Author: LianGuaicryptonaitive

Never think that things happening far away have nothing to do with you.

In recent days, armed conflicts have erupted between the Palestinian organization Hamas and Israel, which is closely related to the field of encryption.

Because Israel is a technological powerhouse, it holds a strong position in the field of encryption. Many encryption companies are headquartered in Israel.

- The ‘suffocating’ cryptocurrency market in September Dare not buy the dip, only dare to invest regularly.

- Find the regularity of DWF Labs operations and lay ambush for the next opportunity of sharp rise or fall.

- Report Binance Spot Market Share Continues to Decline for the Seventh Consecutive Month

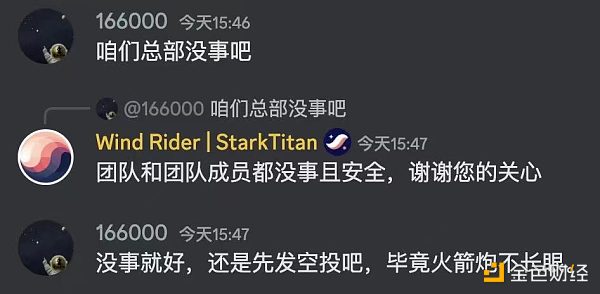

For example, the well-known Ethereum L2 developer StarkWare is located in Netanya, Israel, less than 30 kilometers away from Tel Aviv, which was hit by rocket attacks. Cryptocurrency users are concerned about the safety of StarkWare.

LianGuai has compiled a list of encryption companies headquartered in Israel:

1. StarkWare

Established: 2018

Founders: CEO Uri Kolodny, Chief Scientist Eli Ben-Sasson, Alessandro Chiesa, the latter two are founders of ZCash

Funding: Total funding reached $273 million, with a valuation of $8 billion

In January 2018, StarkWare completed a seed round funding of $6 million, with investors including Ethereum founder Vitalik Buterin, Paradigm, Pantera Capital, PolyChain Capital; in July 2018, Ethereum Foundation invested $12 million in StarkWare; in October 2018, Series A funding of $30 million, with participation from Sequoia Capital, Paradigm, Scalar Capital, Multichain Capital, Intel Capital, Semantic Ventures, Pantera, and others; the latest funding round was on May 25, 2022, with StarkWare completing a Series D funding of $100 million, with a valuation of $8 billion. This round of funding was led by Greenoaks Capital and Tiger Global, and the funds raised will be used for product and business development and ecosystem expansion.

Introduction: StarkWare develops STARK-based solutions for the blockchain industry. Its main products include StarkEx (an independent permissioned Validity-Rollup) and StarkNet (a permissionless Ethereum ZK-Rollup L2). Cairo is the native smart contract language of StarkNet and is a language for creating general computing programs that can be proven by STARK.

2. Bancor

Established: 2016, Tel Aviv

Founders: Guy Benartzi, CTO Yudi Levi, Yudi Levi

Funding: In June 2017, Bancor raised 390,000 ETH through its BNT ICO

Introduction: Bancor is a DEX on Ethereum and was one of the first to adopt the AMM mechanism. The launch of Bancor directly inspired the birth of Uniswap and the subsequent DeFi summer, as AMMs became a core component of DeFi.

However, AMMs face the critical issue of “impermanent loss,” which means that users may suffer losses when providing liquidity to the pool. In October 2020, Bancor V2.1 introduced the first “impermanent loss protection” mechanism. In 2022, Bancor launched Bancor V3, introducing features such as full pool (Omnipool), instant impermanent loss protection, auto-compounding rewards, and dual-sided rewards.

However, in the fierce competition of DeFi, Bancor is currently declining. According to Defillama data, Bancor TVL is only $68 million, ranking 46th among all protocols on Ethereum.

3. Simplex

Founded: 2014, Fintech company

Funding: Raised $18 million and later acquired by Nuvei, a publicly traded company

Introduction: Simplex announced in 2020 the launch of banking services for fiat-to-crypto conversions, generating a personal IBAN for each user, allowing users to purchase cryptocurrencies with fiat or vice versa.

In September 2021, Simplex was acquired by Nuvei, a global payment technology provider headquartered in Montreal, Canada and listed on the Toronto Stock Exchange, for $200-250 million. Prior to the acquisition, Simplex employed over 100 people, with the majority based in Israel.

