Author: Nan Zhi

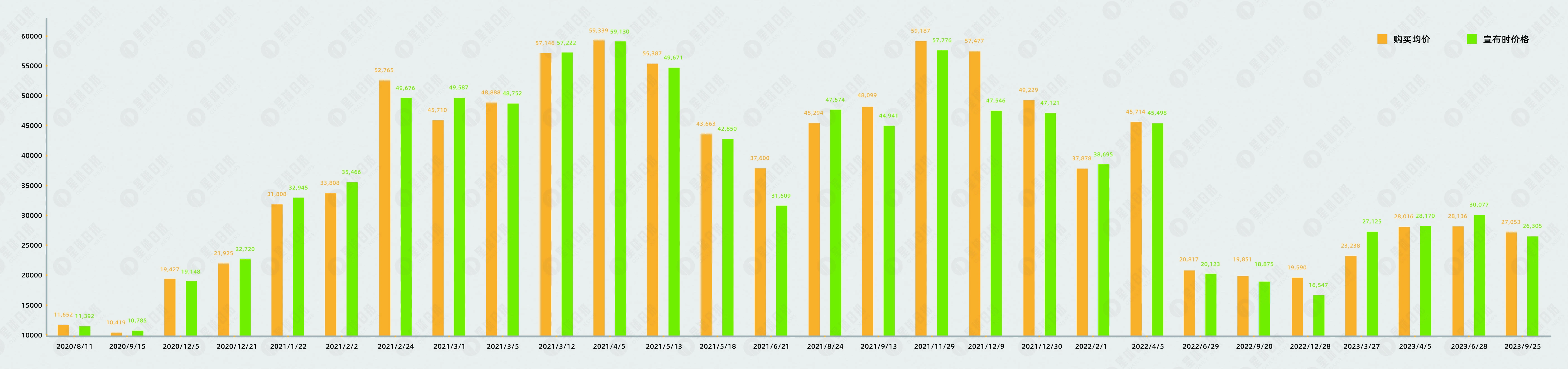

From August 2020 to present, MicroStrategy has announced 28 BTC purchases, accumulating a total of 158,245 bitcoins, with an average holding price of 29,582 USDT.

Whenever a purchase is announced, the following voices often appear on social media:

① The average price of MicroStrategy’s purchases is always higher than the market price at the time of announcement (rescue multiple times);

- Messari 3 on-chain indicators send out Bitcoin bottom signal

- Chainalysis Research Large-scale Cryptocurrency Adoption in India, Philippines, and Pakistan

- OP Research AA | Signs of On-chain Ecology Entering the Buyer’s Market

② Once MicroStrategy announces the purchase of BTC, the market is about to start falling.

This article reviews MicroStrategy’s 28 BTC purchases to explore whether there is a connection between MicroStrategy’s announcement of BTC purchases and market prices.

Analysis of MicroStrategy’s Official Announcement Price Difference

The price situation of MicroStrategy’s 28 BTC purchases is as follows, and there is an obvious price difference between the “market price at the time of announcement” and the “purchase price”.

The proportion of “market price at the time of announcement” being higher than the “purchase price” is 60.7%, and the mean price difference is -1.43%, which means that there is a certain tendency for MicroStrategy to announce the purchase after an average decline of 1.43%.

The specific situation of the price difference (absolute value) is as follows:

- 50% of the price difference is within 1000 USDT;

- 39% of the price difference is between 1000 USDT and 5000 USDT;

- There are three other price differences exceeding 5000 USDT, which are -5716 USDT, -5991 USDT, and -9931 USDT respectively.

The conclusion is even more significant when measured by the price difference rate:

- 25% of the price difference rate is in the range of 0% – 2%;

- 39% of the price difference rate is in the range of 2% – 5%;

- 21% of the price difference rate is in the range of 5% – 15%;

- There are 4 instances where the price difference rate exceeds 15%, which are -15.53%, -15.93%, 16.73%, and -17.28% respectively.

