Author: Lars, Director of Research at The Block

Translation: Jordan, LianGuaiNews

In August, most indicators in the cryptocurrency industry experienced significant corrections, but the sluggish market conditions did not improve in September. Overall, the past month continued to show a depressed state, with many indicators even falling further. This article will use 12 charts to interpret the cryptocurrency market conditions in September.

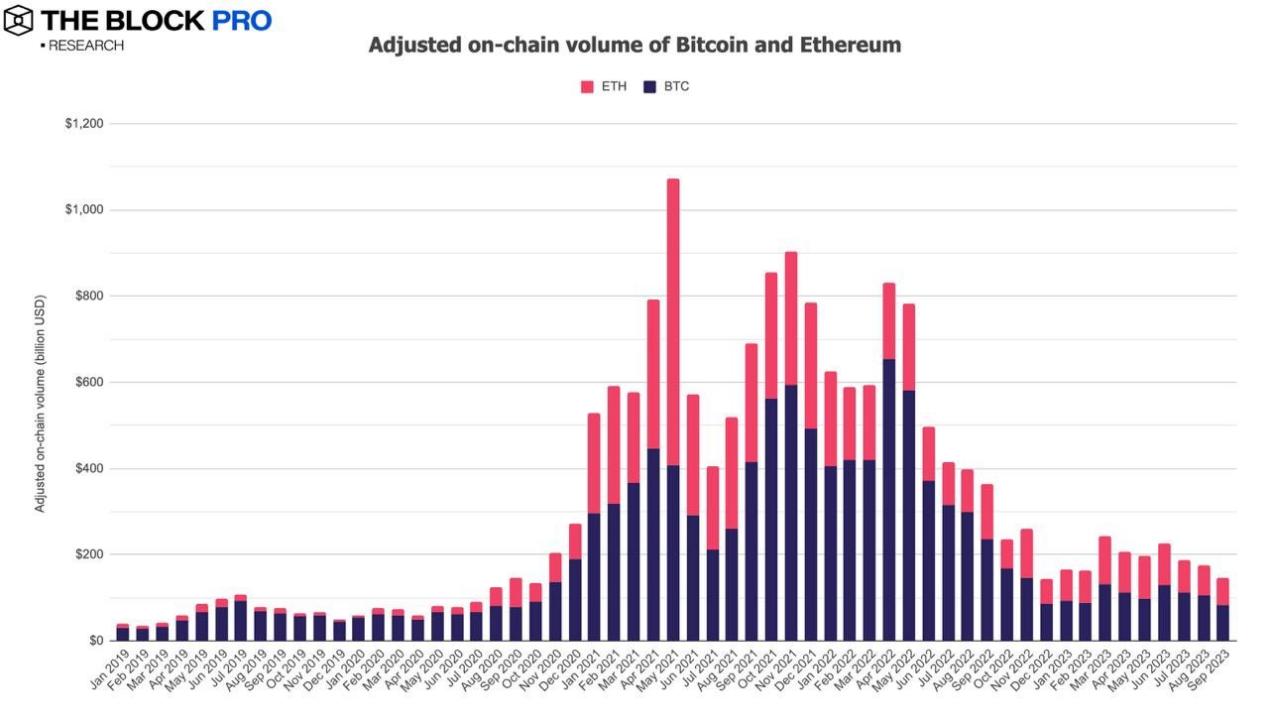

1. In September, both Bitcoin and Ethereum saw a decline in on-chain transaction volume after adjustments, with the overall decrease reaching 17.5% to $145 billion. Among them, Bitcoin’s on-chain transaction volume after adjustment dropped by as much as 20.83%, and Ethereum’s on-chain transaction volume decreased by 12.6%.

- Interpreting the Future Trend of the Cryptocurrency Market Bearish for a Long Time, When Will the Bull Market Arrive?

- Ethereum transactions decrease, Layer 2 dominates the market In-depth analysis of on-chain activities and trends

- Will the launch of ‘Starknet version of GMX’ by Satoru lead to a resurgence in the derivative market?

