Author: Yilan, Invest&Research@LD Capital

Recently, the founder of Curve’s cash-out behavior and the continuous mortgage of CRV to borrow stablecoins have become the focus of market attention when market liquidity is affected by the SEC incident. In order to analyze the on-chain short selling cost, possibility, and related effects of CRV, let’s review how the short selling operations were carried out in last year’s CRV long and short battle.

Shortly after the FTX explosion last year when the market lacked confidence and liquidity was extremely depressed, a whale borrowed a large amount of CRV tokens from Aave and transferred them to the OKX trading platform. A total of 47 million CRV were borrowed. Affected by the whale’s sell-off short selling, the CRV price fell from $0.545 to $0.424, a drop of 21.88%. The lowest point was $0.4. This operation is to suppress the coin price by repeatedly borrowing and transferring tokens on-chain to carry out large-scale short selling.

Founder Michael then bought CRV to boost the coin price. Although the Aave account bears the risk of liquidation, the shorts still have profit potential. One way to profit is to conduct high-leverage short selling transactions on platforms such as OKX, using the lack of market liquidity and the lack of strong bullish interference to obtain high-probability profit opportunities. Another way to profit is to convert short positions into long positions. When market liquidity is depleted, shorts close positions and go long.

- LD Track Observation: Market generally falls, stablecoin market cap down by $950 million, ETH collateralization ratio increases by 1.63% MoM ……

- Overview of Frax frxETH V2 Mechanism: How to Create a Fully Decentralized Peer-to-Peer Market for Node Operators?

- MEV Market Size and Participant Distribution: How Will It Develop in the Future?

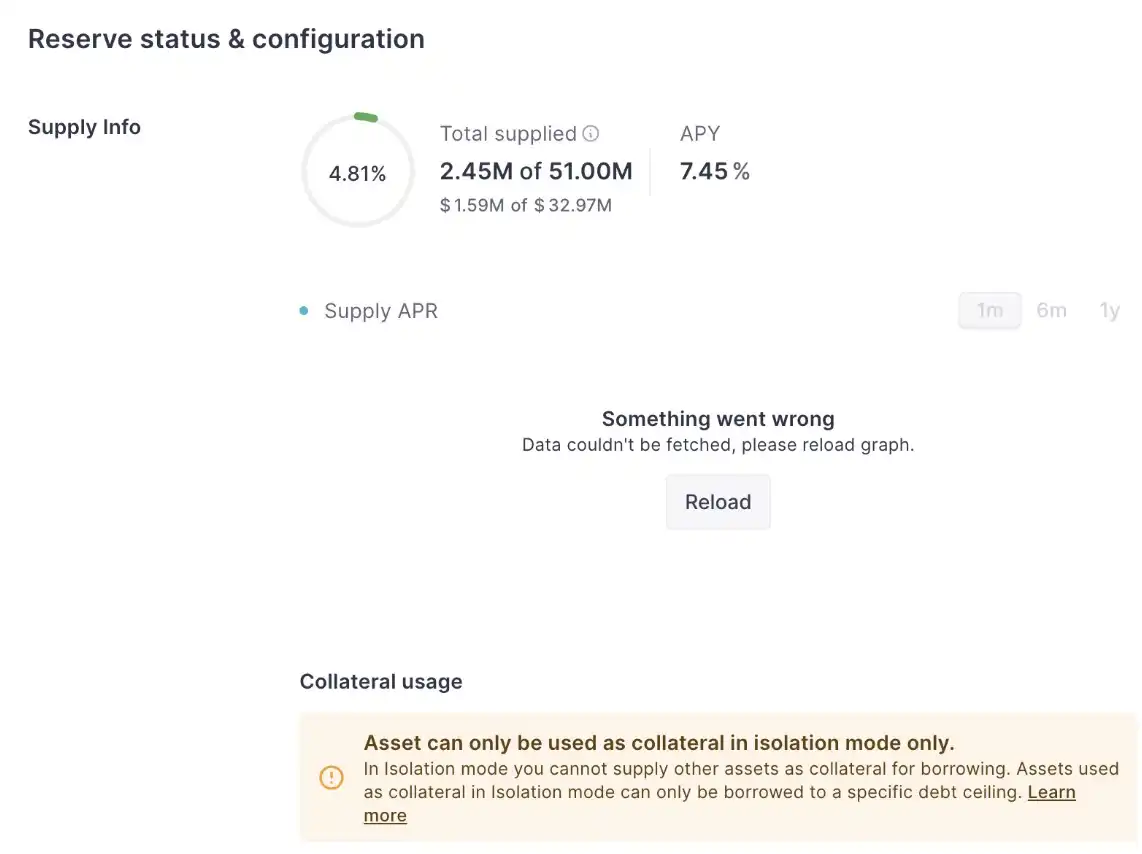

Aave canceled the borrowing of CRV (that is, it is impossible to increase leverage through the same on-chain circular loan to carry out short selling) after the CRV long and short game.

In addition, centralized trading platforms also provide opportunities for borrowing and short selling.

Currently, the chip distribution of CRV tokens is as follows: 116 million are held in Curve dex, 65.47 million are held by Binance, 12.56 million are held by OKX, and a total of 53.29 million are held by other centralized trading platforms.

It can be seen that centralized trading platforms hold a large amount of CRV tokens, accounting for 15% of the total circulation. However, it is impossible to calculate the possible short selling cost without centralized trading platform data.

