By/Zhang Yuge

Produced by/Toilet Finance

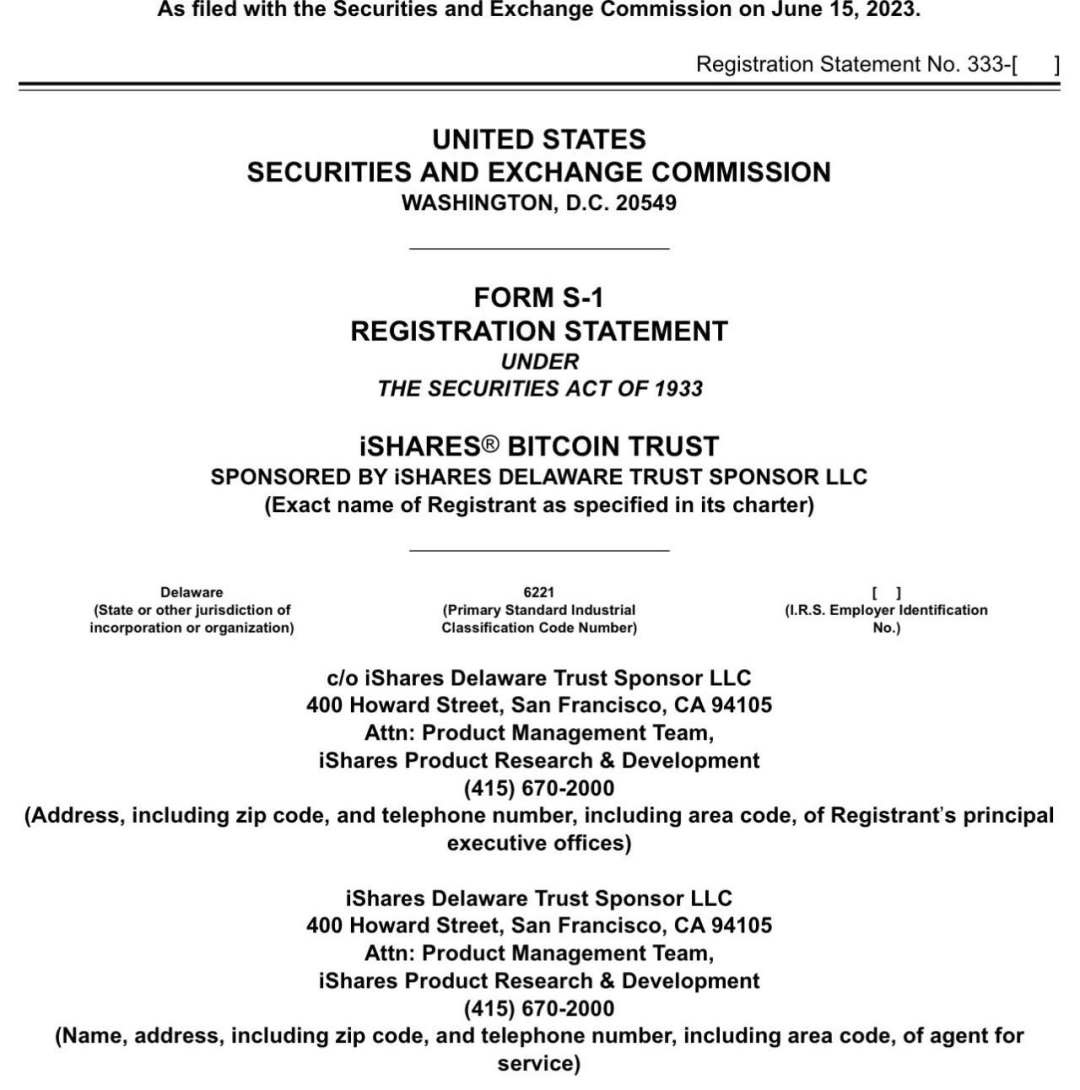

Last Wednesday, Bitcoin rose sharply and broke through $30,000. The market generally believes that this rise in Bitcoin is related to the Bitcoin spot ETF applications submitted by institutions such as BlackRock. Some analysts pointed out that BlackRock’s Bitcoin spot ETF design took into account the risk of previously rejected applications by the US Securities and Exchange Commission (SEC), so the likelihood of approval is high.

