The SEC’s lawsuit against cryptocurrency exchanges Binance and Coinbase alleging that 19 tokens are securities has triggered a massive sell-off in the market.

SEC Allegations

SEC alleges that Coinbase operates unregistered security exchanges, brokers, and clearing agencies, as well as unregistered earning services for its pledged cryptocurrency assets. But the allegations against Binance are different. In addition to being accused of operating unregistered securities exchanges, brokers, and clearing agencies like CB, SEC also accuses it of engaging in more activities similar to FTX: deception, cross-entity mixed assets, and trading against customers, which SEC did not allege against Coinbase.

Written by @jinzejiang0x0, LD Capital

- Foresight Ventures: Market liquidity retreats, altcoin index plummets

- Bankless: In the current market, liquidity is king. Taking stock of DeFi projects that are building sustainable liquidity metaphors.

- Quick Overview of On-Chain USDT and RWA Fixed Income Market

Summary:

-

The SEC’s lawsuit against cryptocurrency exchanges Binance and Coinbase alleging that 19 tokens are securities has triggered a massive sell-off in the market.

-

The SEC’s allegations against Binance are more severe, including fraud, cross-entity mixed assets, and trading against customers.

-

The market reacted strongly, with the prices of 18 tokens defined as “securities” by the SEC falling an average of 28.8%, compared to a 7.4% drop in BTC during the same period. However, even though it was first sued by the SEC, BNB’s market share even increased slightly, demonstrating its relatively strong price resilience.

-

Most of the tokens defined as securities by the SEC in this case are in the public chain industry, accounting for 13/18, followed by entertainment and the metaverse, accounting for 4/18, and the latter saw a larger decline.

-

The report predicts possible future scenarios for the SEC lawsuit, including possible legal impacts and market reactions, and also discusses the progress of cryptocurrency industry legislation.

-

The report summarizes precedents of cryptocurrency cases, including illegal token issuance and unregistered investment and financing cases.

The US Securities and Exchange Commission (SEC) has filed lawsuits against cryptocurrency exchanges Binance and Coinbase on June 5 and 6, respectively, alleging that 19 tokens are securities, which has triggered a sharp sell-off in the entire market.

SEC has issued a warning to the financial market that most cryptocurrencies are securities, a position that may result in strict regulatory requirements for cryptocurrency exchanges.

Since Gary Gensler was sworn in as SEC Chairman in 2021, the industry has been predicting stricter cryptocurrency regulation. Gensler mentioned when he was a blockchain professor at MIT that many cryptocurrencies are likely securities, which means they should be regulated by the SEC and subject to US government jurisdiction.

SEC has taken enforcement actions against some industry companies and projects, such as Ripple Labs, LBRY, Kraken, and Bittrex. Now it seems that before taking action against the two largest exchanges, SEC is likely to “practice” with smaller companies first.

Chain reaction

These lawsuits and their subsequent effects have triggered a chain reaction in the industry. Binance.US announced the suspension of USD deposit and withdrawal in response to SEC’s action. Binance said that SEC’s challenge to its bank partners led to the interruption of fiat currency deposits and withdrawals.

Robinhood, a well-known broker, decided to delist cryptocurrency tokens classified by SEC as unregistered securities. After June 27, the platform will no longer support tokens such as Cardano (ADA), Polygon (MATIC), and Solana (SOL). It is reported that before SEC took action, it held MATIC, SOL, and ADA worth $583 million.

Crypto.com announced the closure of its institutional exchange, citing insufficient demand due to the US market landscape. This decision reflects the challenges faced by cryptocurrency companies as institutional investors, including pension funds, mutual funds, and university endowments, become cautious in turbulent market conditions and regulatory scrutiny.

On June 16, Binance was under investigation by French authorities for allegedly illegally providing digital asset services and engaging in serious money laundering. On the same day, Binance also announced its withdrawal from the Dutch market. Binance said that it will stop providing services to users in the Netherlands because it cannot register in the country.

