Authors: @Tonantzin_LC, markmuro1, Sifan_Liu

Translation: Block unicorn

Last year, it seemed like everyone was talking about cryptocurrency – from celebrities to athletes, news anchors, and investors. Even elected officials got in on the action as local governments looked to cryptocurrencies as a solution to issues like job growth and income inequality.

Now, however, the hype cycle for cryptocurrencies has come to an end (though Bitcoin has seen a recent uptick). Following a major collapse in the cryptocurrency industry, entrepreneurs and venture capitalists have turned their attention to generative AI tools, such as those driving ChatGPT and other systems.

- Deep analysis of data on the Blur blockchain

- A comprehensive analysis of Balancer’s innovation in DEX: 7 liquidity pools and architectural logic

- Ethereum Ecosystem Weekly Report: Plans to conduct stress tests on EIP-4844 at Devnet #7 and develop a complete set of Dencun EIP for Devnet #8.

This raises some questions: Where does the cryptocurrency craze stand as new AI systems dominate headlines? Where has job and startup growth related to cryptocurrencies recovered since the recent crash, and where has it not? What lessons can state and local officials draw from this to prepare for the next big tech opportunity?

To explore these questions, this article examines levels and locations of US cryptocurrency activity using new data. Overall business activity is tracked by analyzing job postings in the cryptocurrency and blockchain industries. Entrepreneurial activity is measured using data from the startup ecosystem. These signals are then discussed to evaluate the wisest next policy moves for state and local lawmakers.

Cryptocurrency trends have been volatile in recent years

Even by the industry’s long history of instability, recent years have been tumultuous for cryptocurrency trends. At the height of the most recent hype cycle, some state and local officials embraced cryptocurrency. These officials competed for cryptocurrency-related jobs by introducing bills or staging publicity stunts, such as announcing that they would accept their salaries in cryptocurrency or promoting city-branded cryptocurrencies. In other cases, they explored methods for allowing residents to pay for government services in cryptocurrency or allowing governments to mine Bitcoin.

However, by the end of 2022, a spectacular collapse by Sam Bankman-Fried (SBF, founder of FTX) and his cryptocurrency exchange FTX triggered a catastrophic tide that sent cryptocurrency values plummeting. Some cryptocurrency firms declared bankruptcy, and many retail investors lost their life savings, with a few groups of investors suffering particularly severe blows. The collapse prompted many local leaders to abandon their earlier “gold rush” efforts, while regulators and other officials stepped in and shifted the focus to consumer protection.

In summary, the overall business and entrepreneurial activity has gone through a crazy and volatile process, with very uneven impacts on different places. We can depict the volatility of the industry by looking at job postings that require cryptocurrency and blockchain skills (an indicator of overall recruitment and employment activity) and the number of cryptocurrency and blockchain startups.

