Author: cr1st0f

Translation: Deep Tide TechFlow

From CryptoPunks and Rare Pepes to Fidenzas, the most famous and successful NFTs belong to the art and collectibles categories.

While some generative art collectibles are beginning to garner attention from the mainstream art world, most NFTs remain a very cryptic niche market that is largely invisible to mainstream media in terms of its cultural value.

- Latest update from FTX: launching a debt claim website soon, rumors of restarting operations may bring a turning point?

- Did this investigation report by ZachXBT provoke Huang Licheng to sue him in anger? (Full text attached)

- Observations on RWA Tracks: Comparison Analysis of On-chain Lending Projects

Although the currently popular types of NFTs are limited, there are several emerging use cases that claim to bring the benefits of decentralized ownership (composability, transparency, and security) to new asset categories. In this article, we will explore five of the most promising NFT use cases that are not related to art and collectibles.

Currently, we are in an NFT bear market, and interest in all categories of NFTs is declining compared to a few months ago, with only the art category remaining relatively strong. Even so, recent research reports predict that the NFT market will grow significantly in the next decade. According to forecasts by SkyQuest Technology, Verified Market Research, and FactMR, the NFT market size will reach $120 billion to $320 billion in the next 5-10 years, perhaps driven by art, but more likely driven by a broader range of tokenized assets. Next, we will focus on the main categories of these NFT-based assets.

We have recently seen five main categories emerge: membership tokens, financial NFTs, legal documents, real-world assets, event tickets, and media.

Most of the development of these new use cases occurred during the 2021 NFT bull market and shortly thereafter when they received significant attention and had sufficient resources to fund development. If some of these use cases prove themselves, we may see significant attention paid to these new product categories in the next cycle.

Membership Tokens

In addition to collectibles, the first use case for NFTs was as membership tokens. As early as 2017, the HAIRPEPE Rare Pepe card gave holders permission to enter a Telegram group called The Salon. Since then, we have seen several NFT-limited membership clubs. While many of these are simply aimed at NFT collectors, such as Proof Collective, MetaverseHQ, and Grailers DAO, some are beginning to push this definition forward, such as Crypto Packaged Goods, which is more like a business club and startup incubator.

One example of combining NFT-limited online membership clubs and decentralized governance is Nouns DAO. Their treasury holds over 27,000 ETH and as a DAO, aims to manage the treasury and ultimately use it to bring value to Noun holders. One Noun equals one vote and also grants access to private chat to discuss proposals and coordinate the use of the treasury.

As better tools and user experiences are built, users can interact with NFTs more easily without needing to understand wallets and self-custody, and we can expect to see an increase in membership clubs with NFT thresholds. With advancements in technology and increased accessibility, we may see more varied use cases and wider industry adoption of this membership and governance model.