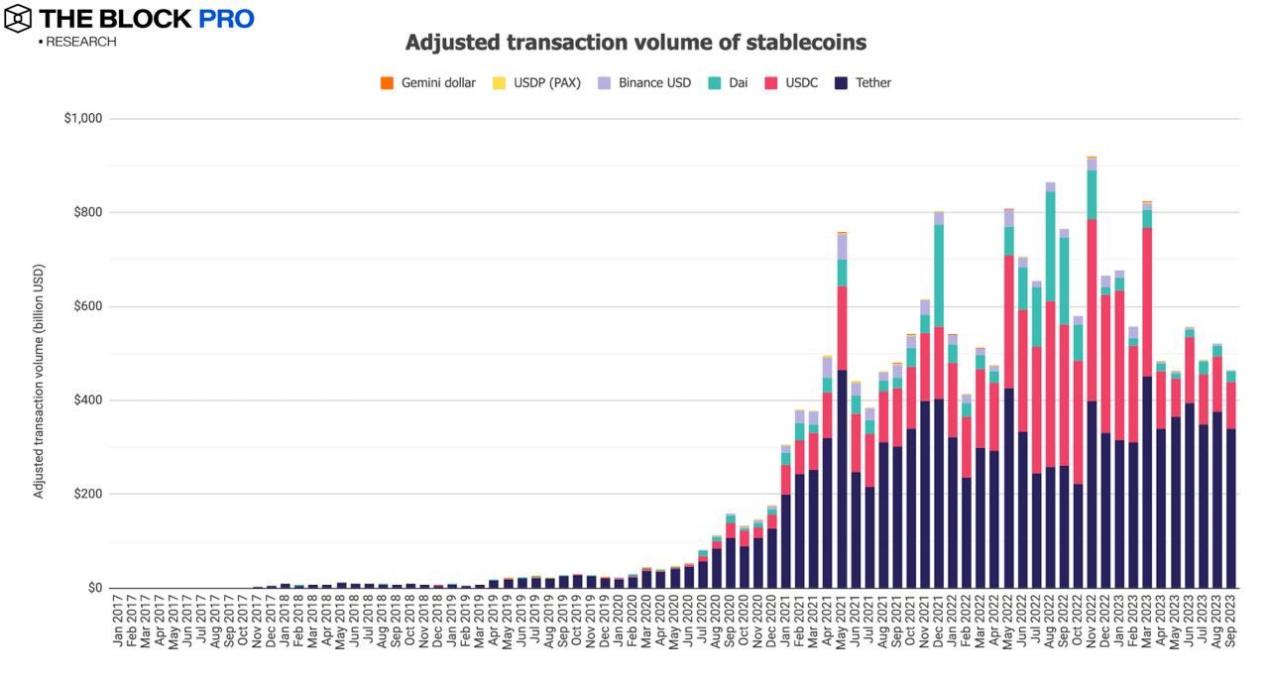

2. After adjustments in September, the on-chain transaction volume of stablecoins also experienced a decline, dropping to $465.2 billion, a decrease of approximately 10.7%. However, the supply scale of issued stablecoins increased to $116 billion, with a growth rate of only 0.75%. This is one of the few industry indicators that saw an increase in September. Among them, the market share of USD stablecoin USDT was 72.3% (a decrease from August), while the market share of USDC further decreased to 20%.

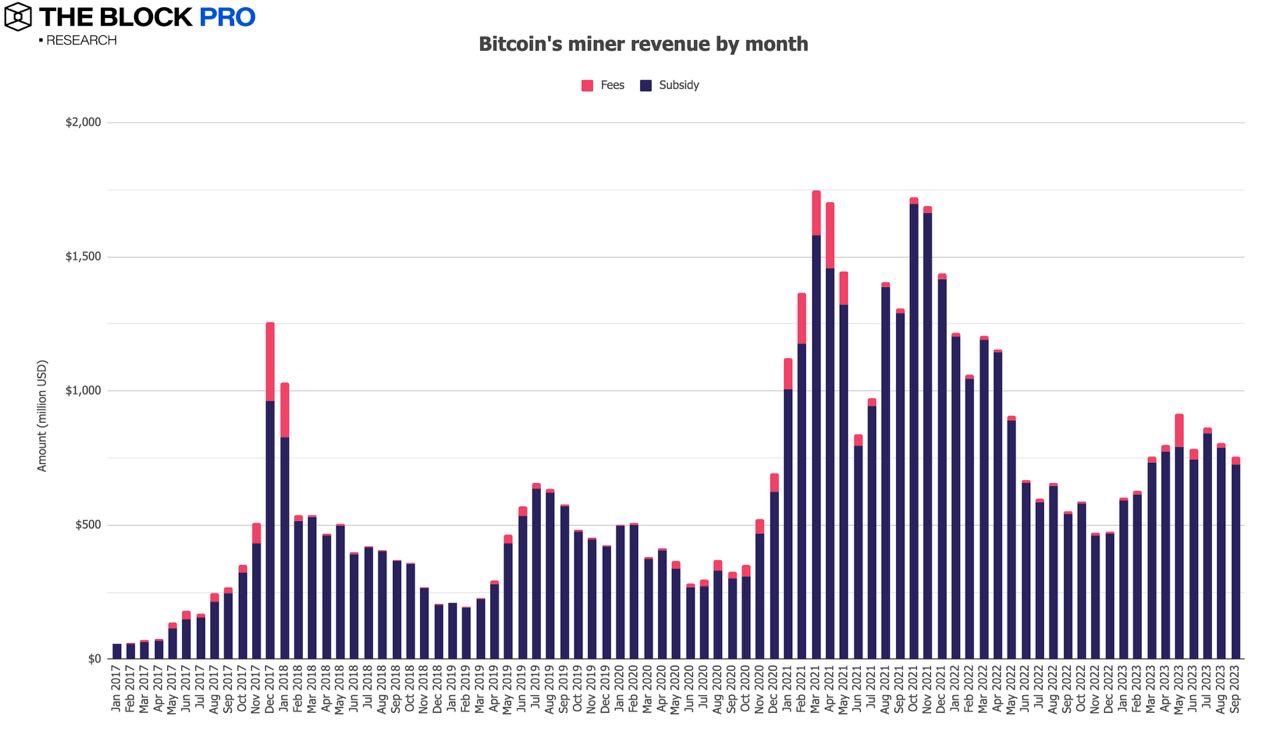

3. Bitcoin miner revenue also further declined in September, dropping to $753 million, a decrease of 6.4%. At the same time, Ethereum staking revenue also experienced a decline, with a decrease of 11.2% to approximately $115 million.

