After the release of the LSDFi Map, most of our predicted products have appeared, such as stablecoins supported by LST (R, TAI, USDL, etc.) and the Governance War (Pendle War) triggered by veToken. However, there were also many unexpected data and findings. This article will organize most of the LSD-related projects and raise questions, thoughts, and action plans.

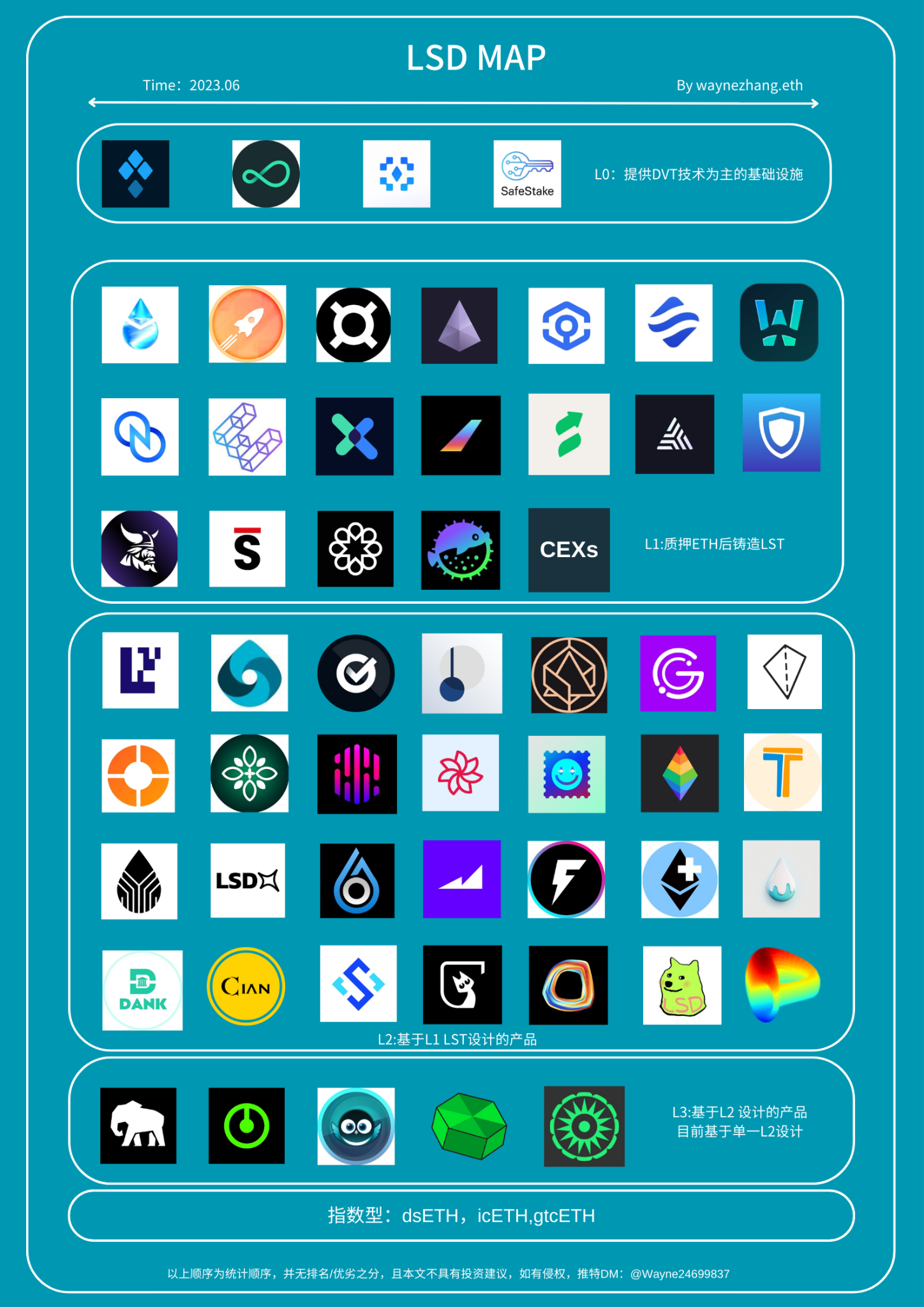

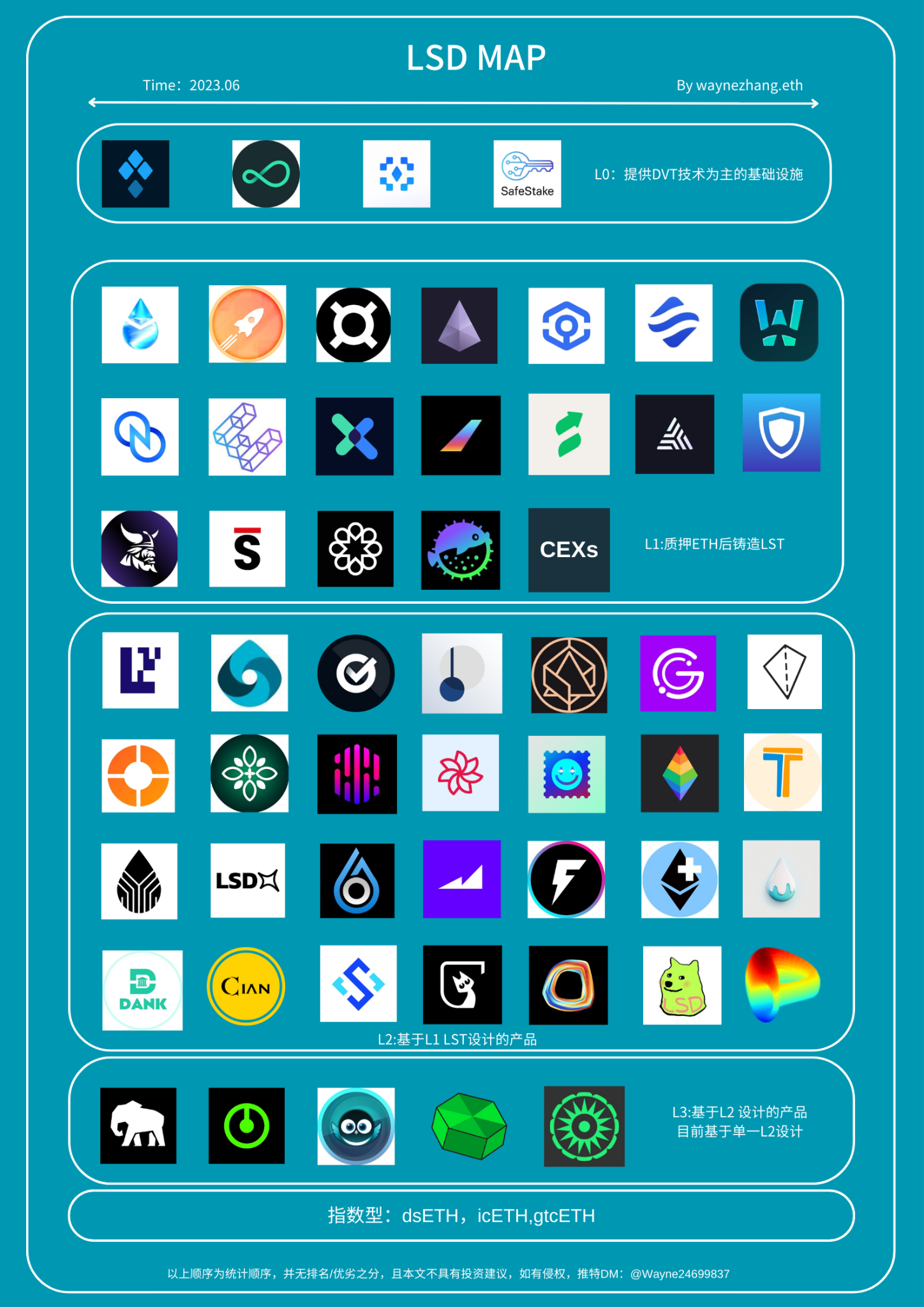

First, here is the organized LSD MAP 2.0, as shown below. For detailed data and subjective evaluation, please see my personal Google Sheet.

Pattern

The LSD track has formed a preliminary pattern. If divided by hierarchy, DVT technology service providers such as SSV Network and Obol Labs can be regarded as L0. DVT technology can make validators more stable and secure in exercising signature responsibilities. As the first project to issue tokens at the hierarchical level, SSV Network has the advantage of being a first mover in brand awareness.

- Nike’s Innovation on NFTs: Drawing Inspiration from Nintendo’s Success

- Freeing Ethereum Performance: The Innovative Path Beyond EVM Bottlenecks

- What is the difference between the spot Bitcoin ETF applications filed by BlackRock and Bitwise?