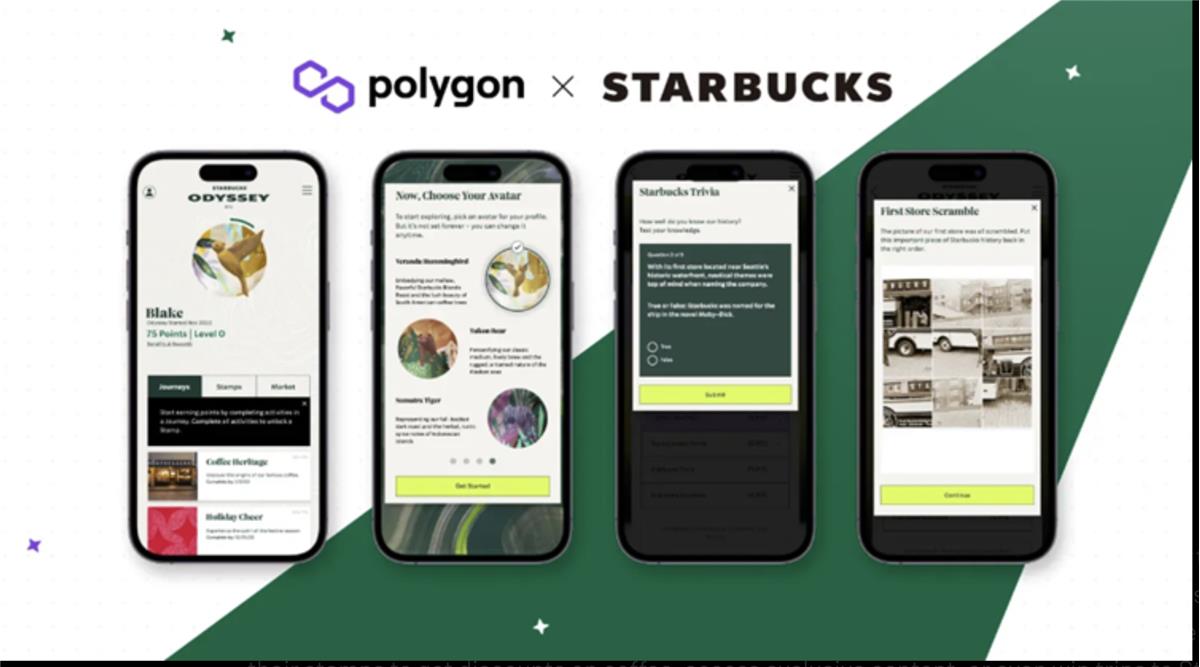

One application closely related to membership tokens is brand loyalty rewards. While a few existing brands have already explored use cases for NFTs and Web3, including Reddit, Nike, and Adidas, one of the most interesting explorations comes from Starbucks.

In December 2022, Starbucks launched a new loyalty program called “Starbucks Odyssey,” which allows members to earn and purchase digital collectibles called “Journey Stamps.” These stamps can be used to unlock new benefits and immersive coffee experiences. For example, members can use their stamps to get discounts on coffee, access exclusive content, and even win a trip to a Starbucks coffee farm.

Starbucks’ Odyssey program is still in its early stages, but it has the potential to completely change the way brands interact with customers. By using NFTs, brands can create more personalized and immersive experiences for customers, and importantly, if these rewards are not of interest to the customer personally, they can sell them.

Financial NFTs

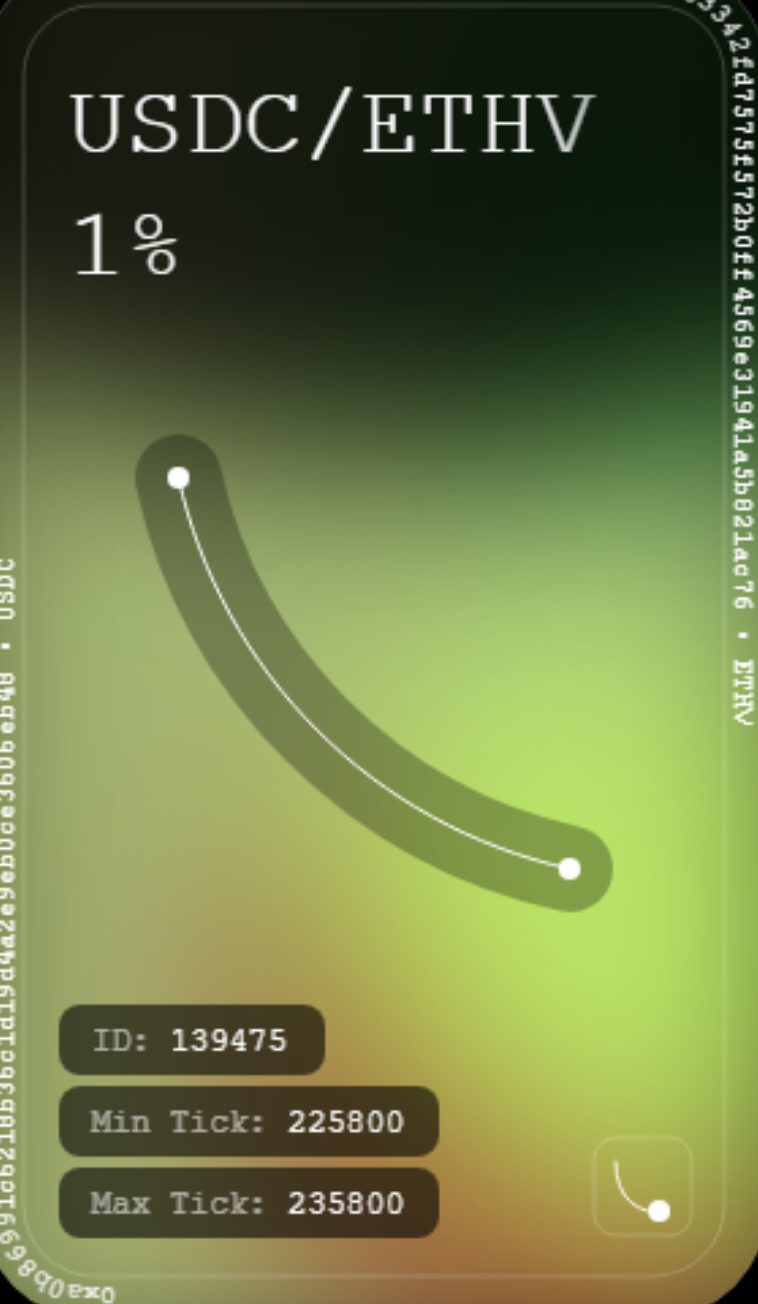

Starting with Uniswap V3 positions, financial NFTs have entered the mainstream consciousness of the DeFi world. Using NFTs as user holdings receipts in DeFi protocols enables more information to be encoded in metadata than just using ERC-20 tokens that represent their holdings, and this is much easier.

