Listing: DODO Research

Editor: Yaoyao & Lisa

Author: dt

Memecoin has always been a hot topic in the blockchain world, attracting the attention of many traders and driving countless people to rush in with dreams of overnight riches and short-term speculation.

- An Analysis of Ethereum’s New Data Economy

- An Analysis of Pendle and the Pendle War it Sparked

- 1inch co-founder: Selling 11,000 ETH is for testing new Fusion mode features

$PEPE, which emerged in April this year, completed tens of thousands of times in gains in just 19 days and went online on Binance, becoming the fastest token to reach a market cap of $1 billion in history. The appearance of $PEPE also ignited another wave of Memecoin Season in the crypto world, with various dog-themed tokens skyrocketing and gas fees surging. Every day, new coins that have risen tens of times are appearing. This trend lasted for nearly two months until the end of June before it began to calm down.

Memecoin, with its meme-like attributes in token naming or avatar itself, community culture, social media influence and celebrity endorsements, as well as its low market cap and high volatility, has become an attractive choice. However, high risk comes with it, as high volatility means that in addition to rising, falling or even disappearing is also common. Coupled with celebrity endorsements, insider information from large holders controlling the market and other factors, Memecoin has become an easy-to-participate-in but difficult-to-master field.

So as a retail investor, what projects are worth tracking and paying attention to without investing in Memecoin itself? With the development of Memecoin to this day, in addition to numerous tokens, many projects that serve Memecoin have also emerged, forming a unique Memecoin ecosystem. These projects are mostly not funded by VCs, and most of them started as community projects with humble backgrounds, but have persisted until now and become profitable with stable customer sources.

Today, DODO Research will introduce you to five tools or platforms that are used by many Memecoin project parties or retail investors participating in Memecoin, and analyze their sources of profit.

1. Pinksale

Project Overview

Pinksale is a pre-sale platform that is often mentioned in the Dogecoin community. Pink pre-sale refers to Pinksale, where anyone can issue coins and set pre-sale rules. It provides the most basic technical support for Memecoin projects. With Pinksale, project owners can focus on community management and community marketing and complete one-click coin issuance without any coding knowledge.

In addition, projects presold on Pinksale are guaranteed to have liquidity deployed, so there is no risk of pre-sale funds being misused. This has made many retail investors only want to participate in pre-sales activities initiated on Pinksale.

Profit Model and Analysis

Pinksale’s main source of revenue is 0.01 ETH / 0.2 BNB minting fees, as well as 5% ETH / BNB of the total pre-sale token fundraising amount.

We analyzed their collection address 0x4b04213c2774f77e60702880654206b116d00508 and found that in the past six months, starting from 2023, Pinksale has made nearly 8 million USD in total revenue (the left side of the chart is ETH and the right side is BSC). In the past three months, the crazy Memecoin Season has brought them 6.4 million USD. It can be seen that the ups and downs of the Memecoin market have a significant impact on their protocol revenue. By analyzing the two chains of ETH and BSC, we can see that Memecoins launched on the platform are more popular on BSC than on the Ethereum mainnet. This may be because most Memecoins on the Ethereum mainnet choose fair launch or self-built pre-sale channels.

Source : https://dune.com/owen05/account-value-flow

In addition, Pinksale has also issued governance token $PINKSALE. The official documentation only provides unlock information for this token and indicates that 20% of profits will be used to repurchase and burn tokens every quarter. However, we have not found any official announcement from the platform regarding the buyback and burn of tokens. This token seems to be a useless governance token without any value capture mechanism, and token holders do not share profits with the project owners. This has led to Pinksale not reflecting its profits in its token price despite its significant profits in the first half of 2023.

Source:https://www.geckoterminal.com/bsc/pools/0x53028de80b359b303178a31741ddf91969ba89ec

2. UNCX Network (formerly Unicrypt)

Project Introduction

UNCX Network, formerly known as Unicrypt, is often referred to as “Green Horse” in the Chinese community and provides lock-up pool services. Memecoin tokens usually choose to deploy liquidity on AMM DEX, and liquidity is the only basis for the value of tokens. Therefore, the ability to remove liquidity at any time is a major consideration for traders, making UNCX’s lock-up pool service almost a must-have for every Memecoin.

When the liquidity of the project party is not locked, few people will take the risk to trade. As UNCX was the first platform to propose the concept of lock-up pools in the market, and also the most famous and widely used lock-up platform, it naturally became one of the reference standards for retail investors. As a result, the project party is willing to give up other cheaper options on the market and choose to pay to lock its liquidity on UNCX.

