Author: Jaden, LD Capital Research

1. Pendle Status

Pendle Finance is a yield strategy protocol deployed on Ethereum and Arbitrum. The v2 version was launched at the end of 2022 and the economic model was changed. It then supported LST assets and went live on Arbitrum. For more fundamental information, please refer to the LD Pendle Historical Report.

Figure: Pendle TVL

Source: Defillama, LD Research

Source: Defillama, LD ResearchIts TVL has been steadily increasing since the end of 2022, and currently exceeds $126 million.

- 1inch co-founder: Selling 11,000 ETH is for testing new Fusion mode features

- Euco-Cloud Chain Research Institute: In-depth analysis of the logic, regulatory rules, and potential impacts of the Hong Kong dollar stablecoin issuance.

- Latest developments in the Arbitrum ecosystem: Which hidden Alphas are worth paying attention to?

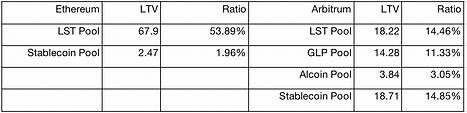

Figure: Liquidity Distribution (Million)

Source: LD Research

Source: LD ResearchThe liquidity within the Pendle protocol mainly comes from LST assets, while GLP, stablecoins, and other tokens account for only about 30% of its TVL. The revenue source of GLP mainly comes from 70% of traders’ profits and protocol fees. The profits and protocol fees change every day, so the yield has a higher game space and tradability.

The initial yield of the LST asset comes from ETH PoS, and there are differences in the amount of staking, the operation mechanism of the LSD protocol, and the platform fees. Therefore, the yield of LST assets on different LSD platforms varies, but the difference is not large. The yield is usually maintained at around 4%, and the yield elasticity is small, which also determines that the yield tradability of LST assets is poor. The Pendle protocol adopts the veToken and Gauge voting mode for liquidity mining, so the yield of the Pendle LST pool can reach 10%-30%.

Figure: Pendle Protocol Trading Volume

Source: app.sentio.xyz, LD Research

Source: app.sentio.xyz, LD ResearchAccording to historical trading volume data, the daily trading volume of the Pendle protocol is generally below $1 million. LSD asset trading volume accounts for 54.82% of the total trading volume, and GLP historical trading volume accounts for 24.09% of the total trading volume. GLP transactions usually occur when the market is more active, so GLP accounted for 51.29% of the transactions in the past day. Considering the LTV ratio of various assets in the protocol, the game space of GLP yield is larger.

2. Pendle Economic Model

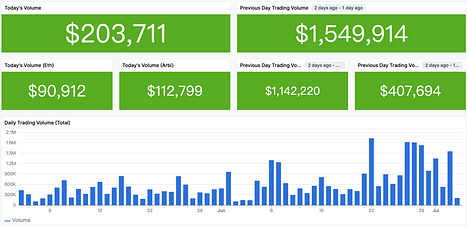

Token Allocation

Figure: Token Allocation

Source: Pendle Docs, LD Research

Source: Pendle Docs, LD ResearchThe team, advisors, and investors have already completed their unlocking period.

For liquidity incentives, 1.2 million tokens will be distributed each week for the first 26 weeks, after which the weekly distribution will decrease by 1.1% until the 260th week. After the 260th week, the final annual inflation rate will be based on the circulating token supply of 2%, and the weekly liquidity release will remain at a relatively stable level. According to the team’s description, the weekly release in October 2022 will be 667,705 (the release in the 79th week), and at present, it is around weeks 113-117, with a weekly release of about 450,000 tokens. PENDLE will continue to be released in the long term.

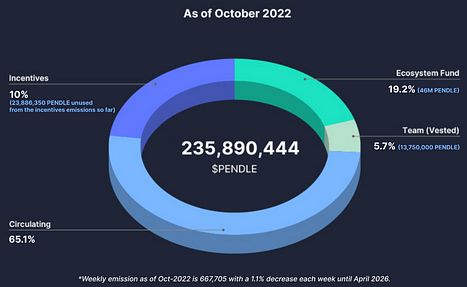

Figure: PENDLE Weekly Release Amount

Source: LD Research

Source: LD ResearchPendle introduced the veToken model in November 2022, mainly to increase the protocol’s liquidity. The lock-up period for Pendle ranges from 1 week to 2 years. VePENDLE holders can direct rewards to different pools through voting, incentivizing liquidity in the voting pool. All snapshots of the votes will be taken at the beginning of each cycle on Thursday at 00:00 UTC, and the incentive rate for each pool will be adjusted accordingly.

Main features of vePENDLE:

1) The motivation for LST asset issuers to bribe vePendle holders is small. As a leading DEX, the asset issuer typically provides token mining rewards and bribes veCRV voting to increase CRV liquidity mining incentives to improve the liquidity of their assets in Curve. The demand for vePENDLE mainly comes from LP that participates in mining, and there is a lack of strong demand from asset issuers.

2) vePENDLE lockers can only participate in transaction fee allocation for voting pools.

3) vePENDLE holders can share 3% of the fee generated by the Yield Token (YT) earnings.

4) vePENDLE holders can receive 80% of the trading fees for the AMM pool they voted for.

