Author: Binance Research; Translation: Plain Language Blockchain

TLDR

Liquidity staking: Due to reduced withdrawals, overall staked ETH is experiencing exponential growth, attributable to lower liquidity risk and the increasing popularity of the LSDfi protocol. After surpassing DEXes, liquidity staking now ranks first in total locked value (“TVL”) across different DeFi segments.

Four main methods of ETH staking: Including pool staking service providers, centralized exchanges (“CEXes”), staking-as-a-service (“SaaS”), and standalone staking.

- Believing in the theory of “karma”, the founder of Sanjian will donate future profits to creditors.

- NFT Lending Track Research Report: Financial Innovation from Idle Assets to Liquidity

- Interpretation of the 4 Key Points of the Digital Asset Bill that May be Introduced Prior to the 24th US Presidential Election

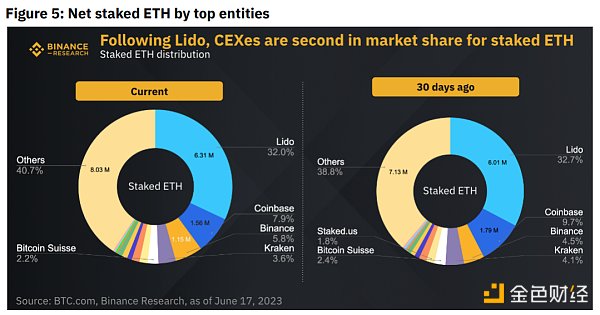

With 32.0% market share, centralized staking via Lido is currently the most popular method. Nevertheless, other competitors like Frax are trying to expand their market share by introducing decentralized, creative point-to-pool lending markets.

Top LSDfi categories: LSDfi has many categories including CDP stablecoins, DEXes, index LST, yield strategies, etc. Loans currently sit atop with $2.59bn TVL, followed closely by CDP stablecoins with $2.35bn TVL. ❖ LST yield and TVL: Typically, LST yields highest on secondary or derivative protocols (such as Pendle, Convex, and Aura), but TVL is usually higher on major DEXes (such as Curve).

Protocol focus: While many LSDfi projects are gaining popularity, we focus on Pendle and EigenLayer, which recently had fluctuations on social indicators. Pendle as a yield trading protocol; EigenLayer supports heavy staking for ETH and LST.

Introduction

1. What is LSDfi?

In our previous LSDfi report, we discussed the prospects and potential growth of LSDfi. This data insight report will delve into liquidity staking and LSDfi from a data-driven perspective, first quickly reviewing what they are.

In Proof of Stake (“PoS”) networks, liquidity staking allows users to stake network tokens (e.g., ETH or BNB) to earn potential yield while providing liquidity to these staked tokens by wrapping the tokens into liquidity staking tokens (“LSTs”), which can be interchangeable with liquidity staking derivatives (“LSDs”).

Some benefits of liquidity staking include improving capital efficiency, liquidity staking opportunities, and enhancing network security by increasing the number of staked network tokens. However, people should be aware of the risks involved, such as slashing or smart contract risks. Insurance funds introduced by market leaders such as Lido can help mitigate risks. There may also be potential conflicts between governance and LST holders due to target differences. For example, due to different holding periods for LST and governance holders, there may be a misalignment of interests. However, LST holders have no voting rights. This conflict can be mitigated through a dual governance system, in which LST holders have veto power over decisions that protect their interests. For a better understanding of other types of risks, please refer to our previous report.

2. Market Statistics

(1) Growth of ETH staked

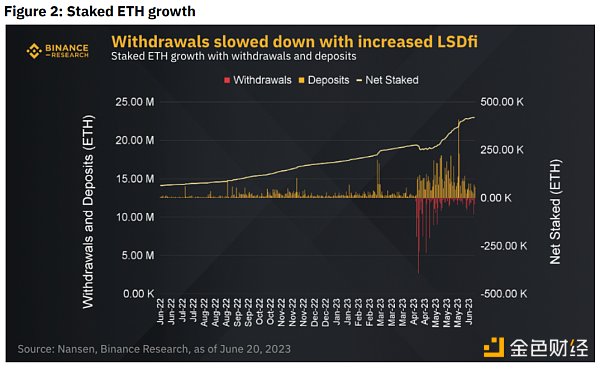

After the Shapella upgrade of Ethereum, users’ confidence in staking increased because they were able to withdraw. Although there were a large number of withdrawals in the early days, withdrawals slowed down as liquidity risks decreased and the LSDfi protocol became more popular. LSDfi provides users with new opportunities to increase yield, which we will discuss further in the later part of this report.