Profit Model and Analysis

UNCX Network’s main income comes from the 0.08 ETH/0.3 BNB charged for lock-up pool services and the 1% of locked liquidity.

Analysis of its collection address 0x997cc123cf292f46e55e6e63e806cd77714db70f shows that it has earned more than 4.5 million USD from early 2023 to the present time (the left figure is ETH and the right figure is BSC), and in the past quarter, it has earned as much as 2.5 million USD due to the influence of the Memecoin Season.

Source : https://dune.com/owen05/account-value-flow

UNCX has also issued governance token $UNCX and reward token $UNCL, but there is no focus on token models and value capture. Only the old-fashioned mechanism of staking mining and repurchase and burning of tokens is available. There has been no record of burning since April 2021, and the project’s profitability has not effectively benefited token holders, which has also led to the fact that the price of governance token $UNCX has not changed with the increase in project profits.

Source:https://www.geckoterminal.com/eth/pools/0xe0f0e02a16b45f949b98856b61175e63ca5f6293

3. Dextools

Project Introduction

Dextool is a K-line website and aggregation trading platform. In addition to viewing and trading functions, it also provides various information on tokens, including project introductions, community links, etc. It also has a board for trend hot searches and banner ads. Memecoin project parties can pay Dextools to update token information and appear on the hot search list or advertisements, providing project visibility.

Although there are many alternative and free platforms in the market, Dextools, as the oldest K-line aggregation trading website in the market, still maintains a leading position. Paying for Dextools is an important indicator for Memecoin players to judge whether a project is doing marketing with sincerity. Therefore, project parties will still choose to pay for Dextools to update token information in order to attract people.

Profit Model and Analysis

Dextools’ main profit comes from the fee of 1300 DEXT, 3 BNB, or 0.5 ETH paid by project parties to update token information. Unlike Pinksale and UNCX, Dextools’ token $DEXT has stronger value capturing ability. Dextools dynamically adjusts the payment method of $DEXT to ensure that it remains the cheapest payment method. The income paid in DEXT will be regularly destroyed and permanently deflated.

We analyzed that from the beginning of 2023 to the past six months, Dextools has earned a total revenue of about 6 million USD (the left side of the figure below is ETH and the right side is BSC), while since the Memecoin Season ignited by $PEPE in April, it has earned nearly 4.7 million USD.

Source : https://dune.com/owen05/account-value-flow

Nearly 1/3 of the revenue is paid through $DEXT, benefiting from its deflation mechanism (about 15,000 $DEXT are destroyed on average every day). The highest increase in $DEXT this year reached 6 times, and it still has 4 times increase after the correction, making it a token with a very bright performance in 2023.

Source: https://www.dextools.io/app/cn/ether/pair-explorer/0xa29fe6ef9592b5d408cca961d0fb9b1faf497d6d

4. Maestro

Project Introduction

Maestro is a Telegram chatroom bot that provides retail investors with quick buy and sell functions for various stop-loss and stop-profit orders. Users can recharge money into the wallet address provided by Maestro and trade coins through conversations with the bot on Telegram. Due to the high volatility of Dogecoin, trading speed can greatly impact earnings, and Maestro is a tool designed for professional Memecoin players.

However, users should be extremely cautious when using this type of tool and avoid investing large sums of money to prevent losses due to private key leaks.

Profit Model and Analysis

Maestro’s profit model is to charge a 1% transaction fee from the amount of each transaction made by the user. When the user accumulates a transaction fee of 0.01 ETH, it will be automatically transferred from the user’s address to Maestro’s collection address.

