Original author: X-explore Translator: angelillu, Foresight News

Since Uniswap began using airdrop strategies to reward early users in 2020, airdrops have caused a huge wave in Web3. Influenced by this, the number of people looking for the next “free lunch” (looking for new airdrop projects) in many projects has surged. Now, the Uniswap airdrop has been over for nearly three years, during which many large projects have followed suit, using airdrops to reward users or attract attention. According to X-explore’s estimates, more than 20% of the airdrops in the Arbitrum airdrop in March this year were taken away by so-called “free riders” who used Sybil attacks. Therefore, we hope to answer the following two questions by conducting in-depth analysis of users who have successfully received airdrops multiple times:

-

Who are these “airdrop experts”?

-

What are their next “targets”?

To answer these questions, we carefully selected 5 projects from numerous Ethereum and its Layer 2 projects, with more than 100,000 “airdrop receiving addresses” and a total airdrop value of more than US$140 million. They are Uniswap, ENS, Optimism, Blur and Arbitrum. The following will delve into the users of these five projects, with special emphasis on the “experts” who have received multiple airdrops from these projects.

Note: The basis for calculating the currency price in this article is the data of CoinMarketCap as of June 7, 2023. Most of the screenshots in this article are June 14, 2023, so the price may be slightly different.

Who are the airdrop hunters?

We classify addresses that have received at least three airdrops among the five projects as airdrop hunters; those who have received three to four airdrops are classified as standard airdrop hunters, while those who have received all five airdrops are called advanced airdrop hunters. In this analysis, we found a total of 34,547 standard airdrop hunter addresses, with an average airdrop income of $9,384 per address and a median airdrop income of $6,497 per address. As for the advanced airdrop hunters, we found a total of 932 addresses, with an average airdrop income of $18,935 per address and a median airdrop income of $14,288 per address. From the perspective of average and median income, the term “advanced” is indeed suitable for advanced airdrop hunters.

X-explore Address Tag Analysis

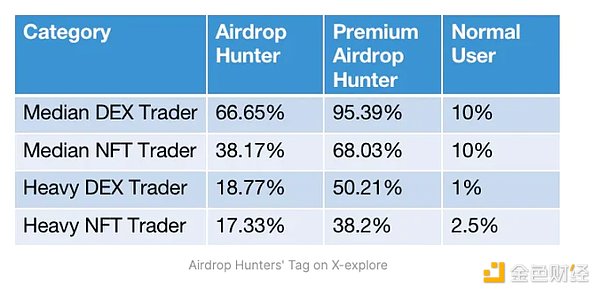

To better reveal the characteristics of airdrop hunters’ addresses, we conducted a thorough analysis of the aforementioned addresses in terms of behavior, assets, activity levels, and trading profits, combined with X-explore’s proprietary on-chain tag system. We found that both standard and advanced airdrop hunters far exceeded ordinary users in trading volume on decentralized exchanges (DEX) and non-fungible tokens (NFT).

-

Median DEX Trader: Users in the top 10% of DEX trading volume

-

Median NFT Trader: Users in the top 10% of NFT trading volume

-

Heavy Dex Trader: Users in the top 1% of DEX trading volume or transaction volume

-

NFT Heavy Trader: Users in the top 2.5% of NFT trading volume or transaction volume

These data indicate that airdrop hunters are more active in the cryptocurrency market than ordinary users, showing a higher enthusiasm for trading digital assets, especially in DEX and NFT trading.