Market changes

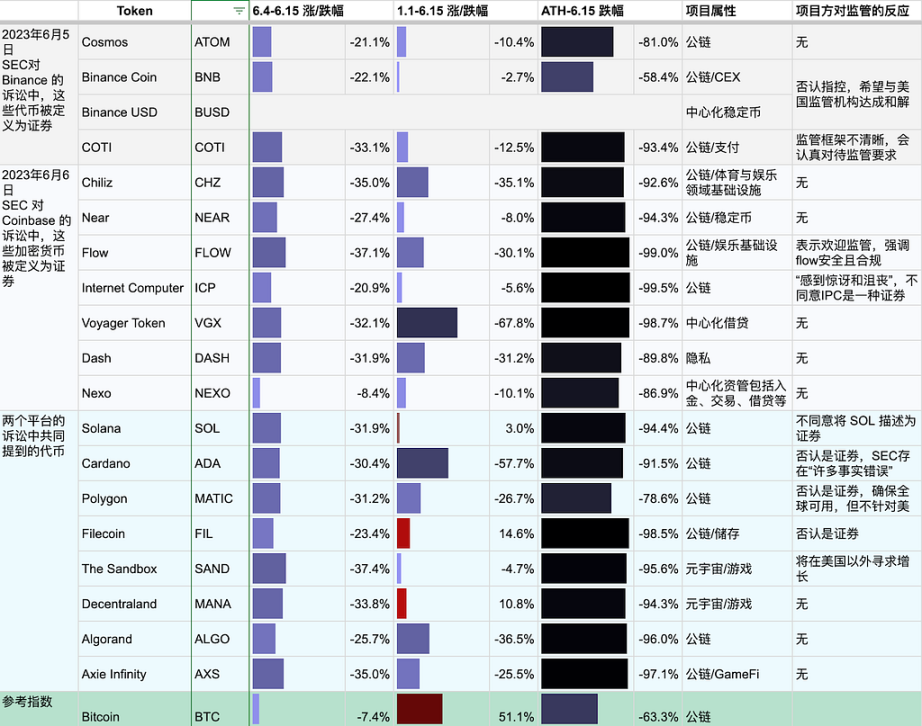

Table 1: Introduction and price comparison of tokens mentioned in June SEC lawsuits that may be securities. Source: Coinmarketcap, Coingecko, TrendResearch

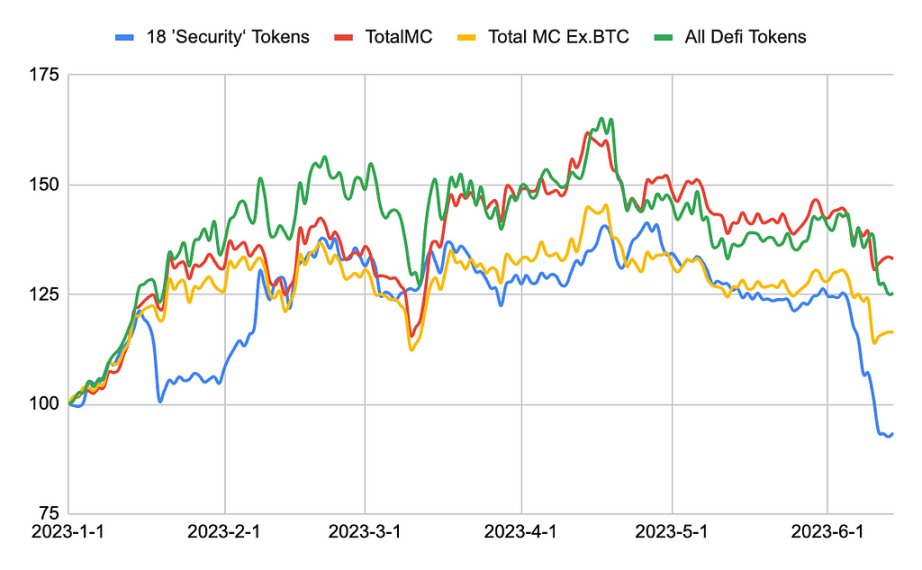

Figure 1: Comparison of the total market value of 18 tokens defined as “securities” by the SEC with the total market value of cryptocurrencies, Altcoins (total market value excluding BTC), and DeFi token total market value from 2023 to the present. Source: Coinmarketcap, Coingecko, TrendResearch

