Author: Michael Nadeau Translator: Felix, LianGuaiNews

The bear market in the cryptocurrency market has been going on for a long time. What is the relationship between the economic cycle and the cryptocurrency market? When will the bull market arrive? This article takes you through the data interpretation of the future direction of the cryptocurrency market.

-

Using data to review past cycles

-

Outlook: preparing for the next cycle

- Ethereum transactions decrease, Layer 2 dominates the market In-depth analysis of on-chain activities and trends

- Will the launch of ‘Starknet version of GMX’ by Satoru lead to a resurgence in the derivative market?

- Reviewing MicroStrategy’s 28 BTC purchases Is each announcement a signal for a decline?

-

Current on-chain market signals

-

Risks

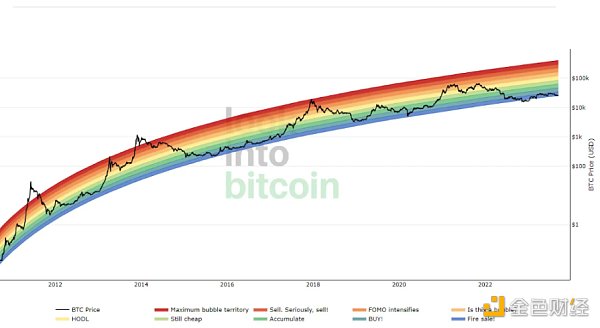

Bitcoin rainbow price chart, source: Look Into Bitcoin

Review of past cycles

To outsiders, the price of cryptocurrencies seems to have no discernible pattern. However, the cryptocurrency market actually has a strong cyclical nature. Using Bitcoin as a benchmark, significant consistency has been found in the past three cycles:

-

Retracement percentage of each cycle’s peak: approximately 80%

-

Time from the cycle bottom to the peak: 1 year

-

Time to reclaim a new all-time high from the cycle bottom: 2 years

Source: Glassnode

In addition, comparing it with the U.S. ISM Manufacturing PMI (Note: The Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) shows the business environment of the U.S. manufacturing sector for a specified month. The index is calculated based on a survey of representatives from hundreds of companies in 18 industries in the United States), it can be found that almost every cycle in the cryptocurrency market is completely consistent with the cyclical changes in the economic cycle.

Source: Delphi Digital

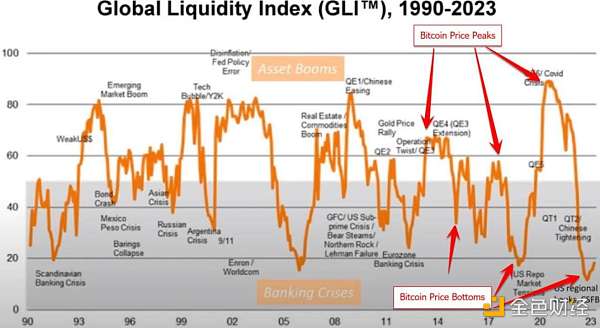

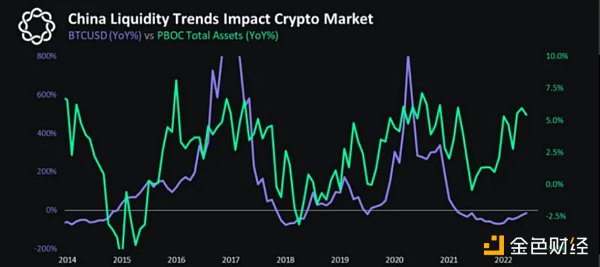

The cryptocurrency cycle also aligns with the global liquidity cycle:

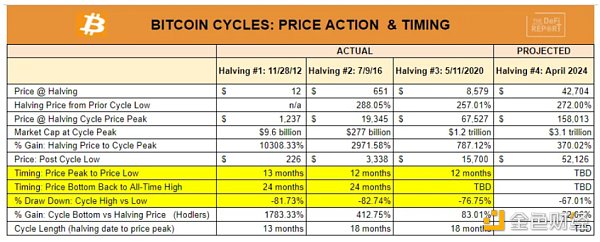

Next cycle

There are still 7 months until the next Bitcoin halving, and Bitcoin has already fallen by about 80% from the high of the previous cycle. At the same time, it took about a year for the market to bottom out. It has now recovered for 10 months.

If history repeats itself, it should break through the previous all-time high in about 14 months (fourth quarter to 2024) and reach its peak in the fourth quarter of 2025.

Of course, this is a big assumption.

In order to understand future price trends, here are potential influencing factors:

-

Changes in the economic cycle (driven by monetary policy and global liquidity)

-

Strong market narratives

-

Continuation of the innovation cycle

-

New market entrants and new speculation (leverage)

-

So far, everything is going smoothly with these factors. Now let’s explore the reasons.

Economic cycle and liquidity

The author believes that global liquidity hit bottom in October 2022. Since then, it can be seen that the Federal Reserve has implemented a round of stealth quantitative easing (related to the banking crisis in March). Now China is struggling with deflation.