Initial Activity Time of Ethereum Airdrop Hunters on the Chain

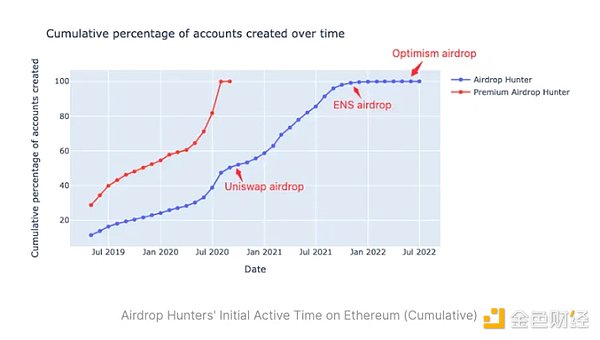

Combining the airdrop time of on-chain projects with the earliest activity time of airdrop hunters on Ethereum, we found that the majority of airdrop hunters are actually early Ethereum users. When Uniswap airdropped (September 2020), over half of the airdrop hunters had already begun their activity on Ethereum. The earliest activity time distribution of advanced airdrop hunters was also significantly earlier than that of standard airdrop hunters.

Activity Level of Ethereum Airdrop Hunters on the Chain

We randomly selected over 30,000 addresses created before June 2021, and compared their activity levels with those of airdrop hunters. As shown in the figure, airdrop hunters are active users on Ethereum, with advanced airdrop hunters conducting over 50 transactions per month on Ethereum on average, and standard airdrop hunters conducting over 21 transactions per month. In contrast, the addresses we randomly sampled conducted only 0.16 transactions per month on average on Ethereum. These results further highlight the enthusiasm and activity of airdrop hunters on the chain. They are significantly better than ordinary users in terms of transaction volume.

Behavior of Airdrop Hunters After Airdrops

After tracking the activities of five airdrop receivers (including regular users and airdrop hunters), we found that after project airdrops, the activity level of all users tends to decline, especially for regular users. At any given time, airdrop hunters are always more active than regular users.

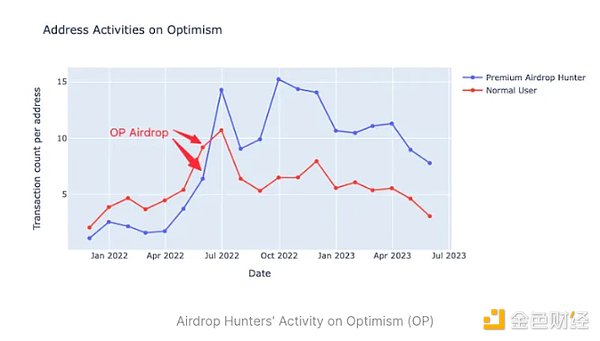

However, Optimism is an exception: before the Optimism airdrop, the activity level of regular users on the OP chain had actually exceeded that of advanced airdrop hunters. However, after the Optimism airdrop, the activity level of regular users continued to decline. On the contrary, high-quality airdrop hunters showed an upward trend in activity on the OP chain after receiving the airdrop, and after one month, their activity level surpassed that of regular users. Through in-depth analysis, we found that this is mainly because the OP airdrop rules considered the activity level of addresses on Ethereum. The results showed that many previously inactive high-quality airdrop hunters became interested in OP after receiving the airdrop, and began to actively interact with different projects on the OP chain.

Summary

After sampling and analyzing the detailed on-chain behaviors of multiple airdrop hunter addresses, we found further evidence supporting the above analysis. The on-chain activity characteristics of airdrop hunters can be summarized as follows:

-

Most airdrop hunters are enthusiastic about DEX or NFT trading.

-

Airdrop hunters are mainly composed of early users.

-

The activity level of airdrop hunters is significantly higher than that of regular users.

-

Well-designed airdrop rules can have a positive impact on airdrop hunters.

What Is the “Next Target” of Airdrop Hunters?

After gaining some understanding of airdrop hunters, what is their “next target”? Which projects do they favor? To answer this question, we studied the projects they participated in and their behavior patterns when interacting with projects through on-chain data. While helping readers understand which on-chain projects are worth interacting with, we further revealed the methods by which airdrop hunters interacted with these projects. It is worth mentioning that we have included these airdrop hunters in our monitoring system. In the future, X-explore will continue to pay attention to the latest developments of these airdrop hunters and bring readers more valuable analyses.

