TL;DR

1. NFT lending is a financial product of NFT securitization that occurs during the holding period. The core mechanism is to allow holders to use idle NFTs as collateral without selling them to borrow short-term capital, obtain liquidity in exchange for cryptocurrencies or fiat currencies, and earn profits while enjoying the benefits of holding NFT, thus improving the efficiency of fund utilization.

2. The NFT lending agreement is mainly divided into collateral lending and unsecured lending two forms.

- Interpretation of the 4 Key Points of the Digital Asset Bill that May be Introduced Prior to the 24th US Presidential Election

- How has the veteran DeFi project MakerDAO regained its vitality?

- Interpreting Singapore’s MAS “Three Initiatives”: Will it lead to success in industrial blockchain?

1) Collateral agreement:

- P2P, suitable for bear markets with liquidity shortages, not afraid of extreme market conditions affecting the security of the platform.

- Peer-to-Pool, suitable for bull markets with abundant liquidity.

- Hybrid, which has higher operational convenience on the basis of the standard peer-to-pool mode.

- Collateralized Debt Position (CDP) is a good choice for those who seek to obtain some liquidity from blue-chip NFTs without paying high interest rates.

2) Unsecured agreement:

- BNPL (Buy Now Blockingy Later)

- Flash loan (pay first and then buy)

It is suitable for NFT market users who have the intention to buy but temporarily lack full payment capacity.

3. The profit model of the NFT lending business mainly comes from the loan interest paid by users for collateral lending, and if there are functions such as flash loans, it will also bring corresponding functional service fees.

4. The main risks of NFT lending are:

- Fluctuation risk of NFT collateral valuation (bad debt risk)

- High concentration of business target users

- The increment of high-quality asset targets is limited, which brings potential overall restricted growth space for the business volume of the entire track.

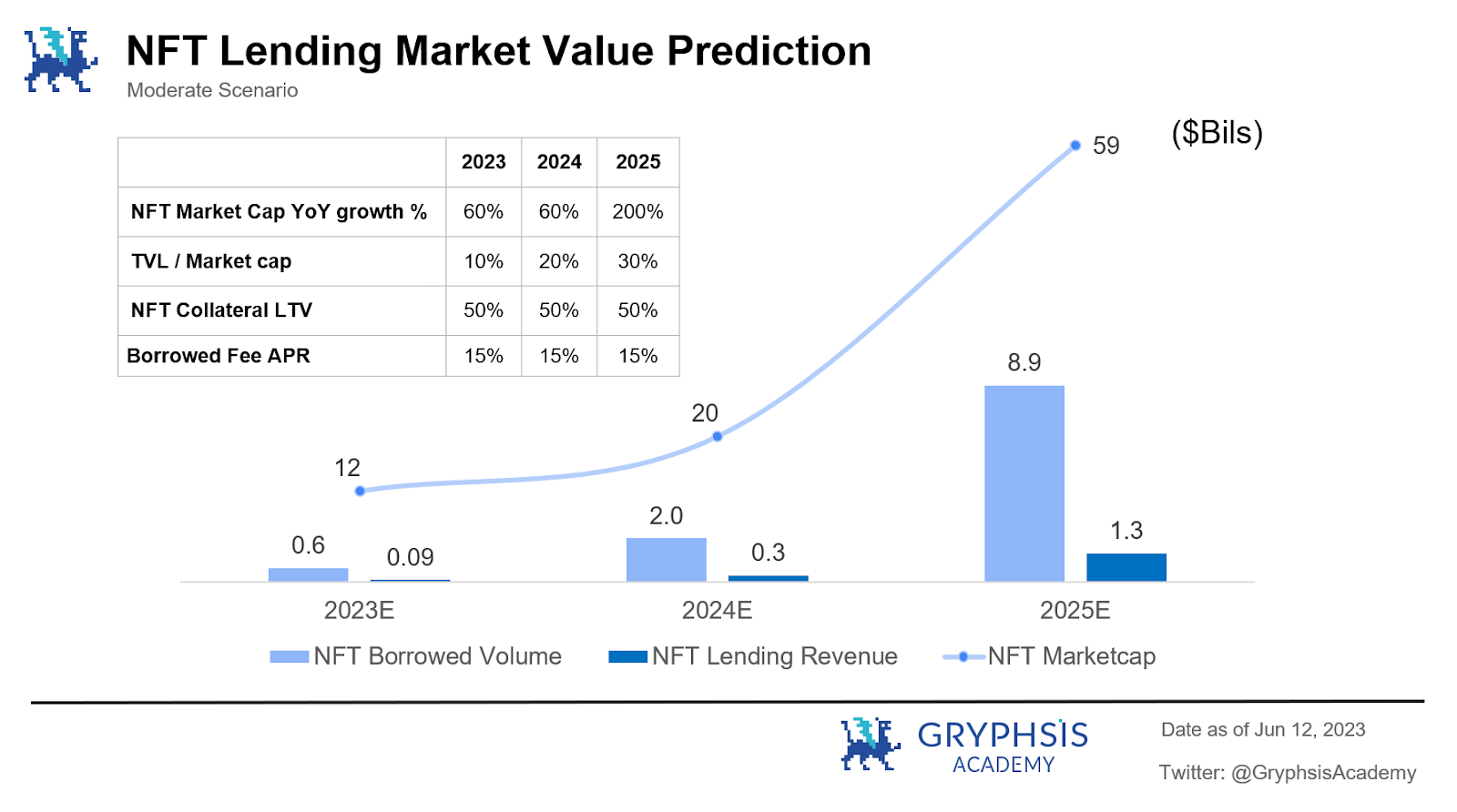

5. It is estimated that within 3 years, the overall market value of NFT based on a neutral hypothesis will reach about $60 billion, and the NFT lending TVL will reach about $18 billion, which can meet the borrowing demand of about $9 billion. The expected revenue of the overall NFT lending industry will reach $1.3 billion.

1. Industry Landscape

In the past few years, there have been two rapidly developing areas in the cryptocurrency industry, one is decentralized finance that experienced the DeFi Summer in 2020, and the other is the NFT boom in 2021.

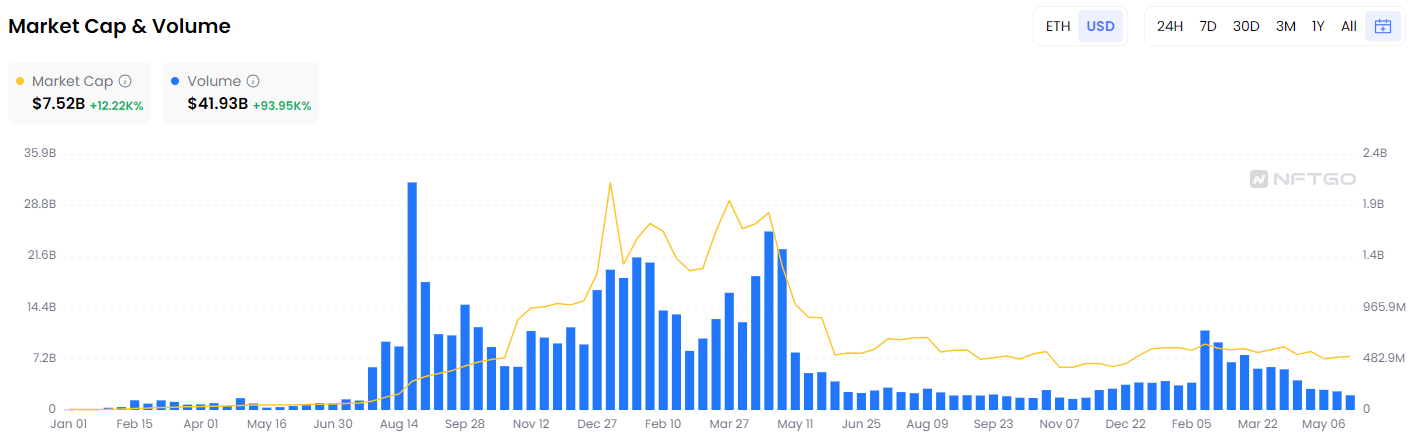

The overall market size of NFTs on Ethereum has grown from around $61 million at the beginning of 2021 to a peak of around $32 billion after just over two years of development. Even though the overall market value has fallen sharply, the market size is still around $7.5 billion, and the industry has grown more than 120 times.

Source: NFTGo.io (May 31, 2023)

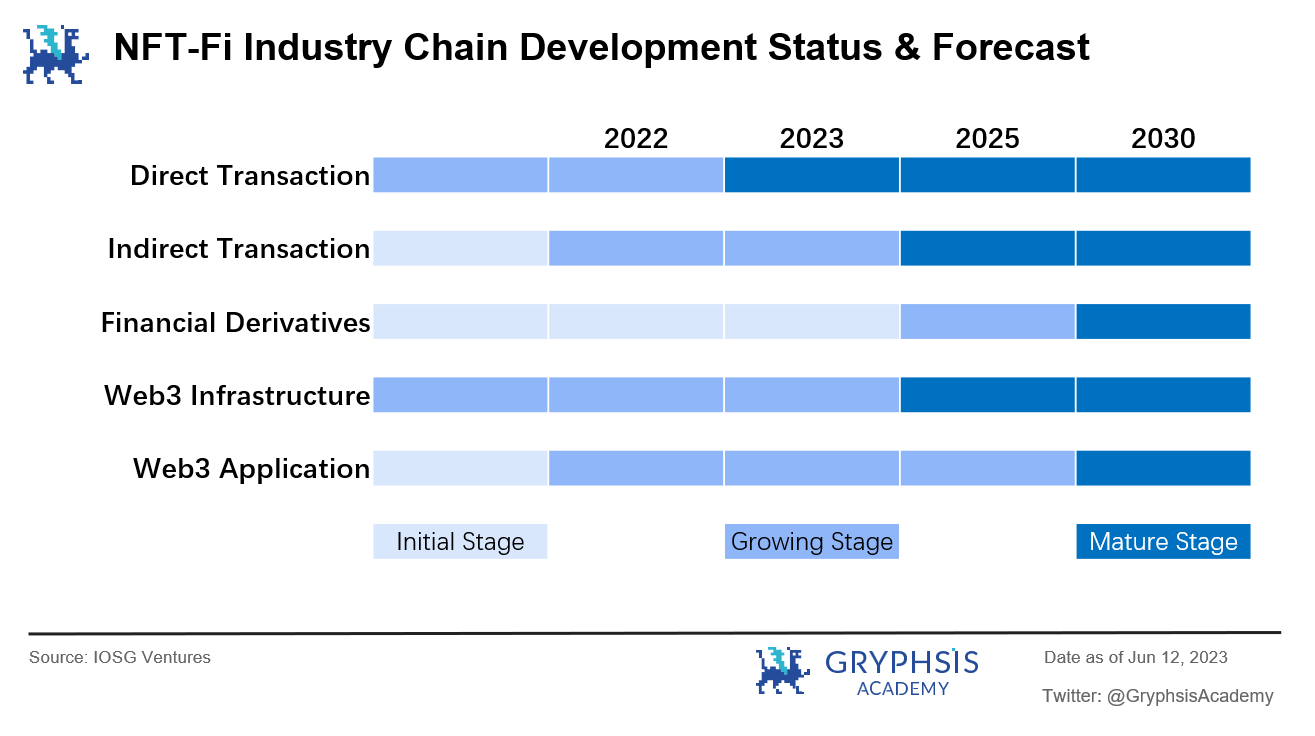

Today, NFT-Fi as a track that combines NFT with DeFi, has rapidly developed from a niche area to an indispensable part of the crypto world.

The significance of NFT finance lies in helping users expand and enhance their consensus and demand for NFTs in a more financial way. Its industrial structure can be vertically divided into three layers:

1) Direct transaction: i.e., through trading markets, aggregators, AMMs, etc., exchanging with cryptocurrencies.

Representative projects: Opensea, Blur

2) Indirect transaction: i.e., providing NFT mortgage lending, financing custody, and other services.

Representative projects: BendDAO, BlockingraSBlockingce

3) Financial derivatives: i.e., providing high-leverage and high-risk categories such as options, futures, indexes, etc.

Representative projects: Openland

Since direct transactions have already developed relatively maturely, and financial derivatives are still in the early stage, indirect transactions as the intermediate layer involve the most basic financial system attributes of deposits, loans, and borrowings, and are still in a rapid development stage. Therefore, this article will mainly focus on the NFT lending direction, which is the focus of the industry in NFT indirect transactions.

2. Industry Market Value

First, let’s answer a question: why is there a market demand for NFT lending?

