Key Narration: Non-Oracle Reliant Protocols

In a relatively calm market environment, a new batch of DeFi builders are garnering attention by reimagining the architecture of lending and derivatives protocols to not rely on oracles. The core design change of these protocols is that they no longer depend on oracles. Traditionally, DeFi protocols that offer leverage use oracles to determine when liquidations should occur or what the outcome of a derivative contract should be, using the spot lending market or derivative financial instruments.

For lending protocols, this means that eligible collateral is limited to assets with reliable oracle price data sources. Loan parameters, such as loan-to-value ratios, are determined by the protocol, so any resulting bad debt is the responsibility of the protocol rather than the individual borrower. Similarly, derivative protocols that rely on oracles for pricing lack an internal price discovery mechanism and are susceptible to lagging price updates, severely limiting their scale and user experience.

Finally, oracles create another attack vector for DeFi protocols. While security is generally thought to be inherited from the underlying smart contract network of the protocol, it also depends on functioning oracles. If a protocol’s oracles are compromised, they can be manipulated to give attackers an unfair advantage over the protocol and its users. This explains why Avi Eisenberg was able to carry out his infamous Mango Markets hack last October.

Newcomers

Rising “non-oracle” protocols aim to rebuild the core services of DeFi with novel architectures but come with their own set of trade-offs. Their basic designs can be broadly categorized into two general types: peer-to-peer lending and hybrid protocols built on automated market makers (AMMs).

- Nansen On-chain Data Report: How has Arbitrum performed after the airdrop?

- Research Report on Parallel Processing of Multiple Blocks for Public Chain Transformers

- Sei Network in-depth analysis: a fast Layer1 public chain designed for trading, can it become a decentralized “NASDAQ”?

Peer-to-peer Lending

Peer-to-peer lending shifts the burden of pricing and underwriting from the protocol to the users. Borrowers no longer define the interest rate and LTV parameters, but instead determine the value ratio themselves. This results in a lending order book similar to trading on centralized exchanges (CEXs). Loans that are within borrowers’ ideal range will attract interest actively, but liquidity beyond the range will remain idle.

Removing oracles from the mechanism of a protocol means that these loans can be created by any on-chain collateral. This shifts the burden of bad debt from the protocol to the user and opens the door for long-tail assets in lending cryptocurrency.

While the peer-to-peer design offers greater loan customization capabilities, it creates a poorer user experience. To ensure that the provided liquidity is effectively utilized, users must actively manage their positions in a manner similar to a centralized liquidity location such as Uniswap V3. Whether it is savvy users or an external protocol managing these positions, they may rely on oracles to determine when to adjust their positions. This effectively reintroduces oracle risk into the equation.

Well-known protocols in this category include Blend by Blur, PWN.xyz, and Ajna.

Hybrids Based on AMM

The second category of oracle-less protocols is built on top of AMM LP positions. The most common design for these protocols is centered around Uniswap V3’s centralized liquidity location, relying on DEX liquidity to provide users with access to leverage or derivative financial instruments.

The degree of reliance on oracles in this design category is reduced, allowing protocols to calculate the results of liquidation and derivative contracts from their underlying liquidity pools. Essentially, the LP position itself acts like an oracle. Additionally, these LP positions provide a primary market during liquidation or contract expiration to unload protocol inventory rather than requiring collateral to be liquidated on an external platform. This creates greater efficiency within the protocol and helps to mitigate some forms of MEV.

Notable protocols in this category include InfinityPools, Limitless, and Blockingnoptic.

Key Events

Arbitrum Supports Native USDC

Source: Circle

Circle, the issuer of the USDC stablecoin, added native USDC issuance support for Arbitrum on June 8. Prior to this, USDC could only be issued on supported chains such as Ethereum and bridged to Arbitrum through derivative products. Now, Circle can directly issue USDC to users on the Arbitrum One rollup, lowering the barrier to entry for users on the most popular rollup on Ethereum. Existing USDC bridged from Ethereum has been renamed to USDC.e.

