Are there any opportunities for Pendle GLP YT at the moment?

In the following content, I will analyze the logic of the asset opportunity from the following two perspectives:

- The operating mechanism of Pendle PT YT

- The reasons for the low APR of GLP and whether there is data support for a bottoming rebound

- HashKey Investment Manager ETH has a lot of positive factors on the virtual level in the first and second half of the year.

- Cryptocurrency Market Weekly Review (08.12-08.18) Deteriorating macro environment leads to market decline.

- Analysis of 6 recent projects that have seen a counter-trend surge Can this speculative frenzy in blockchain continue into a bull market?

The operating mechanism of Pendle PT YT

The value of the original asset (coin-based principal + coin-based income) in a specific time interval = PT + YT

PT represents the principal, and YT represents the income. Because the value of the original asset in a specific time interval is fixed at the beginning, the prices of PT and YT change in opposite directions. YT is affected by the APY/APR of the original asset itself, and it will rise or fall. After its price changes, it will affect the price of PT. Secondly, YT gradually decreases over time and will gradually be realized as profits for the holder of the original asset.

To put it simply, YT is affected by the APY/APR of the original asset. If the APY/APR of the original asset rises, it will not fundamentally affect YT. The price of YT is determined by market expectations and market buy and sell orders. However, it should be noted that if the buyer of YT holds YT until the maturity date, they will need to bear the loss (Implied APY > Underlying APY) or profit (Underlying APY > Implied APY) shown by YT’s Long Yield APY.

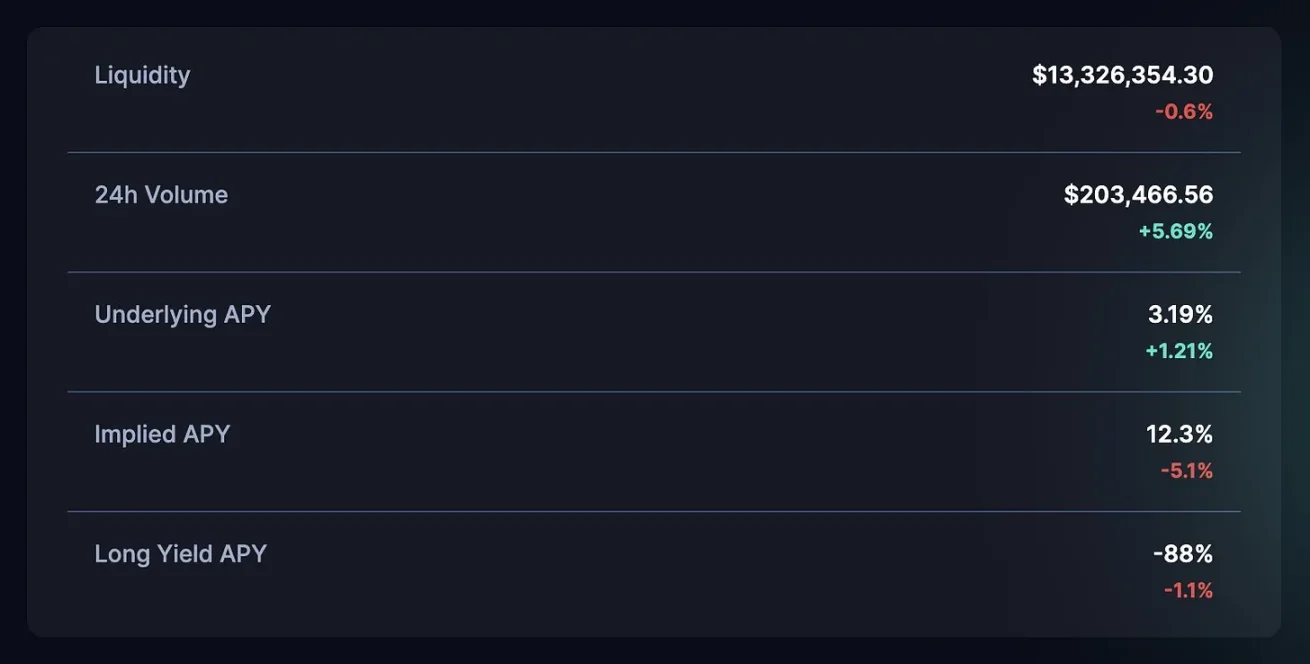

The current situation of GLP is that the Underlying APY is 3.19%, the Implied APY is 12.3%, and the Long Yield APY is -88%. This means that you will definitely lose money if you hold YT now. But why would I consider the arbitrage opportunities that may exist between YT and GLP? It is because of the profit expectations for GLP.

