Original author: Blockingul Timofeev Compilation: Deep Tide TechFlow

Liquidity refers to the ease with which an asset can be converted into cash. The higher the liquidity of an asset, the easier it is to cash out, and vice versa.

In DeFi, liquidity is measured by price slippage, which is the difference between the expected price and the execution price when trading assets on automatic market makers (AMMs) like Uniswap. Better liquidity can reduce price slippage, make trading more efficient, and benefit all participants. Therefore, in DeFi, projects are motivated to create deep liquidity for their native tokens to accumulate value and attract more users.

- 2023 Encryption Trend: Decentralized Physical Infrastructure Network DePIN

- Several thoughts on OpenAI, DeepMind, and other models being opened to the UK government

- Can blockchain technology companies “protect themselves” while project parties use them to scam investors?

However, many L1 and dApp total locked value (TVL) charts look like a similar fate – liquidity and growth explode rapidly, followed by a clear decline. DeFi has learned painful lessons, and acquiring and retaining liquidity over time is much more difficult than building liquidity in the short term.

With top market makers like Jane Street and Jump Trading gradually reducing their participation, the need to design sustainable token models becomes more important.

Liquidity is here…and liquidity is gone.

Liquidity mining is a mechanism that incentivizes users to provide liquidity for tokens through native token rewards. Pioneered by Compound and Synthetix, it has become a common mechanism for DeFi projects to drive growth.

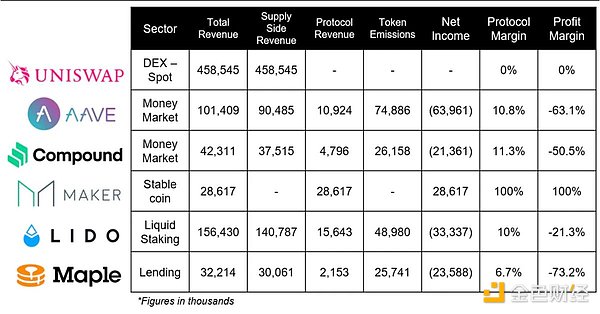

But we will soon find that this approach is extremely unsustainable in the long run and is a terrible business model. Protocols are struggling because they need to generate enough revenue to pay for emissions-related costs. Here are the profit margins of several DeFi blue-chip protocols from January to July 2022.

Take Aave, which has the third largest DeFi TVL, as an example. Although they generated $10.92 million in protocol revenue, they also paid nearly $75 million in token emissions, resulting in a loss of $63.96 million, or a profit margin of -63.1%.

DeFi needs to abandon unsustainable designs that fail to maintain liquidity and adopt token models that are more attractive, encourage long-term participation and growth. Let’s take a look at some models that are designed to optimize the current liquidity state.

LP Gauge Tokenomics

Curve Finance introduced the VoteEscrow model, allowing $CRV holders to lock their tokens to earn $veCRV, granting holders governance rights and increased earnings.

While this model offsets short-term selling to some extent and encourages long-term participation, it also reduces the liquidity of $CRV as many tokens are locked (even for up to 4 years).

Some protocols do not lock native tokens, but instead build models focused on locking LP tokens.

The LP Gauge economic incentive model encourages LPs providing liquidity to lock their LP tokens in exchange for increased rewards and greater governance rights. In this model, traders benefit from the “locked” liquidity safety net, LPs gain governance rights and increased rewards, and the ecosystem benefits from deeper liquidity.

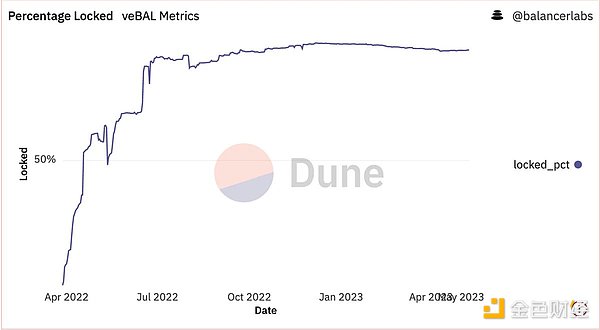

One project that adopts this model is Balancer, which introduced the $veBAL token economics. Here, users providing liquidity for the BAL/WETH pool receive $veBAL, which they can lock up for up to 1 year. $veBAL holders can receive 65% of protocol fees and can vote on pool issuances and other governance proposals.

Over time, the growth in the percentage of veBAL locked demonstrates a strong demand for utilizing the system.

Option Liquidity Mining

In addition to “regular” liquidity mining, an alternative token model is option liquidity mining. Simply put, this refers to the protocol distributing liquidity incentives in the form of options, rather than native tokens.