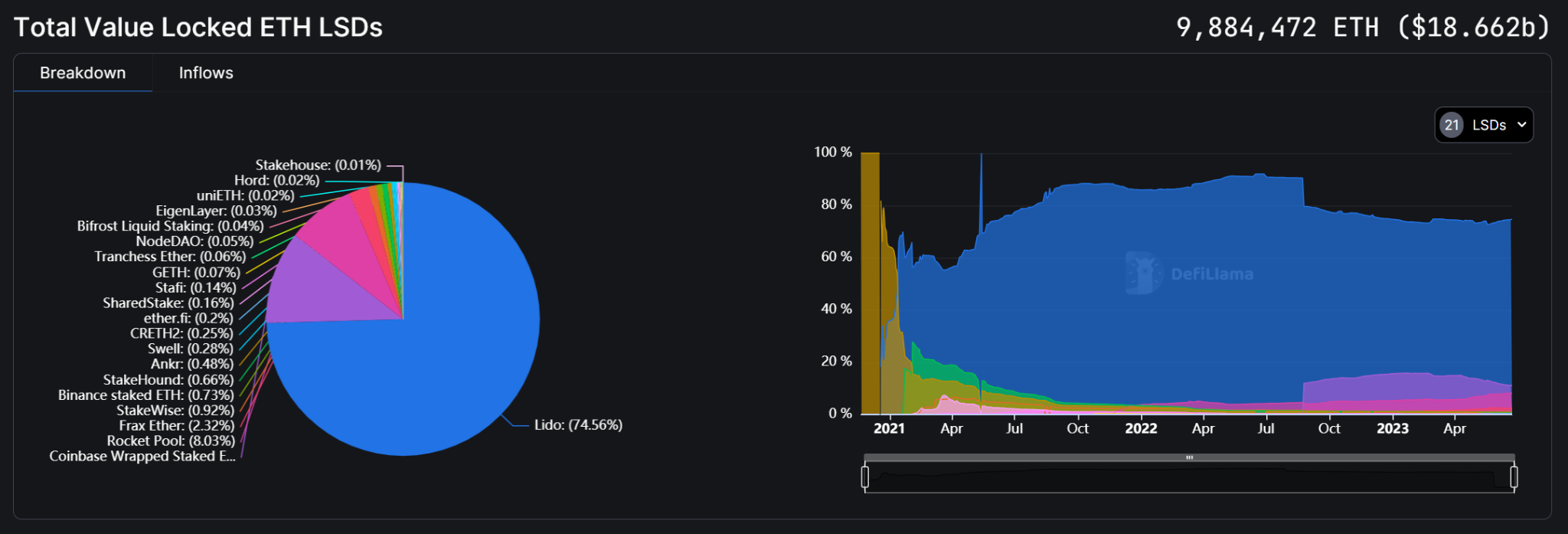

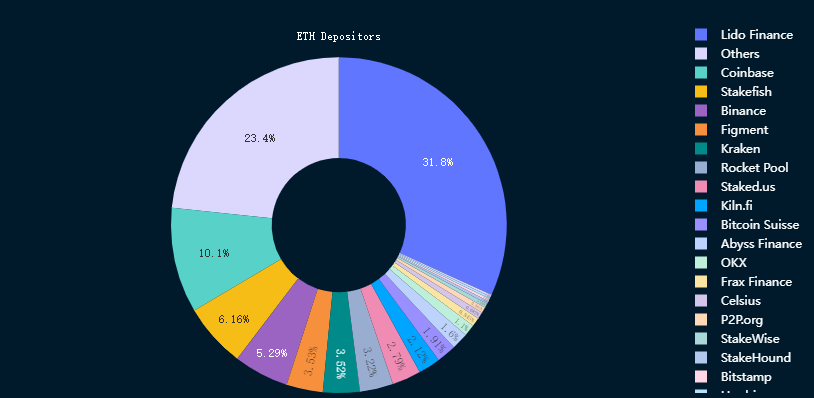

LST issuers such as Lido, Ankr, Coinbase, etc. can be regarded as L1. L1 is mainly a commission model, and users mainly benefit from the POS income of ETH. After the Shanghai upgrade, according to statistics, the number of L1-level projects is far greater than that of the next L2 level, exceeding the first version of the MAP prediction, but investigation found that more than 20% are in the testnet stage. According to Defilama data, Lido accounts for 74.45% of the liquidity staking share. Lido and Rocket Pool account for about 82.5%, and LST issued by centralized exchanges such as Coinbase accounts for more than 12% of the liquidity staking ratio, leaving little room for other decentralized staking. Some participating projects in this level are multi-chain LST issuers sharing a piece of the pie, but in fact, Ethereum’s LSD play is slightly different from other public chains. In addition to Ankr, which has the advantage of being a first mover, no other outstanding projects have been seen in this level.

TVL Share Chart (Source: DeFillama, Time: June 23, 2023)

Fixed-income products, stablecoins based on LST, and yield aggregation, which are designed based on LST, occupy the L3 level, which is what everyone often calls LSDFi. In this level, the largest number of stablecoins based on LST, all of which are listed as collateral, almost all support other stablecoins and ETH/WETH, etc. There are few borrowing and leverage projects, and the lack of such projects directly leads to a temporary shortage of yield aggregation and structured strategy projects. The emergence and development of fixed-income products such as Yearn’s yield pool, Shield’s structured products using options, and Pendle’s fixed-income products will further promote the emergence of yield aggregation and structured strategy projects; projects that use their own tokens to subsidize the increase in staking yields have experienced rapid decline in both token and TVL after the Shanghai upgrade.

