Introduction

After summarizing the technical solutions, token value, and ecosystem of CP and Layer 2 Stacks in the previous article, we have provided corresponding selection ideas for developers and projects based on the technical characteristics of the two and the current token empowerment situation. Each party can choose the solution that suits their needs.

So, subjectively, what is the community’s attitude towards this new force of Layer 2? How should major L2s develop their own superchain networks? In this article, the author will focus on these two questions.

1. Industry Perspectives

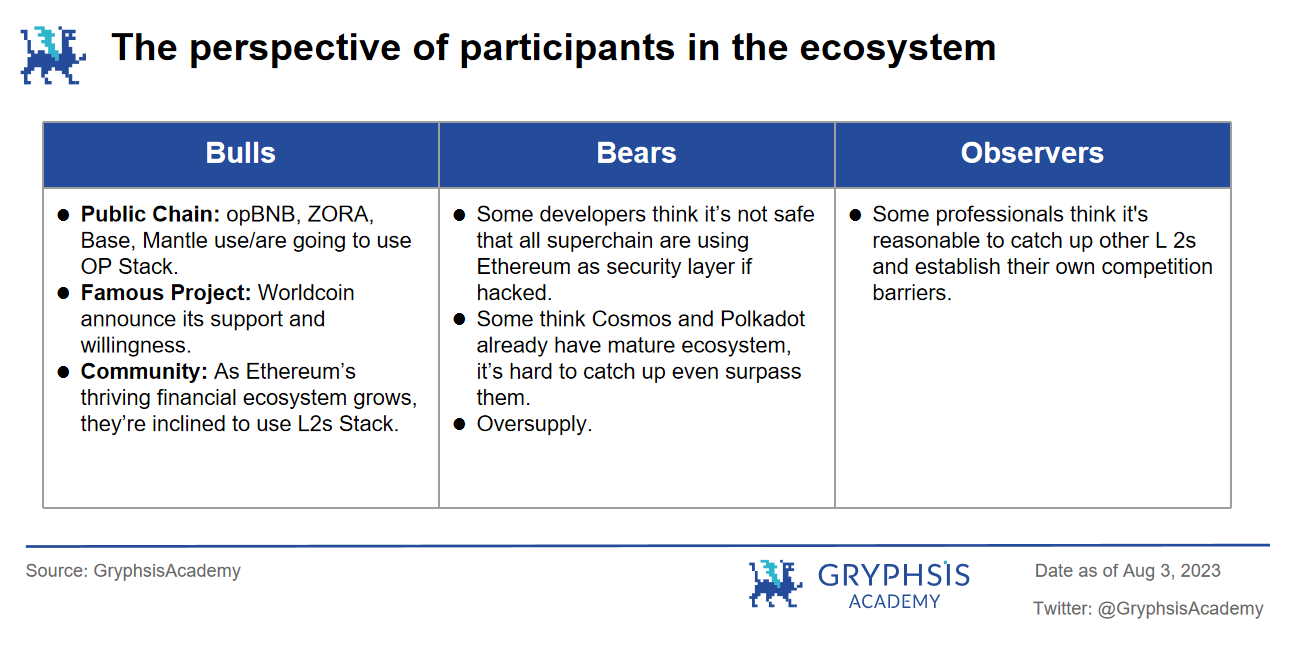

In order to comprehensively understand the voices in the current market, we have collected different perspectives on Layer 2 Stacks solutions in the industry and summarized them into three categories: Bulls, Bears, and Observers.

- Thin box borrows Jay Chou’s intellectual property to sell collectibles, and the car flips over at Naixue Tea.

- The collaboration between Naixue’s Tea and Jay Chou’s IP has been a failure, exposing the challenges behind the metaverse.

- Shanghai Metaverse’s major application scenario Hero Post has a sequel, with competition from Baidu, Alipay, and others, and the results are being realized.

1. Bulls:

-

Public chains: opBNB, ZORA, Base, Mantle, etc. have all announced plans to deploy to OP Stack. Among them, BNB announced its support for OP Stack as early as February this year and created its own opBNB. After 1.5 months of testing on the testnet, there have been over 7 million transactions, 435,972 addresses, and over 40 DApps deployed, including well-known projects like iZUMi Finance, Math Wallet, and BaBYGODE, indicating a high level of acceptance by the community and developers for opBNB.

-

Projects: Taking Worldcoin as an example, it expressed its intention to deploy Worldcoin and World App on the OP mainnet as early as May this year, and began implementing it on the OP superchain in July. Worldcoin itself aims to create a global identity and DID system, combined with the OP superchain, allowing any user to freely manage their identity ID, and also assisting OP Collective in on-chain governance. Additionally, Debank announced on August 11th that it will deploy a dedicated asset social L2 chain on the OP Stack. As a well-established brand providing data asset services for over 5 years, regardless of its success, we can already see the enthusiasm of projects to deploy L2 and the positive impact that OP Stack, as the preferred solution, brings to OP.

-

Community: The community has a high degree of recognition/consensus for Ethereum, and Ethereum itself is a financial superchain with a wide range of applications. Therefore, launching L2 on Ethereum will have more community recognition compared to the independently developed Cosmos & Polkadot ecosystems. It is also believed that Layer 2, due to its complete consensus layer, will develop much faster than CP, and will quickly complete the construction of the superchain ecosystem.