The sudden surge in deposits on June 1, 2023 was facilitated by Celsius, which withdrew 428,000 ETH from Lido. According to 21Shares data, 192,000 was deposited into Celsius’s staking pool, while another 99,000 was staked through institutional staking provider Figment.

(2) Staking rate

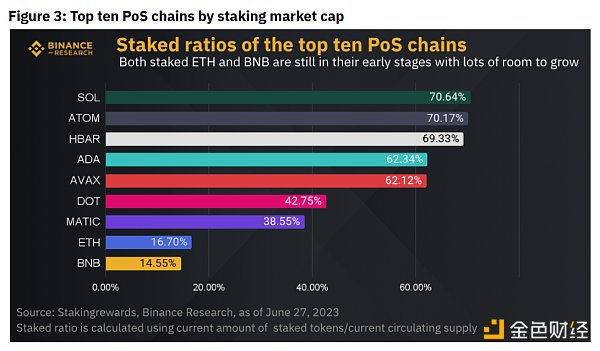

As of June 27, 2023, the ratio of staked ETH tokens to their circulating supply was 16.70%, while the ratio for BNB was 14.55%. These figures indicate that both chains have significant room for development, considering that the average staking rate for the rest of the top ten PoS chains by staking market value (“market cap”) is 49.67%.

(3) TVL of liquidity staking

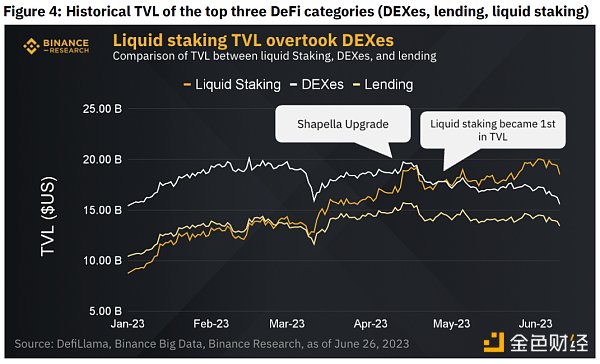

The total locked value (“TVL”) is $18.48 billion, up 131.67% since the beginning of the year. Liquidity staking currently ranks first in TVL among different DeFi industries. On April 28, 2023, it first surpassed DEX with a TVL differential of $6.8 million, the largest leader in TVL.

2. Ethereum’s Liquidity Staking

There are several ways to stake ETH, including centralized staking through service providers, centralized staking services, staking-as-a-service (SaaS), and solo staking. Users can choose the method they prefer based on factors such as staking simplicity and potential returns.

Lido has maintained about 32% market share in the past 30 days. Overall, most entities have gained or maintained market share except Coinbase and Kraken, which have lost 1.8% and 0.5% market share, respectively.

Note that having too much dominance in ETH staking is not entirely healthy. Consensus thresholds that exceed one-third, one-half, and two-thirds can make Ethereum vulnerable to collusion or attacks. Further growth of Lido could bring systemic risk and allow for cartelization of block space. Therefore, new solutions or disruptive competitors are encouraged, especially since self-imposed deposits in Lido can be voted against.

1. Liquidity Staking Pools

Target audience: cryptocurrency and DeFi-native users

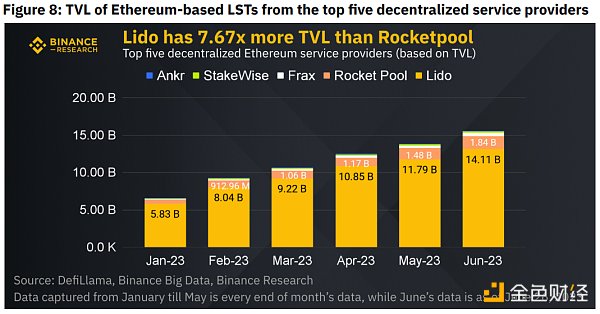

Top providers (TVL): Lido, Rocketpool, Frax, Stakewise, Ankr. Typical fees seem to be around 10%, except for Ankr and Rocketpool. While Ankr has the lowest fee at 5%, its TVL is still lagging, as shown in the graph below.