It is worth noting that this makes Arbitrum the first rollup to receive native USDC issuance support from Circle, joining Layer-1 ecosystems like Avalanche, Solana, Polygon, and Tron. This move signifies Circle’s readiness to launch its CCTP USDC bridge in the most popular cryptocurrency ecosystems in the coming months. The CCTP will allow Circle to mint and burn native USDC across all supported networks.

Prime Trust

BitGo, a wallet infrastructure provider and digital asset custodian, has preliminarily agreed to acquire its competitor infrastructure, Prime Trust. This impending acquisition comes after a tumultuous year for Prime Trust. After completing a $107 million Series B funding round in June 2022, Prime Trust ran into legal troubles in August when the custodian failed to return $17 million worth of crypto assets to crypto lending platform Celsius. In early 2023, reports emerged that Prime Trust had laid off a third of its staff and withdrew its application for a money transfer license in Texas.

Months before the recent acquisition announcement, rumors of Prime Trust’s bankruptcy increased pressure for its partners to move their business elsewhere. Bitcoin payment providers Swan and Strike dropped the platform’s custody services, while TrueUSD suspended stablecoin minting through Prime Trust and briefly lost its dollar peg.

If the proposed deal goes through, BitGo will strengthen its existing infrastructure and add support for Prime Trust’s crypto IRA products. If the current crypto bear market and regulatory scrutiny continue, we may see more consolidation among the largest regulated entities in the industry.

Curve CEO Sparks Controversy

Source: FinTelegram

Michael Egorov, the CEO of Curve Finance, has become the center of controversy among various DeFi lending platforms. Concerns were raised over Egorov’s ability to borrow stablecoins using his CRV holdings in a lending protocol, which reportedly allowed him to purchase AU$40 million worth of Australian real estate, with the possibility that his large loan may never be repaid.

The situation escalated on June 12th when risk management platform Gauntlet proposed a proposal on Aave’s governance forum to prevent further borrowing of CRV on Aave V2. Specifically, Gauntlet proposed freezing CRV as eligible collateral for new loans and setting the loan-to-value ratio of CRV to 0 to ensure that no additional CRV can be deposited to support existing loans. This second point is particularly important because CRV liquidity has decreased by 50% between centralized and decentralized exchanges in the past few months.

According to LookOnChain data, Egorov has deposited 431 million CRV on various lending platforms (more than half of the circulating supply of 854 million) and borrowed a position worth $101.5 million. The price of CRV has fallen 35% in the past week, not far from its all-time low. If the price continues to fall, the lending protocol will be forced to liquidate Egorov’s loan, and given that CRV’s liquidity on exchanges is shrinking, this may result in bad debt.

The whole situation raises questions about the morality of Egorov’s actions. Although the founder did not sell his tokens listed on exchanges, his continuous borrowing achieved the same goal without the negative social sentiment typically associated with insider selling behavior by on-chain sleuths. Additionally, there is a larger debate about whether decentralized protocols should issue emergency parameter changes for specific users who comply with all protocol coding rules. As the situation develops, Messari’s Intel and Governor products will be the best way to stay up to date.

Centrifuge Prime

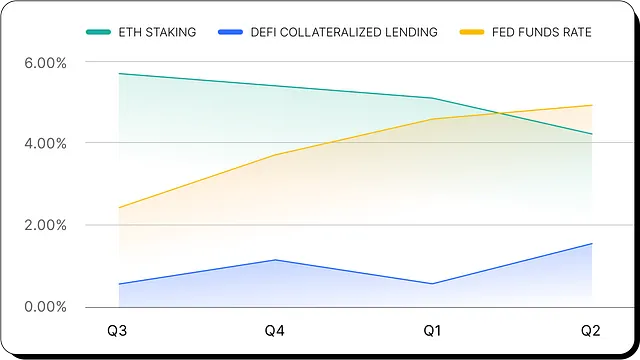

The real-world assets (RWA) protocol Centrifuge announced its new product Centrifuge Prime, which helps Web3 protocols integrate RWA. Centrifuge is already known for supporting well-known DeFi protocols like MakerDAO and Aave by collateralizing RWA as part of its lending service. With the recent rise in federal fund rates, on-chain treasury management strategies are increasing demand for RWAs such as US Treasuries and money market funds.