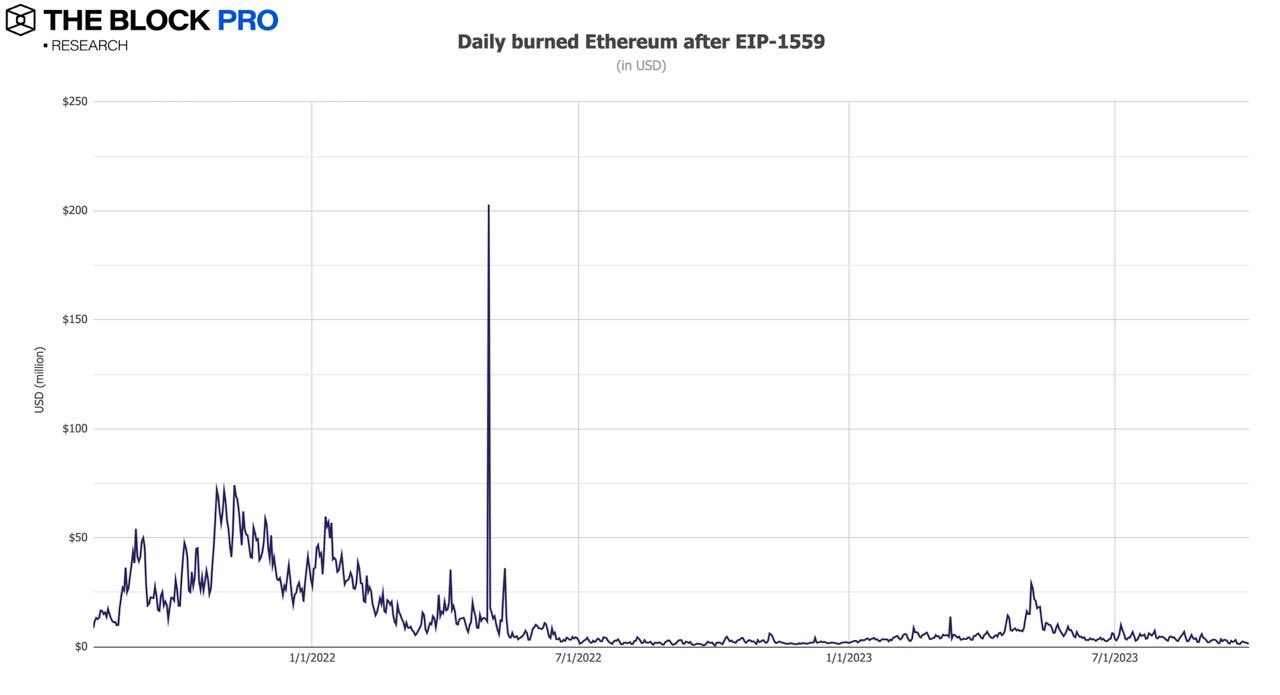

4. In September, the Ethereum network burned a total of 44,267 ETH, equivalent to a value of $71.7 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has burned a total of approximately 3.62 million ETH, with a value of about $10.24 billion.