Analysis of MicroStrategy’s Official Announcement Market Situation

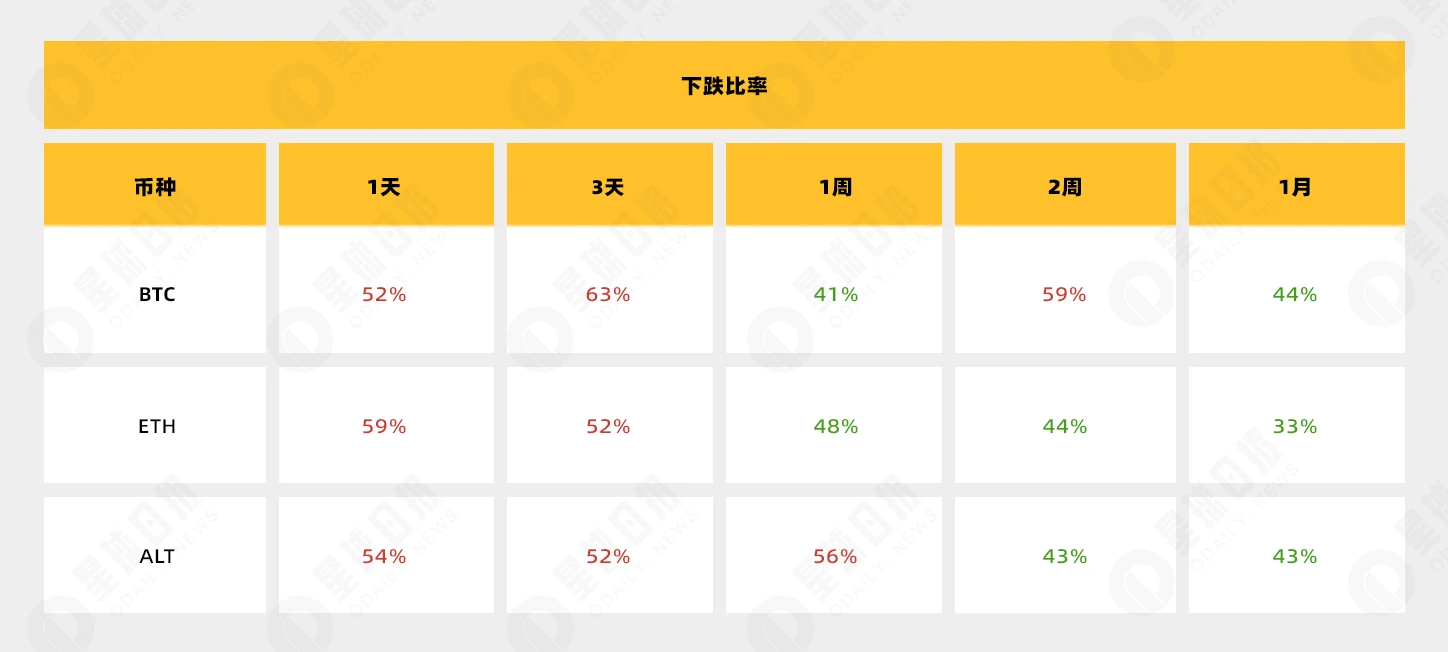

Analyze the market situation of each period after MicroStrategy’s official announcement, excluding the purchase on September 25. The analysis includes:

-

Time: Compare different lengths of time, such as 1 day, 3 days, 1 week, 2 weeks, 1 month;

-

Market: Take the average value of BTC, ETH, and mainstream altcoins (the top 20 non-stablecoins in CoinGecko market capitalization, including BNB, XRP, ADA, DOGE, SOL, TRX, DOT, MATIC, LTC, BCH, LINK);

-

Price: Based on the closing price of each period.

The comprehensive results are as follows:

It can be seen that the saying “Once MicroStrategy announces the purchase of BTC, the market is about to start falling” is not groundless. In the short term, all three types of markets tend to decline, but the probability of an uptrend starts to increase after one week, with ETH market showing the most obvious pattern.