With Centrifuge Prime, Web3 organizations can gain increasingly diverse RWA adapted to their risk configurations. Centrifuge Prime offers the following investment categories:

– Liquidity includes US Treasuries and money market funds, with a targeted annualized return rate (APY) of 4-5%.

– Preservation includes asset-backed securities, private credit, mortgage-backed securities, and loan securitization debt, with a targeted APY of 8-10%.

– Growth includes ESG investments, accounts receivable financing, real estate, and trade financing, with a targeted APY of over 13%.

The most valuable part of Centrifuge Prime is its pre-defined legal settings, allowing DAOs and other Web3-native organizations to hold Centrifuge tokenized assets in compliance with regulatory requirements. In addition to turnkey legal structures and asset management services, Centrifuge Prime also comes with third-party financial reporting and credit risk analysis. These services are initially provided by Steakhouse Financial and The Credit Group, respectively, but may expand if the platform proves popular.

Overall, Centrifuge Prime has created an RWA-as-a-service platform that could become a core RWA onboarding platform for DeFi. However, the close overlap with the traditional financial world means that if Centrifuge’s Prime service is successful, it is likely to become a target for regulation.

Uniswap V4 Announced

With the expiration of the two-year commercial open-source license for Uniswap V3, which prevented the protocol from being legally copied, Uniswap Labs has revealed its plans for Uniswap V4. Key upgrades include the introduction of “hooks,” unified liquidity and accounting schemes, and a four-year commercial open-source license. A detailed analysis of these new features can be found in last week’s newsletter.

