Table of Contents

Key Takeaways

- The state of LSDs

- The financialization of LSDs

- The LSDfi ecosystem

- The growth of LSDfi

- The outlook for LSDfi

Risks

Conclusion

References

Key Takeaways

- LSDfi refers to DeFi protocols built on top of liquid staking derivatives (“LSDs”). By providing additional opportunities to generate yield, LSDfi protocols allow LSD holders to put their assets to work and maximize returns.

- In the past few months, LSDfi protocols have experienced rapid growth in total value locked (“TVL”) thanks to the adoption of liquid staking. In top LSDfi protocols, accumulated TVL has surpassed $400 million, more than doubling from a month ago.

- The factors driving LSDfi growth include the growth of ETH staked and the low penetration rate of LSDfi currently. Currently, LSDfi protocols’ TVL represents less than 3% of the total addressable market.

- While LSDfi offers attractive opportunities for LSD holders, users should be aware of associated risks, including but not limited to slashing risk, LSD price risk, smart contract risk, and third-party risk.

The State of LSDs

Ethereum’s successful transition to proof-of-stake (“PoS”) and the withdrawal of staked ETH enabled by the Shapella upgrade have both contributed to the significant growth in staking.

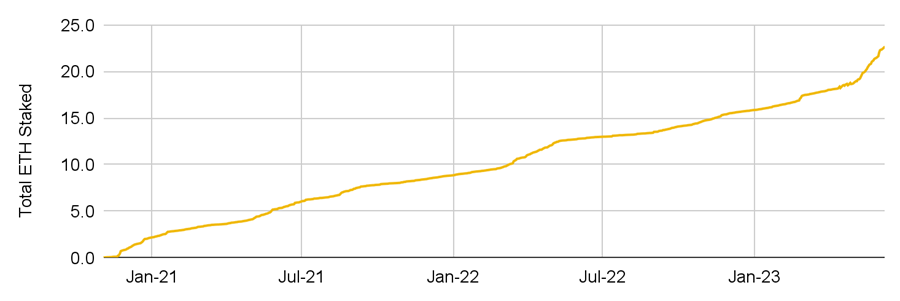

Figure 1: Total staked ETH has accelerated and exceeded 22.8 million ETH

- Will the BlackRock Bitcoin Spot ETF be approved?

- Exploring the Possibilities of NFT Future: Beyond Art and Collectibles

- Latest update from FTX: launching a debt claim website soon, rumors of restarting operations may bring a turning point?

Source: Dune Analytics (@hildobby) as of June 14, 2023

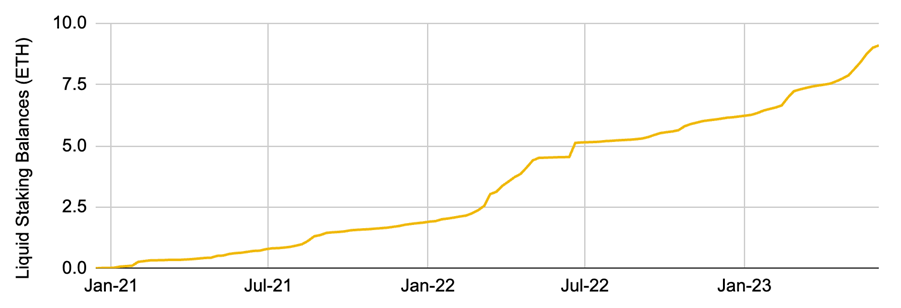

Correspondingly, we have also seen significant growth in liquid staking derivatives (“LSDs”). As a reminder, LSDs are synthetic assets issued by liquid staking platforms (such as stETH, rETH, WBETH, etc.). Running independent nodes may not be suitable for everyone due to the technical difficulty and significant capital requirements involved. As such, liquid staking protocols enable more users to participate in the staking process while retaining the liquidity of staked assets. This is achieved by issuing liquid staking tokens to the protocol’s users, which allows users to participate in a wider range of cryptocurrency ecosystems.