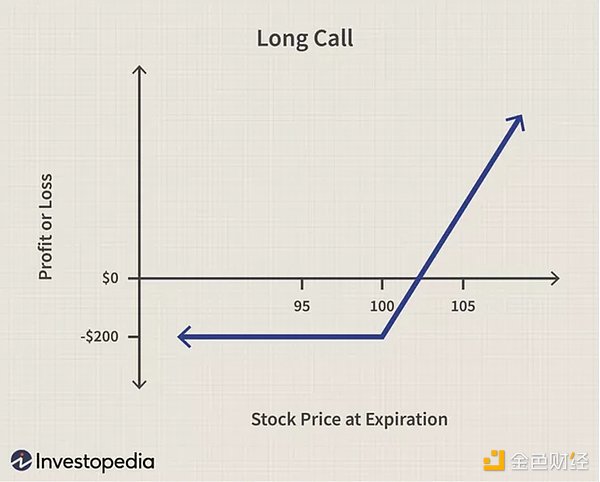

Call options are a financial instrument that allows users to purchase assets at a set price (strike price) within a certain time frame. If the price of the asset goes up, the buyer can use their option to purchase the asset at a discounted price and then redeem it at a higher price, gaining profit from the price difference.

Option liquidity mining allows protocols to distribute liquidity incentives in the form of call options instead of native tokens. This model aims to better align incentives between users and the protocol. For users, this model allows them to purchase native tokens in the future at a larger discount. At the same time, the protocol benefits from reduced selling pressure and can customize incentive conditions according to their specific goals. For example, creating long-term incentives by setting longer expiration dates and/or lower strike prices.

Option liquidity mining provides an innovative alternative to traditional liquidity mining. Although this model is still quite new and untested, some protocols that are trying to lead the way are eager to try it, including Dopex. They recently announced that they will be testing a call option incentive model for their structured products, claiming that this model will bring greater flexibility, price stability, and long-term participation compared to traditional incentive models.

However, some are concerned that this process could overall hinder users. After all, DeFi has long been focused on liquidity mining, and introducing these additional steps may make users hesitate and turn them away from a project, especially if they do not believe that the token will truly perform well in the future.

Whether option liquidity mining can help projects attract more long-term participants or whether the additional steps in the redemption process will make users hesitate and reduce liquidity are questions that need to be observed and evaluated.

Berachain

While the above examples provide some interesting models for maintaining liquidity and users, they are all focused on the application layer. So what if liquidity incentives were solved at the consensus layer?

Berachain is a newly launched project that aims to do just that – establish a sustainable incentive structure within the chain itself.

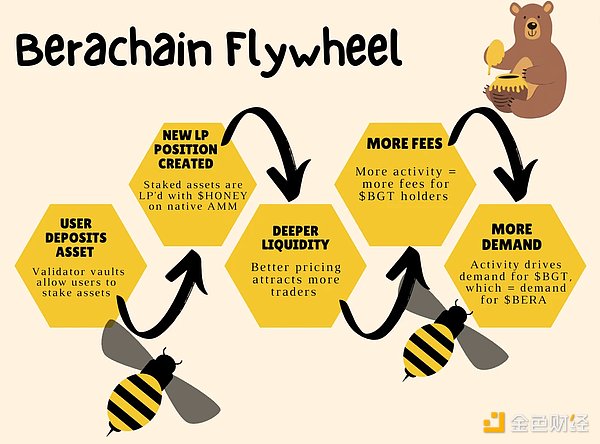

It all starts with the “Three Gen Coin Model” – Gas Token ($BERA), Governance Token ($BGT), and Native Stablecoin ($HONEY).

The novel liquidity proof-of-consensus mechanism allows users to participate as validators by collateralizing their assets to Berachain in exchange for block rewards and LP fees.

When users pledge their assets, their deposits are automatically paired with the native $HONEY stablecoin on the native AMM. At the same time, they also receive governance tokens ($BGT). $BGT stakers, in turn, receive protocol fees and exert an influence on emissions and other incentives within the ecosystem over time.

Theoretically, this will create a positive flywheel effect:

-

More deposits = deeper stablecoin liquidity;

-

Deeper liquidity = more traders will use Berachain;

-

More traders = more protocol fees = more $BGT holder rewards;

-

Better $BGT rewards = higher $BGT demand.

This model incentivizes users to keep their assets in the Berachain ecosystem as there are greater opportunities for returns compared to elsewhere. The beauty of this model is that the value generated by the chain primarily benefits the ecosystem itself, rewarding long-term committed participants. Users start contributing to the liquidity of the native stablecoin as soon as they make a deposit, naturally creating a liquidity mechanism. Additionally, users holding $BERA obtained through block rewards can earn fees generated by on-chain activities by holding $BGT. The protocol may start accumulating $BGT to gain voting rights and steer incentives towards their particular assets, paving the way for a potential Curve Wars-style ecosystem to thrive.

Curve Wars helped Curve become the DeFi giant it is today, can Berachain see similar effects?

Summary

DeFi is still young and raw, and there is a lot of work to be done in its current state. Creating sustainable economic frameworks is an important part of this process. It can be said that given how important liquidity mining is to the foundational nature of DeFi, completely abandoning it is not possible.

However, alternative frameworks such as those mentioned above suggest that liquidity mining frameworks can be optimized to maintain liquidity and users, and actually benefit the long-term ecosystem.

Next time you want to enter your favorite DeFi project and look for returns, take the time to understand the source of the returns and whether it is sustainable. One small tip: if you don’t know where the returns are coming from, then you are the return.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!