BlockingRT00 Introduction As the financial world becomes increasingly digitized, digital currencies have become the center stage of the financial industry.

However, one of the biggest challenges faced by digital or cryptocurrency is their volatility. Only by reducing volatility can a wider audience accept crypto assets. There are many reasons for volatility, including changing public perceptions, emerging markets, static monetary policies, and unregulated markets. To solve the problem of volatility, stablecoins have emerged.

In recent years, stablecoins have received great attention because they can combine the advantages of digital and traditional fiat currencies. By pegging to reserve assets or algorithms at a 1:1 ratio, stablecoins connect the world of digital and fiat currencies.

In this report, we cover everything from the rise of stablecoins, the four major types, market status, application scope, emerging stablecoin models and stablecoin regulations and supervision.

- A Brief Discussion on Uniswap V4: The Culmination of DeFi Innovation

- Uniswap Evolution: A Thousand Miles Journey, Opportunities and Impact of V4

- Inventory of Binance Labs’ five latest incubation projects: Bracket Labs, DappOS…

BlockingRT01 The Rise of Stablecoins

1.1 What is a stablecoin

A stablecoin is a digital currency pegged to reserve assets such as fiat currencies, gold, and other reserve assets. It is also a freely circulating, scalable, and reserve-pegged cryptocurrency.

The original intention behind stablecoins was to reduce price volatility. Stablecoins are in sharp contrast to other cryptocurrencies, including Bitcoin, because they do not have an intrinsic mechanism to reduce volatility. Stablecoins resist volatility by mimicking currencies such as the US dollar, euro, Chinese yuan, and Swiss franc.

In 2014, the first stablecoin, Tether (also known as USDT, Tethercoin), was born, paving the way for parity with the US dollar. For example, one Tether should be equal to one US dollar. Today, Tether is frequently traded in the cryptocurrency field, and its trend has proven to be reliable.

In addition to the US dollar, there are other currencies that can be used to measure the value of stablecoins, including fiat currencies (such as the euro), a combination of fiat currencies (such as the IMF’s special drawing rights), commodities or other physical assets (such as gold, real estate), or economic indicators (such as inflation rates).

Stablecoins have four key characteristics:

(1) Authentication: Authentication reports are an important part of the stablecoin system, completed by professional certification service organizations, which confirms the existence of the underlying assets that support stablecoins;

(2) Nature of reserve assets: A series of high-quality, highly liquid assets are needed to ensure the smooth operation of well-designed stablecoins;

(3) Regulation and registration: Stablecoins and the legal entities responsible for their operation must be subject to strong regulatory oversight, which must be established in a legally mature, well-governed jurisdiction to reduce the risk of financial crime;

(4) Technology: The effectiveness of stablecoins depends on the degree of integration between their underlying technology and traditional non-blockchain technology.

1.2 Classification of Stablecoins According to the different stable mechanisms, the stablecoins commonly seen in the market can be roughly divided into four categories: (1) Fiat-backed stablecoins; (2) Cryptocurrency-backed stablecoins; (3) Algorithmic stablecoins; (4) and commodity-backed stablecoins.

1.2.1 Fiat-backed Stablecoins The most popular stablecoins are backed by legal currency in a 1:1 ratio. The central issuer or custodian holds the legal collateral. It must be proportional to the circulating stablecoin token quantity. Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) are the highest market value fiat-backed stablecoins.

These stablecoins have the following characteristics:

First, centralized issuing institutions, generally a private company.

Second, pegged to fiat currency (mostly the US dollar) at a ratio of 1:1, with a simple and clear issuance mechanism.

Third, implementing a proof-of-reserve mechanism, requiring the addition of one fiat currency reserve for each stablecoin issued.

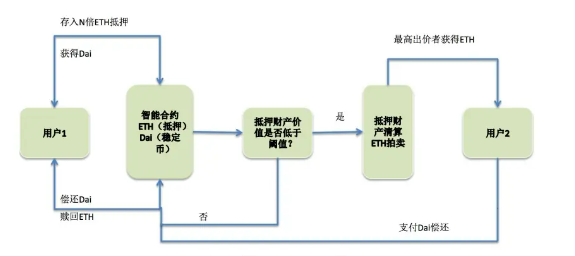

1.2.2 Cryptocurrency-backed Stablecoins Cryptocurrency-backed stablecoins are supported by another cryptocurrency as collateral. Stablecoins collateralized by cryptocurrencies do not use custodians to hold collateral, but use smart contracts. The issuance process of stablecoins occurs on-chain, using smart contracts rather than relying on a central issuer to execute. When purchasing (minting) these stablecoins, you lock your cryptocurrency in a smart contract to receive an equivalent amount of tokens. Then, you put the stablecoins back into the corresponding smart contract, and you can withdraw the collateral amount you previously locked. DAI (a cryptocurrency-backed stablecoin) is the most prominent stablecoin in this category.

Cryptocurrencies require over-collateralization of stablecoins to buffer against price fluctuations in the collateralized cryptocurrency asset required. For example, if you want to buy $100 worth of DAI stablecoins, you need to deposit $180 worth of ETH at a 180% collateralization rate. If the market price of ETH drops but remains above the set liquidation threshold, the price of DAI can still be maintained stable because there is excess collateral. However, if the ETH price drops below the set threshold (e.g. dropping 100%, ETH originally worth $180 is now only worth $90), then the collateral will be forcibly sold off for liquidation based on the smart contract.

1.2.3 Algorithmic Stablecoins Algorithmic stablecoins attempt to maintain a peg to assets such as the US dollar by dynamically expanding and contracting token supply. Algorithmic stablecoins do not use fiat or cryptocurrency as collateral. Instead, their price stability comes from specialized algorithms and smart contracts that manage the token supply in circulation. When the market price is below the price of the asset it tracks, an algorithmic stablecoin system will decrease the number of tokens in circulation. Conversely, when the token price exceeds the price of the asset it tracks, new tokens will enter circulation to adjust the value of the stablecoin downwards.

However, algorithmic stablecoins rely on particularly robust algorithms. The USTC involved in Luna is an algorithmic stablecoin, but its intrinsic algorithm did not consider some extreme situations, leading to black swan or unexpected events and ultimately an anchor collapse.

Algorithmic stablecoins have the following characteristics:

1. No collateral

2. Partial or full support collateralized by native assets

3. Floating stability

1.2.4 Commodity-Backed Stablecoins

Commodity-backed stablecoins are collateralized by commodities such as precious metals, oil, and real estate. Gold is the most popular collateralized commodity, and Tether Gold (XAUT) and BlockingX Gold (BlockingXG) are top-tier gold-backed stablecoins. Commodity-backed assets allow investment in assets that may be far from local and inject liquidity into asset classes with poor liquidity.

BlockingRT02 Stablecoin Market Overview

2.1 Cryptocurrency Market Overview

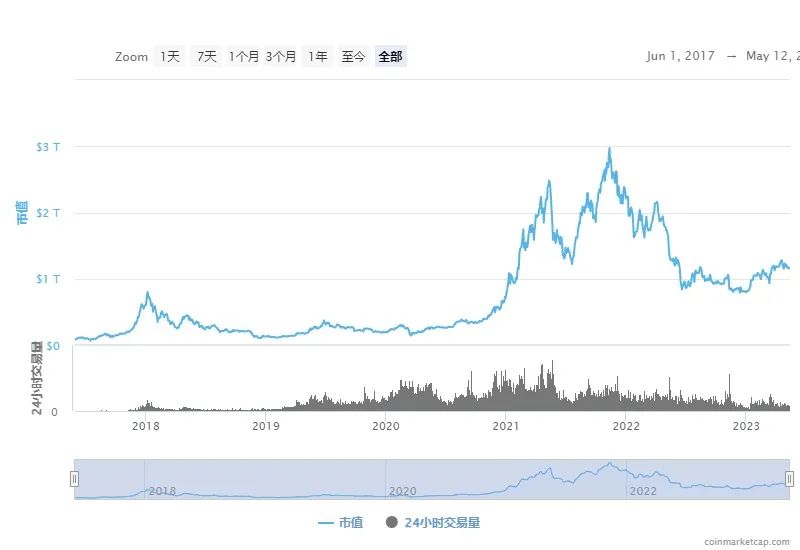

Global Cryptocurrency Chart (2017-2023)

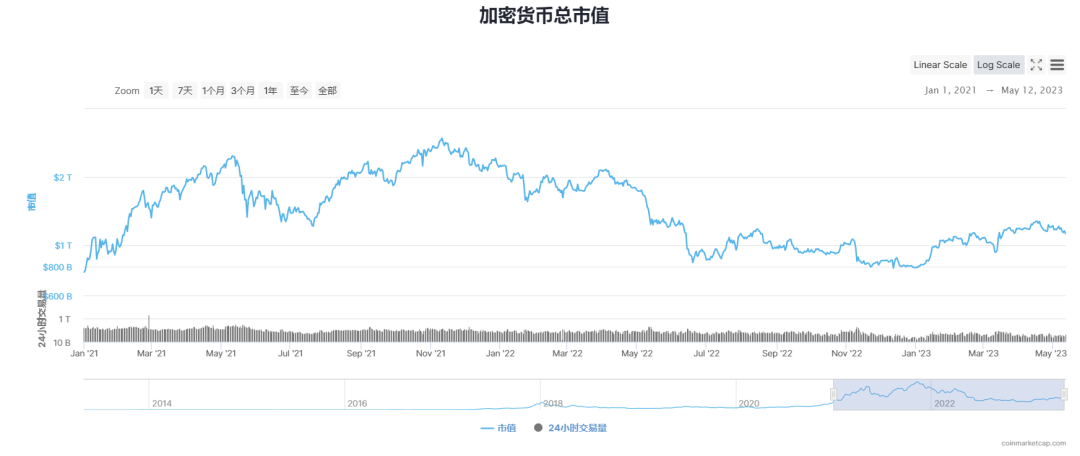

Cryptocurrency Total Market Value (2021-2023)

2021 Cryptocurrency Market Overview:

The cryptocurrency industry continued to reach new heights in 2021, following the momentum from 2020. The market value of the entire industry increased by over three times in 2021, to approximately $2.4 trillion, and briefly reached a record high of $3 trillion mid-year.

2022 Cryptocurrency Market Overview:

The total market value of cryptocurrencies in 2022 was approximately $830 billion, a 64% decrease from the beginning of the year.

The start of the cryptocurrency market in 2022 was rocky, with the first quarter experiencing high inflation, conflict between Russia and Ukraine, and events such as the Federal Reserve raising interest rates. The total market value at the end of the first quarter of 2022 was approximately $2.2 trillion. Compared to the prosperity of the first quarter of 2021, traders in the first quarter of 2022 were generally cautious, and the trading volume of the entire market significantly declined, with a 23% decrease in trading volume compared to the previous quarter.

The third quarter of 2022 was a relatively quiet quarter, but also a quarter of regulatory turmoil. The market was mostly in a consolidation phase, with the total market value of cryptocurrencies briefly reaching $1.2 trillion. The sanctions imposed by the US Office of Foreign Assets Control on Tornado Cash had an impact on the entire industry and rekindled significant concern and discussion about government review systems. Multiple cryptocurrency legislations are also passing through Congress, and the CFTC’s enforcement action against a DAO is particularly noteworthy. As policy makers and regulators continue to engage with the industry, only time will tell if future regulations will be clearer. Considering the geopolitical tensions and macroeconomic turmoil around the world, at least it can be said that the near-term prospects for cryptocurrencies may still be challenging.

The collapse of FTX and Alameda Research in 2022 dealt the final blow to the market, leaving millions with losses and the industry uneasy due to its chain reaction.

2023 Crypto Market Overview:

Crypto markets have shaken off their bearish lethargy. The first half of Q1 2023 was relatively calm, as traders speculated on the Fed’s stance. While overall liquidity was relatively low, the market was also driven by some brief narratives such as Hong Kong concepts, brc20, Al plate, etc.

Crypto’s regulatory challenges cannot hide the larger turmoil in traditional banking: concerns surrounding Silvergate Bank led to its bankruptcy and liquidation on March 8, 2023, triggering contagion effects throughout the U.S. banking industry. In the same week, Silicon Valley Bank and Sianature Bank were taken over by the FDIC, followed by CreditSuisse Bank being acquired by UBS with government support a week later. Such events have exposed how fragile investor trust and confidence in traditional finance can be.

2.2 Stablecoin Market Overview

2.2.1 Total Stablecoin Market Cap

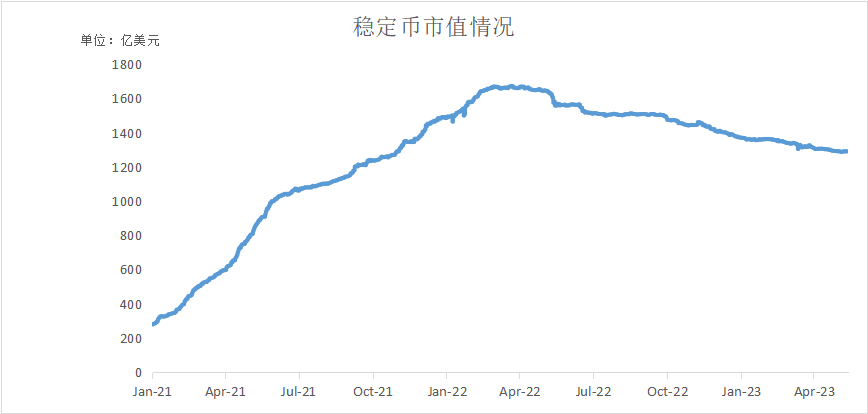

△ Stablecoin Total Market Cap Chart (coingecko)

Stablecoins, as one of the core assets of the entire crypto market, have experienced significant growth in recent years. As of May 12, 2023, the total market value of stablecoins is approximately $131.8 billion.