Liquid staking balances grow alongside the overall staking market

Source: Dune Analytics (@eliasimos) as of June 14, 2023

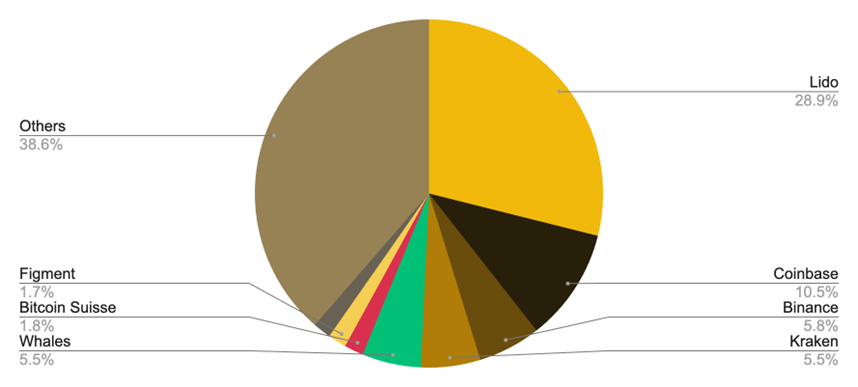

Looking at the overall ETH staking landscape today, Lido is the largest participant in the market, with a 28.9% market share. Next come centralized exchanges like Coinbase, Binance, and Kraken. There are also some smaller liquid staking providers, but their share of staked ETH is much smaller.

Figure 3: Deposit-based ETH staking provider market share

Source: Etherscan as of June 14, 2023

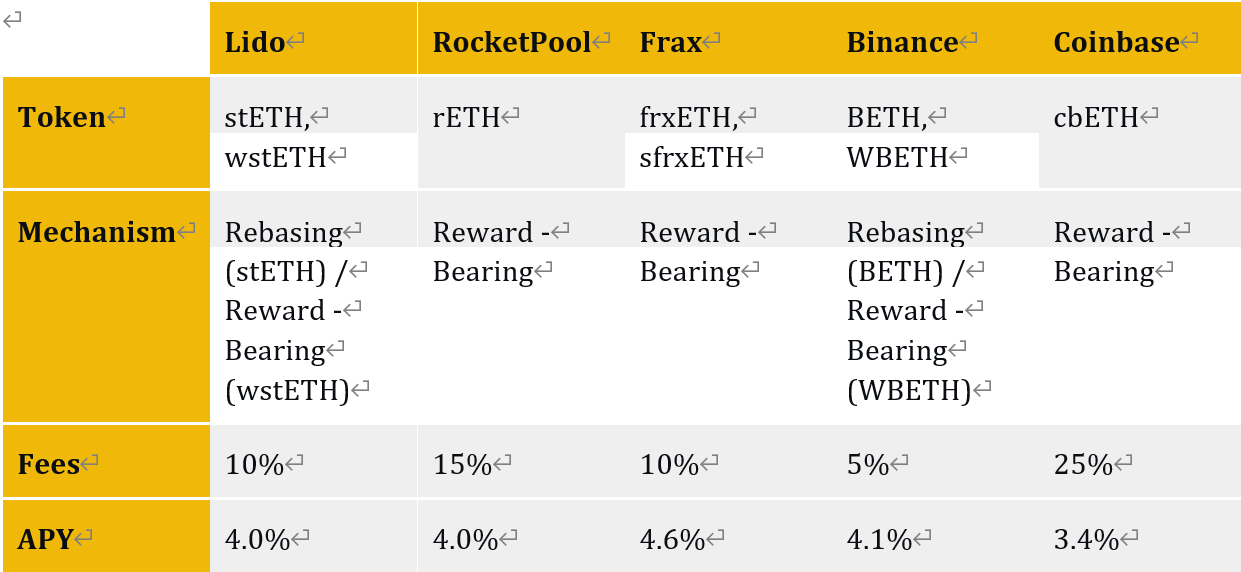

Liquid staking providers issue their own LSDs, unlocking liquidity and allowing holders to participate in a wider range of opportunities within the cryptocurrency ecosystem. LSDs can be either adjustable or yield-bearing tokens. Holders of adjustable tokens such as stETH will experience balance changes as token supply changes due to staking rewards or slashing penalties. In contrast, yield-bearing tokens reflect accumulated earnings through changes in token value rather than changes in balance.

Figure 4: Liquid staking providers within the Ethereum ecosystem

Source: Project websites, DeFi Llama as of June 14, 2023

While this report focuses primarily on Ethereum liquid staking, note that liquid staking is not limited to the Ethereum ecosystem alone.