A chart of the price trend of a certain APY over a thousand project after Shanghai's upgrade.

The L2 level has shown the importance of the team. Some projects that entered the LSD track halfway have achieved good results. After achieving results in the fixed income, options, yield aggregation, stable coins, synthetic assets and other tracks, some teams cannot help but think about the possibility of these tracks entering LSDFi with their same products. With the market liquidity shortage, before and after Shanghai’s upgrade, ETH as the second largest cryptocurrency can still bring strong liquidity in a bear market. How many teams have seized the opportunity? With the cycle approaching and the bull market in sight, after liquidity is enhanced, can other income-producing assets borrow from ETH to develop similar products?

A certain fixed income protocol achieves a 10x increase in token value through LSD products.

This article defines L2 products based on L2 as L3. The Pendle War triggered by StakeDAO, Equilibria, and Penpie, as well as AcidTrip, which automatically reinvests 0xAcid, and gUSHer, which simplifies unshETH operations and increases yields, show that the mainstream is still the governance struggle caused by veToken. There is a lot of room for imagination in this level, not just L2 tools and aggregation governance type projects. For example, L3 with multiple L2 products, and front-ends that aggregate strategies.

In Eigenlayer, individual ETH holders pledge ETH and stETH to the pledge service provider, allowing the node operator allocated by the service provider to participate in the Eigenlayer protocol, directly participating in Eigenlayer validation nodes, or through delegation, delegating other operators to help manage. Various middleware, data availability layers, etc. pay a certain reward (project token, handling fee, etc.) to obtain income. It actually uses the principle of ETH collateral, but does not produce LST, but can pledge LST (currently supports rETH, stETH, cbETH), so it is included in the L2 level.

Index-based products are mainly based on the three LST indices launched by Index Coop, with fewer LST types in the composition.

Overall

【1】L0 has the highest technological barrier, but pay attention to the actual utility of tokens.

【2】The head of L1 has appeared. Except for internal or systematic risks, time and space conditions no longer allow for new TOP3, and there will be new rising stars.

【3】A large part of L2 does not have a moat, which tests the team and BD capabilities more. The more basic DeFi strategy projects based on LST, the more prosperous L2 will be.

【4】The market value/liquidity of L3 is limited by the development level of L2 products, and there is a lot of room for imagination, which requires some time to develop.

Data & Trends

Staking Rate

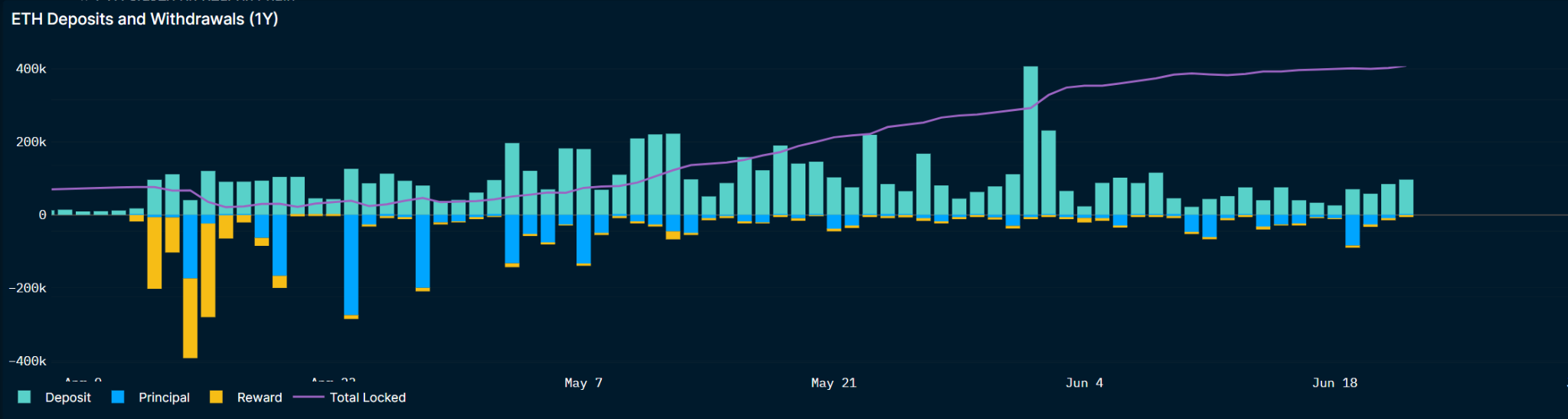

Before the Shanghai upgrade, the predicted result was that there would be a second wave of staking rate decline after a wave of promotion, but the result was not so. After the Shanghai upgrade, the two largest waves of staking were once to receive staking rewards and then continue staking, and the other was to release the principal (mainly from CEX) from staking. After that, it began to steadily rise, with the staking amount surpassing 20M in mid-May and 16% in June.