As we all know, NFT, short for Non-Fungible Token, refers to a type of cryptographic asset that cannot be copied or replaced, and has unique, indivisible, and irreplaceable characteristics. Its pricing is mainly based on personal subjective judgment or group consensus.

And it is precisely because of these characteristics of NFTs that, although they are considered to have viewing and collectible value (as well as potential project empowerment), due to the lack of a standard value benchmark, the audience of NFTs is usually relatively limited compared to ordinary homogeneous cryptographic tokens, thus the liquidity of NFTs is relatively poor in the entire cryptocurrency market.

The usual way for ordinary NFT investors to make profits on NFTs is to sell them when their price rises. However, this method is greatly affected by the current market environment. When the Web3 environment is in a bear market, market confidence is insufficient, and trading activity is low, liquidity will further shrink, resulting in most cases where these NFT assets are idle and the efficiency of fund utilization is extremely low. Without lending services, users may be forced to sell their unique NFTs to obtain valuable liquidity.

NFT lending is a financial product that occurs during the holding period. Its core mechanism is to allow holders to borrow short-term funds by using idle NFTs as collateral without selling them, obtain liquidity in exchange for cryptocurrency or fiat currency, and obtain returns while enjoying the benefits of holding NFTs, thus improving the efficiency of fund utilization.

As a solution to the liquidity problem of NFTs, the demand for this innovative market is becoming larger and larger. NFT liquidity solutions with smooth user experience and sustainable trading models will soon stand out in the entire NFT-Fi.

3. Industry Barriers

The industry barrier of NFT lending business is how to achieve the feasibility of the core business model, mainly including:

1) How to effectively match the system mechanism of NFT lending demand users

Because NFTs are unique by definition, users typically need professional knowledge and financial knowledge related to specific assets to link NFT assets with lending and borrowing businesses. Designing a reasonable business model that is attractive to both borrowers and lenders is the basis for effectively matching user needs.

2) Reasonable pricing mechanism for NFT assets

A critical component of NFT lending and borrowing business is pricing. How to provide the system with a reasonable quote that is effective, fast, and relatively accurate in estimating the value of NFT assets, calculating LTV (Loan To Value ratio), and during the liquidation period is the most important link in the operation of the NFT lending and borrowing business. Especially when the number of users in the protocol increases and the business demand that occurs in the same period increases, the system’s quotation, data tracing and updating mechanism and efficiency will directly affect the customer experience of the entire protocol.

4. Competition Pattern

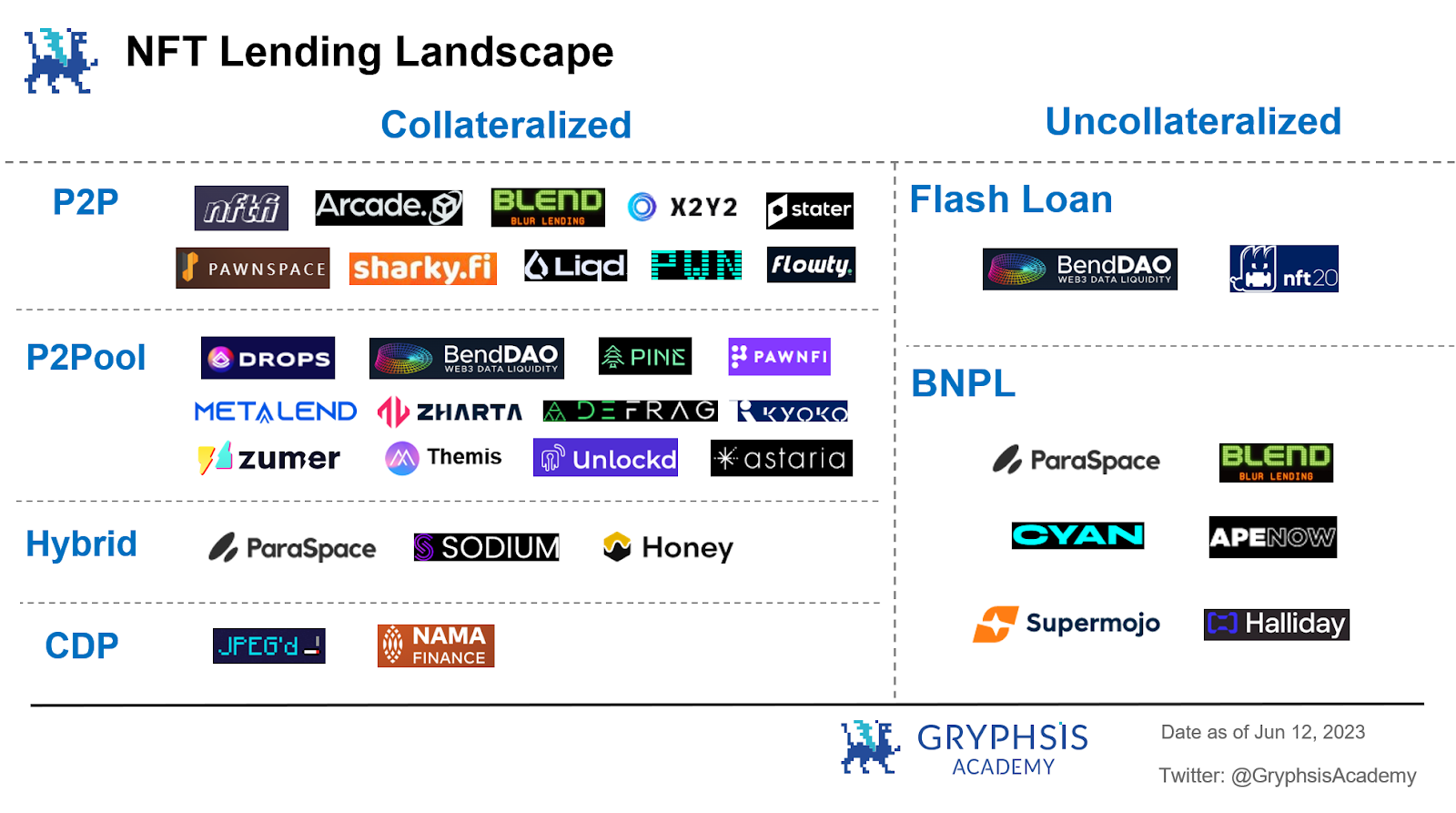

Currently, in the NFT lending and borrowing business, there are two forms: collateralized lending and unsecured lending.

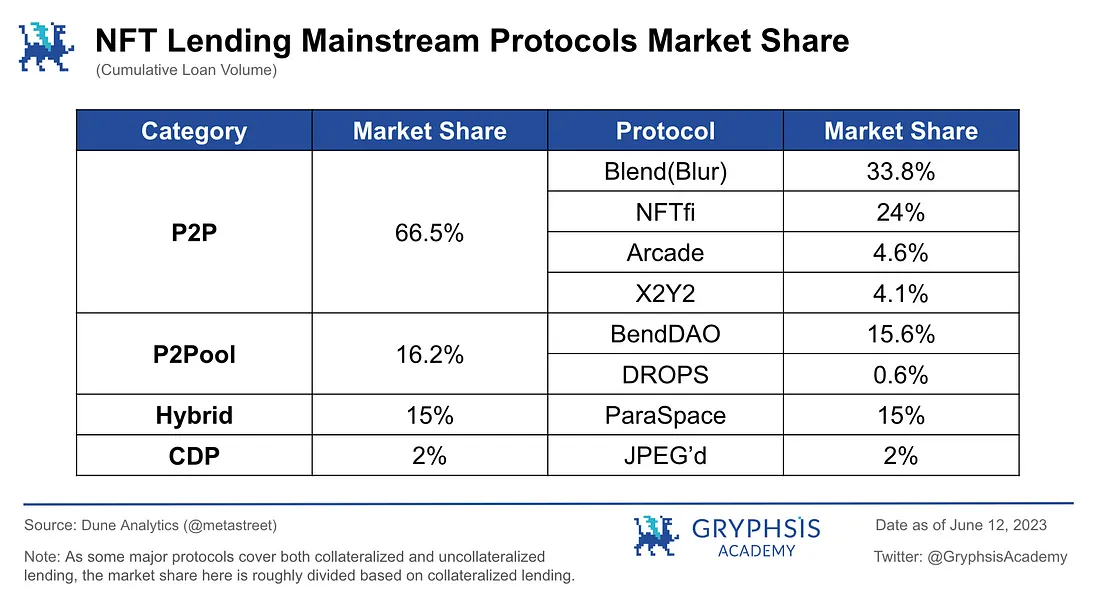

The collateralized lending can mainly be divided into:

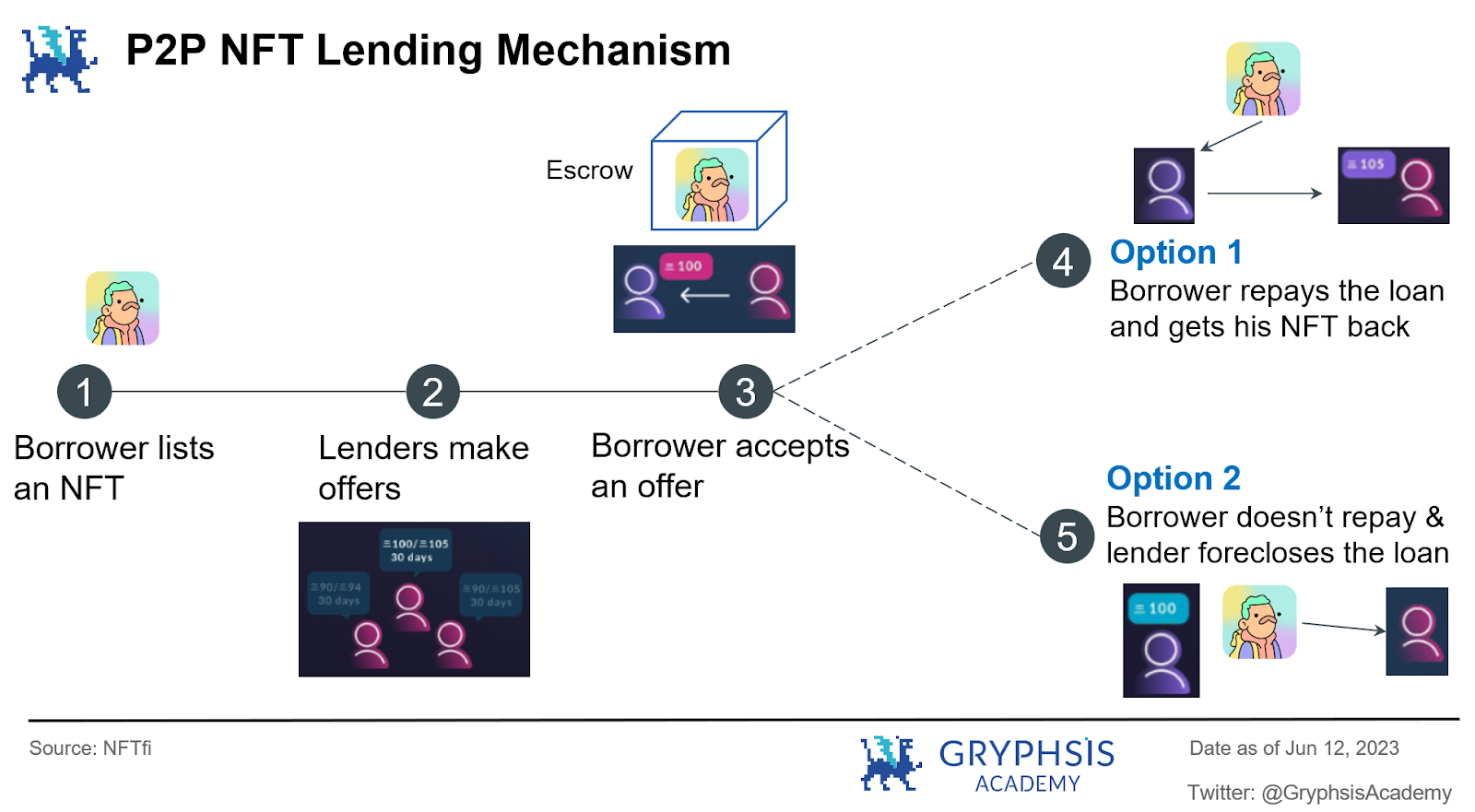

- Peer to Peer/P2P

This is a mode in which users match lending and borrowing directly with each other. The lender and the borrower match in terms of interest rates, terms, types of NFT collateral, etc. Once the demand is matched, the lending and borrowing transaction is completed. Representative projects: NFTfi, Arcade, Blur (Blend)

