Author: LD Capital

On June 27th, Azuki released a new series called Elementals and drew away 20,000 ETH from the NFT market. Due to poor graphics and a team cash-out incident, the entire NFT market suffered a double blow to both its funds and confidence, causing the prices of blue-chip NFTs to plummet. From June 27th to the present, Azuki’s floor price has fallen by about 47%, BAYC has fallen by 20%, MAYC has fallen by 18%, and Crypto Punks has fallen by 9%.

Blue-chip NFTs fell significantly after the Azuki incident.

- In-depth interpretation of Zunami Protocol: decentralized income aggregator, creating more beneficial solutions for stablecoin holders.

- An Analysis of oUSD, the Credit Token Launched by OPNX

- Interview with Justin Sun: stUSDT, which broke 22 million USDT in pledged assets on its first day, is leading a new narrative in the RWA track.

Data source: NFEX, LD Capital

In DeFi’s lending market, a black swan event causing collateral to drop so sharply can lead to passive liquidation of lending agreements, resulting in a chain reaction that makes the market even more extreme. However, due to its poor liquidity, NFT lending markets usually liquidate collateral through auctions, which can take several days. In this way, if extreme market conditions occur, NFT lending protocols may see a large number of bad debts, which the protocol or depositors will have to pay for. (In historical observations, every time the price of NFTs drops to the concentrated liquidation interval of lending agreements, a price support is formed, because the lending agreements at this price range bear the risk of bad debts and absorb a large amount of selling pressure. As there is currently a lack of channels for profiting from shorting NFT lending agreements, the price of NFTs often forms a strong support at this price range).

In this significant drop in blue-chip NFTs, Blend, as a peer-to-peer lending product, does not bear bad debt risks and is not the main focus of discussion. This article will focus on BendDAO, Jpegd, and BlockingraSBlockingce, the three major point-to-pool lending products.

1. BendDAO

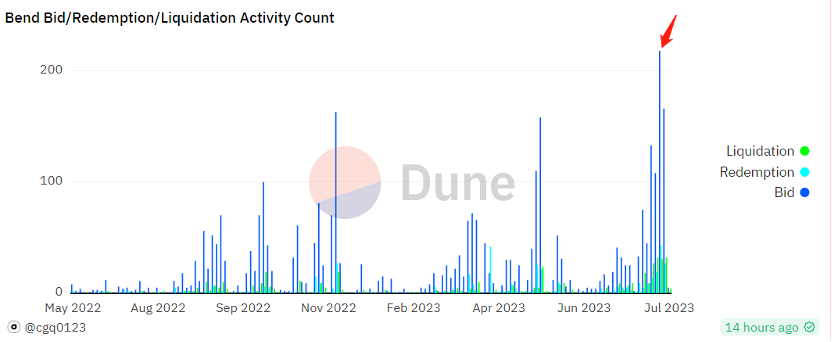

On July 3rd, following Azuki’s significant drop, the BAYC NFT series also experienced a significant drop. BendDAO platform saw a debt of 267 ETH in auction, resulting in bad debts of 22 ETH (meaning the collateral value was less than the corresponding debt; this is the first time BendDAO has experienced bad debt).

The team proposed to use the national treasury funds to clear the bad debts on the platform. At that time, BendDAO had a total of 45 ETH, 326,800 USDT, 13,500 APE, and 2.372 billion BEND in its treasury. Excluding BEND, the other assets were equivalent to 190 ETH. Therefore, BendDAO still had the ability to handle bad debts on the platform and loan issues. However, at the same time, BendDAO’s balance of loans waiting to be auctioned reached about 900 ETH, and the oracle’s feed price was slightly higher than the trading platform’s floor price due to time-weighted averaging, and even higher than the market’s buyer bid price. This increased the risk of platform bankruptcy and greatly reduced the deposit pool.

On July 3, the historical record of loans waiting to be auctioned was reached.

Data source: Dune, LD Capital

After July 3, most of the loans in BendDAO were auctioned off due to a slight rebound in blue-chip NFT prices. Currently, the bad debt on the BendDAO platform is 12.81 ETH, and the auction debt is 72.48 ETH. The team’s proposal to use national treasury funds to clear bad debts on the platform was approved, and the crisis of BendDAO’s bankruptcy was resolved.

When the price of collateral fell sharply, the logical chain and subsequent deductions of events that occurred at BendDAO and BlockingrasBlockingce are as follows:

Collateral prices fell sharply → a large number of collateral was liquidated → platform bad debt risk increased → deposit pool shrank → passive increase in deposit and loan interest rates → users repay and retrieve collateral (or market confidence is restored and deposits increase).

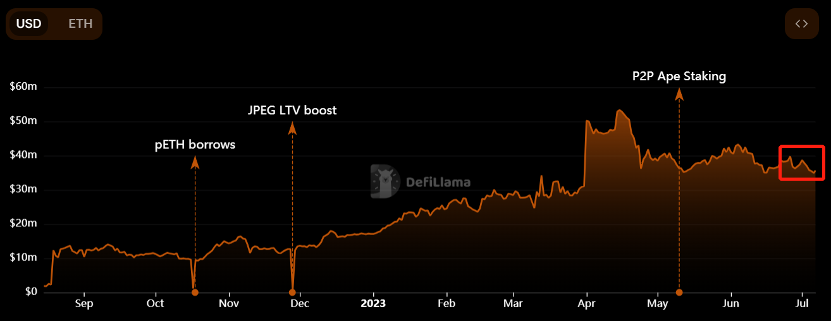

BendDAO’s deposit pool has decreased from about 45,000 ETH before the Azuki incident to about 6,000 ETH now, and TVL has been halved. The deposit interest rate has risen from 5% to 48%, and the borrowing interest rate has risen to 62%.

BendDAO’s TVL dropped by 54% after the NFT prices plummeted.

2. BlockingrasBlockingce

The situation at BlockingrasBlockingce is similar to that of BendDAO, but because a large number of loans at BlockingrasBlockingce are in the form of USDT rather than ETH, the LTV of the platform as a whole is lower than that of BendDAO before the incident, as the exchange rate of blue-chip NFTs to USDT has decreased less than that to ETH in the past six months (ETH has risen in price). This means that the impact of this incident on BlockingrasBlockingce is smaller.

BlockingrasBlockingce’s TVL dropped by 23% after the NFT price crash.

Data source: defillama, LD Capital

III. Jpegd

Since CryptoPunks are the main collateral in Jpegd (with a small price drop), and Jpegd uses CDP to mint pETH and pUSD, the protocol does not have a deposit pool, so there is no situation where the interest rate will suddenly rise when the deposit pool shrinks. Therefore, Jpegd was basically unaffected by this event.

It should be noted that Jpegd may modify the economic model and launch the function of borrowing JPEG tokens to mint pETH. Currently, Jpegd has two Guage pools in Curve, namely pETH/ETH (TVL 21.27m, APY 22.38%) and Jpeg/ETH (TVL 4.22m, APY 55.64%). Due to the insufficient demand for NFT collateralized loans, pETH has been in a long-term premium. The introduction of the JPEG collateralized minting pETH function can release the lending liquidity of JPEG, alleviate the premium of pETH, and share the Crv governance resources of the protocol with the JPEG holders to a greater extent (JPEG collateralized minting pETH and ETH group LP mining does not need to worry about impermanent loss risks).

Jpegd’s TVL dropped by 9% after the NFT price crash.

Data source: defillama, LD Capital

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!