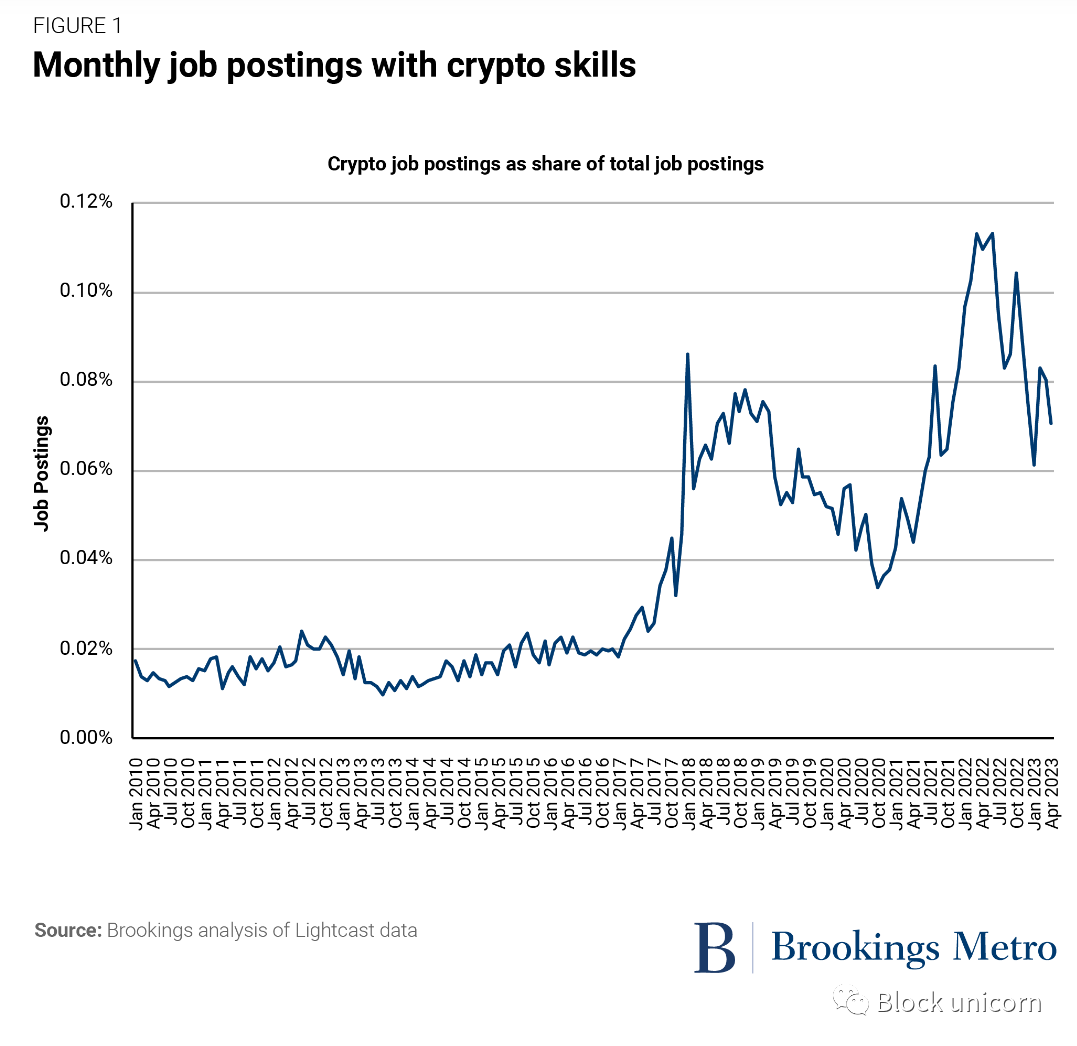

In the mid-2010s, as cryptocurrency became increasingly popular, the industry’s recruitment information showed an overall upward trend. However, like the price of cryptocurrency, this trend was not without fluctuations. With the fluctuation of Bitcoin’s value, recruitment information has also changed, with the most significant spike occurring in 2021 and early 2022.

Then, in the second half of 2022, there was a significant decline, as cryptocurrency projects such as TerraUSD, Three Arrows Capital, Celsius, and Voyager failed, as well as FTX’s collapse at the end of the year. This decline was very severe, but it is worth noting that even at the peak, the number of job postings in the cryptocurrency industry was very few: less than 0.15% of all job postings, and now it is less than 0.08%.

