Editor| Bowen@Web3CN.Pro

Table of Contents

1. Project Overview

2. Project Vision

- SocialFi ultimately moved towards financialization

- Stablecoin #USD on Ordinals: Issuer Stably has deployed 12 chains, but has been questioned for riding on the hype and lack of transparency in its information.

- Suave: A new tool to improve Ethereum transaction processing efficiency

3. Features and Advantages

1. Features

- Modularity

- Architecture

- Decoupled Execution

2. Advantages

- Autonomy

- Easy Deployment

- Minimal Governance

- Efficient Execution Environment

- Scalability

4. Development History

5. Team Background

6. Financing Information

7. Development Achievements

- Project Progress

- Ecological Development

8. Economic Model

9. Risks and Opportunities

- Risks

- Opportunities

On May 26, Celestia (formerly LazyLedger) tweeted to celebrate the 4th anniversary of the publication of its whitepaper. As a pioneer of modular blockchains, how has Celestia developed over the past four years? Read on to find out.

1. Project Overview

Celestia is the first “modular blockchain,” formerly known as “LazyLedger,” and is dedicated to “data availability (DA)” infrastructure.

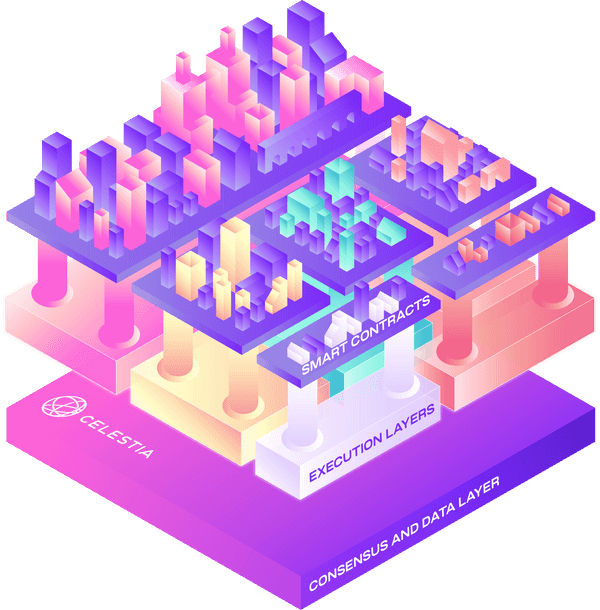

Modularity is the key to solving the blockchain trilemma and will bring a secure, scalable, and decentralized multichain future. Celestia adopts a modular architecture, deconstructing blockchains into data, consensus, and execution. With a streamlined and modular consensus layer, Celestia empowers developers with limited budgets to easily deploy their own blockchains.

2. Project Vision

Ethereum envisions a future centered around Rollups, which are often more expensive and less flexible than L1 but can share security with one another. In contrast, Cosmos is an ecosystem of interoperable sovereign L1s called zones. Cosmos is cheaper and more flexible than Rollups, but they cannot share fully in each other’s security.

Celestia combines the essence of these two projects, with the vision of combining Cosmos’ sovereign interoperable region with Ethereum, which is centered around Rollup and has shared security, to provide a more flexible, secure, and cost-effective public chain.

三、特色和优势

1. 特色

- Modularity

Blockchain has always been a distributed network that executes state machine replication, which is divided into three layers: data, consensus, and execution. In a monolithic blockchain, all three layers of data, consensus, and execution are completed by one network, so the higher the complexity, the higher the cost and complexity of keeping the system synchronized.

