Author: 0xLoki Translation: DeFi Dao

The key to this question is that we cannot simply look at what they say (organizational goals), we also need to look at what they do (actual behavior). There is a simple way to answer this question: understand the business and personnel structure of the SEC and SFC.

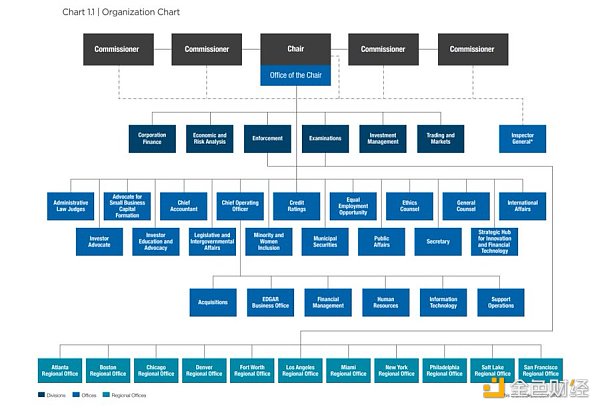

First, let’s take a look at the SEC’s architecture. At the top is a committee consisting of a chairman and four commissioners, with six departments, one inspector general’s office, and 11 offices below. In addition, there are 11 regional offices that need to report to both the Enforcement and Examinations departments at the same time.

- Scammers hijack eight Twitter accounts and steal nearly $1 million in cryptocurrency

- Forbes: SEC’s cryptocurrency enforcement action will not stop at Binance and Coinbase

- Why does everyone want to regulate Crypto?

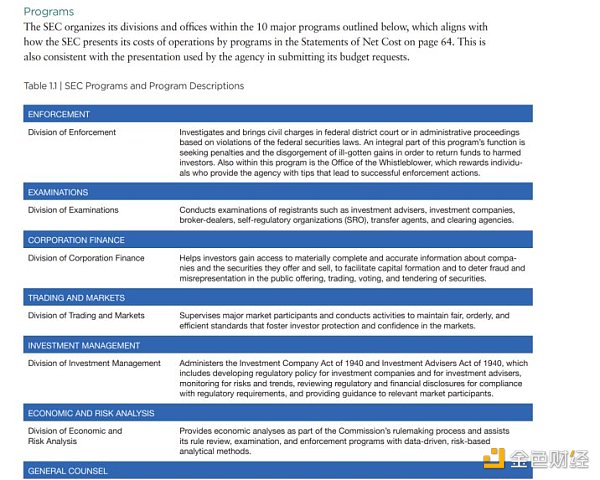

From the organizational structure, we can see that the Enforcement and Examinations departments seem to be the most important in all departments. In the descriptions of the various departments later on, we can also see that the Enforcement and Examinations departments are also ranked first and second.

In addition, there is even more persuasive data: financial information. SEC’s funding comes from roughly three sources:

1) Fiscal budget;

2) Securities transaction fees and application fees;

3) Forfeitures.

Among them, forfeitures are divided into two categories: A. Those that require compensation to victims, where forfeitures will be used to compensate victims and be injected into the US Treasury’s General Fund. B. Those that do not require compensation to victims, where forfeitures will be allocated to the Investor Protection Fund, whistleblowers (providers of investigation clues), and to fund investigations by the Inspector General’s Office.

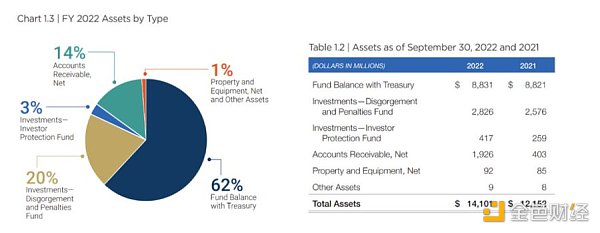

Next, let’s take a look at SEC’s balance sheet. According to the 2022 annual report, SEC’s total assets increased from $12.2 billion to $14.1 billion, an increase of $1.9 billion. Investments increased by $400 million, while accounts receivable increased by $1.5 billion, most of which are from forfeitures, with investment expenses already deducted from the regulatory process.

In addition to forfeitures, the OMB allocated a reserve budget of $50 million to the SEC in 2022, an investor protection fund budget of $390 million; SEC transaction fees of approximately $1.8 billion; and application fees of $640 million. It can be seen that forfeitures have become a “pillar revenue.”