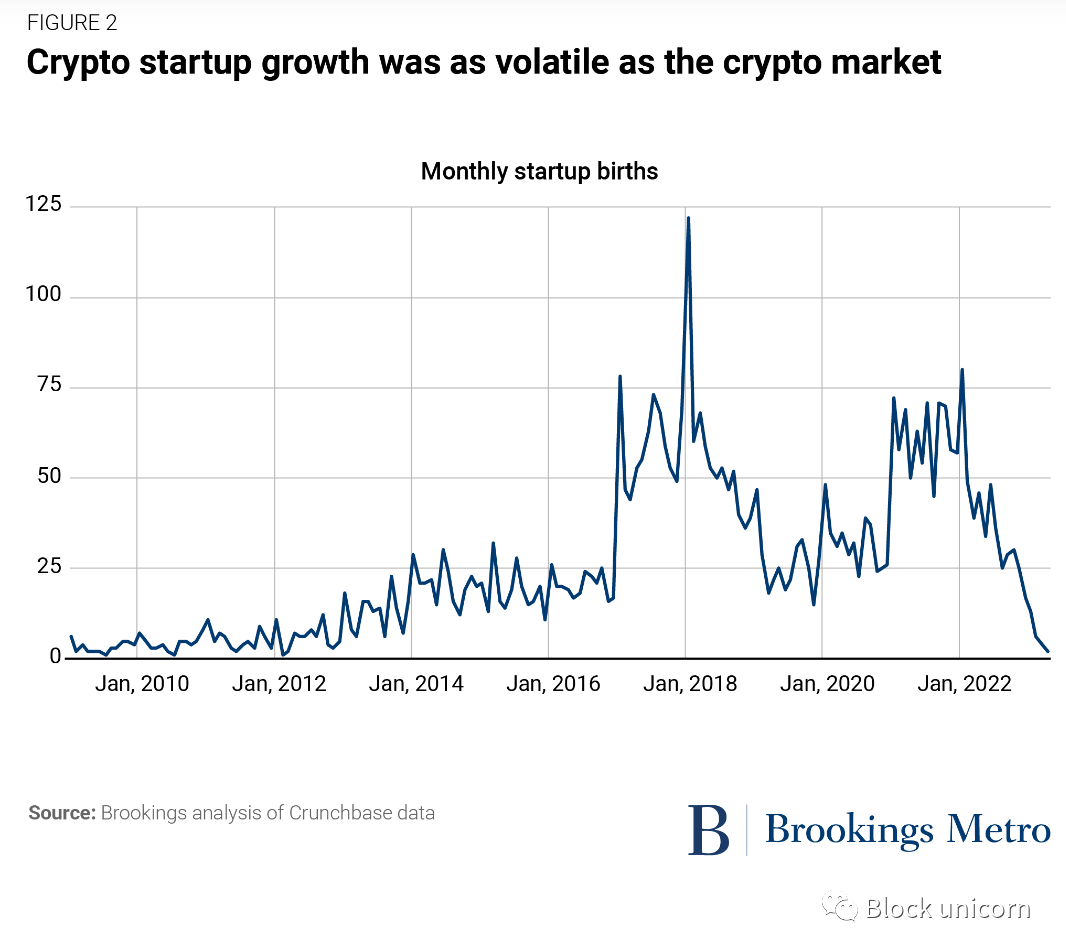

In the cryptocurrency field, entrepreneurial activity has also been full of fluctuations, with the growth and decline of startups closely related to the value of Bitcoin. For example, as of January 2018, the number of cryptocurrency startups increased and then plummeted, which was very consistent with the crash of Bitcoin and cryptocurrency values at that time.

During the pandemic, the number of cryptocurrency startups slowly began to rise again, and then began to decline in January 2022 – once again closely reflecting the gradual decline in Bitcoin prices from January 2022 to May 2022, as well as the more severe decline due to the failures of various cryptocurrency projects (as mentioned above) and FTX’s disastrous failure.

