Authors: Jason Jiang, Lianghuan Bi; Source: Ouke Cloud Chain Research Institute

Foreword

In early June, after the launch of the licensing system for virtual asset trading platforms in Hong Kong, the market gradually shifted its focus to another important track in the virtual asset market: stablecoins. Hong Kong officials have repeatedly revealed in public that Hong Kong will gradually establish a regulatory framework and will officially launch a stablecoin licensing system by the end of 2024.

Due to the important role and huge potential of stablecoins in the digital financial ecosystem, the Hong Kong industry has begun to envision the development prospects of Hong Kong dollar stablecoins. On July 3, several experts and scholars who follow Hong Kong Web 3 jointly published an article in Ta Kung Pao, strongly proposing that the Hong Kong SAR government issue a Hong Kong dollar stablecoin backed by Hong Kong’s foreign exchange reserves to promote financial technology innovation, enhance financial market competitiveness, and maintain a competitive advantage for Hong Kong in the digital economy era. Earlier, the Ouke Cloud Chain Research Institute also published a special article entitled “Seven Questions About Hong Kong Dollar Stablecoins: Issuance Logic, Regulatory Rules and Potential Impact” in the most well-known financial media in Greater China, Caixin, at the end of June, sharing its observations and thoughts on Hong Kong dollar stablecoins with all sectors.

- Latest developments in the Arbitrum ecosystem: Which hidden Alphas are worth paying attention to?

- Apart from the MiCA regulation, what other encryption regulations in Europe are worth paying attention to?

- Binance Research Report: When Liquidity Staking Develops Further into LSDFi

The following is the original text of the report:

While the US SEC is under fire, the virtual asset and Web 3 industry on the other side of the Pacific Ocean is full of hope. Ashley Alder, the CEO of the Hong Kong Securities and Futures Commission, said in a speech at the annual meeting of the Hong Kong Investment Funds Association earlier, “The Hong Kong Securities and Futures Commission is committed to promoting growth. We understand that investment products in the market need to be innovative to keep up with the times and meet the changing needs of investors. We are currently focusing on three main areas: environment, social and governance (ESG), virtual assets, and RMB-priced products.” Hong Kong’s regulation of virtual assets is being carried out in an orderly manner and is gradually penetrating into branches of virtual assets, such as the “Hong Kong dollar stablecoin” that the market has been looking forward to. On June 5th, Hong Kong Financial Secretary Paul Chan Mo-po said that the Hong Kong Monetary Authority has developed a regulatory framework for “stablecoins” and plans to conduct a second round of public consultations within this year. This article will start from seven basic questions to interpret the issuance logic, technical framework, regulatory rules and potential impact of Hong Kong dollar stablecoins, and analyze the operating mechanism that Hong Kong dollar stablecoins can refer to in the future using USDC as an example.

Seven Questions about Hong Kong Dollar Stablecoins

Question 1: Why Are Stablecoins So Popular?

Answer: Stablecoins are popular for the following reasons:

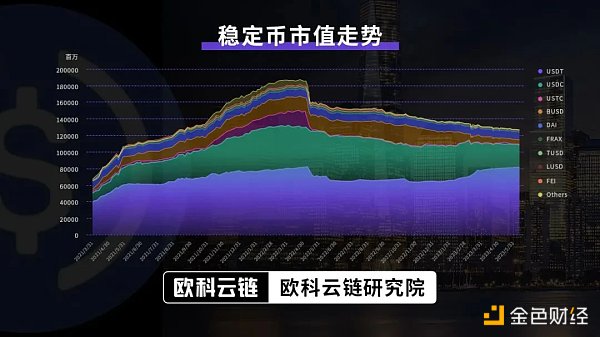

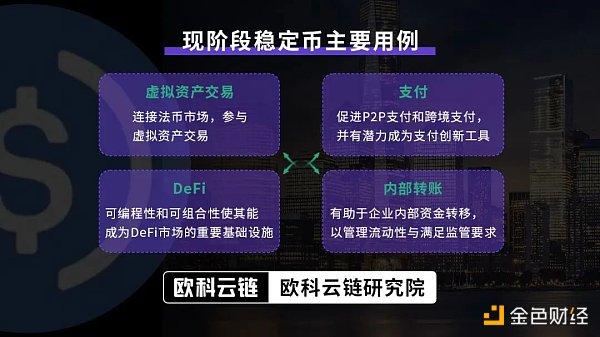

1. They play an important role in the crypto economy. In the early days of virtual asset trading, Bitcoin was used as the pricing unit. However, due to the high volatility of Bitcoin and the cutting off of fiat currency channels due to regulations, stablecoins represented by USDT emerged one after another. Stablecoins not only serve as a bridge between the crypto market and the fiat currency system, becoming an important medium for virtual asset trading, but also provide most of the liquidity for innovative ecosystems such as DeFi and NFTs. According to incomplete statistics, the average quarterly trading volume of stablecoins in 2021 is almost equivalent to the stock trading volume of the New York Stock Exchange in the same period. As of now, the market value of stablecoins has reached nearly 130 billion U.S. dollars, an increase of 376.19% from 2020, accounting for 11.67% of the total market value of virtual assets. Two out of the top five virtual assets ranked by market value are stablecoins.

Market value trend of stablecoins (remade)

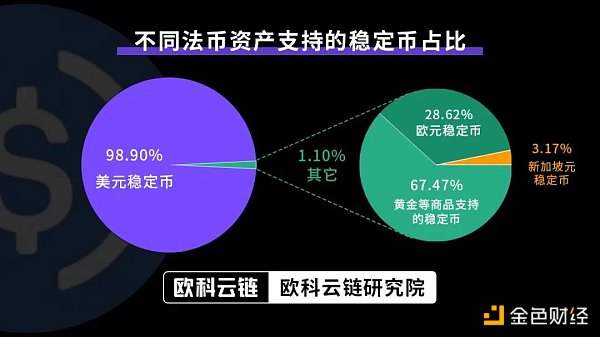

Proportion of stablecoins supported by different fiat assets

2. It is closely related to traditional finance. Since Facebook (now Meta) released the Libra (now Diem) white paper in 2019, traditional finance and technology companies have continued to focus on stablecoins. Stablecoins combine fiat currency credit with blockchain credit enhancement functions and are more easily accepted by traditional markets than other virtual assets, and have a higher possibility of integrating daily economic activities with the mainstream financial system in the future. At the current stage, many institutions are also trying to use stablecoins to provide inclusive financial services to users who cannot use bank accounts, supplementing and improving the existing financial service system.

Main use cases of stablecoins at the current stage

3. Risk events occur frequently, posing a threat to financial stability. Whether it is the Luna thunderstorm event or the more frequent stablecoin anchoring phenomenon, it indicates that the current stablecoin market still faces many risks. Especially considering that the mainstream stablecoins are all associated with real-world financial assets with high liquidity in various countries, the association with the traditional financial market is also increasing, so they may become the main channel for financial risks to spread, posing a potential threat to global financial stability.

2nd Question: How will Hong Kong regulate stablecoins?

Answer: Hong Kong may take the following measures:

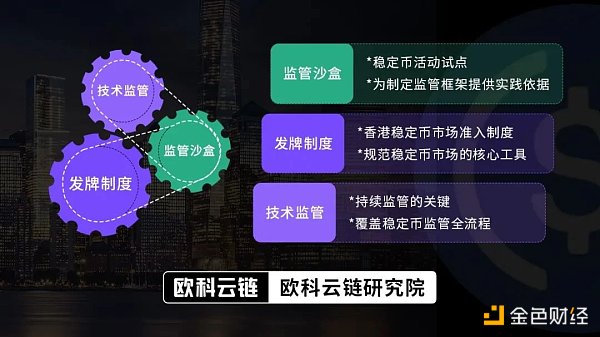

1. Regulatory sandbox. Referring to Hong Kong’s previous development ideas, while formulating a stablecoin regulatory system, the HKMA may adopt a regulatory sandbox to conduct pilot tests on compliant issuance and operation activities of stablecoins, providing a practical basis for subsequent comprehensive supervision.

2. Licensing system. The HKMA will use licenses as the main tool to regulate stablecoins. Entities engaged in stablecoin-related activities in Hong Kong or promoting relevant activities to the Hong Kong public, as well as entities engaged in activities related to stablecoins pegged to the Hong Kong dollar, should hold a license. However, having a license does not mean everything is fine. For different links of stablecoins involving issuance, governance, custody, and wallet services, the HKMA will use different licenses to regulate different activities. At the same time, business restrictions will be imposed, that is, institutions engaged in issuance business cannot provide custody services at the same time, which means that compliant issuance of stablecoins in Hong Kong requires the joint cooperation of multiple licensed institutions.

