Author: Climber, LianGuai

On August 10th, Friend.tech invited the beta test to start, and the trading volume on the first day exceeded 4400 ETH (about 8.1 million US dollars), becoming another hit project after BALD on the Base chain.

Due to the recent unethical run-away incident of the BALD project, many community members are naturally immune to Friend.tech. Since the first day of the project’s birth, there have been continuous voices of doubt, calling it the next Ponzi scheme. However, judging from the recent performance of Friend.Tech, this SocialFi DApp seems to be getting more and more popular and has a rising trend.

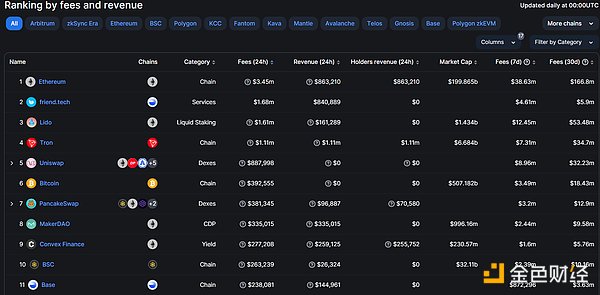

As of the time of this article, the total trading volume of Friend.tech has exceeded 30,000 ETH, and the protocol fees in the past 24 hours have reached 1.68 million US dollars, ranking second only to Ethereum, surpassing Lido and Tron. Some people have also used MEV bots for arbitrage trading, and the profit-making effect has attracted discussions from users both at home and abroad on social media.

- Market volatility returns, analyzing the arbitrage opportunities of Pendle GLP YT

- HashKey Investment Manager ETH has a lot of positive factors on the virtual level in the first and second half of the year.

- Cryptocurrency Market Weekly Review (08.12-08.18) Deteriorating macro environment leads to market decline.

Continuously flourishing Friend.tech

Friend.tech has only been online for about ten days but has continuously set new highs in on-chain data for the project, becoming the new favorite of the Base network.

According to DefiLlama data, the blockchain fees generated by Friend.tech in the past 24 hours have exceeded 1.68 million US dollars, successfully surpassing other well-known blockchain projects such as Lido, Uniswap, and Tron, ranking second only to Ethereum.

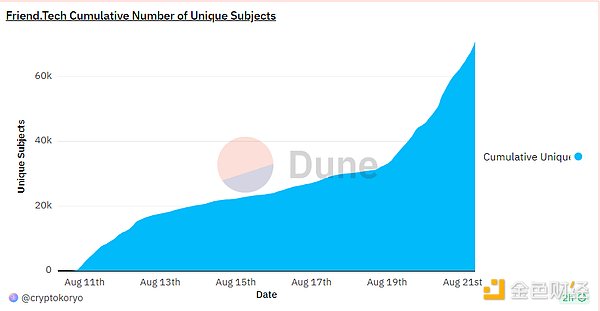

Due to the continuous spread of Friend.tech in the crypto community, according to Dune Analytics data, the number of independent users interacting with the application has more than doubled in the past two days, increasing from about 31,500 people on August 18th to over 69,587 people.