For example, in Uniswap V3, NFTs serve as receipts for storing information related to LP positions: LP pairs, the minimum and maximum tick of concentrated liquidity, LP position size, and importantly, rewards accumulated to the LP. Since the rewards for LP are accumulated to the NFT itself, this further opens up more possibilities for DeFi applications built on NFTs, although we have not yet seen many such applications.

Other examples of financial NFTs include Liquity Chicken Bonds, Superfluid Streaming Payments, NFTfi Futures, BendDAO bNFTs, and Solidly’s innovative veNFTs. The recently launched product Chicken Bonds uses NFTs as deposit receipts for bond positions. With the launch of this feature, Liquity also said they wanted to try changing the appearance of bond NFTs, with some bonds even selling for more than face value due to their collectible value.

Superfluid allows users to make streaming payments and recently turned streaming payments into NFTs, making payments more transparent and composable. Although these fund flow NFTs are currently just for display, they may be transferable in the future.

Legal documents

Traditional legal documents are often paper-based, difficult to manage and verify, while NFTs offer a unique opportunity to create secure, immutable and verifiable digital documents.

The first example of an NFT legal document I saw was at Wrappr. Wrappr focuses on transparency, allowing NFT-based companies to register documents and quickly establish US companies. These documents facilitate secure record keeping, fast registration, and easy document retrieval. By using blockchain security and transparency with NFTs, Wrappr creates a more efficient and secure process for setting up and managing crypto-native companies and legal structures.

Another interesting example of an NFT as a legal document is the case of RBB Labs, who airdropped NFT court subpoenas to defendants in copyright infringement cases. According to an article on Cointelegraph, RBB Labs used NFTs to create a verifiable digital document that can be easily distributed to defendants, even if their true identity is unknown, with just a wallet address to identify them.

The trend of NFTs as legal documents is closely related to the broader trend of using blockchain technology for transparency and on-chain identity, applicable to legal entities. By leveraging the security and transparency of blockchain, NFTs offer a unique opportunity to create secure and verifiable digital files that can be easily managed and distributed.