ETH Staking and Contact Staking/Staking Total Chart (Source: Nansen, Time: 2023.06.23)

Regarding the opinion of comparing the ETH staking rate with other public chains on the market, the author holds a strong staking attitude. In MAP 1.0, the author also predicted that stability would be around 25%, with the following reasons and judgments:

Reason 1: Decentralization of ETH

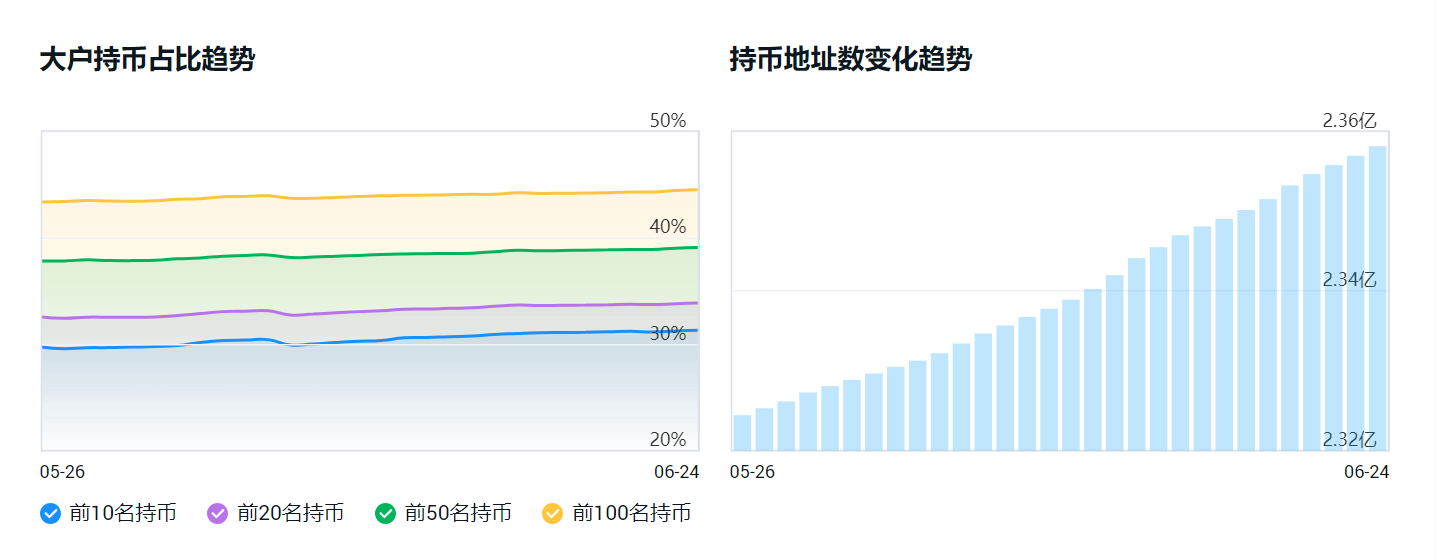

ETH’s chip distribution is different from some “VC chains” and “alliance chains” with high staking rates. Many tokens on the chain have to be staked, the plate is large, the players are few, and selling is equal to collapse.

ETH Large Holders (with Exchange and Bridge Addresses) and Address Number Changes Chart (Source: Non-small, Time: 2023.06.23)

Reason 2: Practicability

As the most active public chain, ETH can be said to be Ethereum’s golden shovel. Using ETH can participate in DeFi, GameFi, NFT, and when participating in on-chain projects, it will involve transactions priced in ETH, ETH Gas. In addition to stablecoins, ETH is undoubtedly the first in terms of frequency of use in on-chain activities. It is also a leader in usage scenarios.

Reason 3: External Expandability

The emergence and prosperity of L2, and the arrival of the era of multi-chain, also means that ETH will become a mainstream asset in multiple ecosystems, further diversifying tokens and reducing the trend of concentration in Ethereum staking. Of course, we will see in the next section the protocol analysis of cross-chain staking of Ethereum, which will further explore the impact of cross-chain staking on the LSD ecosystem.

Reason 4: Compliance

As we all know, cryptocurrencies are the focus of traditional finance and regulatory attention in various countries. In many ETFs, after BTC, ETH has the largest share of holdings, and in secondary funds, ETH generally occupies the top 5 in terms of share. With the increase of crypto ETF/crypto secondary funds, some people have proposed that secondary funds and ETFs will take one step further in pledging tokens, but compliance issues are difficult to solve. Even if they use pledging to increase returns, directly finding StakeFish is more secure and has less legal risk.