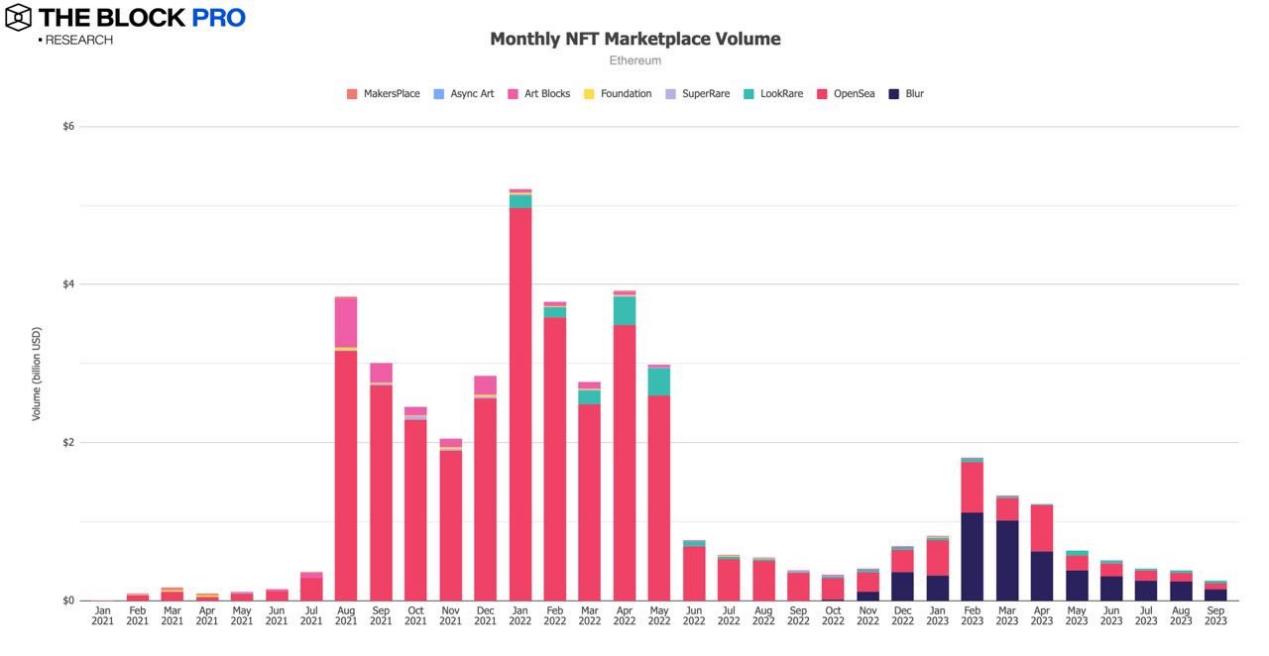

5. The on-chain NFT market transaction volume on Ethereum saw a significant decline in September, dropping to approximately $261 million, a decrease of 31.8%. However, the newly emerged NFT market, Blur, has surpassed OpenSea in monthly transaction volume and other indicators for the eighth consecutive month.