For example, liquid staking is a sector of the BNB ecosystem, with approximately $150 million in TVL.(1) Similar to the mechanism for ETH liquid staking, BNB stakers receive liquid staked BNB, which provides instant liquidity that can be used elsewhere in decentralized finance (“DeFi”) to generate additional yield.

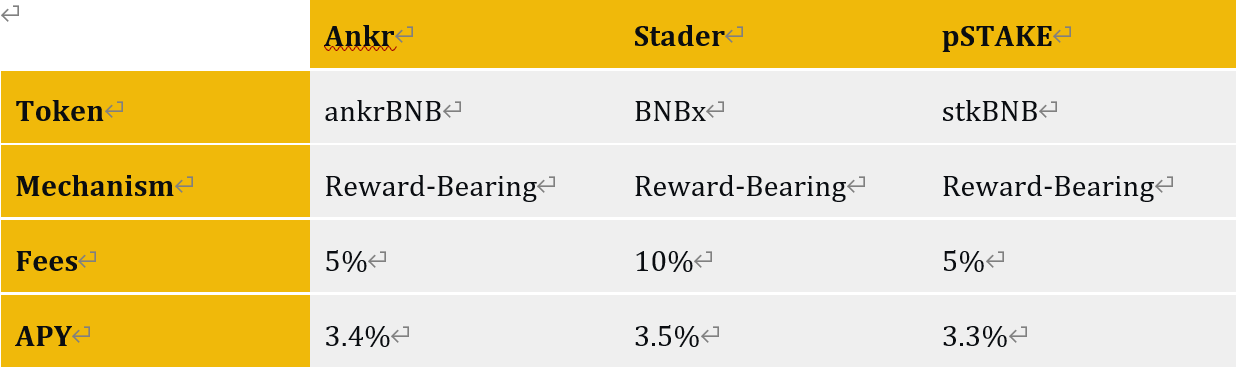

Figure 5: Liquid staking providers within the BNB Chain ecosystem

Source: Project website as of June 14, 2023

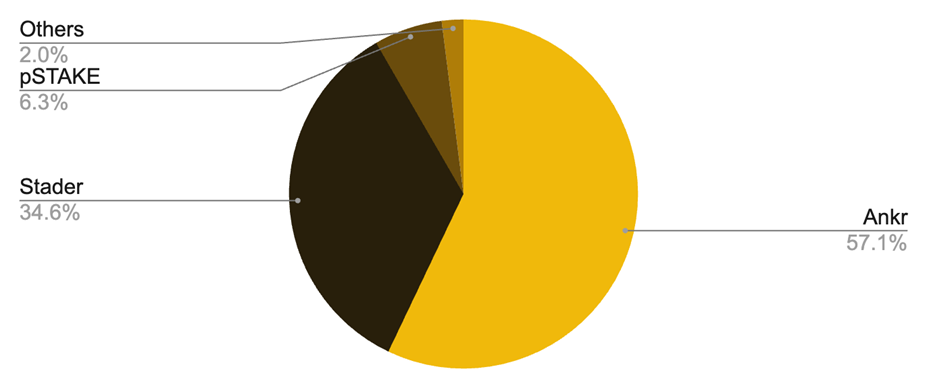

Within the BNB Chain ecosystem, Ankr is the largest liquidity provider, with over 214K BNB staked with the protocol. (2) Along with Stader and pSTAKE, these three protocols are the major liquidity providers on the BNB Chain. The fees for each protocol are generally similar and the competition is fierce, but the availability and liquidity of each protocol’s liquidity staking token in decentralized applications (“dApps”) within DeFi varies.

Figure 6: Market Share of BNB Chain Liquidity Providers by TVL

Source: DeFi Llama as of June 14, 2023

Financializing LSD

Assuming you hold LSDs and receive staking rewards on your holdings. That’s great, but what if you could go further and generate additional yield on top of the base staking rate?

Welcome to the World of LSDfi

LSDfi refers to a DeFi protocol built on top of liquidity staking derivatives. By providing additional yield opportunities, the LSDfi protocol allows LSD holders to put their assets to work and maximize returns.