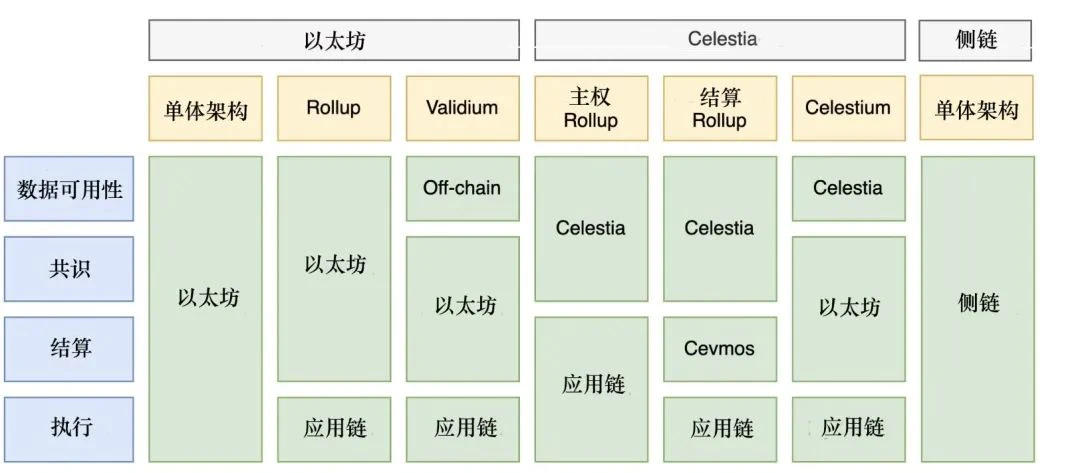

Ethereum Rollup separates the execution layer, processes complex transactions, and solves part of the problem, but Rollup must monitor L1 and execute call transactions for calculation, and then return to L1 in different ways. Data availability still depends on Ethereum’s consensus and execution layers, and the cost of using Ethereum’s execution layer is still high, and the range of deployment available to developers is still limited.

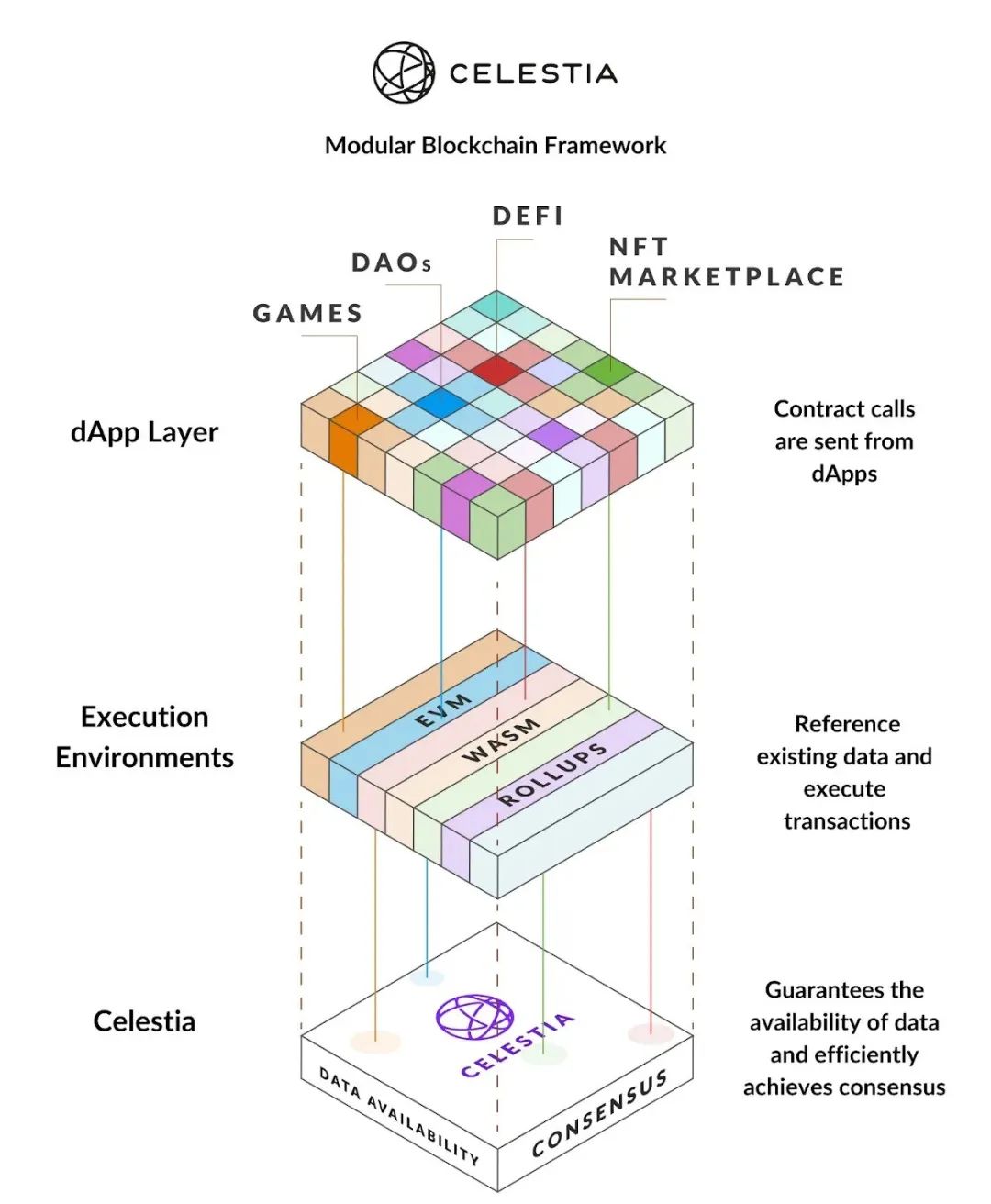

Celestia is a modular protocol that only handles data availability (DA), and other execution and settlement work can be locked to the DA layer. Developers can directly choose the execution environment to use and build DApps on Celestia.