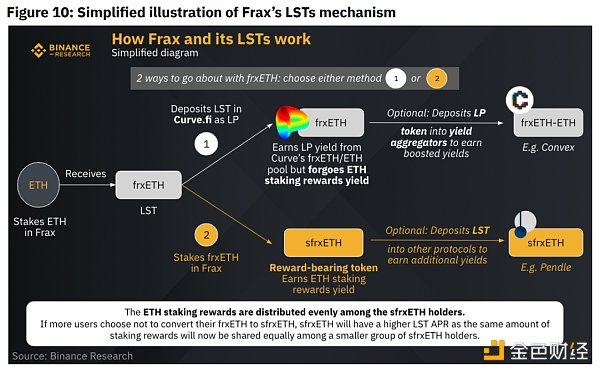

Among the above protocols, Frax seems to be making the most progress in decentralization, especially with the introduction of frxETH V2. Under the current frxETH V1 design, the Frax team has complete control over all validator nodes using a 3/5 multisig mechanism. frxETH V2 will be a decentralized, permissionless ETH lending market for node validators using a peer-to-pool model.

It allows operators to borrow ETH for validation at market rates without extra fees or commissions, paying only interest driven by market forces. This increases efficiency and decentralization while reducing dependence on central authorities. Unused ETH goes into the Curve AMO smart contract, providing deeper liquidity for frxETH holders. Additionally, sfrxETH holders have the opportunity to earn interest from their holdings. These upgrades could increase Frax’s TVL upon release.

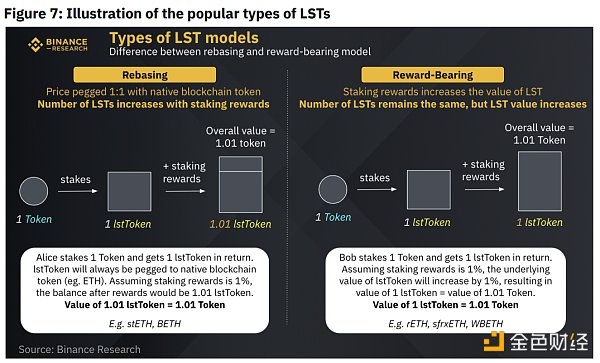

(1) LST models mainly have three types:

A. Evaluable tokens (e.g. stETH)

● Token supply changes algorithmically due to staking rewards or possible slashing penalties

● Theoretically pegged 1:1 with the native token

B. Reward-bearing tokens (e.g. rETH, ankrETH)

● Value increases over time to reflect token staking rewards

C. Base token + reward token (e.g. Frax, StakeWise)

● One pegged 1:1 while the other accumulates rewards

● Frax: Base (frxETH) and reward (sfrxETH)

● StakeWise: Base (sETH2) and reward (rETH2)

Note that not all DeFi protocols support rebasing tokens. For example, the stETH/ETH trading pair on Uniswap encountered compatibility issues when rebasing tokens, which could lead to loss of staking rewards for stETH.

When users choose to wrap their rebased tokens (such as stETH), the wrapped token typically becomes the reward-bearing token. For example, stETH is wrapped into wstETH. The balance of wstETH remains constant over time, but its value increases.

Assuming a user wraps 1 stETH and receives 0.98 wstETH. If the price of wstETH increases by 5%, the user can unwrap 0.98 wstETH to receive 1.05 stETH.

Lido is the undisputed market leader among the top five decentralized service providers, with a TVL growth of 142.02% since the beginning of this year. Founded in December 2020, its early mover advantage helps it maintain its stronghold in the Ethereum liquidity staking space, despite its yield not being the highest. This hierarchy also means that there is deeper liquidity for stETH.

Compared to other LSTs, most protocols and pools integrate with stETH, making it more attractive and flexible for users to earn yields and exchange their LSTs in the DeFi ecosystem. Therefore, it attracts more new users and staked amounts, effectively creating a positive feedback loop.

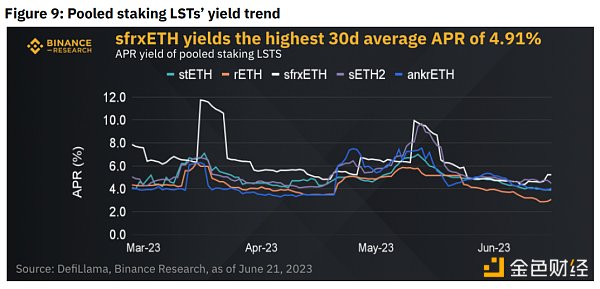

(3) Which LST has the highest yield?