After looking at revenue, we can see that the net spending of the enforcement office and the inspection office is the highest, totaling $1.75 billion, or 65% of total spending. These expenses ultimately translate into law enforcement actions: according to another SEC public article, the SEC filed a total of 760 enforcement actions in the 2022 fiscal year, an increase of 9% over the previous year. This includes 462 new or “independent” enforcement actions.

These enforcement actions have brought in substantial revenue: the total amount ordered to be paid is $6.439 billion, including civil fines, forfeited gains, and pre-judgment interest, the highest in SEC’s history, surpassing the $3.852 billion in 2021 fiscal year. Among the total amount ordered, civil fines were $419.4 million, also a historic high.

Under this system, the SEC has provided generous rewards for whistleblowers. In the 2022 fiscal year, the SEC awarded approximately $229 million in 103 awards, the second highest in history. At the same time, the number of whistleblower reports in the 2022 fiscal year was also the highest in history, with the SEC receiving 12,300 reports. Gensler requested that the SEC obtain resources and increase its staff from 4,685 to 5,139 people, which is also reasonable.

In summary, the SEC’s behavior path is not difficult to understand. This is a form of after-the-fact law enforcement. First, let as many people as possible come in and make their own actions, and then investigate, collect evidence, prosecute, and punish as much as possible. Therefore, it is not difficult to understand the statement that the SEC is “all securities except BTC”. Expanding law enforcement targets is the first step, of course, whether to choose law enforcement and whether the prosecution is established depends on many factors.

After talking about the SEC, let’s take a look at the SFC. The structure of the SFC is significantly different from that of the SEC, and may only involve market inspection and intermediary supervision under the intermediary department. In addition, the intermediary department also set up a “licensing department”, which is closely related to the familiar licensing system.

According to the SFC’s 2021-2022 annual work summary, the SFC conducted a total of 220 individual case investigations throughout the year, initiated 168 civil proceedings, and fined licensed institutions and individuals a total of HK$410.1 million. In addition to law enforcement, another important data is that the SFC received 7,163 license applications that year; and processed more than 38,000 license data verifications through WING.

Although SFC mentioned that “we will take enforcement action against unlicensed platform operators in appropriate circumstances”, from the enforcement cases, illegal activities in traditional financial fields such as insider trading and market manipulation, corporate fraud and improper conduct, negligence of intermediaries, and improper internal control are still the main focus.

In terms of revenue and expenditure, SFC’s structure is very simple. The total revenue of SFC for 2021-2022 is HKD 2.247 billion, of which “transaction levy” accounts for 95.3%, and other income accounts for 6.7% (mainly charged to market participants). Confiscated income does not appear in SFC’s revenue sharing. Among the expenditures, 75.7% are personnel expenses. According to the annual report data, as of 2022, SFC has a total of 913 employees.

In addition, based on this data, the statement that SFC makes money from “licensing” is not accurate, as market transactions contribute the majority of SFC’s revenue. According to the application fee/annual fee of HKD 0.47-12.97 per activity for licensed corporations and HKD 1790-5370 per activity for licensed representatives, the 3231 licensed institutions and more than 40,000 licensed personnel cannot contribute much revenue.

From past data, SFC does not have the motivation like SEC. On the other hand, SFC does not have the enforcement capabilities like SEC. SFC only has 903 employees, and these employees also need to deal with the complicated business of HKEX and HKFE, handle a large number of license applications, maintenance and inspections, and even go to “promote kindness and make the world a better place”, making it difficult to allocate so much manpower and resources for proactive law enforcement.

Based on the above data, it can be seen that SFC does not have the policy inclination like SEC, and SFC/SEC are essentially operating in accordance with the principle of “same business, same principle, same risk”; SEC has a very strong regulatory tendency towards cryptocurrencies, but it also has the same tendency towards other financial institutions; and SFC is unlikely to treat cryptocurrencies differently.

Overall, I think the likelihood of SFC enforcing laws on a large scale like SEC is very small. For entrepreneurs, as long as they do not explicitly violate current Hong Kong laws and regulations, they do not need to worry about regulatory pressure. However, I do not think that “Hong Kong market” and “actively licensed” are suitable for every project party, as the application and maintenance require considerable costs. Even without a license, there are still many other Web3-related things that can be done in Hong Kong.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!