So, let’s talk about the second point: the reasons for the low APR of GLP and whether there is data support for a bottoming rebound

The income of GLP is not as good as before, and the reason is the low trading volume caused by market confidence and a long period of sideways movement (as well as competition from perp DEX through airdrop expectations and transaction mining for market share) – fundamentally, the income expectation of GLP depends on “volatility”.

So, will the yield of GLP experience a bottoming rebound?

Now, after a new round of decline, volatility has arrived in the market. Regarding the long period of sideways movement before, it feels like the sideways movement around 29k mainly came from the disagreement between the bullish and bearish sides of the market – of course, this is just my personal opinion, and we still cannot confirm it with certainty at the moment. The future market volatility may be higher, but this wave of decline has finally brought some vitality back to the market.

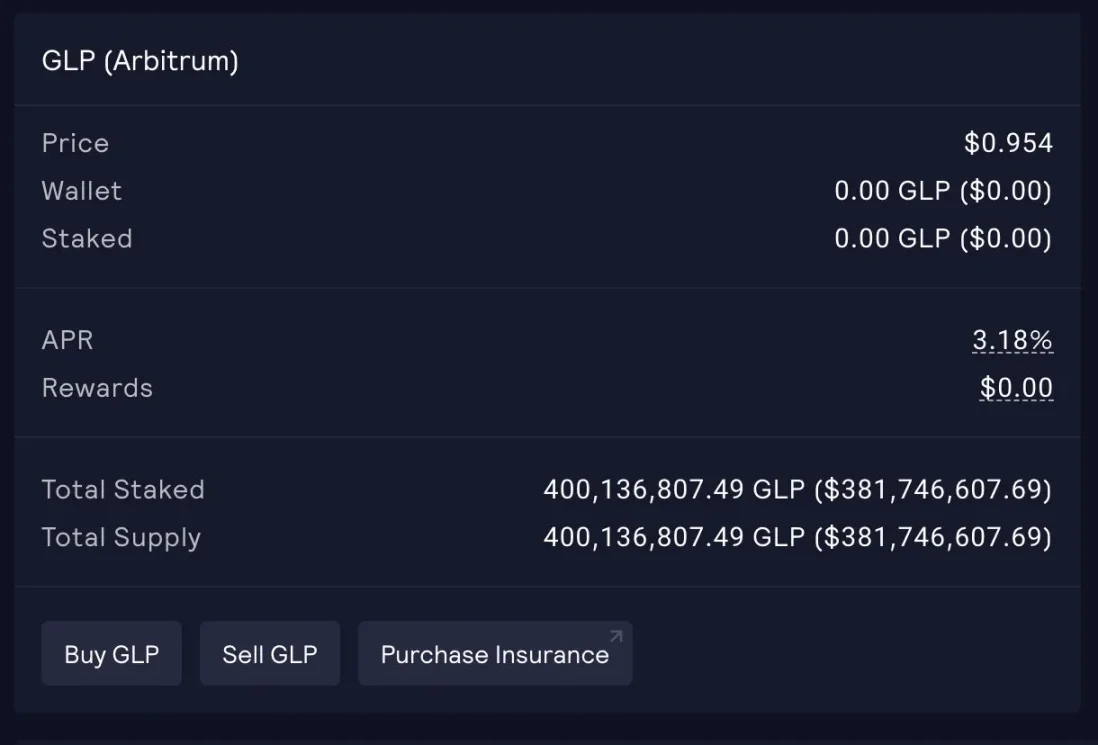

So, what is the current data like? The GLP APR (Arbitrum) next Wednesday will rise from 3.18% to 27.43%, and the reason for this is market fluctuations.

This means that as long as the future yield rate of GLP (Underlying APY) > Implied APY, then holding YT will be profitable. If the market is bullish on GLP or market fluctuations, then buying YT-GLP is a good choice – even though the Long Yield APY is negative (which is currently at a low position), as long as the market becomes active, the performance of GLP APR/APY returns will be better. Market expectations of positive values will drive up the price of YT-GLP. (Another point to pay attention to is GMX v2. Although the launch of GMX v2 has performed mediocrely in terms of token price, I believe that GMX has optimized many potential issues in trading experience, which is not bad.)

Therefore, from the perspective of income expectations, YT is very likely to follow the rise of GLP APR, experience a rebound, and then return to a normal level (higher than the current level), which is also the opportunity I believe in.

Thank you for reading. This is a content related to my interests – because I have bought YT-GLP. The purpose of this content is to analyze my buying logic and is not investment advice.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!