DeFi Dashboard

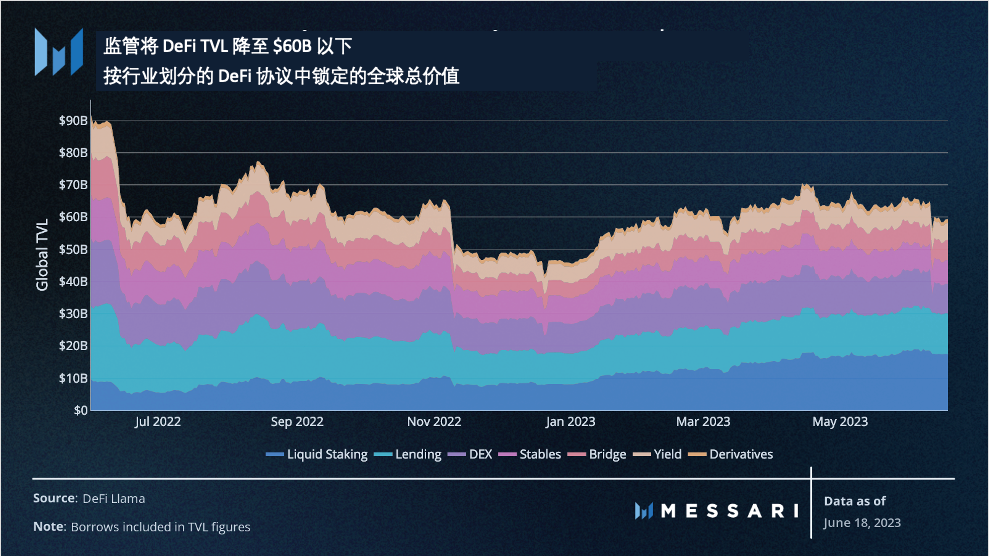

Global TVL

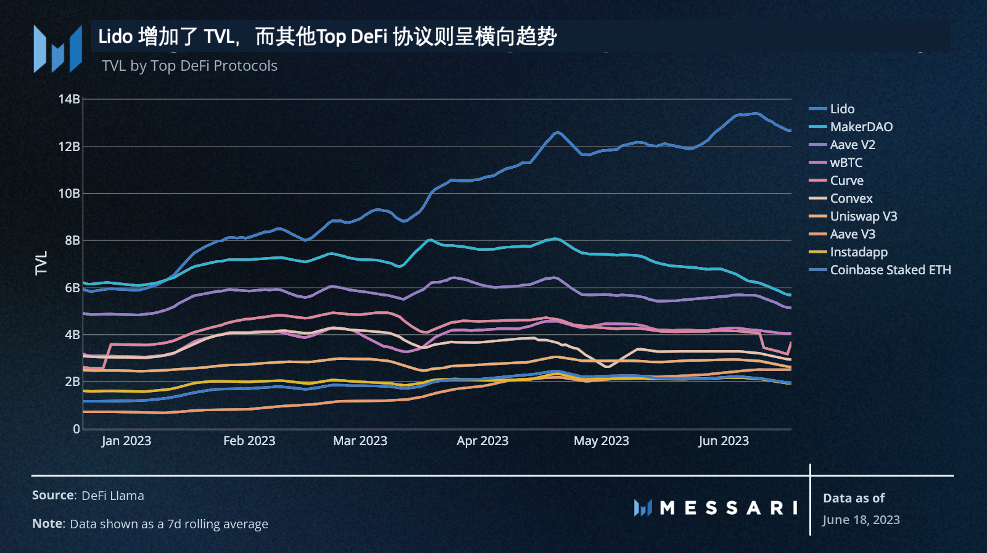

With the US Securities and Exchange Commission’s lawsuit against Binance US and Coinbase, DeFi TVL has once again dropped below $60 billion. Liquidity staking protocols continue to grow at a steady pace and remain the largest subfield within DeFi TVL.

In the past month, TVL for top-tier DeFi protocols has slipped slightly with one exception: Lido. As we mentioned last week, Ethereum’s staking rate has accelerated since the successful Shapella upgrade at the end of April. As the largest liquidity staking provider, it’s not surprising that Lido is benefiting from this. It’s worth noting that Lido’s share of staked ETH (currently at 31.6%) continues to be below its implied upper limit of 33.3%.

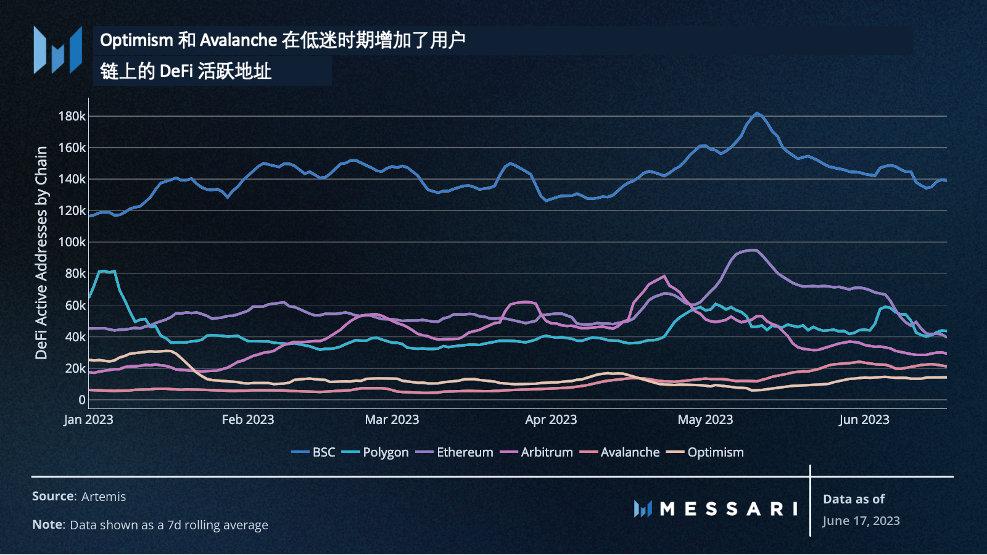

Global Users

Last month, Binance Smart Chain and Ethereum attracted the most users, but their activity levels have both declined since our last report. BSC’s activity has fallen by 9%, while Ethereum’s daily active address count has fallen by 46%. Ethereum’s activity level is now back to the average level before the Meme coin craze in late April and early May.

Last month, Binance Smart Chain and Ethereum attracted the most users, but their activity levels have both declined since our last report. BSC’s activity has fallen by 9%, while Ethereum’s daily active address count has fallen by 46%. Ethereum’s activity level is now back to the average level before the Meme coin craze in late April and early May.

Optimism and Avalanche saw daily active addresses grow by 59% and 20%, respectively. Optimism’s usage increase was mainly due to users transacting and bridging USDC through Stargate Finance. Avalanche’s activity level was driven by the emergence of Holograph (a full-chain token issuance platform) and XEN (a free minting platform known for clogging other smart contract networks).