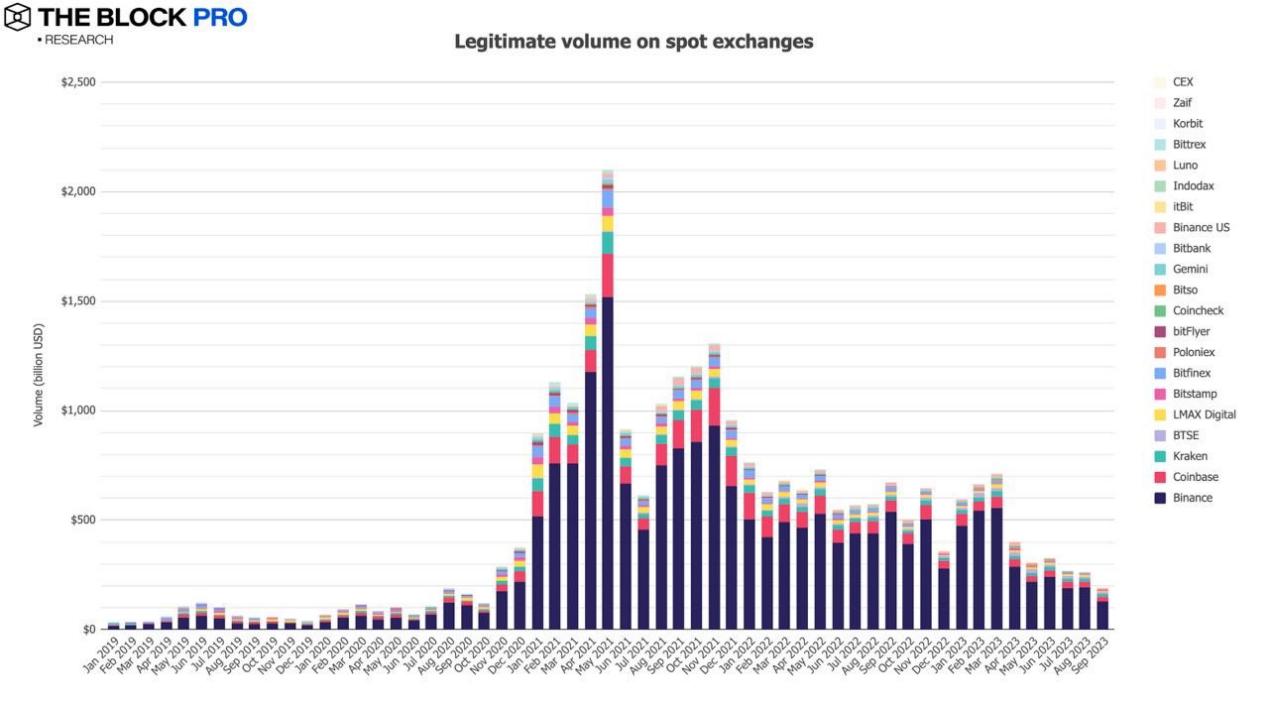

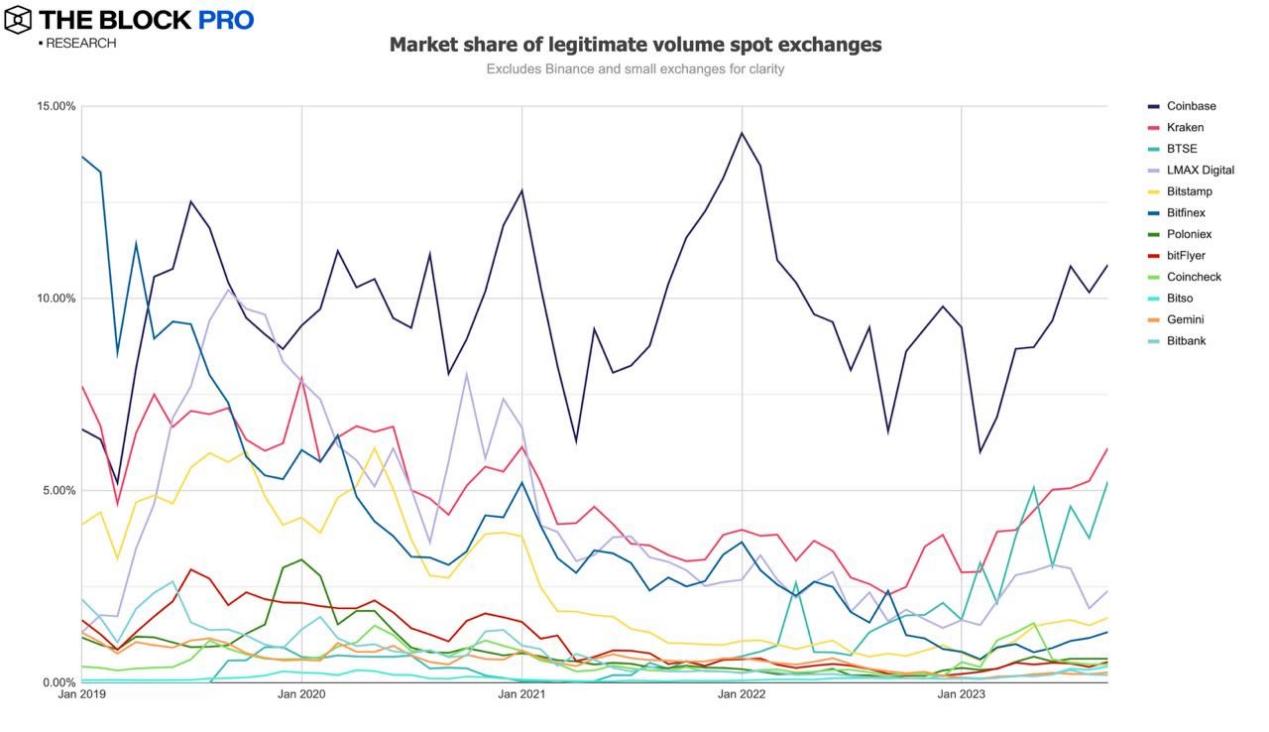

6. The spot trading volume of centralized exchanges (CEX) also saw a staggering decrease in September, reaching 28.3% to approximately $187 billion, marking the lowest level since October 2020.

7. The market share rankings of major cryptocurrency exchanges in September are as follows: Binance accounts for 69.3% (a decrease of about 5 percentage points from August), Coinbase accounts for 10.9%, Kraken accounts for 6.1%, BTSE accounts for 5.2%, and LMAX Digital accounts for 2.4%.

