Author: thiccy

Translation: Luffy, Foresight News

One of the largest asset management giants in the world, BlackRock, has submitted an application for a spot Bitcoin ETF to the US SEC, which has attracted widespread attention and discussion in the crypto community.

In fact, the SEC has already approved quite a few Bitcoin futures ETFs, which hold near-term Bitcoin futures contracts on the CME, but there is still no spot Bitcoin ETF.

- Exploring the Possibilities of NFT Future: Beyond Art and Collectibles

- Latest update from FTX: launching a debt claim website soon, rumors of restarting operations may bring a turning point?

- Did this investigation report by ZachXBT provoke Huang Licheng to sue him in anger? (Full text attached)

These futures ETFs currently trade on the US stock market, but have small asset management scales. So why aren’t they popular?

The reason lies in something called “drag”. Drag refers to the adverse performance that occurs when a fund attempts to replicate the return of an underlying asset. This drag is the long-term result of regular investment portfolio rebalancing necessary to maintain risk exposure.

For this reason, Bitcoin futures ETFs all label themselves as “strategies”. Because for retail investors, long-term holding of these ETFs instead of holding spot Bitcoin makes no sense.

BITO is the largest of these ETFs. Two-thirds of its holdings are futures expiring in the current month, with one-third expiring in the next month.

At the end of June, ProShares needed to sell its June expiring futures and buy one-third July expiring futures and one-third August expiring futures to maintain its risk exposure.

This is called “rolling”.

Rolling is not only costly in terms of trading fees and slippage, but also because Bitcoin futures prices for the latter month are often higher than for the former month. This is called “futures premium”. Each time it sells expiring futures and buys next month’s, it incurs a loss.

The futures premium is not friendly to investment exposures reliant on futures. This is why futures ETFs like VZX (VIX), USO (crude oil), and BITO (Bitcoin) are not suitable for long-term holding.

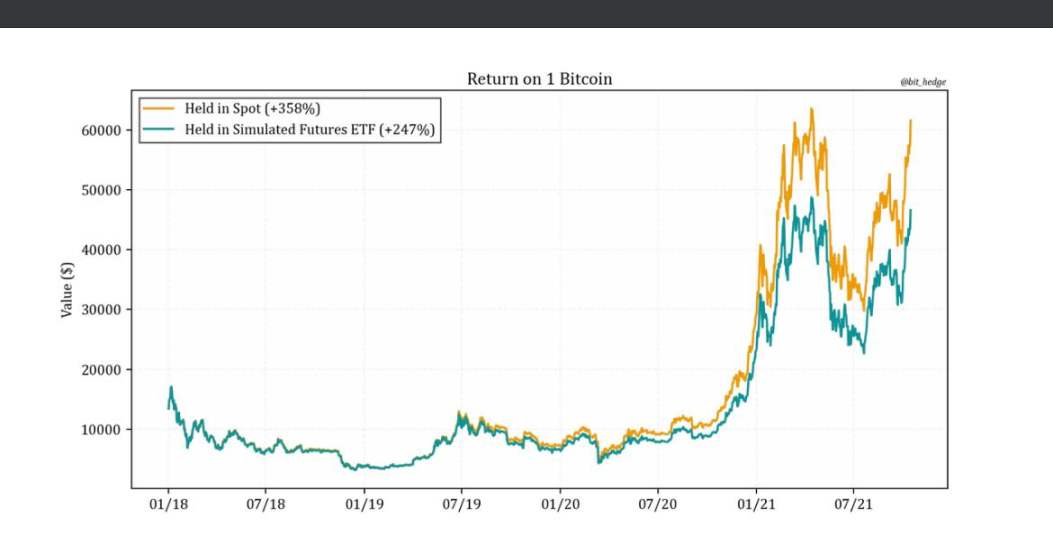

Bithedge simulated the cost of holding a Bitcoin futures ETF from 2018 to 2021, resulting in a 25% loss compared to holding spot during that period.

Now, let’s talk about spot ETFs, which no longer need to roll to maintain risk exposure. Why don’t we have a fund that is backed by physical Bitcoin and has no drag?

