Overview

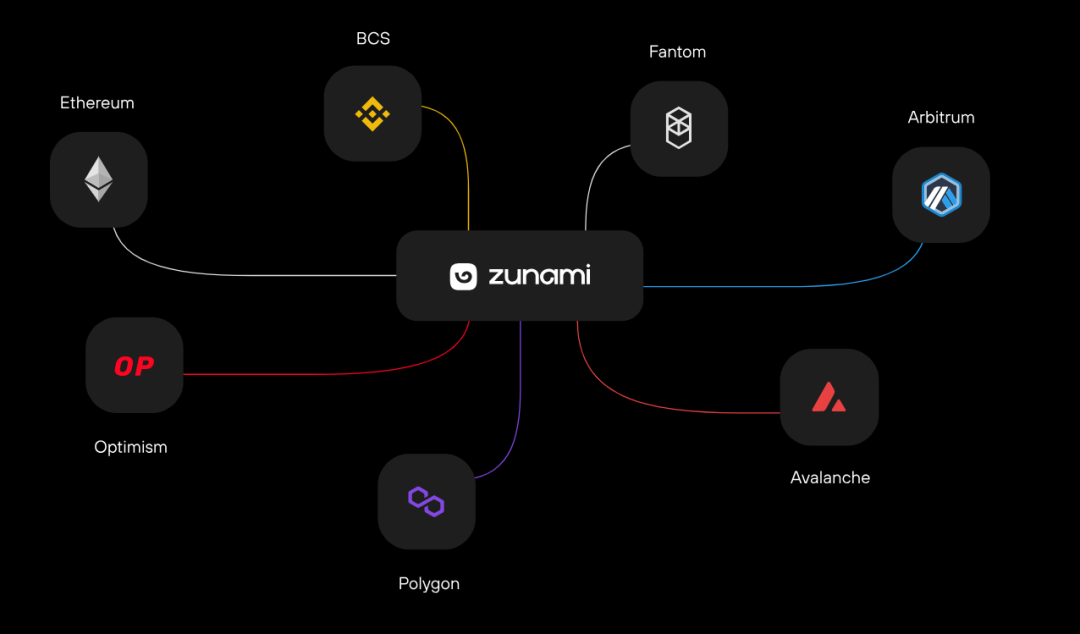

Zunami Protocol is a DAO working with stablecoins that aims to solve the major issues of yield protocols by simplifying interactions with DeFi, making it easier and cheaper, and by enhancing profitability by differentiating and rebalancing users’ funds. It has an automatic revenue generation mechanism that reduces entry barriers and Gas costs through batch trading and automatic compounding. Zunami Protocol is currently based on the Ethereum blockchain, while also supporting BSC and Polygon. Zunami plans to support Avalanche and other popular alternative chains in the future.

Mission

Traditional banking can be a frustrating and inefficient process. Interacting with money should be simple and self-directed, giving everyone the right to financial freedom. With the rise of stablecoins and DeFi, the financial landscape is changing rapidly. While liquidity mining is becoming increasingly popular, it still has not been widely adopted. Zunami’s team identified the pain points that hinder new and experienced crypto world users in existing solutions. The team’s goal is to bridge the gap between traditional finance and DeFi and create the ultimate solution for stablecoin holders through the Zunami Protocol.

Application

The main problems of the existing liquidity mining interfaces are:

- An Analysis of oUSD, the Credit Token Launched by OPNX

- Interview with Justin Sun: stUSDT, which broke 22 million USDT in pledged assets on its first day, is leading a new narrative in the RWA track.

- BlackRock’s application for a spot Bitcoin ETF triggers a chain reaction, an overview of the SEC review process.

- The current DeFi interfaces are designed for professionals and are not user-friendly for beginners.

- There are a large number of functional pools.

- It is necessary to interact with multiple applications continuously to complete the operation.

Zunami designed a smooth and user-friendly UI solution for the above problems: the single pool system and the new user interface perform all operations in one step, making interactions with DeFi applications simple and easy to operate.