Figure: PENDLE Pledge Status

Source: Pendle Finance, LD Research

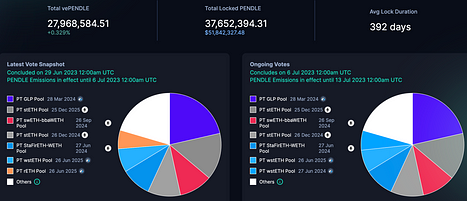

Source: Pendle Finance, LD ResearchAs of July 3, the locked amount of PENDLE is 37 million coins, with an average lock-up period of 392 days.

3. Penpie/Equilibria

Penpie and Equilibria are both auxiliary protocols that increase LP revenue based on the Pendle veToken economic model. LPs can receive Pendle mining boost revenue without staking Pendle. The business models of the two are similar.

Penpie

The protocol currently supports Ethereum’s mainnet and Arbitrum.

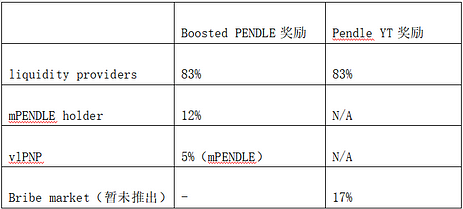

Users can convert PENDLE to mPENDLE through Penpie, and the protocol will collect the PENDLE pledged for vePENDLE to achieve LP mining boost. 83% of the boost income will be distributed to LPs, 12% to mPENDLE holders, and 5% to vlPNP. The team plans to allocate 17% of the YT rewards in vePENDLE equity to the Bribe market, but it has not yet been launched.

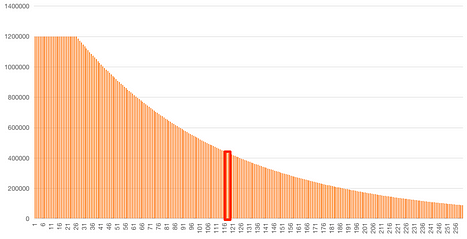

Table: Income distribution

PNP is the governance token of Penpie. Users can lock PNP tokens to receive vlPNP at a ratio of 1:1. Holding vlPNP can earn protocol distribution income and participate in governance. Once the user locks the PNP token as vlPNP, it will enter the default lock-up state, and the lock-up period has no time limit. Users must “start unlocking” to enter a 60-day cooling-off period. During the cooling-off period, vlPNP holders can continue to earn passive income but cannot participate in voting. After the 60-day period, users can fully unlock their vlPNP as PNP. The penalty cost on the first day of the cooling-off period is 80% of the total amount of PNP tokens locked by the user, and it will decrease non-linearly over time.

Equilibria

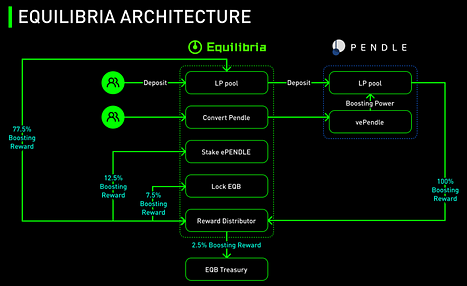

The business model of Equilibria is basically the same as Penpie, which also helps Pendle LPs achieve mining boost without staking PENDLE. Pendle pledges for ePendle are irreversible. Users need to lock EQB/xEQB as vlEQB to obtain protocol fees and voting rights. xEQB can be converted into vlEQB. The team plans to integrate xEQB into other protocols, but currently, there are not many use cases.

Figure: Equilibria Architecture

Source: Equilibria docs, LD Research

Source: Equilibria docs, LD ResearchAfter boosting mining through Equilibria, 77.5% of the earnings are allocated to LP, 12.5% is allocated to ePendle holders, 7.5% is allocated to vlEQB holders, and the Treasury receives 2.5%. The income distribution ratio for each role has a range set.

Table: Income Distribution

Protocol Data

Figure: PENDLE Lockup Data

Source: dune.com, LD Research

Source: dune.com, LD Research*Dune data is for reference (stagnated on June 28th) and differs from the current data on the official website of the protocol.

According to the official website data, as of July 4th, Penpie PENDLE lockup amount was 7.45M, and Equilibria lockup amount was 7.54M. Although ePENDLE and mPENDLE and PENDLE are exchanged at a ratio of 1:1, Equilibria announced on June 19th that it will suspend the liquidity pool of ePENDLE/PENDLE, and the original plan indicated that it will be delayed for 2 weeks or longer. Currently, from the community dynamics, the team has not given a definite time, and mPendle has been launched on Wombat, but the exchange ratio is about 1:0.72 and is severely worn out.

Table: Penpie vs Equilibria

Source: LD Research

Source: LD ResearchCompared to Equilibria, Penpie distributes a larger portion of the boost earnings to LP, which is more friendly to LP and retains more earnings for LP. Under the same conditions, LP would be more willing to choose Penpie.

From the perspective of data, the Pendle protocol TVL is steadily increasing, and the fundamentals are gradually solidifying. The risk is that the PENDLE token is currently continuously emitted. Both the PENDLE protocol and Penpie and Equilibria cannot maintain a high APR in the long term, making it difficult to continue to attract users to pledge PENDLE. Moreover, a large amount of ePENDLE and mPENDLE cannot be sold due to the absence of a pool or being unanchored, which is implicit selling pressure.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!