Price factors may also affect the pledge rate. If the halving cycle that arrives one year later ignites the bull market sentiment, will a large number of ETH pledgers choose to sell and realize gains in ETH and buy new hot coins during the rise of altcoins? This hot spot needs further observation.

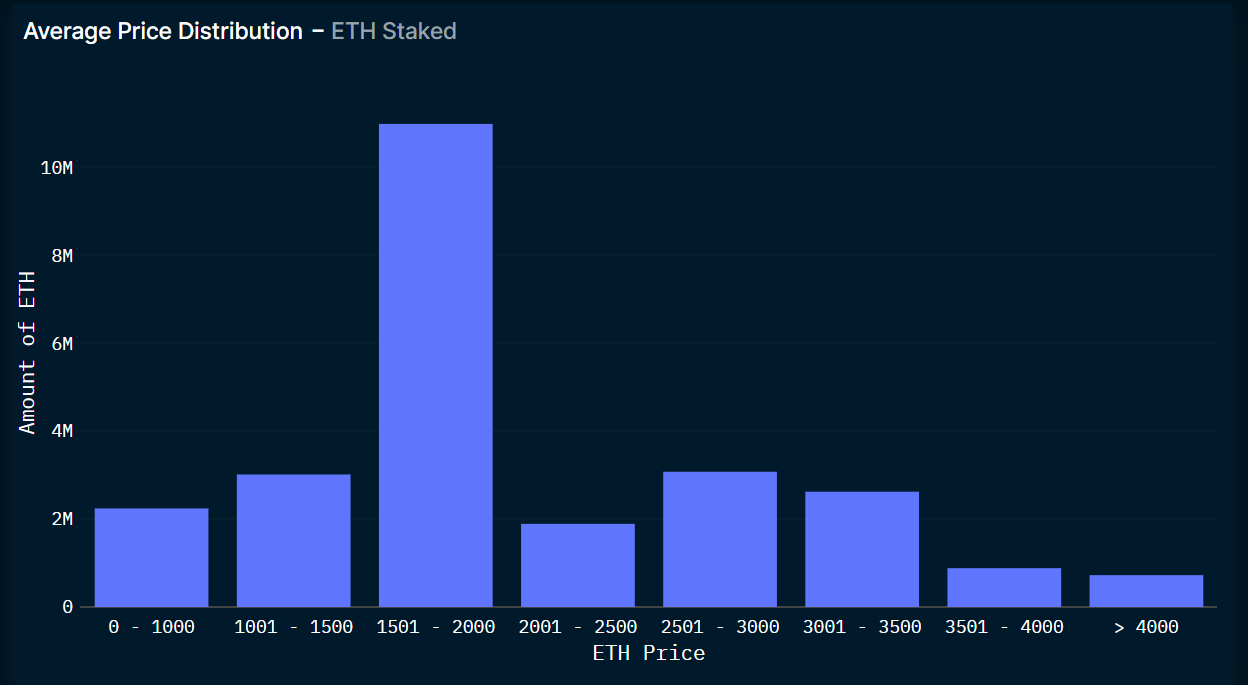

Pledge ETH purchase price distribution map (Source: Nansen, Time: 2023.06.23)

LSDFi will undoubtedly promote the increase of the pledge rate. The LST generated from pledging can enter multiple projects to earn multiple returns and reduce opportunity costs, and even earn excess returns. However, there are currently no L2 projects that can accommodate a large amount of ETH, and many LSTs in L1 are not used in L2, so the author believes that L2 still has huge investment opportunities.