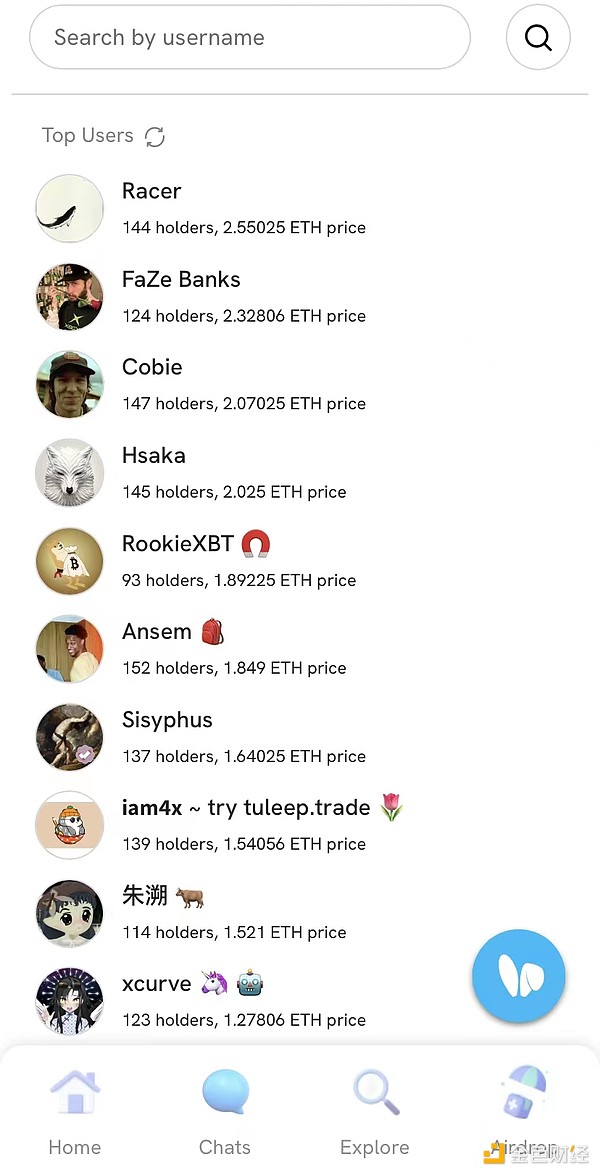

The popularity of Friend.tech continues to expand, and some well-known figures in non-crypto fields have also joined this social media DApp, such as Y Combinator founder Garry Tan, NBA player Grayson Allen, and professional gamer Faze Banks.

Reasons for the popularity

In the depressed bear market, the occasional appearance of a popular crypto application is enough to attract investors’ attention. Among them, LianGuaiRadigm, a leading crypto investment institution, helped Friend.tech establish a foothold in the early stages of its birth, and the addition of the friend.tech-related token section on the well-known crypto data analysis website CoinGecko represents a certain degree of recognition for the project.

However, a standout project is mostly due to its own product mechanism design that caters to market demand. Specifically, there are several key points that have contributed to the popularity of Friend.tech:

1. Exquisite admission threshold design

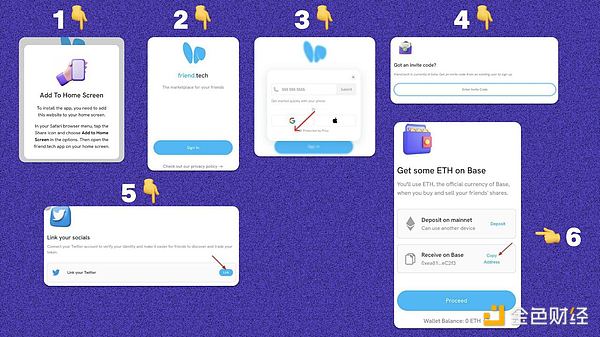

Although Friend.tech has certain thresholds for registration and login, the process and difficulty are simplified in the SocialFi section.

Friend.tech DApp requires a third-party invitation code to login, and it needs to be linked to a personal X account through a Google email or Apple ID. The final step, which is the basis for buying and selling social account stocks, is to deposit at least 0.01 ETH into the designated contract address on the Base chain. In other words, the basic cost of using this product is about 17 U.

However, Friend.tech has simplified the economic mechanism in the design of X to Earn. Social media KOLs can directly “issue” personal tokens, and all transactions are priced in ETH instead of other tokens, which directly improves the efficiency of buying and selling financial products tied to trading projects for users.

2. Early earning effect

So far, the Friend.tech project is still in the early growth stage. The product has a short opening time and various functions are not yet complete. Racer, the co-founder of the project, stated that they initially made the application public to start load testing, but did not expect it to become popular and spread quickly.

In the SocialFi mechanism designed by the project, users gain chatting permissions by buying and selling “stocks” of other users. In this process, the price of user “stocks” increases as the number of transactions increases. Therefore, for early users, both the initial capital threshold and the cost of buying celebrity “stocks” are relatively low.

The biggest beneficiaries of this mechanism are obviously the KOLs on social media, so their promotional behavior can be seen tirelessly. Ordinary users can also resell their own shares and make a profit.

