Written by: THOR HARTVIGSEN

Translated by: Deep Tide TechFlow

Market Overview

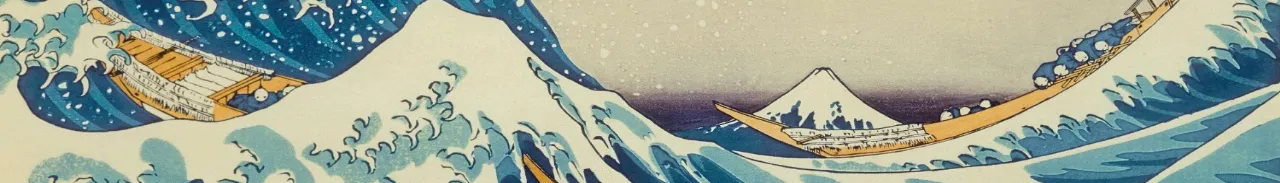

DeFi liquidity is at its lowest level since February 2021. It is well known that a high interest rate environment makes pursuing on-chain returns less attractive. Coupled with the decline in cryptocurrency prices, this has resulted in a new low in TVL.

- Glassnode The breakthrough of the critical price support in the market is caused by the leverage liquidation in the derivatives market.

- When friend.tech has options contracts Speculation on speculation, is it worth participating?

- Dynamic Feast How do popular concepts in the cryptocurrency market rotate, and what are the returns of 14 mainstream sectors?

What does this mean? It means that profitability in the short term has become more difficult. To get a project off the ground, liquidity needs to flow out from other areas of DeFi. Unless you have a solid advantage in this field, or you spend more than 16 hours a day staring at the screen, the best practice may be to develop a long-term investment strategy and stick to it. Avoid excessive trading in this hostile environment that can shake you.

Why did the price collapse?

As can be seen from the chart below on Coinalyze, on August 17th, most of the open futures contracts were liquidated, resulting in a large number of long positions being liquidated. The volatility of cryptocurrencies has been very low in the past few weeks, and when this happens, futures traders increase their opening interests to bet on the market trend as volatility returns. When prices start to fall, a large number of long positions are forced to close, leading to more positions being liquidated, and the cycle continues. Therefore, it is difficult to attribute recent price movements to any specific news. In addition, there has been a further sell-off in the spot market, which may indicate that larger participants are selling their positions.

Winners of the past 14 days

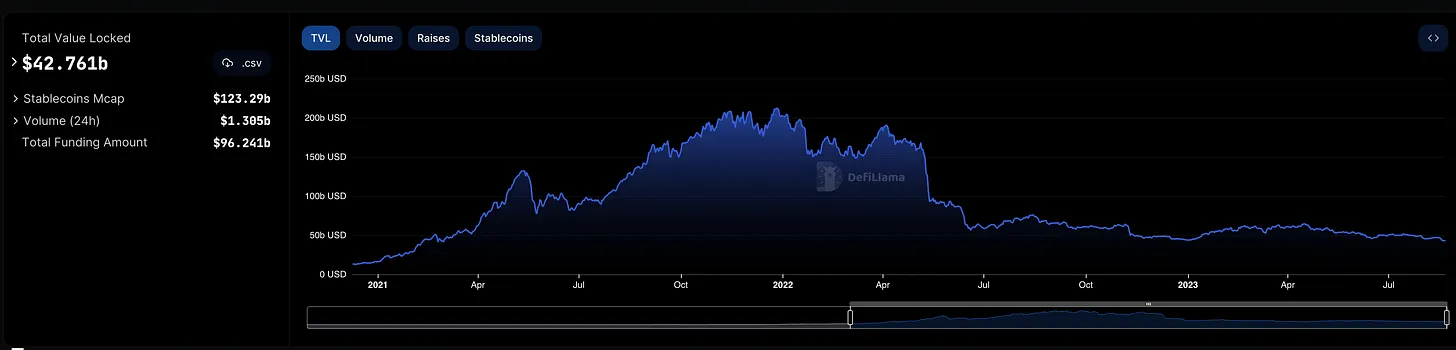

By just looking at cryptocurrency Twitter (cryptocurrency X??), you wouldn’t notice the price drop and the dull market. Coinbase’s new Rollup chain Base has recently attracted a large number of users and liquidity due to the Friend tech application.

Some statistics comparing Base/Arbitrum/Optimism:

14-day fees:

- $3.4 million – Base;

- $2.6 million – Arbitrum;

- $2.5 million – Optimism.

14-day revenue:

- $2.3 million – Base;

- $0.9 million – Arbitrum;

- $0.8 million – Optimism.