3. Technical supervision. After the regulatory framework is formulated, Hong Kong will rely on regulatory technology to actively and continuously monitor and observe the stablecoin market. Obtain more timely market information and higher-quality regulatory data through embedded supervision and other modes. At present, some countries/regions have realized or plan to introduce such active regulatory mechanisms. In the future, Hong Kong may introduce similar technologies in stablecoin regulation to enhance regulatory adaptability.

3rd Question: How should Hong Kong dollar stablecoins be issued? How to compete with US dollar stablecoins?

Answer: As long as the issuing institution meets the HKMA’s licensing conditions, it will theoretically be allowed to issue stablecoins. However, for considerations of liquidity and security, stablecoins supported by the Hong Kong dollar will become an important option for compliant Hong Kong dollar stablecoins. This is because Hong Kong dollar-backed stablecoins can maintain relatively good stability while establishing closer ties with traditional commercial institutions and regulators to quickly gain broad user trust. Globally, USDC is currently one of the best stablecoins in terms of compliance, and Hong Kong dollar stablecoins can refer to USDC to a certain extent.

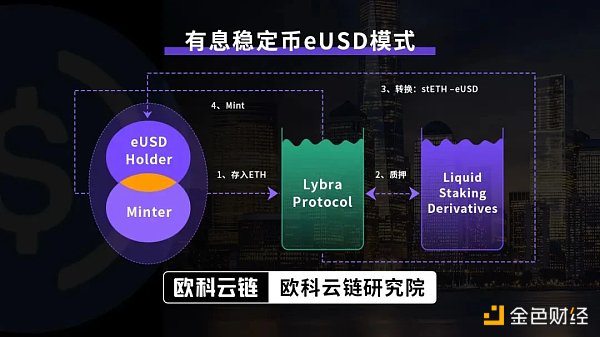

However, currently, 99% of circulating stablecoins are US dollar stablecoins, and stablecoins supported by other fiat assets cannot compete with them. In addition to circulating on a virtual asset trading platform licensed by the Hong Kong Securities and Futures Commission through non-market means, Hong Kong dollar stablecoins also need to attract more institutions and users through mechanism innovation to compete for greater development space. Developing an interest-bearing Hong Kong dollar stablecoin supported by fiat currency may be a good choice, that is, using Hong Kong dollars as collateral assets and paying users all or part of the interest generated by the collateral to gain more trust and use by institutions and users. The interest-bearing stablecoin model has been widely explored in the DeFi field. For example, the eUSD interest-bearing stablecoin protocol launched by Lybra Finance and the LSD interest-bearing stablecoin protocol launched by Prisma Finance have achieved good market response. This model may be expanded to the centralized stablecoin market in the future. However, if the Hong Kong dollar stablecoin is interest-bearing, its attribute definition and regulatory mechanism need to be reconsidered, because the stablecoin attribute is more complicated under this model and may cause a run on bank deposits.

eUSD interest-bearing stablecoin model

4 Questions: Which institutions can participate in the Hong Kong dollar stablecoin ecosystem?

Answer: Traditional financial and technology institutions are highly concerned about the stablecoin market and have begun to study and explore stablecoin applications. In the United States, giants such as JP Morgan and BlockingyBlockingl have long been eager to try, and once the MiCA bill in the European Union takes effect, banks and financial institutions will also have greater interest in issuing stablecoins or providing related services. Compared with cryptocurrency enterprises, traditional commercial institutions have natural advantages in stablecoin risk control and application. It is expected that more traditional financial and technology companies will also appear in the Hong Kong stablecoin market.

Among them, Hong Kong commercial banks will play an important role in the Hong Kong dollar stablecoin ecosystem, and many banks will launch their own Hong Kong dollar stablecoin products/services. Different from the stablecoin applications currently dominated by non-bank institutions in the virtual asset field, Hong Kong dollar stablecoins launched by commercial banks will explore more integrated application scenarios and expand the use of stablecoins to a larger digital ecosystem, such as data assetization and real asset tokenization.

“`html

However, for this reason, all institutions attempting to participate in compliant Hong Kong dollar stablecoin transactions must register as operating entities in Hong Kong. Only companies that establish local legal entities in Hong Kong can apply for relevant licenses from the HKMA and operate in accordance with the law. Foreign companies with branches or offices in Hong Kong cannot apply for licenses and therefore cannot participate in Hong Kong dollar stablecoin issuance and operation activities.

Giants who have issued/still planning to issue stablecoins (partially)

5 questions: Which sub-sectors are worth paying attention to if issuing Hong Kong dollar stablecoins?