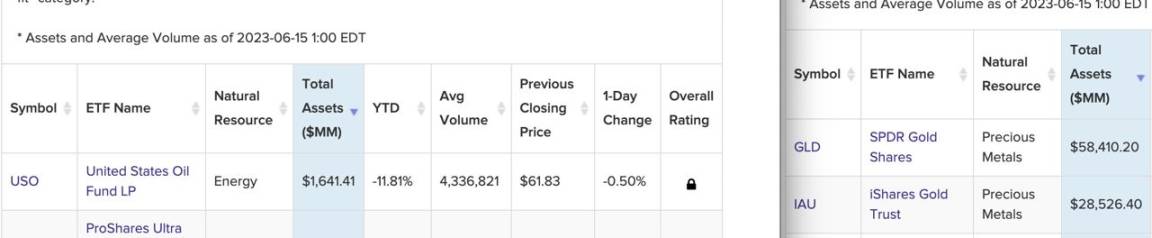

This is why physically-backed ETFs like GLD and IAU have a combined $90 billion in assets under management, while futures-backed ETFs like BITO and USO have only a measly $1.6 billion.

Spot ETFs have long been hailed as the holy grail of entry into American 401Ks and savings.

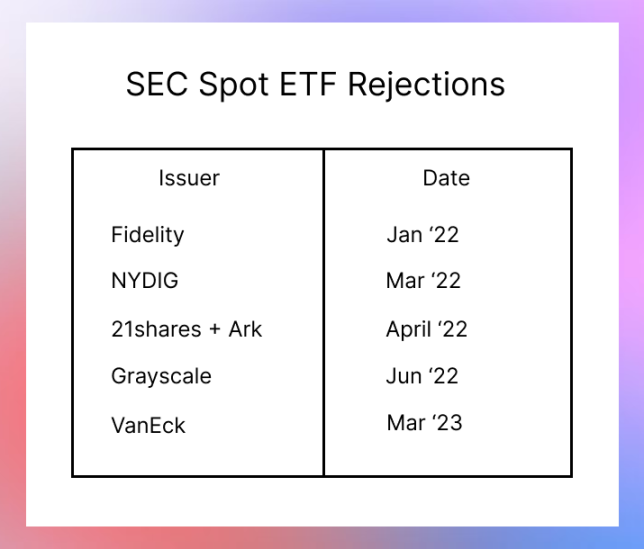

However, the US Securities and Exchange Commission has long denied spot ETFs, citing concerns about market manipulation and a lack of supervision-sharing agreements between “heavily regulated markets” and regulated exchanges.

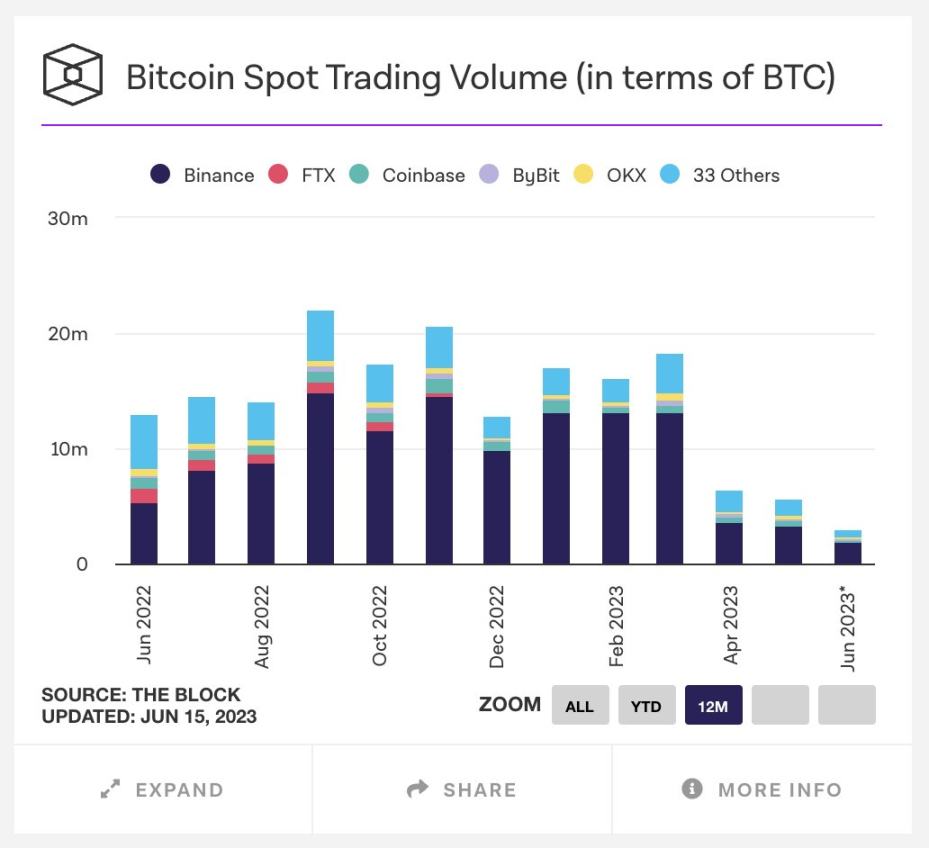

This concern has some merit, as Coinbase and other US exchanges account for less than 10% of Bitcoin spot trading volume. Market manipulation is indeed a concern, especially considering regulators’ dissatisfaction with Binance.