Income is calculated based on the fees paid by users on the Rollup chain minus the cost of publishing these transactions (call data) on Ethereum. From the data, it can be seen that not only has Base generated more fees recently, but the profit margin is also significantly higher.

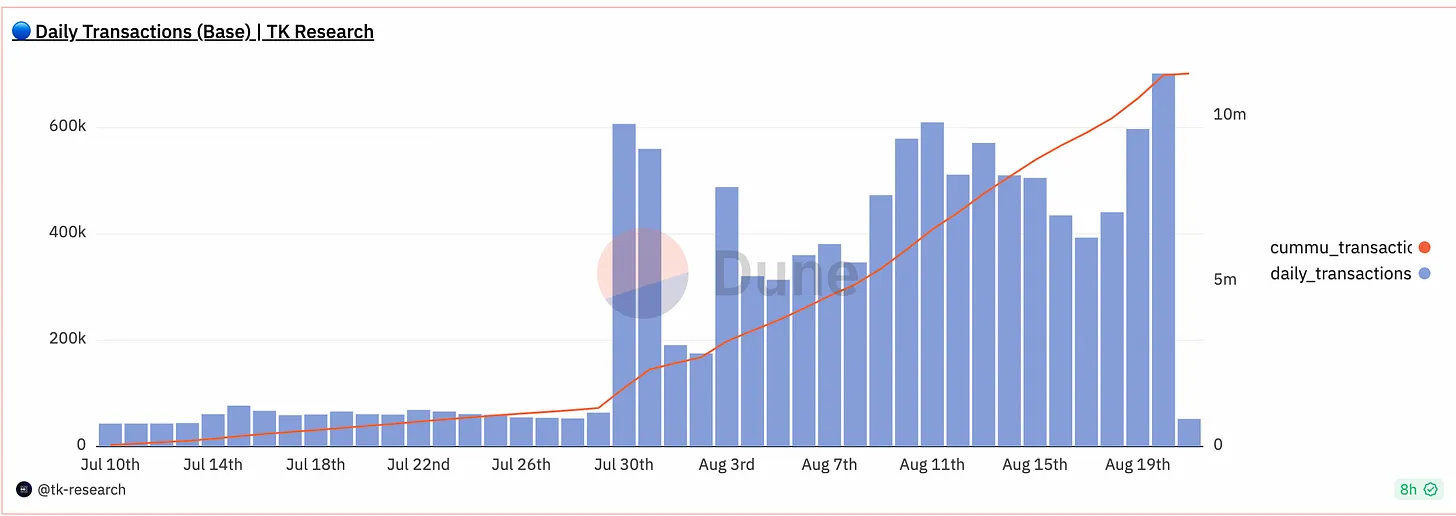

Friend tech

Friend tech is a new social application on Base where you can buy and sell shares of registered Twitter profiles. It has experienced explosive growth in user adoption and generated over $3 million in revenue in the past 7 days. All transactions require a high fee of 10%, with 5% going to the platform and 5% going to the user whose shares are being traded.

Friend tech is a major dApp attracting users to use Base. With the launch of more protocols (such as Aave and Uniswap) and the expansion of the ecosystem, Base is likely to continue growing. The current 7-day annualized revenue is approximately $42 million, which is a significant component of Coinbase’s annual revenue.

News and Catalysts

ETF Deadline and Grayscale

Grayscale is engaged in a lawsuit with the U.S. Securities and Exchange Commission (SEC) over converting its existing GBTC trust into a spot Bitcoin exchange-traded fund (ETF). While many have anticipated a decision this week, Grayscale may be required to reapply and the process could take up to 240 days before a final decision is made. However, as seen below, Grayscale is expanding their ETF team. What does this mean? It is likely that they are trying to convey a message that they are serious about the conversion to an ETF and not that they have some insider information about the outcome of the case.

According to ETF experts, a delay in the approval of the ETF is most likely to occur.

Coinbase Acquires Circle’s Stake

Coinbase recently acquired a stake in Circle, adding another potential cash cow to their team. The terms of the acquisition are not yet clear, but it has been revealed that the “Centre Consortium” responsible for managing USDC will be shut down. USDC will also be launched on 6 other blockchains this year. Some of these are expected to include Polkadot, Near, Optimism, and Cosmos. In terms of revenue sharing, Coinbase and Circle will still share revenue based on the amount of USDC held on their respective platforms, while interest income generated from the widespread use of USDC will be evenly distributed.