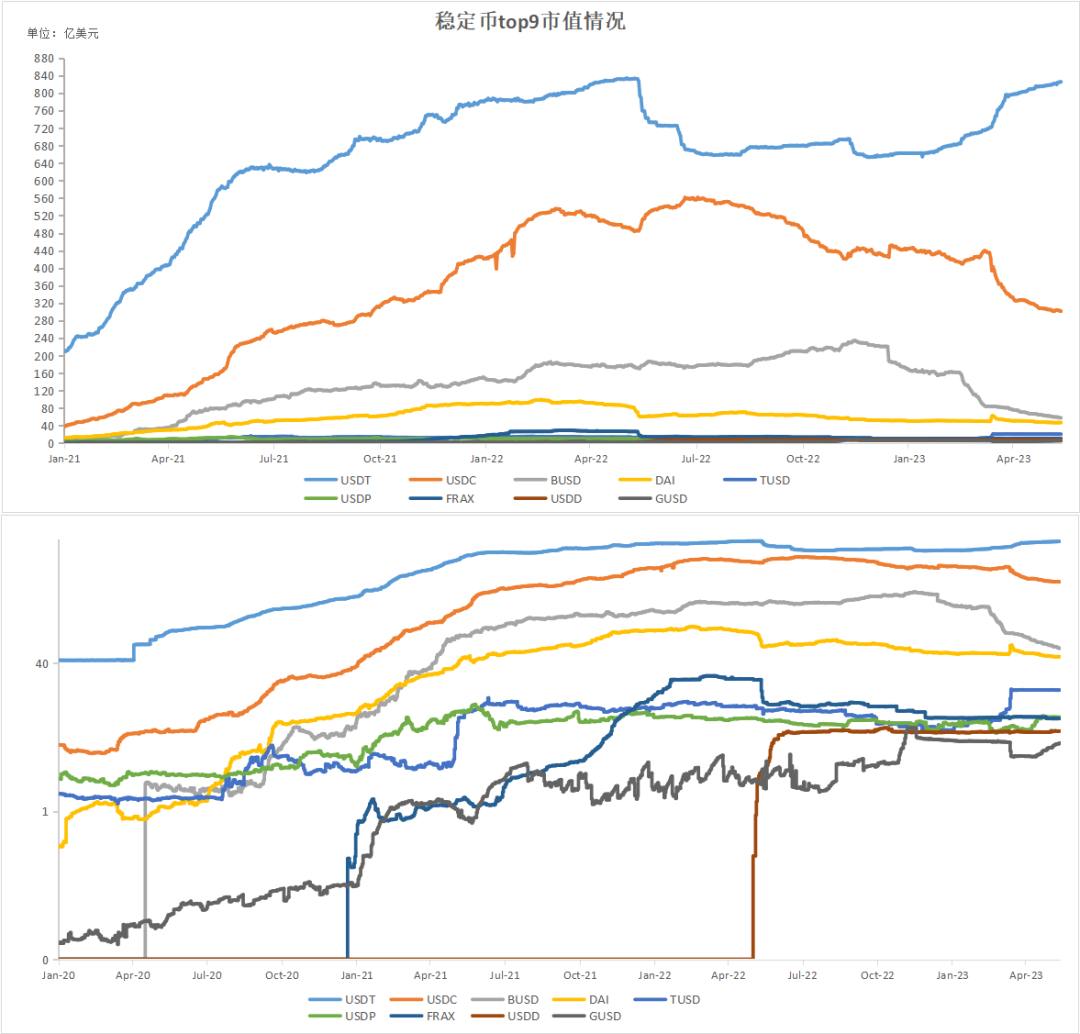

△ Stablecoin Top 9 Market Cap Chart (coingecko)

2021 Stablecoin Market Overview:

In Q2 2021, stablecoins rebounded to a new high with a market cap of $105.1 billion (+76%) but trading volume decreased to $7.36 billion (-35%). This may be because traders opted for safe havens during the 20% market slump.

In Q3 2021, the overall market capitalization of the top five stablecoins increased steadily by 17%. At the end of the quarter, the overall market capitalization of stablecoins reached $123 billion. Except for USDT, the growth rate of the top five stablecoins exceeded 20%, which means that investors chose to use other stablecoins as alternatives to USDT in the face of strong regulation.

2022 Stablecoin Market Overview:

Stablecoins were not immune to net outflows in 2022, losing a total of 27.3 billion US dollars (about 17%). Most of this loss occurred during the collapse of Terra, after which the sector performed relatively well, although periodic “black rumors” of possible anchor breaking emerged.

In the first quarter of 2022, the uncertain environment made most investors more inclined to stablecoins, and the market capitalization of stablecoins increased significantly (+23 billion US dollars) this quarter. Unlike other cryptocurrencies on the market in the first quarter of 2022, the top five stablecoins saw growth of 13%.

The second quarter of 2022 saw a significant increase in stablecoins, with BUSD, which was previously ranked 13th, now ranking 6th. However, the slight decline in stablecoin market share (excluding USTC) indicates that a certain amount of capital has completely exited the cryptocurrency ecosystem. In comparison, investors in the previous quarter may have entered the stablecoin market to reduce risk in the face of market uncertainty.

The market value of the largest stablecoin USDT in 2022 fell by 16%, or about 12 billion US dollars. On the other hand, USDC and BUSD each saw a moderate increase of about 2 billion US dollars. The proportional loss of decentralized stablecoins DAI (-43%) and FRAX (-44%) is similar, but DAI’s absolute loss of 4 billion US dollars is nearly 5 times that of FRAX.

2023 Stablecoin Market Overview:

In the first quarter of 2023, the market capitalization of the top 15 stablecoins decreased by about 4.5%, or 6.2 billion US dollars. This was due to panic in the stablecoin market after the US Securities and Exchange Commission (SEC) investigated the decoupling of BUSD and USDC.

In the first quarter of 2023, USDC’s market share decreased the most (-2.7%), possibly due to anxiety among holders after the stablecoin decoupled during the banking crisis.

After Blockingxos decided to stop issuing BUSD, its market capitalization ranking dropped significantly from 7th to 12th.

Due to decoupling and regulatory concerns, there has been a large outflow of funds from USDC and BUSD, while USDT and TUSD have become the biggest beneficiaries. After the US Securities and Exchange Commission (SEC) investigated the decoupling of BUSD and USDC, there was panic in the stablecoin market. USDT, the largest stablecoin by market capitalization (+20.5% or $13.6 billion), saw the most absolute growth, while USDC and BUSD lost 26.9% and 54.5%, respectively. The growth of TUSD was largely driven by the large-scale new minting by Binance (approximately $130 million) and Tron (approximately $750 million).

2.2.2 Market Share of Stablecoins

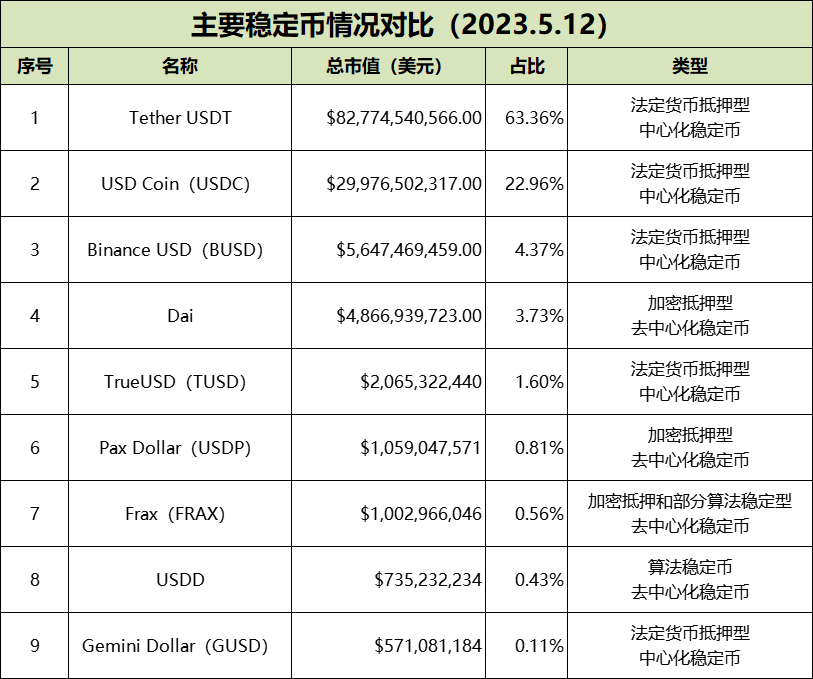

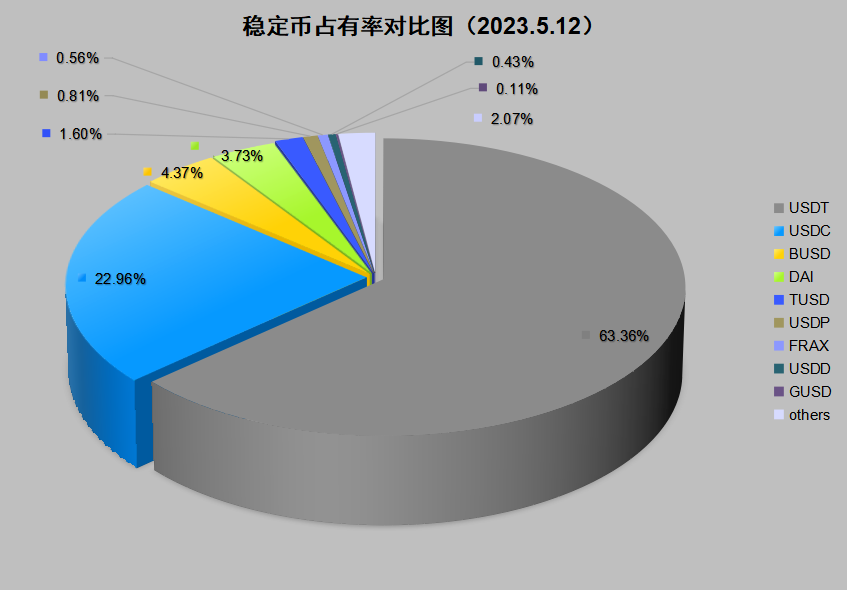

As of May 12, 2023, there are 24,071 cryptocurrencies in the world with a total market capitalization of $1.117 trillion, and the total market capitalization of stablecoins is about $131.8 billion, accounting for approximately 11.84% of the cryptocurrency market share.

As of May 2023, the market share of centralized stablecoins has reached 94%, while that of decentralized stablecoins is only about 6%. The market share of decentralized stablecoins increased significantly from 2019 to 2022. However, after the collapse of Terra, UST quickly dropped to zero, and the market share of decentralized stablecoins gradually decreased.

△Comparison chart of major stablecoins

△Comparison chart of stablecoin market share (Coinmarketcap)

As can be seen from the above chart, in the stablecoin market, the top nine stablecoins by market capitalization account for over 97% of the share. The top five stablecoins account for over 96% of the share, namely Tether USDT, USD Coin USDC, Binance USD BUSD, DAI, and TrueUSD TUSD. The above three stablecoins account for over 90% of the entire stablecoin market. In terms of stablecoin type, USDT, USDC, and BUSD are all centralized stablecoins issued with real assets as collateral. In addition, there are also decentralized stablecoins, such as DAI issued by MarkerDAO, which has a market capitalization of $4.86 billion and a share of only 3.73%.

2.2.3 Comparison of Major Stablecoins

△Comparison of major stablecoins (TokenInsight20)

BlockingRT03 Classification and Application of Stablecoins

3.1 Centralized Stablecoins The total market value of centralized stablecoins exceeds USD 129.4 billion, with USDT and USDC being the two largest centralized stablecoins in terms of scale. Both are pegged to a target of 1 US dollar, and the reserve assets are all in US dollars, government bonds, or other commercial bills. USDT, USDC, BUSD, TUSD, USDP, and GUSD are the six most popular centralized stablecoins and are also stablecoins supported by asset reserves.

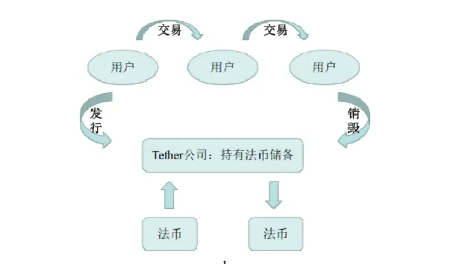

3.1.1 Tether USDT:

Tether (a subsidiary of iFinex) launched USDT in October 2014. USDT is currently the largest stablecoin on the market, with a market value of over USD 82.7 billion.

USDT Operating Mechanism:

The issuance and circulation process of USDT can be divided into the following steps:

Step 1: Users deposit US dollars into Tether’s bank account.

Step 2: Tether creates separate Tether accounts for users and places digital currencies corresponding to the US dollars they deposited into their accounts.

Step 3: Users can trade USDT on exchanges or over-the-counter markets.

Step 4: Users return USDT to Tether and redeem fiat currency.

Step 5: Tether destroys USDT and returns US dollars to users’ bank accounts. In addition, after USDT enters circulation, any investor can purchase and trade USDT from other investors or exchanges, forming a complete cycle of issuance, trading, circulation, and redemption.

USDT Operational Situation:

Price analysis:

At the time of issuance, investors need to exchange one US dollar for one USDT; in the secondary market, investors can use other cryptocurrencies to exchange USDT, or use fiat currency to purchase USDT. When the actual price of USDT exceeds one US dollar, many investors will subscribe to USDT from Tether and then sell it in the secondary market; when the actual price of USDT is lower than one US dollar, many investors will buy USTD from the secondary market and then redeem US dollars from Tether. In either case, theoretically, the price of USDT will gradually return to one US dollar, or fluctuate slightly around one US dollar.