The LSDfi Ecosystem

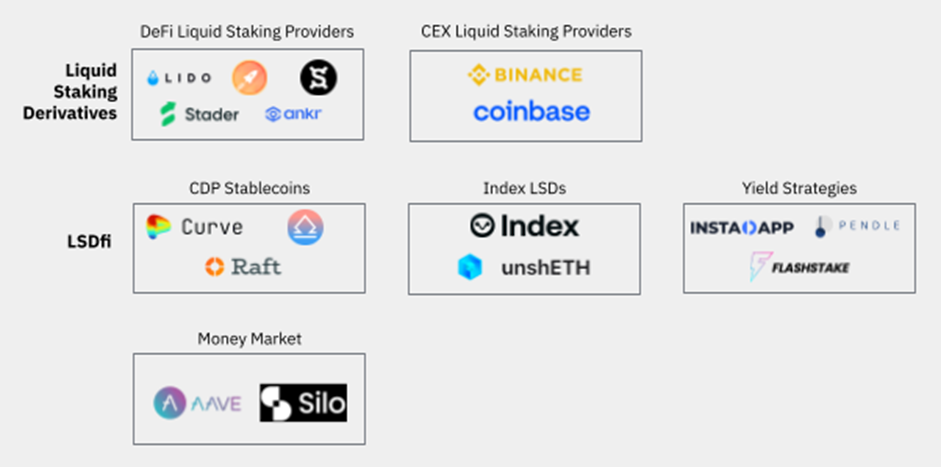

The LSDfi ecosystem consists of some mature DeFi protocols that have already incorporated LSD as part of their diversified product packages, as well as some major new projects based primarily on LSD.

For completeness, we also include major LSD protocols and providers.

Figure 7: Liquidity Staking and LSDfi Map

Source: Binance Research as of June 14, 2023

◆ DeFi Liquidity Providers: DeFi providers that enable users to participate in staking and earn LSD as a reward

◆ CEX Liquidity Providers: Centralized exchanges (“CEX”) that offer liquidity staking services

◆ CDP Stablecoins: Debt position (“CDP”) protocols that allow users to generate stablecoins using LSD as collateral

◆ LSD Index: Tokens representing a basket of LSD shares

◆ Revenue Strategy: A protocol that allows users to access additional revenue opportunities