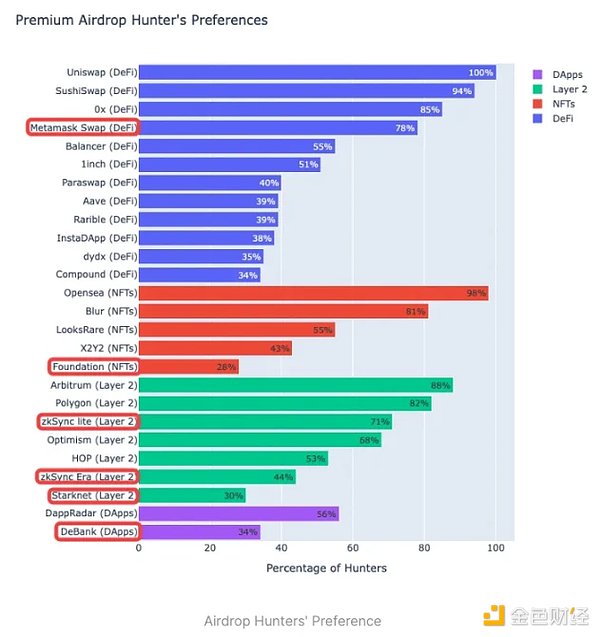

We have divided the projects favored by airdrop hunters into several tracks. Each track is sorted by the participation rate of advanced airdrop hunters, and projects with a participation rate of 25% or more are selected. If a project has multiple smart contracts, we will choose the one with the highest participation rate. Here are the tracks and project categories:

-

DeFi: Uniswap, SushiSwap, 0x, MetaMask Swap, Balancer, 1inch, Blockingraswap, Aave, Rarible, InstaDApp, dydx, Compound

-

NFT: Opensea, Blur, LooksRare, X2Y2, Foundation

-

Layer 2 solutions and cross-chain protocols: Arbitrum, Polygon, ZkSync lite, Optimism, HOP, ZkSync Era, Starknet

-

Decentralized Applications (DApps): DeBank

The bold and circled projects indicate that the project has not yet been airdropped or issued tokens. We will conduct in-depth research on the behavior of airdrop hunters on these projects.

DeFi Track: MetaMask, Trading Route

After our analysis, the total trading volume of airdrop hunters on Metamask is $191,438,051, with a median transaction volume of $1,255 per airdrop hunter. In addition, we removed airdrop hunters from all 1,811,782 Metamask Swap users and selected the same number of other Metamask users from these 1,776,303 addresses. We found that their total trading volume on Metamask was $205,673,503, with a median transaction volume of $474. Although there is not much difference in the total trading volume, the median indicates that the transaction volume among airdrop hunters is more evenly distributed, with most of the transaction volume being over $1,000. Here is the transaction pair information for airdrop hunters and other users:

We found that airdrop hunters have very similar preferences for trading pairs on Metamask Swap and Uniswap. Compared with ordinary users, airdrop hunters are more inclined to trade stablecoins and more mainstream cryptocurrencies: USDC, USDT, WETH, DAI, WBTC, etc. These stablecoins and mainstream cryptocurrencies have higher liquidity and relatively stable prices, reducing transaction risk. In addition, stablecoins and mainstream cryptocurrencies are also easier to transfer and trade across platforms, enhancing fund flexibility. This indicates that airdrop hunters focus on risk control and flexible use of funds while pursuing returns.