Simplex provides a complete fiat infrastructure for the crypto industry, guaranteeing 100% processing of cryptocurrency to credit card payments. Currently, Simplex integrates over 200 cryptocurrencies and over 100 fiat currencies.

4. Chain Reaction

Founded: 2019

Founders: CEO Alon Webman and CTO Oren Yokev

Funding: $115 million

In August 2023, Chain Reaction announced raising $70 million in a Series C funding round led by Morgan Creek Digital, with participation from Hanaco Ventures, Jerusalem Venture LianGuairtners, KCK Capital, Exor, Atreides Management, and Blue Run Ventures. The total funding raised by Chain Reaction reached $115 million.

Introduction: Chain Reaction is a semiconductor company focused on blockchain and privacy hardware. Chain Reaction was founded by CEO Alon Webman and CTO Oren Yokev in 2019. The Chain Reaction team currently has 100 full-time employees. The new funding will be used to expand the engineering and development team, accelerate the deployment of enterprise-grade blockchain solutions – Application-Specific Integrated Circuits (ASICs) and systems, and further expand Chain Reaction’s privacy technology solutions involving the design of cloud data center infrastructure to accelerate Privacy-Enhancing Technologies (PET).

5. Chaos Labs

Founded: 2021

Founders: CEO Omer Goldberg and CTO Yonatan Hayun

Funding: $20 million

In August 2023, Chaos Labs announced raising $20 million in seed funding, led by Galaxy and LianGuail Ventures, with participation from Coinbase, Uniswap, Lightspeed, Bessemer, as well as top angel investors such as Balaji Srinivasan and Naval Ravikant.

Introduction: Chaos Labs has developed an automated economic security system for crypto protocols. In its first year of operation, Chaos Labs has partnered with major DeFi protocols including Aave, Chainlink, Uniswap, BENQI, and Osmosis to ensure and optimize protocols against manipulation and black swan market events, while also providing capital optimization advice.

6. Ironblocks

Founded: 2022

Founders: CEO Or Dadosh and CTO Assaf Eli

Funding: $7 million

In August 2023, Ironblocks announced the completion of a $7 million seed round of financing, led by Collider Ventures and Disruptive AI. Other investors include LianGuairaFi, Quantstamp, Samsung Next, former Coinbase CTO and former a16z partner Balaji Srinivasan, EigenLayer Chief Strategy Officer Calvin Liu, Simplex co-founder and former CEO Nimrod Lehavi, Fos Finance, venture capitalist Lluis Pedragosa, etc.

Overview: Ironblocks has developed a blockchain-native network security platform, which is a smart contract-based security solution. This solution runs on-chain to automatically detect threats and enables DeFi protocols, Web3 platforms, liquidity providers, and cross-chain bridges to take action and prevent hackers in real-time, ensuring fund security before any funds are stolen.

7. Addressable

Founded: 2022

Founders: CEO Tomer Sharoni, CTO Tomer Shlomo, and Chief Scientist Asaf Nadler

Funding: $7.5 million

In late January 2023, Addressable announced the completion of a $7.5 million seed round of financing. It was led by Viola Ventures and Fabric Ventures, with participation from Mensch Capital LianGuairtners and North Island Ventures.

Overview: Addressable has developed an end-to-end solution for Web3 marketing. Addressable’s SaaS solution provides a platform for Web3 marketing teams to launch campaigns and target new audiences by matching blockchain activities with social profiles. This type of targeting reduces acquisition costs compared to more traditional Web2 tools and has been used by Web3 companies such as Polygon, Bancor, Immutable, and Kryptomon.

8. CyVers

Founded: 2022

Founders: CEO Deddy Lavid and CTO/Chief Product Officer Meir Dolev

Funding: $8 million

In December 2022, CyVers announced an $8 million financing round led by Elron Ventures. Crescendo Venture LianGuairtners, Differential Ventures, HDI, Cyber Club London, and Cyber Future also participated in this round.

Overview: CyVers provides proactive Web3 security for smart contract applications by detecting and intercepting cross-chain cryptographic attacks. CyVers’ agentless and plug-and-play solution captures transactions within minutes between transaction broadcasting and irreversible inclusion in the blockchain distributed ledger. CyVers’ clients include Israeli-founded companies Bit2C, Solidus Capital, and CoinMama.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!