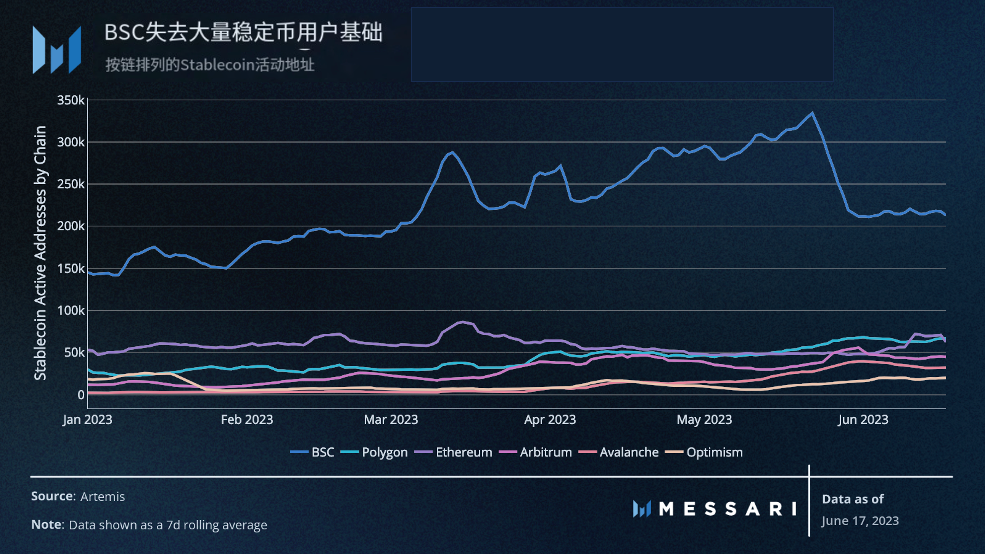

In terms of stablecoin users, the BNB smart chain has erased the growth in active addresses over the past two months, while other chains have seen an upward trend in the past month. Optimism has the highest daily active address growth rate at 75%, as its users engage in more USDC trading.