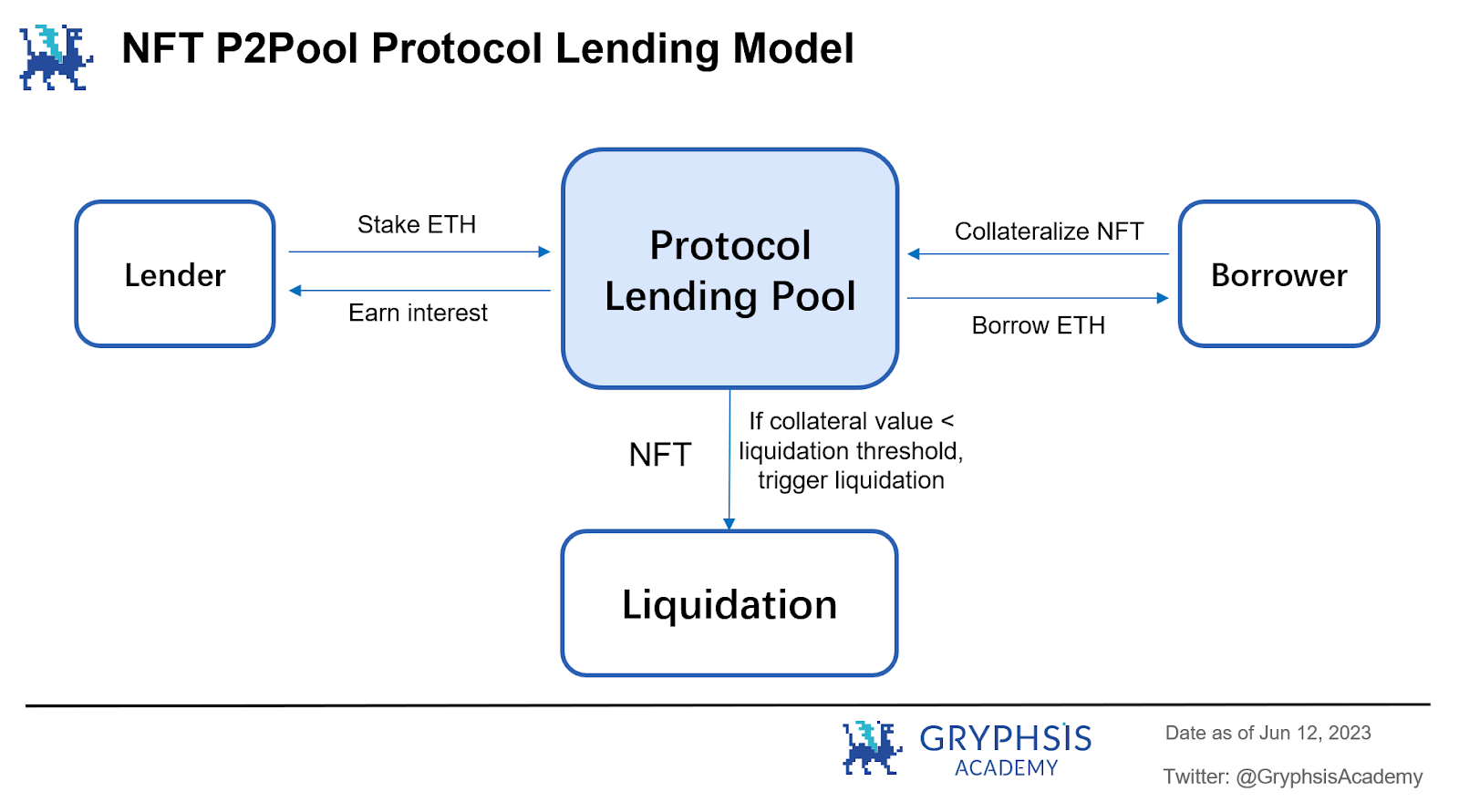

- Peer to Pool

This is a mode in which users match lending and borrowing with the protocol pool. The lender pledges NFT to the protocol pool to quickly obtain a loan, and the depositor provides funds to the protocol pool to earn interest income. Representative projects: BendDAO, DROPS

- Hybrid

This is a protocol that integrates peer-to-peer and peer-to-pool models. Under this model, the lender sets a series of parameters such as interest rates, terms, and loan amounts, and when requesting a loan on the platform, it is equivalent to establishing a separate protocol pool. Multiple borrowers can deposit funds into the protocol pool to earn interest income. Representative projects: BlockingraSBlockingce

- Collateralized Debt Position (CDP)

A NFT collateralized loan model pioneered by MakerDAO. Represented by project: JPEG’d

Unsecured loans can be further divided into:

1) Buy Now Pay Later (BNPL), represented by projects: CYAN, BlockingrasBlockingce, Blur(Blend)

