Author: Jiang Haibo, BlockingNews

The emergence of the Ordinals protocol brings a new narrative to Bitcoin. When these inscriptions or BRC20 tokens are traded on decentralized markets, they are almost always mediated by BTC, and there is no stable payment tool. In more heavily traded centralized exchanges, people typically prefer to use USDT, USDC, or USD for trading.

On May 25th, Stably announced on Twitter that they had issued a USD-backed, regulatory-compliant stablecoin #USD on the Bitcoin Ordinals protocol. Subsequently, the main wallet of Ordinals and the NFT market UniSat also announced a collaboration with Stably. If stablecoins can be used to buy and sell BRC20 tokens on the UniSat market, it will undoubtedly be more convenient for users. Stably has not issued stablecoins for the first time. Previously, stablecoins had been issued on Ethereum, Harmony, Stellar, and other chains.

Basic information of BRC20 #USD

The stablecoin issued by Stably is called Stably USD, usually abbreviated as USDS. Since USDS in Ordinals has already been taken, and the BRC20 token symbol cannot be duplicated and must be four characters, Stably ultimately chose “#USD” to represent its stablecoin issuance.

- Suave: A new tool to improve Ethereum transaction processing efficiency

- Comparative analysis of the four major ZK solutions on Polygon: What are their characteristics and advantages?

- BRC-1155 and GBRC-721: New Bitcoin NFT gameplay with a minimum minting cost of $5