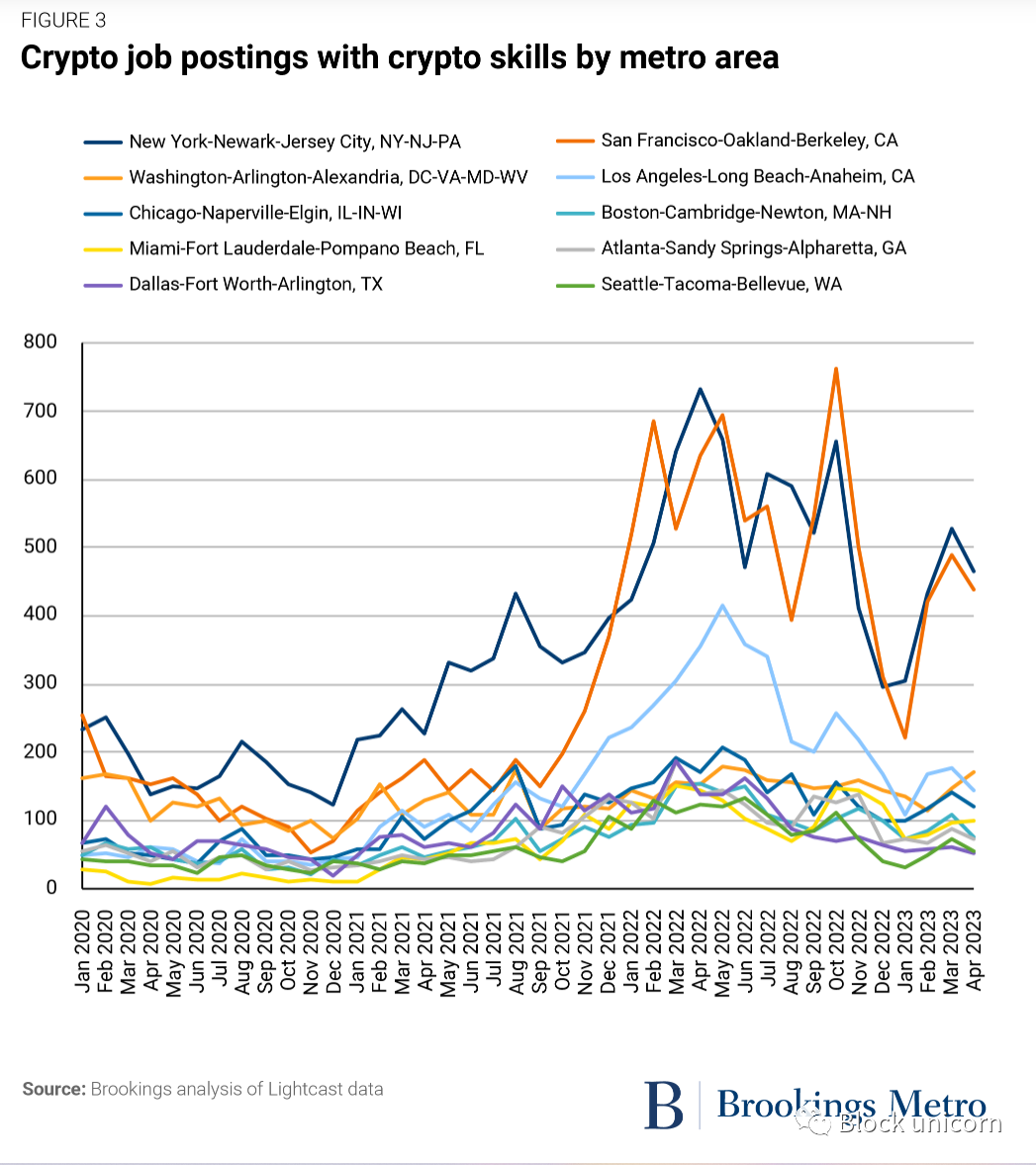

These trends have not been evenly represented in major urban areas. On the contrary: although cryptocurrency consumption activities and disruptions are widely distributed, some pre-existing technological and financial centers have seen heavy concentration of business and entrepreneurial activity, and some places have also seen at least some rebound in cryptocurrency-related job postings (and possible employment).

From January 2020 to April 2023, only a very few metropolitan areas in the United States dominated cryptocurrency activity. For example, the most prominent places for cryptocurrency activity included the metropolitan areas of New York, San Francisco, and Los Angeles – all of which were large technology or financial centers from the outset. In contrast, in most other places, the number of job postings related to cryptocurrency plummeted shortly after the bitcoin price declined in 2022, due to the collapse of the TerraUSD stablecoin. After the cryptocurrency crash, employment rebounded in few places other than the metropolitan areas of New York, San Francisco, and Los Angeles, as well as in Miami and the Tampa metropolitan area of Florida, all of which attracted a large number of remote workers during the pandemic.