Real-World Assets

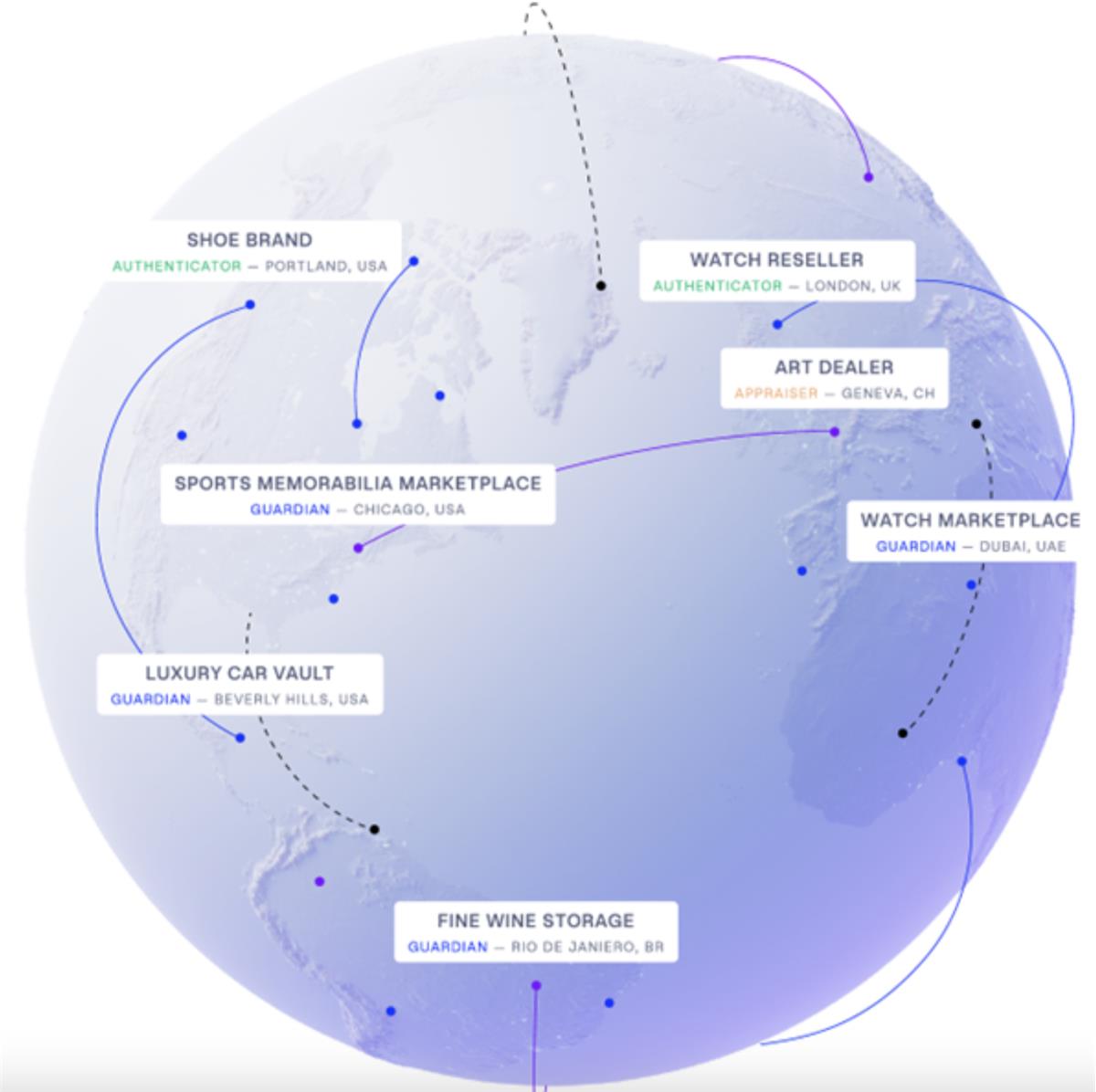

Consultancy firm BCG estimates that tokenization of illiquid real-world assets will bring about $160 trillion in business opportunities by 2030. Some of these tokenized assets will be ERC-20 tokens, but some will also be ERC-721 or NFTs. Currently, the range of assets tokenized through NFTs is quite limited, mainly luxury items such as high-end watches, physical collectibles, and real estate.

Although NFTs have historically only been used to represent ownership of real-world assets, Silta is a good example where more data is involved. In this case, NFTs are used to store and update important information for infrastructure projects funded through the platform. Structural, financial, technical, and sustainability information is stored in NFTs, making data easily accessible while ensuring that it cannot be modified or tampered with without a record.

4K, on the other hand, offers the ability to tokenize any object you want, with physical items stored by their partners in a secure facility, and NFT owners able to redeem their NFTs for the physical items at any time. One of the most popular tokenized items is high-end watches, with several tokenized Rolexes already being used as loan collateral. Collectible sports cards have also been tokenized by 4K. As the user base expands, the types of objects being tokenized are expected to expand beyond jewelry and collectibles.

Perhaps one of the biggest and most obvious assets to tokenize as an NFT is real estate. The global real estate market was valued at $326 trillion in 2020, so if it can be brought onto the chain, it would be a very valuable market. Several high-profile real estate deals have already occurred on-chain, attempting to achieve this goal.

As this use case is proven and legal uncertainties are resolved, it may become one of the biggest use cases for NFTs supporting real-world assets. Real estate transactions are costly and time-consuming, which means there is a strong incentive for both buyers and sellers to explore this avenue. Perhaps we will first see this happen in commercial real estate transactions, where complex participants can agree on a system that makes transactions legally enforceable. However, the greatest benefits will be realized when complexity and technicality are abstracted and ordinary people can cut out intermediaries from these transactions.

Event Tickets

Issuing event tickets as NFTs has several notable advantages. They provide exceptional security and are virtually impossible to counterfeit, which is crucial for organizers trying to reduce fraud and scalping. NFTs can also facilitate seamless transfer between buyers and sellers, significantly streamlining the process of buying and selling tickets.

Perhaps most interestingly, these tokens can provide fans with a more personalized and immersive experience. Event organizers can use NFTs to offer exclusive content or experiences to fans, increasing engagement and fostering closer relationships between audiences and organizers.