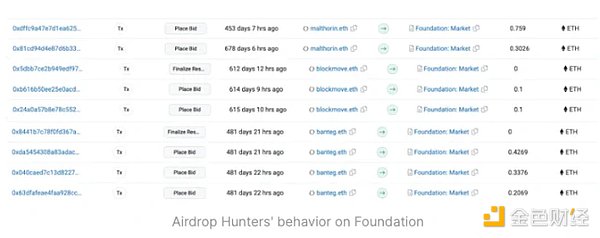

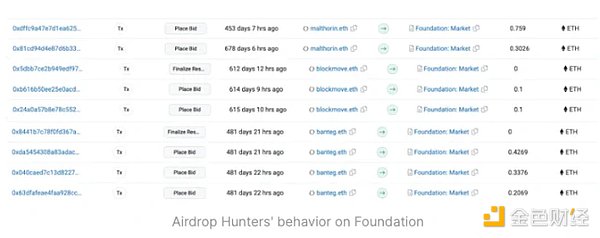

NFT Track: Foundation

We randomly selected three airdrop hunters who participated in Foundation and found that their interaction on Foundation was not frequent. Although two of the airdrop hunters actually purchased NFTs, most of the interaction was bidding on NFTs.

The airdrop rules of Blur can give us some inspiration. Some people can get considerable airdrop income just by exchanging coins and bidding, even if they have not purchased NFTs. So when interacting with the project, we can try different functions of the project, which may bring unexpected benefits.

Layer 2 Track: zkSync lite, zkSync Era, Starknet

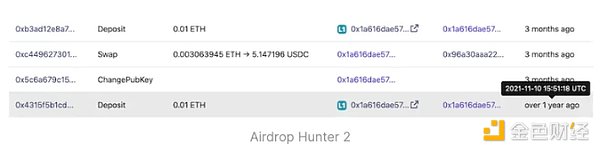

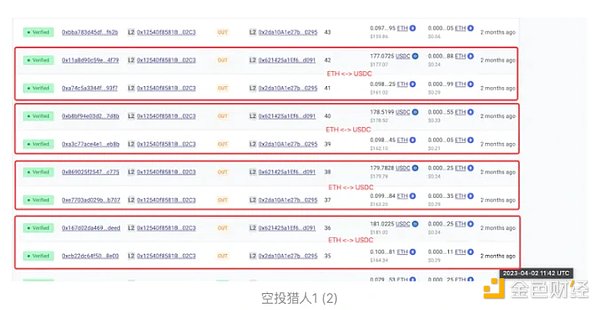

zkSync (lite): We randomly selected 4 airdrop hunters who have bridged to zkSync lite. Next, we will guide you to understand the behavior patterns of these airdrop hunters on zkSync through screenshots and explanations. If you want to know the complete behavior of the airdrop hunters, please refer to the link attached.

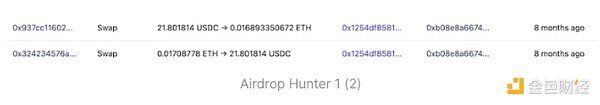

Airdrop Hunter 1:

The first transaction of the first airdrop hunter occurred on November 1, 2021, when he transferred an amount from another address. It is worth noting that the interval between his next two Swap transactions was only 15 seconds. He first exchanged ETH for USDT and then exchanged USDT back to ETH. This fast and continuous trading behavior seems to be an attempt to increase his activity level on zkSync.

We omitted several cross-chain and address transfer operations in the middle. Airdrop Hunter 1 performed a similar transaction operation again 8 months ago, on October 20, 2022. This time, the stablecoin was switched from USDT to USDC, and the interval time was about 30 seconds.

Two months ago, the address performed a series of similar transaction operations (a total of 39 transactions), with each transaction interval of about 20 seconds.

Airdrop Hunter 2:

The behavior of the second airdrop hunter is relatively simple. He bridged from the main network on November 10, 2021, and made his first transaction three months ago (exchanging ETH for USDC). Then, there was another transaction from the main network bridge, and there have been no other transactions since then.