2. Bears:

-

Developers: Some developers believe that relying on Ethereum as the sole infrastructure for the consensus layer of all superchains is too risky. If Ethereum as a single infrastructure experiences a failure or attack, all superchain networks will be affected. In comparison, CP has taken security considerations into account more thoroughly. Cosmos allows each chain to customize validators to ensure security. Even in the event of a failure, it will only affect a single chain or related chains, without impacting the entire ecosystem. Polkadot provides more options, allowing shared security with relay chains or custom security layers similar to Cosmos, significantly reducing risks. Therefore, regardless of the situation, Layer 2 Stacks should develop more solutions in terms of security.

-

Projects: The superchain networks of Layer 2 Stacks are slightly oversupplied, and for ordinary projects, the perception is not strong, as they are essentially still based on Ethereum. Additionally, some project teams believe that the industry needs L1 (such as CP), and not all chains are suitable for L2.

-

Community: Layer 2, as a scaling solution for Ethereum, is difficult to exist independently in the short term, so how to handle the economic models of ETH and native tokens is a difficult point. Compared to Cosmos, which has already connected to 246 chains, and Polkadot with a market capitalization of 6.5 billion, Layer 2 Stacks will be at a disadvantage in competing with CP without a complete community-driven approach.

3. Observers:

-

Some developers believe that Layer 2 Stacks are created to attract more developers to build ecosystems. After the top Layer 2s such as OP and Arb announced the idea of superchains, taking proactive measures can be seen as catering to market demand, which is understandable. And since Layer 2s only handle and package transactions (execution layer), it may not be a bad thing to greatly increase throughput by recursively compressing packaged transactions from Layer 3 to Layer 2. However, in order to keep up without examining the current on-chain ecosystem and economic incentives, the actions may be a bit hasty.

In the current situation, I believe that the Stack solutions, especially the OP Stack, are favorable. BNB, Base, ZORA, Mantle, Worldcoin, Debank, and others are backed by top exchanges and well-known Web2 giants. The capital support makes OP Stack one of the leaders in Layer 2 and is likely to become the preferred choice for future flagship projects to launch on-chain with one click. This also indicates that the market and the industry recognize the logic of Layer 2 Stacks and have already put them into practice.

However, in the long run, the Ethereum ecosystem built by ETH and Layer 2 will become more prosperous, but there are also some internal issues within the ecosystem. For example, how Layer 2s handle their relationship with Ethereum, how to capture value from the multi-chain system they build, how to establish core competitive barriers, or how to collaborate with other Layer 2s to create a Layer 2 superchain network. These will be the situations that Layer 2 will face next, and every step taken afterwards will greatly influence the future direction of Layer 2.

II. Development Strategies

1. Technical Optimization

In the traditional development process of public chains, there is the impossible triangle problem: scalability, security, and decentralization. The emergence of Layer 2s alleviates the scalability problem, and each Stack launched focuses on the superchain network as the main goal, solving the scalability issue for most underlying infrastructures. So besides this, what kind of problems will arise in the development of Layer 2 Stacks?

1) Structural Security:

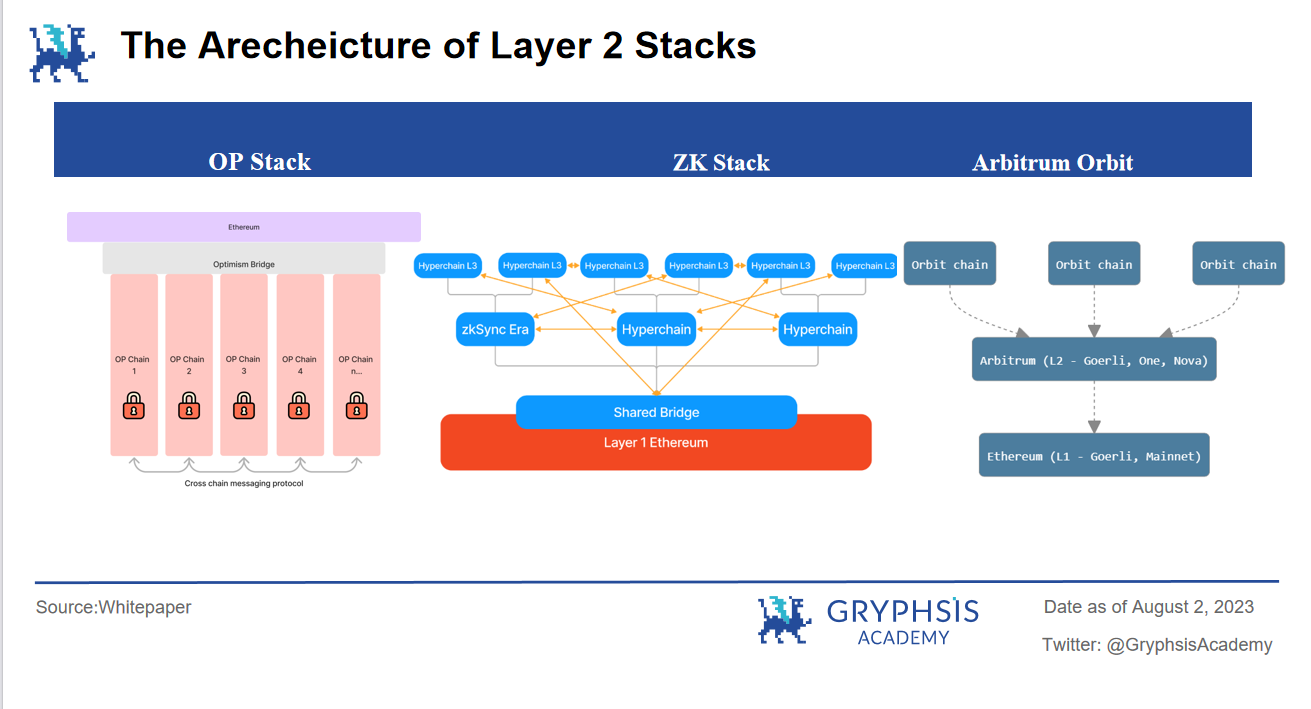

The emergence of superchain structures undoubtedly increases the complexity of Layer 2. Can the Stacks framework of Layer 2 support the concurrency of various application chains? We analyze the structural layers of Optimism, zksync, and Arbitrum, which have already released Stack frameworks.