Centralized Pledging and Decentralized Pledging

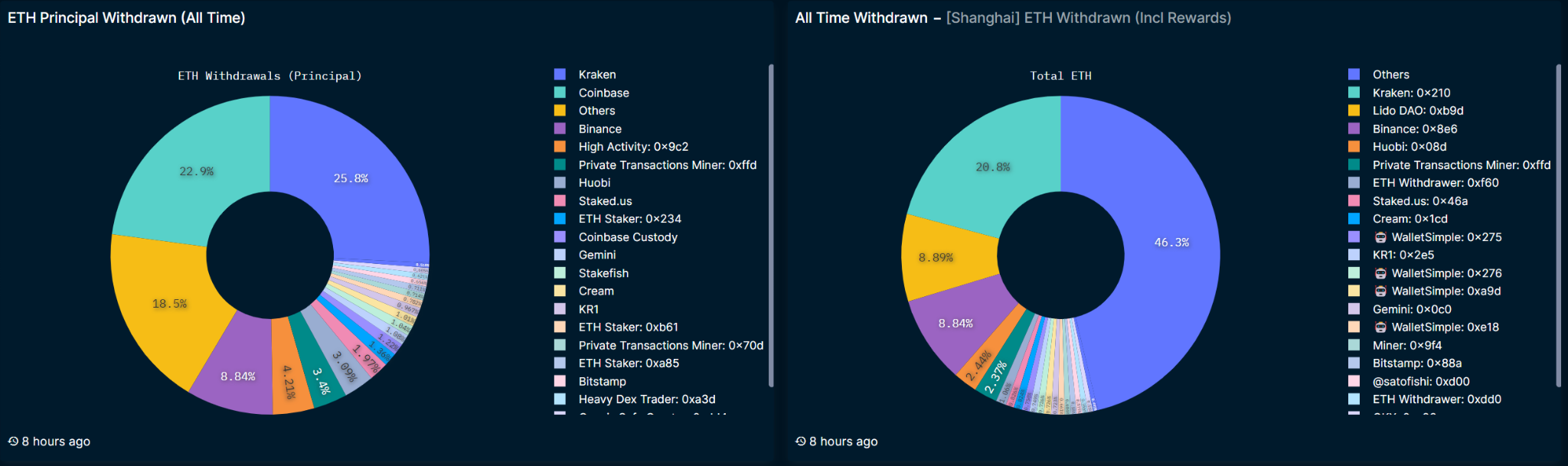

According to Nansen’s data, the pledge ratio of decentralized pledging platforms is less than 40%, and the ratio of CEX is about 20%, with the vast majority of remaining ETH being node pledging and solo staking. After the Shanghai upgrade, CEX still withdrew the most principal, accounting for 57.74%. Due to Lido occupying 31.8% of the total pledge share, it is easy to produce centralization in decentralized platforms. In L2, projects with balanced LST ratios have emerged, which promote participants to obtain more LSTs from smaller platforms to obtain rewards by distributing reward incentives in proportion.

ETH Staking Status (Source: Nansen, Time: 2023.06.23)

There are many L1 platforms that use DVT technology to make themselves more decentralized, but from a rational person’s perspective, the first priority for stakers is security, and the second is earnings. Lido and Rocket Pool’s LSTs are almost suitable for all LSDFi projects at the L2 level, and no security incidents have occurred. Lido relies on its ETH staking dominance to gain revenue and market share. As a vested interest, harming Ethereum after centralization will also harm its own fundamental interests. Of course, internal risks and external risks such as regulation are risks that every L1 platform needs to pay attention to.

Shanghai upgraded ETH principal/reward solved staking chart (Source: Nansen, Time: 2023.06.23)

Therefore, the author continues to be optimistic about the Top 3 staking platforms, but believes that decentralization, as a natural attribute of encryption, is an inevitable trend in L1 diversification, and many L1 products that balance decentralization, security, and low thresholds have emerged. However, some high-quality products cannot escape the token utility problem.

Yield

In terms of factors other than security, high yield and yield sustainability are the two most important factors for LSD-related projects. Regarding high yield, stakers need to rely on their own risk tolerance to participate. In the early stages of many L2 projects, staking LSTs directly under token subsidies can reach three digits, and LPs can even reach four digits, but price fluctuations are inevitable when mining and selling. Currently, some projects adopt a point reward model and staking for airdrops to minimize impact on user retention and token prices.

Stakers can consider the following methods to increase yield, similar to common DeFi Lego methods:

1. Choose LSTs with multiple use cases/partners

2. Increase capital efficiency through leverage

3. Participate in L2 products (some L2 products have L3 nesting)

4. Participate in new project IDOs or reward activities (low security, but high returns). By using a two-layer nested system, the staking yield can be increased to over 10%. Readers can design their own strategies based on their own risks.

After research, it was found that projects that can maintain sustainability generally have one characteristic: low yields, many of which rely on their own tokens or other project tokens (such as Frax using Curve) for certain subsidies. If the yield from ETH to LST is the foundation, which comes from Ethereum staking rewards, then where do the L2 and L3 yields based on LST come from?

After research, it can be summarized as follows:

【1】Token incentives: self-token subsidy/other party token subsidy

【2】Lending fees: some stablecoins

【3】LP liquidity pool fees

【4】Derivative hedging

【5】Eigenlayer subsidizes staking nodes by charging service providers

【6】Product transaction fees/commissions

……

The stability of L2/L3 yields can be determined by the stability of income sources. Only methods 【1】, 【4】, and 【6】 can meet the characteristics of high yield, but methods 【4】 and 【6】 have strong uncertainty in operation, so method 【1】 is currently and will be the mainstream method for a long time. However, in the specific use process, there are significant differences in details. But if the project wants to survive in the long run, adopting method 【1】 requires excellent Tokenomics.