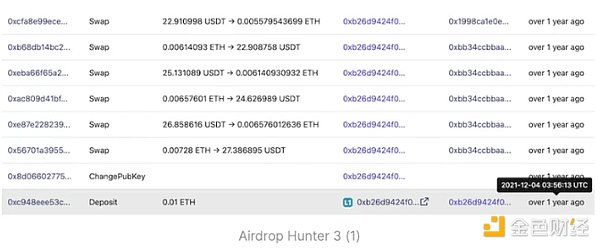

Hunter 3:

The behavior of the third hunter on zkSync lite is very similar to that of the first hunter. They both bridged from the mainnet to zkSync at the end of 2021, then used zkSync’s Swap function to convert ETH to stablecoins, and then exchanged the stablecoins back to ETH (ETH <-> USDT). Additionally, they both conducted multiple trades with time intervals of around 20 seconds. This may indicate that they are trying to increase activity through frequent trading.

Ignoring the several scattered transactions in the middle, Hunter 3 executed a similar set of operations on May 25, 2022, with a transaction time interval of about 20 seconds.

Hunter 4:

After bridging to zkSync lite, Hunter 4 conducted some trades and then bridged again after a period of time. This behavior pattern may indicate that they are trying to maintain a certain level of activity on zkSync and distribute funds as needed.

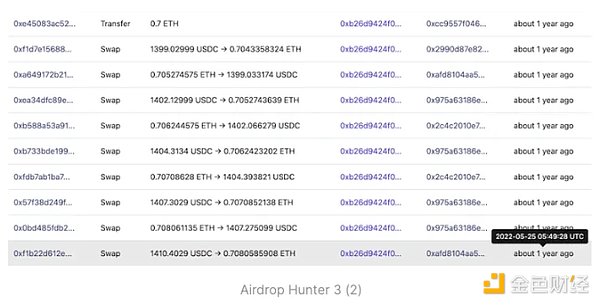

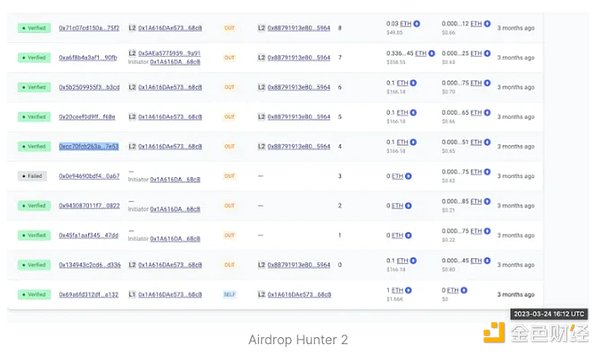

zkSync Era: In addition to zkSync lite, many hunters also choose to interact on the zkSync Era mainnet through cross-chain transactions. It is worth noting that in the first two days after the zkSync Era mainnet went live, a large number of hunters began to interact, demonstrating their high interest and active participation in the zkSync Era project.

Hunter 1:

Hunter 1 exhibits almost identical behavior patterns on zkSync lite and zkSync Era. After the zkSync Era went live on March 24, 2023, Hunter 1 immediately bridged to zkSync Era the next day, demonstrating a high level of interest and quick response to this new project. They then executed token exchange operations using the SyncSwap contract.

Seven days after the initial interaction (April 2, 2023), Hunter 1 conducted similar trading behavior again to increase activity. This timing is very clever and seems to be increasing the activity level of the address on different weeks.

The last operation of Airdrop Hunter 1 on zkSync Era occurred a month ago (May 19, 2023), and this operation still involved using SyncSwap to complete the exchange between ETH and USDC.

Airdrop Hunter 2:

Airdrop Hunter 2, like Airdrop Hunter 1, bridged to zkSync Era on the day of its launch, indicating their high level of attention and activity in the project. His multiple transactions on zkSync Era were all conducted through Mute. Unlike Airdrop Hunter 1’s exchange between cryptocurrencies, Airdrop Hunter 2 exchanged ETH for ETH through a contract. This method can pay lower fees, avoid the risk of price fluctuations, and leave active traces on zkSync.

