Original text | Grayscale

Compiled by | Odaily

Recently, Grayscale released its September market report, with the following key points:

-

Bitcoin rose in September, while many traditional assets suffered significant losses, highlighting the diversification characteristics of cryptocurrencies. The global market pressure seems to be due to rising government bond yields and oil prices.

-

With Bitcoin’s on-chain indicators improving this month, strong fundamentals have played a key role. Stablecoin market capitalization has stabilized after a decline last year, and the digital asset market continues to focus on the development of Layer 2 blockchains and the potential of physically-backed Bitcoin ETFs in the US market.

-

Although the cryptocurrency industry itself has shown encouraging signs, the broader financial market environment may still be challenging. However, Bitcoin’s recent stability suggests that once the macro backdrop improves, its valuation may start to rebound.

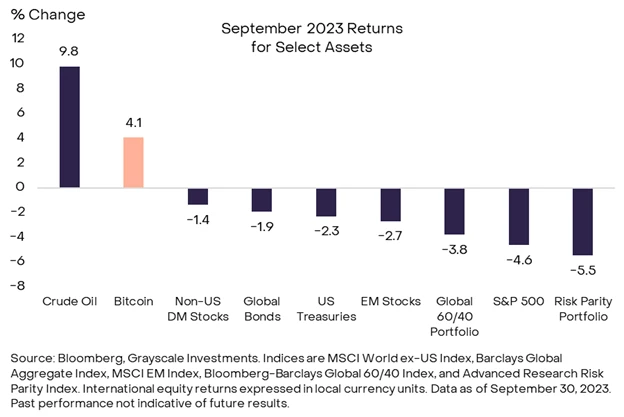

BTC rose by 4% in September, in sharp contrast to the significant losses of many traditional assets this month (Table 1). Cryptocurrencies now have a stronger correlation with other markets, but in this challenging market environment, they continue to provide investors with a certain degree of diversification.

Bitcoin (BTC) rose by 4% in September, which is in sharp contrast to the significant losses of many traditional assets this month (Chart 1). Cryptocurrencies now have a stronger correlation with other markets, but in this challenging market environment, they continue to provide investors with a certain degree of diversification (returns).

Chart 1: Bitcoin provides diversified returns in a shrinking global market

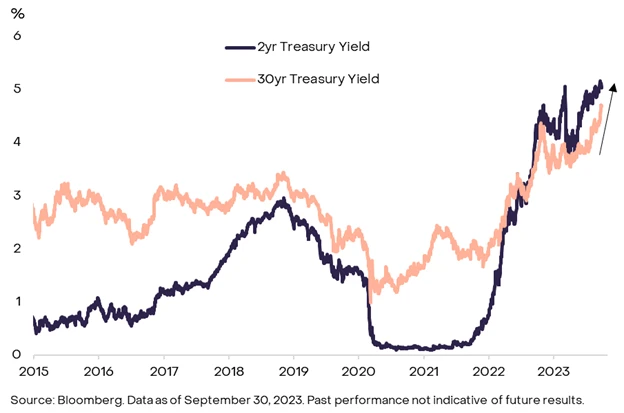

The latest pressure on global assets appears to be coming from the US bond market (Chart 2), which may be related to the actions of the Federal Reserve. At its mid-September meeting, the Fed hinted that it may raise interest rates again later this year and that the pace of rate cuts next year may be slower than previously expected. The Fed’s new guidance helps push up short-term bond yields and boost the value of the US dollar.

Chart 2: Rising bond yields put pressure on global markets

However, a greater challenge facing the fixed income market may be an oversupply of long-term government bonds. The yield on 30-year Treasury bonds rose by nearly 50 basis points (bp) in September, reaching its highest level since 2011. Long-term bonds, such as those with a remaining maturity of over 10 years, are usually less sensitive to minor changes in Fed rate guidance.