Answer: The following sub-sectors are worth paying attention to:

1. Hong Kong dollar stablecoin payments. Hong Kong dollar stablecoins will be used more as a payment tool than as an asset, which means that they will be used more for commercial payments. In the premise of widespread participation of commercial banks, Hong Kong financial technology companies closely related to merchants and consumers will have broad market space, as they are more innovative than banks and can provide consumers and merchants with better stablecoin payment services through the stablecoin network opened by banks.

2. Risk control and compliance services. Third-party risk management and compliance services related to Hong Kong dollar stablecoins will become more and more popular. Although there are already third-party risk management companies such as stablecoin auditing, consultants, and insurance providers, Hong Kong dollar stablecoins need more effective and proactive risk control and compliance tools to monitor and regulate the market. If Hong Kong dollar stablecoins are issued on the public chain, transaction and circulation data will be presented in the form of on-chain data. Using blockchain data analysis technology for on-chain AML and intelligent early warning analysis will become an important choice to provide industry norms and transparency.

6 questions: What is the relationship between Hong Kong dollar stablecoins and tokenized deposits and digital Hong Kong dollars?

Answer: 1. Hong Kong dollar stablecoins and tokenized deposits. The two have a certain competitive relationship. Before the compliance framework of Hong Kong dollar stablecoins is clear, tokenized deposits may become an alternative solution for connecting fiat currency systems in Hong Kong Web 3. Tokenized deposits are essentially digital expressions of deposits held by financial institutions and are collateralized by bank deposits with commercial banks as the main body. They can be seen as intermediate products between CBDC and private stablecoins. Singapore and the United States have both had positive explorations in the field of tokenized deposits, and globally renowned credit rating agency Moody’s believes that tokenized deposits have the potential to become alternative solutions to solve the shortcomings of stablecoins.

“`

Hong Kong is exploring tokenized deposits in the Cyberport Ecosystem, and is considering appropriate regulatory measures. If the pilot of bank-led tokenized deposits goes well in Hong Kong, it may provide technical and experiential support for the subsequent launch of Hong Kong dollar stablecoins, but it may also reduce the enthusiasm for exploring Hong Kong dollar stablecoins: because deposit tokenization can play the role of most Hong Kong dollar stablecoins while solving the problem of Hong Kong dollar stablecoins.

2. The biggest difference between Hong Kong dollar stablecoins and digital Cyberport dollars is that the digital Cyberport dollars will be issued by the Hong Kong Monetary Authority and have the same legal currency status as the Hong Kong dollar, while Hong Kong dollar stablecoins are issued by private institutions or commercial banks and can only exist as payment tools or digital assets in the short term.

Comparison of CBDC, stablecoins, and tokenized deposits

7 Questions: Does Hong Kong really need Hong Kong dollar stablecoins?

Answer: Since Web 3 relies on stablecoins for payment settlement, Hong Kong dollar stablecoins are an important infrastructure for promoting the localization of Web 3 development in Hong Kong, and can also promote the development of cross-border trade and payment settlements denominated in Hong Kong dollars, leaving Web 3 innovation in Hong Kong. If Hong Kong dollar stablecoins are successfully launched, they will not only connect the virtual asset market with the Hong Kong financial market, attract more talents and funds, but also further enhance Hong Kong’s discourse power in the field of virtual assets and Web 3. Therefore, the market has a high enthusiasm for the launch of Hong Kong dollar stablecoins.

However, there are almost no official expressions about Hong Kong dollar stablecoins in Hong Kong’s official expressions. More are encouraging innovative practices such as digital Cyberport dollars and tokenized deposits. At the same time, considering that the Hong Kong government is accelerating the formulation of stablecoin regulatory policies, but it may take time to implement the regulatory, so in the short term, the Hong Kong government’s demand for Hong Kong dollar stablecoins may not be strong, and the possibility of compliant Hong Kong dollar stablecoins appearing is not large.

The reason for the difference in attitudes between regulators and the market towards Hong Kong dollar stablecoins is that the priority of compliance and efficiency in different stands is different. Regulatory agencies are more concerned about achieving a balance between compliance, risk control, and market innovation. In the case where practical problems such as anti-money laundering have not been resolved, Hong Kong dollar stablecoins are not a necessity for regulatory agencies.