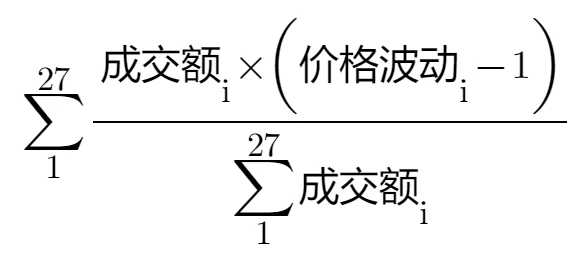

On the other hand, the amount (or value) of MicroStrategy’s purchases varies each time. Calculating the weighted average based on the value can better highlight MicroStrategy’s judgment. The calculation formula is as follows:

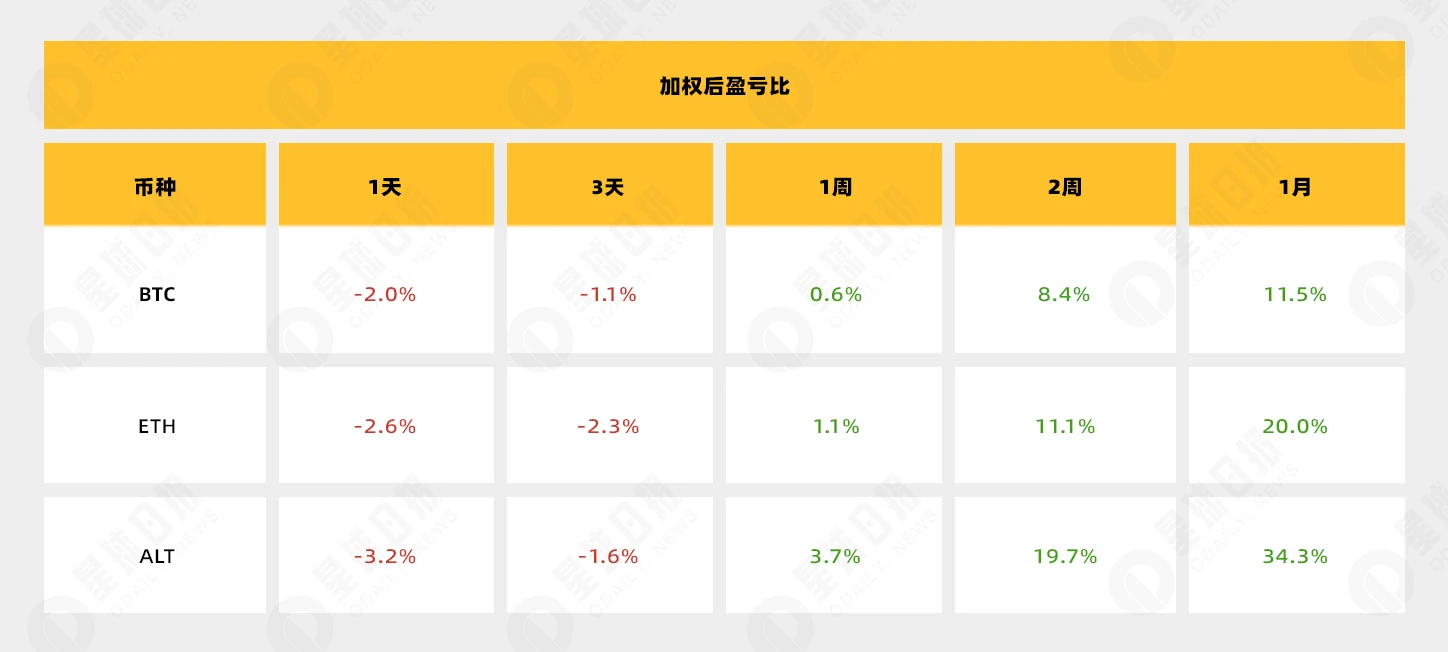

The weighted calculation results are as follows: the situation of the first three days of decline remains unchanged, but the magnitude has decreased. The profit-loss ratio in the following period has started to increase significantly, indicating that when MicroStrategy adds heavy bets, the probability of long-term rise is higher.

Conclusion

The two patterns summarized by the market about MicroStrategy do indeed match the statistical results. As the first Nasdaq-listed company to purchase Bitcoin, MicroStrategy, with its heavy position in BTC, mostly established its position by the end of 2020 and once had considerable unrealized gains. However, it has only sold Bitcoin once to date, showing its confidence in the bull market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!