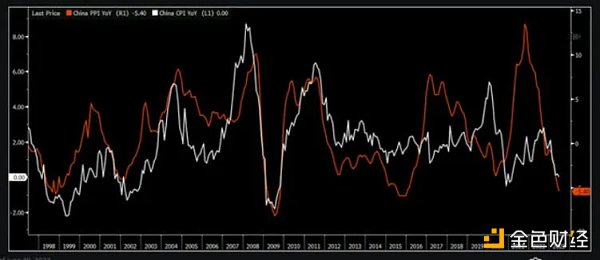

China’s PPI and CPI turned negative year-on-year:

Data: Delphi Digital, Bloomberg

This has led to the recent interest rate cuts by the People’s Bank of China. This is a positive sign for global assets such as Bitcoin, as shown in the following figure.

China: Bitcoin and total assets of the People’s Bank of China

Source: Delphi Digital, Bloomberg

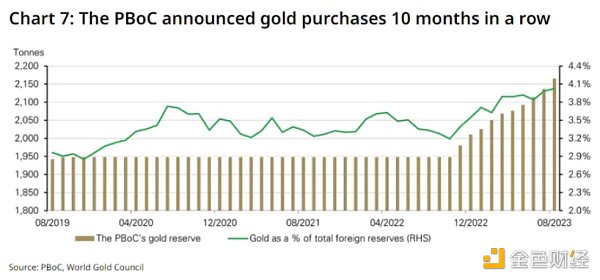

Meanwhile, the People’s Bank of China has been buying gold, causing the spot price of gold in China to be more than $120 higher per ounce than the global price. Is the People’s Bank of China taking action before the depreciation of the renminbi?

Looking at the United States, over $7 trillion of debt will mature next year. The Federal Reserve may have to buy a large amount of such debt as they need to refinance. In addition, debt interest payments currently account for over 31% of tax revenue (red line) – tax revenue is declining, indicating an imminent economic recession (gray line). How to increase tax revenue? Lower interest rates (green line).

Data: Federal Reserve FRED database

43 million Americans will resume student loan payments in October, averaging $503 per month in interest.

The commercial real estate industry has over $1.5 trillion of debt that needs to be refinanced in the coming years. 5

Commercial bank loans in the United States are currently at recession levels (gray line = recession):

Data: Federal Reserve FRED database

Ongoing initial jobless claims are starting to rise:

Data: Federal Reserve FRED database

Economic Cycle / Liquidity Summary

The author has looked at multiple data points in the FRED database, most of which indicate an economic recession. Given that liquidity appears to have bottomed out in October 2022, it is more likely to see monetary policy easing in the coming months until 2024 – but the precondition is that the economy really begins to slow down.

Assuming an economic recession occurs in the next 6 months or so, the Federal Reserve adopting a more dovish policy may align perfectly with the Bitcoin halving schedule.

Innovation Cycle

Despite the ongoing crypto winter, significant progress can still be seen in public chains in terms of infrastructure construction. The highlights are:

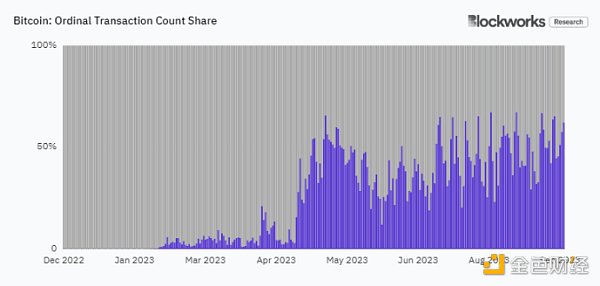

Bitcoin is expanding on the Lightning Network, and the Ordinals protocol is driving new demand for block space.

Data: Blockworks Research

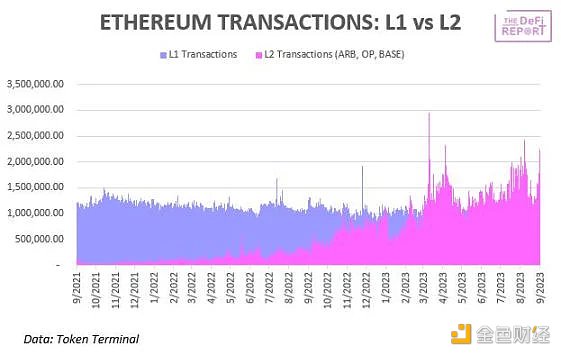

With the play of Moore’s Law, Ethereum is also expanding through Layer 2. Note: Moore’s Law is the experience of Gordon Moore, one of the founders of Intel. Its core content is that the number of transistors that can be accommodated on an integrated circuit will double approximately every 18 to 24 months. In other words, the performance of processors doubles approximately every two years, while the price drops to half of the previous price.)