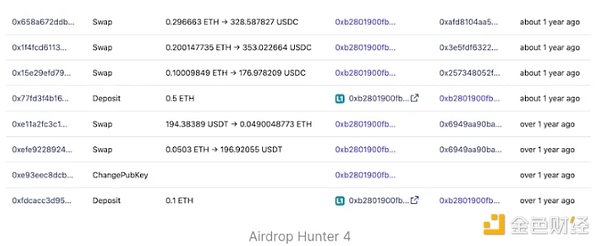

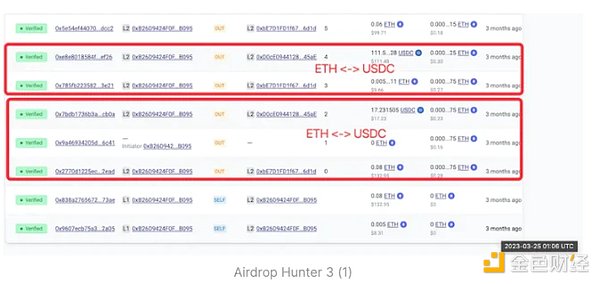

Airdrop Hunter 3:

Airdrop Hunter 3 bridged to zkSync Era on the same day as Airdrop Hunter 1 (March 25, 2023), and their on-chain operations were very similar to those of Airdrop Hunter 1. The only difference is that Airdrop Hunter 3 used SBlockingceFi to exchange ETH for USDC.

A week after the first interaction (April 3, 2023), Airdrop Hunter 3 made another operation on zkSync Era and used SyncSwap instead of SBlockingceFi. It can be seen that while increasing their activity, they also participated in multiple projects within the zkSync Era ecosystem.

After that, Airdrop Hunter 3 continued to engage in transfer activities and also participated in the iZUMi project, conducting transfers between ETH and ETH. It is worth noting that there were multiple outgoing records from this address on May 15, 2023.

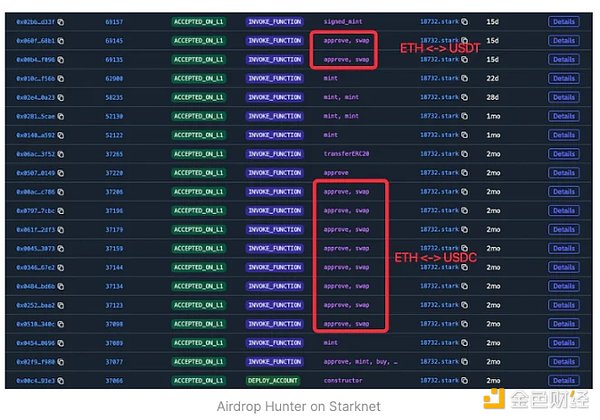

StarkNet: Since there are few Airdrop Hunters bridged to Starknet and their trading behavior pattern is very similar to zkSync, we chose a representative address for analysis and explanation.

Airdrop Hunter:

-

About two months ago (April 12, 2023), Airdrop Hunter crossed over to Starknet and used the myswap project on the same day to exchange ETH for USDC.

-

On Starknet, he also minted some NFTs.

-

25 days ago (June 1, 2023), he again used myswap to exchange ETH for USDT.

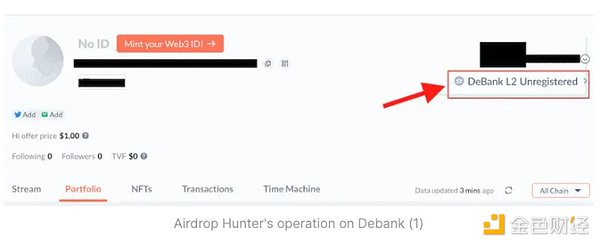

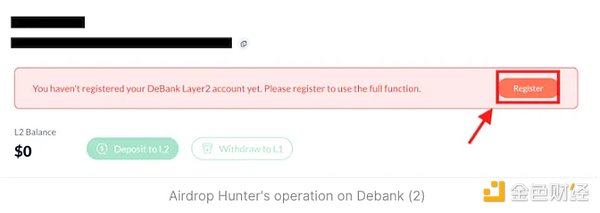

DeBank in the Dapp track

DeBank is a decentralized finance (DeFi) data analysis and asset management platform that provides users with a comprehensive view of investments and debts across different DeFi projects. It provides real-time project data, transaction records, and risk assessments to help users make informed investment decisions.