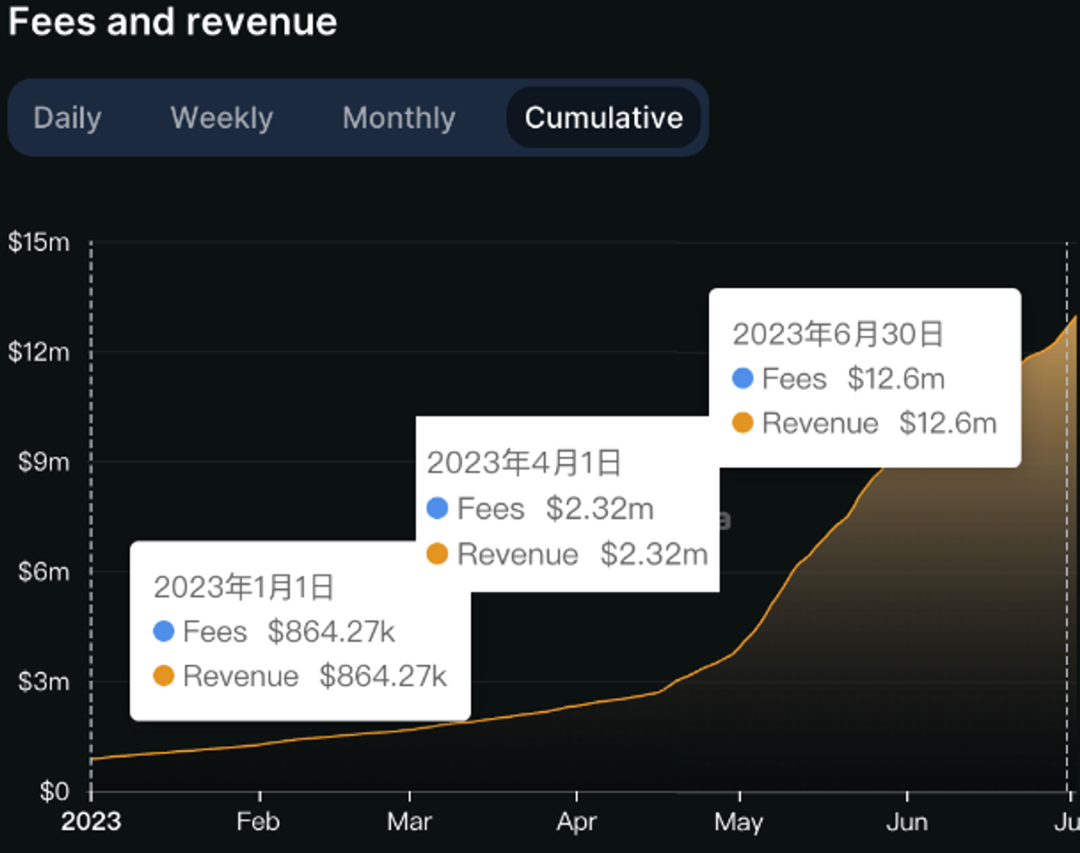

According to Defillama’s data, Maestro’s cumulative revenue in 2023 is close to 12 million USD, and the revenue in the past three months of Memecoin Season is about 10 million USD, making it one of the most profitable projects of the quarter.

Source: https://defillama.com/protocol/maestro

Although the Memecoin market has relatively cooled down this month, Maestro still ranks 11th on Defillama’s fees and revenue board, surpassing many well-known DeFi protocols such as Metamask, Compound, and Curve, and even public chain projects such as Arbitrum, Optimism, Avalanche, and Polygon can only look up to it.

Source: https://defillama.com/fees

5. Unibot

Project Introduction

Unibot and Maestro have the same business content, both are TG trading robots, and there is no difference in product functions. The only difference is that Maestro did not issue a token, while Unibot has its own token and has a token dividend mechanism. Retail investors have the opportunity to share the value captured by the agreement with the project party, and Unibot has a referral system, so it has relatively high visibility in the Twitter community. The next stage of product update in the team’s roadmap will be in cooperation with GMX and Dopex, and TG robots will be able to use GMX’s perpetual contracts and Dopex’s options products.

Compared to the four projects mentioned above, Unibot is relatively young and was launched in May this year. The product and tokens were launched at the same time, and its tokens were launched in a fair manner, with a maximum increase of 400 times, making it a god coin of this quarter.