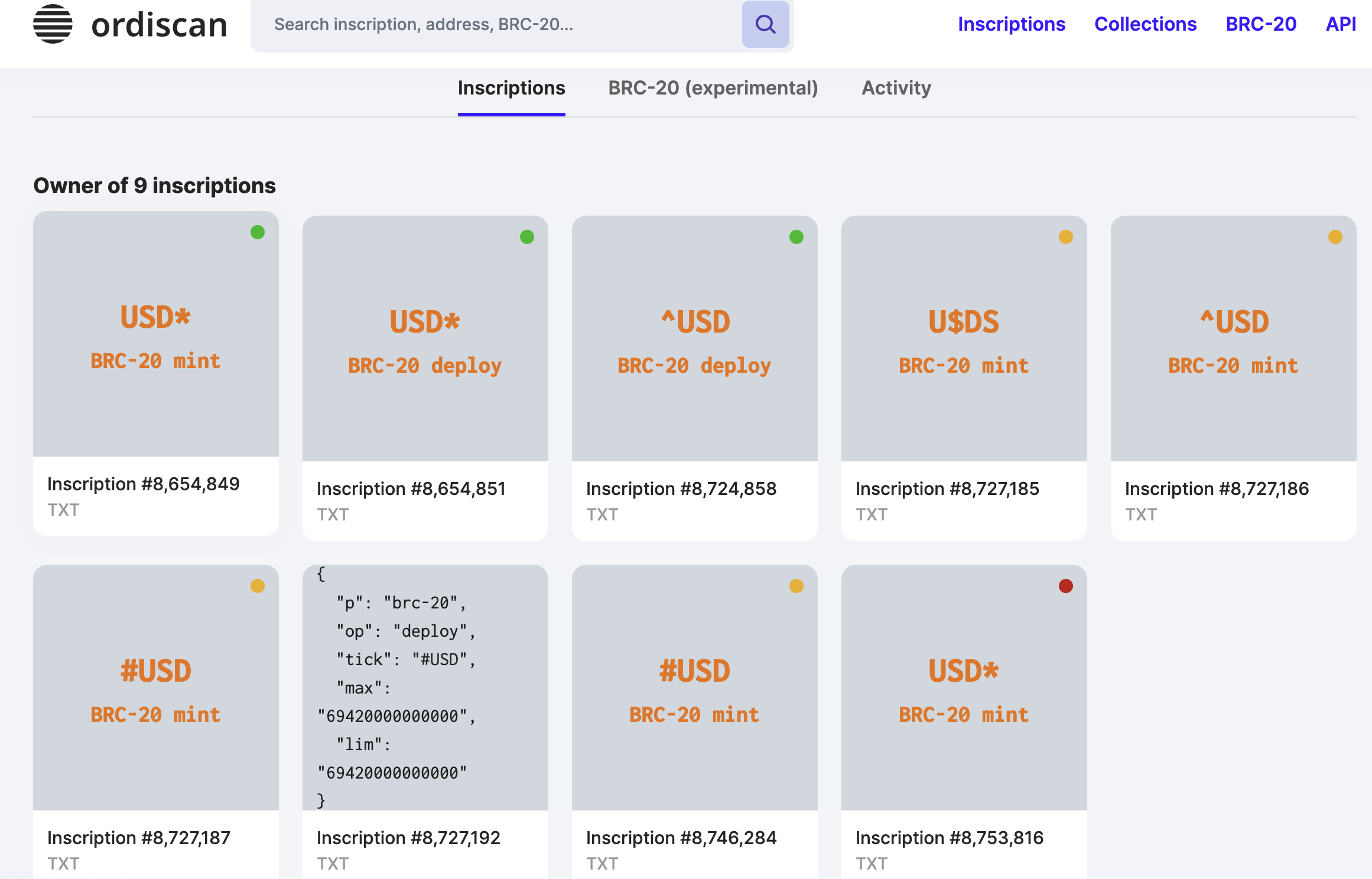

The maximum supply of #USD adopts the maximum theoretical limit of 69.42 trillion BRC20 tokens. According to the disclosed Treasury wallet, the casting of #USD has reached the upper limit through a casting transaction of the Treasury wallet, and Stably has also deployed and cast multiple BRC20 tokens related to the USD name, including USD\*, ^USD, and others.

It should be noted that Stably does not directly hold the US dollars required for issuing #USD, but they are held by Prime Trust. Prime Trust helps Stably with custody and sets up a custody account in a bank with FDIC deposit insurance. However, Prime Trust is not an FDIC-insured deposit institution or bank, and the FDIC deposit insurance has a maximum coverage limit of only $250,000 per customer and does not protect against losses caused by Prime Trust’s bankruptcy or unauthorized access to accounts.

Stably #USD casting and redemption requirements

According to Stably’s description, #USD is a regulatory-compliant stablecoin, and there are no requirements if it is traded on the secondary market. However, if you want to cast or redeem #USD through Stably, you need to follow the corresponding compliance process.

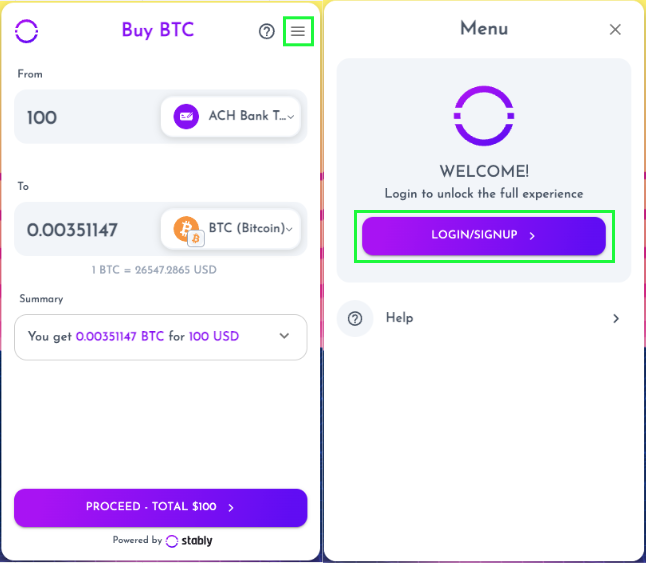

First, users need to register for a Stably Ramp account, complete KYC verification, add a bank card payment method, and create a trading buy and sell request. The Stably team will then contact the customer by email within 2 working days and explain the next steps.