Figure 2: Comparison of the total market value of 18 tokens defined as “securities” by the SEC with the total market value of cryptocurrencies, total market value excluding BTC, and DeFi token total market value from 2022 to the present. Source: Coinmarketcap, Coingecko, TrendResearch

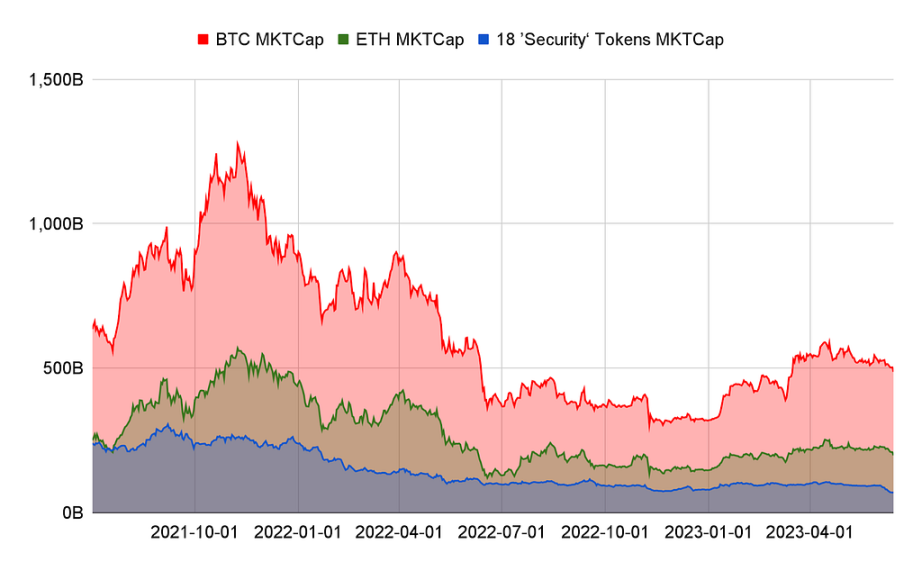

Figure 3: Comparison of the total market value of 18 tokens defined as “securities” by the SEC with the market value of BTC and ETH. Source: Coinmarketcap, Coingecko, TrendResearch

Figure 4: Comparison of the market capitalization changes of the 18 tokens defined as “securities” by the SEC. Source: Coinmarketcap, Coingecko, TrendResearch

We have compiled the price changes of the cryptographic tokens that have been identified as securities by the SEC this month over a period of time. Except for BUSD, among the 18 named tokens, it can be seen that:

Table 1 shows that there are mostly public chains in the industry, accounting for 13/18, followed by entertainment and metaverse with 4/18, and asset management and lending with 2/18;

Figure 4 shows that BNB has accounted for over 50% of the total value this year, and even though it was first sued by the SEC, its market share has even slightly increased, indicating that its price has relative resilience; since early June, the average price has dropped by 28.8%, compared to 7.4% for BTC during the same period, indicating that the drop is considerable;

Figure 3 shows that the market value peak of the 18 tokens appeared in September 2021, when it exceeded 300 billion U.S. dollars, and the market value trough appeared after SEC regulation was implemented this month, only 70 billion U.S. dollars;

Since early June, the top three declines are FLOW (-37.1%), SAND (-37.4%), and CHZ (-35.0%), indicating that the decline of entertainment-related tokens is relatively large;

Since early June, the smallest declines are NEXO (-8.4%), ATOM (-21.1%), and BNB (-22.2%). NEXO has paid fines and reached a settlement with the SEC earlier this year, so it has the smallest impact. BNB is the largest market value among the charged tokens (nearly 50 billion U.S. dollars before the decline), and its low volatility can be understood, but the market value of ATOM is only over 3 billion, and its resistance to decline is shown;

Since their respective price highs, these tokens have fallen an average of 91%, with the smallest decline being BNB (-58.4%), MATIC (-78.6%), and ATOM (-81.0%). BNB and ATOM have also been among the coins with the lowest decline since June, indicating their price resilience.