◆ Money Market: A protocol for lending and borrowing using LSD

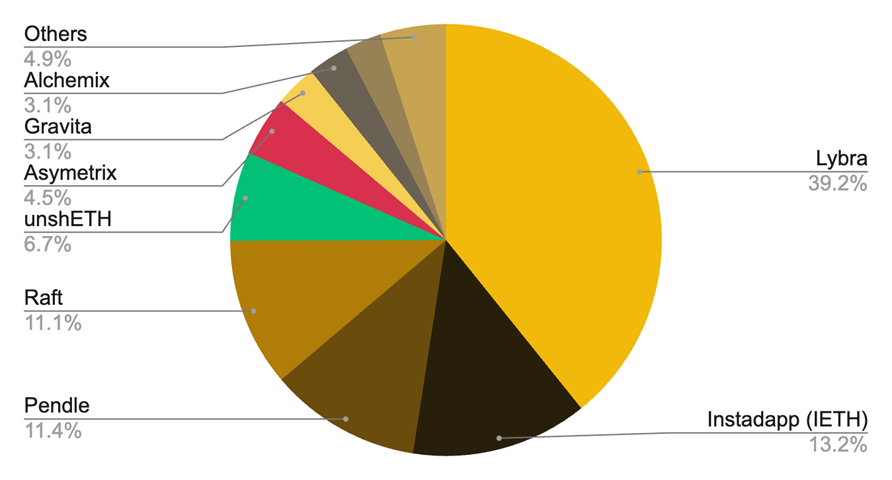

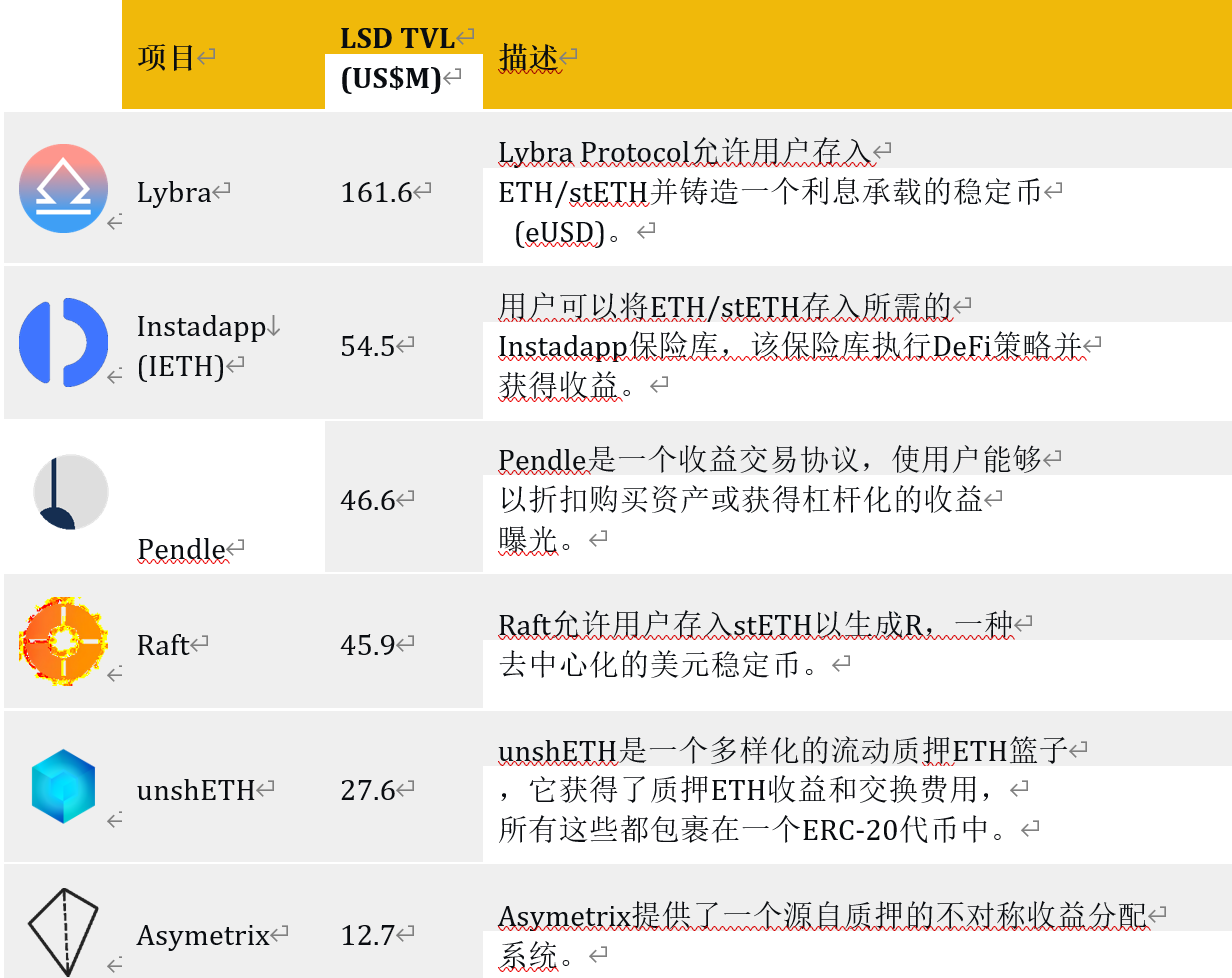

LSDfi’s landscape is relatively concentrated, with the top 5 players owning over 81% of TVL. Lybra is the market leader, considering that the project only launched its mainnet in April and has risen quickly.

Figure 8: TVL Market Share of LSDfi Ecosystem Participants

Source: Dune Analytics (@defimochi) as of June 14, 2023

LSDfi Project Overview

Source: Project website, Dune Analytics (@defimochi), Binance Research as of June 14, 2023

The table above provides an overview of several LSDfi projects. There is a wide range of projects, from CDP stablecoins to automated revenue strategies. As time goes on, we can expect to see more innovation in this space, which will benefit LSD holders by providing more options to generate revenue.

