Crypto Market Secondary Fund Metrics Ventures September Market Observation:

1. The overall market was lackluster in September, with multiple indicators at their lowest levels of the year. Both Bitcoin and Ethereum chip data showed significant losses, with chips being sold off and contract positions dropping significantly.

2. MVC’s buying operation. In mid-September, we made moderate buy orders, acquiring approximately 20% of Ethereum positions. The transaction price was around $1,600. This was mainly based on the following positive signals: after three months of volatility, potential selling pressure was released; market sentiment indicated panic, etc.

3. The main contradiction in the market is still the lack of funds, which cannot be resolved at present.

4. The monthly report uses the metaphor “fish gasping for breath in the market” to describe our current investment strategy. Before determining the trend, we will remain patient and wait for true allocation points to appear.

- Find the regularity of DWF Labs operations and lay ambush for the next opportunity of sharp rise or fall.

- Report Binance Spot Market Share Continues to Decline for the Seventh Consecutive Month

- Grayscale September Market Report Amidst global market turbulence, BTC demonstrates the dual characteristics of store of value and safe haven in times of crisis.

This article is an overview and commentary by Metrics Ventures on the overall market situation and trends in the crypto asset market in September.

The title of this monthly report comes from a famous meme. An elderly woman went to the market to buy fish and stood by a stall staring at the fish. The vendor, confused, asked why she didn’t buy the fish she liked. The woman said, for the same fish, the live one costs 13 while the dead one costs 3. I am waiting for it to gasp for breath. This is similar to the mentality of most secondary investors who hold a significant amount of coins in the current market. They sit on the sidelines and observe quietly, only taking action when the live fish gasps for breath to snap up cheap goods.

Of course, our mentality is similar as well. The bustling token2049 conference in September is particularly like a market, where some fish have turned belly-up and some seemingly fat and delicious fish are still flapping around. But everyone knows that they won’t last much longer.

In mid-September, we made some positions, mainly buying approximately 20% of the ETH positions at an average price of around $1600, because we observed some marginal changes in the emotional and chip aspects that we have been monitoring.

From the chip aspect, we can observe that as the market declines, the chips accumulated in the $29,000-$30,000 range of Bitcoin are gradually shifting to the $25,000-$26,000 range. This indicates that the trapped positions due to the anticipation of Bitcoin ETF approval and the XRP/DCG lawsuit positive expectations are surrendering and selling off chips. Moreover, on-chain funds in the market are providing relatively supportive buying pressure. ETH also exhibits similar chip characteristics. Currently, nearly 50% of the ETH chips on-chain have realized losses, which is similar to the features of previous panic bottoms, indicating that blood-stained chips at the spot level are being sold off. (Through on-chain data observation, we also found that on September 10-11, Arbitrum experienced large-scale whale selling behavior, with a general loss range of 30-40%. This also represents that since June, the patience of major holders and whales in the market has finally reached its limit.)

From the emotional perspective, market sentiment has quickly turned pessimistic.