- Architecture

Ethereum Rollup’s Layer 2 network is an execution layer, and the data availability, consensus, and settlement layers of these projects are all Ethereum, so Rollup theoretically has security close to the Ethereum mainnet. Layer 2 networks that use off-chain solutions such as Validium sacrifice data availability security to expand the throughput of the Layer 2 network.

Image source: DeFi之道

Celestia provides different solutions for modular expansion. The architecture currently has three types:

① Sovereign Rollup: Data availability layer and consensus layer are Celestia, settlement layer and execution layer are their own sovereign chain;

② Settlement Rollup (representing project Cevmos): Data availability layer and consensus layer are Celestia, settlement layer is Cevmos, and the application chain is the execution layer;

③ Celestium: Data availability layer is Celestia, consensus layer and settlement layer are Ethereum, and the application chain is the execution layer.

- Decoupled Execution

Celestia will receive transactions packaged by the sovereign Rollup and order them using the consensus protocol Tendermint. Unlike other blockchains, Celestia will not question the validity of these transactions or be responsible for executing them. Celestia treats all transactions “equally” and will accept them as long as they pay the necessary fees, sort them, and broadcast them on the chain. Rollup nodes for the sovereign Rollup will execute transactions to calculate their state, and any transaction that Rollup nodes consider invalid will not be processed. As long as Celestia’s history remains unchanged, Rollup nodes that run the same validity rules can calculate the same state.

2. Advantages

- Sovereignty

Currently, Ethereum’s Rollup publishes block headers on Ethereum, and fraud/validity proofs are executed on the chain, so their state is determined by a series of smart contracts on Ethereum.

The operation mode of the Rollup on Celestia is completely different, it has no perception of the data it stores, and leaves all interpretive and execution powers to the Rollup, which operates like most L1 blockchains currently. Therefore, the Rollup on Celestia is essentially a blockchain with its own sovereignty.

- Easy Deployment

The Celestia team is implementing the ORU specification using Optimint’s Cosmos SDK. This tool supports the deployment of any chain without developers worrying about the cost of consensus or expensive deployment/operation costs. New chains can be deployed in seconds, and users can interact with them securely from day one.

- Minimal Governance

Blockchain governance is slow, and improvement proposals often require years of social coordination to implement. While this is necessary for security, it significantly slows down development in the blockchain space.

Modular blockchains provide a better way for blockchain governance, where the execution layer can act quickly and independently, while the consensus layer can remain stable.

- Efficient Execution Environment

In Celestia, state growth and historical data are completely separated. Celestia’s block space only stores historical Rollup data, which settles in bytes, and all state execution is metered by them in their own independent units of Rollup. Since activity is subject to different fee markets, a peak in activity in one execution environment does not disrupt the user experience in another execution environment.

- Scalability

Although decoupling execution does not require everyone to execute all transactions, it sacrifices composability and has limited scalability.

Celestia addresses the scalability issue by Data Availability Sampling (DAS). Celestia does not care about the validity of transactions; it is interested in whether block producers have fully published the data behind the block headers. Celestia only provides data availability and does not execute state, so block production can be higher, each block has more space, blocks become larger, more data can be sampled, and higher TPS is achieved.