Growth of LSDfi

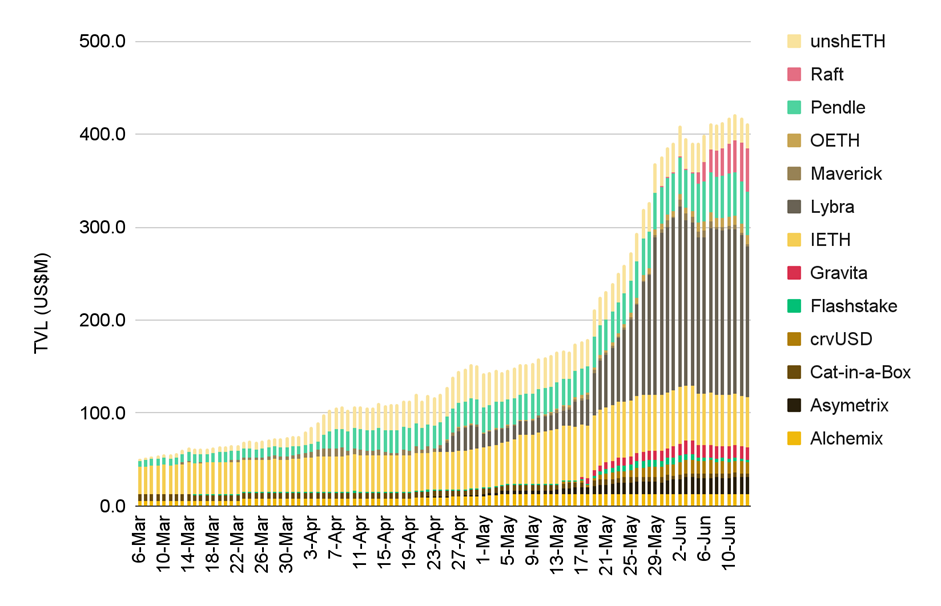

Over the past few months, the TVL (Total Value Locked) of the LSDfi protocol has experienced rapid growth, driven by the adoption of liquidity staking. As this trend has strengthened, the cumulative TVL of top LSDfi protocols has surpassed $400 million, more than doubling in just a month.

Figure 10: Strong Exponential Growth in the TVL of the LSDfi Protocol since Mid-May

Source: Dune Analytics (@defimochi) as of June 14, 2023

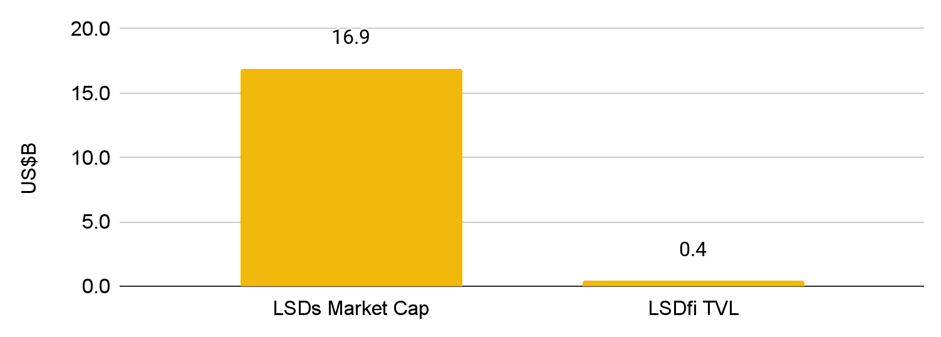

The growth of the LSDfi protocol has been fueled by the structural growth of ETH staked after Shapella. As participation in staking has increased, the adoption of liquidity staking has also increased. Naturally, LSD holders also seek the LSDfi protocol to generate additional revenue. Given that there is currently over $16.9 billion worth of LSD on Ethereum and only approximately $412 million of TVL in the LSDfi protocol (a penetration rate of approximately 2%), such growth is not surprising.

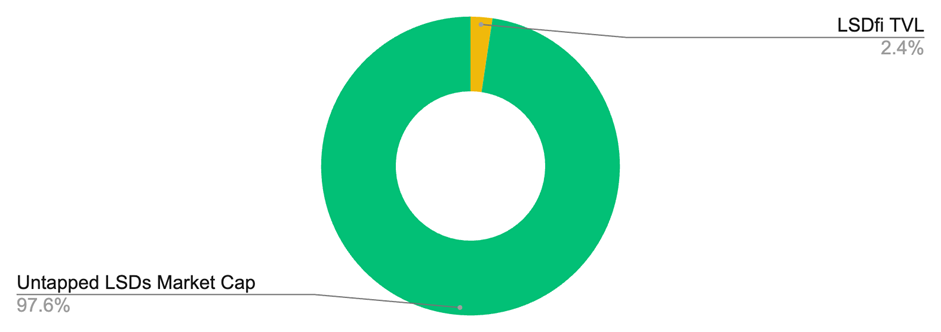

Figure 11: LSDfi has barely scratched the surface compared to the total addressable market