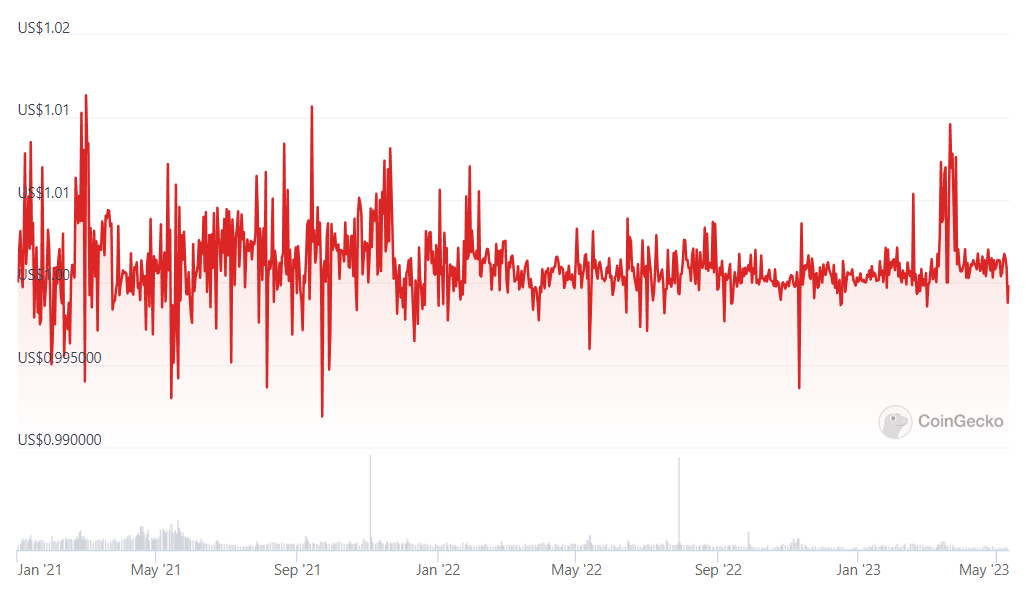

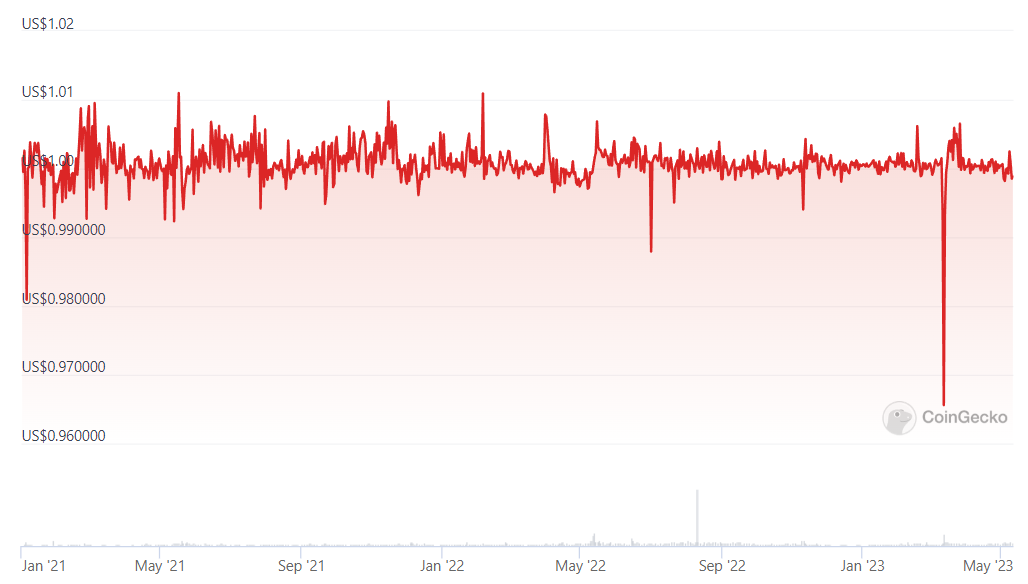

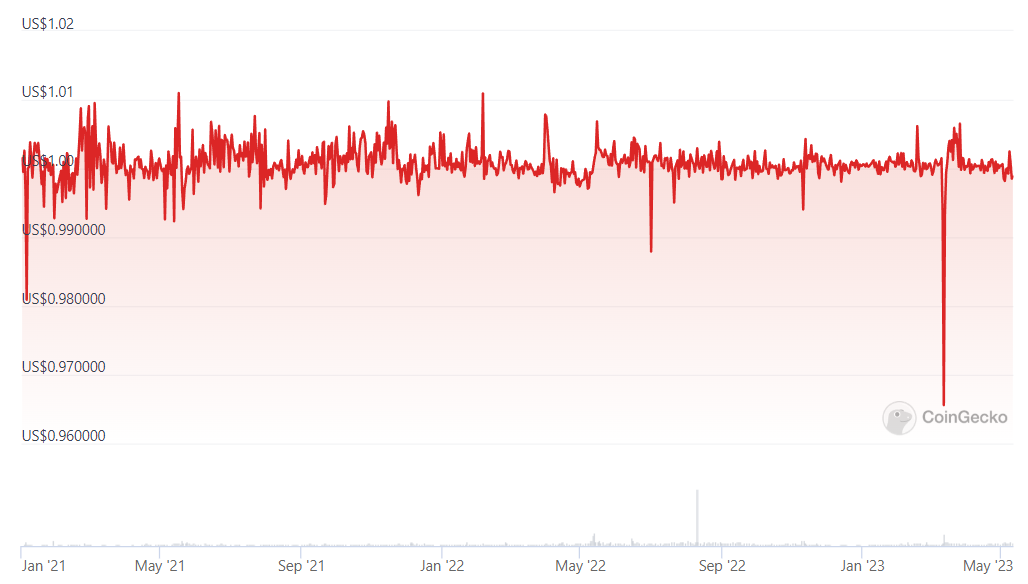

△USDT price trend chart (2021-2023)

USDT has always been criticized for “not having enough reserves”, but even so, USDT still maintains the largest market share, and its price can remain around $1 for the most part.

The most serious incident of USDT price decoupling occurred on October 15, 2018, when Bitcoin’s price was around $6,000. Due to market panic, the price of USDT fell to a low of $0.88. But since then, even though there have been continuous rumors in the market, the price of USDT has always been stable.

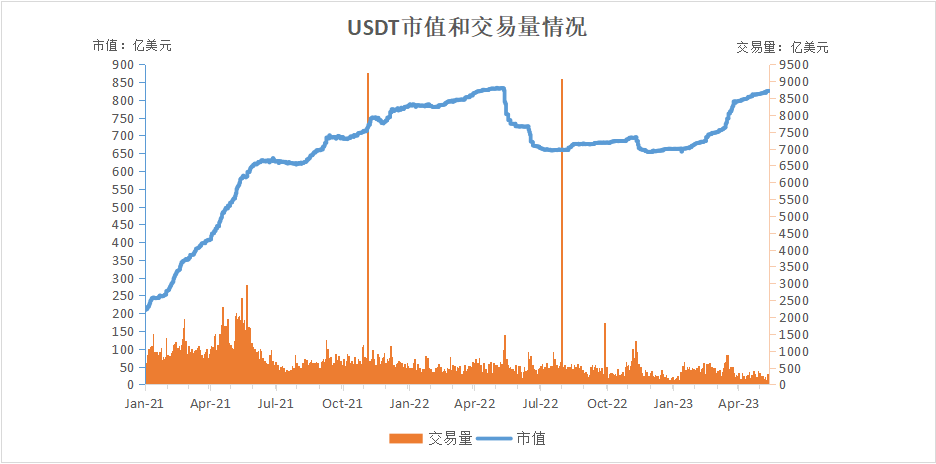

△2021-2023 USDT market capitalization and trading volume (coingecko)

The OFAC sanctions have caused some damage to the status of USDC, and the overall stablecoin market performance was mediocre in the third quarter of 2022. USDT has a small increase (possibly due to absorbing some USDC sell-offs). In the first quarter of 2023, after the US Securities and Exchange Commission (SEC) investigated the decoupling of BUSD and USDC, panic appeared in the stablecoin market, and the largest stablecoin by market capitalization, USDT (+20.5% or $13.6 billion), had the largest absolute growth.

USDT reserve asset situation:

Tether’s USDT white paper clearly states that Tether tokens are called stablecoins because they provide price stability when pegged to fiat currencies. This provides traders, merchants, and funds with a low-volatility solution for withdrawing market funds. All Tether tokens are pegged to matching fiat currencies at a 1:1 ratio and are 100% backed by Tether’s reserves.

However, there are two prerequisites for this mechanism to be effective:

First, the company strictly enforces the 1:1 reserve between USDT and the US dollar.

Second, the company conducts regular audits and publicly discloses the audit results. The reserve proof mechanism is the core mechanism for ensuring the relative stability of stablecoin prices, but if the company cannot fulfill the 1:1 reserve commitment, the anchoring relationship between stablecoins and fiat currencies will be challenged.