Profit Model and Analysis

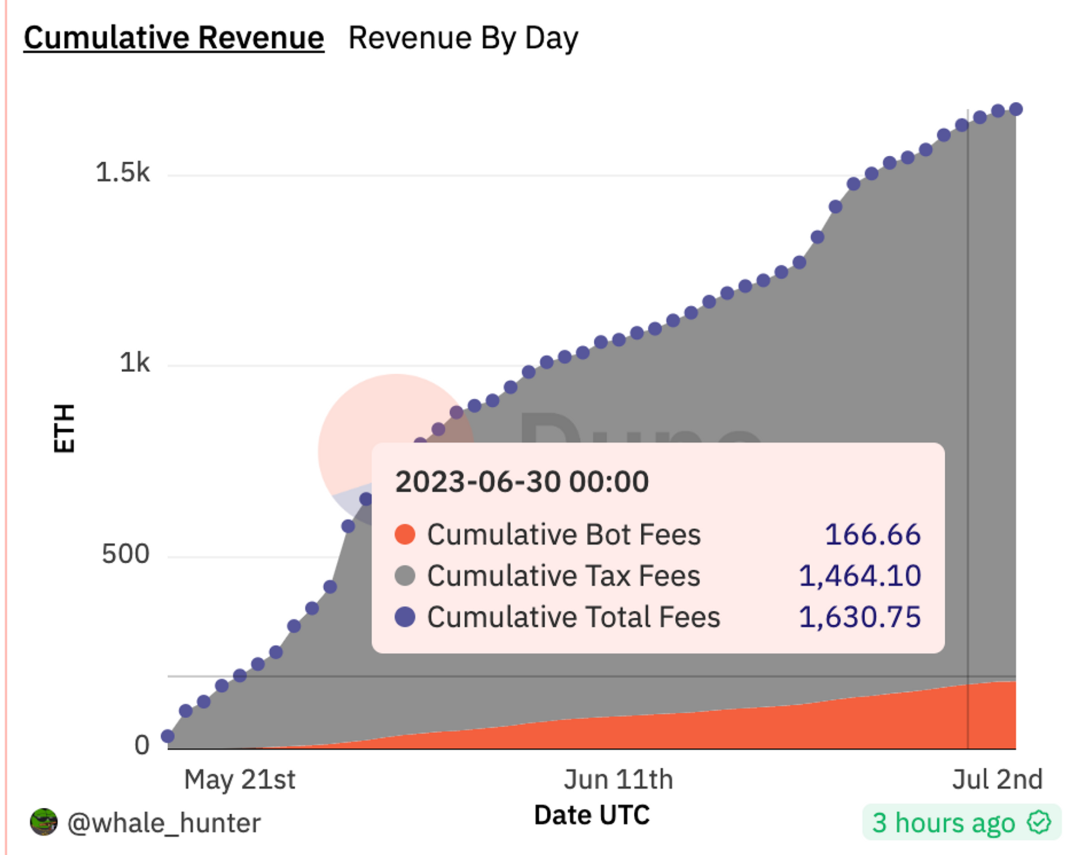

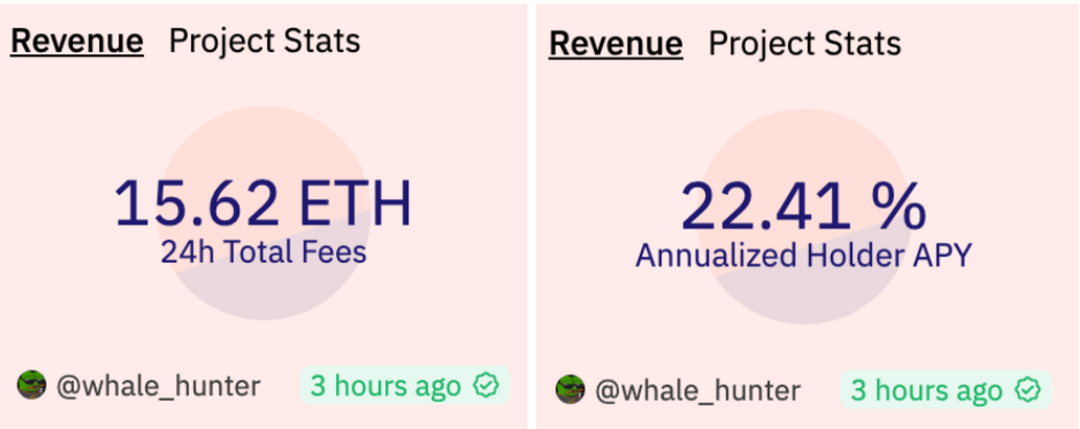

Unibot’s profit model is the same as Maestro’s, both of which deduct 1% from the user’s transaction amount as a handling fee, but benefiting from Unibot’s token mechanism, $Unibot itself is a taxable token, and 5% of the token must be paid as tax for buying or selling in the transaction, which is also considered as the project party’s income. Since the project was launched, accumulated revenue has exceeded 1630 ETH, or about 3M USD, of which 166 ETH (300K USD) comes from handling fee income.

Source: https://dune.com/whale_hunter/unibot-revenue

And two weeks ago, on 6/14, bonus rewards were implemented. 40% of the project’s income will be distributed to token holders. Up to now, about 200 ETH (about 380K USD) has been distributed, and $Unibot has risen nearly three times due to this positive news.

Source: https://dune.com/whale_hunter/unibot-revenue

Source: https://www.geckoterminal.com/eth/pools/0x8dbee21e8586ee356130074aaa789c33159921ca?utm_source=coingecko&utm_medium=referral&utm_campaign=searchresults

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!