Some companies are already using NFTs in their event ticketing systems. For example, YellowHeart has partnered with artists like Kings of Leon and Grimes to sell NFT-based tickets. In 2021, Grimes performed with NFT tickets at Art Basel and offered fans the ability to customize their tickets with their own photos or artwork. In 2022, Kings of Leon used NFT tickets on their tour, giving fans access to exclusive content like behind-the-scenes videos and photos. Similarly, Live Nation has partnered with Ticketmaster to develop an NFT ticket sales platform.

Using NFTs for event tickets is still in its early stages, but it has tremendous potential. By using NFTs, event organizers can offer fans a more secure, efficient, and personalized experience.

The Future of Non-Art and Collectible NFTs

In the previous section, we looked at some emerging applications and use cases beyond collectibles. But what’s the point of tokenizing things that already exist? Of course, some financial NFTs bring entirely new functionality that didn’t exist before DeFi – but why make event tickets into NFTs, why tokenize your Starbucks rewards or your house? Many critics would say that putting things that already exist on the blockchain is simply a waste of time, so here we discuss some of the benefits and opportunities for NFTs beyond collectibles.

Overall, new NFT use cases can be divided into two categories. The first is things of value, such as real-world assets, event tickets, membership tokens, and even brand loyalty rewards. The second is information and documents. Examples include company formation documents, procedural documents such as subpoenas and summonses, and use cases for Silta that explore project metrics through NFTs.

For the first category of “things of value,” NFT finance and the integration of NFTs into the broader DeFi ecosystem appear to be the fundamental drivers of asset tokenization. Currently, there are five major NFT financial primitives that have seen widespread adoption: collateralized lending, where NFTs can be used to secure loans and obtain liquidity without selling the asset; fractionalization, where NFTs can be divided into smaller parts, allowing more investors to participate in asset ownership; derivatives, where NFTs can serve as underlying assets for options or futures contracts; leasing, where NFTs can be lent out to others for a fee; and liquidity pools, where NFTs can provide liquidity in automated market makers (AMMs) for trading and earn trading fee returns. The NFT financial ecosystem brings many benefits, such as ease of trading, removal of intermediaries, capital efficiency, and transparency. Additionally, there is the potential to build entirely new financial products that cannot be created in traditional financial systems.

In the more mundane scenarios of NFT financial applications, you can imagine a world where a wide range of goods and services markets become more efficient. Removing intermediaries and the transaction fees they generate is beneficial in itself, and perhaps already justifies the tokenization of a wide range of assets. If smart contracts could execute legally enforceable transactions of items such as houses, commercial real estate, or planes, it could save the significant fees charged by lawyers and intermediaries.

Imagine the benefits of transparency these systems can bring – imagine if NFT-based real estate ownership and debt had been widely used during the subprime crisis. Lack of transparency and accurate information on underlying mortgage assets for subprime mortgage-backed securities (MBS) and collateralized debt obligations (CDO) was a major contributor to the crisis. If NFTs were used to record ownership and debt of these financial products, anyone could inspect the underlying mortgages and make better risk assessments on MBS and CDO, potentially revealing the risks in these systems before they collapsed.

When considering the benefits of decentralized ownership and self-custody, imagine renting out your Starbucks rewards, or memberships you don’t use often. Or being able to quickly obtain competitive loans by collateralizing almost anything you own, like your house, car, watch, a set of sports cards, or a physical artwork on your wall.

There are also several common DeFi products that may be attractive when applied to new NFT assets. Options that use individual attributes as underlying assets can allow for speculation on specific communities or even individual house prices. They can also allow homeowners to hedge their property prices by buying put options. Covered Call Vaults, like the one offered by Ribbon, have already become a popular DeFi product.

Perhaps it’s not very attractive for individuals, but it could be a way for large institutional landlords to generate additional revenue. Overall, one can imagine a world where many DeFi-native products can be applied to real-world assets and create truly novel financial products that were unimaginable before blockchain technology.

Conclusion

NFTs demonstrate tremendous potential beyond traditional art and collectibles use cases. The most promising applications involve representing assets as NFTs to help unlock previously illiquid assets, increase transparency and auditability, offer more personalized and customizable services to customers, or reduce transaction and middleman costs, among others.

However, there are still challenges to overcome, including legal and regulatory clarity around NFT representations of these assets and the technical complexity required for end-users. By addressing these challenges, the NFT revolution can be better realized and change industries such as real estate, legal documents, and financial assets. Additionally, it’s important to continue developing the ecosystem around NFTs, with NFT finance being a particularly important area for developing new categories of tokenized assets.

With continuous innovation and collaboration, we can expect NFTs to play a more important role in surpassing art and collectibles, changing the industry and creating new opportunities.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!