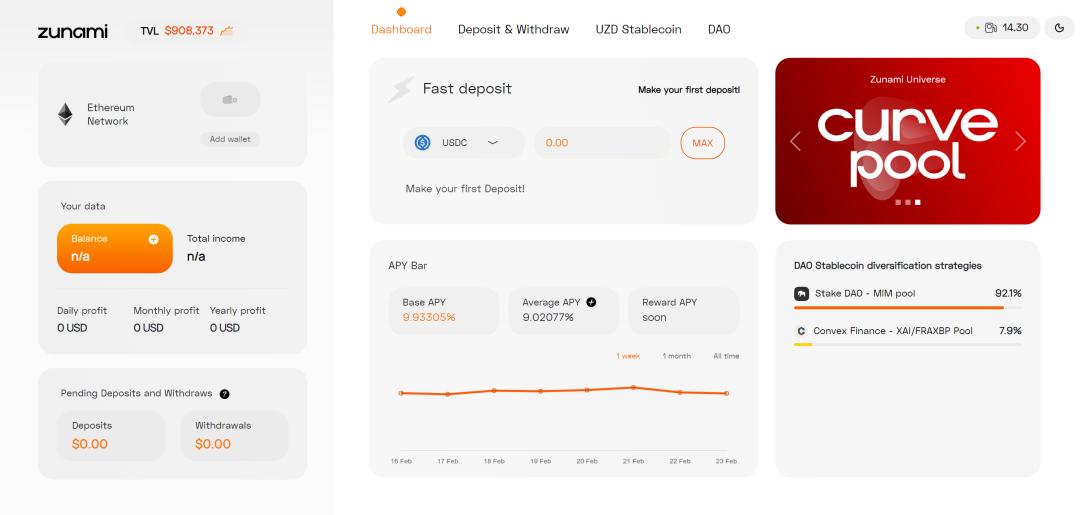

Earn Yield Aggregator

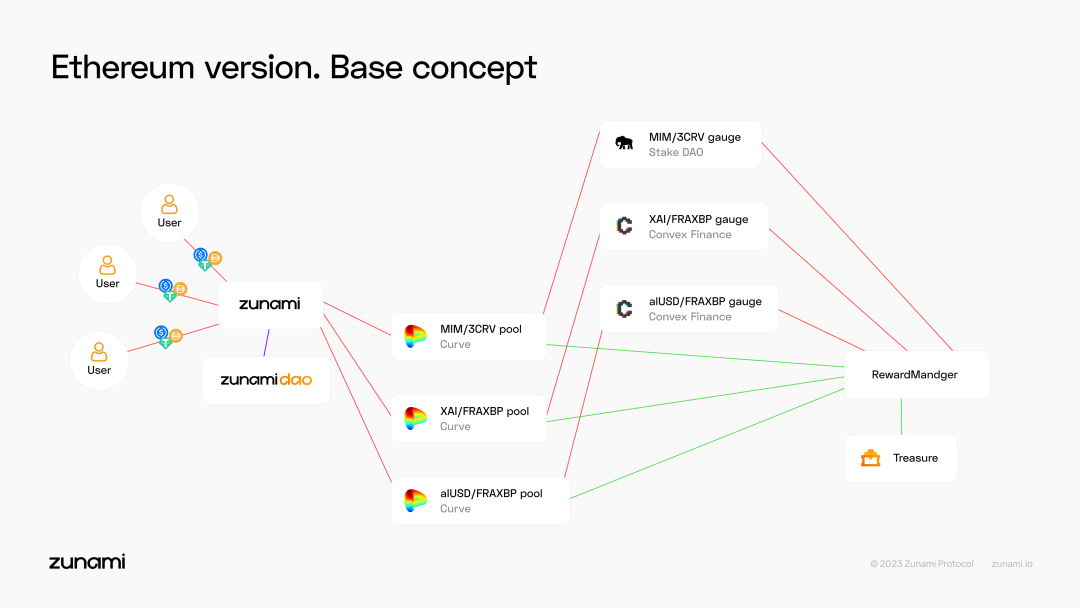

Zunami Global Pool enables users to send stablecoins (DAI, USDC, and USDT) directly or in an optimized way and earn ZLP (Zunami LP token) based on the proportion of funds invested and earned in the protocol. Then, Zunami invests stablecoins into a series of strategies (usually 2-3 strategies running), which put them as liquidity providers (LP) into a Curve pool and gain Curve LP tokens, which are then collateralized in Convex or StakeDAO reward contracts (Gauges). Direct deposits or withdrawals can be executed immediately but require users to pay a lot of Gas fees. On the other hand, by optimizing deposits or withdrawals, users can save Gas fees by delegating the protocol to aggregate deposits or withdrawals once a day.

The protocol operator regularly calls Zunami’s automatic compounding method, which collects earned rewards from all strategy contracts and sends them to the rewards management contract. A portion of the rewards is sold, with profits reinvested into the Curve pool and corresponding rewards contract, increasing the value of the user’s ZLP tokens and allowing users to fully benefit from compounding. Meanwhile, a second portion of the rewards, including performance fees and rewards earned from UZD held in the Curve pool, is sent to the treasury. To achieve decentralized governance, Zunami DAO is responsible for making all major decisions, including adding new strategies, rebalancing funds, and setting management fees.