OP Stack uses a shared cross-chain bridge for asset transfer. All OP Chains (1-n) created with the Stack solution are on par with the OP Mainnet. The underlying structure of ZK Stack & Arbitrum is similar, but they support the issuance of Layer 3 and Layer 4, forming a scalable superchain network. Polygon 2.0 (not listed in the table as a sidechain for now) uses Ethereum as the staking layer, and the existing Polygon zkEVM blockchain operates in parallel with the superchain, sharing an interoperability layer.

Their structural frameworks are similar, and they all face the same type of problem: all the sidechains rely on Ethereum as the underlying security consensus. So if Ethereum is attacked, are the sidechains still secure? In terms of the coordination of the sidechains, Layer 2 is essentially achieved through shared communication bridges. So how should problems with the bridges be resolved? In response to this type of single solution, Layer 2 should adopt multiple alternative solutions or directly optimize the framework to address them.

2) Risk Assessment

The security of Ethereum is unquestionably high, but whether Layer 2 can fully inherit the security of L1 is a question. As the main Layer 2 solution, Rollup’s current most important feature is to transition the “execution” of operations to the main chain. But when users initiate transactions on the L2 chain, although the cost is greatly reduced, can the security be guaranteed? Are there corresponding escape mechanisms to timely protect user assets?

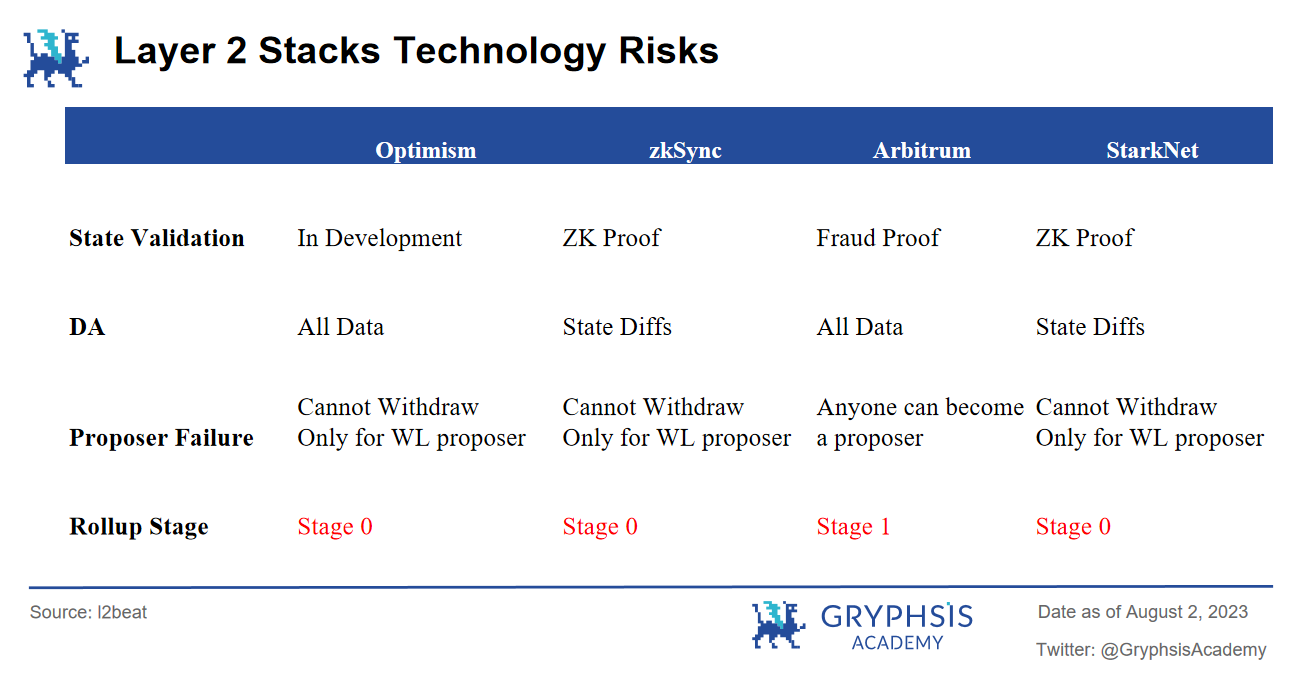

In response to this, we have summarized several important indicators from the l2beat website to assess the current risk vulnerabilities of Layer 2:

-

State Validation: This refers to the mechanism used by Layer 2 to validate the correctness of transactions. From the table, we can see that as the first network to use OP Rollup, Optimism’s validation mechanism is still not fully developed at this stage. In comparison, Arbitrum already has a fraud-proof mechanism for validation, and the development progress of Rollup Stage is also higher than Optimism’s. It can be said that Arbitrum has an advantage in terms of transaction security/correctness.

In addition, both zkSync and StarkNet adopt ZK Proofs, and their Rollup Stages are at the same level of development.

-

DA: Data Availability. The definition of this term varies slightly in the market, and we will analyze it based on l2beat’s interpretation. l2beat believes that in data availability, “‘data availability” refers to the correctness of state transitions as long as it is publicly disclosed. There is no need to broadcast the complete transaction data, as doing so would invade user privacy. And all this data must be on-chain, so that those capable of verifying “state transitions” can verify them on the chain.