Since their respective price highs, the biggest declines have been ICP (-99.5%), FLOW (-99%), and FIL (-98.5%), among which ICP fell only 5.6% this year and FIL has gained 14.6%. This shows that the downward momentum of prices after a major adjustment has already slowed down.

Figure 1 shows that before the regulatory events in June, the performance of 18 tokens within 2023 was lagging behind the broader market, and the lag widened after the regulatory events, with the return of all gains turning into losses within the year.

Figure 2 shows that if the timeline is extended to the beginning of 2022, the performance of 18 tokens still lags behind the broader market, but has outperformed Defi tokens for most of 2022.

Figure 5: The 30-day rolling beta value of 18 tokens defined as “securities” by the SEC versus BTC+ETH. Source: Coinmarketcap, Coingecko, TrendResearch

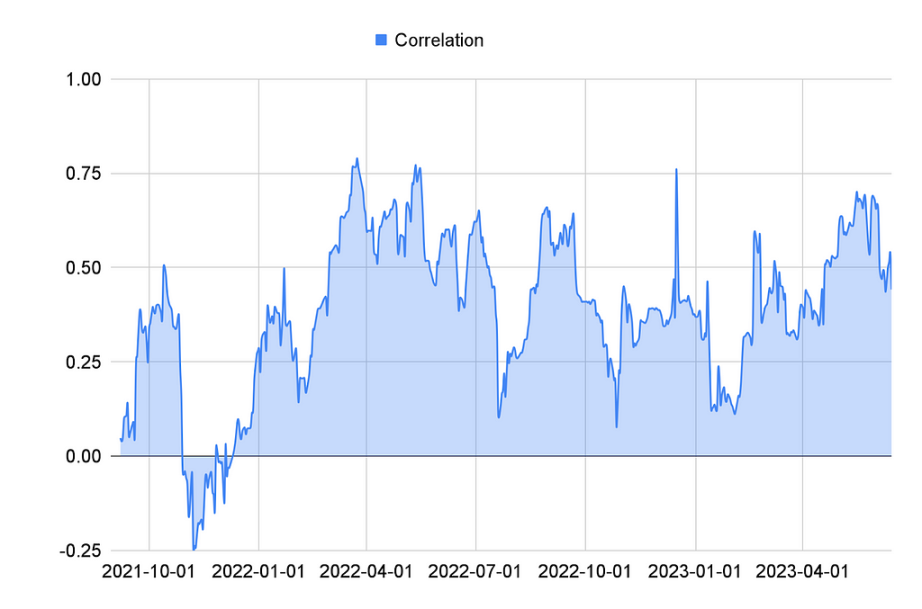

Figure 6: The 30-day rolling correlation of 18 tokens defined as “securities” by the SEC versus BTC+ETH. Source: Coinmarketcap, Coingecko, TrendResearch

Beta represents the systematic risk or market risk of tokenized securities relative to the benchmark index. If the beta is greater than 1, the price fluctuations of tokenized securities may exceed the benchmark index; if the beta is less than 1, the price fluctuations of tokenized securities may be lower than the benchmark index.

Looking at the rolling beta value, the market value fluctuation of these “security” tokens is actually smaller than that of blue chips based on BTC and ETH. This is not surprising, mainly considering that under diversified allocation, the rise and fall cycles of each token due to project factors are not completely overlapping, which also lowers the entire portfolio’s beta relative to the benchmark index.

From the data, we can see that beta and correlation have significant changes at different time points, which may be related to market conditions, token fundamentals, or macroeconomic factors. When the beta value is high, it indicates that the price of tokenized securities is more affected by the market. When industry sentiment is extremely optimistic or pessimistic, correlation and beta tend to rise, which means that the utility of diversified allocation is weakened.

Overall, if invested in a market-weighted manner, such a portfolio has underperformed BTC and ETH in the past two years, indicating that the price resilience of altcoins is not as good as BTC and ETH in a bear market.

What is a security?

According to US regulations, whether something is a security depends primarily on whether it resembles the shares issued by a company when it raises funds. The SEC currently mainly applies the Howey Test, a 1946 Supreme Court ruling. Under this framework, when an investor puts in money with the intention of profiting from the efforts of the organization’s leaders, the asset may fall within the jurisdiction of the SEC.