Frax has the highest 30-day average annual interest rate of 4.91%, followed by Stakewise at 4.83%.

The higher yields may partially be due to Frax’s design, where users can choose to stake frxETH in the ERC-4626 vault to receive sfrxETH, or put it into the frxETH/ETH curve pool. If they choose the latter, they will have to forego their ETH staking rewards and instead earn income as liquidity providers (“LPs”).

sfrxETH holders will be able to receive staking rewards from the frxETH supply. sfrxETH is a yield-bearing token, where 1 sfrxETH represents 1 ETH plus accumulated staking rewards. Those who choose not to stake frxETH for sfrxETH will receive the average share of the unclaimed ETH staking rewards among all sfrxETH holders.

If more users decide not to convert their frxETH to sfrxETH, then sfrxETH holders will experience an increased LST APR. This is because the same amount of staking rewards will be distributed among a reduced pool of sfrxETH holders on average.

Currently, 60.28% of frxETH is staked on Frax; therefore, ETH staking rewards will be distributed on average among the sfrxETH holders staking these.

In the case of Stakewise, it separates its deposit and reward systems. sETH2 is pegged to ETH 1:1, while rETH2 represents the earned rewards. This helps users avoid impermanent loss, but may result in segmented liquidity.

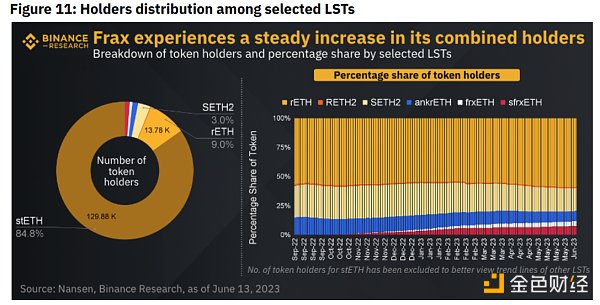

(4) Token Holders

Undeniably, stETH has the largest token holder share, as it dominates both staked ETH and TVL. Since September 2022, the percentage share of token holders for ankrETH and SETH2 has decreased, especially with Frax entering the liquidity staking market.

Frax ranks third among the top five aggregate staking providers by TVL, despite having the fewest token holders. Nevertheless, the protocol has consistently shown growth. In the past 30 days, the number of frxETH and sfrxETH holders has increased by 22.87% to 2.74K. The introduction of frxETH V2, as well as enhanced marketing and education, may help Frax attract more retail users and whales due to its higher yields and innovative design.

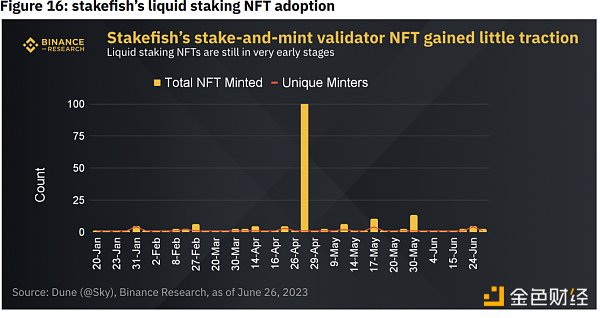

However, its staking and liquid staking NFTs have not seen much adoption. So far, only 182 NFTs have been minted. The outliers for the 100 NFTs minted all come from the same address that recently received funding in the first three days of minting.

4. Individual Stakers

Target audience: Individuals who can run validators As of the end of 2022, individual stakers on Ethereum make up about 6.5% of active stakers. Individual staking is suitable for those who do not want to rely on any SaaS or service provider and have at least 32 ETH. The validator queue is at 93,683, representing the number of validators waiting to enter or leave the network.

This means that new validators must wait 46 days (2) to stake. This brings an opportunity cost in terms of time return and may deter potential solo stakers. For pool staking and CEX, this is not a problem as the generated yield is evenly distributed among all users.

If individual stakers are able to wait, they may earn more by becoming their own validators due to no third-party fees. Nevertheless, overall cost calculation should also consider hardware and cloud hosting fees.