Personally, I think that high-quality projects should be a combination of real income + application scenarios + good Tokenomics. Currently, L2 has already appeared real income + veToken projects led by PENDLE, which basically meets the above conditions.

L2’s LSD

From the table, we can see that many projects have been deployed at the L2 level, and the top 3 decentralized staking LST: wstETH, rETH, and fraxETH are used for statistics.

| Non-ETH Chain\LST | wstETH

2,028,607 |

rETH

458,397 |

fraxETH

229,062 |

| Polygon | 5,348 | 71 | 3,302 |

| Arbitrum | 65,753 | 5,929 | 5,302 |

| Optimism | 40,570 | 12,226 | \ |

| Gnosis Chain | 1,294 | \ | \ |

| BNB Chain | \ | \ | 2,352 |

| Fantom | \ | \ | 301 |

Top 3 decentralized staking LST on different chains (source: blockchain explorer provided by coingecko)

Arbitrum has the highest quantity in total, and the research shows that the most L2 level products are built on Arbitrum. Although there are many LSTs on Optimism, there are far fewer projects dedicated to LST than DeFi projects providing liquidity pools. Trading fees on L2 are lower, transactions can occur more quickly, and the number of holders is increasing, so there is reason to be optimistic about the development of L2 on Layer2. The earlier the deployment, the more opportunities there are to capture the liquidity of L2 LST.

User Classification

Different users have different needs for staking, but the basic elements are security, yield, decentralization, token economics, UI/UX, and ease of use.

Currently, there are fewer L0 levels due to late token issuance, high technical barriers, and many early VC investments. The leading players have appeared at the L1 level. Many whales and large holders have also staked ETH at the L1 level and participated in L2. There are prospectors from all sides at the L2 level, but from the perspective of L1 TVL and L2 TVL, for example, Lido’s stETH has a total of 7.383M, and the number of staked quantities that can be statistically counted in LSDFi is about 150K, leaving a large market space on L2.

(It is recommended to track more detailed data. The data here is too complex, and the analysis has been simplified.)

Each factor has a different degree of attraction/retention for users with different amounts of funds. The author believes that future newcomers appearing in L1 and L2 will fully grasp each element.

【1】Security: team members and internal management, audits, fund custody, etc.

【2】Yield: high and low, persistent, diverse yield varieties

【3】Decentralization: custody method, DVT technology, token concentration degree

【4】Token economics: can it ensure utility while balancing supply and demand, or even demand exceeding supply

【5】UI/UX: whether it has a clear and concise page and how user-friendly it is

【6】Ease of use: Can the product’s purpose be clearly communicated to users

Project Recommendations

Project basic information has been placed in Google Sheet, please configure it according to your own risk preferences

As an individual investor with limited funds, the author pursues high returns through personal strategies and only participates in one L1 leading/L1 newcomer, with the remainder being L2 real yield projects and L3 projects, with small amounts invested in new project launches. (The above does not constitute financial advice)

Summary

The entire LSD ecosystem is based on POS token currency, which also means that LSDFi users need to understand Web3 and most are on-chain projects. Tokens have not been listed on exchanges and returns are token-based, which means that those who participate in LSD are Web3 users with some experience, and participants are only a small part of the small user group of Web3. External user entry is extremely limited.

In addition, during the bear market, liquidity has always been scarce. During DeFi Summer, there were no NFTs, GameFi, BRC20, etc., and the current liquidity entering the cryptocurrency market needs to be divided among various tracks. LSD cannot obtain most of the DeFi liquidity in the subdivided track of the DeFi track, so in addition to hype, the real Summer may come with the bull market.

Due to space constraints, some of the more eye-catching projects are not introduced here. Some of them have enriched their own products through strong cooperation ability, and some have expected the LSD hype to explode and achieved impressive results with no prior experience. This directly proves the importance of the team. The homogenized L1 and L2 tracks require both technological innovation and project team efforts. Cancun upgrade is imminent, and the bull market cycle is coming. Whether new products can be designed or different assets can be designed for different assets may be a problem that many projects need to consider.

There are cross-level products appearing in all levels, which may be a trend in the future. After occupying the share of the current level, using advantages to develop other levels is also a choice for business expansion. At the same time, expanding to Layer 2 still seems to be a suitable choice, and many projects are already in development planning. We look forward to their appearance.

As a staker and investor, faced with a wealth of products, the author suggests that you first recognize your risk preferences, and then choose products with higher security (more attention, no security incidents, etc.) to build strategies. Recently, there have been Rug projects and scam projects, and vigilance needs to be increased.

Disclaimer: All projects mentioned in this article do not constitute investment advice, and I hold tokens of some of the projects, which creates a conflict of interest. The analysis presented here is subjective.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!