Frax Expands to RWA

After decoupling from USDC earlier this year (FRAX has a strong collateral relationship with USDC), the vision of FraxV3 has been brewing. Founder Sam Kazemian referred to FRAXV3 as the “ultimate stablecoin”. This involves collaborating with Financial Reserves and Asset Exploration Inc Public Benefit Corporation (FinresPBC) to tokenize real-world assets as collateral for FRAX. The profits from these operations will be passed on to token holders through so-called “Fraxbonds” (FXB). Fraxbonds allow people to purchase future FRAX at a discounted price (i.e., purchase FRAX at $0.9 per FRAX two years from now).

Thorchain Loan Launch

Thorchain has just launched their loan product, and users can currently borrow a variety of assets with BTC and ETH as collateral. The collateral list will soon expand to include various new assets such as BNB, BCH, LTC, ATOM, AVAX, and DOGE.

One of the core mechanisms of this loan design is to destroy $RUNE (the collateral used by users to borrow) upon issuing debt and mint $RUNE upon liquidation. This allows for loans without liquidation even if the price of collateral such as ETH or BTC drops, as the collateral is stored in the form of RUNE behind the scenes.

On-chain Capital Flow

Off-chain Labs Appears to Be Buying Back $ARB

1.72 million ARB tokens were purchased on Binance for $0.98 per token (a total of $1.7 million) and sent to an address labeled Offchain labs (the company behind Arbitrum). This is close to the lowest trading price of $ARB since its listing earlier this year.