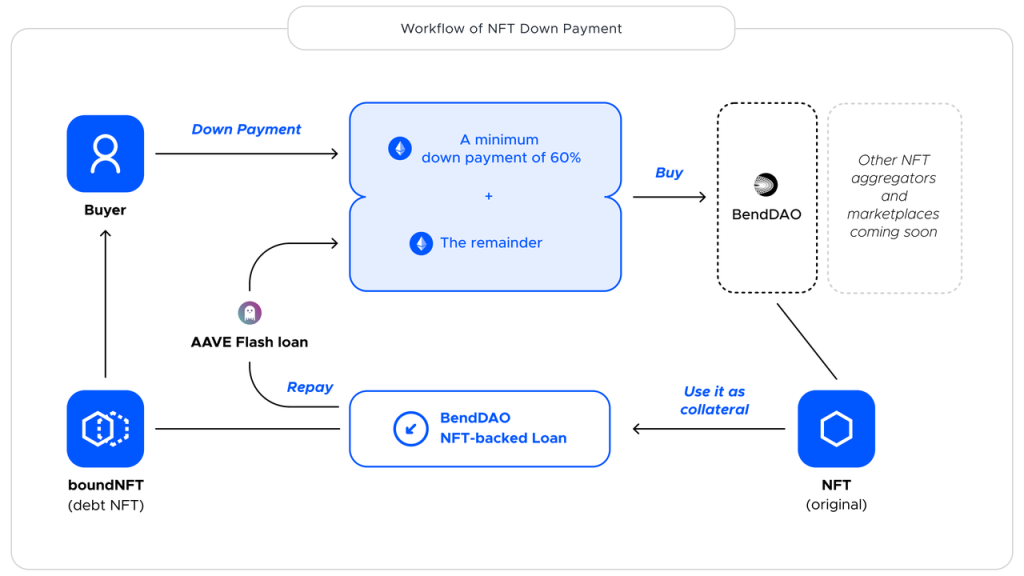

2) Flash loan (pay first buy later), represented by project: BendDAO

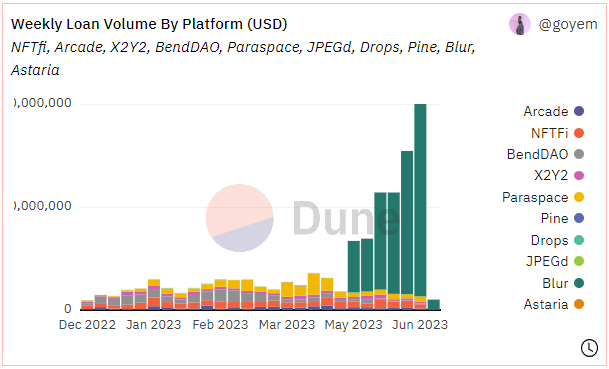

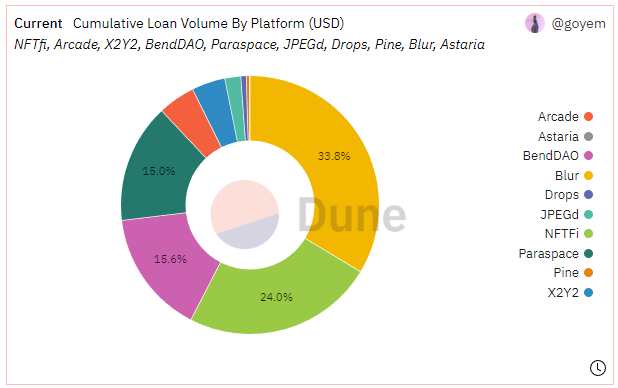

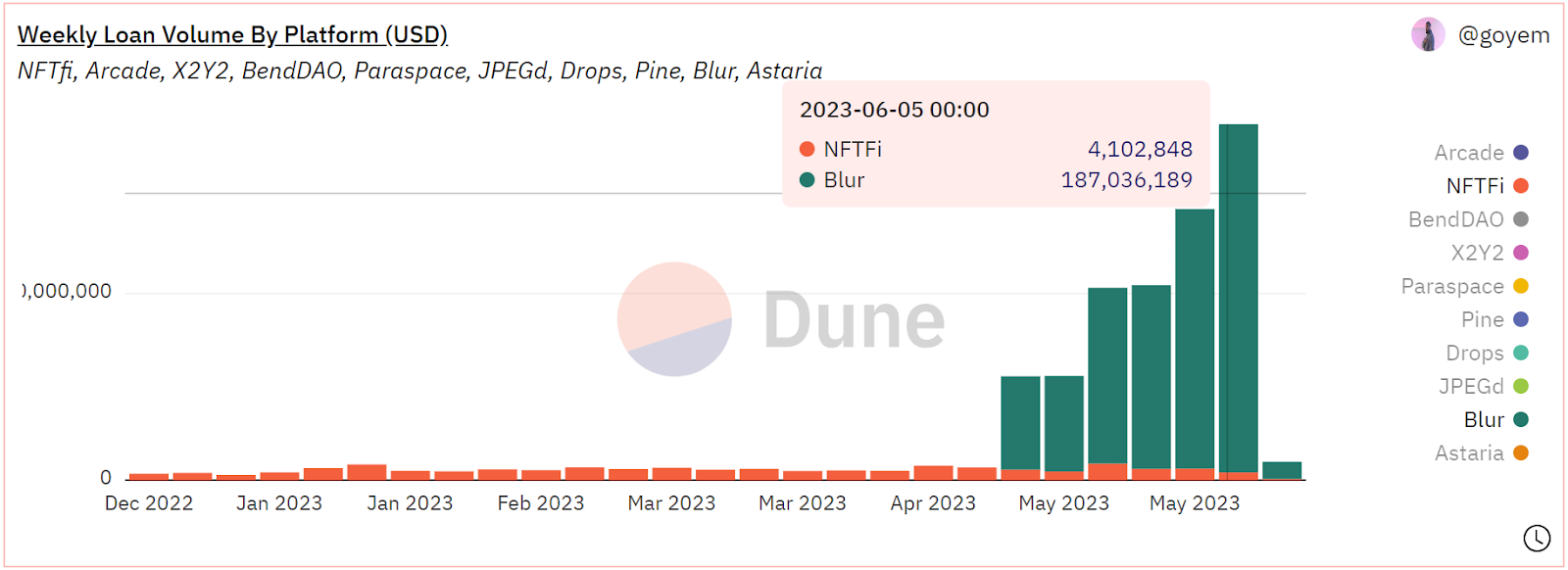

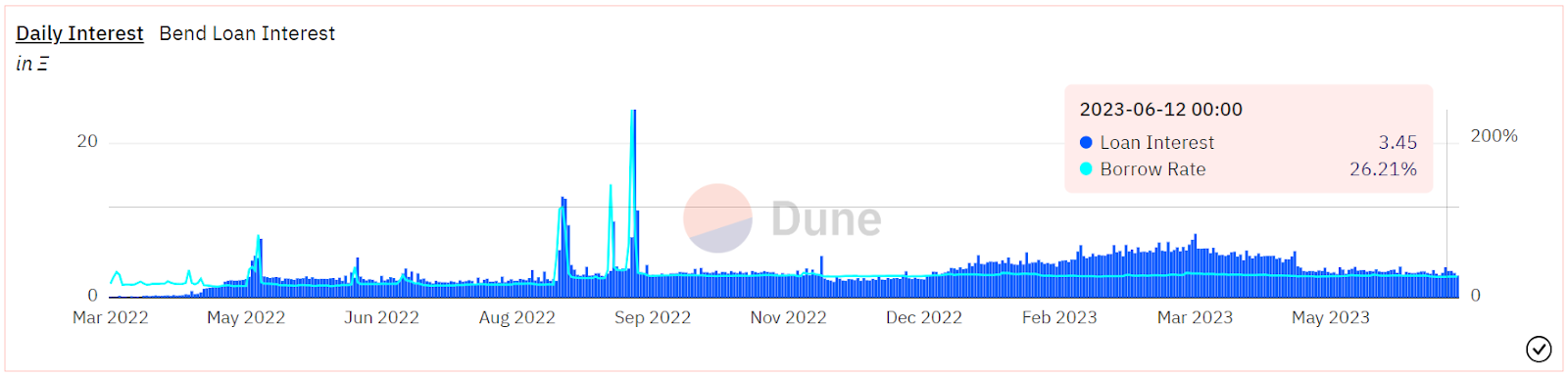

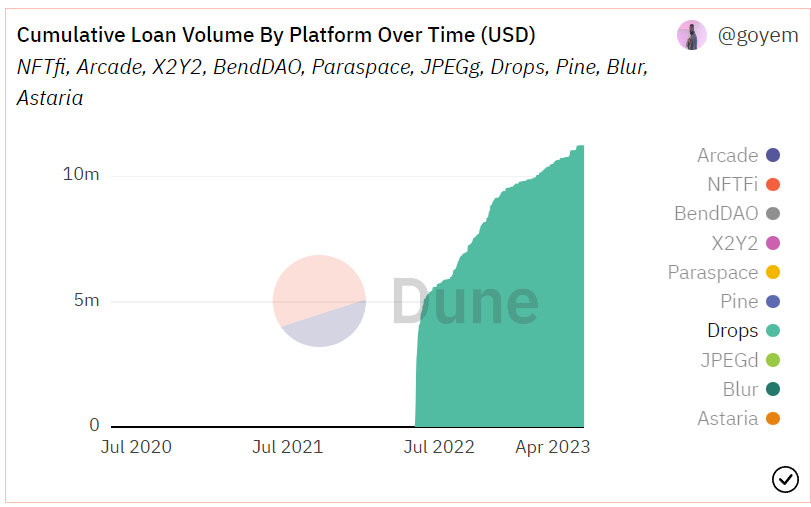

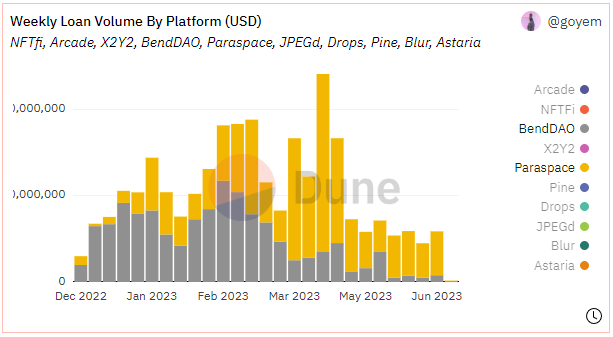

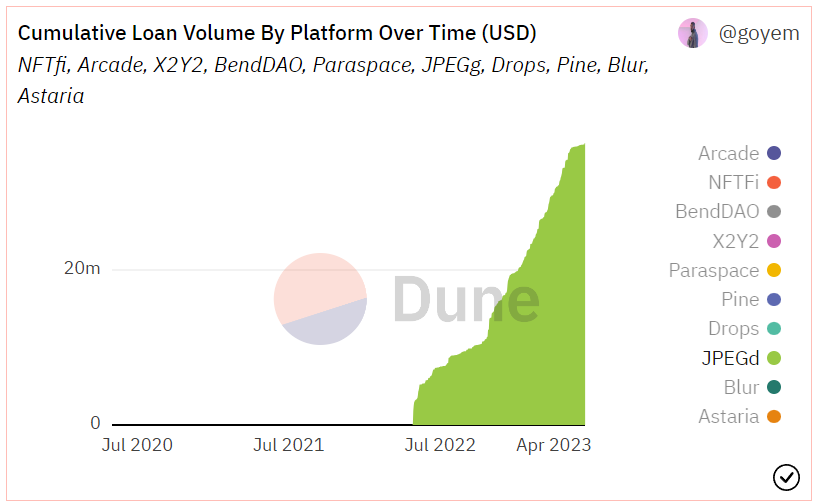

Source: Dune Analytics@goyem (June 12, 2023)

Source: Dune Analytics@goyem (June 12, 2023)

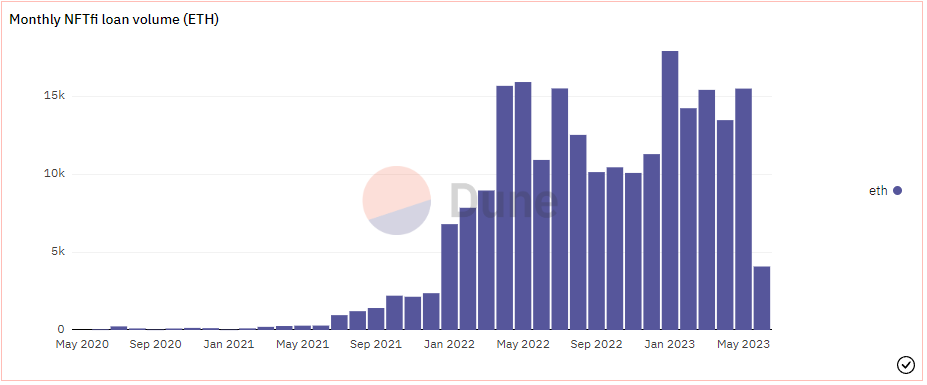

From the two charts above, it can be seen that peer-to-peer and pool-to-pool protocols dominate the entire NFT lending market.

It is worth noting that since the launch of Blend by Blur in May, due to the head position and user base advantages of Blur as a NFT trading market, Blend has rapidly occupied the leading position in mainstream lending protocols, and its trading volume for several consecutive weeks is far greater than the total trading volume of several other protocols. Currently, its accumulated lending business volume has jumped to the top of the industry.

5. Technical Implementation Path and its Advantages and Disadvantages

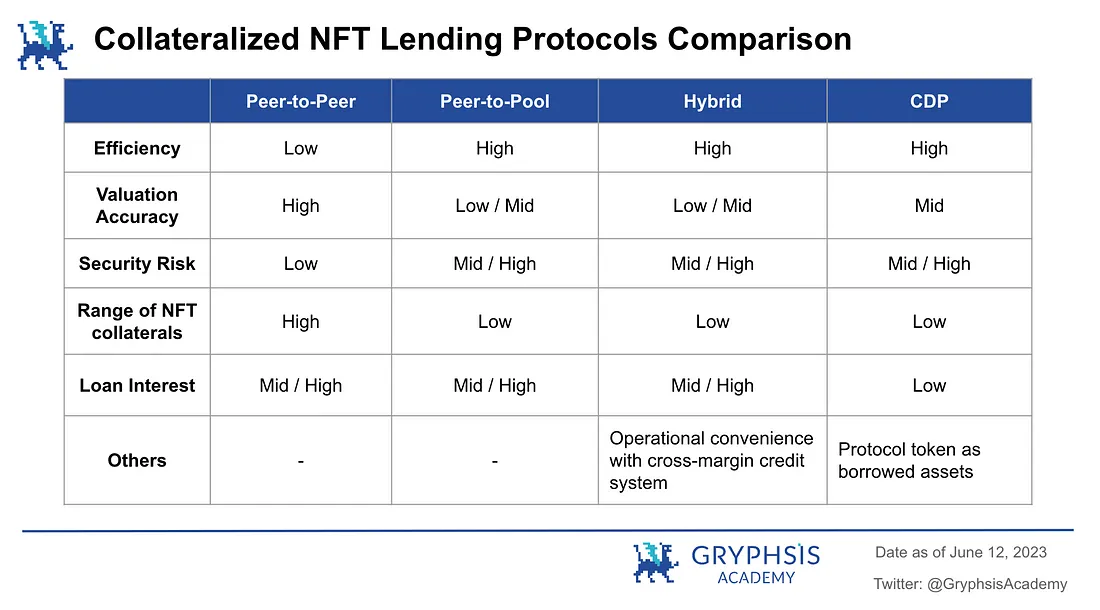

Based on the different protocol types mentioned in the previous chapter of NFT lending business, each has its own characteristics.

5.1 Collateralized Loan

5.1.1 Peer-to-Peer

The user valuation method is mainly used in peer-to-peer lending, and the pricing of NFTs is based on the price estimate given by the user. Users give specific quotations based on the uniqueness of each individual NFT. It has the following characteristics:

- Low efficiency: The pairing of lenders and borrowers may take a long time.

- Relatively accurate valuation: NFTs of different attributes in the same series have different values. Lenders and borrowers can negotiate and determine the value based on the attributes of individual NFTs, rather than using the floor price of the entire NFT series as the only valuation standard.

- High security: When an individual defaults, it will only affect the lender and borrower of that loan, and the risk exposure will not be extended to other users on the platform.

- Supports a wider range of NFT collateral: since it is a peer-to-peer quotation, theoretically any NFT series can be used as collateral for lending.

Summary: The peer-to-peer model is more suitable for bear markets with low liquidity, and is not afraid of extreme market conditions affecting the platform’s security.

5.1.2 Point-to-Point Pool

The Time-Weighted Average Price (TWAPs) is widely used in point-to-point pool type lending protocols. Oracles like Chainlink can obtain and publish TWAPs for the sale price and floor price to create such a blended price to evaluate the value of NFTs. This model can reduce the impact of abnormal events on prices by taking the average of multiple prices over a predetermined period of time, thereby increasing the difficulty of potential malicious price manipulation.

Its main features are:

- High efficiency: direct interaction with the lending pool, borrowable at any time.

- Less accurate valuation: the platform cannot conduct detailed collateral valuation for each NFT attribute and can only determine the valuation through the floor price of the NFT series. The loan amount that can be obtained by mortgaging NFTs with any attribute of the same series is the same.

- Security risks: every loan on the platform will affect the interests of all depositors on the platform. In extreme cases, a large number of NFT liquidations may cause systemic risks.

- Support for a small number of NFT collateral: for security reasons, only blue-chip NFTs with high trading volume, good liquidity, and relatively stable prices are supported as collateral.

Summary: The point-to-point pool model is more suitable for bull markets with sufficient liquidity.

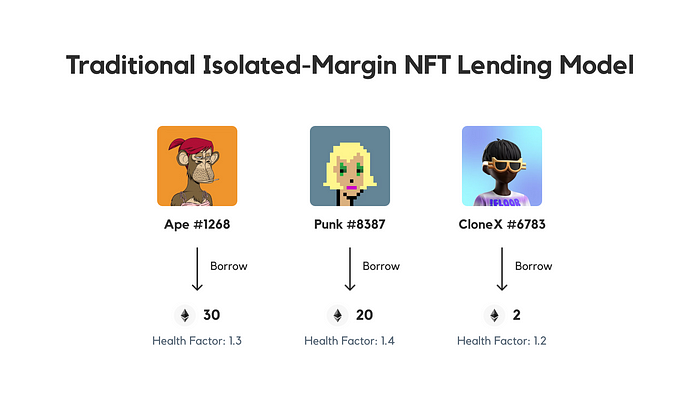

5.1.3 Hybrid Model

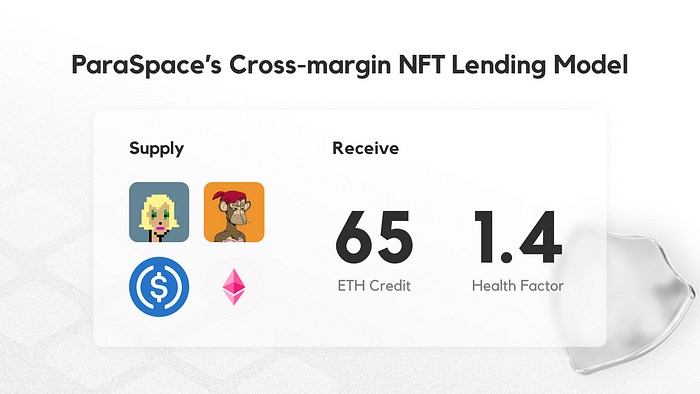

The underlying lending business of the hybrid protocol also adopts the Peer-to-Pool model, where users can mortgage NFTs in real-time as borrowers or provide funds as lenders to earn interest paid by borrowers. Its innovation lies in creating a cross-margin credit system rather than using the existing platform’s isolated margin pool design, which will allow users to provide loans with a credit limit for all collateral.

Let’s use an example to illustrate:

Suppose you own 61 BAYC, and you decide to mortgage 5 of them to borrow money and then buy one more. Using the existing lending protocol with its isolated margin model, you would need to borrow ETH with these 5 BAYC separately, and then go to the market to buy new BAYC.