The Zunami protocol leverages a decentralized revenue aggregator to select the most profitable stablecoin pools and balance funds between them, eliminating the need for continuous market research and manual transfers.

The community and Zunami team constantly analyze the risk/reward ratios of stablecoin positions and make strategic asset rebalances through DAO voting decisions to ensure users achieve the highest possible yield while diversifying funds across trusted pools and dApps.

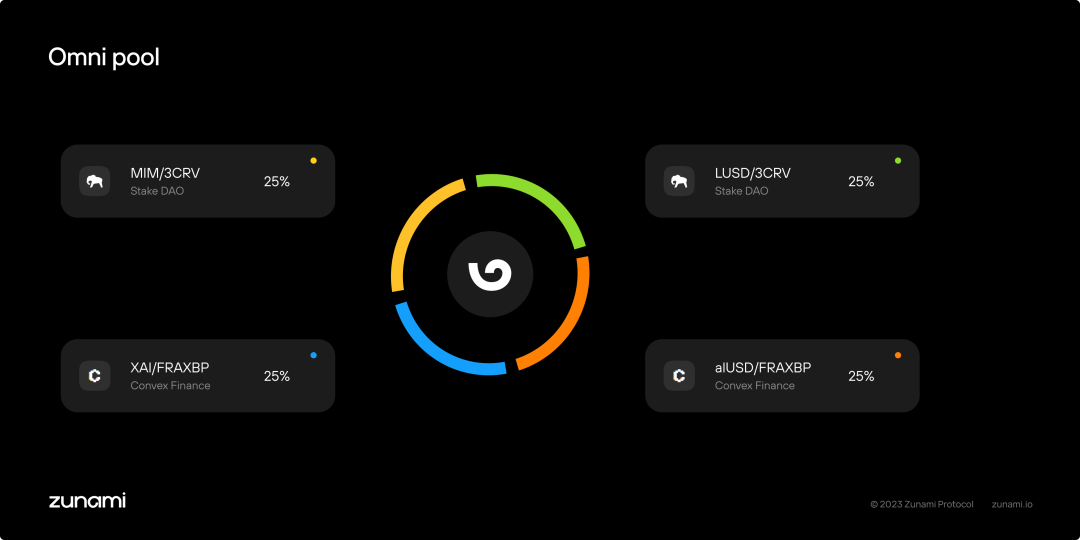

Omni Pool

Zunami offers the Omni pool, a decentralized location where users can deposit USDT, USDC, and DAI. These funds are then allocated to multiple strategies, with 2 to 10 strategies available at any given time. The selection and rebalancing of these strategies are determined by DAO voting.

The role of the DAO is to identify new strategies, submit them for voting, and ensure timely rebalancing and fund diversification. Regardless of which strategy funds are allocated to, every depositor in Zunami will receive ZLP tokens in proportion to their contribution to the protocol. All profits generated by the Zunami protocol are distributed to ZLP holders, except for a performance fee that is used for the treasury.

Trade Batch Mechanism

The high commission costs on the Ethereum network are an important issue for DeFi progress and the future. To address this issue, the Zunami protocol team has developed a Trade Batch Mechanism (TBM) to optimize costs.

This multi-layer smart contract allows users to deposit funds into the initial contract using the delegateDeposit() function. Then, once a day, the completeDeposit() function will automatically allocate the user’s funds to the strategy without incurring any additional fees.

This allows for fees to be reduced by up to 10 times compared to using Curve and Convex directly. Delegating withdrawals and deposits can be done by checking a box in the application. Users on alternative networks can use Zunami on BSC chain and Polygon gateways to interact with smart contracts at a cost of less than $1.

Strategies and Auto-Compounding

The DeFi ecosystem is becoming increasingly complex, and to maximize returns, users need to deposit funds into Curve and obtain LP tokens, and then deposit them into StakeDAO or Convex. The Zunami protocol simplifies this process by creating multiple strategies and automating the entire process in one transaction, making it more convenient for users.

In StakeDAO or Convex, users receive rewards in the form of tokens, but for users with small deposits, selling these rewards may not be cost-effective due to high commission costs or lack of time. Zunami handles the sale of rewards for users, allowing them to fully enjoy the benefits of compounding.

