Recently, the cryptocurrency world experienced a major earthquake. Zhao Changpeng, the once glorious Chinese cryptocurrency tycoon, may be in trouble. Just a few days ago, the U.S. Securities and Exchange Commission (SEC) threw out a 136-page file. They sued Binance and Zhao Changpeng, and froze their related assets.

As the largest cryptocurrency exchange in the cryptocurrency world, Binance is known to everyone. 70% of spot trades in the entire cryptocurrency market are completed on Binance, so when Binance moves, the entire cryptocurrency market shakes. The founder of Binance, Zhao Changpeng, has a legendary background. Although he once worked at McDonald’s, he became the richest Chinese person at the end of 2021 with a net worth of over $90 billion due to his cryptocurrency business.

- What impact will SEC’s consecutive lawsuits against Binance and Coinbase have on the cryptocurrency market?

- Can the GameFi market usher in a new round of innovation and growth in the competition of blockchain games?

- Is the NFT Bull Market Reviving? Eight Sets of Data Analyze the Current Situation of the NFT Market

Due to Zhao Changpeng’s enormous influence in the cryptocurrency world, there are many memes about him. For example, the famous pun “playing coins for Zhao” implies that people who trade cryptocurrencies are putting money into Zhao Changpeng’s pocket. There are also news stories about “Sun Yuchen and Zhao Changpeng being shot by the FBI and large amounts of virtual currency being found in their homes.” Although Zhao Changpeng is attacked by various marketing accounts hundreds of times a year, SEC’s lawsuit may be the real threat to Binance and Zhao Changpeng.

Not only that, the entire cryptocurrency world, or the so-called Web3 circle, is facing a great upheaval.

In the SEC’s lengthy 136-page indictment, there were up to 13 charges. However, what the author considers the most important point is that they equate most virtual currencies with securities.

After all, whether virtual currency is a commodity or a security has always been a major problem for the cryptocurrency industry.

Take the United States as an example. If it is classified as a commodity, the regulator should be the Commodity Futures Trading Commission (CFTC). However, once it is defined as a security, the regulatory body becomes the Securities and Exchange Commission (SEC) and everything related to virtual currency must comply with the provisions of the Securities Exchange Act.

It is important to note that compared to “commodities”, the regulation of “securities” is much stricter.

Under the premise that virtual currency is a security, virtual currencies like Ethereum are long-term unregistered securities.

Zhao Changpeng’s operation of Binance is “illegal operation of a securities exchange”.

All of these result in huge fines.

So the question is, how did the SEC determine that these virtual currencies are securities?

The author found that the SEC used a method called the “Howey Test”, which includes the following four criteria:

- It is an investment of money;

- There is an expectation of profits from the investment;

- The investment is in a common enterprise;

- Any profit comes from the efforts of a promoter or third party.

In simpler terms, did you invest money? Are you looking to make a profit? Did you and many other investors put money into the same project? Are you only responsible for investing money, and do not affect the final outcome of the investment?

The more criteria that are met, the closer it is to being classified as a security.

If this standard is applied, many virtual currencies on the market will find it difficult to escape the sword of Damocles that is the “Howey Test.”

As a result, Zhao Changpeng and Binance were charged with “operating an unlicensed exchange without registering as a securities market” and “illegally issuing and selling unregistered virtual currency securities.”

Of course, other “crimes” committed by Binance and Zhao Changpeng are also quite interesting. For example, in order to evade regulation, Binance claimed that it did not conduct business in the United States, but secretly modified the IP address of American users to help some wealthy Americans evade regulation.

Zhao Changpeng even used customer funds to buy a yacht.

The powerful SEC even obtained the internal chat records of Binance personnel.

The contents include but are not limited to: “Brother, we are a damn unlicensed securities exchange in the United States.”

“We don’t want Binance to be regulated forever.”

“On the surface, we don’t have US users, but in fact, we should find other creative ways to get them.”

SEC also mocked them, turning one of the sentences into a poster and posting it on Twitter.

To sum up, the SEC accused Binance and Zhao Changpeng of “unlicensed operation, false statements, evasion of regulation, and fraudulent transactions.”

SEC’s demands are simple: fines, freezing of relevant assets, shutting down Binance and its subsidiaries, and returning illegal gains, etc.

However, the exact amount of the fine is still unknown.

Anyway, when the news of Binance and Zhao Changpeng’s being hammered came out, most people, like the reviewer, laughed and ate melon, after all, the chaotic cryptocurrency industry should have been hit a long time ago.

But the cryptocurrency industry is like facing a major enemy, because once Binance falls, especially if “most cryptocurrencies are securities” becomes a precedent, the entire cryptocurrency industry will enter a period of strong regulation.