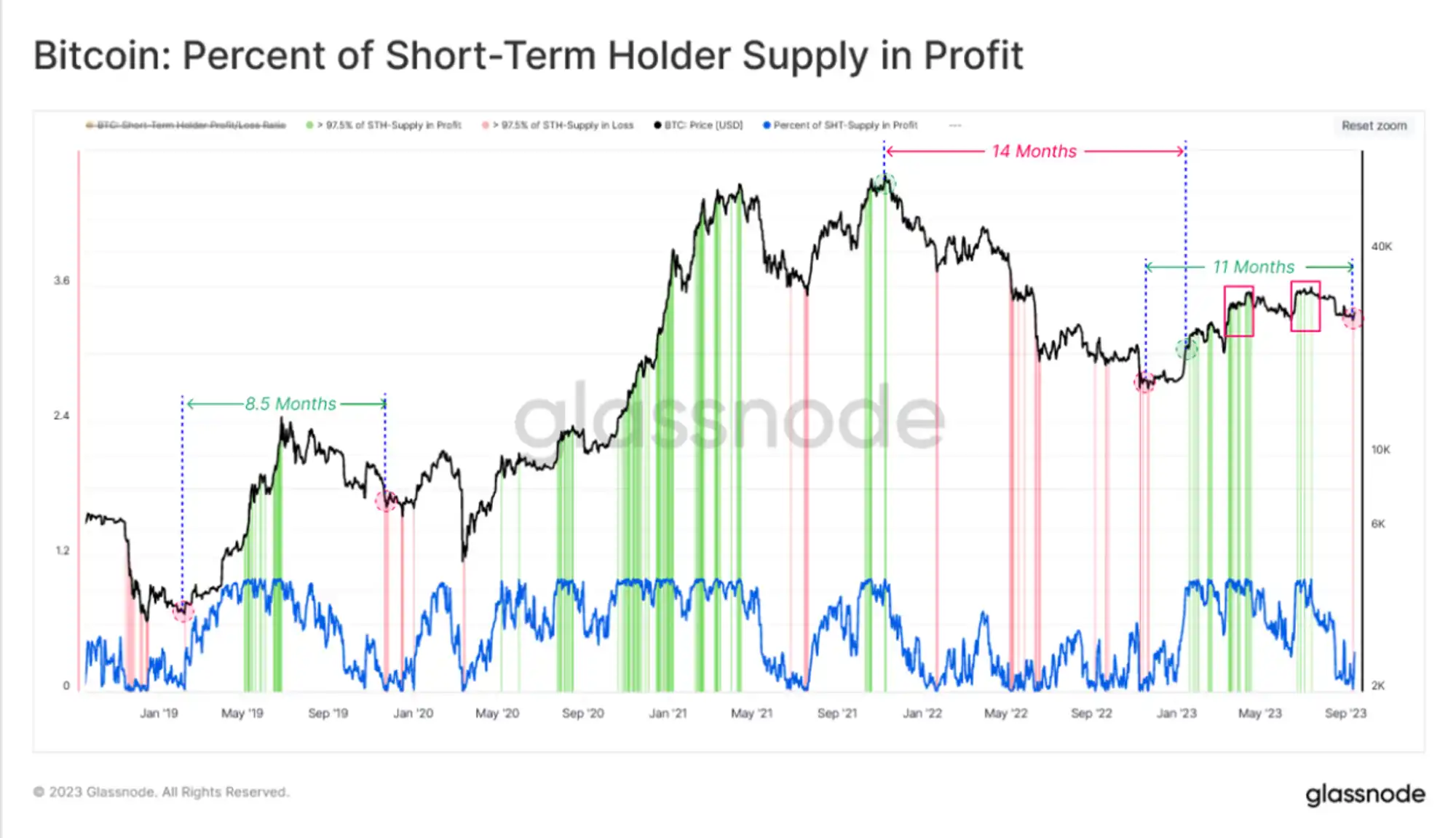

From the above chart, it can be observed that after nearly 11 months of market consolidation, more than 97.5% of short-term BTC chips are in a floating loss. The drop from the $30,000 level to the $25,000 level may not seem like a significant decline, but the pain of cutting losses and selling off is actually very intense. This level of market clearance should bring about a calm period of about one month.

From the observation of contract positions, in early September, the BTC contract positions on Binance platform alone dropped from a peak of $4.81 billion to $2.88 billion, a decrease of about 40%. This number was $2.52 billion during the most sluggish moment in January 2023 and around $2.85 billion during the US banking crisis in March. This indicates that the disappointment of a series of positive expectations in September has greatly destroyed the confidence of market participants and resulted in a strong cleansing of leverage in the market. Moreover, throughout September, the recovery of contract OI positions was slow, the fees were moderate, and the sentiment was in a state of stagnation where no one dared to go long or short.

If we look more closely, from the hourly chart of BTC shown below, we can roughly observe that the narrow-range fluctuations in the market in September were a hellish mode for contract funds. The phenomenon of liquidation occurred frequently, both during rallies and declines, and there were repeated liquidations (poor souls) after rallies followed by declines. So it is quite obvious that the sentiment around $27,000 for Bitcoin is actually more depressed than the sentiment around $16,000, showing clear signs of a deep bear market. The entire month of September and even October can be considered as a phase of oscillating and digesting trapped selling pressure.

