Source: Bankless

Translation: BlockingBitpushNews, Mary Liu

June has been a month of ups and downs for the crypto community. A few weeks ago, U.S. regulators attempted to deal a fatal blow to the crypto industry, and now Bitcoin has hit a new high for 2023, while altcoins are slowly recovering. This article will explore the institutional attitude towards Bitcoin, which has largely driven the broad recovery of the crypto market.

For years, over a dozen asset management firms have been seeking regulatory approval from the U.S. Securities and Exchange Commission (SEC) to launch some form of physically-backed bitcoin exchange-traded fund (ETF), but so far, the applicants have received only silence or rejection.

- Discussion on Cryptocurrency Governance by a16z

- Viewpoint: The “NFT Retrogression” caused by Ordinals is not a return to idealism

- Bankless: Wall Street wants Bitcoin

However, just last week, BlackRock, the world’s largest asset manager with over $9 trillion in assets under management and an almost 100% record of ETF approvals, joined this list. Hope has been rekindled that the status quo of a physically-backed BTC ETF may soon change, and BlackRock’s proposed ETF is seen by many as having a legitimate chance of SEC approval.

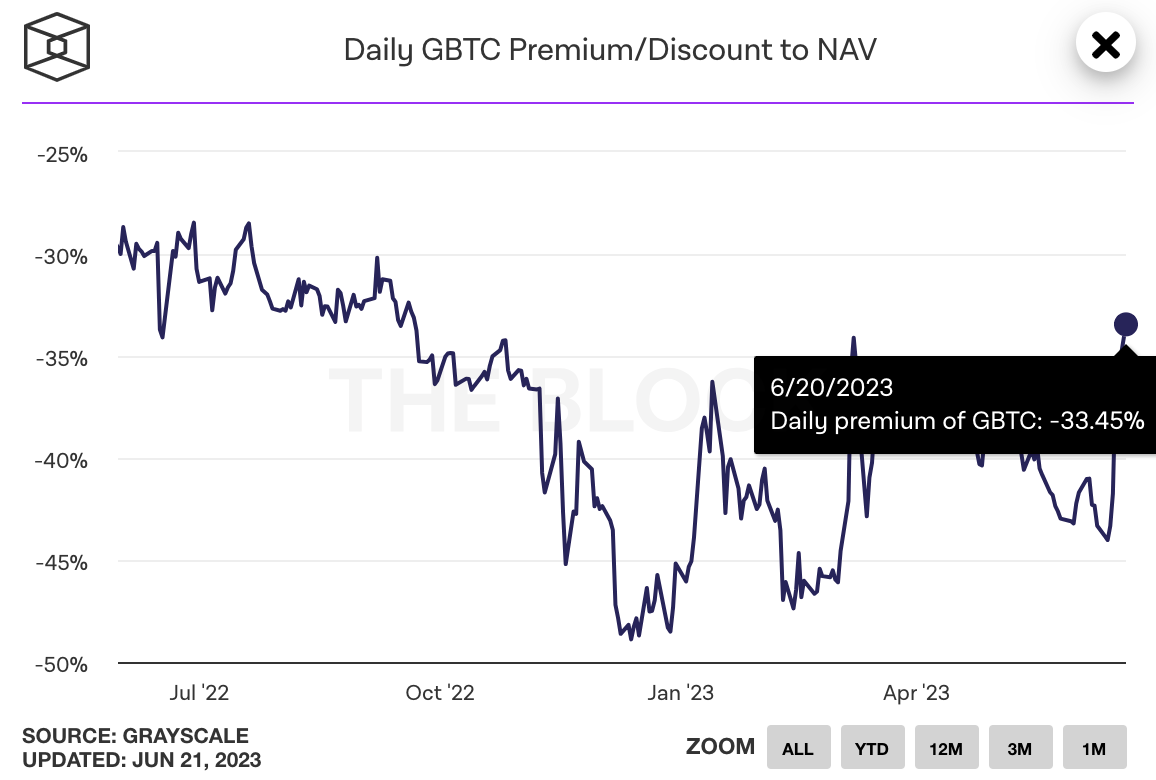

The market is now signaling that BlackRock’s application increases the likelihood of other physically-backed BTC ETFs being approved. The market premium of Grayscale Bitcoin Trust Fund (GBTC) relative to its net asset value (NAV) is a barometer of the likelihood of its physically-backed BTC ETF being approved. Currently, this discount is at a 2023 low of 33.5%.