From the table, we can see that the current data of these L2 solutions are all On-Chain. The chain of OP Rollup uploads all the data related to transactions to L1, while in comparison, the chain of ZK Rollup only sends “state variables” to the chain, greatly reducing transaction costs and block congestion.

-

Proposer Failure: This refers to a node/proposer being unable to complete a task due to certain reasons, which can cause network errors or interruptions and may also result in failed transactions and loss of node data. As a result, users cannot withdraw their assets from L2 to L1, which is also known as an escape mechanism.

In fact, currently all the L2 solutions on the market do not fully implement escape mechanisms. From the table, we can also see that all L2 solutions are Whitelist Proposers, and only they have the right to submit the L2 state root to L1. So once they are attacked, users are helpless, and their assets can only be frozen.

One slight advantage of Arbitrum is that it allows anyone to apply to become a Proposer after about a week of discovering the inactivity/failure of nodes/Proposers. This mechanism does provide some degree of protection. However, the Whitelist Proposer mechanism is essentially a closed system, contradicting the decentralized and open nature of blockchain.

Although users can apply to become a Proposer, the process still has a high technical barrier. Users may need basic equipment to become a node/Proposer. Furthermore, such a solution has not been actively applied in the market, and there is no corresponding incentive mechanism for these Proposers.

Therefore, overall, the asset emergency measures of Layer 2 at the current stage are not well-developed.

-

Rollup Stage: Stage2 is the endpoint for inheriting security in all L2s. However, currently, Arbitrum is the safest among all L2s, with the most complete risk mechanism.

Considering its upcoming BOLD mechanism, a new permissionless verification scheme that strengthens its dispute protocol to defend against a form of denial-of-service attack known as “delayed attacks,” it may further accelerate progress towards decentralization.

3) Interchain Security:

Take OP Stack as an example. Its goal is to provide a unified modular development stack for seamless communication between superchains. The modular architecture allows any developer to use the framework to develop their own blockchain, but it also means that anyone can develop and request messages. OP Stack also allows developers to easily abstract different components of a blockchain and insert different modules to modify it.

In simpler terms, if you want to replace your fraud proof with a validity proof or want to use another data availability layer, OP Stack allows you to do so. However, this raises a question: when diffusion becomes fragmentation, when OP Stack modules are no longer a system but instead use OP as a bottom-layer chain deployment tool, how do you manage the security between different chains?

4) Cross-chain Coordination:

As Polkadot founder Gavin Wood said, shared chains/bridges are essentially fragmented in terms of communication. Although chains can communicate with each other, it is the single chain + bridge model, with Polkadot using a relay chain for communication between parallel chains. In Layer 2 Stacks, OP, ZK, and Polygon are all shared cross-chain bridges.

So, how can we achieve seamless communication and interaction between chains? Is the current communication framework of Layer 2 Stacks a cross-chain protocol or even an opportunity for the development of public chains? Here, we list several possibilities:

-

Public chains lacking growth drivers: For example, Celo and LianGuaintom, whose market value is only 1/10 compared to the current EVM L2 and have low ecosystem activity. If their ecosystem can be integrated into the Stack, relying on the underlying super financial chain ETH and rich parallel superchains, it will undoubtedly bring them new growth, regardless of ecosystem cooperation or interaction needs between DApps. Some public chains have already started to deploy:

-

-

Celo initiated a vote in July this year, and the proposal to switch from the original EVM L1 to the OP Stack L2 has been approved;

-

Pontem Network plans to develop a new Move VM L2 using OP Stack

-

-

Highly cohesive and loosely coupled DApps: such as derivative exchanges, GameFi, Socialfi, etc. These applications have complex and diverse internal transactions, high frequency, and less dependence on external assets or projects. For these applications that do not require cross-chain capabilities but require efficient internal transaction processing, Stack may be the best development environment for them.

-

Cross-chain protocols: such as the popular Owlto Finance, which is a Defi protocol for cross-chain interaction on L2 Rollups public chains and currently supports cross-chain transactions on all ETH Layer 2 chains; in addition, there is Socket Protocol (more famous for its Bungee), dedicated to the development of cross-chain protocol Stack. If it can be deployed on OP Stack, it undoubtedly plays a crucial role in asset and information communication between chains.

2. Ecological Incentives

In addition to attracting support from developers and users through technology, Layer 2 can quickly build an ecosystem through the most direct incentive methods. Take Optimism & Polygon as examples to see what methods Layer 2 may adopt to build an ecosystem.

-

OP Grants: As an ongoing developer incentive program for Optimism, it funds developers to build Dapps and tools on Optimism. Multiple rounds have been conducted, with an investment of over $30 million.

-

RetroPGF (Retroactive Public Goods Funding):

-

In March 2023, RetroPGF Round 2 provided 10 million $OP as incentives for ecological projects. It mainly incentivizes projects/developers in three categories: Tool, Infrastructure, and Education, with a total of 195 projects/developers receiving rewards.

-

In June 2023, RetroPGF Round 3 will provide 30 million $OP as incentives for contributors to OP Stack, Collective Governance, Developer Ecosystem, End User Experience & Adoption, etc.

-

OP Warriors Season: Users can earn NFT rewards by participating in community activities (projects in the ecosystem).

-

Bridging Summer: On August 3, 2023, OP officially sponsored the Socket cross-chain protocol with 400,000 $OP. Any project that performs cross-chain operations during Bridging Summer will receive a certain amount of $OP refund. For example, if you perform a cross-chain operation worth $100U from Polygon to OP and need to pay a fee of $2.5, you will receive $2.25 worth of $OP at the same time, and you can claim it every month.