However, the number of job postings related to cryptocurrency in these Florida metropolitan areas – whether increasing or rebounding – was significantly smaller than in New York and San Francisco. And even in metropolitan areas that already had technology or financial centers, the number of job postings dropped again after the FTX crash in November 2022, as the price of bitcoin fell and the volatile cryptocurrency market was shaken again.

Cryptocurrency is concentrated in “super” cities, while other places lag behind

As local leaders strive to attract economic growth to their areas, the volatility of cryptocurrency business activity – and its geographic patterns – presents an important consideration.

While some state and local governments are working to attract cryptocurrency activity, the startups and jobs associated with it are rarely stable or sustainable. Although the above-mentioned large, established markets saw most of the job activity rebound after the cryptocurrency market crash, recent statistics show that, in most cases, the long-term employment or entrepreneurial benefits left by the boom in cryptocurrency-related business are few. Instead, they create troubling pollution and energy costs, failed business projects, significant consumer and investor losses, and outbreaks of fraud that local law enforcement agencies struggle to contain.

Given this, local and state leaders who are interested in building their regional economies should carefully consider whether the current cryptocurrency industry is worth their time, resources, and taxpayer money. At the same time, leaders may also consider whether they can develop other advanced emerging industries to stimulate economic growth.

On the first point: the significant cryptocurrency surge and relatively sustained activity witnessed in New York, San Francisco, and Los Angeles highlights how disruptive technology (especially digital) concentrates in the largest markets, often leaving other places behind. Although many local leaders are trying to attract cryptocurrency business to create or grow technology centers in their regions, the evidence presented here suggests that urban areas, which serve as the most important and resilient cryptocurrency centers, had already developed solid regional advantages in technology or finance before seeing significant cryptocurrency growth. In contrast, most other urban areas struggled with the decline of the cryptocurrency labor market and startups after the spring 2022 market crash and have not significantly recovered from these losses. In short, digital elites have won, while most others have remained stagnant.

These dynamics present a warning to regional leaders: it seems more important to have a technology center first than to make explicit efforts to attract cryptocurrency companies.

Also worth noting is that the existence of a large local technology ecosystem seems to be more important than loose regulation. For example, the relatively active New York metropolitan area is just one of the few places with important cryptocurrency regulations. Despite claims to the contrary by cryptocurrency enthusiasts, New York’s regulation does not seem to have hindered employment growth related to cryptocurrency, as it remains one of the few areas with continuous job posting activity. Meanwhile, “cryptocurrency-friendly” environments have not seen a faster rebound.

How local leaders can prepare for the next big tech opportunity

As far as thinking about future economic development is concerned, the brief cryptocurrency craze may have faded, but the lessons of the past few years can still provide local leaders with experience in how to leverage other emerging technologies, particularly given the current interest in generative AI.

Local leaders face huge pressure to innovate, adapt to new technologies, and stimulate economic growth. In most (if not all) locales, the collapse of the cryptocurrency bubble should prompt local leaders to turn to other strategies for regional economic development. This should also be seen as a useful warning: not all emerging technologies are viable, no matter how hotly they are hyped. Local leaders should conduct due diligence to ensure that emerging technologies are both validated and appropriate for their economic development goals.

Additionally, local leaders should consider building more robust innovation ecosystems, rather than relying on the development of a single industry or technology. This includes cultivating local education and training resources to meet the evolving demands of the workforce, encouraging and supporting entrepreneurial innovation, and enhancing community attractiveness through smart city planning and infrastructure investments. Ultimately, the success of economic development will depend on a diversified economic structure that can adapt to and leverage a variety of technological opportunities, rather than chasing one potentially fleeting hot trend.

In conclusion, the collapse of the cryptocurrency boom provides a valuable lesson: local leaders need to be cautious, wise, and forward-looking when deciding how best to utilize limited resources to attract and develop emerging industries. While emerging technologies may bring tremendous economic potential, they also bring risks and challenges. In order to achieve sustainable economic development, leaders need to focus on building strong, diversified economic ecosystems rather than chasing potentially short-lived hot trends.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!