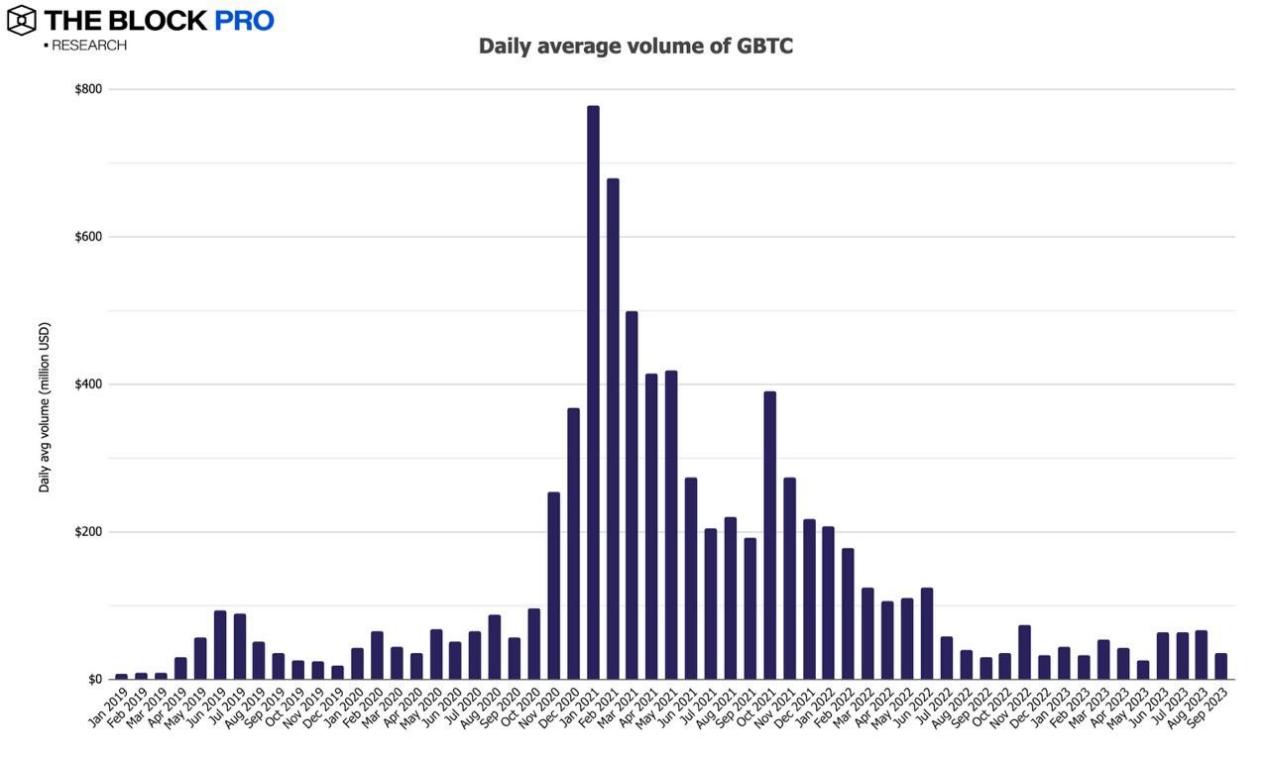

8. The average daily trading volume of Grayscale’s Bitcoin Trust (GBTC) almost halved in September, falling to $36 million, a decrease of 46.9%.

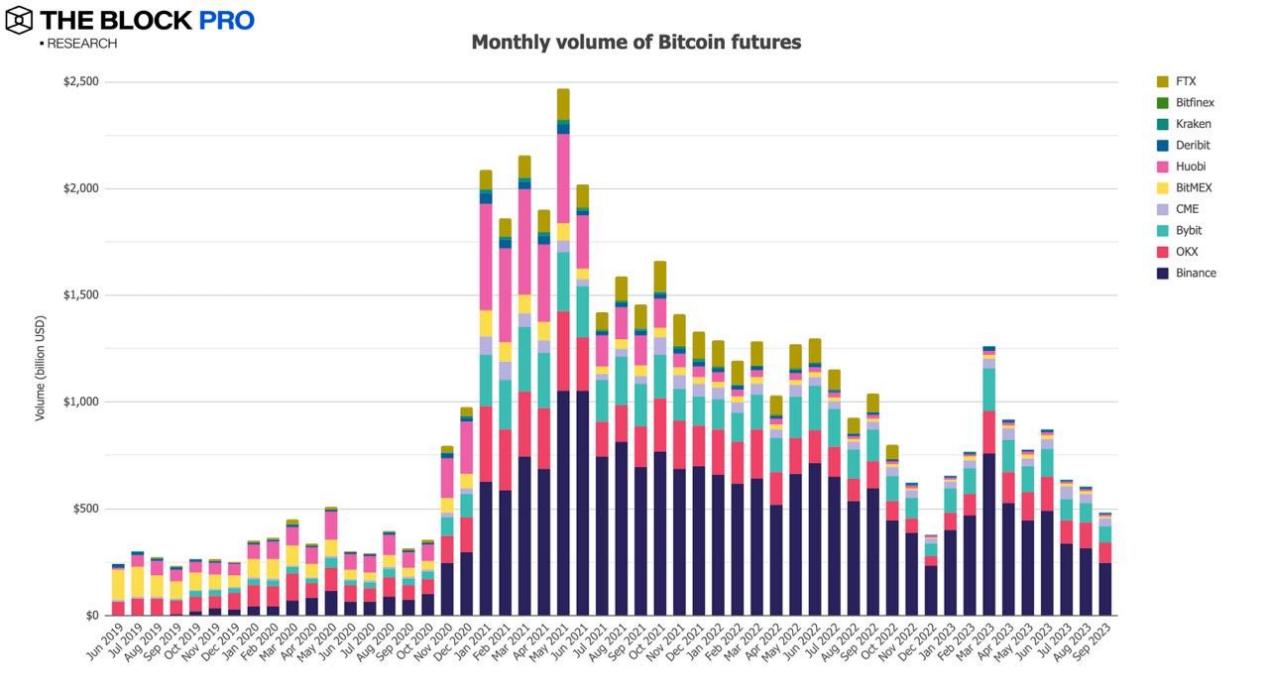

9. In terms of cryptocurrency futures, the open interest of Bitcoin futures increased by 3.9% in September, and the open interest of Ethereum futures increased by 11.4%. In terms of futures trading volume, the trading volume of Bitcoin futures in September decreased by 20.2%, falling to $481 billion.

