Author: Jiang Haibo

Balancer has made many innovations in the development of DEX, but is often overlooked. In June, Balancer’s liquidity ranked fourth in DEX, and its trading volume ranked fifth.

Balancer has made many innovations in the development of DEX, but lacks a presence under the competition of Uniswap and Curve. According to DeFiLlama’s data, Balancer’s liquidity in DEX is only second to Uniswap, Curve, and PancakeSwap, ranking fourth. The dashboard compiled by Dune co-founder shows that Balancer’s trading volume in June this year is only second to Uniswap, PancakeSwap, Curve, and DODO, ranking fifth.

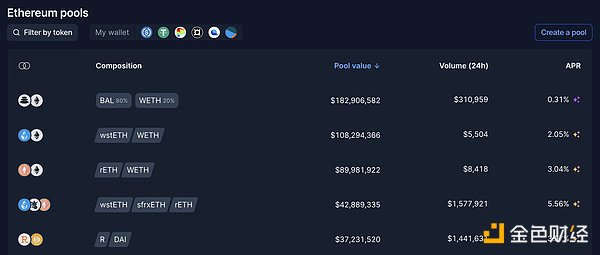

In the development of LSD, Balancer also occupies a good market. Among the top five liquidity pools of Ethereum, wstETH/WETH, rETH/WETH, wstETH/sfrxETH/rETH, and R/DAI, four liquidity pools belong to LSD or LSDFi.

- Ethereum Ecosystem Weekly Report: Plans to conduct stress tests on EIP-4844 at Devnet #7 and develop a complete set of Dencun EIP for Devnet #8.

- Data Analysis of Azuki Incident: Is the NFT Lending Platform Bankrupt?

- In-depth interpretation of Zunami Protocol: decentralized income aggregator, creating more beneficial solutions for stablecoin holders.

Boosted Pools: Using Idle Liquidity for Mining

Balancer cooperated with Aave at the end of 2021 to launch Boosted Pools, which can use idle liquidity for liquidity mining of protocols such as Aave. In actual use, the Boosted Pool usually only retains 20% or even lower ratio of total liquidity for trading, and invests the rest of the funds in lending protocols such as Aave and Morpho to earn additional income. For example, liquidity providers in the Balancer Boosted Aave V3 USD pool composed of DAI, USDT, and USDC can simultaneously receive trading fees in DEX, deposit interest in Aave, and $BAL mining rewards issued by Balancer.

Combining Balancer’s composability with lending protocols, this innovation can incentivize deeper liquidity, more efficient trading routes, higher capital efficiency, and higher returns. However, due to composability, liquidity providers in Boosted Pools may also suffer losses when underlying lending protocols have security issues. For example, in March of this year, the Euler attack caused liquidity providers in the Balancer Boosted Euler USD pool to lose $11.9 million, fortunately, the hacker returned the funds in the end.

Composable Stable Pool

In August 2021, Balancer announced the launch of MetaStable pool with Lido, and launched liquidity incentives. Although Uniswap and Curve previously occupied the main market in non-stablecoin and stablecoin trading respectively, the emergence of some new types of highly correlated but not fully linked assets also led to new demands, such as Lido’s wstETH and Compound’s cDAI and other yield tokens. Their value is close to the underlying assets but will change over time. If the Stableswap mechanism of Curve is used to provide liquidity, as time goes by, the value of one of the assets changes, and the appreciation part of the assets is obtained by arbitrageurs.

Front-end website Fjord Foundry (formerly Copper Launch), which uses the Balancer liquidity bootstrapping pool, has shown that it has auctioned off over 130 communities on multiple chains, worth $750 million (with Balancer and Fjord Foundry charging fees of 1% of the sales amount). The Xirtam scam project raised funds through Fjord Foundry.

The sale of $AKITA tokens gifted to Gitcoin was a successful use case for Fjord Foundry. The issuer of the Meme token $AKITA sent some of the tokens to Vitalik’s wallet, which Vitalik donated to Gitcoin, but selling the tokens became a problem. Gitcoin then sold $AKITA through Fjord Foundry, and the slow sales process prevented a large amount of slippage, accumulating some fee income through the pool.

Weight Pool: Provides liquidity with specific weights for multiple tokens

The Weight Pool is Balancer’s main feature, which is an extension of the AMM formula x*y=k proposed by Uniswap. In Uniswap, only two tokens are allowed to provide liquidity, and before Uniswap V3, the value of the two tokens had to be equal.

But tokens have different risks, and a 50/50 weight liquidity pool is not suitable for all liquidity providers and all assets, and sometimes it is necessary to deposit multiple assets in the same liquidity pool. Balancer was born to solve this problem, allowing users to build liquidity pools with more than two tokens and customize their weights, such as a 60/20/20 weight pool for three tokens.

Yearn has used Balancer’s 80/20 weight pool as a liquidity incentive pool for YFI during token distribution.

Managed Pools: Suitable for fund managers, can charge management fees

Managed Pools are derivatives of Weight Pools, which allow the pool creator (Owner) to update token weights, allowing creators to adjust the distribution of internal assets to suit different strategies.

Managed Pools are highly flexible, unlocking complex investment portfolio strategies and providing a framework for fund managers. Fund managers can create various pools and strategies, users can participate in these pools, fund managers can charge a certain percentage of management fees, and Balancer can also charge a portion of the management fees as protocol fees.

Linear Pool: Introducing a target price range for trading pairs

Linear Pool is designed for users to trade between raw assets and yield-wrapped assets, such as DAI and Aave’s aDAI. The linear pool introduces a target range, encouraging the price to be maintained within the range.

The linear pool has a fee and reward mechanism that incentivizes arbitrageurs to maintain the exchange rate between the two tokens at the ideal ratio. Leaving the price outside the target range incurs a fee, while trading the price back to the range earns a reward. Meanwhile, the linear pool is also often a component of an enhanced pool.

Protocol Pool: DeFi protocols built on top of Balancer

The protocol pool represents the entire DeFi protocol built on top of Balancer infrastructure. Balancer provides the infrastructure for customized AMMs by separating liquidity pools and accounting logic. Other AMM logics can be implemented on top of the Balancer Vault through customized pools, achieving programmable liquidity.

For example, the stablecoin project Gyrscope concentrates liquidity within the price range of BlockingMM through a customized Balancer liquidity pool.

Balancer v2 architecture

Balancer v2, launched in April 2021, was the first to separate AMM logic, token management, and accounting, with token management and accounting handled by the Vault, and the AMM logic of each pool independent. In terms of architecture, Balancer V2 also transitioned from each Vault separately managing assets in V1 to a single Vault managing all assets. Because Balancer has many liquidity pools, such as pools with different transaction fee ratios and pools with the same assets in different asset compositions, the original architecture resulted in high fees when trading with assets such as BAL and ETH across multiple Vaults. The new architecture has better flexibility, capital efficiency, and gas efficiency.

Summary

Balancer has made many original updates in the development of DEX, such as adjusting the architecture to manage all assets with a single Vault; the auction mechanism of liquidity-guiding pools; multi-token management of weighted pools and custody pools; and allowing other developers to customize various functions on Balancer. However, the development of DEX is becoming more and more homogeneous, and Balancer’s initial inspiration may have come from Uniswap, while the recently released Uniswap V4 is also planning to implement a single Vault architecture to manage all funds and allowing developers to develop various functions on Uniswap. The competition in the DEX market is becoming increasingly fierce.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!