IV. Development History

2019.05 LazyLedger Whitepaper Released

2021.03.04 LazyLedger Labs Completes $1.5 Million Seed Round, Plans to Launch Testnet by Year-End

2021.06.15 LazyLedger Renamed Celestia

2022.05.25 Celestia Launches Its First Testnet, Mamaki

2022.10.20 Celestia Completes $55 Million Funding Round, Led by Polychain Capital

2023.03.15 Celestia Testnet BlocksBlockingce Race Goes Live, Block Explorer Has Been Launched

2023.05.12 Celestia: Quantum Gravity Bridge Initial Version Goes Live on BlocksBlockingce Race Testnet

V. Team Background

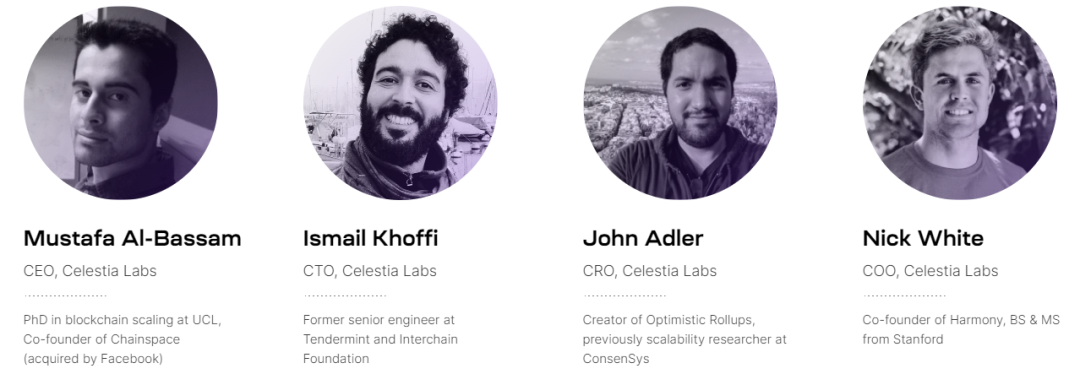

The mission of the Celestia team is to change the way blockchain and decentralized applications are built, making them more secure, scalable, and autonomous.

Team members have extensive experience building and extending blockchains in projects such as Ethereum, Cosmos, and Harmony.

- Mustafa Al-Bassam

CEO of Celestia Labs, graduated from University College London with a PhD in computer science. Co-founder of hacker organization Lulzsec and ChainsBlockingce. ChainsBlockingce is a company that implements smart contract platforms, which was acquired by Facebook in 2019. Mustafa has also written several groundbreaking papers on the security of sharded blockchain systems. Named one of Forbes’ 30 Under 30 in Technology in 2016.

- Ismail Khoffi

Ismail Khoffi, Chief Technology Officer at Celestia Labs, is a well-known research engineer in the industry. He holds a Ph.D. in Computer Science from the University of Bonn. Khoffi has contributed significantly to various non-blockchain and blockchain projects, such as Google UK and Tendermint, in addition to building academic research models.

- John Adler

John Adler, Chief Risk Officer at Celestia Labs, previously worked as an L2 scalability researcher at ConsenSys, focusing on Ethereum 2.0’s Phase 2 work. Adler identified a new application of data availability from Mustafa and created the first pioneer for the Optimistic Rollup solution. Adler is also a co-founder of Fuel Labs.

- Nike White

Nike White, Chief Operating Officer at Celestia Labs, holds a Bachelor’s and a Master’s degree from Stanford University. Before joining Celestia, White co-founded the blockchain protocol Harmony, which provides scalable blockchain infrastructure, to provide new momentum for the decentralization revolution. White is also a senior AI expert for Zeroth.ai, an Asian AI startup accelerator project.

In addition, Celestia Labs has dozens of members, including engineers, managers, and advisors.

VI. Financing Information

In March 2021, Celestia completed a $1.5 million seed round of financing led by Binance Labs, with other investors including Interchain Foundation, Maven 11, KR1, Signature Ventures, Divergence Ventures, Dokia Capital, P2P Capital, Tokonomy, Cryptium Labs, Michael Ng, Simon Johnson, Michael Youssefmir, and Ramsey Khoury.

The seed round investment lineup is quite luxurious, mainly focusing on two institutions. One is the Cosmos creator Interchain Foundation, and the other is Binance Labs. These two institutions can provide a lot of help in terms of project resources and trading venues.

On October 19, 2022, Celestia Labs announced the completion of a $55 million financing led by Bain Capital Crypto and Polychain Capital, with other participating investors including Coinbase Ventures, Jump Crypto, FTX Ventures, Placeholder, Galaxy, Delphi Digital, Blockchain Capital, NFX, Protocol Labs, Figment, Maven 11, Spartan Group, and several angel investors including Balaji Srinivasan, Eric Wall, and Jutta Steiner.

The institutional lineup for this round is even more luxurious, with top-level traditional web2 institution Bain Capital Crypto and web3 leading institutions Polychain Capital and FTX Ventures.

According to an insider, Celestia has raised a total of $55 million in its A and B rounds, and the latest round of funding has made Celestia a unicorn with a valuation of $1 billion.