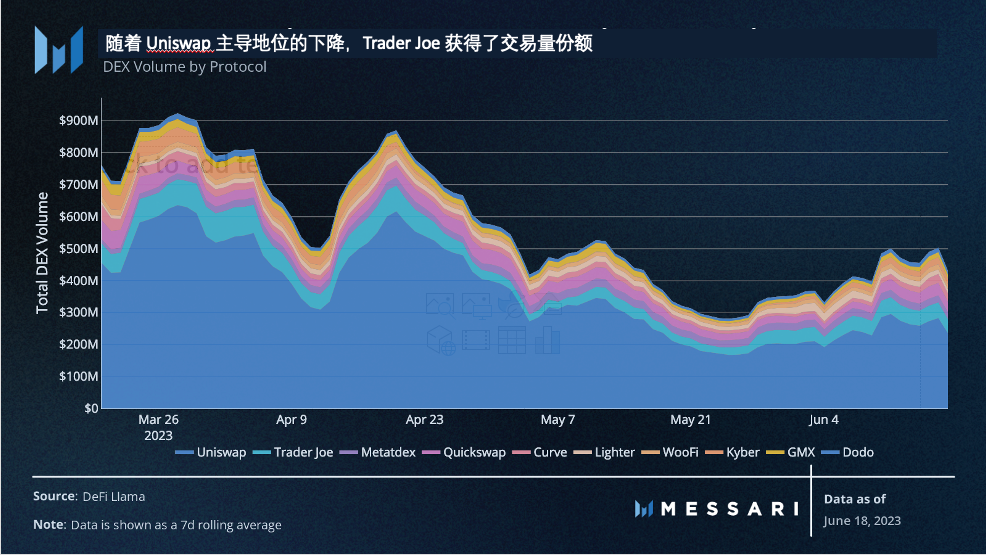

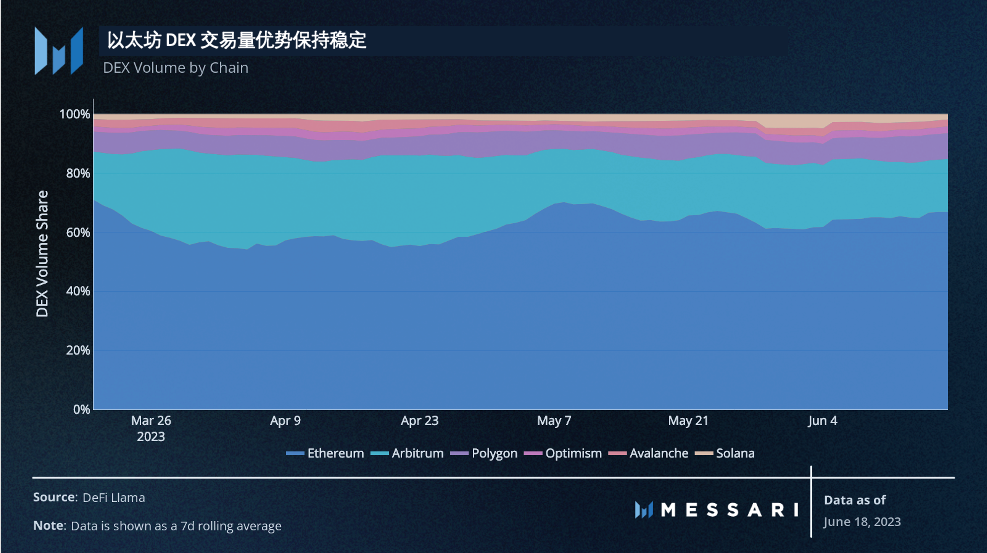

DEXvolumes

Over the past month, DEX trading volumes have remained relatively stable despite higher trading volumes in March and April. Uniswap remains the preferred DEX for many users, but its share of trading volumes in the past 30 days has decreased from 52% to 43.5%. This decline can be attributed in part to the increase in Trader Joe’s trading volume, which has grown from 5% to 8% in the same period. Trader Joe has benefited from the release of its Auto Pools feature, which allows users to automatically rebalance their concentrated liquidity positions on its Liquidity Book.

At the ecosystem level, DEX trading volumes have stabilized, with Ethereum and Arbitrum continuing to account for over 80% of all on-chain trading volumes.

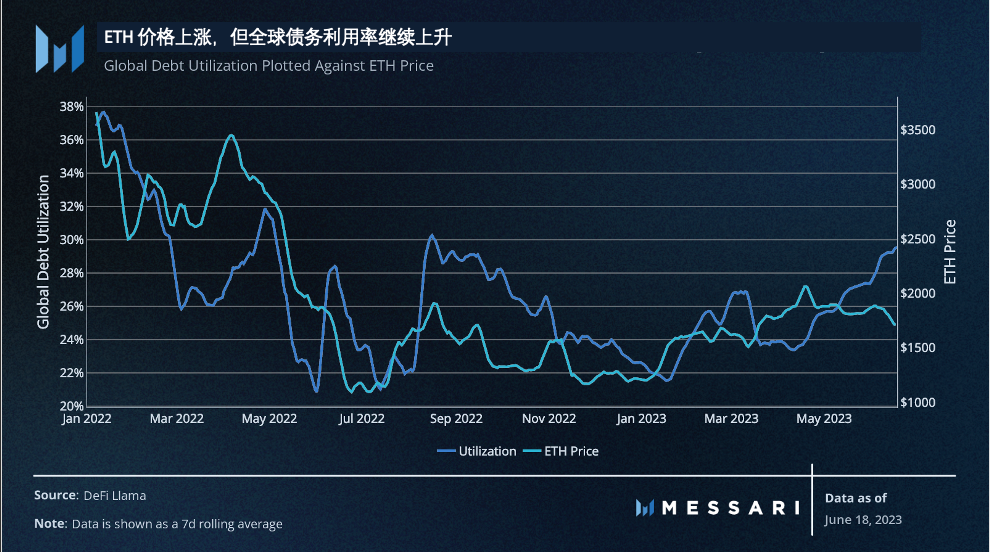

Loan Market

On-chain global debt levels remain at $4.5B from last month. However, debt utilization continues to rise. As mentioned in last month’s DeFi report, the historical increase in on-chain debt utilization has been associated with a decrease in ETH prices. Over the past month, the price trend of ETH has been similar, declining by 5% while utilization has increased by 4%.