DAO

Zunami places great importance on the opinions and feedback of users and the community in protocol development, so Zunami has launched a DAO voting system that allows early project participants to voice their opinions on the direction of the project. By depositing funds into Zunami, users receive ZLP tokens proportional to their contribution, which can be used to vote in the Zunami DAO. All major decisions, such as selecting and adding new strategies and rebalancing funds, will be made there. Users holding GZLP (Zunami BSC Gateway users) also have voting rights. Before proposals are voted on, there will be discussions in the Discord community, giving everyone a chance to voice their opinions on the proposals.

Treasury

The Zunami protocol has established a treasury system to accumulate funds to deal with losses in emergencies and to support the development and expansion of the protocol.

The sources of funds for the treasury include:

- 15% performance fee from profits collected from depositors using auto-compounding.

- 15% performance fee from profits collected from APS depositors using auto-compounding.

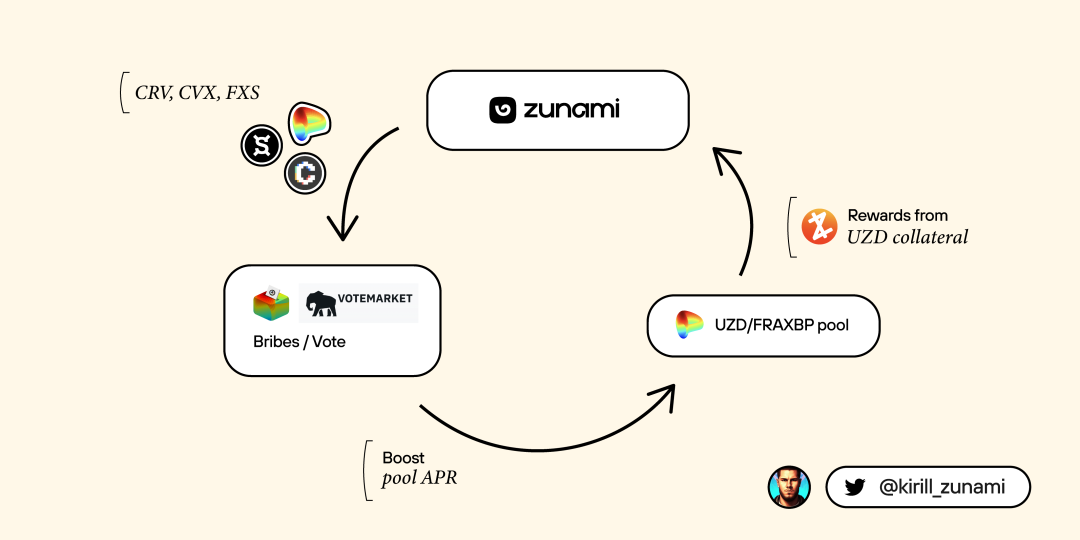

- Additional tokens (CRV, CVX, FXS) accumulated from the rebase stop of UZD stablecoin stored on Curve in the FRAXBP pool.

DAO tokens will be locked and used to increase the profitability of the UZDFRAXBP pool. The income from stablecoins enables Zunami to maintain a leading position in the market and mitigate risks during periods of volatility, while providing funds for development and operational costs. Overall, the treasury aims to reduce risk, provide funding for growth, and cover operational expenses to ensure the long-term operation of the Zunami protocol.

Tokenomics

UZD is collateralized by stablecoins stored in the Curve pool, generating income. UZD is also a re-based token, with its value increasing proportionally to the APY of the Zunami protocol. It is over-collateralized with stablecoins allocated in the Curve Finance pool and minted using ZLP. UZD will not deviate from its peg as it can be exchanged for USDT, USDC, or DAI at any time. Users can mint UZD through the Zunami interface or obtain UZD by swapping in Curve.

In the Curve pool, UZD’s re-basing feature is disabled, and rewards for CRV, CVX, and FXS are directed to Zunami’s treasury instead of being sold to increase the quantity of UZD. The UZD economy is designed such that the generated rewards are sufficient to pay for the next bribe and sustain pool incentives, creating a self-sustaining cycle where the bribe essentially pays for itself.

Summary

The Zunami protocol is a platform that distributes stablecoins to users, with the main idea behind it being to create a simple, profitable, and absolutely safe alternative to bank deposits. At the same time, the Zunami protocol eliminates the challenge of self-managing assets for users, making it easier for users to focus on growing their wealth in the decentralized finance ecosystem. In its development, Zunami attempts to bridge the gap between traditional finance and DeFi, trying to create more beneficial solutions for stablecoin holders.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!