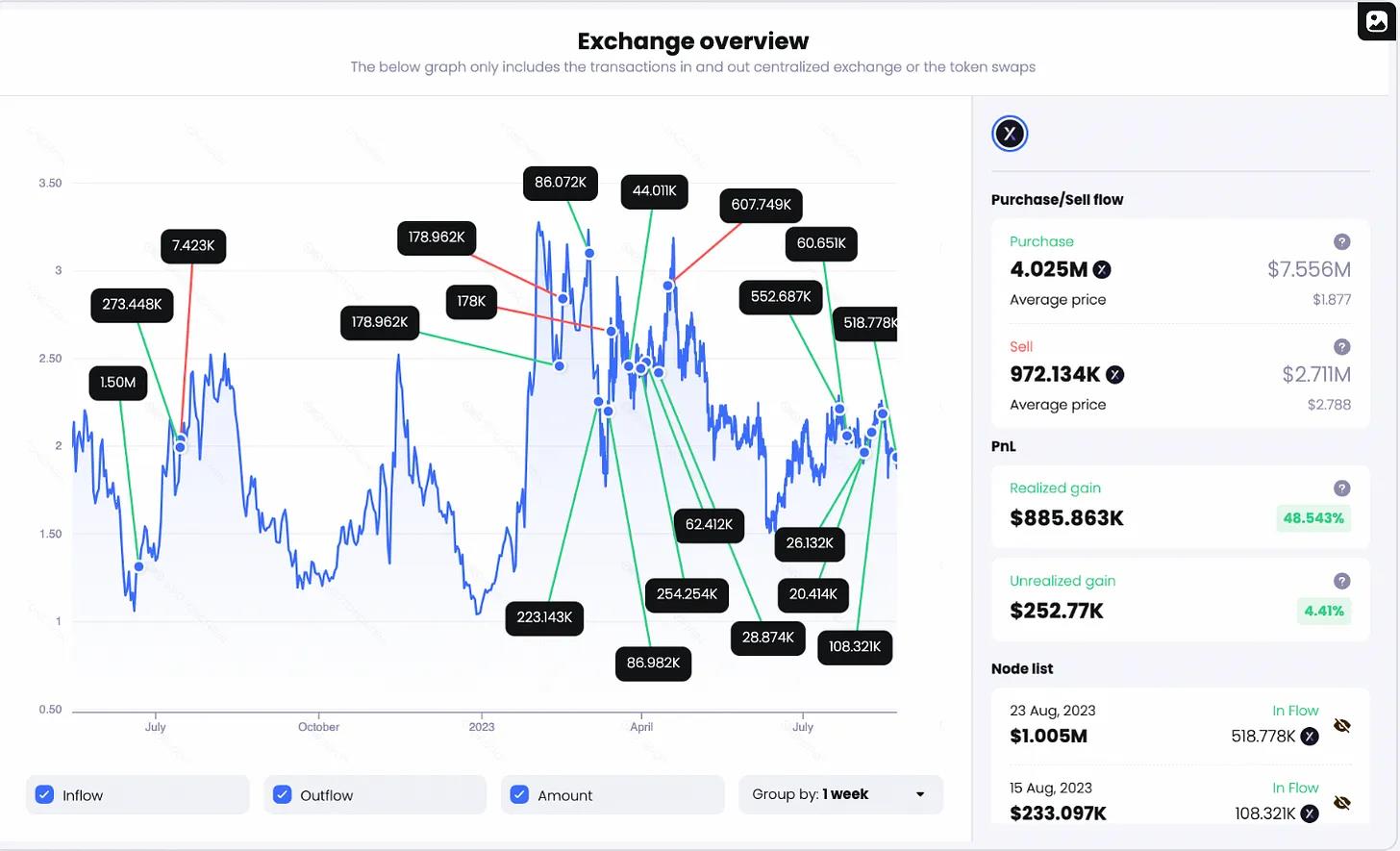

CMS Holdings Accumulates $DYDX

CMS is an early investor in dYdX and has further traded the token over the past two years. They recently purchased 519,000 $DYDX on Binance for $1.94 per token (a total value of $1 million). The average purchase price on CEX trades (excluding private sales) was $1.88, and the average selling price was $2.78. Currently, CMS holds 3.05 million $DYDX (valued at $5.98 million).

DeFi Airdrops and Strategies

Friend tech Airdrop

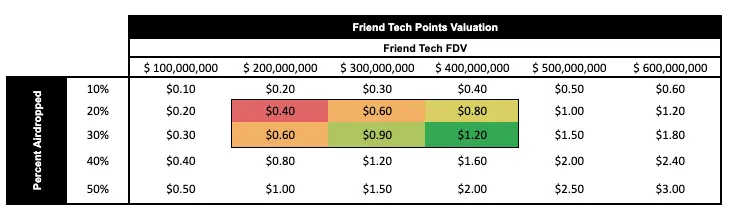

Friend tech will reward platform users with 100 million points over the next 6 months. The table below estimates the price per point based on the issuance valuation and the percentage of airdropped token supply.

It appears that the points are rewarded based on trading volume but may also be related to referrals. Nevertheless, it seems that top users have already accumulated the majority of the distributed points.

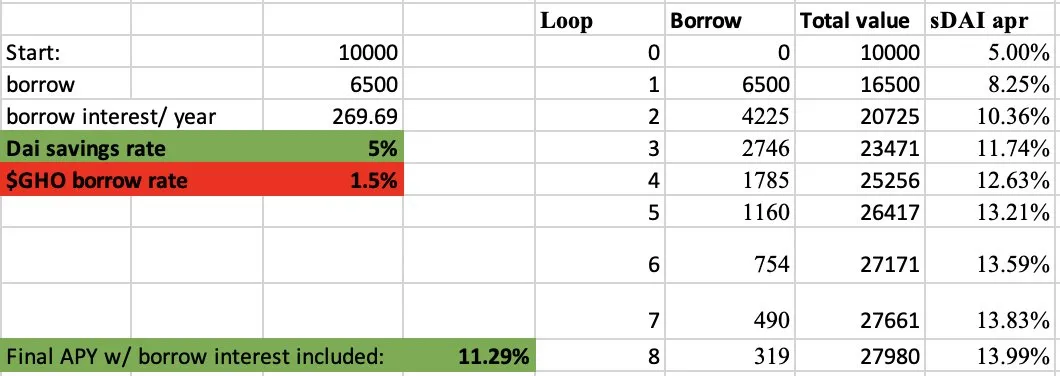

Real-World Assets (RWA) Mining

Maker’s SLianGuairk protocol offers a 5% annual yield on the Dai Savings Rate (DSR). This yield comes from the income generated by DAI, which serves as collateral for real-world assets (RWAs) such as US Treasury bonds. While this may not sound exciting if you are a US citizen with direct access to US Treasury bonds, a current proposal on Aave suggests adding the flow token (sDAI) of the DAI Savings Rate as collateral for the lending market. As shown below, cycling 8 times (depositing sDAI on Aave, borrowing the native stablecoin $GHO, converting it back to sDAI, and repeating) would result in an 11.29% annual yield!

This may go live in the next few weeks and the annualized yield does not take into account gas fees. Nevertheless, an 11% annualized yield on investing in DAI and obtaining sustainable yield from the US government is very exciting and can attract new and more sophisticated participants in this field over a longer period of time.

Swell Airdrop

Swell is an Ethereum liquidity staking protocol that is currently conducting an airdrop campaign. Staking ETH as swETH will earn “Pearls” over time, which will be converted into $SWELL tokens later this year. Depositing your swETH into protocols like Pendle or Maverick can also earn additional Pearls. Recent calculations estimate that 1 Pearl is approximately equal to $0.33.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!