There are at least two downsides to this process:

1. User experience. Users have to execute 5 different on-chain transactions and manage these 5 separate lending positions.

2. If any of your lending positions are about to be liquidated, you must repay the loan immediately to avoid being auctioned off.

On the other hand, a hybrid protocol generates a credit line for you by collateralizing your NFT assets, and generates a health factor for your entire collateralized asset portfolio. As long as the health factor for your entire collateralized asset portfolio remains above 1, none of your NFTs will ever trigger a liquidation auction. To reduce risk, you can always choose to deposit more collateral (NFTs or ERC-20 tokens) to maintain a high health factor.

This credit system is similar to a valuation system that assesses the value of all your collateral and automatically approves loans based on that assessment. As long as your collateral is of a collateral type supported by the credit system, you can borrow based on their total value. This is the full-position leverage mode with cross-collateralization adopted.

It is easy to understand that this mode has higher operability convenience on the basis of the standard spot pool mode.

5.1.4 Collateralized Debt Positions (CDP)

After a user deposits NFTs as collateral into the vault, they can mint the corresponding protocol currency, which allows the protocol currency debt position to reach a certain proportion of the collateral value, and collect a certain annual interest rate.

When the user’s debt/collateral ratio exceeds the liquidation threshold, the DAO will execute liquidation. The DAO repays the debt and retains or auctions off the NFT to build up its vault.

Users can purchase insurance against liquidation when taking out a loan, paying a specified percentage of the loan amount upfront, which is non-refundable. With insurance, users can choose to repay the debt themselves within a specified time after liquidation (with fines).

CDP loans are a good option for those seeking to get some liquidity out of their blue-chip NFTs without paying high interest rates.

5.2 Non-collateralized loans

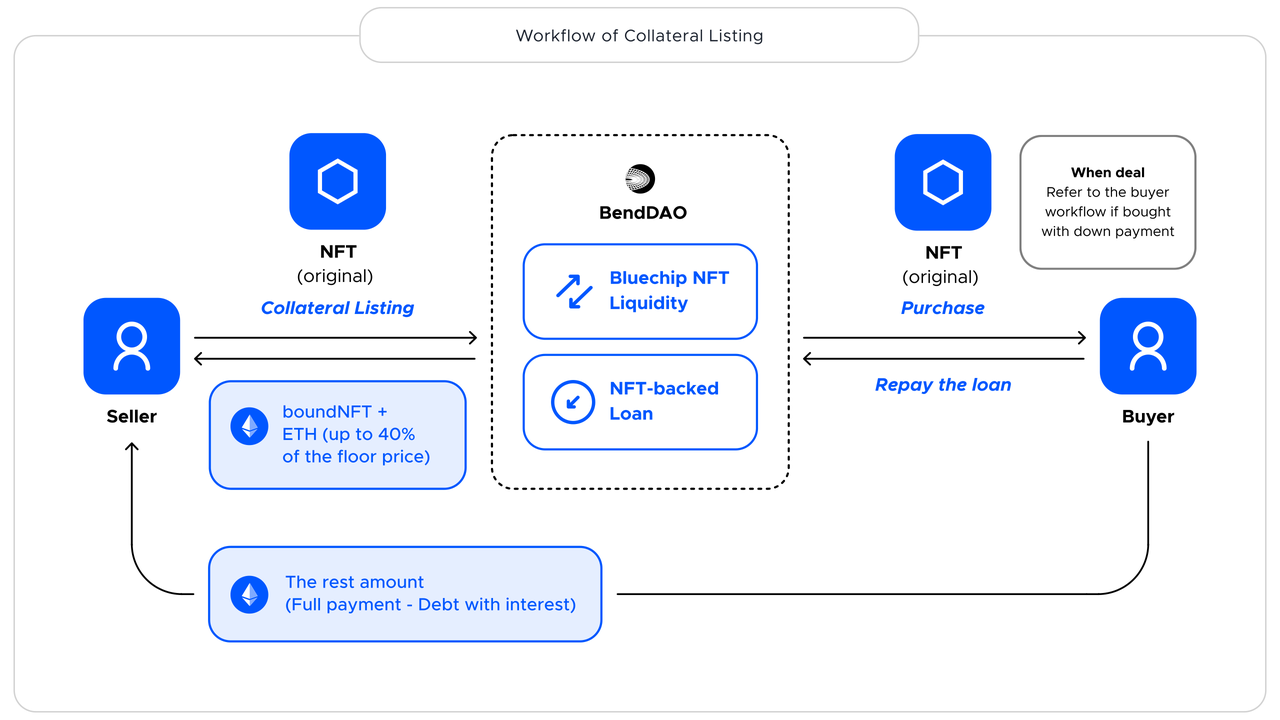

5.2.1 Flash Loans (Down Payment Buying)

Flash loans (down payment buying) are a variant of traditional lending, where users can pay a certain down payment on the protocol to purchase NFTs on the trading market, with the remaining funds provided by a third-party DeFi protocol flash loan service (such as Aave). When the buyer pays the down payment and the remaining funds obtained by the third party through flash loan to buy the NFT, the buyer owns the NFT and at the same time takes out a collateralized loan on the NFT lending protocol, and the protocol fund pool will return the borrowed fund to the flash loan. The remaining interest calculation, repayment mechanism, and liquidation mechanism are all based on the provisions of the lending protocol. When the asking price is higher than the floor price of the NFT in the protocol, the down payment ratio will be correspondingly increased. Fees usually include down payment fees and flash loan function fees.

Its workflow diagram is as follows:

Source: BendDAO

5.2.2 BNPL Buy Now Pay Later

Briefly explain its operation from the buyer’s perspective:

1. Bob wants a Pudgy Penguin. First, he initiates a BNPL plan on the platform to purchase any Penguin currently listed on Opensea, LooksRare, or X2Y2.

2. Then, the platform offers Bob an installment payment plan that includes a pre-quoted interest rate that he needs to repay within a three-month installment payment period. Regardless of how the NFT price fluctuates, the installment payments will not change and are fixed for three months.

3. If Bob accepts the plan, he will receive ETH from the platform’s fund pool to buy the NFT and be held in custody according to the platform’s smart contract.

4. When Bob completes all his installment payments, the NFT will be transferred to his wallet, and he will have full ownership. (Hint: If the NFT’s price appreciates during this period, Bob can pay off the BNPL plan in full and sell the NFT.)

5. Late payments will be considered a breach of contract, and the NFT will be retained in the corresponding platform Vault for liquidation.

The BNPL function provides a “blocking” service that allows users to temporarily post their NFTs as collateral in exchange for a loan. The loan, along with interest, is then repaid, and the interest goes directly into the fund pool. To prevent plan breaches, the platform has adopted various risk management measures, such as increasing interest rates to regulate loans and prevent holding high-risk NFT products.

It can be seen that the business model of non-collateral loans, whether it is flash loans (down payments) or BNPL buy now pay later, actually places the collateral behavior in the post-purchase sequence of events. It allows users to obtain NFTs with a smaller initial investment and pay off the corresponding loans within a predetermined time frame, while paying a partial down payment upfront. This is suitable for NFT market users who have purchasing intentions but currently lack the ability to purchase in full.

Therefore, the characteristics of such loan models are:

- Reasonable use of funds, which can advance purchase behavior with a smaller initial investment and reduce the user’s financial pressure

- A reliable credit evaluation system is needed to judge the risk of each transaction through credit evaluation

- The risk control model needs to be verified, especially in the early stage of the product. It is critical to effectively control risks and maintain business health when the number of users using the product increases in the future.

6. Profit Model

Generally speaking, the revenue sources of the NFT lending protocol mainly include: (1) loan interest paid by users for mortgage lending, (2) loan fees generated by functions such as flash lending, and (3) transaction market fees.

The profit model of the NFT lending business in the protocol mainly comes from loan interest and loan function fees, and the transaction market fees are not related to the lending business.

According to the different settings of the project agreement, the distribution of project income will also be different. There may be different proportions of distribution between the project treasury and token holders/users.

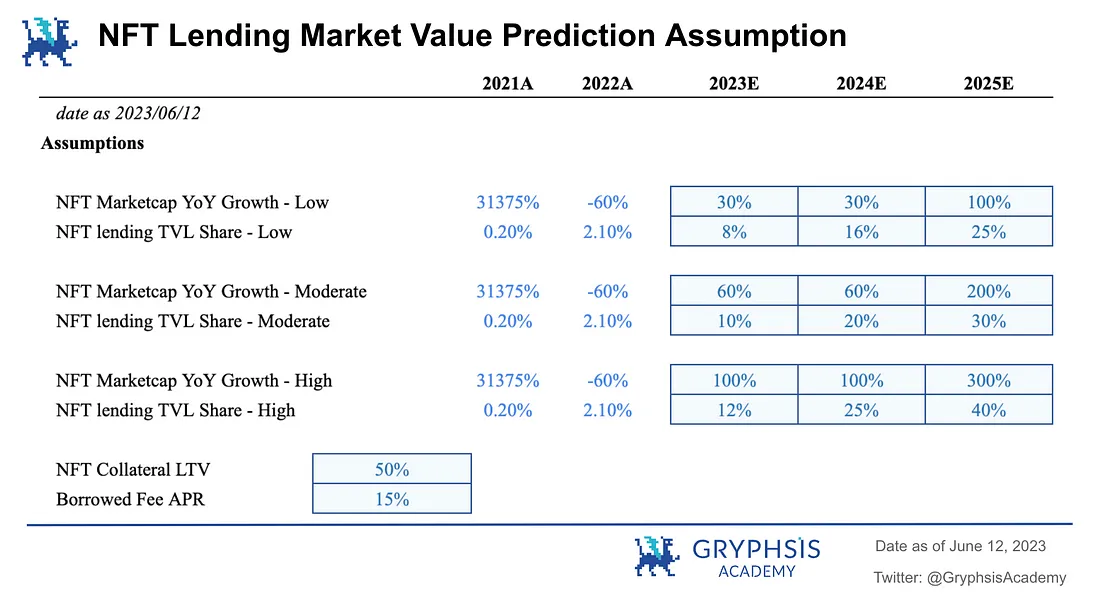

7. Industry Valuation

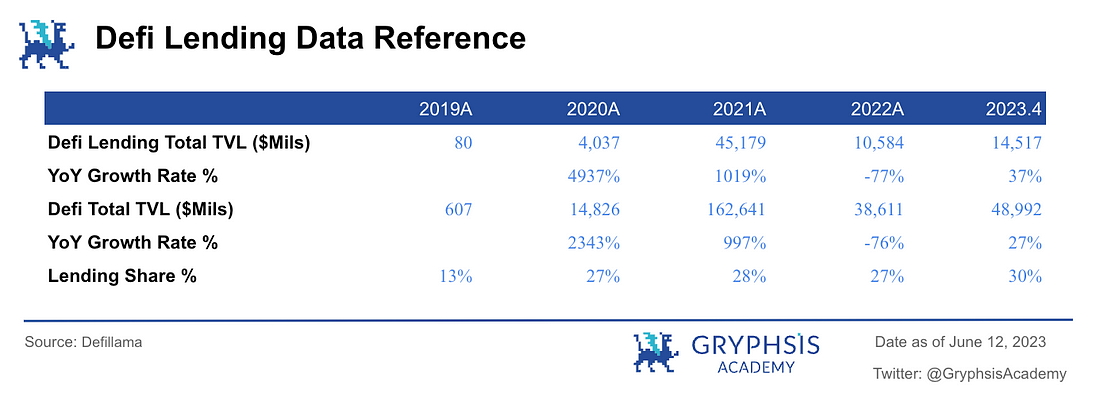

Using the top-down valuation method, the estimated value is calculated by analogy with the scale of the Defi lending market. The growth logic is mainly that the NFT market size will continue to grow with the development of the entire Web3 industry. As a track that is still in the early stage of development, NFT lending still has considerable overall track growth space.

7.1 Valuation assumptions

The encryption market has periodicity, and it is currently in a cyclical bear market. The overall size of the NFT industry will fluctuate with the overall market cycle. However, the penetration rate (TVL of locked assets) of NFT lending will increase relatively quickly.