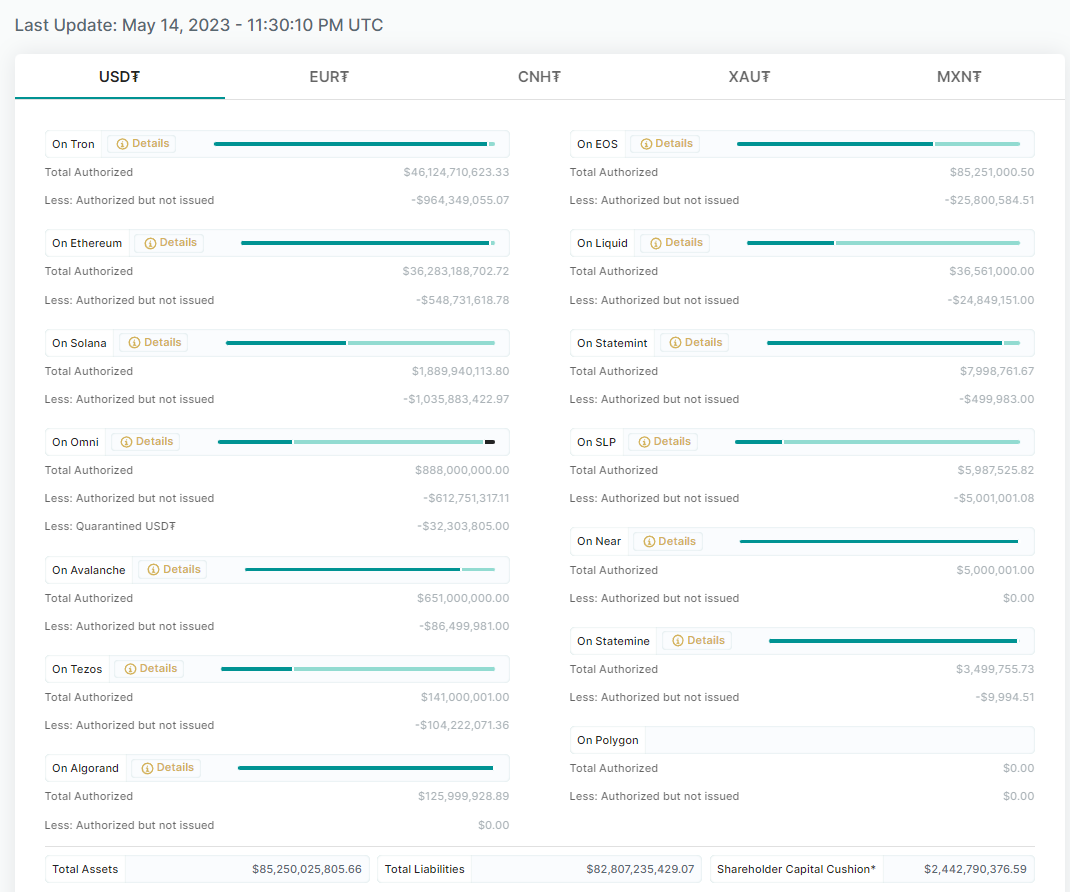

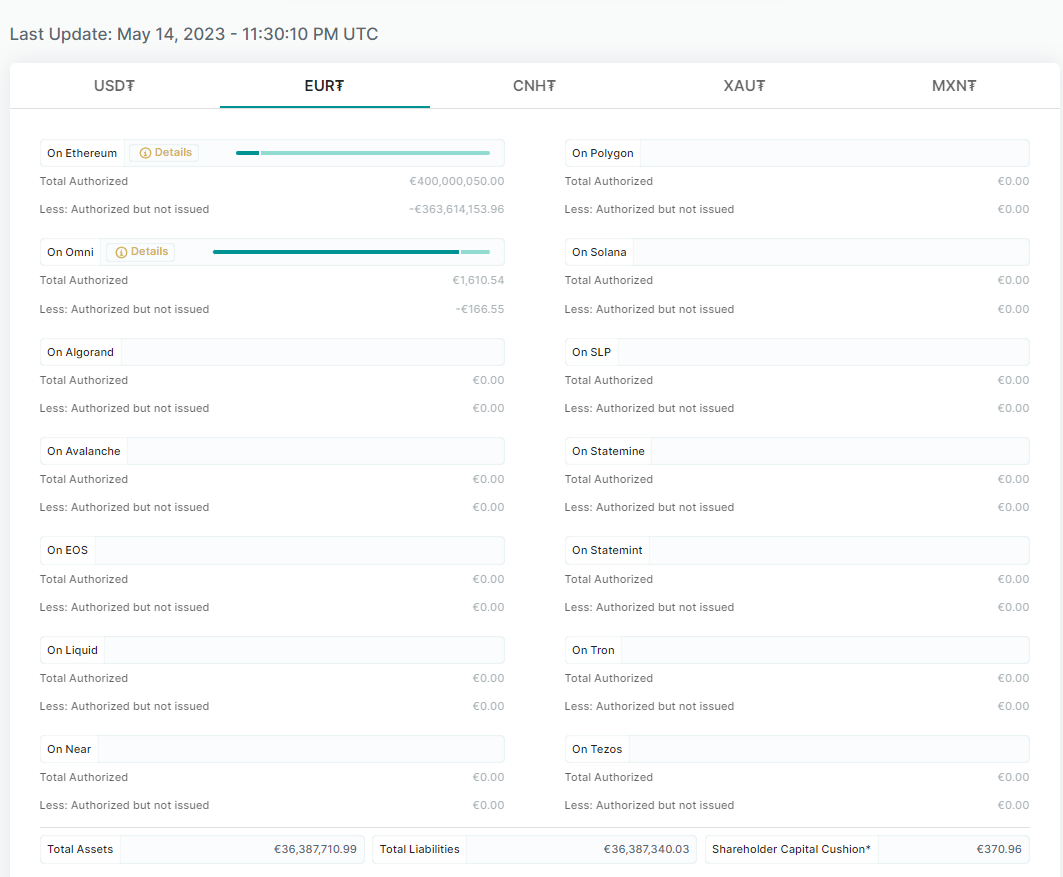

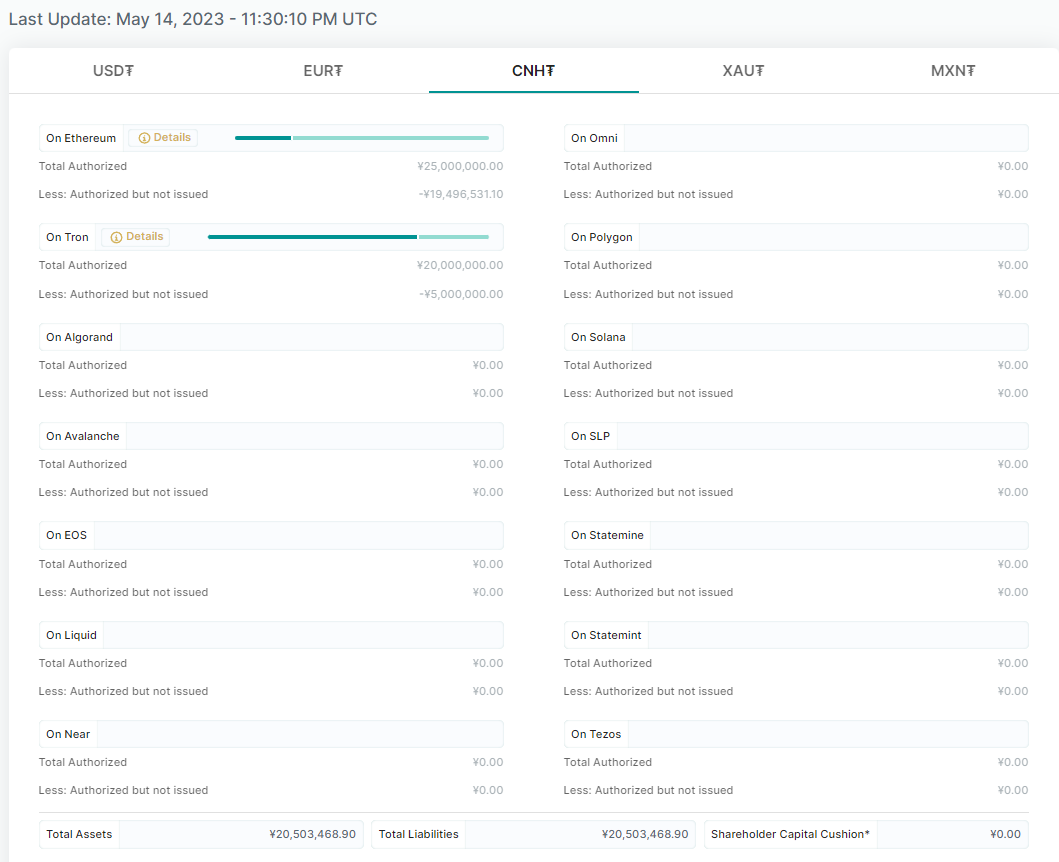

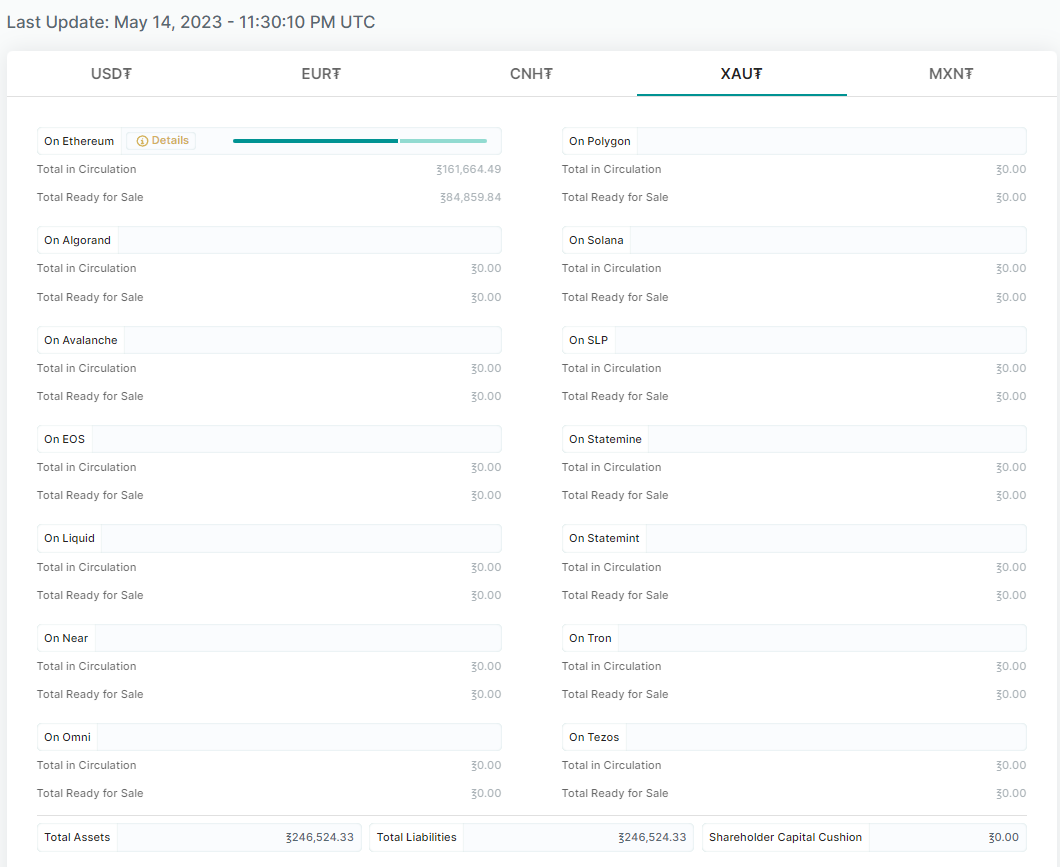

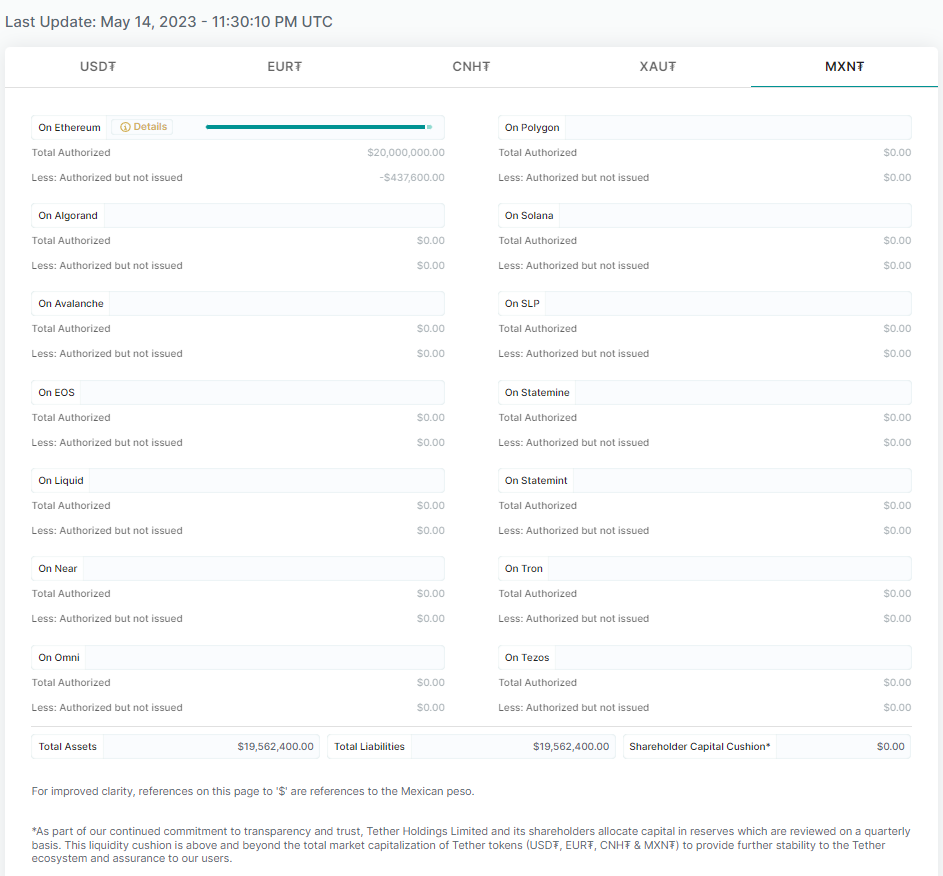

Tether’s official website provides the current balance sheet for the USDT project , as shown in the figure below. Total Assets represent the dollars, euros (EUR), offshore yuan (CNH), gold (XAU), and Mexican pesos (MXN) that the company holds. Total Liabilities represent how much money investors have used to purchase this stablecoin, which is approximately $82.8 billion, €36.38 million, CNH 20.5 million, XAU 2, and MXN 195.6 million. Looking at the project’s balance sheet, Shareholder Equity is positive, which means that the company has achieved the goal of adding one US dollar worth of fiat currency reserve for each USDT it issues.

△ USDT balance sheet as of May 14, 2023 (Tether official website)

△ EUR balance sheet as of May 14, 2023 (Tether official website)

△ CNH balance sheet as of May 14, 2023 (Tether official website)

△ XAU balance sheet as of May 14, 2023 (Tether official website)

△ MXN balance sheet as of May 14, 2023 (Tether official website)

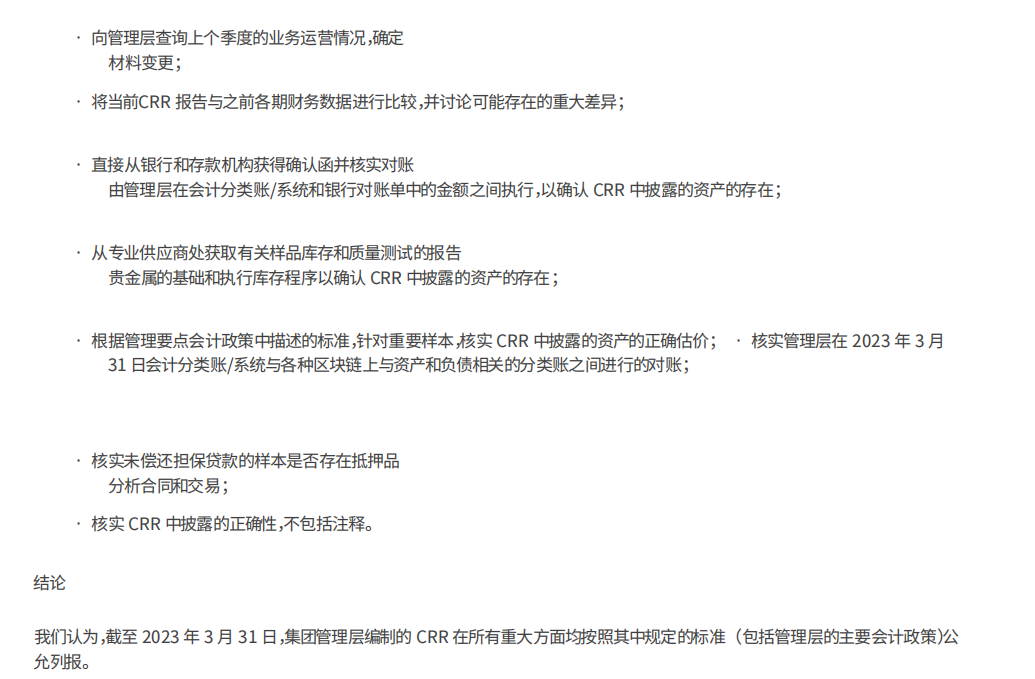

Tether has released the audit results of the accounting firm (as of March 31, 2023):

3.1.2 USD Coin (USDC)

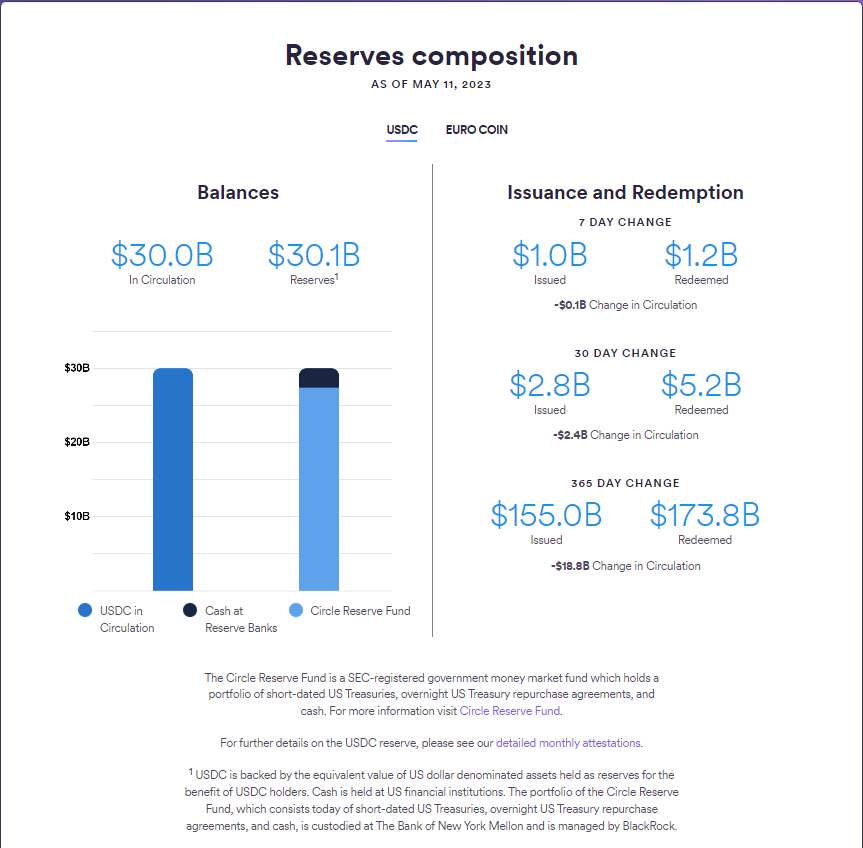

USDC is a USD-stablecoin that was issued jointly by Circle and Coinbase exchange in July 2018. From the background, USDC seems to be a more stable and transparent stablecoin, and the market has always trusted USDC. Currently, the market value of USDC is approximately $30.1 billion, ranking second in the stablecoin market, about half the size of USDT. At its peak on July 1, 2022, the market value of USDC exceeded $56 billion, which was almost close to the $66 billion level of USDT.

USDC Operating Mechanism:

Customers who enter through a stable coin gateway (such as a web application created and maintained by a licensed CENTER token issuer) can transfer fiat funds to the account of the CENTER issuer. The issuer uses the CENTER network to execute a series of commands to validate, mint, and validate fiat tokens tied to the value of these deposited funds. Customers can then transfer these tokens elsewhere for use.

Redemption follows the opposite order: when customers access the exit, fiat tokens are destroyed, such as by a web application maintained by a licensed CENTER issuer. After successful validation and verification, funds from the underlying fiat reserve are transferred to the customer’s external bank.

USDC Operational Status:

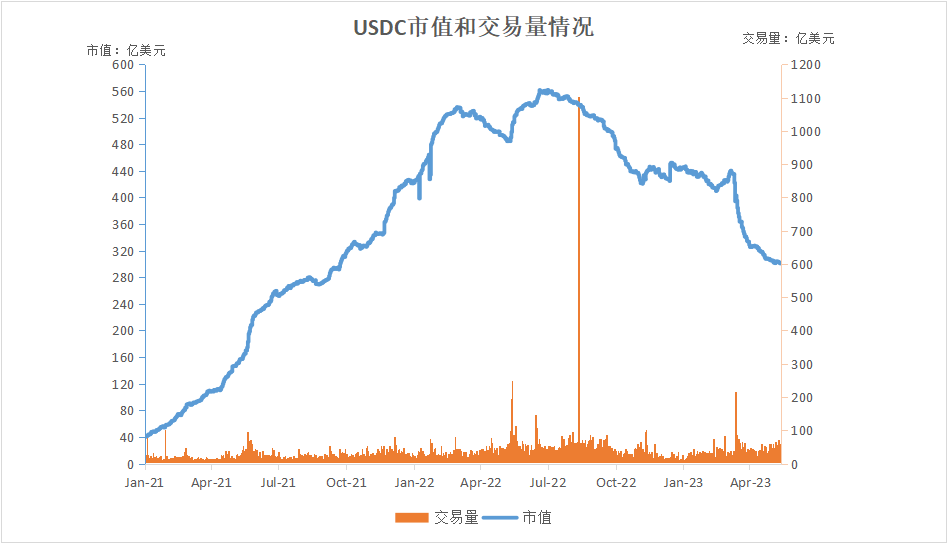

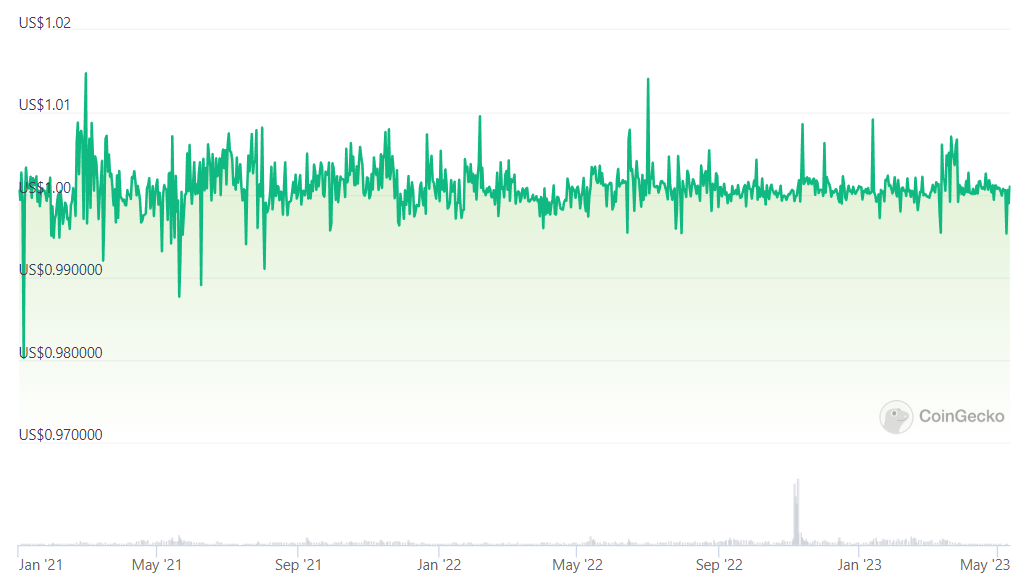

△USDC price trend chart (2021-2023)

△USDC market capitalization and trading volume (CoinGecko)

Coinbase and DeFi protocols have always been more friendly to USDC than USDT, which is one of the reasons why USDC has expanded rapidly since 2021.