- FTX accuses former executives of using “hush money” to suppress whistleblowers

- Azuki’s new game “Spot the Differences” earns nearly 38 million dollars in just 15 minutes, but faces a wave of selling due to trust crisis.

- Mad PUA community earns 2000 ETH through Azuki’s “dirty tactics” causing public outrage

According to analysts, although the SEC did not disclose specific details during the approval process, if BlackRock’s application for this Bitcoin spot ETF is approved, it is expected to have a significant boost effect on the cryptocurrency market.

BlackRock submitted the application to the SEC on June 15, and the SEC has never approved spot ETFs before. But BlackRock has a record of 575-1 in SEC applications to approve its ETFs. That is, the SEC has approved 575 ETFs previously applied by BlackRock, and only rejected 1 ETF in October 2014. With such a high pass rate, it is difficult not to expect BlackRock’s latest application.

According to statistics, there have been more than 30 attempts by various institutions to apply for Bitcoin spot products, but they have been opposed by regulatory agencies due to market concerns and lack of investor protection. Cryptocurrency supporters have long believed that such products should be available for trading. Coinbase said that the lack of clear rules in the digital asset industry is harming the competitiveness of the United States’ economy.

01. Bitcoin spot ETF has been rejected multiple times

Since the birth of Bitcoin, people have been looking forward to a convenient way to participate in investment, one of which is to invest through exchange-traded funds (ETFs). However, the approval of Bitcoin spot ETFs has been under review and delayed by regulatory agencies.

The core concept of Bitcoin spot ETF is to link the price of Bitcoin with the traditional financial market, allowing investors to buy and sell Bitcoin through traditional stock exchanges without directly holding and managing Bitcoin. This mechanism is considered to provide investors with a more convenient and safer way to invest in Bitcoin.

However, regulators have been cautious about approving Bitcoin spot ETFs. One of the main regulatory pressures is the SEC. Since 2013, the SEC has rejected multiple Bitcoin spot ETF applications. One of the main reasons why the SEC refuses to approve Bitcoin spot ETFs is concerns about market manipulation and risk management. It is concerned that due to the uncertainty and potential manipulation risks of the Bitcoin market, Bitcoin spot ETFs may cause losses to investors.

Roughly speaking, since the first Bitcoin spot ETF application was submitted in the United States in 2013, many asset management institutions have submitted Bitcoin spot ETF applications to the SEC, but the applications have been rejected or delayed.

In March 2017, the Winklevoss brothers applied for a Bitcoin spot ETF, which was rejected by the SEC in July of that year. The SEC said that the Bitcoin market lacked regulation and that there was potential market manipulation risk.

In August 2018, asset management company VanEck and blockchain technology company SolidX collaborated to submit a Bitcoin spot ETF application. The application was rejected by the SEC in September 2019. The SEC believes that the applicant has not been able to prove that the Bitcoin market has sufficient measures to prevent fraud and manipulation.

In January 2019, Bitwise Asset Management submitted a Bitcoin spot ETF application. The application was rejected by the SEC in October 2019. The reason given by the SEC was that the applicant had not been able to provide sufficient evidence to support their claim that the Bitcoin market has measures to prevent market manipulation.

In fact, there are tradable Bitcoin spot ETFs in countries outside the United States, such as Canada and Brazil. In February 2021, the Purpose Bitcoin ETF, listed by PurposeInvestments in Toronto, became the first Bitcoin spot ETF in North America. On June 23, 2021, the Latin America’s first Bitcoin spot ETF, launched by QR Capital, was listed on the Brazilian stock exchange.