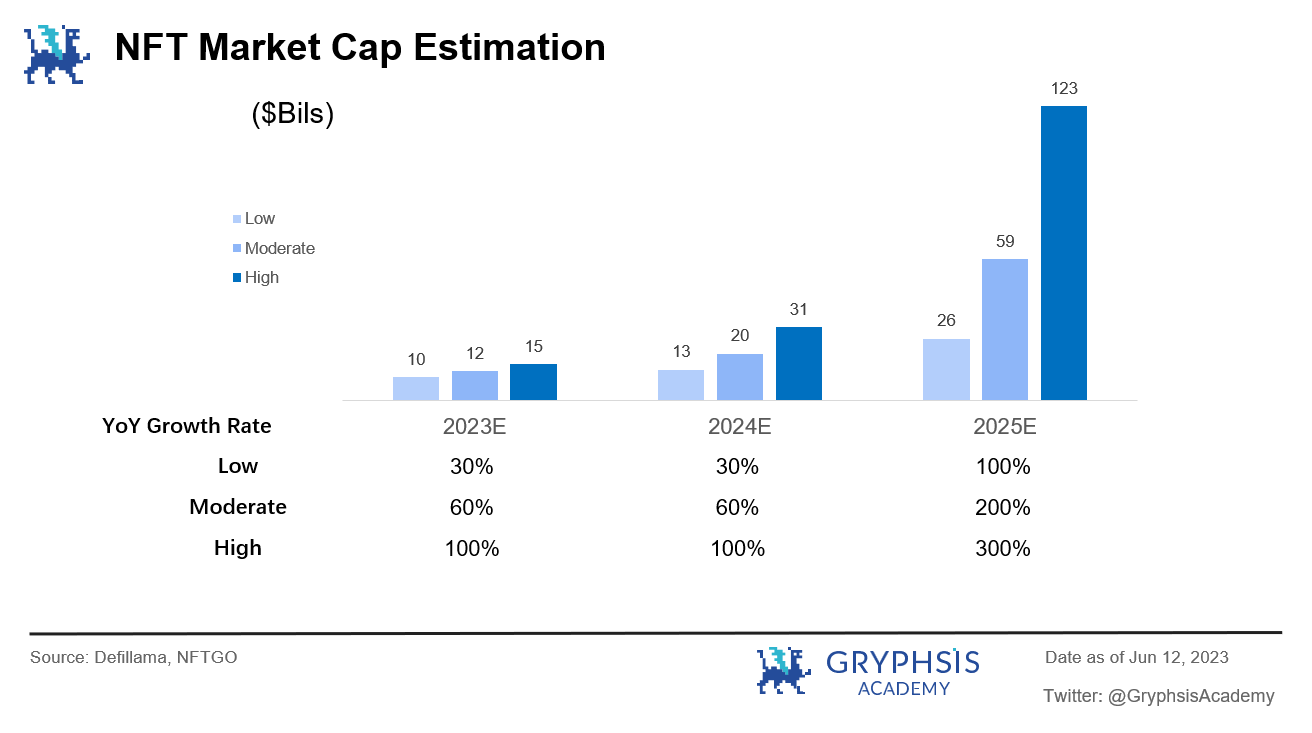

(a) Annual growth rate of industry market value

Referring to the development of the Defi lending market for about four years from 2019 to the present, it can be seen that in the first two years of rapid development of the industry and under the conditions of a relatively healthy market environment, the overall market size will gain dozens of times of high-speed growth due to the small market base. However, in 2022, due to the overall market weakness, the total market value will decline sharply. The trend of NFT market changes in the past two years is similar to this. Since the beginning of this year, the overall Defi market value has slowly recovered based on the 2022 basis, and if it continues to recover slowly, it is expected to recover last year’s decline after a whole year.

Therefore, assuming that the overall NFT industry market value will grow by 60% this year. Referring to the bull and bear cycles, assuming that 2024 is also a stable period, the growth rate is the same as that of 2023, and 2025 is a period of bull market outbreak, with a growth rate three times that of the stable period.

Use the above assumptions as neutral hypotheses. The conservative hypothesis takes 50% of the neutral hypothesis’s annual growth rate, and the radical hypothesis gives a high expectation based on the neutral hypothesis.

(b) NFT lending TVL ratio

The TVL lock-in penetration rate of reference lending business in the overall Defi market has been in the range of 25% to 30% in the past three years. The NFT lending TVL is expected to reach a similar ratio in 2025, taking 30% as the neutral hypothesis. Take 25% as the conservative hypothesis and 40% as the radical hypothesis.

(c) NFT collateral LTV

After synthesizing the LTV data of several mainstream NFT lending protocols at present, 50% is taken as the LTV hypothesis for valuation.

(d) Loan interest rate APR

Referring to the annualized interest rates of Defi lending and current NFT lending, 15% is taken as the APR interest rate assumption for NFT lending.

7.2 Market valuation prediction

Within the next three years, if the neutral hypothesis in the valuation model is used as the basis for estimation, that is, the overall market value of the NFT industry steadily grows in 2023 and 2024 (annual growth of 60%), it may enter a bull market cycle in 2025 with a significant increase (annual growth of 200%). NFT lending TVL accounts for 30% of the overall industry market value. LTV=50%, borrowing APR=15%.

Based on the above assumptions, the overall market value of the NFT market is expected to reach about $60 billion within 3 years, NFT lending TVL will reach about $18 billion, and the borrowable demand that can be met is about $9 billion (calculated based on an average LTV setting of 50%). The operating income of the overall NFT lending industry is expected to reach $1.3 billion, a scale of nearly tens of billions of RMB (calculated based on an average annualized interest rate of 15% for lending).

Note: The operating income here only considers the absolute majority of lending interest income in the industry, referring to historical lending data of several major NFT lending platforms (the relatively stable interest rate range is mostly concentrated between 15% and 30%) and combined with the trend of Defi lending interest rate evolution. Take 15% as the average annualized interest rate assumption for NFT lending.

8. Main Company/Protocol Product Introduction

This chapter introduces the main company products under the mortgage lending model.

8.1 Peer-to-Peer

8.1.1 NFTfi

NFTfi.com is a mature auction-style P2P NFT lending platform, where the bid, interest rate calculation, and time are jointly determined by the funding provider and the NFT collateral provider. It is a leading platform in P2P lending businesses.

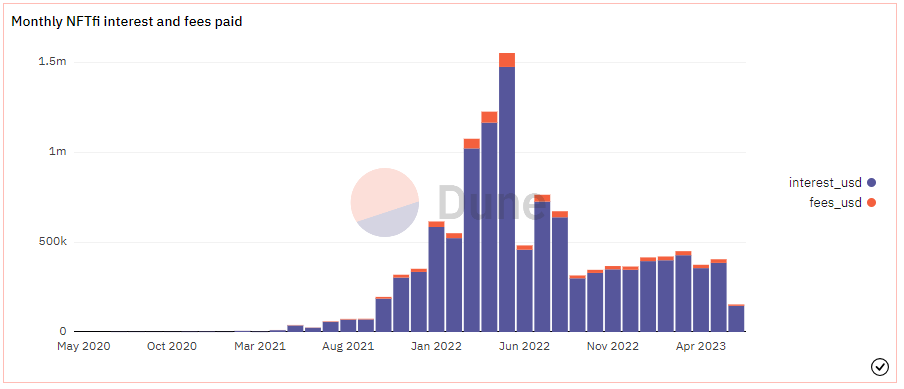

Since its launch in 2020, it has accumulated over 45,000 loans, with a loan amount of about $450 million (as of the end of May 2023). Since April 2022, the monthly ETH loan amount has remained at over 10,000 coins, with a peak of nearly 18,000 coins in January 2023. From March to May 2022, monthly revenue exceeded $1 million, with a peak in May of over $1.5 million.

Source: Dune Analytics@rchen8 (June 12, 2023)

Source: Dune Analytics@rchen8 (June 12, 2023)

8.1.2 Arcade

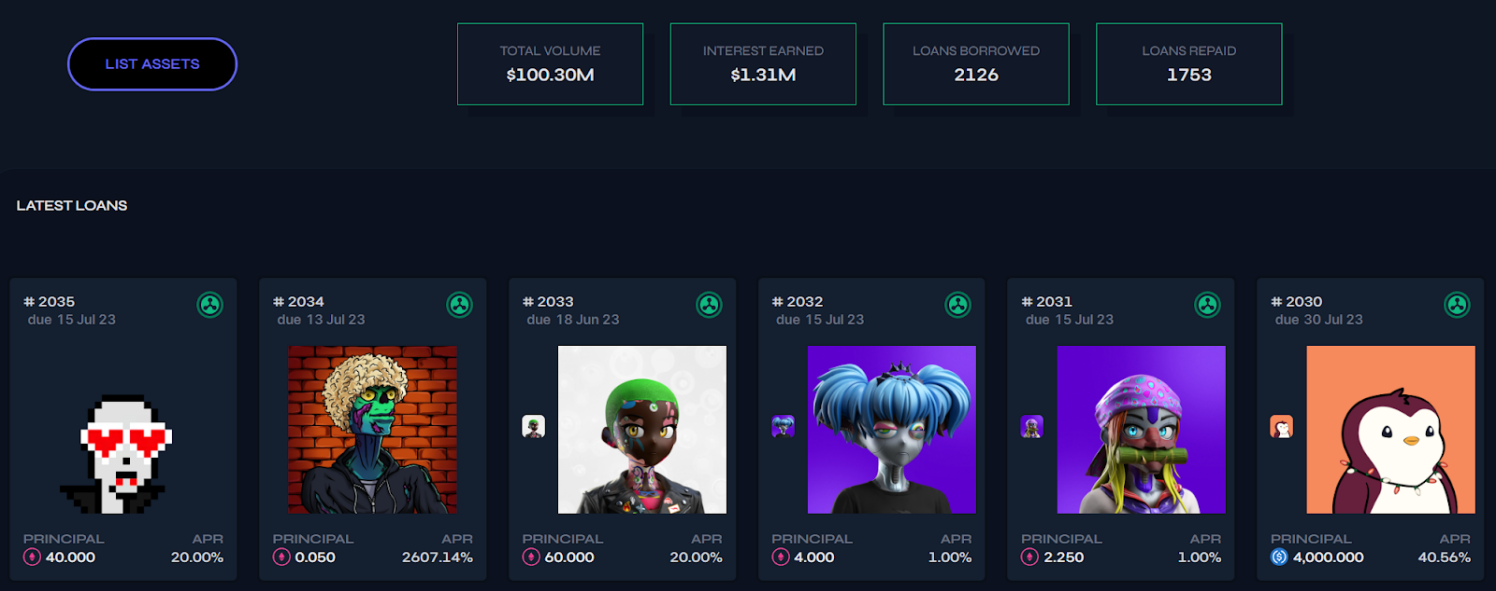

Arcade is also a P2P platform that provides liquidity lending markets for NFTs. It is the predecessor of Blockingwn.fi. The project is built on the Blockingwn protocol, which is an NFT liquidity infrastructure layer and includes a set of smart contracts deployed on the Ethereum blockchain that can securitize non-fungible assets. NFT holders can use one or more of their assets as collateral to apply for a loan through the Arcade application. Then, the loan with specified terms is required.

Source: Arcade (June 12, 2023)

The platform uses smart contracts to create a packaged NFT (or wNFT), which represents the borrower’s loan collateral, to be used when applying for a loan. The wNFT is locked in a custodial smart contract, which records when the principal is sent to the borrower and repaid to the lender.

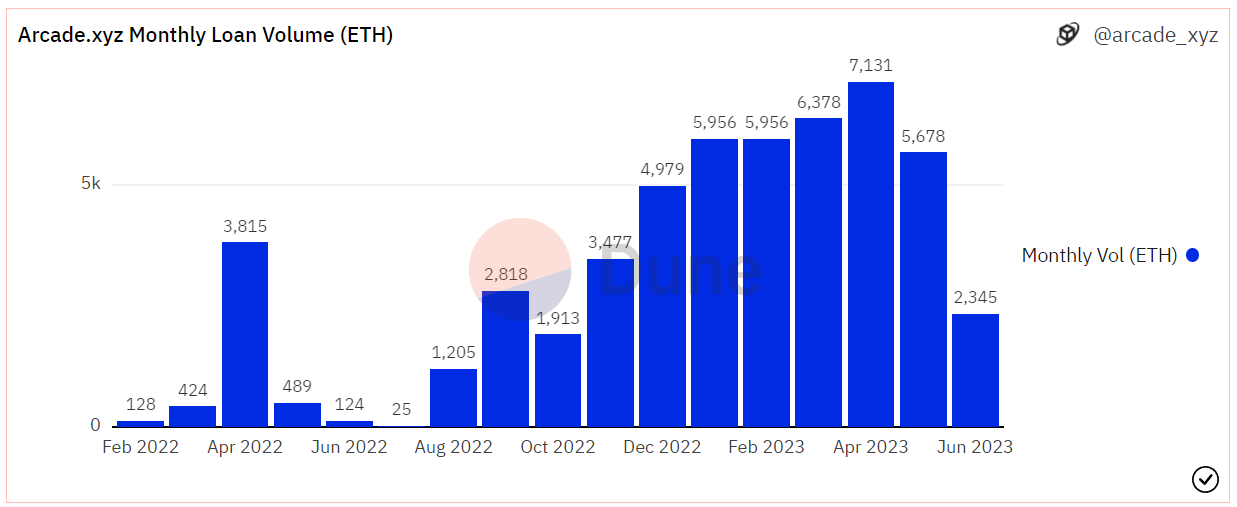

As of June 12th, Arcade has accumulated over 2,000 loans, with loan funds of around $100 million, and the monthly loan amount has remained at over 5,000 ETH per month in the past six months. The accumulated loan interest income exceeds $1.3 million.