In Q3 2022, USDC’s market capitalization decreased by $8.8 billion, or 16% of its market capitalization. This is due to regulatory turmoil, OFAC sanctions on Tornado Cash have had an impact on the entire industry, and have rekindled significant concerns and discussions about government review systems, and OFAC sanctions have also caused some damage to USDC’s position.

In Q1 2023, USDC’s market share decreased the most (-2.7%), which may be due to stablecoins being decoupled during the banking crisis, causing holders to feel uneasy, and USDC lost 26.9% due to the US Securities and Exchange Commission (SEC) investigation into USDC uncoupling, causing panic in the stablecoin market. The price of USDC fell to around $0.8 on March 11, 2023, due to the bankruptcy of Silicon Bank and questioning of USDC’s reserve fund.

USDC Reserve Asset Status:

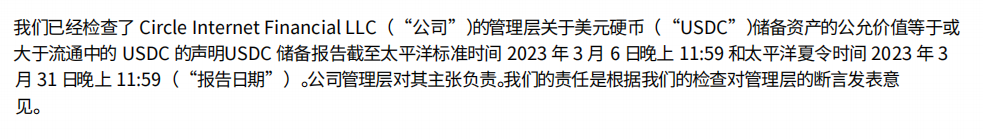

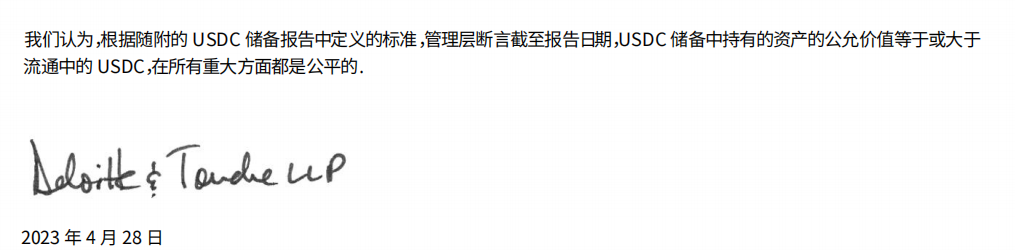

Circle must maintain a full legal reserve for all issued USDC. Third parties report on these holdings each month according to standards established by the American Institute of Certified Public Accountants (AICBlocking).

Circle has released the audit results of its accounting firm (as of March 6, 2023):

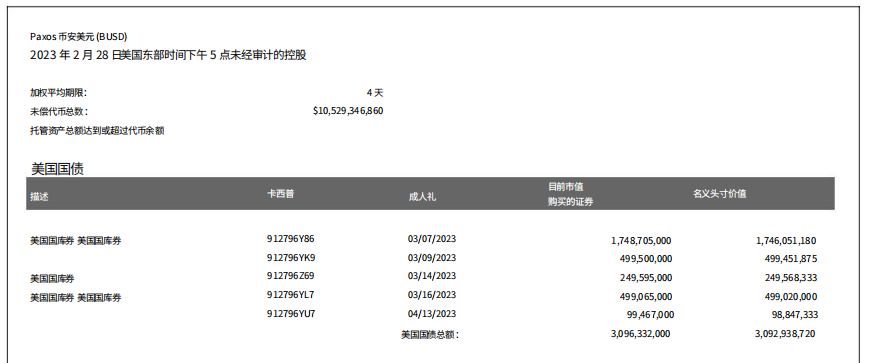

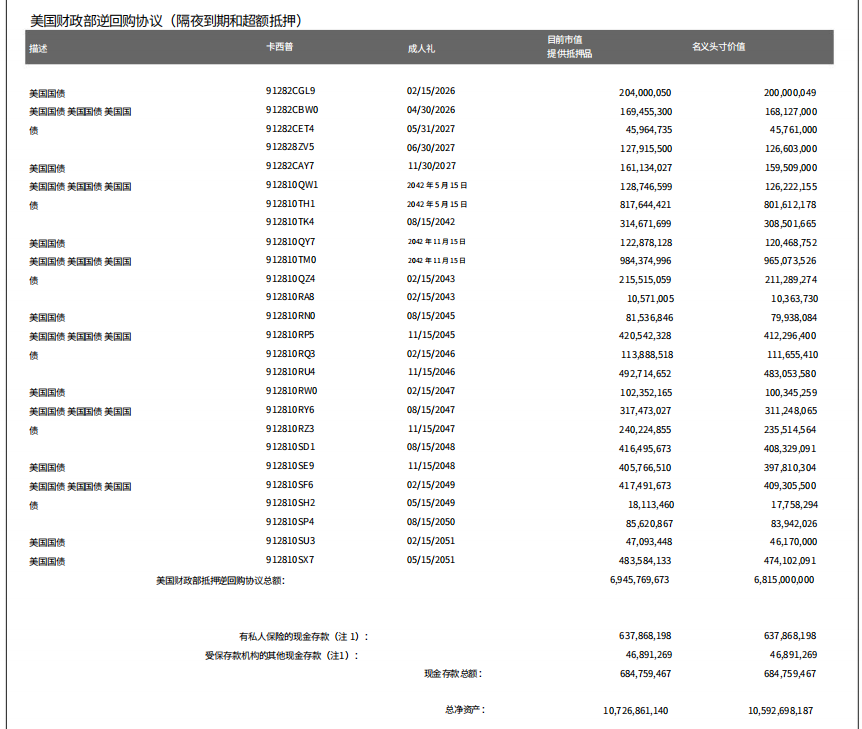

3.1.3 Binance USD (BUSD)

In September 2019, Blockingxos (issuer) collaborated with Binance to launch BUSD, which is a fiat-backed stablecoin pegged to the US dollar at a rate of 1 BUSD to 1 USD and is currently the seventh largest cryptocurrency by market capitalization and third largest stablecoin.

BUSD is a more centralized stablecoin than any other stablecoin. To fully understand why, it is necessary to distinguish between two types of BUSD on the market:

1. BUSD issued by Blockingxos on Ethereum, which is regulated by the New York State Department of Financial Services (NYDFS);

2. Binance-Peg BUSD issued by Binance on other chains (BNB chain). This type of BUSD is not regulated by any entity, and Binance issues its own Binance-Peg BUSD by holding BUSD on Ethereum.

BUSD Operating Mechanism:

To maintain its $1 value, the amount of USD held by Blockingxos is equal to the total supply of BUSD. BUSD and USD can be exchanged at any time through Blockingxos.

1. Users send USD to Blockingxos’ bank reserve account.

2. The issuer (Blockingxos) creates an equal amount of BUSD on Ethereum.

3. The newly minted BUSD is delivered to the user, while the USD is held in the bank reserve account.

4. This mechanism also works in reverse. Users can destroy BUSD using Blockingxos and receive a return of $1.

By using smart contracts to destroy/mint BUSD, the mechanism can maintain the ratio of supply and reserves at a constant 1:1.

BUSD Operation:

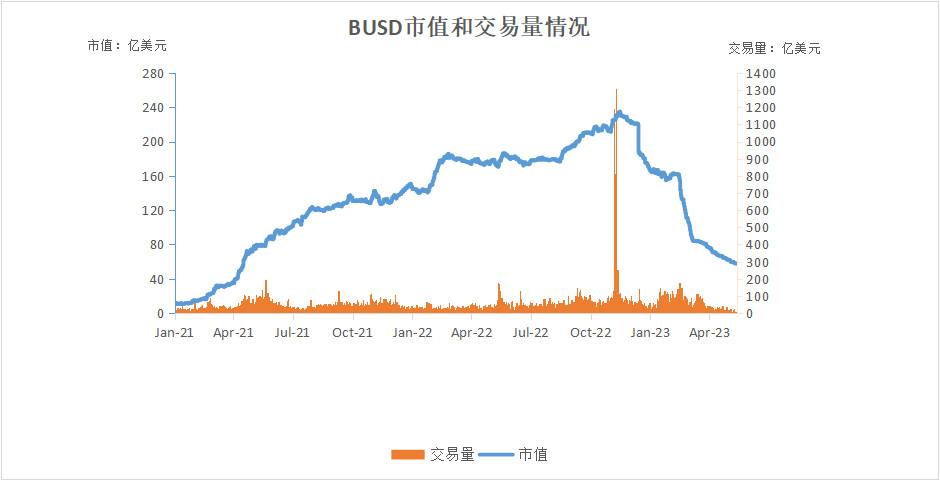

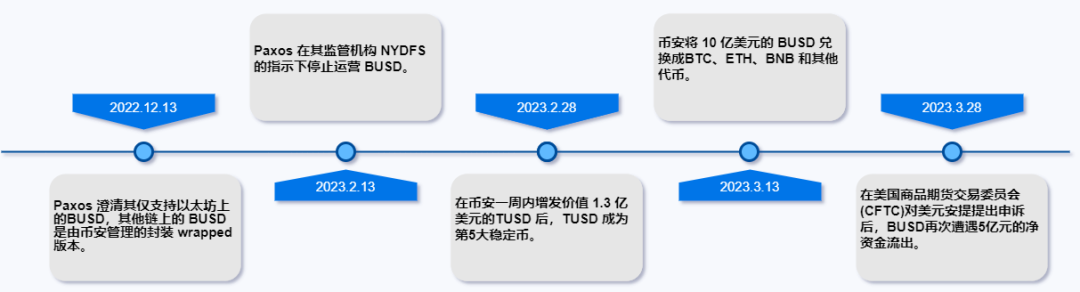

Everything has gone smoothly with the development of BUSD, especially since the bull market and the frenzy of the BNB chain began in 2021.

In September 2022, Binance announced that user balances and newly charged USDC, USDP, and TUSD would be automatically converted to BUSD. Circle CEO said this was a good thing.

In 2023, Circle reported to the New York Department of Financial Services that there were problems with the reserves of BUSD:

In January, Binance admitted that BUSD had a reserve management defect.

In February, the issuer of BUSD, Blockingxos, was investigated by the New York Department of Financial Services, and BUSD began to experience capital outflows. Subsequently, the SEC plans to sue Blockingxos, claiming that BUSD is an unregistered security. On the 13th, BUSD was announced to be suspended.

On February 13th, Binance CEO Zhao Changpeng stated that BUSD will no longer be the main trading currency on Binance.

On February 28th, Coinbase announced that it will suspend BUSD transactions from March 13th.

In March, AAVE DAO voted to remove BUSD from its lending platform.

△BUSD Price Trend Chart (2021-2023)

△BUSD Market Capitalization and Trading Volume (CoinGecko)

Although the starting point is low, the circulation of BUSD increased by about 250% in the first quarter of 2021, which is most likely due to the rise of the BSC and Terra public chains.

In the first quarter of 2023, the situation with BUSD has deteriorated, especially after SEC sent a Wells Notice to Blockingxos regarding the issuance of BUSD in mid-February. Blockingxos ultimately decided to stop issuing BUSD. The active law enforcement actions of U.S. regulators have made the development of the crypto industry more challenging in an opaque regulatory environment, and have also sparked greater calls for regulatory transparency. After Blockingxos decided to stop issuing the stablecoin, BUSD’s market capitalization ranking fell sharply from 7th to 12th. After the SEC investigated the decoupling of BUSD and USDC, the stablecoin market experienced panic, and BUSD lost 54.5%.

Since the announcement of its discontinuation of operation in February 2022, as users continue to withdraw, the market value has dropped rapidly. In the first quarter of 2023, BUSD’s market value decreased by 47.3% or $6.8 billion, a 67.6% drop from its peak in November 2022. As of mid-May 2023, there is still $5.7 billion worth of BUSD in circulation on the market.

BUSD Reserve Asset Situation:

Each Blockingxos Standard bank account is supervised by the US auditing company Withum, and Blockingxos publishes its monthly BUSD reserve report.

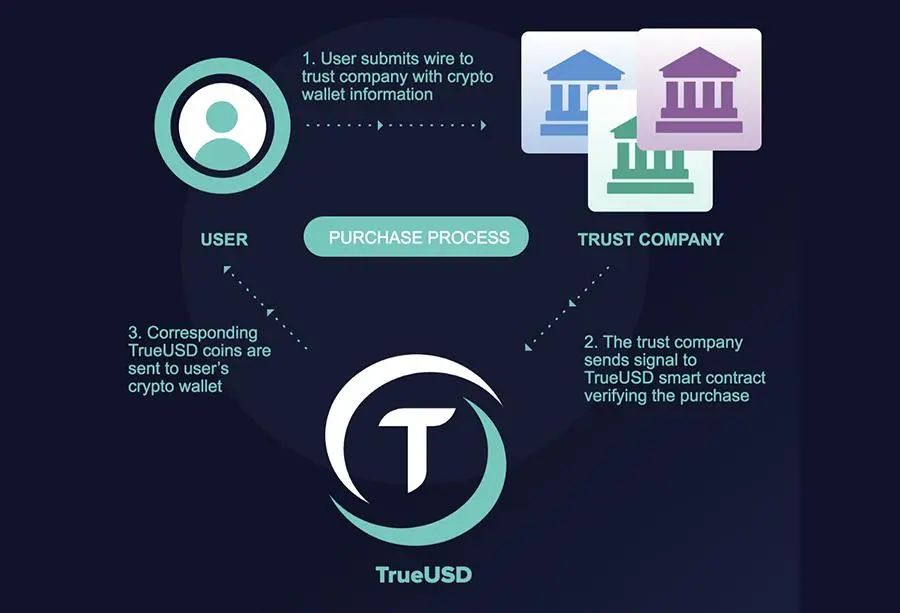

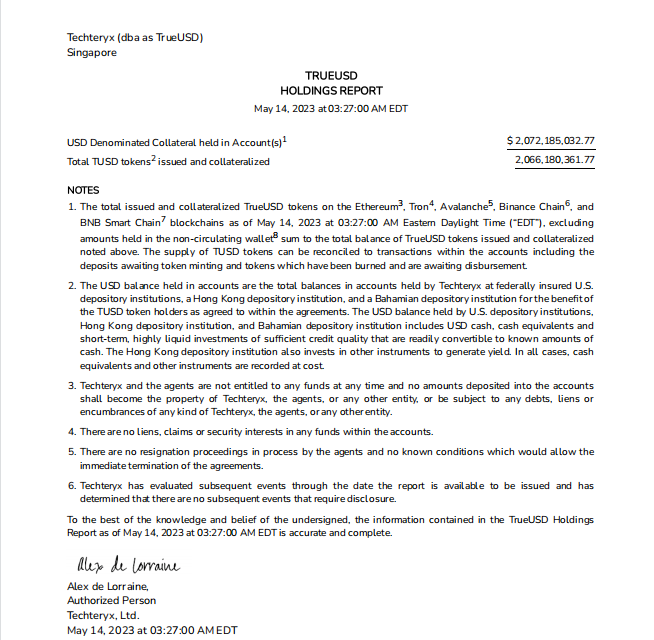

3.1.4TrueUSD(TUSD)

