Author: Joy, BlockingNews

After every major market crisis, USDT seems to experience an anchor break, which seems to have become an iron law of the market. Today, after Binance and Coinbase were sued by the SEC and two Korean crypto institutions suspended user withdrawals, USDT once again broke its anchor. After analysis, BlockingNews did not find a direct reason for the USDT break, the biggest reason may be the combination of FUD and the lack of liquidity in the market.

At around 12:00 on June 15th, according to 0xScope monitoring, a total of 99 million USDT was sold in the 3CRV pool in the past 24 hours, resulting in a net outflow of $64.4 million. In the past three days, a total of 205 million USDT has been sold in the 3CRV pool, resulting in a net outflow of $130 million. Currently, USDT accounts for 54% of the 3CRV pool, slightly tilted. Two hours later, the proportion of USDT exceeded 73%, and the USDT price slightly broke its anchor, reaching 0.997.

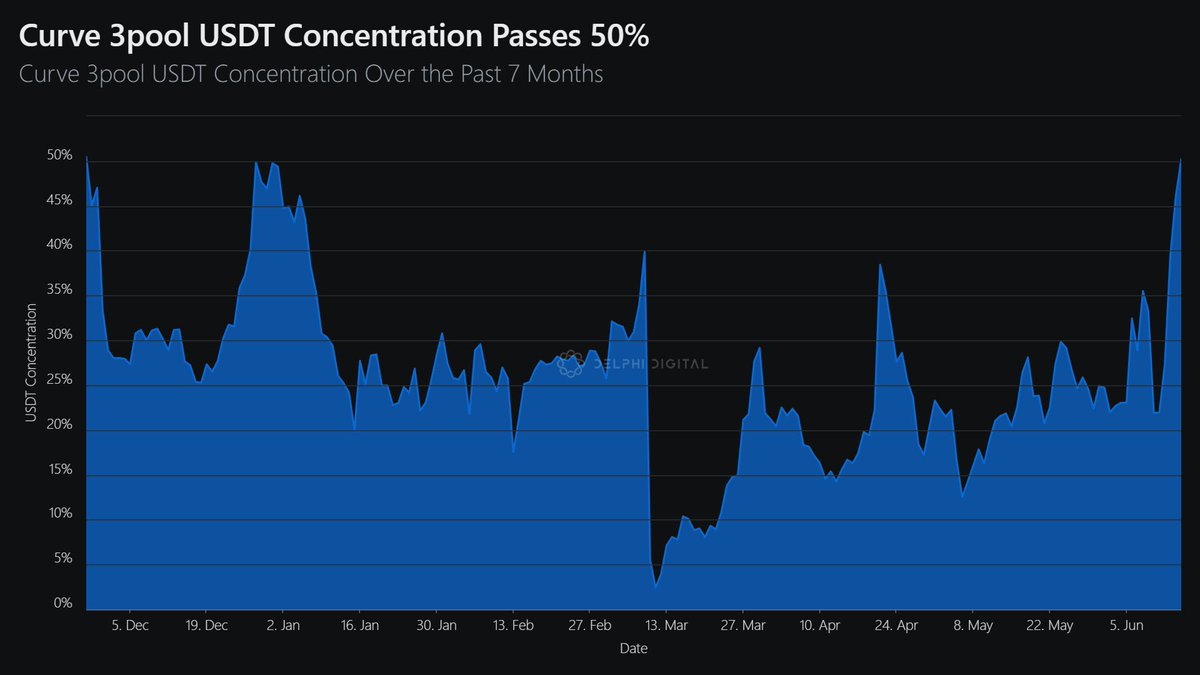

According to Delphi Digital data, the concentration of Curve 3pool USDT has increased to the highest level since the FTX collapse in November 2022. In the past 48 hours, the inflow of Cureve 3pool USDT has significantly increased.

- Analysis of Curve Founder’s “Collateralized Cash-Out” Behavior: From Shorting Costs to Market Impact

- LD Track Observation: Market generally falls, stablecoin market cap down by $950 million, ETH collateralization ratio increases by 1.63% MoM ……

- Overview of Frax frxETH V2 Mechanism: How to Create a Fully Decentralized Peer-to-Peer Market for Node Operators?

The market was once in a state of conflicting opinions, and everyone was looking for reasons, but some analyses and guesses were untenable.