Source: Dune Analytics@arcade_xyz (June 12, 2023)

8.1.3 Blur (Blend)

NFT trading platform Blur launched Blend, a P2P NFT lending protocol, and a function that allows for the purchase of NFTs through loans, in collaboration with Blockingradigm in May.

The core features of Blend include:

- Peer-to-peer, perpetual lending, no expiration date, no need for oracles

- Lenders can set the loanable amount and APY to publish their offers, and borrowers can choose from the offers

- If a lender exits, the borrower needs to repay within 30 hours or borrow anew, otherwise there will be liquidation

- Borrowers can repay at any time

- Support for buy now, pay later, i.e. down payment + loan to buy NFTs

Source: Blur

The core advantage of Blend is the unification of non-essential elements, which reduces system complexity and enables flexible migration of lending relationships within the system. Pricing of risks and returns is determined through market games, maximizing user satisfaction.

Compared to the traditional peer-to-peer model, Blend unifies the lending element of the three elements of collateral ratio, interest rate, and term into a perpetual flexible model, greatly improving the liquidity problem of lenders.

Blend unifies the lender’s exit and liquidation, and the oracle serves as the decision-making service for liquidation timing. Blend unifies the right to exit and leaves it up to the lender to handle it flexibly.

Blend achieves efficiency improvement by unifying non-essential elements in the traditional peer-to-peer lending model and is fully integrated with the trading module of Blur, resulting in significant improvements at the product level. It has been well-received by the market since its launch, with lending transactions quickly surpassing those of NFTfi in May.

Since its launch in early May, Blend has processed nearly 50,000 lending transactions and the total amount of lending has exceeded 700 million US dollars, with nearly 20,000 cumulative users. Since June, the business scale has further increased. The number of daily lending transactions has remained at around 2,000, and the amount of lending per day has steadily exceeded 20 million US dollars, with a peak of 34 million US dollars on June 6th.

Source: Dune Analytics@goyem (June 12, 2023)

Source: Dune Analytics@impossiblefinance (June 12, 2023)

8.2 Peer-to-Pool

8.2.1 BendDAO

The Peer-to-Pool model is led by BendDAO, the pioneer of the “Peer-to-Pool” (P2P) NFT lending protocol in the industry. BendDAO mainly serves blue-chip NFT holders. The borrower (peer) can quickly borrow funds in ETH from the protocol pool (pool) by pledging blue-chip NFTs, and the depositor (peer) provides ETH to the funding pool (pool) to obtain interest calculated in ETH, and both parties will receive BEND mining rewards. When the pledged NFT price falls to a certain level, liquidation will be triggered. Currently, BendDAO supports 10 mainstream blue-chip NFTs for collateralized lending.

Source: BendDAO

BendDAO interface:

Source: BendDAO

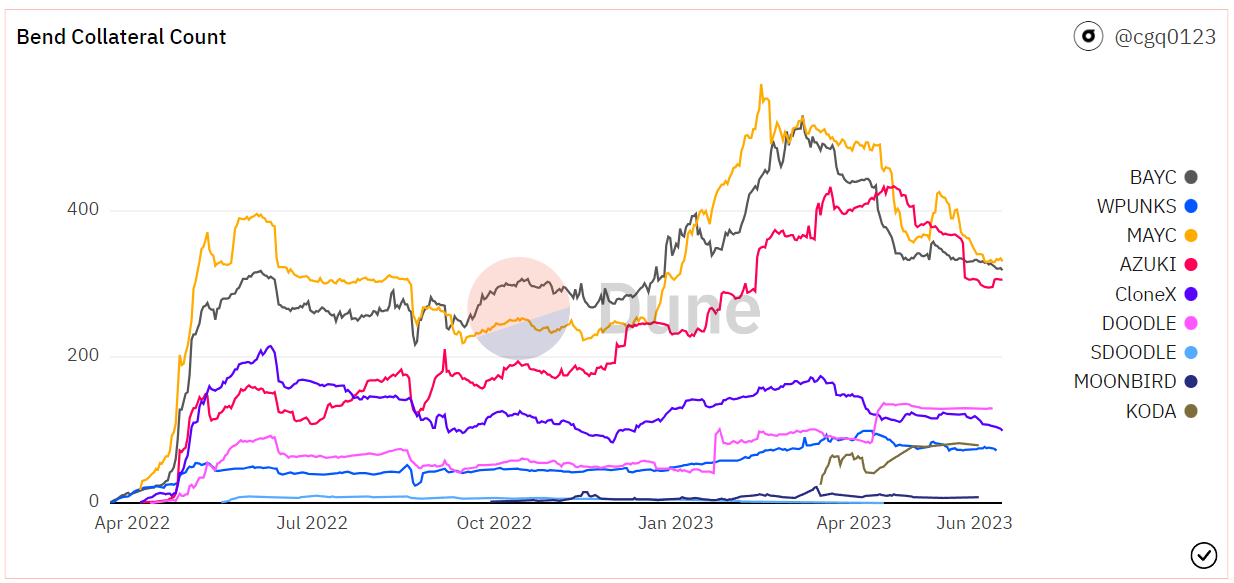

BendDAO collateralized NFT Quantity:

Source: Dune Analytics@cgq0123 (June 12, 2023)

The floor price data of NFTs is obtained through the Bend oracle, which is developed by the BendDAO team in collaboration with Chainlink. The original data of the oracle comes from the floor price of Opensea, X2Y2, and LooksRare, and the raw data will be filtered, and the low price will be calculated based on the trading volume of each platform. The TWAP (Time-Weighted Average Price) is used to ensure that the data is not manipulated.

Source: BendDAO

Since its launch in March 2022, the protocol has been continuously updated and iterated, and the team has continued to develop new services to meet market demand. Currently, in addition to the main lending business, BendDAO has also launched a built-in trading market, supporting new functions such as “Flash Loans” and “Collateralized Orders”, as well as “Peer-to-Peer” lending (Peer-to-Peer) function and asset pairing function “Bend Ape Staking” for Yuga Labs pledging function.

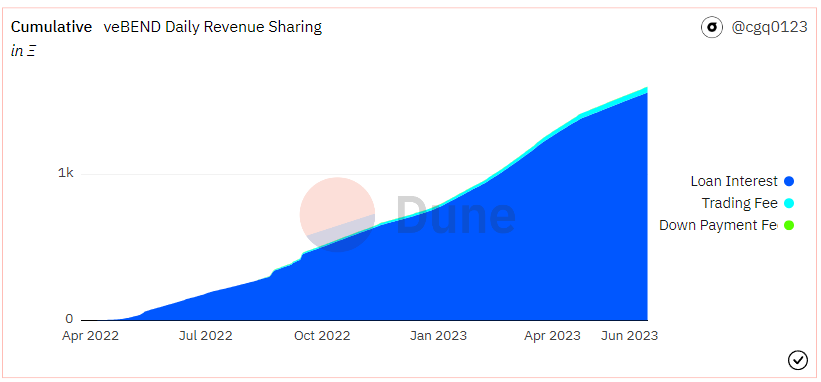

Source: Dune Analytics@cgq0123 (12 June 2023)

The sources of BendDAO protocol fees related to lending and borrowing services include (1) loan interest and (2) flash loan function fees (paid by the buyer, with a rate of 1%). There are also transaction market fees (paid by the seller, with a rate of 2%), but they are not related to lending and borrowing services. Among them, 30% of the interest paid by the borrower and 50% of the flash loan fee are included in the protocol revenue that goes to the treasury.

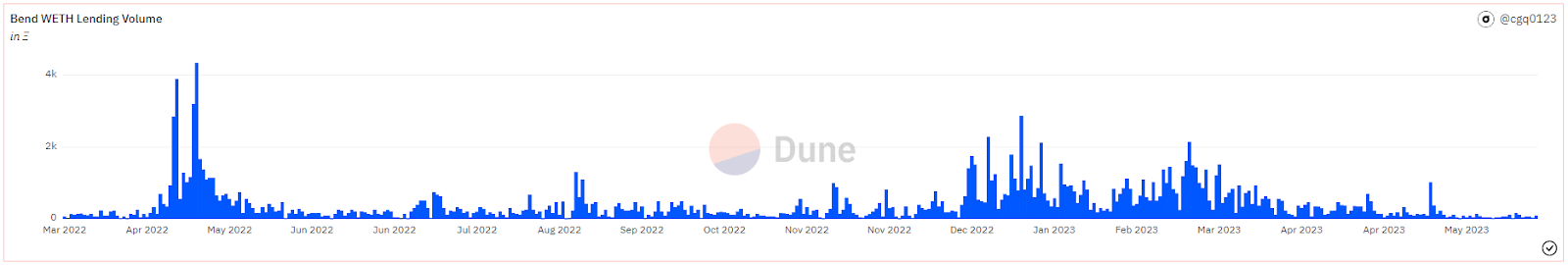

Source: Dune Analytics@cgq0123 (12 June 2023)

As of 12 June, BendDAO has lent out over 170,000 ETH, with a daily lending peak of 4,340 ETH in May 2022. The project has achieved a total income of 1,669 ETH, of which lending interest income accounts for about 94%, or 1,563 ETH. As a point-to-pool project, BAYC/MAYC/Cryptopunks are the three major blue-chip collateral targets, accounting for more than 70% of the collateral quantity. Since the beginning of this year, the project’s loan annual percentage rate (APR) has been maintained at the range of 25% to 30%, with daily interest income of about 3 to 6 ETH.

Source: Dune Analytics@cgq0123 (12 June 2023)

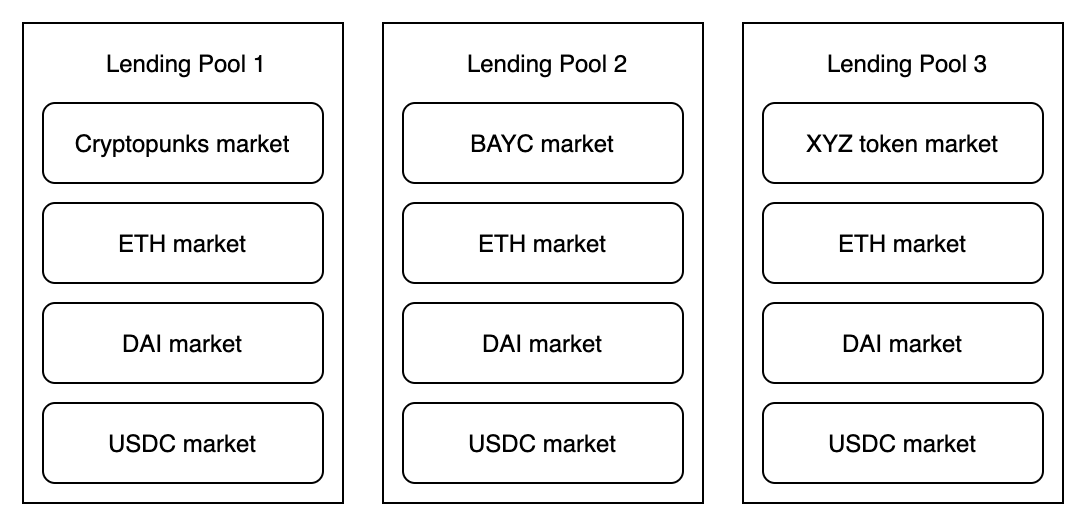

8.2.2 DROPS

DROPS operates a currency market similar to Compound, where users can collateralize their NFT portfolios to obtain loans in USDC and ETH. NFTs are priced by the Chainlink oracle, which adjusts based on outliers and the average over a period.

Like Compound and Aave, DROPS uses a segmented interest function that targets a specific utilization rate, and the interest rate that borrowers pay will increase significantly when there is not enough funding for withdrawal.