It can be seen that Optimism has been continuously launching various activities to enrich the ecosystem and attract more users. Moreover, OP already has a relatively mature incentive mechanism. In the early Grants, many project teams disappeared after receiving sponsorship, failing to fulfill their commitments to the development of the OP ecosystem. OP has learned from these experiences and lessons, gradually improving the rules in recent Grants to ensure that “everything is utilized”.

The governance mechanism of OP is becoming more and more perfect, and the incentives for projects are becoming richer. These can be used for the future development of Stack, just replacing the original Dapp with the superchain L2.

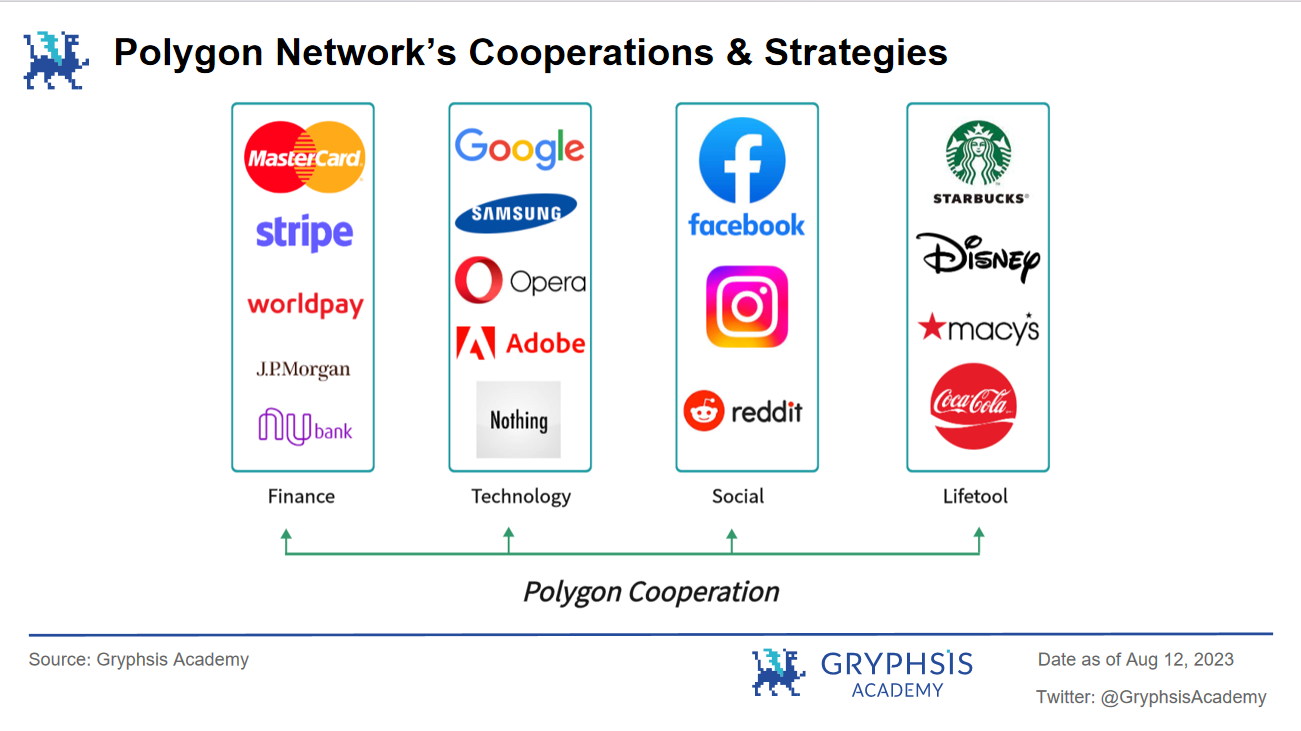

In addition, Polygon’s approach of promoting ecosystem development through business cooperation is also noteworthy:

-

Nation: Cooperate with India to issue “caste” certificates on Polygon to prevent vulnerable groups from making fraudulent claims on government welfare; cooperate with Singapore to facilitate cross-border transactions of digital yen and new yuan using Polygon and Aave.

-

Finance: Cooperate with MasterCard, a payment giant, to launch the MasterCard Artist Accelerator, which helps music artists learn how to expand their brand through minting NFTs and building online communities; WorldLianGuaiy (a payment giant), as a subsidiary of FIS Group, has added support for Polygon USDC.

-

Technology: Cooperate with software giants such as Adobe and PS developers to integrate NFTs into their social platform Behance; Google’s big data analytics service BigQuery adds support for Polygon blockchain data; Samsung has issued NFTs wearable in the metaverse platform Decentraland through Polygon.

-

Social: Meta’s Facebook and Instagram plan to develop an NFT marketplace based on Polygon and integrate it into both platforms, allowing users to create and sell their own NFTs; Reddit has launched an NFT series “Collectible Avatars” on Polygon.

-

Life: Starbucks has launched the loyalty program “Odyssey” through the Polygon network; it has been selected as one of the six companies in the “2022 Disney Accelerator Program”; collaborated with Coca-Cola artists to launch 136 NFTs to pay tribute to the brand’s 136-year history.

-

Games, music, entertainment, fashion and beauty, sports, automotive, celebrities…

This business approach can also be applied to the Polygon 2.0 plan. Adapt its superchain network to enterprises, invite traditional business institutions to deploy, and bridge the gap between blockchain and the business world. These collaborations can bring more high-quality projects to Polygon 2.0, promote its ecosystem development, and form a positive cycle.