Some say that this is market makers withdrawing USDT funds from Curve, but in fact, if you want to convert to US dollars, you can directly find Tether for exchange, without the need to exchange USDT for USDC or DAI on Curve. Not to mention that DAI cannot be directly exchanged for US dollars. Even if Circle, the issuer of USDC, exchanges USDC for US dollars, according to a market maker told BlockingNews, its handling fee is higher than directly exchanging USDT for US dollars through Tether. Therefore, this statement is not reliable.

There are also claims that Curve’s founder mortgaged a large amount of CRV to borrow USDT, which caused dissatisfaction among some members of the community, so they wanted to attack CRV, shorted CRV on one side, and raised the lending rate of USDT on the other. This statement has some truth, but there is no data to support it, and there is no obvious change in the amount of CRV on AAVE. BlockingNews checked the Curve founder’s address, and he only repaid 1.35 million USDT in the afternoon to maintain the health of the loan. Therefore, today’s market changes did not have a significant impact on him. On AAVE, the borrowing interest rates of USDC and USDT have increased significantly today, which is not a unilateral impact on USDT.

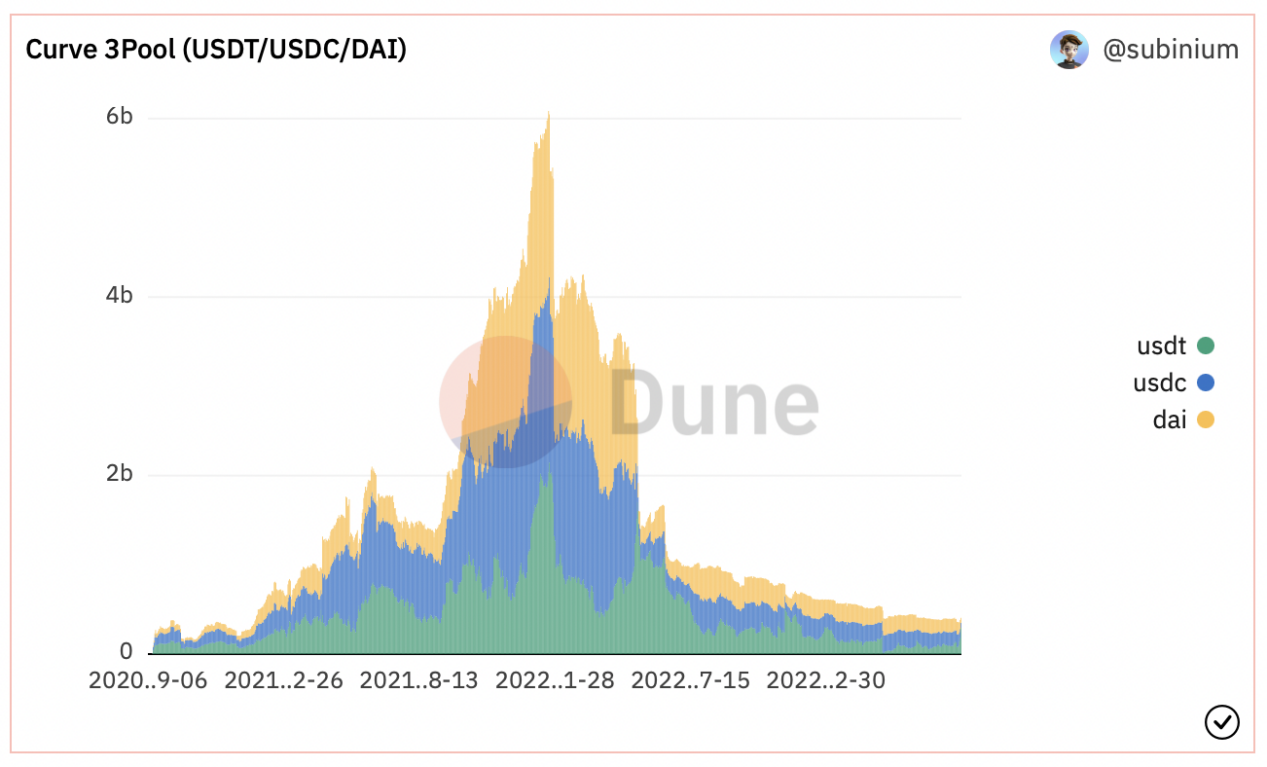

Actually, the TVL of Curve 3pool has dropped sharply from its peak of $6 billion in January 2022 to only $400 million currently, a total decrease of 93%, which also means that the liquidity of 3pool has significantly decreased.

