the range of 300-900 million US dollars, and the MEV TAM in 2022 may exceed 1 billion US dollars. But calculating the real TAM of MEV is difficult because MEV analysis is best at identifying MEV that follows predictable or deterministic patterns such as arbitrage, sandwich and liquidation. This does not capture the long tail of MEV with NFT and other DeFi applications, so the actual TAM is actually larger than the estimated value. Nowadays, market participants are becoming increasingly mature in competing with each other. For example, off-chain hedging cannot be tracked, multi-block MEV is difficult to identify, and probability MEV is almost undetectable.

MEV TAM from 2022 to early 2023 based on observable strategies of arbitrage, liquidation and sandwich according to EigenPhi. Note that liquidation data only exists after May.

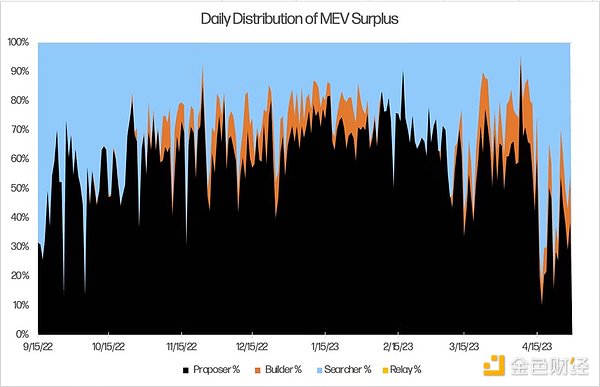

Validators control most of the MEV

The current situation is that validators (also known as proposers or block producers) capture most of the observed MEV. Over time, we have seen profitability shift from searchers to validators, and recently back to searchers. The income compression of sandwiches and liquidations is particularly evident because competition for these types of MEV opportunities is very intense. Searchers must bid most of their expected value to block producers to ensure that transactions are included.

From the merger to the end of April 2023, the distribution of observable MEV among different participants is: block producers (56%), searchers (38%), builders (6%), and relays (0%) on Ethereum. MEV also reaches all users of Ethereum through EIP1559’s burning, but this is not calculated.

However, since the total MEV is far greater than the observed MEV, validators may receive a smaller share in practice. In addition, the competition in the unobserved MEV field is often lower. Therefore, searchers do not have to bid so high for transactions to be included.

Who will capture MEV in the future?

Although pre-Flashbots and MEVgeth share the same market participants, we suspect that MEVgeth has shifted the value capture from searchers to miners (block producers). Additionally, the term “user” is loosely used and can be the user of the dApp protocol itself. The future may include MEV-burn and other small tools.

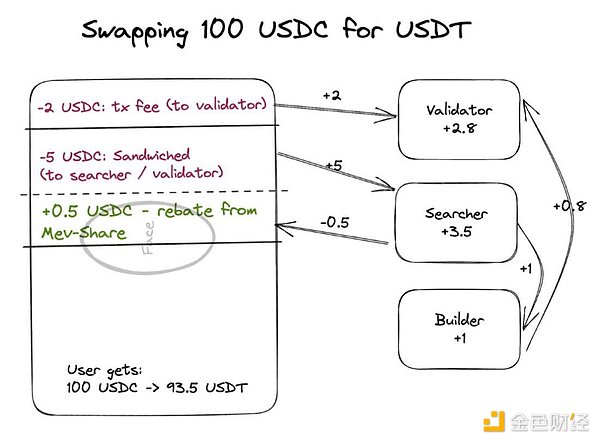

Today’s standard is a three-party capture of MEV – block producers, searchers, and builders. However, a popular notion is that MEV initiators (usually transaction initiators) should receive kickbacks for the MEV they generate. MEV-Share is the latest example of this idea, where searchers can bid on order flows from users, wallets, and/or dApps. Ultimately, market dynamics will drive how much kickback the sender receives for the MEV they generate and how the remaining MEV value is distributed among different market participants. However, there is a philosophical question of what is the optimal allocation between MEV initiators, searchers, and other parties?

MEV-Aware applications will reduce MEV TAM

However, this debate about fairness and value distribution may be moot. As multiple parties vie for the surplus MEV, we expect the TAM of MEV to decrease. From the perspective of an application or dApp, why leak value to searchers when they can retain value for themselves or their users? These “MEV-Aware” applications will implement functionality to reduce the MEV they generate.

This is already happening. For example, both MakerDAO and Euler use auctions for liquidation, instead of credit protocols Compound and Aave, which set liquidation to a fixed discount. In the case of Maker and Euler, the losses of liquidated users have been reduced, as keepers compete on price to liquidate loans. In other words, they regain value they might have lost. For Aave and Compound, there is a fixed liquidation discount. This means that users who are liquidated suffer fixed losses rather than variable losses that may be less than the fixed amount. As applications compete for users and liquidity, we can expect dApps to implement functionality to reduce value leaks and encourage use over competitors.

How will dApps consider value allocation? The protocol can implement auction fees to transfer some value back to token holders instead of reducing LP losses through liquidation auctions.

We hope to better combine mechanism design (primarily auctions) and smarter default parameter values to plug the MEV leaks that users experience. Examples include UI warnings to prevent AMM slippage, volatility, and pool-aware slippage limits. The famous 2.08 million USDC to 0.05 USDT liquidation can easily be avoided.

Related meme

Reviewing our MEV taxonomy, we expect certain categories to be easier to minimize than others. For example, front-running and sandwiching can be minimized by smarter slippage settings. However, some forms of MEV may be unavoidable – for example, there may be no easy way to reduce arbitrage between DEXs without changing the underlying protocol [2].

Who decides the future of MEV?

The MEV market landscape will continue to evolve and affect various market participants. Many questions still remain: how will protocols balance the needs of different user groups, and how will value flow between these groups? Will the market decide how much MEV should be returned, or will protocol designers intervene? Will users tend towards protocols that better protect them from MEV, or will users not care at all? We expect the MEV of specific applications to approach zero in the medium term. In the long run, cross-application MEV will slowly transfer more value back to the initiators of order flow through protocol design. Ultimately, the protocols and dApps that best protect users will win. Many thanks to Sina, Hasu, Dev Ojha, Walter Smith, and Christine Kim for their conversations and feedback.

Footnotes:

[1] MEV TAM estimates from different data providers.

MEV TAM estimates from different data providers.

[1] Chorus One’s annualized data is about $92.1 billion per year (their data starts from August 2020 to the end of Merge) [2] Chorus One further divides the numbers into good and bad MEV, 713.95 million US dollars good (arbitrage and liquidations) + 1206.11 US dollars bad (sandwiches) [3] EigenPhi only has data for 2022 and beyond [4] Flashbot does have sandwich data in Dune, but unfortunately the data is not particularly clean. However, the numbers dug up from everywhere are similar to Chorus One’s top line. [2] It is difficult to minimize arbitrage between venues without changing the underlying L1/L2 protocols. Some designs include auctions for access to the first transaction in a block, but this requires changes to the underlying layer. Although there may be some structures, additional protocol auctions can be performed if a sufficient proportion of ETH validators re-delegate. [3] Dev from Osmosis pointed out how to mitigate this situation by incorporating oracles into the consensus of the application chain (it is difficult to force 1/3 of the validator set to collude). Perhaps re-delegation can be used to mitigate this situation. Or auction the “submission” of oracle updates to gain front/back operational rights.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!