When buying stablecoins, customers deposit dollars or USDC/USDT into Prime Trust and receive #USD in the BRC20 wallet. When selling, #USD is sent to the Treasury wallet address and customers receive dollars or USDC/USDT.

Payments in USDC and USDT on Ethereum can be received on the same day, but because the current transactions require manual confirmation by Stably, if fiat deposits are made using Fedwire and SWIFT, customers may need to wait up to 5 working days. Stably plans to support automatic transactions for Fedwire, ACH, SWIFT, and other methods in the third quarter of this year.

In addition, while there are no fees for minting and redeeming, there is a 0.5% conversion fee for using USDT/USDC for minting, and a fixed fee for using Fedwire or SWIFT for fiat deposits. Additionally, customers will also need to pay the gas fee for the blockchain network.

Stably USD has been issued on 12 chains, but the scale is small

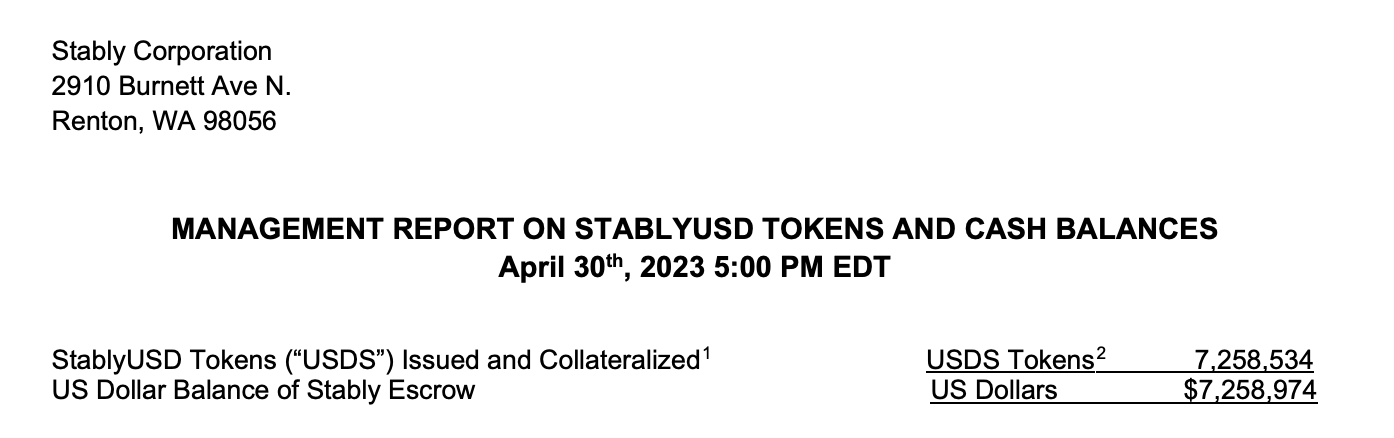

Stably USD has been issued on 12 different chains, including Bitcoin’s Ordinals protocol, but the overall scale is not large. According to an independent auditor’s report provided by The Network Firm for Stably, as of April 30, 2023, the total circulation of Stably USD was 7258534, and the reserve account balance was $7,258,974, slightly higher than the issuance of USDS.

Regarding compliance, Stably’s official website shows that its subsidiary holds an MSB financial license issued by the Financial Crime Enforcement Bureau (FinCEN) of the Treasury Department. The partner chosen by Stably, Prime Trust, is a trust company regulated by Nevada and acts as a “qualified custodian” regulated by the US Securities and Exchange Commission under the Investment Advisers Act, helping customers to custody both cryptocurrencies and fiat currencies.

Based on this information, Stably’s license for issuing stablecoins seems to be somewhat behind that of stablecoin issuers such as Circle, which also holds a BitLicense license issued by the state of New York.

Stably’s stablecoins are being questioned

As a stablecoin issuer that is not among the top players, Stably has frequently launched stablecoins on multiple blockchains, and its practices have been questioned by Decrypt. The following are some points summarised from Decrypt’s article.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!