Author: Bankless; Translation: BlockingBitpushNews Mary Liu

After last week’s regulatory crackdown, it’s not easy to think about whether cryptocurrency is facing a threat to its survival, but in this article, we will discuss the centralization issue of Lido-the CEX lawsuit last week may only exacerbate this problem.

For several months, steadfast Ethereum decentralization supporters and LSD holders have patiently waited for what crypto analysts consider inevitable: the outflow of Lido’s staking.

Many people (including some of us at Bankless) naively concluded that enabling withdrawals during the Shapella upgrade would help decentralize Ethereum staking. Unfortunately, reality does not match this statement, and now, as the more mature Lido approaches controlling 1/3 of Ethereum staking, the Ethereum community is beginning to seriously sound the alarm.

- After the SEC “clean-up”, are there still gray areas for cryptocurrency assets?

- Inventory of LSDFi classification and 8 early projects worth paying attention to

- What’s the story behind Taiko, the Type-1 zkEVM rising star who secured a $12 million funding from Sequoia Capital despite the market downturn?

We will explore why the U.S. Securities and Exchange Commission’s (SEC) attack on exchange staking will only further benefit Lido, demonstrate why Lido’s success story is self-perpetuating, and explain why breaking Lido’s staking centralization is urgent.

SEC’s “Assistance”

Just last week, the U.S. Securities and Exchange Commission traced Binance and Coinbase. The scope of the charges against these two exchanges varies, but both complaints have a common theme: the SEC is investigating the staking services these two CEXs offer to their U.S. users.

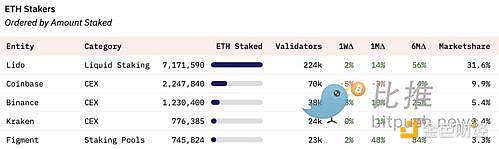

Binance and Coinbase control 15.3% of all ETH on the beacon chain by offering products that are highly competitive with Lido’s.

Although the SEC’s complaint is not specifically against Ethereum staking solutions, the agency has hinted that it is willing to investigate Ethereum staking.

As early as February, as part of a settlement agreement with the SEC, Kraken was forced to terminate its Ethereum staking service for U.S. users, and Gensler Chairman claimed that “everyone in this market should be aware of this.”

The deposit pattern caused by the SEC’s continued crackdown will be more centralized, and Lido may occupy a larger market share of ETH staking.

Prophecy of Self-Continuation

Despite the enabling of withdrawals, Lido maintained its dominant position in Ethereum staking with nearly 900,000 ETH (14.3%) added to deposits this month. Since Shapella, Lido’s market share has grown from 31.4% to 31.6% – evidence that the protocol has transformed past success into self-fulfilling dominance in the future.

Lido derives these sustained advantages from the natural advantages of its ETH staking derivatives and the ability to weaken competitors’ cost structures.

Token Advantages

Holders of stETH benefit from the token’s deep liquidity – making it one of the few viable liquidity collateral options for whales in DeFi – and widespread collateral integrations in DeFi have increased the token’s use cases.

Because stETH has certain characteristics that make it more attractive than regular LSD, capital – especially mature capital seeking the best investment attribute combinations – will continue to pour into the token, further giving Lido’s staking derivatives an advantage over other competitors.

Cost Structure

Currently, Lido offers the lowest fees among all blue-chip staking providers, which means that financial incentives are actively driving stakers toward Lido.

The gap between Lido and its closest competitors will only grow over time, while squeezing out profits, which will crowd out other competitors’ market space as more and more stakers flock to Lido to take advantage of what they see as increasingly lucrative staking opportunities.

There are cases similar to Lido in the traditional financial world.

Vanguard completely changed the investment world in the 1980s as a low-cost passive index giant, constantly lowering competitors’ fees in a bottom-up competition, and has maintained an advantage for nearly half a century. Lido directly borrows from this playbook!

Breaking Lido’s Centralized Position

Lido’s governance organization is indifferent to the survival threat posed by its ever-increasing stakeholding, and overwhelmingly voted against self-limiting deposits in June 2022.

At first glance, doing so seems to go against the best interests of LDO token holders and harm Lido’s profitability, but it’s clear that the consequences of not self-limiting are very real.

More and more Ethereum holders are supporting opposition to Lido, with some believing that if they refuse to self-limit, the community should forcibly correct their behavior. While concerning, we’re unlikely to see such controls implemented at the base layer as it would require a hard fork, which could compromise Ethereum’s fragile social consensus layer and could lead to a contentious chain split.

The Lido community should worry about the prospect of its staking centralization turning into a hindrance to future demand for Ethereum block space.

The protocol is approaching the first of three critical thresholds, at which Ethereum’s core properties of value proposition are downgraded, thereby giving potential attackers greater power over the chain. If Lido continues to grow at an uncontrolled pace, it will inevitably exceed these thresholds and pose systemic risk to the ecosystem.

In past bull markets, narratives about decentralization and resistance to censorship were always overlooked by the hottest trends of the moment.

There’s no better time than a bear market to protect the fundamental properties of the Ethereum network. Without active measures to undermine Lido’s dominance, staking providers are likely to continue expanding their market share.

So how do you get involved?

Fortunately, the crypto disruption wars always stem from small forces, and you don’t have to be a whale to participate in decentralizing the staking of ETH.

First, don’t stake with Lido.

You can consider staking with Swell and qualifying for a SWELL airdrop later this year, starting your own Rocket Pool mini-pool with as little as 8 ETH, earning higher returns by taking a commission on Ethereum staked to your personal node, or depositing Ethereum LSD into unshETH to increase rewards through token incentives. For technically adept users, we may recommend running your own validator.

Anyway, transferring the pledge out of Lido will help in the fight against centralization, but relying solely on the power of wallets cannot stop Lido from continuing to dominate. It is now time to follow the example of activists and continue to speak out!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!