02. Is it likely that new applications will be approved?

It is not easy to change the SEC’s thinking, but there are some reasons to remain optimistic. BlackRock’s proposal is similar to previous proposals, which is to create a trust that holds Bitcoin and can create and redeem shares in exchange for Bitcoin, similar to the operation of physical commodity ETFs such as gold.

According to documents submitted to the SEC, BlackRock applied for the iShares Bitcoin Trust. Coinbase Global Inc., the largest cryptocurrency exchange in the United States, will serve as the custodian. This trust, if launched, will be traded on Nasdaq.

Although the official documents have made it clear that the application is for a trust product, it has still caused huge differences and controversies in the encryption industry.

Some people think that what BlackRock is applying for is a trust, but it is different from trust funds such as GBTC issued by Grayscale. It is more flexible and can be redeemed. Another view is that what BlackRock is applying for is an alternative structure of an ETF. It represents publicly traded bitcoin trust fund stocks, which are completely different from financial instruments such as GBTC and are more like GLD and other ETF funds managed by BlackRock’s iShares.

Anthony Pompliano, the co-founder of Morgan Creek Digital, tweeted that what BlackRock is applying for is not a Bitcoin ETF, but a Bitcoin trust. These products are only technically different, especially in terms of regulation and approval, but the end result for investors is similar.

Pompliano also said that if the product is approved for issuance, it may force GBTC to introduce daily redemption and reduce fees to compete with it. Many Wall Street companies may launch products that follow suit to compete with BlackRock.

There is another highlight worth noting in BlackRock’s application. On page 36 of the 19b-4 file it submitted, BlackRock stated that it will sign a supervision sharing agreement with the operator of Nasdaq and the bitcoin spot trading platform, aiming to reduce the risk of market manipulation. Such a supervision sharing agreement allows the exchange to share confidential information about market transactions, settlements, and customer identities. In other words, exchanges can get confidential information related to buyers, sellers, and prices, almost reducing the possibility of market manipulation to zero.

Graeme Moore, the tokenization director of the Polymesh Association, said that the monitoring sharing agreement proposed by BlackRock is called “Spot BTC SSA”, which makes this application different from others and has a high chance of approval.

The potential manipulation of spot bitcoin prices has always been one of the important reasons why the SEC has rejected bitcoin ETF applications. If the monitoring sharing agreement involves Coinbase, this may be significant, because Coinbase is one of the exchanges of CME CF Bitcoin Reference Rate, and BlackRock’s ETF will use this reference rate.

It remains to be seen whether BlackRock’s application will be enough to persuade the SEC to make a different decision. In addition to the issue of futures versus spot, how regulators evaluate the “scale of the market” and whether it is a “fully regulated market” is still an open question.

But if approved, it could have a huge impact on the struggling cryptocurrency industry. If BlackRock’s physically-backed ETF is successful, other ETFs could adopt the same mechanism. If exchanges can successfully apply for a listed physical bitcoin ETF, the process will usually be simplified for other exchanges.

03, Conclusion

As expected, after BlackRock, many institutions have resubmitted their ETF applications.

Asset management company WisdomTree has once again submitted a bitcoin spot ETF application, Invesco has resubmitted its bitcoin spot ETF 19b-4 file, and cryptocurrency fund company Valkyrie has also submitted an S-1 registration form for a bitcoin spot ETF to the U.S. Securities and Exchange Commission.

Although it is unclear whether the SEC will ultimately allow a bitcoin spot ETF, BlackRock’s move seems to have given the industry a shot in the arm, and institutional investors seem to have regained interest in bitcoin.

Outside the United States, HSBC in Hong Kong has also begun allowing its clients to buy and sell cryptocurrency asset ETFs listed on the Hong Kong Stock Exchange, and the butterfly effect brought about by BlackRock is spreading in the industry.

If the application is approved, a wave of bitcoin spot ETF applications will be launched, and the cryptocurrency market will receive more attention and liquidity. For the currently lackluster cryptocurrency market, it is hard to say that this is not a “timely rain” to regain confidence.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!