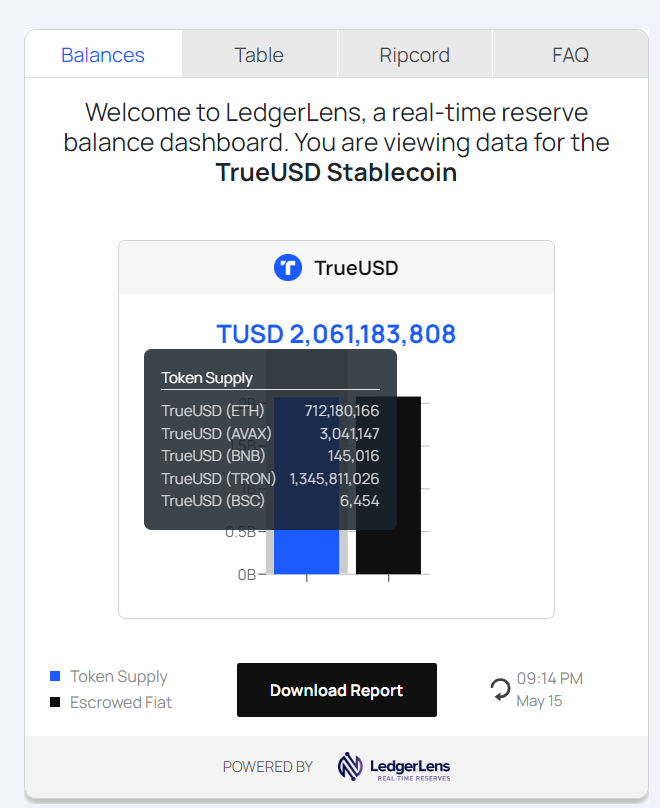

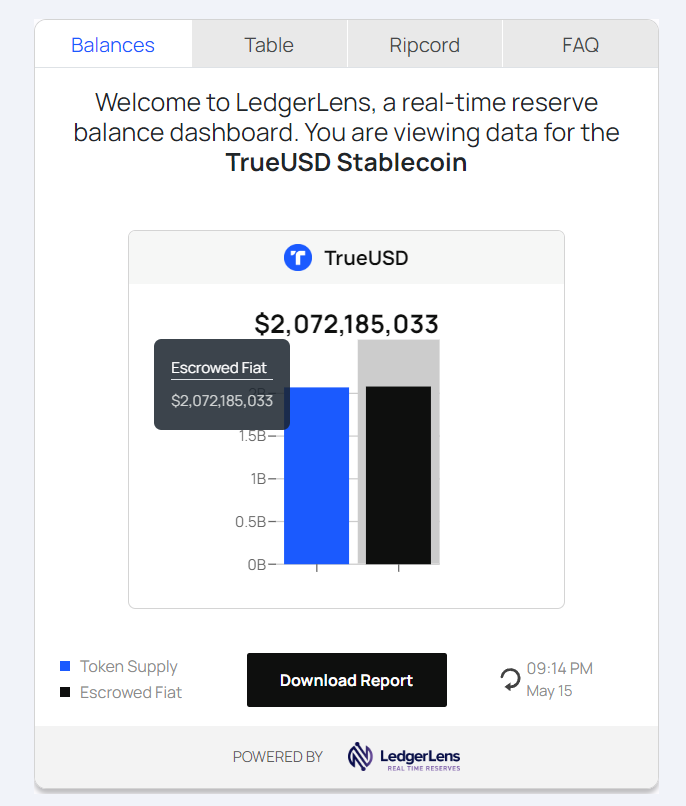

In March 2018, Archblock (the issuer) launched TrueUSD, which was listed on the Bittrex exchange. TrueUSD (TUSD) is a fully collateralized, legally protected, and transparently verified ERC-20 token. It is pegged to the US dollar and maintains a 1:1 ratio. In addition, it is the first cryptocurrency asset built on the TrustToken platform. It aims to be a simple, transparent, and reliable stablecoin. Therefore, it does not use hidden bank accounts or any special algorithms.

TUSD Operating Mechanism:

The US dollar holdings of TrueUSD are distributed among different bank accounts belonging to different trust companies. The parties have signed agreements to publish collateral assets daily and conduct monthly audits. The token uses multiple custody accounts to reduce counterparty risk and provide legal protection for holders against theft.

TrustToken uses publicly audited smart contracts to limit its own issuance of tokens. The money never even touches the hands of the TrustToken team. Whenever a custody account receives US dollars, new TUSD is automatically generated. Every time a user redeems US dollars, an equal amount of TUSD is immediately destroyed. In this way, TrustToken ensures a 1:1 ratio of US dollars to TUSD between the funds in the custody account and the TUSD in circulation.

TrueUSD has the following characteristics:

- Legal protection: The company regularly releases attestations, which are legally protected by the strong protections provided by the custodial accounts.

- Convertible to US dollars: Anyone who passes AML/KYC checks on the TrustToken platform can convert TUSD to US dollars. However, the minimum withdrawal amount is $10,000.

- Trusted fund management: The TrueUSD system is designed to allow you to exchange dollars directly with the custodial account through design, rather than through TUSD network remittances.

- Full collateral: Each individual TUSD token is always collateralized by US dollars held by the custodial account company. New tokens are minted and burned by audited smart contracts.

- Regular attestations: All holdings of the custodial account are subject to regularly published attestations.

The key to the normal operation of each TrustToken tokenized asset is the third-party custodial account. Anyone who meets KYC and AML requirements can purchase/redeem TrueUSD using their application.

TUSD Operating Status:

As of October 7, 2022, TUSD has been granted legal status in the Commonwealth of Dominica as an authorized digital currency and exchange medium.

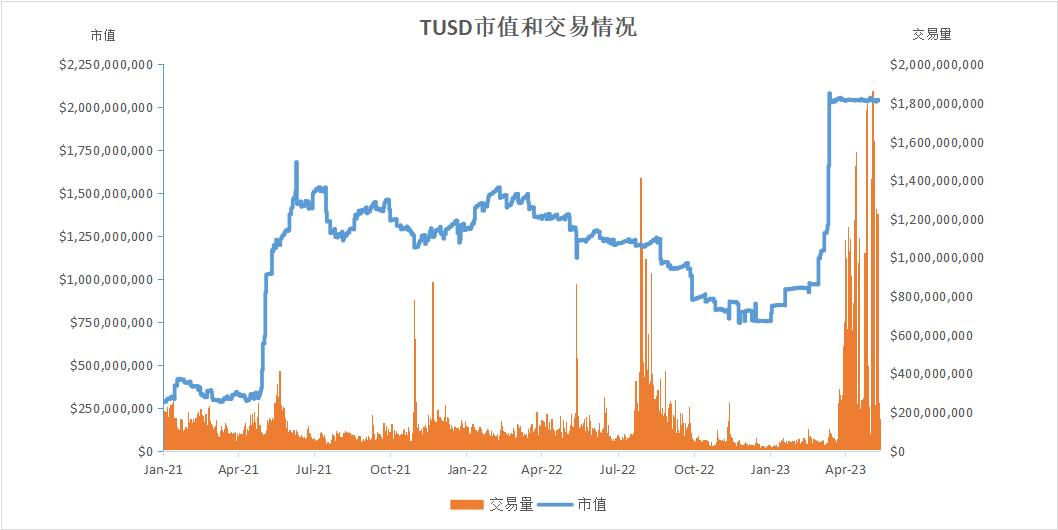

△TUSD price trend chart (2021-2023)

TUSD (+169.3%) had the highest increase in the first quarter of 2023 (outpacing FRAX +2.6%). TUSD’s growth was largely driven by large-scale new minting by Binance (about $130 million) and Tron (about $750 million).

△ TUSD market capitalization and trading volume (CoinGecko)

TUSD Reserve Asset Status:

Through a partnership with leading US accounting firm Armanino, TrueUSD holders can view a real-time dashboard of TrueUSD account holdings, which is a highly transparent example.

3.2 Decentralized Stablecoins

Decentralized stablecoins are managed by designated communities and stabilized by calculation protocols. There are four types of decentralized stablecoins: over-collateralized stablecoins, algorithmic stablecoins, fractional stablecoins, and non-pegged stablecoins.

One commonality among decentralized stablecoins is that they are guided by multiple control points, rather than a single entity as seen in centralized stablecoins. The issuance and distribution of centralized stablecoins are controlled by central organizations, and the peg of coins is maintained by actual legal currency or other commodities such as gold, oil, and real estate.

Decentralized stablecoins differ in two aspects: governance and pegging systems. The governance systems of different types of decentralized stablecoins are similar, so decentralized stablecoins are grouped according to their minting and pegging maintenance schemes. The following are two popular decentralized stablecoins:

3.2.1 MakerDAO (DAI)

In December 2017, MakerDAO introduced DAI. Unlike USDT, DAI exists entirely on the blockchain, avoiding the credit risks that may arise from third-party trust intermediaries.

DAI Operating Mechanism:

DAI’s generation, access, and usage thresholds are all low. Users generate DAI by using the Maker protocol to create a smart contract called the “Maker Vault” and deposit assets (approved collateral) into it. This process is both the process by which DAI enters circulation and the process by which users obtain liquidity. Additionally, users can also purchase DAI from intermediaries or exchanges.

Think of MakerDao as a pawnshop where you can pledge your digital assets (currently only MKR) on the MakerDao system to get a certain amount of DAI. You can imagine that this collateral contract is the function of this system contract. This important function is called the Vault (formerly known as CDP) smart contract for multi-collateral systems. This contract allows you to borrow DAI within the MakerDao system, which can be reinvested (leveraged), international remittances, etc. It is important to note that if the digital currency you pledge depreciates rapidly and you cannot repay the DAI loan, your digital currency will be forcibly auctioned off and converted into DAI to repay the loan. This is what we commonly call a “forced liquidation.”

DAI Stable Mechanism:

The initial goal of DAI was to be pegged to the US dollar at a 1:1 ratio, but market behavior can cause some price differences, so there are mechanisms in place to stabilize the price of DAI. The price stabilization mechanism mainly relies on interest rate adjustments and liquidation, with interest rate adjustments being done through governance voting, including stable interest rate adjustments and DAI deposit interest rate (DSR) adjustments. Liquidation is mainly an emergency shutdown measure to control risk.

1. Stable interest rate adjustment: This refers to the annualized interest rate that users need to pay when generating DAI from collateral assets, which is essentially a loan interest. When the price of DAI is higher than $1, lowering the stable interest rate (i.e., lowering the loan interest) encourages users to create Vault to generate DAI. When the market price of DAI is below $1, increasing the stable interest rate (i.e., increasing the loan interest) stimulates users to close Vault, destroy DAI, and reduce the market supply of DAI.

2. DAI deposit interest rate (DSR) adjustment: Users can lock DAI into the DSR contract of the Maker protocol to automatically receive savings income, and the DSR determines the size of income that DAI holders can receive based on their deposits. DAI deposit interest is paid by borrowing interest, which means that deposit interest is guaranteed by the stability fee. For the Maker protocol, if the income from the stability fee cannot cover the total expenditure of DAI deposit interest, the difference is a system bad debt, which will be compensated by increasing MKR issuance, which means that MKR holders bear the risk of this part.

3. Emergency shutdown: It is the last resort to ensure that DAI holders can redeem at the target price in emergency situations. Once the emergency shutdown is triggered, users can no longer create new Vaults or operate existing Vaults, and the price feeding mechanism will also be frozen.

DAI Operation:

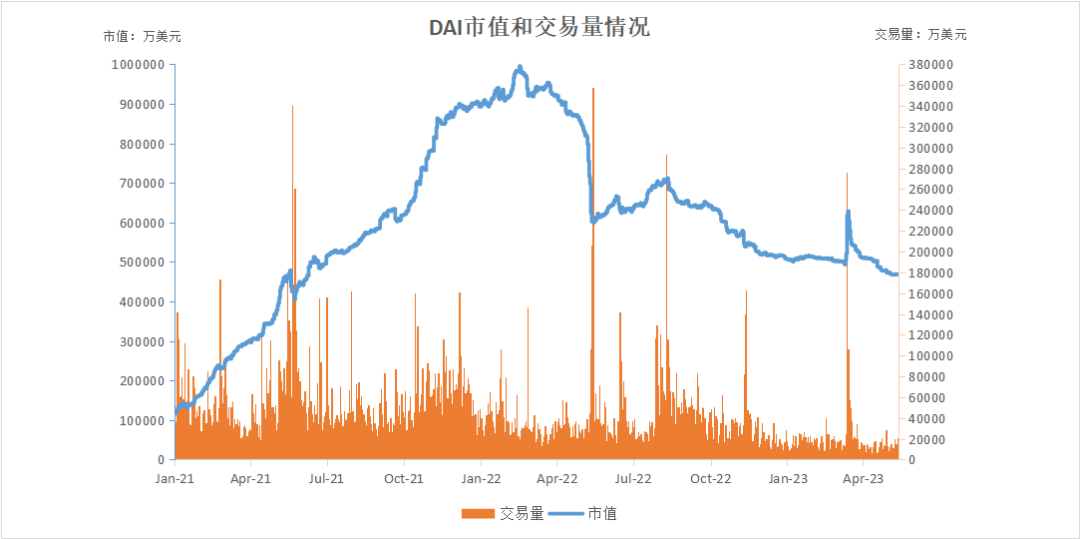

△ DAI market cap and trading volume (CoinGecko)

In the first quarter of 2022, DAI’s growth slowed down due to competition from similar projects. In the second quarter of 2022, DAI’s market cap fell by 32%, possibly due to its negative correlation with algorithmic stablecoins. In the first quarter of 2023, DAI remained relatively stable.