SEC’s concerns

The first BTC futures ETF was approved by the SEC regulatory agency in October 2021, but the agency has yet to approve a physically-backed BTC ETF.

The SEC’s numerous rejection letters for physically-backed Bitcoin ETF applications contain similar language, citing the failure of listing exchanges to fulfill the obligations under the Exchange Act to prevent fraud and market manipulation as reasons for rejection.

To demonstrate that the listing exchanges of the proposed physically-backed Bitcoin ETFs are capable of fulfilling the obligations under the Exchange Act, the U.S. Securities and Exchange Commission has mandated a “comprehensive surveillance-sharing agreement with a regulated market of significant size related to bitcoin-based or referenced assets.”

The lack of US regulatory oversight over the Bitcoin spot market is hindering the potential for a comprehensive monitoring sharing agreement. Applicants have long criticized this framework, arguing that if regulatory agencies are satisfied with ETFs that hold asset derivatives, they should logically also be satisfied with ETFs that hold the underlying asset.

Additionally, the SEC frequently accepts supervision sharing agreements with regulated futures exchanges in commodity and currency markets, where unregulated spot trading is the norm (such as soybeans and the US dollar).

So why are these rules being applied differently to Bitcoin, whose commodity attributes are so strong that even the SEC dare not block its reputation to resist it? Perhaps the SEC’s decision is being forced by the behind-the-scenes manipulators of the “chokehold action 2.0″…

Is regulation paving the way for Wall Street giants?

In June, when Gary Gensler attacked cryptocurrency exchanges and labeled tokens as securities, BlackRock chose to apply for a Bitcoin spot ETF. Do you also think this is a bit suspicious?

Is BlackRock’s ETF application just part of the government’s concerted effort to elevate TradFi institutions as leaders in the crypto field? Or has BlackRock just seen the “ominous sign” and is looking for an opportunity to enter to fill the institutional trust vacuum caused by the SEC?

Either way, Nic Carter sounded the alarm on “chokehold action 2.0” in February, and over the next four and a half months, we witnessed the regulatory agency’s ongoing crackdown on cryptocurrency-related banks, exchanges, and custody service providers.