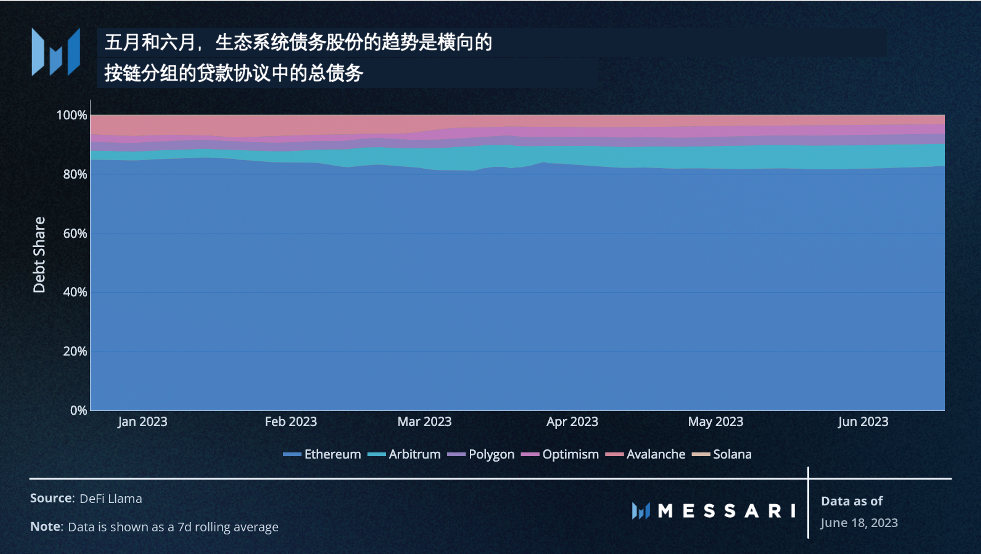

Since Arbitrum increased its share of outstanding debt in early 2023, ecosystem debt shares have remained stable, with Ethereum accounting for 80% of all on-chain debt.

