Author: BlockingBitpushNews Mary Liu

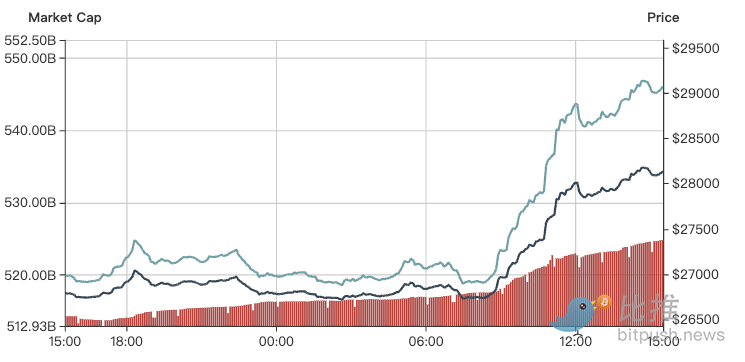

On the afternoon of June 20th, New York time, Bitcoin broke through $28,000, its first time since May 29th.

Blocking terminal data shows that as of 4:05 PM New York time, Bitcoin rose to $28,016, a 5% increase in 24 hours. According to CoinGlass data, short sellers lost about $36.6 million in liquidation in the past 24 hours. This is the largest short position closing since May 28th.

- 6 Narratives That Could Take Off in the Next Bull Market

- Understanding Global Stablecoins: An In-Depth Analysis of Their Current Status and Regulations in 2023

- A Brief Discussion on Uniswap V4: The Culmination of DeFi Innovation

Institutions entering the market trigger Bitcoin rebound

After several large traditional financial institutions announced their crypto plans, market sentiment turned optimistic.

Banking giant Deutsche Bank said on Tuesday that it has applied for a digital asset custody license in Germany. Financial giants such as Charles Schwab Jiaxin Wealth Management, Citadel Securities, and Fidelity Digital Assets invested in the cryptocurrency exchange EDX Markets, which has opened BTC, Ethereum, Litecoin, and Bitcoin Cash (BCH) transactions.

Last week, investment management giant BlackRock submitted an application for a spot BTC exchange-traded fund (ETF), which surprised the market and also pushed up the price of Bitcoin. This move also affected other Bitcoin products, such as Grayscale’s Bitcoin Investment Trust Fund (GBTC), which saw trading volume surge by 400%.

Although BlackRock is not the first company to apply for a Bitcoin ETF with the SEC, it is currently the largest among all applicants. Managing assets of more than $8.5 trillion, the company will also use Coinbase to custody Bitcoin in the trust. So far, the SEC has refused to approve a spot Bitcoin ETF, although companies including Cathie Wood’s ARK and 21Shares have submitted three applications.

Brent Xu, CEO and co-founder of the decentralized finance (DeFi) bond market platform Umee, told Coindesk: “The rise in Bitcoin is definitely related to all the news that these large traditional financial institutions want to seriously engage with the digital asset ecosystem. Obviously, the client base of BlackRock, Fidelity, and others wants to invest in Bitcoin and other cryptocurrencies through ETFs and other more traditional investment tools. This to some extent offsets the impact of the relatively pessimistic regulatory environment in the United States, and also seems to indicate that these large companies want a clearer and fairer regulatory environment than now.”

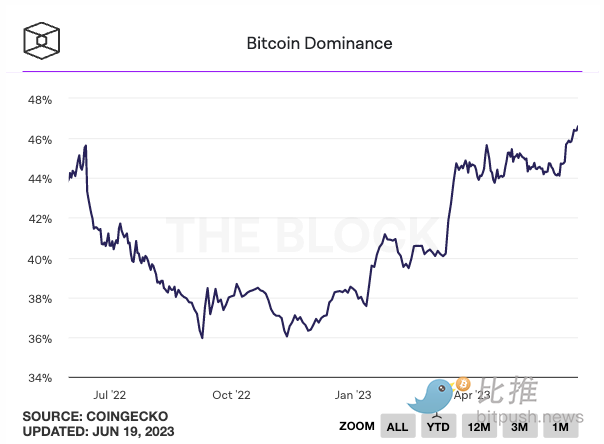

Recent data shows that bitcoin’s dominance has risen to its highest level in nearly two years, at 45.84%, after the US SEC filed lawsuits against cryptocurrency exchanges Binance and Coinbase and declared multiple tokens as unregistered securities. The last time such a level was seen was in July 2021, when it peaked at 46.77%.

US dollar index cools, halving event is positive

Another positive signal is the cooling of the US dollar index (DXY). Historically, when the DXY index falls, the sentiment of risk assets such as bitcoin increases. As the Fed paused its interest rate hike last week, some market participants believe that the US economy may grow and the dollar may continue to cool. If this happens, bitcoin may continue to rise with the stock market. The better the macro environment, the more favorable it is for the bitcoin price.

The upcoming bitcoin halving in April or May 2024 may also be a factor. Bitcoin halving occurs approximately every four years, reducing the reward for mining new bitcoin blocks by half, effectively slowing down the rate of new bitcoin production to control inflation and maintain bitcoin scarcity. The upcoming halving will reduce the block reward from 6.25 BTC to 3.125 BTC. Morgan Stanley analysts predicted at the end of last month that the upcoming halving may help bitcoin reach a price of $45,000.

Bitcoin is bullish and MicroStrategy founder and chairman Michael Saylor said earlier this week in an interview with Bloomberg that he expects BTC to rise tenfold from around $25,000 and then rise tenfold again. He said: “The whole industry is going to rationalize and you’re going to be left with bitcoin and six to ten or twelve other proof-of-work (POW) tokens.”

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!