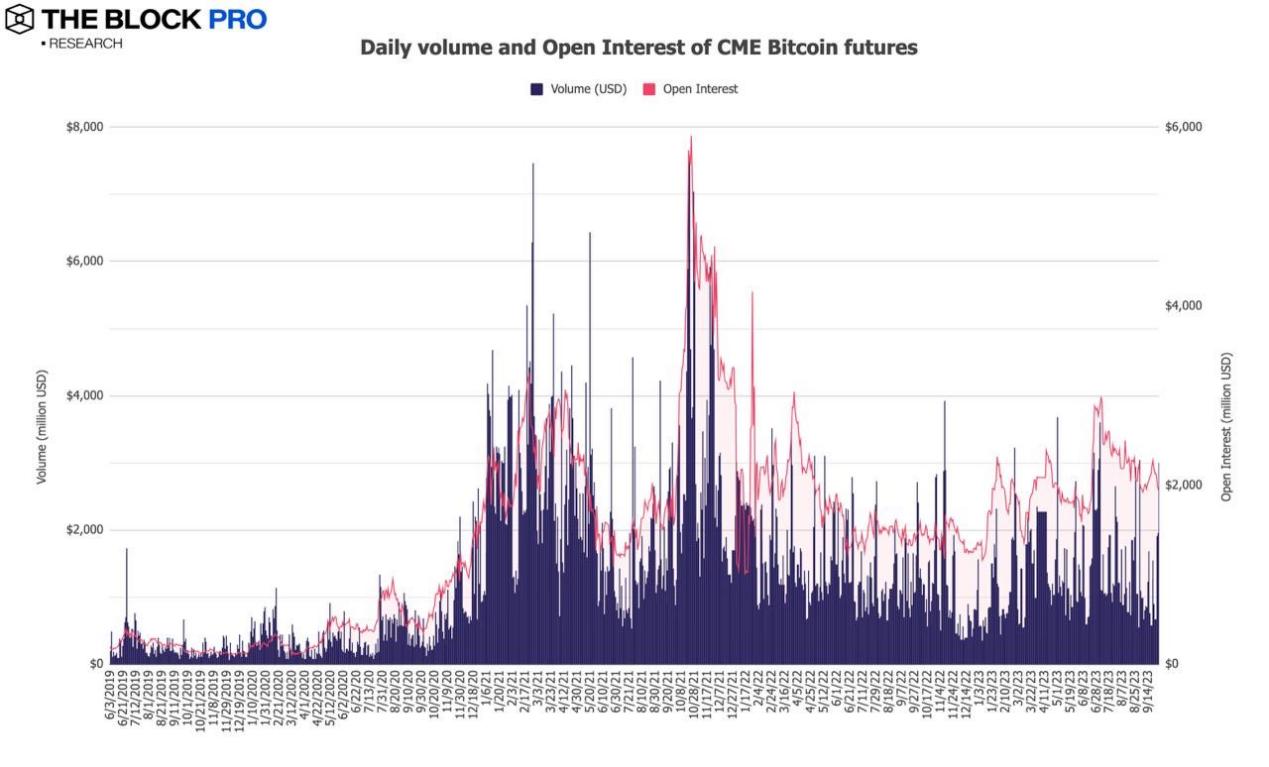

10. The open interest of Bitcoin futures on the Chicago Mercantile Exchange (CME) decreased by 12.8% in September, and the daily average volume dropped even more, reaching 16%, falling to approximately $1.15 billion.