Yield

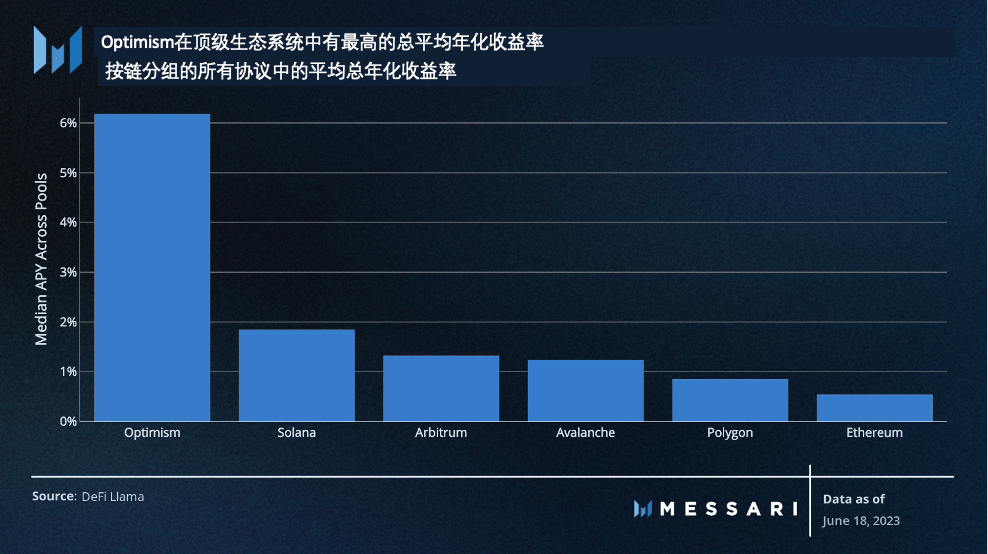

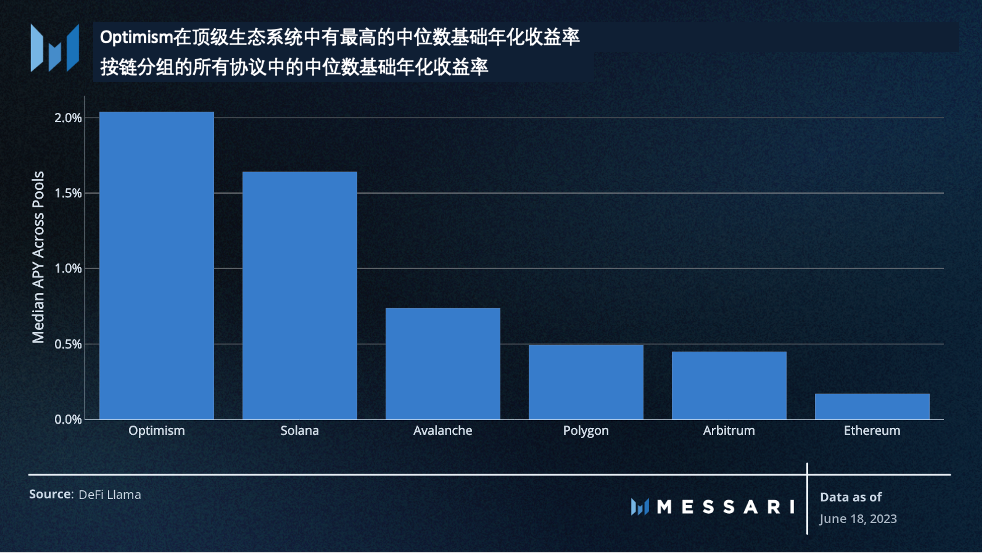

Once again, Optimism leads the way in average DeFi yields. The majority of these yields continue to be driven by the farming rewards of its largest DEX, Velodrome. In addition, the Exactly protocol has seen an increase in TVL in recent weeks, which can be attributed to its potential as a potential airdrop target.

Optimism still has the highest average returns in all DeFi ecosystems even when considering incentive factors.

Fundraising

Powered by Messari fundraising data

Meanwhile – $19M Seed Round

Meanwhile is a life insurance company with a twist: user premiums and claims are paid out in bitcoin. To make money, Meanwhile uses a traditional life insurance business model, lending out a portion of collected premiums and charging interest on unpaid loans. Its users can transfer their bitcoin wealth without incurring tax burdens for its recipients.

While individual rates vary, Meanwhile estimates that a 35-year-old man in average health can buy $25M in death benefits with a $10M premium paid in bitcoin. While these services are licensed and regulated in Bermuda, Meanwhile says they are designed for U.S. citizens. Given the U.S.’s recent hostile stance toward cryptocurrency, Meanwhile will tread a fine line in the highly regulated field of financial services.

Meanwhile’s $19M seed round brings the startup’s valuation to $100M. The funding comes from two independent rounds three years after founding, with participation from Sam Altman and Lachy Groom.

Transak – $20M Series A | BoomFi – $3.8M Seed Round

Transak and BoomFi are the latest fiat-to-crypto platforms to raise funds. This subset of crypto payment providers has garnered significant attention during the sustained bear market as investors push for capital backing the future gateway of cryptocurrency adoption.

Both platforms offer API-based software stacks for enterprises and applications to easily integrate crypto payment channels while meeting regulatory requirements. Transak launched in 2020 and has leveraged early advantages to integrate with leading crypto apps such as MetaMask, Coinbase Wallet, and Aave. It plans to use the new funding to expand into new international markets, including the Middle East and Southeast Asia.

BoomFi is taking an alternative approach. Unlike Transak, which attempts to integrate fiat payments into Web3 apps, BoomFi integrates crypto payments into traditional business. In the short term, this strategy offers a larger market as Web3 only provides a handful of useful applications for Transak. However, BoomFi faces an additional challenge in educating traditional enterprises on cryptocurrency. Both companies will play a critical role in the increasingly competitive sub-industry of the crypto economy.

Original link: https://messari.io/report/defi-brief-oracle-free-protocols?referrer=all-research

Translation: Terry | Huzi Guanbi

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!