Author: Karen, Foresight News Researcher

Derivatives and synthetic markets are one of the largest markets in the cryptocurrency field. After dYdX moved from Ethereum and StarkWare to the Cosmos ecosystem, StarkWare’s ecosystem urgently needs its own derivatives market.

According to DefiLlama data, GMX occupies 25% (420 million USD) of the 16.8 billion USD total value locked (TVL) in Layer solution Arbitrum, ranking first in the network, and more than twice the TVL of Uniswap V3, which ranks second. In Optimism’s 646 million USD TVL, Synthetix also ranks first with a TVL of 150 million USD.

It is not difficult to see that to some extent, a large derivatives market is key to promoting the network ecosystem and is a mutually beneficial relationship.

- Reviewing MicroStrategy’s 28 BTC purchases Is each announcement a signal for a decline?

- Messari 3 on-chain indicators send out Bitcoin bottom signal

- Chainalysis Research Large-scale Cryptocurrency Adoption in India, Philippines, and Pakistan

Therefore, in late September, StarkWare announced that its exploration team is about to launch the decentralized synthetic product Satoru inspired by GMX V2.

What is Satoru?

Satoru is developed by StarkWare’s exploration team Keep StarkNet Strange, which is mainly responsible for launching innovative projects and collaborating with the community. All projects are fully open source from day one. Projects initiated by StarkWare’s exploration team include modular zkEVM based on CairoVM, high-performance sequencer Madara, etc.

The main contributor to Satoru is Abdelhamid Bakhta, head of StarkWare’s exploration team, who is also an Ethereum core developer and one of the “authors” of EIP-1559.

Satoru is inspired by the modular design of GMX V2 and leverages Cairo to provide all the performance advantages of Starknet. It will develop into a neutral public product so that anyone can build products or businesses on top of it. The first MVP with an end-to-end process is expected to be released by the end of October.

What are the features of Satoru?

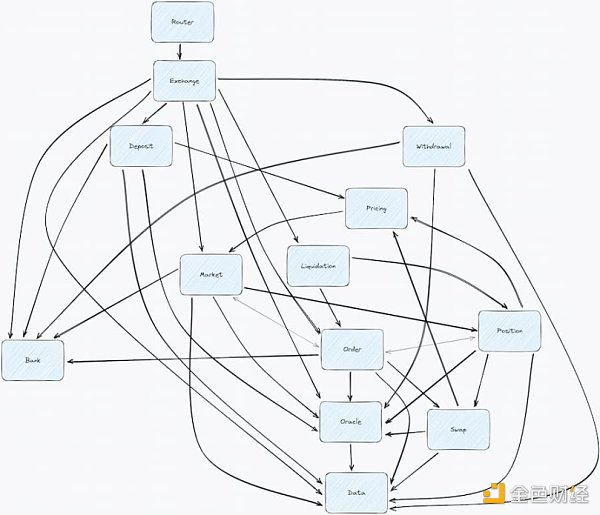

Satoru refers to the modular architecture of GMX V2, consisting of around 20 modules. Each module is a set of smart contracts and libraries related to specific domains. This makes it easier to add new features or remove them, and also allows multiple functional modules to be combined for composability.

The router module is the main entry point for users, and the transaction module handles the routing to the appropriate module. In addition, there are modules for automated deleveraging, data storage and management, fees, settlement, etc. The following are some of the main modules and related functions:

-

Router module: where users initiate token transactions, exchanges, and transfers using the router;

-

Transaction module: contains the main handlers for creating and executing operations, such as the DepositHandler contract for handling deposit creation, execution, and cancellation, the LiquidationHandler contract for handling liquidation, and the WithdrawalHandler contract for handling withdrawal creation, execution, and cancellation;

-

Fee module: responsible for collecting fees for specified markets;

-

Settlement module: used to assist with settlement;

-

Position module: tracks the borrowing factor of positions, if the BorrowingFactor is 100.20% when opening a position and is updated to 100.25% after a period of time, the position will owe 5% of the position size as borrowing fees. The total amount of pending borrowing fees for all positions is included in the calculation of LP pool value. When a position increases or decreases, the pending borrowing fees for that position will be deducted from the collateral of that position and transferred to the LP pool;

-

Gas module: used for fee estimation and payment;

-

Callback module: used to facilitate the use of other contracts that interact with the Satoru protocol, thereby achieving better composability.

In terms of operation execution, Satoru adopts two steps to perform key operations such as deposit, withdrawal, exchange, and order execution. First, the user sends a transaction request, which is then verified and executed by the Keeper, with the price provided by the off-chain oracle system. Satoru states that this helps protect users from front-running transactions and unauthorized issues, similar to GMX V2.

Role-based access control is another feature of Satoru, ensuring the security of all modules.

It is worth noting that Satoru has also clarified that it does not have tokens and is a 100% open-source public product. Its long-term goal is to become autonomous like other exploratory projects, maintained by the community.

With modular architecture, composability, and other features, can Satoru open up its own derivative market on the Starknet network, thereby fostering the development of applications and contributing to the prosperity of the ecosystem?

Reference: https://book.satoru.run/index.html

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!