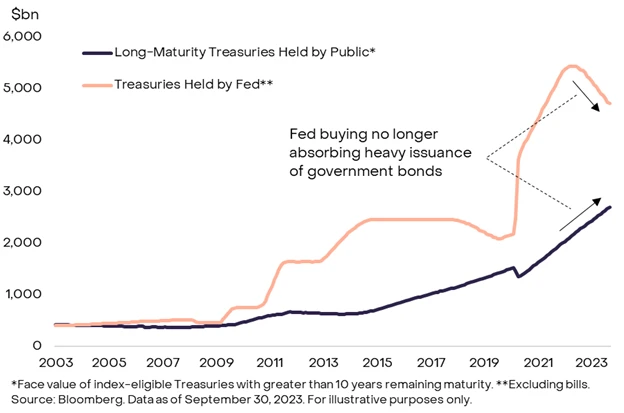

On the contrary, the bond market seems to struggle to absorb the massive borrowing from the U.S. Treasury, which is a result of the huge budget deficit. Although the budget deficit has been significant for some time, the Fed’s previous purchases (“quantitative easing”) have absorbed some of the bond supply. Now, as the Fed is shrinking its balance sheet (“quantitative tightening”), more government borrowing is impacting the public markets, putting upward pressure on interest rates (Chart 3).

Chart 3: Without Fed quantitative easing (QE), the bond market struggles to absorb U.S. government debt.

The rising bond yields and oil prices seem to have put pressure on the stock market and most other risk assets. The S&P 500 index fell nearly 5% in September, with sectors related to the health of the U.S. economy leading the decline – home builders, industrials, and companies related to retail performance.

Bitcoin has largely been unaffected by the downturn in traditional assets and has outperformed most other large cryptocurrencies.

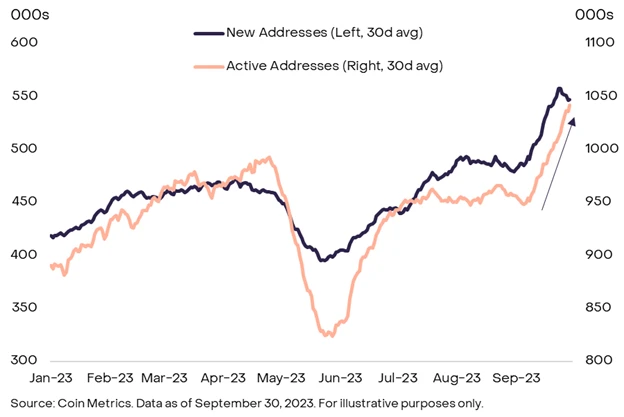

Although trading volume continued to decline this month, various on-chain indicators for Bitcoin have improved: the number of funding addresses, active addresses, and transactions have all increased (Chart 4). Given the progress of the spot Bitcoin ETF at the end of August, the recovery in on-chain activity may represent new investors entering the market and building positions before regulatory approval.

The price recovery of Bitcoin may also be related to the following news: the trustee of the cryptocurrency exchange Mt. Gox will postpone repayment to creditors until October 2024 – it currently holds about 13,800 Bitcoins, which are worth about $3.7 billion, and this decision may reduce market selling pressure.

Chart 4: Bitcoin on-chain activity increased in September.

Meanwhile, the price of ETH tokens has slightly declined compared to September, and the ETH/BTC ratio has fallen to a new low in a year. The volatility of ETH prices is also extremely low: as of September 30, the 30-day annualized price volatility of ETH is only 25%, lower than the volatility of BTC during the same period, and the average volatility since January 2022 is about 60%.

Unlike Bitcoin, the on-chain fundamentals of ETH have not changed much. In late September, market attention focused on the potential approval of ETH futures ETF, and the ETH/BTC ratio slightly rebounded.

In addition to BTC and ETH, one notable fundamental change in September is that the market capitalization of stablecoins has stabilized after a long-term decline. According to data from DeFiLlama, the total market value has stabilized at around $124 billion, which has been continuously declining for almost a year. Since mid-August, the circulation of DAI and True USD (TUSD) has significantly increased, while the supply of Tether (USDT) has also slightly increased since early September.