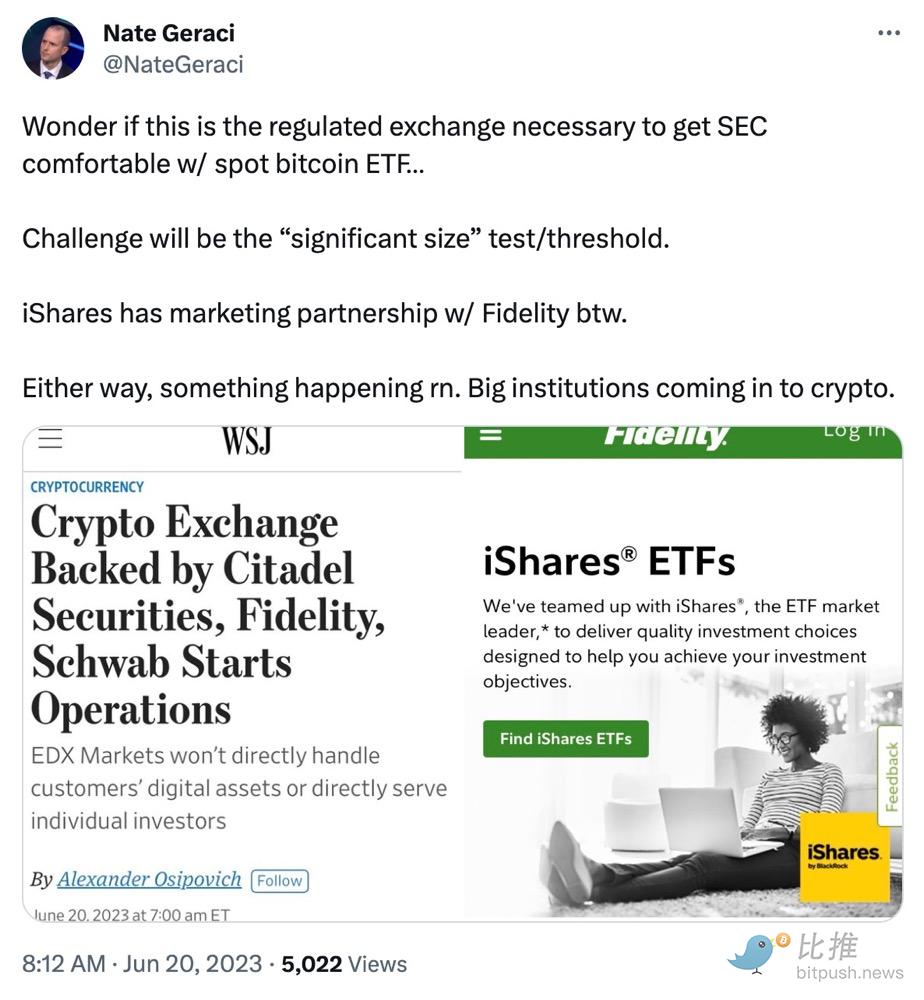

First was BlackRock. Then it was EDX: an institutionally tailored cryptocurrency exchange founded by TradFi giants such as Charles Schwab, Citadel Securities, and Fidelity, which launched on June 20, 2023.

Like any “exchange” in traditional finance, EDX only acts as a market, matching buyers and sellers and separating trading functions from brokerage and custody services. Although different from the integrated model provided by CEXs such as Coinbase and Binance, EDX’s approach appears to meet the SEC’s requirements for separating core trading functions.

In addition, EDX has initially limited its market to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). TradFi seems to be operating within the unwritten SEC rule book, and EDX’s unique structure is likely to meet that agency’s definition of a “regulated” Bitcoin spot market.

Whether there is a real conspiracy theory here or just a series of regulatorily-approved actions, it is clear that the government is expending a lot of energy punishing the builders in the cryptocurrency field while paving the way for TradFi speculators on Wall Street.

Is the Bull Market Coming?

As it turns out, rumors of BlackRock’s application were the only factor signaling the rebound of the crypto market, which was then suffering endless regulatory blows, and the global asset management company stood out as the future seller of Bitcoin investment products.

Traders are now betting that institutions pouring into cryptocurrencies will adjust their narratives and sell BTC products to clients in the coming years, meaning that users holding cryptocurrencies now may soon see huge returns.

Since BlackRock announced this news, the market has risen across the board, and altcoins have been boosted, but Bitcoin is the major beneficiary, reaching a high of $31,300 in the subsequent week of bullish price action, the highest since 2023.

Although the short-term direction of asset prices is always unknown, especially in the volatile cryptocurrency market, the thoughtful decision made by the US financial giant to strengthen its position in the industry proves that cryptocurrencies will continue to exist.

The giants of TradFi are looking for opportunities to profit, and currently, major participants are evidently investing corporate resources to establish a foothold in the industry, with BlackRock beginning to recruit digital asset talent two weeks ago.

As the price still faces heavy resistance, the institution-driven rebound may be coming to an end (at least for now), but BlackRock’s move has reinforced our long-term confidence in cryptocurrencies!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!