Seven. Development Achievements

Project Progress

Although it has been polished for four years, Celestia is still a young project, having raised a total of $56.5 million in two rounds of financing. At the end of March this year, the testnet of BlocksBlockingce Race Phase II was launched, and cross-chain bridge nodes, full storage nodes, and light nodes can start participating. Celestia’s official Twitter currently has 120,000 followers, and the Discord and Telegram communities are also very active.

Ecological Development

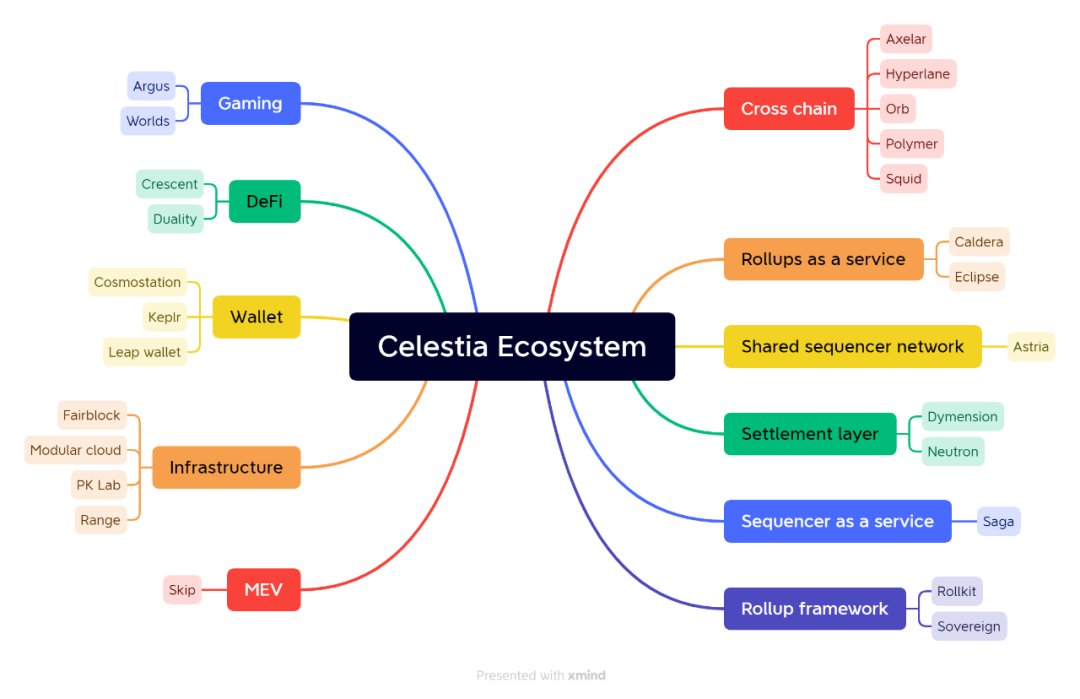

Officially, Celestia has 25 projects in its ecosystem, covering categories such as Gaming, DeFi, Wallet, RaaS, cross-chain, and infrastructure.

Eight. Economic Model

Celestia has not yet issued tokens

Nine. Risks and Opportunities

Risks

As the first modular blockchain, Celestia has a long way to go. Whether its envisioned technology can be realized, whether its roadmap can be completed, and whether its ecosystem can attract more projects to settle in are all difficulties and potential risks that Celestia currently faces. The project is still in its early stages, and its success requires further market validation.

Opportunities

Celestia has built a public chain that separates the data layer and allows developers to focus on the design above the data layer without having to pay attention to the underlying data records. Many people believe that this modular design of the data-available layer can not only provide faster solutions for expansion but also greatly reduce the difficulty for developers to enter Web3 in the future.

Currently, Celestia has not yet issued tokens, and you can follow the official community to keep up with the development and participate in ecosystem construction. Among many new public chains, Meta’s Aptos, Sui, and others are relatively dazzling, and this time it is Aleo in the privacy track, while Celestia is also doing well in terms of financing, ranking high on the new public chain list, and its strength should not be underestimated.

Reference:

https://celestia.org/ecosystem/

https://www.odaily.news/post/5177802

`

https://foresightnews.pro/article/detail/15497

`This is already in English and appears to be a link. However, the HTML code is incomplete, as it is missing the opening `` tag. If you want to create a hyperlink, the correct format would be:`https://foresightnews.pro/article/detail/15497`This would display the link as clickable text, leading to the specified URL.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!