What are the implications of being defined as a security?

Calling tokens securities will make operating a cryptocurrency exchange more expensive and complex. According to US rules, this label carries strict investor protection requirements for the platform and issuer. This means that exchanges will face ongoing scrutiny from regulatory bodies, which could result in penalties, and in the worst case, criminal charges if law enforcement is involved.

If a large number of cryptocurrencies are classified as securities, it will fundamentally change the way the cryptocurrency industry operates. First, compliance with securities laws becomes critical, requiring these altcoins and their issuers to comply with strict regulatory requirements. This includes registering with the SEC, providing necessary disclosures, and complying with reporting obligations.

In addition, classification may lead to potential trading restrictions. If most altcoins are viewed as securities, they can only be traded on registered securities exchanges subject to specific rules and regulations. This may limit retail investors’ liquidity and accessibility to these assets and introduce additional barriers to market participation.

For POS public chains such as Polygon or Binance Smart Chain, wearing the security hat will create many problems, such as financial accounting for user payment of transaction fees, KYC for validators, taxation, and whether any DeFi applications on the chain are legally authorized. These labels can be said to be more destructive to the long-term health of the industry than the closure or exit of several exchanges from the US market.

SEC lawsuit future scenario

Lawsuits against Binance and Coinbase reflect the increasingly tense relationship between the government and the cryptocurrency industry. SEC Chairman Gary Gensler has made it clear that more digital currencies are not needed and emphasized that the US already has a digital currency called the dollar. US Treasury Secretary Janet Yellen also expressed support for the SEC’s actions, agreeing to use regulatory tools to protect consumers and investors. This reflects regulatory agencies’ clearer stance against cryptocurrencies or becoming the basic principles of the traditional financial system.

In the future, we may see the following four possible scenarios:

-

Expansion of regulatory enforcement against more blockchain projects, especially high-market-cap public chains, through direct lawsuits. Recently, the SEC has mainly filed lawsuits against exchanges, and in the relevant documents, the 19 listed tokens, except for BUSD and NEXO, have not yet received a direct warning or lawsuit, which may foreshadow more legal actions in the future.

-

Accusations from civil to criminal charges. Since the SEC and CFTC do not have the power to initiate criminal charges, such charges may not yet have arrived. Criminal charges against cryptocurrency exchanges or projects typically involve fraud, money laundering, or other illegal activities. These cases are usually handled by law enforcement agencies such as the FBI or the US Department of Justice. For example, last year, the DoJ announced criminal charges against six defendants in four cryptocurrency issuance cases, alleging involvement in cryptocurrency-related fraud. Another example is Sam Bankman-Fried, who faces 12 criminal charges in the case involving FTX and Alameda, including conspiracy to commit bank fraud and operate an unlicensed money transfer business, wire fraud against FTX customers, securities fraud against FTX investors, and conspiracy to make illegal political donations and defraud the Federal Election Commission.

-

SEC or Gensler’s authority may be revoked. Many US politicians do not approve of the SEC’s tough regulation.

For example:

US Senator Bill Hagerty wrote on Twitter, “The SEC is using their role to kill an industry. Allowing a company (Coinbase) to go public, then hindering them from registering as a compliant exchange.”

US Senator Cynthia Lummis also wrote on Twitter, “The SEC has failed to provide a path for digital asset exchanges to register, and worse, has failed to provide adequate legal guidance to distinguish what is a security and what is a commodity.”

On June 16, Republican Representatives Warren Davidson and Tom Emmer proposed a bill called the “SEC Stewardship Act” to reshape the SEC and remove current Chairman Gary Gensler. The bill proposes increasing the number of SEC commissioners, adding directors to supervise the commission, and avoiding regulation policies from being influenced by the personal ideas or political struggles of the SEC chairman.

4. Legal disputes or quick rectifications with fines. The sued team or individual actively defends, and the legal battle may last for years, such as the Ripple and SEC lawsuit, which has been ongoing since December 2020 and has yet to reach a conclusion. Of course, if the sued team or individual quickly compromises, makes business adjustments, and accepts fines, the case may also be quickly settled, such as Kraken and the SEC settling in less than a month earlier this year.