Looking at the Future of Hong Kong Dollar Stablecoins from the Compliance US Dollar Stablecoin USDC

USDC is a centralized stablecoin backed by the US dollar, pegged at a ratio of 1:1 with the US dollar. It has now gained widespread application and recognition. According to a recent report by Kaiko, during the ongoing drama surrounding the US debt ceiling, USDT and USDC have hardly fluctuated, indicating that investors have full confidence in the stability of stablecoins. Currently, the market value of USDC has reached $28.782 billion, and its product architecture and operation mechanism have been tested over time. The issuer of USDC is also constantly expanding its business map to banks and other businesses, and compliance is the foundation of the development of USDC. In long-term practical experience, USDC has established corresponding compliance and risk control mechanisms, and these experiences can provide reference for the issuance and operation of Hong Kong dollar stablecoins.

First, analyze the operating mechanism of USDC. When a user deposits US dollars in exchange for USDC, USDC is issued on the Ethereum network, and the corresponding assets are mortgaged and stored in the storage account in a corresponding relationship of 1:1. Conversely, USDC is reduced and destroyed to allow users to withdraw USDC. From the product architecture point of view, in addition to the token issuance smart contract, the storage contract is also an important contract of USDC. Taking purchase as an example, when a user purchases USDC, the amount of USDC purchased will be frozen and stored in the USDC storage contract. The storage contract is also responsible for regulating the issuance of USDC to ensure the stability of USDC. USDC deposits its mortgaged fiat assets in accounts of the Federal Deposit Insurance Corporation (FDIC) and other institutions for dispersed storage to ensure the safety of assets. USDC reserves are the assets of USDC holders, not Circle’s assets, and are all stored in a designated independent account for the “benefit of USDC holders”. This is different from banks, which can use depositors’ funds for lending and other businesses.

Issuance and operation mechanism of USDC

In terms of risk management, as an electronic “stored value” tool, USDC is regulated by state currency transfer laws. In addition to external supervision, third-party validators also conduct regular audits of the code and finance. In internal risk management, USDC has built four sections: “risk reminder”, “fraud management”, “monitoring plan”, and “complaint management”. In compliance management, the issuer of USDC will follow regulatory requirements, conduct KYC/AML, and establish corresponding risk control systems.

The development and operation of a Hong Kong dollar stablecoin should follow suit. Risk management will be the first line of defense for whether virtual assets are safe, and compliance management is the first step in the development of Hong Kong dollar stablecoins. In the process of compliance management, especially for internal compliance management of on-chain assets, traditional financial AML tools may fail.

For on-chain assets, your wallet address is an account. Unlike ordinary bank accounts, this address usually does not require personal information, so compliance technology solutions for virtual assets are essential. Taking Onchain AML solution by Oklink as an example, for the new requirements of virtual assets, the traditional KYC part is upgraded to KYA (know your address) and KYT (know your transaction). KYA has accumulated a long-term practice and uses machine learning and multimodal algorithms to accurately identify various address labels. The label library of more than 30 trillion address labels can effectively enable companies to achieve internal compliance management. KYT can detect the transaction risk of each transaction in real-time, fully understand the transaction information, and meet the compliance and risk control needs of virtual asset service providers.

Conclusion

In the Web 3 world, the Hong Kong model is being widely watched. The core of the Hong Kong model is compliant transactions. As a key financial infrastructure in the Web 3 era, stablecoins, including Hong Kong dollar stablecoins, must be based on safe and compliant transactions. However, in fact, the difficulty in launching Hong Kong dollar stablecoins at this stage is not in the market-oriented procedures such as issuance and operation, but in whether compliant technology and services that match Hong Kong regulatory requirements can be developed to solve difficult problems such as anti-money laundering and counter-terrorism financing. Similar to the regulatory framework for virtual asset trading service providers, when regulating Hong Kong dollar stablecoins, licenses are only the foundation. The key is to use regulatory technology and compliance tools such as Onchain AML by Oklink to monitor market changes and take corresponding measures to keep regulatory innovation up with technological innovation.

In the current transition of the global virtual asset and Web 3 market from stock to incremental competition, how to balance compliance and innovation needs in the process of integration with the real world has become an important topic. However, the conflict of interests between the Web 3 world and real-world supervision is increasingly fierce, and the continued high pressure of countries such as the United States has put a group of encryption companies in a passive position. Compared with institutions such as the US SEC, Hong Kong’s current regulation is more flexible, not only open and transparent but also actively seeking regulatory capabilities that adapt to changes. This friendly adaptive regulation may promote the Hong Kong model to become a template for the global virtual asset and Web 3 regulation and development.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!