Overall, the cooperation between Polygon and traditional Web2 industry giants, in terms of impact and breadth of cooperation, is likely to become the preferred blockchain network for Web2 users and global enterprises in the next 10 years. If these resources can be effectively utilized, it is likely that potential project parties of the future Polygon 2.0 superchain network will emerge.

3. Token Empowerment

When launching the Stack solution with Rollup as the main technology, how to design an economic model to increase the value empowerment for the native token? Compared to L2 Stacks, CP’s token empowerment has fewer obstacles.

For example, in Cosmos, although each chain has its own ecosystem and token in the initial version, $ATOM is difficult to play a significant role. However, in the Cosmos 2.0 conference, the team decided to use $ATOM as the gas fee standard for the Hub, allowing custom chains to share security with the Hub. In Polkadot, the current $DOT supports network governance, treasury, and slot auctions. In the upcoming 2.0 version, the original auction will be transformed into the Coretime market.

This is also the biggest difference from CP, because both ZK and OP are Ethereum’s L2, and their value is to solve the scalability problem of L1. All transactions need to be deployed on L1’s smart contract for verification, and confirmed assets are considered real money, and users will trust L2, so Gas is always ETH.

In other words, L2 is like a wedding dress for L1, not only helping L1 achieve scalability, but also enhancing the credit and value of L1 tokens for every transaction processed, and L2 can never truly separate from L1. This is why, in the vision of superchains, how to achieve token distribution is particularly important for L2.

Although there is currently no detailed solution, the above-mentioned EVM L2 also does not explain how the native tokens of this chain will be driven from the superchain network. However, the following points can be considered to design the economic model:

-

Governance of L2 network (refer to Polkadot):

Although it is inevitable to use ETH as the underlying token of the ecosystem, the acceptance of the native token of L2 is relatively high at the network governance level.

-

-

In order to participate in the Stack ecosystem, the superchain must hold a certain amount of native tokens;

-

Token holders can participate in network governance, vote, adjust parameters, and other governance activities to empower the tokens;

-

Establish a governance center/treasury: as the governance institution of the ecosystem, while retaining the autonomy of L2, unify value management;

-

In this way, both developers and users can fully participate in the ecosystem, enhance their sense of identity and participation in the ecosystem. For L2, it also increases the use cases of tokens and more efficiently mobilizes network participants.

-

Superchain fee allocation (refer to Cosmos):

When Layer 2 is building a cross-chain network, it can learn from Cosmos’ practice of using native tokens to participate in cross-chain fee allocation. Although running smart contracts on Layer 2 still requires using ETH to pay for Gas fees, for the fees generated by cross-chain interoperability between superchains, it is possible to consider using the native tokens of L2 for payment.

For example, in Cosmos, $ATOM is used to pay for IBC cross-chain fees, and cross-chain validators participating in verification will also receive token rewards. Extending this to L2 Stacks, when assets are transferred across superchains, a certain cross-chain fee can be set, which must be paid with native tokens; a portion of the cross-chain revenue can be distributed to token stakers; in addition, the development and verification of some cross-chain functional modules can also be incentivized with their tokens.

This way, it not only maintains the core role of ETH in the Ethereum ecosystem, but also allows the $OP token to have governance and value transmission functions in the cross-chain network. If designed properly, it can form a positive incentive mechanism to promote the development of the Optimism cross-chain network.

-

Rental model (referencing Ethereum):

On August 25th, Base introduced an economic cooperation agreement with OP: Base will provide OP with two modes of income, 2.5% of the sorter’s revenue or 15% of the profit (whichever is higher); and OP will give Base 2.75% of $OP.

This release immediately sparked widespread discussion. Based on the issuance and price of $OP, it is estimated that the total value of tokens that OP gives to Base is approximately $177 million. Additionally, based on the valuation of Base’s chain, the estimated profit of 15% is around $1.1 billion, which is equivalent to OP holding a 15% stake in Base. Furthermore, even if the 2.5% sorter fee is used, it can essentially be understood as OP collecting rent.

In the past Ethereum network, as a bottom-layer chain for ToB, other interaction actions are outsourced to L2, and a portion of the fees generated on L2 is given to L2 as execution fees, while the remaining portion is given to L1 as secure settlement, which is the source of Ethereum’s revenue. Therefore, OP and Base’s approach can also be seen as a novel rent collection model for L2.

Although the possibility of using L2 native tokens as the gas unit of the superchain is small, ETH is ultimately the consensus token. But if L2 is seen as a contractor for the Stack, responsible for contracting network construction, introducing investment, and helping to build the ecosystem, and the superchain’s task is to deliver a portion of the profit, this profit model is indeed very attractive, especially considering the resources that a super L2 like OP possesses.

-

Mutual empowerment with project parties:

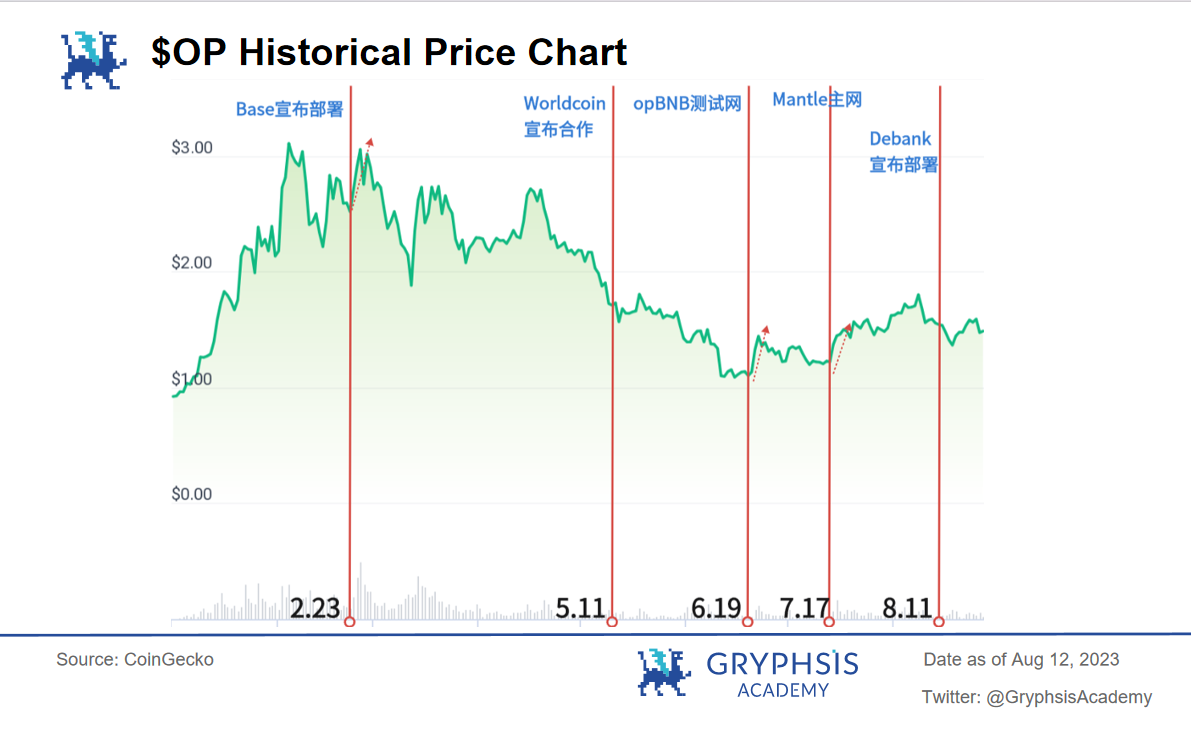

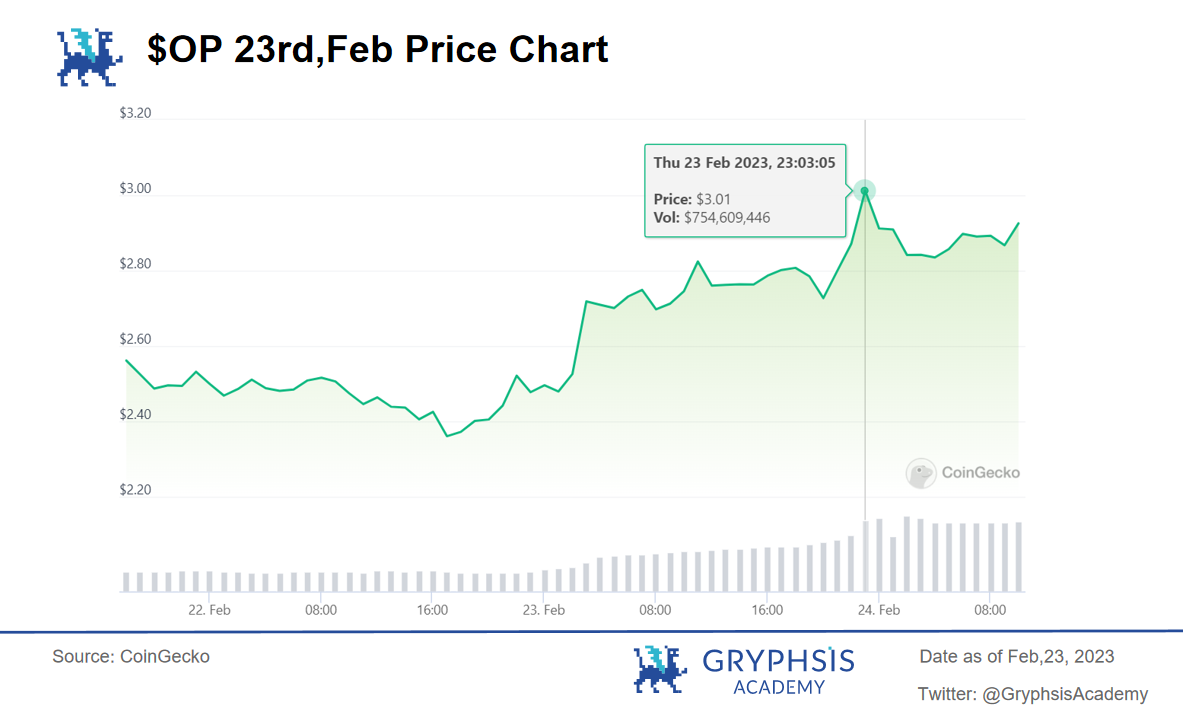

Take OP Stack as an example. Currently, opBNB, ZORA, Base, Mantle, Worldcoin, and Debank have successively joined OP Stack, and they have a significant impact on the price of OP. However, due to time constraints, it is not possible to intuitively observe the daily growth trend. Therefore, we temporarily select the price changes of $OP announced by Base on the deployment day as an example:

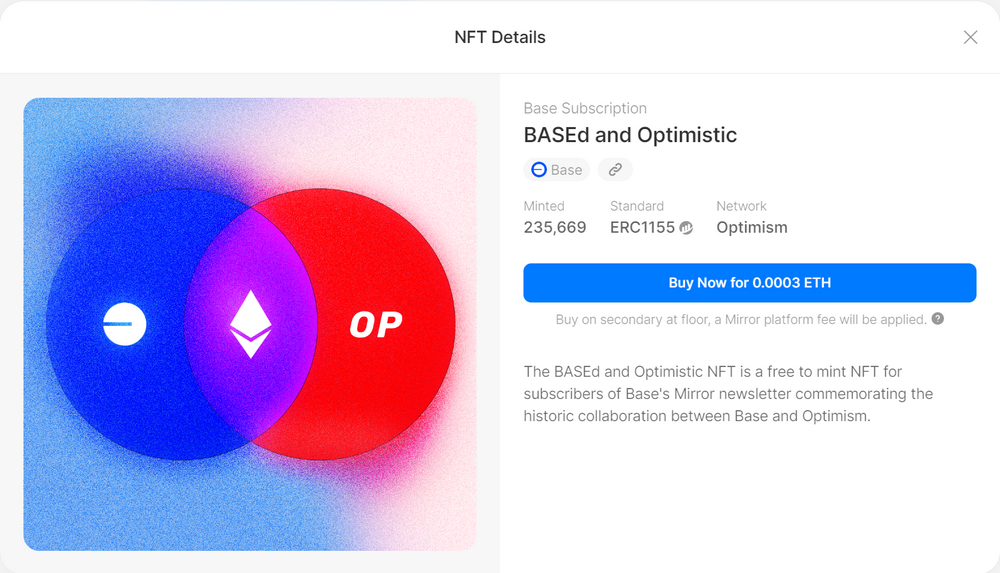

It can be seen that on February 23rd, the price of $OP briefly rose to $3.01. This is highly likely due to Base announcing the cooperation NFT on the OP mainnet around 10:30 pm, followed by a sharp rise in price around 11 pm, and then a subsequent decline.

It can be seen that on February 23rd, the price of $OP briefly rose to $3.01. This is highly likely due to Base announcing the cooperation NFT on the OP mainnet around 10:30 pm, followed by a sharp rise in price around 11 pm, and then a subsequent decline.

Since Binance announced the opBNB concept, and with the involvement of high-quality projects such as Base Protocol, ZORA, Mantle, and Debank, it is undeniable that these projects themselves bring reputation and prestige to OP, attracting more project parties to become interested in OP Stack.

Therefore, when project parties decide to deploy on OP Stack, it is a very reasonable choice to purchase and hold $OP tokens. This is not only to participate in the ecosystem but also a value investment.

$OP will definitely have a place in the future superchain ecosystem, and holding $OP tokens can give project parties more rights in the future. In addition, because project parties and OP are essentially a community of shared interests, as more and more projects are deployed on OP Stack, the increasing value of $OP tokens will directly benefit project parties. OP Stack will actively support/promote project parties for the development of the ecosystem, bringing positive exposure and growth to project parties. This win-win situation will encourage more projects to join, forming a positive cycle. In this regard, OP seems to have set a good precedent.

3. Summary

With this, the CP V.S. Layer 2 Stacks series of articles comes to an end, and next we will summarize the entire series.

The competition between CP and Layer 2’s superchain networks is essentially aimed at improving the infrastructure of blockchain. For a blockchain team, implementing all the network and consensus codes, including security, cryptography, etc., is very time-consuming, not to mention optimizing their own business logic.

If, at this point, a complete open-source code framework appears, which prepares elements such as network, consensus, communication, etc. for you, and you only need to deploy your business logic, then it will greatly achieve specialization in network and support interoperability, which also opens up the Roman road for the prosperity of the entire ecosystem.

However, at present, CP’s technology is more mature compared to Layer 2, but the L2’s ecosystem community is more prosperous. However, if L2s want to develop superchain networks on this basis, they should focus on how to solve the technical risks of this chain.

In addition, there is an interesting phenomenon, which is that the Ethereum Foundation’s definition of L2 is very vague, and the Ethereum official website also states that there is currently no officially certified L2. We can anticipate the impact of Ethereum’s attitude on L2. If we stand from the perspective of L1, we certainly hope to outsource only the “execution” to L2 and enjoy the “rent” by ourselves. The definition of L2 must certainly align with its own interests.

If one day the superchain networks of L2s abandon ETH and create their own tokens to establish gateways, what action will Ethereum take?

But whether it is CP’s multi-chain ecosystem of L0-L1 or Layer 2 Stacks’ multi-chain ecosystem of L2-L3, each has its own advantages and applicable scenarios. Except for the possibility of gradually disappearing due to their own operational issues, these different multi-chain solutions are more likely to survive and ultimately achieve a fully connected ecosystem of different public chains and multi-chains through different connection methods. As for who can capture more market share in such a fully connected future, it depends on how each project operates in the future.

References:

https://medium.com/@eternal1997L

https://medium.com/polkadot-network/a-brief-summary-of-everything-substrate-and-polkadot-f1f21071499d

https://tokeneconomy.co/the-state-of-crypto-interoperability-explained-in-pictures-654cfe4cc167

https://research.web3.foundation/Polkadot/overview

https://foresightnews.pro/article/detail/16271

https://v1.cosmos.network/

https://polkadot.network/

https://messari.io/report/ibc-outside-of-cosmos-the-transport-layer?referrer=all-research

https://stack.optimism.io/docs/understand/explainer/#glossary

https://www.techflowpost.com/article/detail_12231.html

https://gov.optimism.io/t/retroactive-delegate-rewards-season-3/5871

https://wiki.polygon.technology/docs/supernets/get-started/what-are-supernets/

https://polygon.technology/blog/introducing-polygon-2-0-the-value-layer-of-the-internet

https://era.zksync.io/docs/reference/concepts/hyperscaling.html#what-are-hyperchains

https://medium.com/offchainlabs

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!