Progress of cryptocurrency industry legislation

Congress may pass a cryptocurrency regulatory framework, which will provide clearer rules for the operation of US cryptocurrency and related businesses. This clarity may stimulate further development and innovation in the industry. A legislative draft initiated by Representatives Blockingtrick McHenry and Glenn Thompson in the House Financial Services Committee is considered the most viable legislation. This legislation attempts to clarify the jurisdiction of various agencies over certain digital assets and “strike an appropriate balance” between protecting consumers and encouraging responsible innovation.

This 162-page draft was released in early June, which initially considered digital assets that were securities to eventually be regulated as commodities. Whether it is a security or a commodity largely depends on the degree of decentralization of the underlying blockchain network.

It is suggested that if a network meets certain requirements, the network will be regarded as decentralized, and tokens that meet the commodity conditions will be regulated by the Commodity Futures Trading Commission (CFTC).

The specific criteria include no one unilaterally having the “ability to control or make substantial changes” to the network’s functions or operations in the past 12 months, and no token issuer or affiliate holding more than 20% of the tokens.

However, this bill is expected to face significant opposition from Congressional Democrats. SEC Chairman Gary Gensler and some Democrats believe that most digital assets should be classified as securities and that existing regulations are sufficient.

It is unclear when the bill may be put to a vote in Congress, but it is an important step in the ongoing discussion of digital asset regulation.

Cryptocurrency case precedents

Ripple (XRP): In 2020, the SEC sued Ripple Labs Inc. and its two executives, accusing them of conducting an unregistered securities offering worth $1.3 billion using a digital asset called XRP. The SEC’s claim is that although Ripple positions XRP as a cryptocurrency, its issuance process is closer to traditional securities issuance and should therefore be subject to securities law. This is the largest cryptocurrency-related lawsuit the SEC has filed to date. As of my knowledge update (September 2021), the case is still ongoing with no final decision.

Block.one (EOS): In 2019, the SEC announced a settlement with Block.one, which agreed to pay a $24 million fine to resolve the SEC’s charges that Block.one’s initial coin offering (ICO) of EOS between 2017 and 2018 violated securities laws. This was an important case because it showed that the SEC may impose substantial fines for ICOs that violate securities laws.

Telegram (Grams): In 2020, the SEC successfully halted the issuance of Telegram’s Grams tokens. The SEC’s position in this case was that the Grams tokens were unregistered securities, and as such, their issuance violated securities laws. Ultimately, Telegram agreed to pay a fine and refund investors’ funds.

Kik (Kin): In 2020, the SEC successfully brought a lawsuit against Kik Interactive Inc., which had conducted an unregistered securities offering through a digital asset called Kin. Kik ultimately agreed to pay a $5 million fine to settle the SEC’s charges.

BlockFi: The SEC believes that investors lending cryptocurrency to BlockFi in exchange for promises of variable monthly interest payments constitutes a security under applicable law; additionally, the SEC believes that BlockFi has issued securities and that it has invested over 40% of its total assets (excluding cash) in securities, and that it has violated registration requirements under the 1940 Investment Company Act. BlockFi will ultimately pay a fine of $50 million directly to the SEC and an additional $50 million in the form of fines to 32 U.S. states to settle similar charges. The settlement represents the largest recorded fine suffered by a cryptocurrency company at the time.

NEXO: The SEC charged Nexo Capital with issuing and selling unregistered retail cryptocurrency lending products called Earn Interest Product (EIP). On January 20, 2023, cryptocurrency lending platform Nexo reached a settlement with the SEC and state regulators, agreeing to pay a total of $45 million in fines and to stop offering lending products. The SEC agreed to settle with Nexo, taking into account the company’s swift remedial measures and cooperation with the commission’s staff.

Kraken: In February 2023, the SEC filed securities violation charges against cryptocurrency exchange Kraken due to transparency concerns over its staking token interest business. The SEC reached a $30 million settlement with Kraken that same month, and Kraken will discontinue its “cryptocurrency staking” program which provides investment returns.

Encrypted Livelihood Business

US regulation not only applies to the issuance and trading of security tokens, but also to financial businesses, such as BlockFi and NEXO mentioned above.