Currently, the total on-chain liquidable amount of CRV is 113 million U.S. dollars, of which 99% (28.9 million CRV) is concentrated around the price of $0.375. This means that borrowing and short selling may be sufficient to press the price to the vicinity of the liquidation price, but Curve’s founder has the ability to add margin to continue to lower the liquidation price, and the cost of simple short selling will be very high.

Aave Launches CRV and CRV Liquidation Levels

However, no one can liquidate this amount of CRV, so if Aave wants Michael to reblock his loan, reducing the CRV borrowing pool LTV is the right risk control measure, but suddenly changing the LTV to 0 should not be done, which will greatly increase the bad debt risk of Aave.

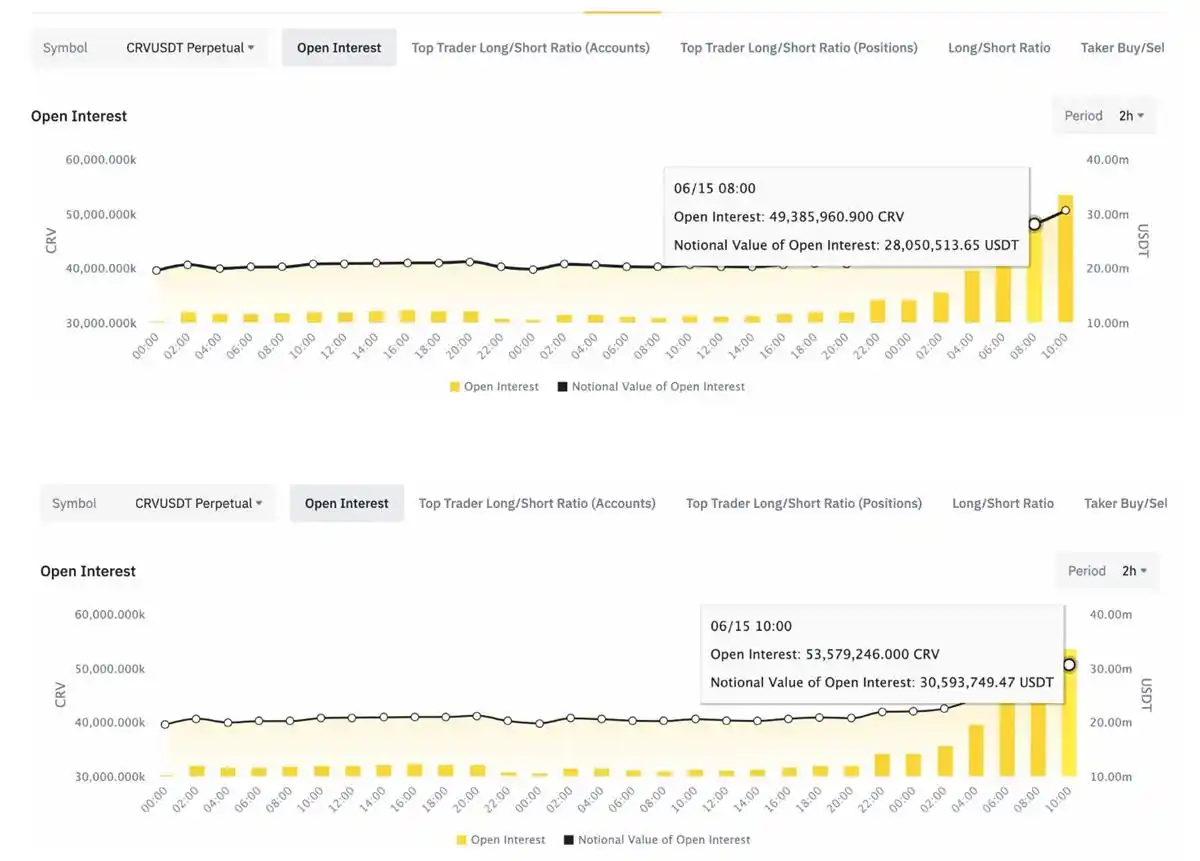

Although there are few ways to borrow CRV on-chain, there is a large amount of on-chain CRV spot selling pressure, and in the past 6 hours, the short-selling behavior of centralized trading platforms has increased significantly (190%+ APY on BN to short CRV), with an OI increase of 5 million in two hours and 14 million in 24 hours.

The founder of CRV currently borrows more than $44 million in stablecoins from AAVE, Abracadabra, Fraxlend, Curve, and Inverse Finance. If liquidation (specific information about liquidation price, etc. can be found in the previous thread) occurs, these lending platforms have potential bad debt risks.

However, in fact, Aave’s CRV of this volume will be liquidated in the case of a large slippage, so reducing the CRV borrowing pool LTV is the right risk control measure, but it should be slowly adjusted instead of suddenly changing the LTV to 0, which will greatly increase the bad debt risk of Aave.

In the past day, founder Michael withdrew more than 7 million wCRV (25%+) from Fraxlend and deposited it into Inverse Finance (fixed borrow rate 6.84%) address 0x73f8af created by Inverse Finance FiRM CRV market. The Curve founder mortgaged at least 6 million wCRV in this address, and currently there is over 9 million w TVL in the Inverse Finance CRV pool, most of which is mortgaged by the CRV founder.

In addition, 4 million CRV is still mortgaged in Abracadabra, and nearly 80 million CRV is in the Abracadabra CDP.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!