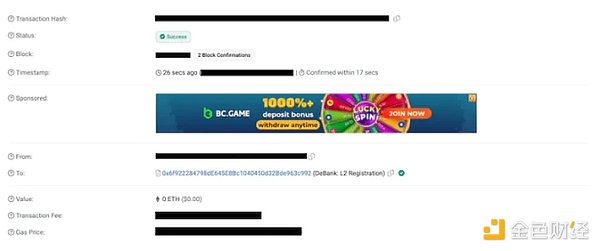

Recently, DeBank has been expanding its DeFi services, including trading functions. The community is eagerly awaiting an airdrop from DeBank. However, unlike community members who used DeBank’s Swap function according to the airdrop tutorial, most airdrop hunters simply registered on DeBank. They did not follow the advice in the airdrop tutorial to use DeBank’s Swap function. Below, we illustrate how airdrop hunters interact with DeBank:

Based on the behavior of these high-quality airdrop hunters, they seem to be using DeBank more to enable its analytical functions than to increase their chances of potential airdrops by using DeBank’s Swap function.

Summary

Through an in-depth analysis of airdrop hunters’ interactions with airdrop projects, we identified key driving factors for their choices:

-

Industry influence: Most airdrop hunters tend to choose projects with broad influence and reputation in their fields. In addition to DeBank, these projects have contract interactions on Ethereum exceeding a staggering 700,000 times.

-

Preference for Layer 2 solutions: Airdrop hunters clearly prefer Layer 2 projects, such as Arbitrum, zkSync lite, and zkSync Era. Layer 2 solutions provide faster transaction confirmation times and lower transaction fees, which is clearly important for hunters who frequently participate in DeFi and NFT projects.

Through an in-depth analysis of X-explore, we found that while airdrop hunters on Arbitrum and Optimism showed high-quality interaction behavior, they seemed to artificially increase transaction volume and activity on zkSync and Starknet. This is closely related to the integrity of the on-chain ecosystem. Optimism and Arbitrum had some development and precipitation time before the airdrop announcement, while zkSync released airdrop information before the launch of the Era mainnet. These findings force project teams to rethink what airdrops really mean. How to identify truly valuable users in formulating airdrop rules, rather than users who simply interact meaninglessly with airdrops?

Opinion on Airdrop Hunters

Airdrop hunters are mainly authentic and high-quality users: They actively participate in various blockchain projects, engage in cross-chain transactions, and maintain consistent activity across multiple platforms. Although there is a heated discussion about “Sybil addresses”, we have not found any obvious “free-riding” behavior among airdrop hunters. On the contrary, their behavior patterns reflect deep participation in projects and enthusiasm for the blockchain world, rather than just short-term airdrop benefits.

Successful examples can be referred to when setting airdrop rules: When analyzing the traces of airdrop hunters on Optimism, we found that many high-quality airdrop hunters obtained a large amount of OP airdrops due to their activity on Ethereum, and eventually became loyal users of the OP chain. Therefore, when formulating airdrop rules, project parties can consider the behavior of airdrop hunters to ensure that airdrops are more effectively distributed to such high-quality users. This also helps project parties use airdrops as incentive mechanisms to increase project participation and user loyalty.

A good airdrop needs to meet two core conditions: reasonable airdrop rule design and a sound ecosystem. Under well-designed airdrop rules and a strong ecosystem, we have witnessed how high-quality users on Arbitrum/Optimism continue to maintain activity. However, if airdrop information is released hastily before the ecosystem is fully developed, it may lead to the appearance of superficial prosperity. Even high-quality airdrop hunters may engage in “deliberate boosting activities” on zkSync/Starknet.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!