Meanwhile, the 24-hour trading volume of only USDT and USDC in Uniswap V3 is $222 million. As of 5pm on June 15, according to CoinMarketCap data, several USDT-related trading pairs with other stablecoins or fiat currencies rank high, with a total trading volume of $1.7 billion. Curve 3pool can no longer be an important source of liquidity for the stablecoin market, and Curve has also lost its pricing power in the market.

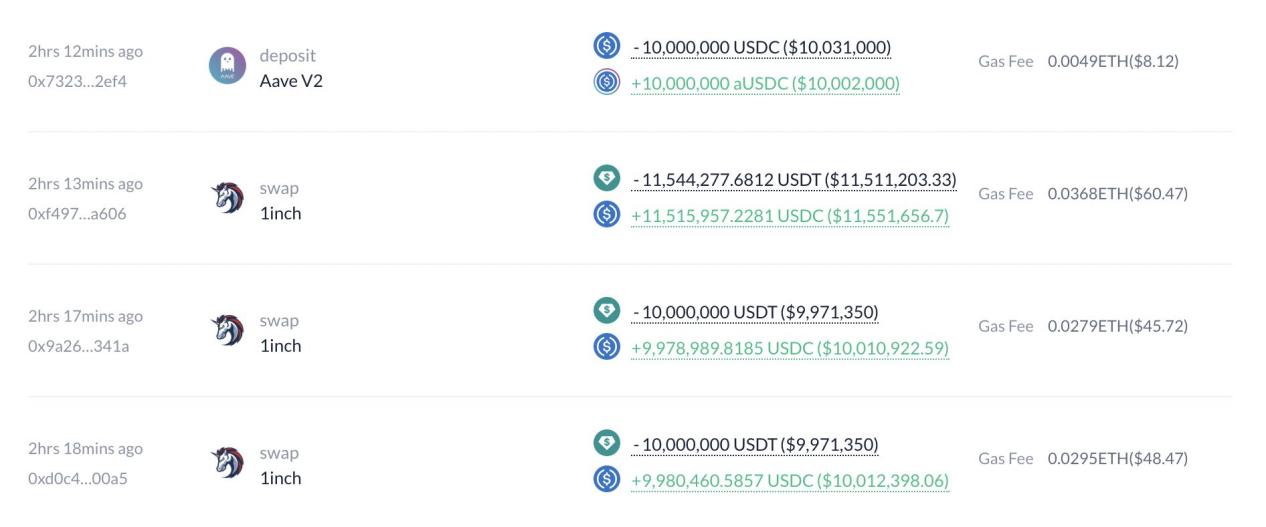

The market volatility has signaled to whales and traders to make money. After the unpegging, the USDT borrowing and lending rate in Aave V2 soared, with deposit rates soaring more than 20% and lending rates soaring more than 30%. Some big players borrowed USDT on Aave and sold it on Curve and other DEXs. The whale with the address czsamsun.eth borrowed 31.5 million USDT from Aave V2 using 17,000 ETH and 14,000 stETH as collateral, then exchanged all of it for USDC in 1inch. He then deposited 10 million USDC and 21 million USDC into V2 and V3 respectively, and then borrowed 12 million USDT from V3 and deposited it into V2. The whale opened a large number of short positions, which may have contributed to the initial panic.

After the USDT unpegging, the whale address starting with 0xD275 borrowed 50 million USDC from Aave and began arbitraging by buying USDT. He used 52,200 stETH as collateral in Aave V2 to borrow 50 million USDC and gradually exchanged USDC for USDT in batches of several million USDC at a time on Curve. In addition to on-chain operations, many traders also conducted arbitrage on centralized exchanges.

In the face of a slight unpegging, Tether CTO Blockingolo Ardoino also tweeted: “During this period of market turbulence, attackers can easily take advantage of widespread emotions. But Tether is as ready as ever, and we stand ready to redeem any amount.”

Therefore, the direct reason for the slight deviation of USDT today is not clear, but the current situation of weak liquidity, high uncertainty in the market, and investors’ worried psychological state have all become factors affecting the deviation of USDT.

Andrei Grachev, managing partner of DWF Labs, stated on Twitter: “Trading activities have reached the bottom, with a 24-hour spot trading volume of 23 billion US dollars, the lowest since the winter of 2019. Even currencies with large market capitalization can see price fluctuations of 20-30% within 24 hours, but they are still fragile. Projects, exchanges, market makers, and other market participants are trying to repair the market (behind the scenes), there is no 100% solution, but it will bring something to the market. We are at the bottom in terms of activity, but the price is uncertain. But at the same time, if lucky, our market activities should increase in the next few months, along with the price.”

In any case, it is a good thing for investors to remain cautious in the current state.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!