“It’s time for us in the cryptocurrency industry to unite!”

“SEC is a joke!”

Old brothers in the currency circle exploded SEC’s Twitter.

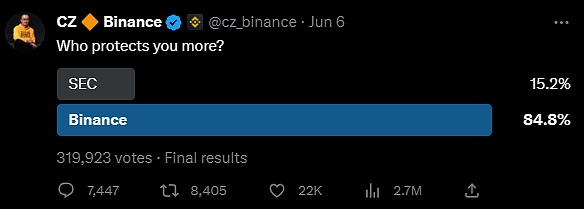

Even Zhao Changpeng himself took the lead in charging, initiating a vote on Twitter to determine who protects users better: Binance or SEC.

What’s even more interesting is that after CCTV reported on the SEC’s lawsuit against Binance, Zhao Changpeng took the time to tweet and tell everyone that he was “on CCTV again.”

It can only be said that his head is really hard…

If you think that the currency circle only knows how to tweet, then you underestimate them.

Because they really dug up some extra news.

And the story is far more exciting than you might imagine.

They discovered that Gary Gensler, the chairman of the SEC who was chasing Zhao Changpeng with a hammer this time, has quite a bit of “black history.”

Let me put it this way, back in the day, Gary Gensler loved virtual currency so much that he couldn’t get enough of it.

Someone dug up his comments from when he was teaching at university, and at the time he told students: three-quarters of virtual currencies are not securities, they are just commodities.

Binance’s lawyers also revealed that Gary Gensler, who was a professor at a university four years ago, even wanted to apply to be a consultant for Binance.

Of course, if you loved something so much back then, you would be tough on it now.

However, everyone speculates that Gary Gensler’s “blackening” is not due to love turning to hate, but due to personal reasons.

Remember the article by Bad Reviewer, “From a Net Worth of 10 Billion to Filing for Bankruptcy in Just 5 Days”?

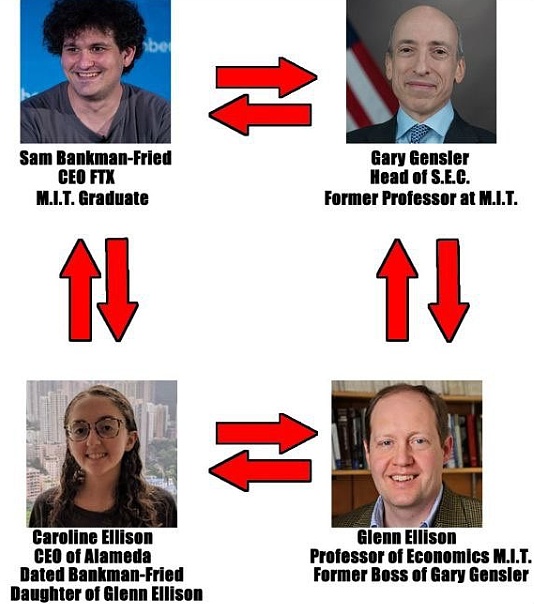

There is an entangled relationship between the bankrupt SBF and SEC Chairman Gary Gensler in the article.

SBF’s parents were once colleagues with Gary Gensler.

Gary Gensler’s former boss when he was in university later jumped to SBF’s company and became CEO. Half a year before SBF’s company went bankrupt, Gary Gensler met with SBF several times.

Anyway, between these two, they have gotten quite close.

But the relationship between Zhao Changpeng and “Explosion Head” is well-known, they both run exchanges and are enemies in the same line of work.

Zhao Changpeng’s liquidation of FTT tokens is also recognized as the trigger for Explosion Head’s bankruptcy.

In the eyes of many, the bankruptcy of Explosion Head is actually a strangulation of FTX, the world’s second largest virtual currency exchange, by Binance, the world’s number one.

So when Gary Gensler hit Zhao Changpeng with a stick, some interpreted it as revenge for “nephew” Explosion Head.

More conspiratorially, before Explosion Head had any trouble, he was also one of Biden’s biggest political donors, and Gary Gensler took over the SEC after Biden took office.

So some people speculate that this is still a “revenge against dad” by the Democrats for their financial supporters.

Of course, these speculations are currently only for fun, until there is solid evidence, they are all just unfounded.

Also, it’s not just Binance, but exchanges like Coinbase, Bittrex and others that have been hit hard by the SEC.

So let me make one thing clear, Gary Gensler is not the so-called destroyer of the coin circle and Web3. On the contrary, he is still the university professor who loves the coin circle very much.

Just love it a little too deeply.

After all, it is only by reducing speculation and deception and leading the coin circle towards standardization that it can truly contribute to the development of the entire industry.

This wave of SEC, is quite epic.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!