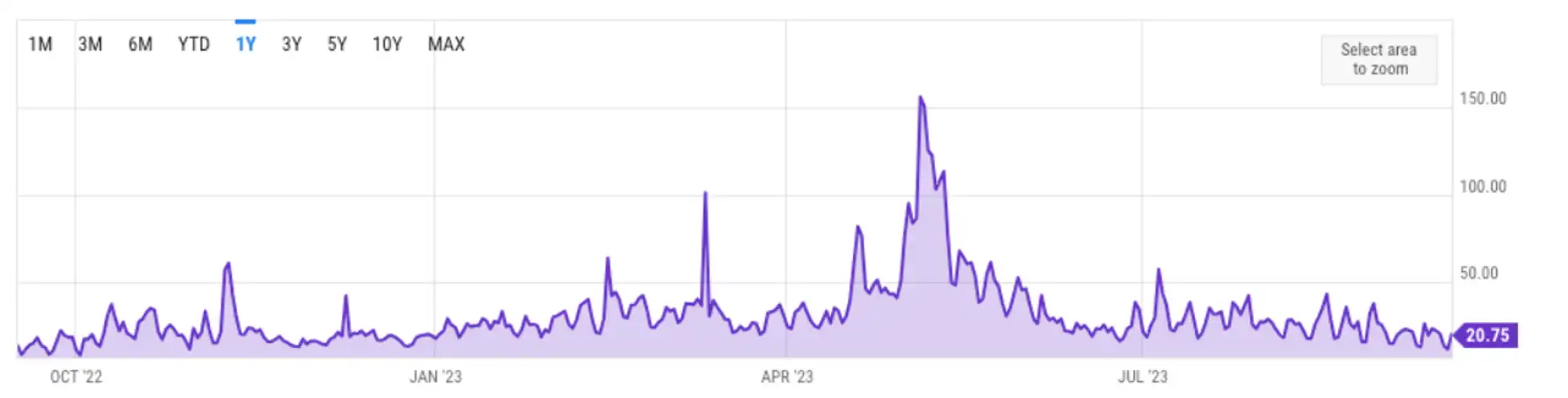

Not only is the sentiment low in the spot and contract markets, but even the on-chain Meme market that extreme left players in the industry like to speculate on is completely cold. As shown in the chart below, the ETH network Gas base has reached a new low for the year, and ETH has entered a rare inflationary state since the completion of the Merge, with a heavier sense of coldness compared to the freezing point in December 2022. According to our backtesting of Mempool transaction data, the activity of tokens without transaction fees has sharply declined.

Furthermore, in September 2023, the DEX trading volume has not exceeded 30 billion, which is even lower than the 40 billion in December 2022, setting a new record low for monthly DEX trading volume since 2021. This also aligns with the market sentiment we intuitively perceive, where the market heat at $27,000 for BTC is surprisingly lower than when it was at $16,000.

When we observe the market being trapped and sentiment extremely low, we choose to enter the market with a small-scale bottom fishing. This does not mean that we believe there will be any significant rebound opportunity in the short term, but at this moment, there are blood-soaked spot chips being released (a high proportion of realized losses), the leverage has been thoroughly cleaned (positions close to the lowest of the year, long/short ratio is low), the sentiment is extremely low (volume is weaker), and the market has given a signal of inclination to take over. At the moment, it is a position with a relatively good risk-reward ratio, and the price is reasonable for long-term allocation. Even if there are possible signs of a short-term sharp decline, we can stop-loss and exit at a clear target with minimal cost.

Coincidentally, recently there have been widely circulated screenshots about the BTC calendar effect in the market, which mainly means that the cryptocurrency market is very likely to perform well in October of each year, and there will be a spectacular Alt Season. The calendar effect can be considered as mysticism, and we do not have high expectations for the market in October.

Currently, the market has barely caught its breath from the game of reduced volume, and the total market value of the top five stablecoins has not significantly decreased in the past month, at most, it can be considered an upgrade to a stock game. In this situation, the market is more dominated by oversold rebounds, with limited upside and the driving force for the rise is also in the spot market. Since all market participants generally have low positions, there is buying pressure from short sellers covering their positions. Through market research, we have found that second-tier institutions and individual investors with capital scales of over 100 million US dollars choose to bottom fish with a dollar-cost averaging mindset.

If there is really an alt season, due to the weak market liquidity and low market capitalization, the funds from some short sellers covering their positions may bring huge gains, but there will also be a large number of altcoins competing for funds, resulting in very rapid sector rotation and poor sustainability of the market. It is estimated that there will also be limited profit-making effects in short-term trading, and the value of participating in short-term trading is low, and if you don’t run fast enough, you will become an unfortunate liquidity exit.

The market is stagnant, with consecutive new lows in volatility, the proportion of long-term chips being locked and not moving slowly rising, and short-term investors repeatedly chasing high and cutting losses, which has brought us into a state of numbness where we can’t go up or down. The main contradiction in the market is still the lack of funds, and this contradiction cannot be resolved at present.

The core constraint of the main contradiction is still the Federal Reserve. The Fed paused a rate hike at its September meeting, but the market interpreted it as interest rates staying high in the long term. During the October holiday period, it is also a critical point for the US government’s new fiscal year budget resolution. US bond yields have returned to 2008 levels, and US stocks, gold, and crude oil have experienced a sharp decline, while the US dollar has risen. Overseas markets are severely shaken, and signs of liquidity tightening have already appeared. This is also the main consensus of the current crypto market. Those whales who have not lost everything and are closely watching the fishpond are generally waiting for the collapse of the US stock market in 2023Q4-2024Q1, using the collapse of the US stock market or interest rate cuts as a signal to confirm that the fish has completely died (the ghost of the 312 memory is echoing).

We are keeping an eye on this, but we would like to emphasize that since 2023, we will not base our investment decisions in the cryptocurrency market on macro information. We are not macro experts, and the end of the rate hike cycle does not necessarily mean the beginning of a rate cut cycle. Each rate cut only happens after risks have appeared, and it is not a pre-signal. At the end of each rate hike cycle, a bubble will burst in some corner of the world, but it may not necessarily be the U.S. stock market this time. Whether it will collapse or not, and when it will collapse, all these various factors are not helpful for our decision-making.

In short, the market is currently short of money, and for a while, we don’t know where the liquidity will come from. What we may face is a situation where Bitcoin oscillates within a 15% fluctuation range indefinitely. Fish, oh fish, when will you take your last breath?

In conclusion, the cryptocurrency market is still in a downturn in September, and we maintain a cautious attitude. Volatility and oscillation may continue to exist until the market liquidity improves. We will continue to monitor the fundamentals, allocate assets at the right time, and patiently wait for the real buying opportunity.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!