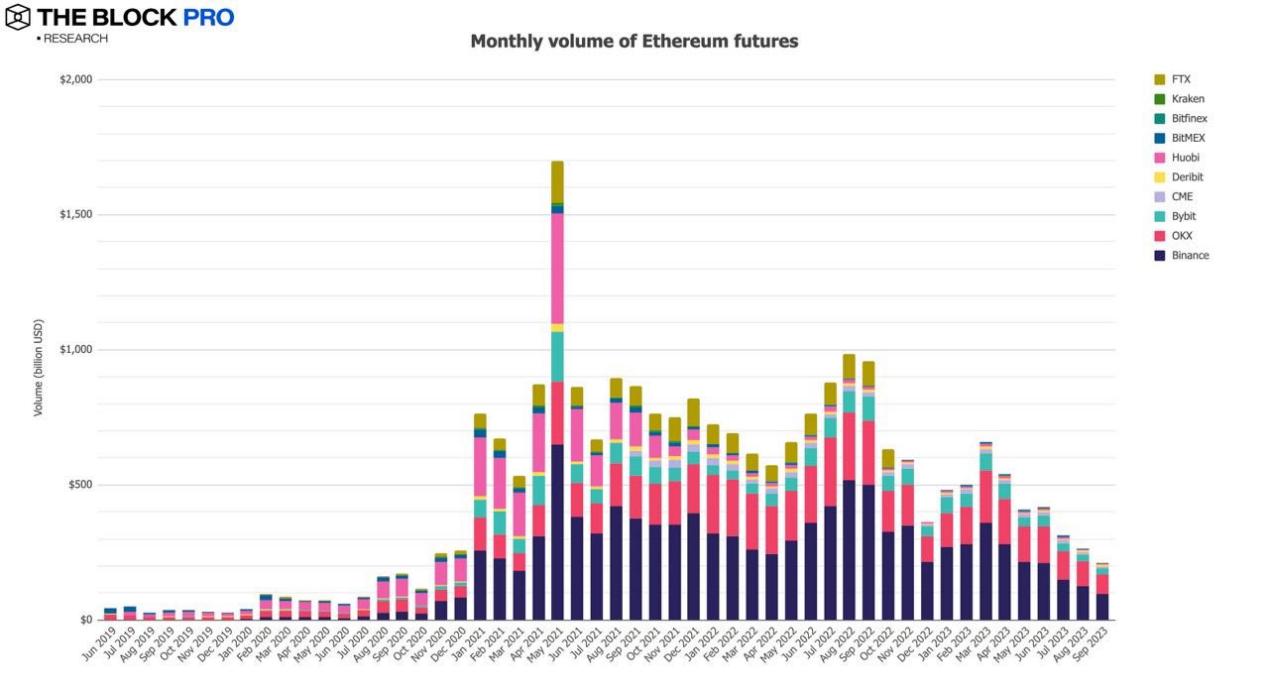

11. The monthly average trading volume of Ethereum futures in September fell to approximately $209.7 billion, a decrease of 20.6%.

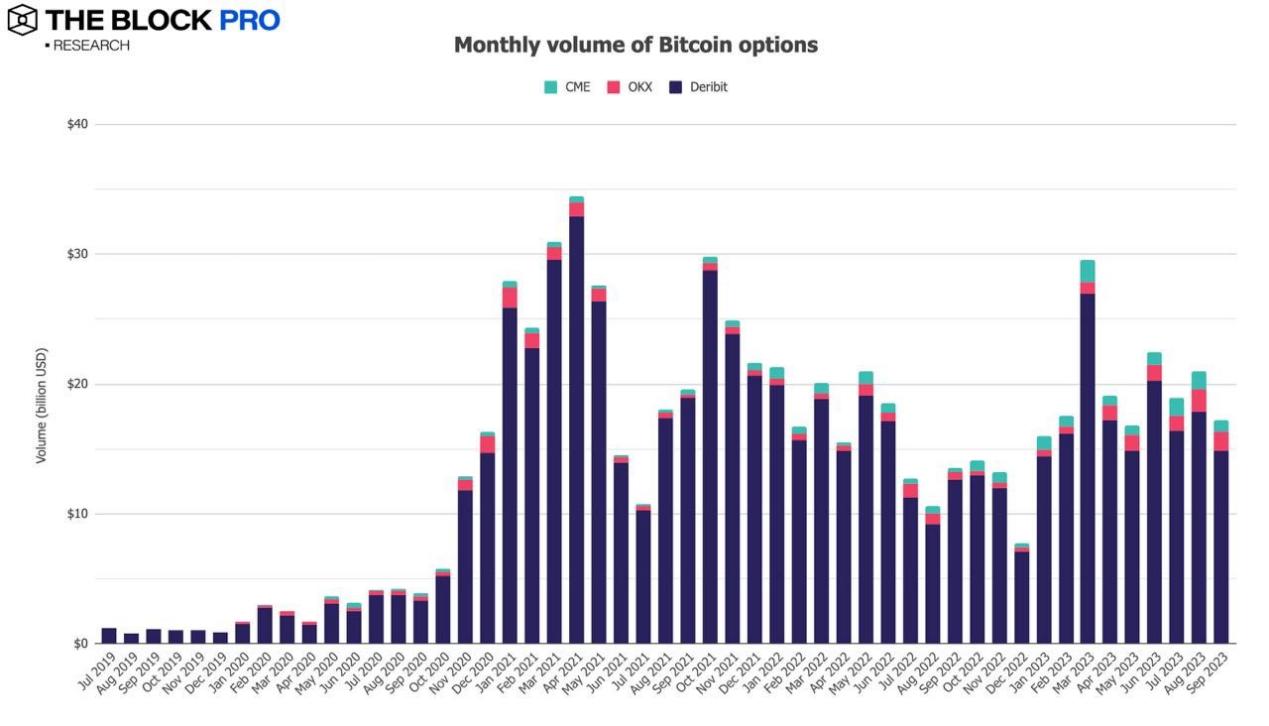

12. In the cryptocurrency options market, the open interest of Bitcoin and Ethereum options both experienced a general decline in September. The open interest of Bitcoin options decreased by 15.6%, and the open interest of Ethereum options decreased by 6.4%. Additionally, in terms of trading volume, both Bitcoin and Ethereum options saw significant declines. The trading volume of Bitcoin options decreased by 17.9% in September, falling to $17.3 billion. The trading volume of Ethereum options decreased by 10%, falling to $10.1 billion.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!