From the Friend.tech DApp, it can be seen that the number of “stock” holders among the top KOLs in the application is not too many, with the highest being only 152 people. In addition, the highest selling price of “stocks” has reached about 2 ETH in just 10 days.

3. Airdrop interaction expectation

In mid-August, SEI and CyberConnect were listed on Binance, but the airdrop reward settings made many airdrop hunters cry out against being “anti-rubbed”, so users who expected to profit from airdrops began to pay more attention to popular high-quality projects.

Prior to this, Friend.tech officially announced that it would airdrop reward points to application test users. Points will be distributed every Friday and will have special uses. Over the next six months, one billion points will be distributed in succession.

Although the project team did not specify the use of points, the implication of the airdrop is already very clear, and the way to obtain points is also very simple, just use Friend.tech.

In addition, since Friend.tech is deployed on the Base chain and the L2 network has officially stated that it will not airdrop tokens, the high-quality projects on the chain have become the biggest airdrop targets.

Therefore, as Friend.tech becomes more popular and more airdrop hunters join the platform, the project will create a snowball effect.

Continued controversy

Although Friend.tech continues to break records in terms of data, community popularity, and network influence, various doubts have never stopped since its inception.

First of all, in terms of data and information security, Friend.tech requires users to use their personal Google or Apple IDs on the login page, and then they must link to an X account to proceed. For individual users, this undoubtedly means handing over their personal information to a third party.

Recently, the on-chain data monitoring platform Spot on Chain stated that Friend.tech has issues of data leakage through API and the ability to buy and sell shares from contracts without an invitation code. In addition, Yu Xian, the founder of SlowMist, also wrote that the wallet addresses of more than 100,000 Twitter accounts corresponding to Friend.tech have been leaked.

Secondly, in terms of the project’s business model, cryptocurrency commentator @Yazan suggests that this business model will fail due to its poor pricing model, which may be heavily manipulated due to the concept of shares.

Other institutional analysts also suggest that although the popularity of Friend.tech is rising, this hype may be short-lived.

The biggest controversy comes from the fact that Friend.tech is an application that goes against the spirit of Web3 encryption. It not only collects users’ Twitter account and social relationship information, but only well-known KOLs and early participants benefit from it.

Although users earn 5% in each transaction, the “shares” of platform users are rarely sought after. They can only profit from the price difference in the next transaction by buying KOL “shares” at a high price, but this undoubtedly carries investment risks.

Therefore, some US securities practitioners believe that because the project model appears similar to the stock market, it is likely to quickly attract the attention of the SEC for regulation.

In addition, the Friend.tech product itself is also very mysterious. Whether logging into its official website or app, no information about any product can be obtained, including product introductions, official documents, etc.

In response to the above controversies, Racer, co-founder of Friend.tech, stated that the project is only a test version and inevitably has some shortcomings. They are currently focusing on expanding the project’s infrastructure, fixing errors, and setting basic policies for the website. As for how to maintain the growth of Friend.tech or protect it from increasingly serious legal issues, etc., it needs to wait until the website stabilizes.

Regarding the issue of data leakage, the official statement from Friend.tech is that the so-called data leakage is just someone using its publicly available API to display the association between public wallet addresses and public X (original Twitter) usernames. Therefore, regarding this question, it is like saying that someone is attacking by viewing users’ public information on X.

In addition, in order to avoid a strong association between “Shares” in Friend.tech and “stocks” in traditional securities markets, the project’s official has renamed “Shares” to “Keys” and explained that “Keys” better reflects their function as in-app items used to unlock user chat rooms.

Although the voices of these doubts and controversies are growing louder, it seems that they have not stopped the progress of Friend.tech and the pursuit of members from both domestic and foreign communities. The most obvious evidence is the increasing trading volume, active users, and discussion intensity of Friend.tech.

Conclusion

Based on the current community’s perspective, the voices against the Friend.tech model still dominate. Especially considering the previous failure of BitClout, a decentralized social product that is very similar to it, some people predict that the hype cycle of Friend.tech will end within a month.

However, the current trend of Friend.tech’s continued popularity indicates that its product potential and commercial value have not been fully explored, especially as an exploratory application for Web3 social. Considering the relatively low entry and investment threshold, users may wish to give it a try.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!