Figure 5: Stablecoin market value has stabilized after a decline

The adoption of stablecoins seems to have driven Tron tokens to outperform other major tokens. In September, the price of TRX rose by 15%; the total locked value (TVL) of stablecoins hosted on Tron is higher than any other blockchain, even surpassing Ethereum. A large portion of the TVL comes from Tether (USDT), which is primarily hosted on Tron and currently accounts for an average of 35-40% of daily transactions on the network.

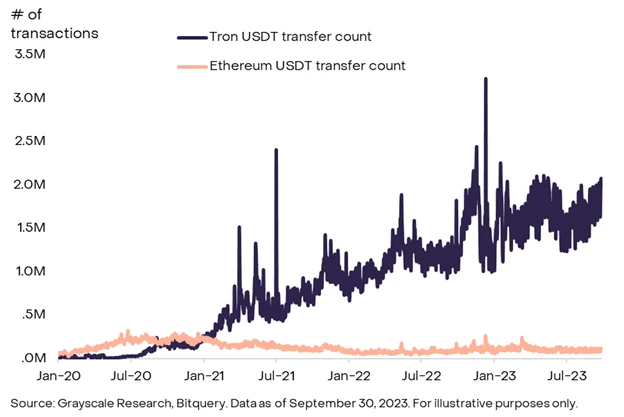

Tron is leading in terms of TVL, largely due to lower transaction fees. The number of TRC-USDT transfers far exceeds that of ERC-USDT, with daily trading volume being about 15 times higher (Figure 6). The strong adoption of USDT on Tron demonstrates the market fit of stablecoins and highlights their growing importance in the modern cryptocurrency ecosystem.

The symbiotic relationship between the success of USDT on Tron and the recent price increase of TRX may indicate that stablecoins are becoming an increasingly important part of the modern cryptocurrency market mechanism.

Figure 6: Tether activity on Tron far surpasses Ethereum

In addition to stablecoins, the cryptocurrency market continues to focus on the ongoing development of Layer 2 blockchains, as discussed in a recent report by Grayscale Research.

It is worth noting that the total fees collected by the social media application friend.tech on BASE exceeded those of the decentralized exchange Uniswap in September. From a price perspective, other strong-performing DeFi tokens include AAVE, CRV, MKR, and the oracle protocol token LINK, which we attribute to their recent collaborations with Swift and BASE.

Finally, Toncoin (TON) briefly surpassed TRX to become the tenth largest cryptocurrency by market capitalization. The project announced integration with the messaging application Telegram at the Token 2049 conference in Singapore (TON was originally launched by the founder of Telegram). While we are optimistic about the prospects of integrating cryptocurrencies with messaging applications, investors should consider factors such as asset liquidity when evaluating their valuations. It is worth noting that most of TON’s supply is held by a few whales, and the token’s trading volume is extremely low compared to its market capitalization. For example, according to data from The Tie, TON’s market capitalization is over 200 times its monthly trading volume.

In our view, the resilience of Bitcoin and the significant losses of traditional assets demonstrate the diversification advantages of digital assets and the steady improvement of the industry’s fundamentals. The next major catalyst for the price of Bitcoin may come from the approval of spot ETFs. In the previous legal dispute with Grayscale, the SEC lost and needs to appeal for reconsideration by October 13th; if the SEC drops the appeal, it will reconsider Grayscale’s pending application to convert its Bitcoin Trust (GBTC) into a spot Bitcoin ETF, as well as other spot Bitcoin ETF applications currently under consideration.

Despite these encouraging signs, the broader financial market backdrop may still be challenging for the time being: the Federal Reserve is still tightening policy, government bond yields may still be searching for a new equilibrium, and the outlook for a “soft landing” of the US economy is uncertain. However, the recent stability of Bitcoin suggests that once the macroeconomic backdrop improves, its valuation may start to recover.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!