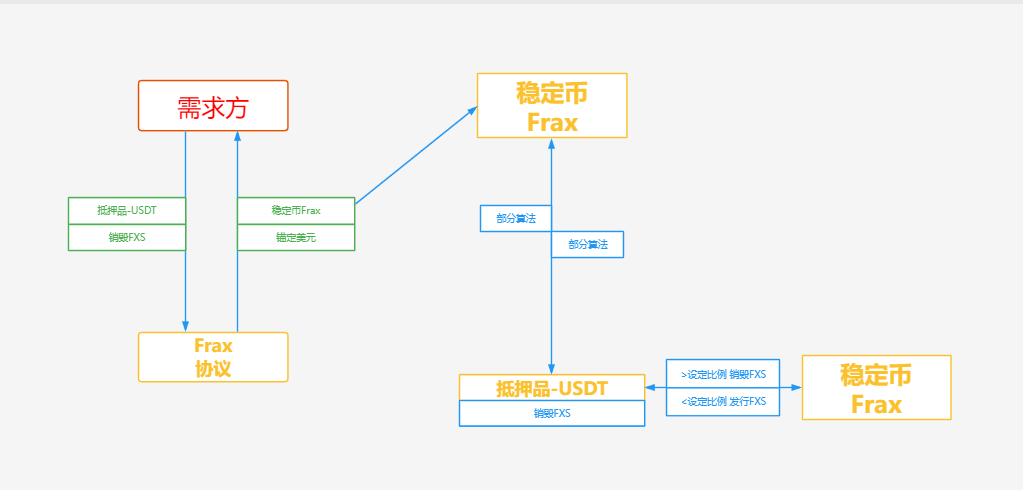

3.2.2 FRAX

In December 2020, FraxFinance launched FRAX, the first and only partially collateralized and partially algorithmically supported stablecoin project. FRAX is a dual-type minting tax model, and its stablecoin FRAX is supported by two types of collateral, collateralized stablecoins (USDC) and FRAX Share (FXS).

FRAX Stable Mechanism:

In the initial state, FRAX is in the 100% collateral stage, which means that only collateral needs to be placed in the minting contract to mint FRAX, and 100% of the value of the FRAX created in the system is collateral. As the protocol enters the hybrid phase, a portion of the value entering the system during the minting process becomes FXS (which is then burned during the flow process). For example, at a 98% collateralization ratio, each minting of FRAX requires $0.98 in collateral and burns $0.02 worth of FXS. At a 97% collateralization ratio, each minting of FRAX requires $0.97 in collateral and burns $0.03 worth of FXS, and so on.

Although the FRAX protocol is designed to accept any type of cryptocurrency as collateral, the implementation of the FRAX protocol will primarily accept on-chain stablecoins as collateral to eliminate collateral volatility, allowing FRAX to smoothly transition to more algorithmic ratios.

The redemption process for FRAX is seamless, easy to understand, and economically reliable. In the 100% collateral stage, it is very simple. In the hybrid algorithm stage, when FRAX is created, FXS is burned. When FRAX is redeemed, FXS is minted. As long as there is demand for FRAX, redeeming it for collateral plus FXS will start minting a similar amount of FRAX into circulation (burning the same amount of FXS).

At the beginning, the FRAX protocol adjusts the collateralization ratio every hour, with each adjustment being 0.25%. When the FRAX price is at or above $1, the function lowers the collateralization ratio once per hour, and when the FRAX price is below $1, the function raises the collateralization ratio once per hour. This means that if the FRAX price is above $1 or close to it for most of the time during a certain period, the net change in collateralization ratio will be reduced. If the FRAX price is mostly below $1, the collateralization ratio on average will increase towards 100%.

FRAX has the following characteristics compared to UST (February 9, 2022 anchor, Terra collapse):

- Flexible collateralization ratio: FRAX automatically achieves collateralization ratio through proportional-integral-derivative (PID) controllers. FRAX redeploys collateral to other places to earn revenue, which helps bring in external income and keeps the protocol floating through its algorithmic market operation controller.

- FRAX speculation is transferred to FXS. Due to FRAX’s destruction/buyback mechanism, its price volatility has been transferred to FXS.

- Reliable collateral: Some of FRAX’s collateral is USDC (backed by US dollar cash reserves), which injects changes in growth rates.

- FXS provides value beyond governance, such as coinage requirements and protocol fees, which incentivizes users to purchase FXS.

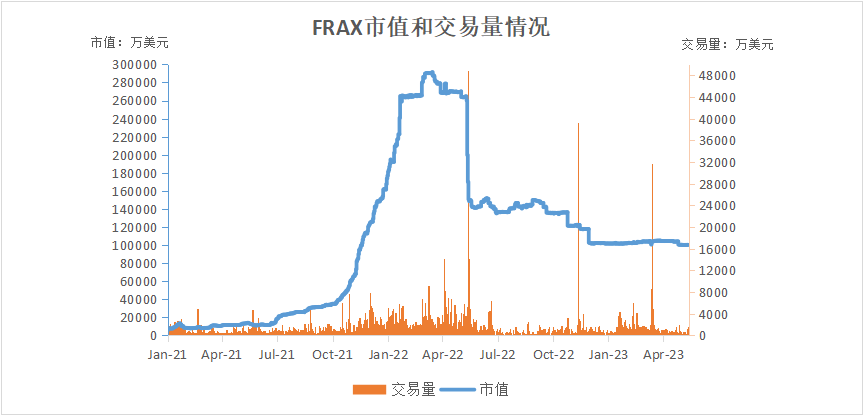

FRAX Operations:

△ FRAX Market Cap and Trading Volume (CoinGecko)

FRAX has developed rapidly in 2021, with a market cap exceeding $100 million. This also reflects the increasing acceptance of algorithmic stablecoins in the market. In the second quarter of 2022, FRAX’s market cap fell by 48%, possibly due to its negative correlation with algorithmic stablecoins. In the first quarter of 2023, FRAX remained stable.

3.3 New Stablecoins

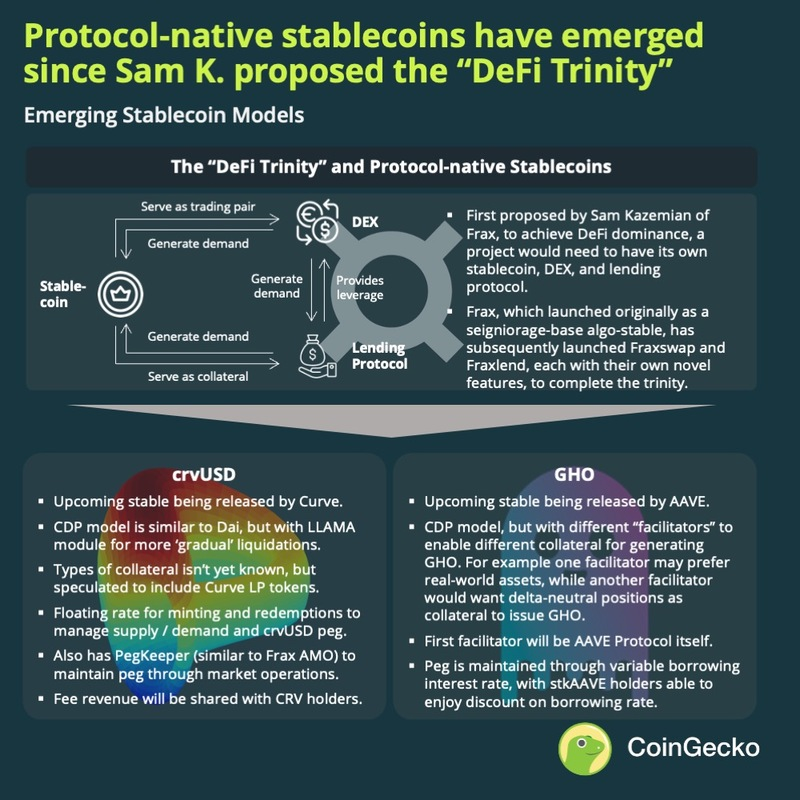

According to Sam Kazemian’s “DeFi Trinity” theory, a project needs its own stablecoin, decentralized exchange (DEX), and loan agreement to achieve DeFi dominance.

Some of the largest protocols have begun to build in this direction, developing their own DEX and loan agreements alongside stablecoins. Not surprisingly, FRAX has taken the first step, introducing Fraxswap and Fraxlend to supplement its stablecoin, and other protocols are quickly catching up. The ongoing issues surrounding centralized stablecoins, such as regulatory scrutiny risks – especially the recent closure of BUSD – have only accelerated efforts to build a truly decentralized stablecoin model.

The market eagerly awaits the two largest DeFi protocols to launch protocol-native stablecoins, namely Curve’s crvUSD and AAVE’s GHO, both of which have their own novel designs based on their respective underlying protocols, and more importantly, will have the function of strengthening their respective flywheels.

Aside from protocol-native stables, other stablecoin models remain experimental. USDD (USDD) continues to represent an endogenous collateral stablecoin, supported by multiple tokens including BTC, USDT, and USDC. Projects like Rai and Olympus are attempting to create a stablecoin that isn’t actually pegged to fiat. Ampleforth might be the most interesting – a pure algorithmic stablecoin with no collateral.

BlockingRT04 The Growth Potential and Use Cases of Stablecoins

4.1 Growth Potential of Stablecoins

1. Solving the problem of digital currency price volatility

Stablecoins are a type of digital currency issued with assets as collateral, and their prices are relatively stable compared to other digital currencies. Therefore, stablecoins can be used to solve the problem of digital currency price volatility. For example, when you buy goods with Bitcoin, the large fluctuations in Bitcoin prices may cause the price you need to pay to increase or decrease due to price fluctuations, which increases transaction uncertainty. However, if you use stablecoins for transactions, you can avoid this situation because their prices are relatively stable.

2. Can assume financial functions

Stablecoins have all the functions of general digital currencies, such as payment, storage, etc., and can also assume some financial functions, such as payment fees, exchange rate conversion media, etc.

3. More transparent market transactions

Stablecoins are usually issued by institutions, and the collateral preparation process also requires auditing, which increases the transparency of market transactions and provides more guarantees.

4.2 Use Cases of Stablecoins

Legal currency exchange channels

From the issuance and circulation process of USDT, it can be seen that investors can purchase USDT from Tether or from other investors, and when investors want to exchange legal currency, they can redeem it from Tether.

Serve as a trading intermediary

Many digital currencies also face obstacles in the process of exchanging with mainstream digital currencies such as Bitcoin. Therefore, users can first exchange other digital currencies for USDT, and then exchange them for Bitcoin for trading.

Serve as a hedge asset

USDT promises that users can exchange USDT for legal currency at any time. Therefore, when the digital currency market price fluctuates drastically, investors can first exchange the digital currency they hold into USDT to hedge their assets, and then exchange them back to other digital currencies when the market price stabilizes.

Used for fund payments. USDT can be used as a means of fund payment, especially in cross-border payment scenarios. Currently, the SWIFT system is used for global cross-border payments, which takes 3-7 days and incurs high fees.

BlockingRT05 Stablecoin Regulations and Global Supervision

5.1 Stablecoin Regulations

After major setbacks such as the collapse of Terra/UST and FTX, many investors suffered significant losses, and governments and regulatory agencies were forced to take action. Although legislation and regulatory work were already underway before the widespread contagion increased the urgency and speed of these efforts. Specifically, stablecoins have been an area of special concern.

International standard-setting bodies such as the Financial Stability Board (FSB) and the Basel Banking Supervision Committee (BSBC) have developed initial regulatory standards for digital assets in an attempt to promote consistent regulation globally. On the other hand, the Bank for International Settlements (BIS) has been supervising and monitoring, deploying a project that enables central banks to effectively monitor the balance sheets of stablecoins.

The US Congress has proposed a stablecoin bill, and individual countries are also working to address the issue with the US and other countries. The Monetary Authority of Singapore (MAS) is how industry participants can develop an overall regulatory framework for stablecoins, and the Hong Kong Monetary Authority (HKMA) has issued a regulatory framework that requires stablecoin issuers to obtain operating licenses and may even ban the regulation of algorithmic stablecoins.

5.2 Are Stablecoins Regulated?

Due to their unique combination of legal tender and cryptocurrency, stablecoins have caught the interest of regulatory bodies around the world. Because they are designed to maintain stable prices, they can be used for reasons beyond speculation and can facilitate low-cost international high-speed trading. Some countries are even trying to create their own stablecoins. Issuing stablecoins with legal reserves may also require approval from regulatory authorities and may be subject to the same regulations as local jurisdictions for cryptocurrencies.

5.3 Latest Developments in the Regulation of Stablecoins in Major Countries Around the World

Currently, the regulatory stance on cryptocurrency, including stablecoins, varies among major countries and regions, and corresponding regulatory frameworks and legislation are at different stages. The following briefly introduces the latest developments in China Hong Kong, mainland China, the United States, Singapore, and the EU to provide some summary reference and guidance for readers regarding the regulation of the following countries and regions.

5.3.1 China Hong Kong

On January 12, 2022, the Hong Kong Monetary Authority (HKMA) issued a discussion paper on extending the Hong Kong regulatory framework to stablecoins, inviting the industry and the public to provide opinions on the regulatory mode of cryptocurrencies and stablecoins. The discussion paper outlines the HKMA’s thinking on the regulatory mode of cryptocurrencies, especially stablecoins used for payment. The HKMA expects to formulate a plan before July 2023 and promulgate new regulatory regimes before the 2023/2024 fiscal year.

The HKMA believes that stablecoins are increasingly seen as a widely accepted payment method, and in fact, the growth in their usage increases the potential for stablecoins to be integrated into the mainstream financial system. In the view of the HKMA, this will have a wider impact on currency and financial stability, making stablecoins a regulatory priority for the HKMA.

The HKMA issued the “Consultation Conclusions on the Discussion Paper on Cryptocurrencies and Stablecoins” in January 2023, summarizing the feedback from the industry on the HKMA’s consultation on stablecoins a year ago and the HKMA’s corresponding stance. The main contents of the consultation conclusions are as follows:

1. Key regulatory focus

The HKMA stated that it will prioritize the regulation of stablecoins that claim to be anchored to legal tender. Whether anchored to legal tender through algorithms or arbitrage mechanisms and whether the stablecoin is primarily used for retail, wholesale, or cryptocurrency trading, any stablecoin that claims to be anchored to legal tender will be included in the regulatory focus.

2. Regulatory jurisdiction over stablecoins

In the HKMA’s conclusion, the HKMA pointed out that the mandatory issuance system for stablecoin activities may have some overlap with the virtual asset service provider licensing system currently managed by the Securities and Futures Commission of Hong Kong, and stated that it will further consult other regulatory bodies’ opinions to consider how to avoid future regulatory arbitrage.

3. License Application

The Hong Kong Monetary Authority concluded that mandatory licensing is required for all types of stablecoin-related activities, and that licenses are issued based on different types of stablecoin activities, including (1) governance: establishment and maintenance of regulated stablecoin rules, such as ownership structures and operational arrangements; (2) issuance: issuance, creation, or destruction of regulated stablecoins; (3) stability: arrangements for the stability and reserve assets of regulated stablecoins (whether or not provided by the issuer), including maintaining the value of stablecoins in an effective manner; and (4) wallets: providing services for storing user private keys to enable users to use and manage their regulated stablecoins.

It is worth noting that the same entity needs to obtain different licenses for different types of stablecoin activities. As far as stablecoin issuance activities are concerned, the Hong Kong Monetary Authority recognizes that both banks and non-bank institutions can serve as stablecoin issuers.