If a company provides a platform for users to store funds and pay a certain interest, then this business model is closer to the deposit business of banks or financial institutions. In this case, the company needs to register and obtain a license as a bank or financial institution according to local laws and regulatory requirements.

In the United States, such companies may need to obtain licenses from the Federal Reserve System, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), or state banking regulatory agencies. These agencies are responsible for regulating banks and financial institutions to ensure that their operations comply with legal and regulatory requirements.

In other countries and regions, companies may need to obtain licenses from the corresponding bank and financial services regulatory agencies. For example, in Europe, this may include the European Central Bank and national bank regulatory agencies in each country.

It should be noted that such licenses usually require meeting a series of requirements, including capital requirements, risk management requirements, and corporate governance requirements. In addition, companies also need to comply with regulations such as anti-money laundering (AML) and customer identity verification (KYC).

Is regulation outdated?

Supporters of more regulation believe that the designation of securities will bring more information and transparency to investors due to the applicable SEC disclosure requirements. However, cryptocurrency enthusiasts argue that their projects are decentralized to some extent, which makes old rules unsuitable, and cryptocurrency trading platforms believe that the assets they list should be considered commodities rather than securities. In the United States, rules governing the trading of commodities and their derivatives focus more on ensuring that companies, producers, and farmers can effectively hedge against price fluctuations.

Despite the increased scrutiny of regulatory agencies, the cryptocurrency industry is still looking forward to the passage of new laws by Congress to legalize the industry. Last year, Democrats and Republicans proposed several bills that would bring cryptocurrency under the jurisdiction of the Commodity Futures Trading Commission and make other products, including stablecoins, more legitimate by regulating the assets they can hold.

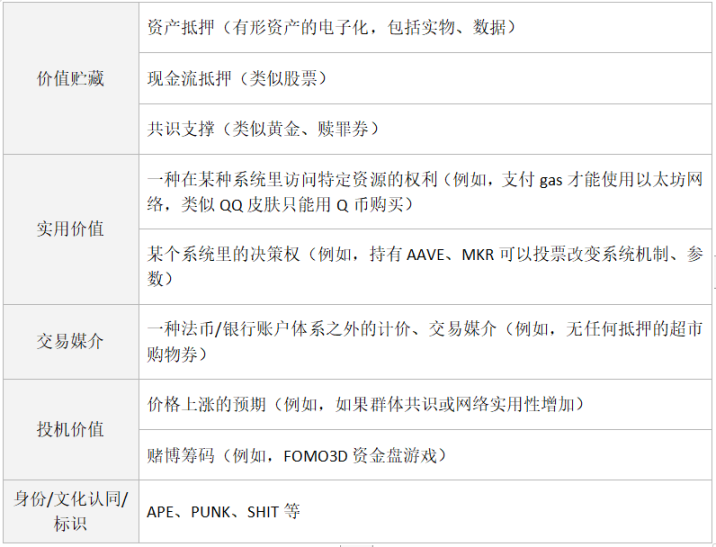

Due to the unique properties of encrypted assets, which can contain multiple sources of value beyond traditional securities, it may be outdated to regulate them using the securities law framework of ninety years ago.

Table 2: Classification of the sources of value of digital assets. Source: TrendResearch

Table 3: Cryptocurrencies defined as securities by the SEC in various lawsuits before June. Source: SEC, TrendResearch

Reference:

https://beincrypto.com/full-list-cryptos-securities-sec-lawsuit-binance-coinbase/

https://www.bloomberg.com/news/articles/2023-06-13/these-are-the-19-cryptocurrencies-are-securities-the-sec-says

https://www.bloomberg.com/news/articles/2022-07-29/why-crypto-flinches-when-sec-calls-coins-securities-quicktake

https://mp.weixin.qq.com/s/DSytFWfcnlA2FdWhTQt2IQ

https://www.sec.gov/files/litigation/complaints/2023/comp-pr2023-101.pdf

https://www.sec.gov/litigation/complaints/2023/comp-pr2023-102.pdf

https://www.justice.gov/oBlocking/pr/justice-deBlockingrtment-announces-enforcement-action-charging-six-individuals-cryptocurrency-fraud

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!