To limit the risk of liquidity providers, DROPS separates the protocol into isolated pools, each with its own NFT collection. This is similar to Fuse’s operation on Rari Capital and can ensure that borrowers choose the collection they are satisfied with.

Source: DROPS

DROPS has currently realized a total loan amount exceeding 11 million USD (as of 6.12).

Source: Dune Analytics@metastreet / @goyem (6/12/2023)

8.3 Hybrid

8.3.1 BlockingraSBlockingce

BlockingraSBlockingce is an NFT lending protocol that uses a pool-based pattern as the underlying mode, allowing users to collateralize and borrow NFTs and fungible tokens. BlockingraSBlockingce allows users to bundle assets of ERC-721 tokens or ERC-20 tokens, collateralize and borrow them, and use underutilized funds for further investment, improving the efficiency of on-chain asset capital and earning profits.

Source: BlockingraSBlockingce

BlockingraSBlockingce’s innovative collateralized lending model is the first to create a cross-margin credit system, rather than using the isolated margin pool design used by existing platforms, which will allow users to provide loans with a credit line for all collateralized assets.

Source: BlockingraSBlockingce

By collateralizing your NFT assets through BlockingraSBlockingce, you will generate a credit line for yourself and a health factor for your entire collateralized asset portfolio. As long as the health factor of your entire collateralized asset portfolio remains above 1, none of your NFTs will ever trigger a liquidation auction.

This credit system is similar to a valuation system that evaluates the value of all your collateralized assets and automatically approves loans based on that evaluation. As long as they are collateralized asset types supported by BlockingraSBlockingce, you can borrow based on their total value.

This is the full-position leverage mode that adopts cross-margin.

In addition, BlockingraSBlockingce also has features such as “hybrid Dutch auction” liquidation mechanism, “buy now pay later” under credit system, high rarity NFTs’ high amount lending, borrowing and short selling, etc., to meet the user needs of the current NFT market.

Since its official launch in December 2022, BlockingraSBlockingce’s business scale has grown rapidly, with growth rate significantly higher than the overall NFT lending market data. The project’s cumulative lending funds have reached nearly $300 million (as of 6/12/2023), and the cumulative number of users has exceeded 13,000. In April of this year, the single-week lending peak exceeded $20 million, and the lending funds have remained at a scale of $5 million per week in the past month.

Source: Dune Analytics@goyem (June 12, 2023)

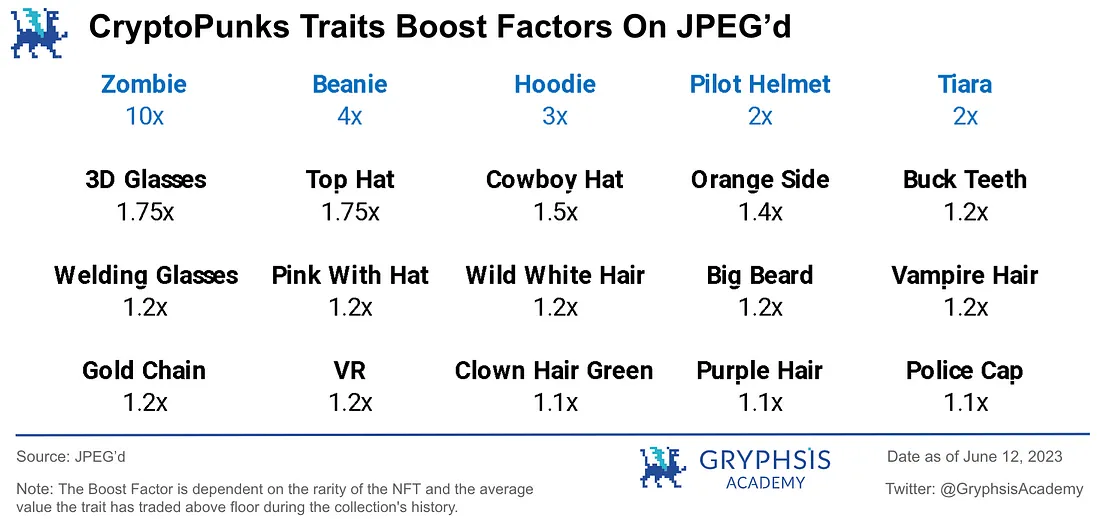

8.4 Collateral Debt Position (CDP) of JPEG’d

8.4.1 JPEG’d

JPEG’d is an improved lending protocol for NFT P2Pool, which adopts MakerDAO’s CDP (collateralized debt position) model in lending mechanism. Protocol users pledge NFTs into the protocol and borrow stablecoin PUSd generated from the NFT collateral. They can borrow up to 32% of the PUSd floor price. The first NFTs allowed to be collateralized by JPEG’d are CryptoPunks. The initial borrowing annual interest rate is 2%, with a one-time borrowing fee of 0.5%. JPEG’d sets the LTV (loan-to-value ratio) at 32%, and liquidation is triggered when the LTV reaches 33%.

Source: JPEG'd

Due to the significant fluctuations in the NFT floor price, JPEG’d uses Chainlink as its data source, with the core being time-weighted average price. It is worth mentioning that JPEG’d has designed a novel insurance mechanism. Users can choose to pay a 5% borrowing fee for insurance, which allows them to repurchase the NFT after being liquidated, provided they pay off the debt, accrued interest, and 25% liquidation penalty within 72 hours. Otherwise, the NFT will belong to JPEG’d DAO.

JPEG’d also innovatively provides a platform-defined weighted valuation of the rarity of designated blue-chip NFTs (CryptoPunks, BAYC, Azuki). For each specific attribute, after being weighted differently, the valuation will receive corresponding weight enhancement rewards. Currently, there are relatively few platforms in the market that provide a valuation of rarity attributes.

In addition, pETH generated from JPEG’d has relatively good yields when ETH-pETH assets are pledged on Convex, with peaks reaching around 30-45% in early 2023.

Currently, the project has accumulated more than 36 million US dollars in loan funds (as of June 12, 2023). It reached a single-week borrowing peak of around 770,000 US dollars in January-February this year. CDP-type NFT lending protocols account for a relatively small share of the entire market.

Source: Dune Analytics @goyem (June 12, 2023)

9. Risks and Prospects

Although the NFT lending track is developing rapidly, some of the major risks cannot be ignored:

1) Risk of NFT collateral valuation fluctuations (default risk)

For lending projects, the worst case scenario is that the liquidity of the funding pool dries up, and borrowers who pledge collateral cannot repay their debts.

For NFT lending protocols, it is particularly important to define high-quality NFT collateral assets. When the floor price of the NFT series pledged as collateral drops sharply, many borrowers may voluntarily abandon the NFT assets and choose to default on their loans. In such cases, the NFTs with collapsed prices are likely to have no bidders.

(Historical Event Review – BendDAO Liquidity Crisis: From August to September 2022, the floor price of blue-chip NFTs fell overall, triggering liquidation of multiple collateral assets without any bidders. The market panicked and caused a large amount of ETH to be withdrawn from the funding pool, resulting in the liquidity of the funding pool drying up, and loan and deposit interest rates skyrocketing. BendDAO protocol faced a potential collapse crisis. To cope with the crisis, the team initiated a proposal to modify some parameters. Over the next few days, the funds in the protocol pool gradually recovered, market sentiment eased, and fund utilization and loan interest rates returned to normal levels.)

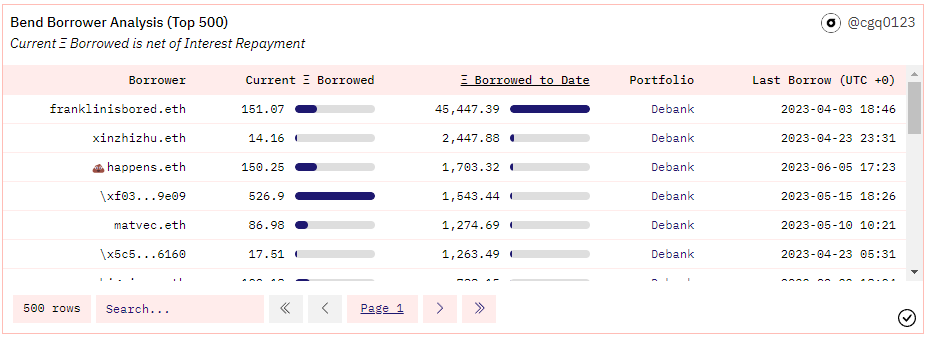

2) Business target users are highly concentrated

The audience for NFT lending is not particularly broad, and although the industry is developing rapidly, the operational data of some projects shows that the head users account for a relatively large proportion of the business, and the projects have a certain dependence on the business volume of the target key customer group.

For example:

BendDAO protocol: As of June 12, 2023, the cumulative loan amount is 178,820 ETH, and the user with the highest cumulative loan amount, Franklinisbored.eth, has lent a total of 45,447 ETH, accounting for more than 25% of the total business volume.

Source: Dune Analytics @cgq0123 (June 12, 2023)

3) Growth potential of the track business volume may be limited

NFT lending projects often focus on high-quality blue-chip NFTs as collateral assets to ensure healthy business development. These NFTs have strong price consensus and risk resistance abilities. However, the types of blue-chip NFTs that meet these conditions are limited, and the NFT issuance of each project is fixed. In the current market environment, high-quality NFT collateral assets that are included in the incremental growth require a long period of market testing, and it is difficult to predict and judge in advance. This may pose a potential risk to the overall size and business growth of the NFT lending market, and may be a potential risk point.

As for the development of the overall NFT market, currently, subcategories including blue-chip PFP (Profile Picture), high-quality GameFi assets, and NFT assets with unique project empowerment will be an important part of the future industry development. As the industry matures, more and more users will accept and invest in the field of NFTs. The link between NFTs and real life will become more diversified, and the influence of NFTs will continue to spread with various derivatives. With the growth of the overall NFT market size, the opportunities for NFTs in various sub-sectors will also increase. For NFT lending, the diversity of protocols can meet the needs of different users. If the overall lending protocol can achieve high activity and high popularity, it will be able to provide a better liquidity solution for NFT and Defi users in both directions.

10. Conclusion

In the current NFT market, most users are still concentrated in the markets and aggregators with the lowest operating thresholds, but these two areas have not fully demonstrated the greatest capital efficiency. As more and more users join the NFT field, how to use NFTs for financialization to improve market capital efficiency more effectively and attract users’ attention may be a sustained breakthrough in Web3 business growth.

As an important part of NFT financialization, the improvement of oracle and liquidation mechanisms has gradually shown the efficiency advantage of P2Pool in competition with P2P. The iteration of different products has also made the product form of this market more and more mature. How to independently rate different NFTs, accurately price and establish liquidity, etc., are key issues to better improve customer experience.

We believe that NFT liquidity solutions that have reasonable and accurate pricing mechanisms, smooth user experience, sustainable transaction models and profit models, and complete risk control mechanisms will become an important cornerstone for the progress of the NFT-Fi industry.

11. References

– Official websites of various NFT lending protocols

– BAYC price drop: A comprehensive analysis of the “danger” and “opportunity” of BendDAO, a leading NFT lending platform

– An in-depth analysis of the operation of NFT lending and lending platforms

– Systemic opportunities for the financialization of NFTs? An overview of 152 projects in the field

– Galaxy Digital researcher: A preliminary look at peer-to-peer, peer-to-pool, and CDP types in NFT lending

– Project research report | BendDAO: A point-to-pool NFT collateral lending protocol!

– Unlocking NFT liquidity: A comprehensive analysis of the operation of the NFT lending race and representative projects

– In-depth analysis of NFTFi: Looking at the future development of NFTFi from the current market

– NFTFi ultimate guide | An overview of projects worth paying attention to in the lending, leasing, and fragmentation fields

– Is full-margin leveraged NFT lending protocol BlockingraSBlockingce the “BendDAO killer”?

– Introducing BlockingraSBlockingce Pt.1— Universal Liquidity, Instantly Unlocked

– Overview of NFT lending platform BlockingraSBlockingce

– A brief analysis of the characteristics and advantages of NFT lending protocol Blend launched by Blur and Blockingradigm

– Road to Financialization of NFTs

– Dune Analytics (@cqg0123)

– Dune Analytics (@metastreet @goyem)

– Dune Analytics (@rchen8)

– Dune Analytics (@arcade_xyz)

– Dune Analytics (@impossiblefinance)

– Dune Analytics (@beetle)

This article was published on June 22, 2023. Original link:

NFT Lending: An In-depth Analysis of Market Dynamics, Risk Landscape, and Future Prospects

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!