4. Algorithmic stablecoins

The Hong Kong Monetary Authority stated that stablecoins anchored to a legal currency through an algorithm or arbitrage mechanism, regardless of whether the stablecoin is mainly used for retail, wholesale, or cryptocurrency trading, will be subject to regulatory focus as long as it claims to be anchored to a legal currency. One of the conditions that the Hong Kong Monetary Authority’s conclusion listed for issuing stablecoin licenses is that the reserve value of the relevant stablecoin should always match the quantity of issued stablecoins, and the reserve assets should be of high quality and liquidity. Algorithmic stablecoins do not meet these requirements. Therefore, entities engaged in algorithmic stablecoin-related activities do not meet the Hong Kong Monetary Authority’s licensing requirements. After the stablecoin licensing system is officially launched, entities that have provided algorithmic stablecoin-related services should consider how to respond, such as whether to gradually close or adjust services to Hong Kong, and whether existing Hong Kong users can continue to use algorithmic stablecoins.

5. Localization requirements for license applicants, and whether non-domestic fiat-pegged stablecoins can be hooked up

In the Hong Kong Monetary Authority’s conclusion, the Hong Kong Monetary Authority believes that the requirement for the licensed entity to “establish a company in Hong Kong” is conducive to the supervision and enforcement of regulatory requirements for the licensed entity. This requirement can separate the assets related to regulated business from the assets and liabilities of other entities within the licensed entity group, and facilitate the confiscation of its assets when necessary. Nevertheless, the Hong Kong Monetary Authority also stated in its conclusion that it will refer to the regulatory developments in other countries or regions and the opinions of the industry to further weigh whether other measures can be adopted to replace the requirement of “establishing a company in Hong Kong” while ensuring the soundness and effectiveness of regulatory measures. It remains to be clarified by the Hong Kong Monetary Authority whether entities established outside Hong Kong can obtain stablecoin-related business licenses in Hong Kong.

6. Key points of regulatory requirements

(1) Comprehensive regulatory framework: Regulatory requirements should cover a wide range of issues, including but not limited to ownership, governance, financial requirements, risk management, AML/CFT, user protection, and periodic audit and disclosure requirements.

(2) Full support and redemption at face value: The value of the reserve assets arranged for stablecoins should always match the value of stablecoins in circulation. Reserve assets should be of high quality and high liquidity. Stablecoins based on arbitrage or algorithmically derived value will not be accepted. Stablecoin holders should be able to exchange stablecoins for reference fiat currency at face value within a reasonable time frame.

(3) Restriction on main business: Regulated entities must not engage in activities that are different from their main business allowed by their relevant licenses. For example, wallet operators should not engage in lending activities.

In addition, under the Securities and Futures Ordinance of Hong Kong, unless specific exemptions apply, carrying on regulated activities related to “securities” (such as securities trading, providing services for securities trading, providing advice on securities, etc.) requires obtaining a license issued by the Securities and Futures Commission of Hong Kong in advance. Therefore, specific analysis and judgment should be made on whether the stablecoin involved falls within the scope of “securities” under the Ordinance before engaging in stablecoin-related business. If the stablecoin involved constitutes “securities” under the Securities and Futures Ordinance, conducting business related to that stablecoin will be regarded as carrying on regulated activities and will require obtaining the relevant license issued by the Securities and Futures Commission of Hong Kong in advance.

4.3.2 Mainland China

The regulatory policy of China’s crypto assets began with the “Notice on Preventing Bitcoin Risk” issued by the People’s Bank of China and five other ministries on December 5, 2013. On September 4, 2017, the People’s Bank of China and seven other ministries issued the “Announcement on Preventing the Risks of Token Issuance and Financing”, also known as the 9.4 Ban. The announcement clearly stipulates that no organization or individual may engage in illegal currency exchange between legal currency and tokens or “virtual currencies”. No one is allowed to buy or sell tokens or “virtual currencies” as a central counterparty, or provide pricing, information intermediary services, etc. for tokens or “virtual currencies”.

On September 24, 2021, the People’s Bank of China and ten other departments issued the “Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation,” also known as the 924 notice. Compared with the 94 ban, the 924 notice clearly states that the following five types of “related business activities” for virtual currencies are “illegal financial activities”: (1) conducting transactions between legal tender and virtual currency, as well as transactions between virtual currencies; (2) buying and selling virtual currencies as central counterparties; (3) providing information intermediary and pricing services for virtual currency transactions; (4) token issuance and financing; and (5) trading of virtual currency derivatives.

Given that some stablecoins issued by certain commercial institutions discussed in this article are one of the virtual currencies defined by the 924 notice, any “related business activities” related to stablecoins currently fall within the scope of “illegal financial activities” prohibited by the 924 notice.

4.3.3 United States

In November 2021, the US Presidential Working Group on Financial Markets, the Federal Deposit Insurance Corporation, and the US Office of the Comptroller of the Currency jointly issued a report on stablecoins. To address the risks of payment-type stablecoins, the report recommends that the US Congress quickly enact legislation to ensure that payment-type stablecoins and their related arrangements are subject to uniform and comprehensive federal regulatory frameworks, to fill legislative gaps in market integrity, investor protection and illegal financing, and to address the following important concerns:

(1) to prevent stablecoin runs, legislation should require all stablecoin issuers to be insured depository institutions and subject to appropriate supervision at the depository institution and holding company levels;

(2) to mitigate payment system risks, legislation should regulate custodial wallet providers under appropriate federal supervision;

(3) to address systemic risk and the risk of economic concentration of power, legislation should require stablecoins to comply with activity restrictions on limits and business entity affiliations.

Regulators should have the authority to enforce standards to promote interoperability between different stablecoins. In addition, the US Congress is also considering other standards for custodial wallet providers, such as limiting their affiliation with business entities or user transaction data.

On March 31, 2022, Senator Bill Hagerty submitted the Stablecoin TransBlockingrency Act to the Senate, which aims to improve transparency in the stablecoin market and set reserve standards for reserve assets. The requirements for stablecoin issuers under the bill are:

(1) government securities with a holding period of less than 12 months;

(2) repurchase agreements with fully collateralized securities;

(3) reserves backed by USD or other non-digital currencies, and a monthly report on the reserve assets held by the stablecoin issuer audited by a third party must be published on their website.

On April 6, 2022, US Senate Banking Committee member Blockingt Toomey announced a discussion draft of the Stablecoin TRUST Act. The draft legislation proposes to limit the issuers of payment stablecoins to the following three types of institutions:

(1) nationally registered money transmitters;

(2) holders of new federal licenses specifically designed for stablecoin issuers;

(3) insured depository institutions. Payment stablecoin issuers would be required to disclose their reserve assets, establish redemption policies, and undergo periodic certification by registered accounting firms.

In May 2022, Securities and Exchange Commission (SEC) Chairman Gary Gensler told the House Appropriations Financial Services Subcommittee that, according to the SEC’s definition, many cryptocurrency exchanges are trading securities rather than commodities, and called on lawmakers to increase the SEC’s enforcement budget to require cryptocurrency exchanges to register with the SEC. Therefore, cryptocurrency exchanges should also be aware of whether stablecoins will be considered “securities”.

In April 2023, the US Congress issued two versions of stablecoin legislation (referred to as “US Draft 2023 First Edition” and “US Draft 2023 Second Edition”, collectively referred to as “US Draft”), and held two hearings on the matter. The US Congress stated that it will issue a third version of the legislation within two months, and believes that the draft legislation is likely to be supported by both parties and officially passed.

The main contents of the US Draft 2023 First Edition are as follows:

1. A detailed definition is given for “stablecoins used for payment”, which is “a virtual asset (subject to individual exceptions) (1) used or designated for use as a means of payment or settlement, and (2) (its issuer) is obligated to convert, redeem, or repurchase (stablecoins) at a fixed currency value; or (its issuer) claims to maintain or create a reasonable expectation that the value of (stablecoins) relative to the value of a certain fixed fiat amount will remain constant.”

2. The license is issued to stablecoin issuers. Banks only need to be approved, while non-bank issuers need to be licensed, otherwise there will be corresponding fines and penalties. There is no distinction between the licensing applicant being established within or outside the United States.

3. Different types of algorithmic stablecoins are treated differently. It adopts the concept of “endogenously collateralized stablecoins,” which can be roughly understood as uncollateralized stablecoins, or stablecoins whose value is supported by digital assets issued by the same issuer. Endogenously collateralized stablecoins are likely to be restricted by the ban for two years after the law is implemented, and no new coins can be issued during this period, while the existing stock of algorithmic stablecoins is not subject to this ban.

4. Asset segregation requirements are more focused on protecting customer rights from being affected by creditor claims. The US draft law explicitly prohibits the re-pledging and commingling of client funds.

5. It is stipulated that the issuer must publicly disclose the composition of its reserve assets on its website every month. Certification is not only required to be submitted to federal regulatory agencies every month, but the certifier must also be the CEO of the issuer.

4.3.4 Singapore

Singapore’s Payment Services Act, which was enacted in 2019 and came into effect on January 28, 2020, regulates digital payment tokens (DPTs) and e-money; under the Act, DPT services and e-money issuance services are regulated activities under the Payment Services Act, and require a license as a payment service provider.

The Monetary Authority of Singapore (MAS) believes that stablecoins, because of their fixed exchange rate with fiat currency and the fact that stablecoin holders do not need to have a contractual relationship with or open an account with the stablecoin issuer, do not possess the characteristics of e-money and therefore do not fall under the category of e-money under the Payment Services Act.

The MAS further stated that it would take a case-by-case approach to examine the specific features of individual stablecoins from a technology-neutral standpoint to determine the appropriate regulatory measures. In the view of the MAS, based on the characteristics currently exhibited, USDC and USDT should be considered DPTs, and the provision of DPT services related to these two types of stablecoins should be subject to restrictions under the Payment Services Act and require the appropriate license.

In October 2022, the Monetary Authority of Singapore (MAS) issued a consultation paper proposing regulatory approaches to stablecoin-related activities, which includes more specific regulations compared to other countries or regions, and plans to release a summary response to the consultation in mid-2023. The main contents of this consultation paper are as follows:

1. MAS stated that single-currency pegged stablecoins are more suitable for payment and settlement functions and will be the main regulatory object of this proposal.

2. The licensing system in the Singapore consultation paper is issued to stablecoin issuers. In addition, different regulations apply to bank and non-bank issuers.

3. MAS stated that the current legislation focuses on stablecoins issued locally. In addition, considering that the same stablecoin issued by different issuers in different countries or regions under homogeneity, it plans to solve it from two aspects: First, requiring Singapore issuers to submit annual certification to MAS to prove that other major issuers (issuing more than 5%/10% stablecoins in circulation) comply with the same reserve asset requirements and prudential standards; Second, establish regulatory cooperation between relevant regulatory agencies that peg single-currency stablecoins to exchange operational information of the stablecoins.

4. According to the MAS consultation paper, the issuer must segregate the stablecoin reserve assets from the issuer’s other assets in different accounts, and the client’s MAS-regulated single-currency pegged stablecoins, other assets, and the issuer’s own assets should also be segregated in different custody accounts to reduce the risk of fund confusion.

5. The Singapore consultation paper stipulates specific standards for reserve assets and their high quality and liquidity, such as market pricing, the reserve assets can only be cash or equivalents, or bonds that mature within no more than three months, and are issued by the central banks of stable pegged currencies or government internationalization institutions with credit ratings not lower than AA-. They are priced in the currency pegged by the stablecoin. Specific clarifications have also been made on the frequency, independence, and public channels of disclosure, certification, and auditing requirements.

It is worth noting that if the issuance or issuance of stablecoins constitutes capital market products under the Securities and Futures Act (such as securities or units of collective investment plans), such issuance or issuance behavior will be regulated by the Securities and Futures Act; intermediaries (including platform operators that provide platforms for the issuance, issuance and/or trading of stablecoins and intermediaries that provide financial advice related to stablecoins) that assist in such issuance or issuance will also be subject to regulatory requirements for licensing and other compliance requirements under the Securities and Futures Act and/or the Financial Advisers Act.

4.3.5 EU

In May 2023, the European Union Council, composed of government ministers from 27 EU member states, approved the Markets in Crypto Assets (MiCA) proposal, which was introduced by the European Commission in 2020 and is set to be implemented in 2024. MiCA defines crypto assets as “digital representations of value or rights that can be transferred and stored electronically using distributed ledger technology or similar technology.”

MiCA can be divided into three main frameworks:

1. Rules for the issuance of crypto assets: Various requirements are imposed on issuers of various types of crypto assets. Issuers must draft a white paper (functionally similar to a prospectus) and obtain prior authorization from the competent authorities for practical tokens and crypto assets. A more complex set of issuance, authorization, governance, and prudential requirements apply to asset-referenced tokens and electronic money tokens.

In addition to lifting the ban on algorithmic stablecoins in the EU, MiCA requires that fiat-backed stablecoins be backed by a liquid reserve in a 1:1 ratio. The requirements for stablecoin issuers to apply include:

(1) ARTs are subject to stricter regulatory requirements than EMTs (considered more likely to threaten the stability of the European Union’s currency), and must apply to local regulatory authorities before issuance. After obtaining approval, they must regularly report information such as transaction customers, transaction gold loans, and reserve funds to regulatory authorities.

(2) Protect the assets held and reserved by the support, and require issuers to establish sufficient liquidity reserves in a certain ratio or deposit to protect consumers and avoid runs.

(3) Establish an investment litigation procedure and a program to prevent market cessation and insider trading.

(4) Establish and maintain separate asset reserves from other assets, managed by a third party.

2. Crypto asset service providers (CASP): Need to be authorized by the competent authorities and apply to financial companies under the Markets in Financial Instruments Directive II (MiFID II);

3. Rules to prevent abuse of the crypto asset market: These rules are broadly similar to those envisaged in the Market Abuse Regulation applicable to securities, but are more concise. The last rule aims to prevent behavior similar to that of Elon Musk, where a statement by a well-known figure can suddenly change the value of a crypto asset.

Stablecoins have attracted close attention from regulatory authorities around the world. Different countries have different regulatory situations and legislation is also at different stages. The regulation of stablecoins is constantly being strengthened. Institutions engaged in related businesses should assess risks and applicable laws and regulations at any time, adjust business models quickly to comply with stablecoin-related regulations, and avoid potential compliance risks.

Reference: [1] Hong Kong Securities and Futures Ordinance (Electronic Version);

[2] Hong Kong Special Administrative Region Government news bulletin, Legislative Council passes the “Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Bill 2022”;

[3] CoinGecko 2021/2022/2023 Cryptocurrency Industry Report;

[4] Stablecoin Research-Issuance background and market overview 2018;

[5] TetherGoldWhiteBlockingper;

[6] USDC centre-whiteBlockingper;

[7] BUSD: Everything you need to know about stablecoins;

[8] Beginner’s Guide_What is TUSD Cryptocurrency? Cryptonews-Market Cap;

[9] MakerDai-Whitepaper;

[10] Frax-Whitepaper;

Statement: The above content and opinions are for reference only and do not constitute any investment advice. The above content is obtained from general public network information collection and collation. The above content only states objective situations and does not constitute any form of advice. This article also does not represent any views or positions of the previous observation. This article has multiple sources of content. If there is any omission in the quoted part, please leave a message for correction;

This article only studies and analyzes the global stablecoin development trend and is only for readers’ learning and discussion, without any commercial and practical reference value.

There are differences in policies on digital currencies and stablecoins in different countries and regions. Readers must comply with the laws and regulations of their own countries or regions.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!