Source: Dune Analytics (@eliasimos, @defimochi) as of June 14, 2023

Prospects for LSDfi

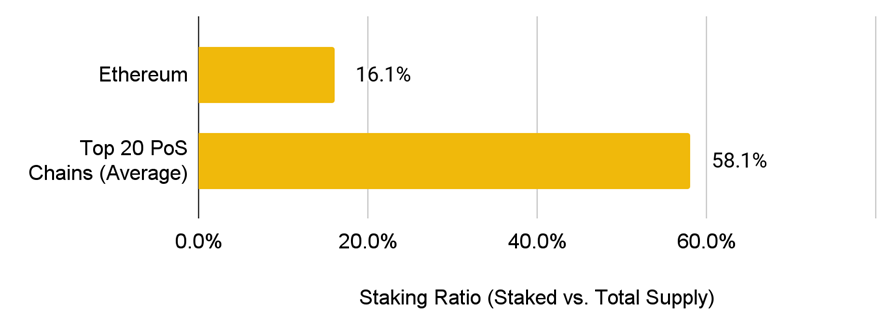

Driving force 1: Growth in staked ETH

Currently, the staking rate for ETH is 16.1%, which is significantly lower than the average for the top 20 PoS chains (58.1%). Looking ahead, this gap should narrow as withdrawals become possible with the upgrade to Shapella, which increases the attractiveness of staking by allowing stakers to exit their positions at any time.

If the staking ratio does indeed increase, the influx of staked ETH would provide a positive catalyst and structural driver for the LSD and LSDfi protocols.

Figure 12: Low staking ratio for ETH presents significant growth potential

Source: Staking Rewards, Binance Research as of June 14, 2023

According to on-chain data, there are already signs of increased demand for staked ETH. The staking rate has increased from just under 15% before Shapella to over 16% currently, and over 4.6 million ETH have been staked since the Shapella upgrade. Furthermore, further evidence of staking demand comes from the current validator queue of 46 days. Any new validators looking to enter the network and stake their ETH must wait 46 days.

Driving force 2: Penetration of LSDfi

Although adoption of the LSDfi protocol (measured by TVL) has increased, it is still a relatively small industry. Considering that most projects have been launched in the past few months, the industry is still in its early stages. However, with LSD continuing to gain attention and more holders seeking to generate yield, it would not be surprising to see more innovation and projects released to meet the growing demand.

From another perspective, the TVL in the LSDfi protocol currently accounts for less than 3% of the total addressable market (using LSD market capitalization as a proxy). While some LSD holders may have reservations about using the LSDfi protocol, and achieving 100% penetration is unlikely in practice, low single-digit penetration represents significant room for growth.

Figure 13: LSDfi’s penetration remains relatively low

Source: Dune Analytics (@eliasimos, @defimochi), Binance Research as of June 14, 2023

Risks

It is worth noting that LSDfi is a relatively young market and people should be aware of the risks associated with interacting with such projects, including the general risks associated with liquidity staking.

- Slashing risk: If a validator fails to meet certain staking parameters (e.g., offline), they may face penalties, and LSD holders may be exposed to these slashing risks.

- LSD price risk: The price of liquidity staking tokens may fluctuate due to market forces and may differ from the underlying token. This may expose users to price volatility and potential liquidation risks if used as collateral.

- Smart contract risk: Each interaction a user has with a smart contract brings a new level of smart contract vulnerabilities.

- Third-party risk: Some projects may use other dApps (e.g., yield strategies) as part of their normal operations. In such cases, users are exposed to additional counterparty risks.

In addition, the above factors do not include specific project risks that may differ between individual projects. Users should conduct thorough due diligence before participating.

Concluding Thoughts

The LSDfi protocol opens up new opportunities for LSD holders seeking yield. By providing additional use cases for liquidity staking tokens, LSDfi incentivizes staking participation and has the potential to accelerate the growth of liquidity staking. Given that the industry is still in its early stages of development, further observation of innovation in this space and LSDfi’s adoption will be interesting.

Liquidity staking is a nascent ecosystem and we are only just beginning to explore it. With this idea in mind, a deep research report on liquidity staking is expected in the coming weeks.

References

1. https://defillama.com/protocols/liquid%20staking/BSC

2. https://www.ankr.com/staking-crypto/binance-bnb/

3. https://dune.com/hildobby/eth2-staking

4. https://wenmerge.com/

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!