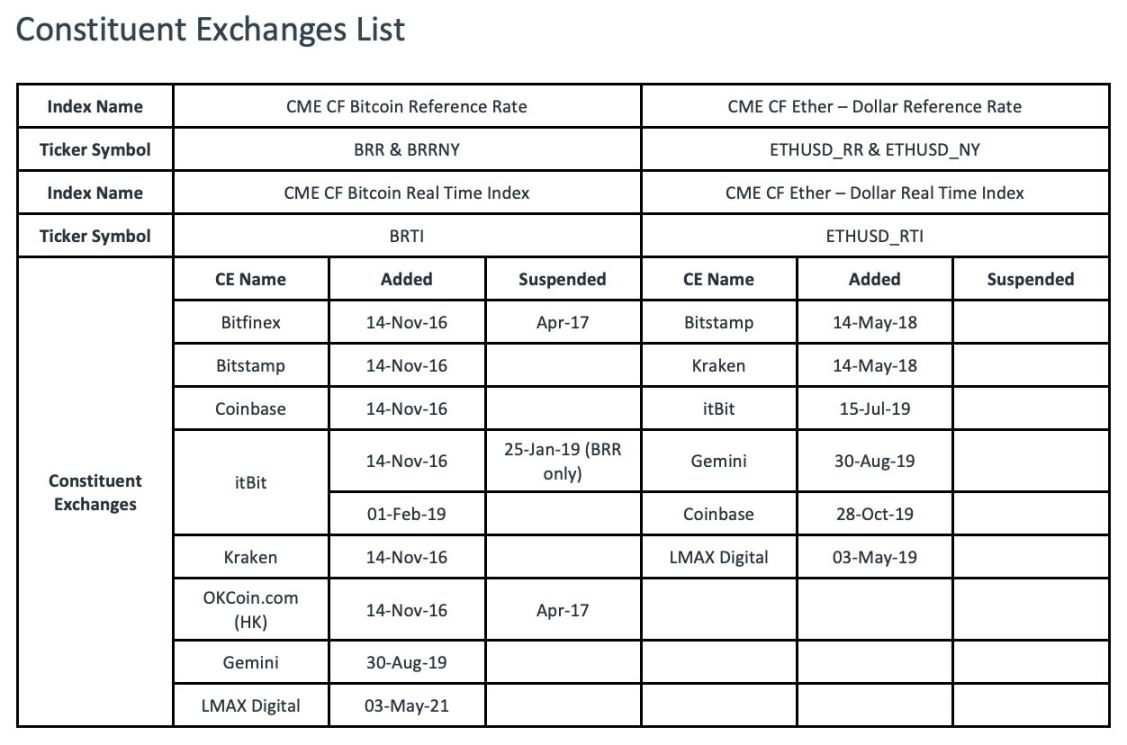

What is unreasonable is that approved Bitcoin futures ETFs use these US exchanges to calculate reference prices used for futures settlement. Futures ETFs should have the same potential for market manipulation as spot ETFs.

Ultimately, the SEC will not allow spot ETFs to exist unless there is a trustworthy exchange intermediary like CME to oversee the market.

So will BlackRock’s application be approved? I’m not sure.

These fund managers are praying that this trading could bring $100 billion in assets under management and $1 billion in management fees annually.

Vaneck has made three submissions and even Fidelity has been rejected.

BlackRock is the largest and most influential asset management company, and it may have a special relationship with the SEC.

In addition, the pressure on SEC chairman Gary Gensler from the Republican Party is increasing, and the US Securities and Exchange Commission may make some arbitrary decisions, such as allowing BlackRock to pass.

It is obvious that if BlackRock’s Bitcoin spot ETF is approved, it will be a huge driving force for the development of cryptocurrencies. It is even clearer that if the Republicans win the 24-year election and dismiss Gary Gensler, this will unlock many resources for the crypto industry.

Until then, we can only wait patiently.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!