EIP 4844 (Expansion Upgrade) is expected to be implemented in the fourth quarter. Significant progress has been made in important improvements such as account abstraction (related to user experience bridging assets), smart contract wallets, tokenization of real-world assets, stablecoins, liquid staking protocols, Eigen Layer (heavy staking), data availability (Celestia), and DeFi blue chips.

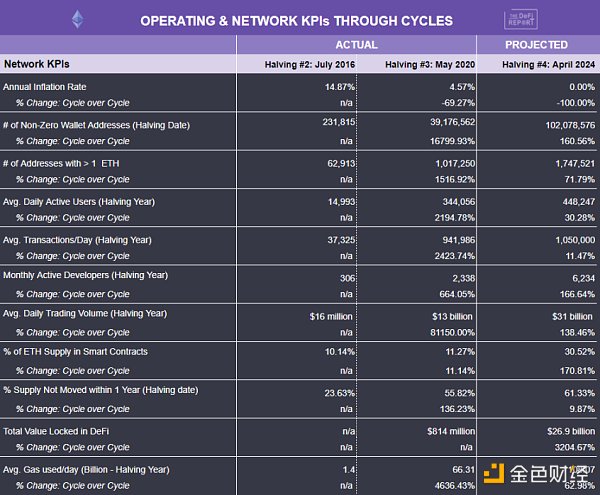

In order to highlight the growth of operational and network KPIs during each cycle, here are some quick views of Ethereum data:

The author believes that the “broadband moment” of cryptocurrency is coming, which may usher in the next wave of consumer applications and new users.

Finally, competing L1 public chains (such as Solana) are showing strong resilience.

Narrative

The following are the remarks of famous investor Jeff Gundlach at the recent Future Proof conference:

“Overall, I believe the US dollar will depreciate significantly in the next economic recession. This is because the response to the next economic recession will be a complete disaster relative to our financial situation. This will sound the alarm and make us realize that the United States is bankrupt. We cannot fulfill our debts. The United States has nearly $200 trillion in unfunded liabilities-almost 8 times GDP. In terms of today’s purchasing power, we must pay 10% of GDP in the next 80 years. We will not do that. We will completely abandon the US dollar. We will see a restructuring of the US financial system.”

If this really happens, we will see the following:

The author solemnly declares that he does not want a future great recession. But it is important to consider that if certain situations arise, such narratives may prevail.

Narratives are difficult to predict. Did anyone predict that LianGuaiul Tudor Jones would publicly share his views on Bitcoin in the previous cycle? Michael Saylor and Microstrategy? Did anyone predict that Tesla, Square, and Mass Mutual would buy Bitcoin and include it in their balance sheets? Did anyone predict that BlackRock would apply for a Bitcoin ETF before this cycle?

Remember, the “shame” associated with crypto is finally starting to disappear. BlackRock is a catalyst. This means that cryptocurrency is now entering a “turning point” stage in the traditional market-as the integration of new technologies and the traditional financial system becomes higher and higher, new regulations “bless” new technologies. Recent victories in court (Ripple, Grayscale, Uniswap) indicate the significant changes that are emerging.

Not to mention, the media loves cryptocurrencies. There is a reason why major platforms like CNBC and Bloomberg continue to increase their coverage of cryptocurrencies. Cryptocurrencies are very eye-catching. These media outlets are eager to promote the next narrative.

But ultimately, the future narrative is determined by the market. However, it seems to be consistent with the economic cycle in the United States, the global liquidity cycle, the innovation cycle of public chains, and the halving cycle of Bitcoin.

On-chain Signals: Market Value and Realized Value

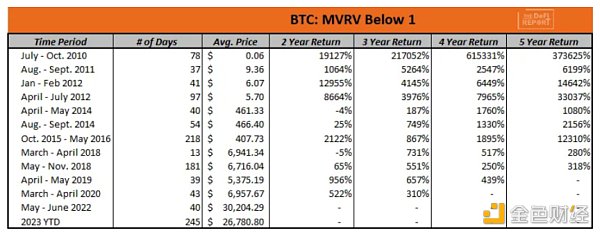

Let’s take a quick look at one of the on-chain signals: MVRV. The current ratio of market value to realized value is 0.41.

Historically, long-term investors have been able to make a lot of money by entering the market when the MVRV signal is below 1.

Risks

Although the above explanations look good, nothing is guaranteed. So where are the problems? The author believes that the following points need to be noted:

-

Inflation. If inflation does not continue to decline (or accelerates), the Federal Reserve will find it difficult to change its monetary policy. This may delay or negate judgments about the economic cycle and the shift in monetary policy.

-

No recession. Although reluctant to say so, the economy needs to really be in trouble for the Federal Reserve to adjust its monetary policy. If this situation does not occur, the author’s viewpoint is unlikely to be confirmed.

-

Regulation. The SEC may still continue to take a tough stance and prevent the approval of the BlackRock ETF. The author believes that this is unlikely, but it is still something that needs to be considered.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!