Three, Flow Staking on BNB Chain

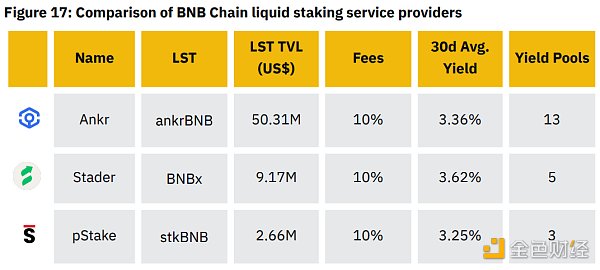

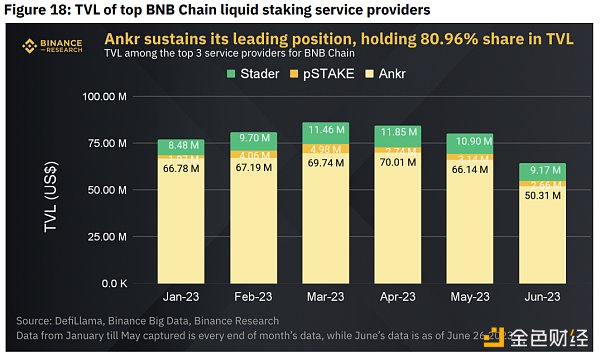

Liquid staking, popularized by Ethereum, is also accessible on chains such as BNB Chain. The top three major service providers – pStake, Ankr, and Stader – have a set of standard fees, among which the 30-day average annual yield of BNBx is the highest at 3.62%. All three LST – BNBx, ankrBNB, and stkBNB are rewarding tokens.

To be one of the elected validators in the top 21 rankings on BNB Chain, one will need approximately 100,000 BNB. This may not be feasible for most retail users. Therefore, pool staking is introduced, allowing them to delegate their BNB to selected nodes. Ankr dominates the liquid staking market on the BNB Chain, holding an 81.18% share among top providers (based on TVL).

This dominant position can be attributed to its position as the only liquid staking collateral choice in the BNB Chain ecosystem, allowing users to mint stablecoins. In addition, its market share on Ethereum and its partnership with Microsoft may help increase brand awareness among users.

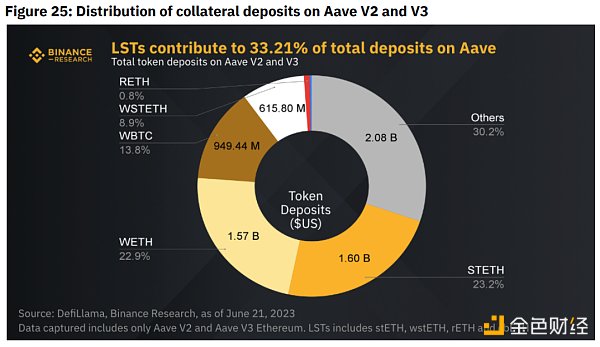

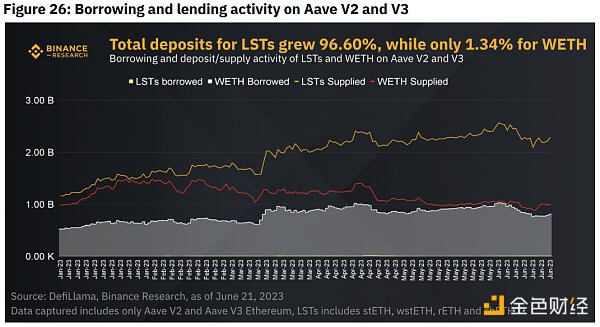

In the lending field, we observe a trend of demand for using LST as collateral and the increasing gap between the total supply of LST and ETH on Aave. The introduction of LST helps to grow deposits without cannibalizing the provided ETH.

(2) CDP Stablecoin

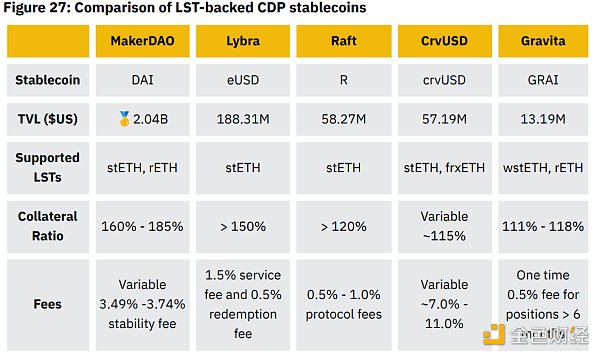

CDP is created by depositing and locking collateral (in this case, LST) into a smart contract and minting stablecoins as a result. There has been a lot of hype around the new protocol due to the high APY brought on by increasing token issuance, but OG protocols such as MakerDAO remain the clear market leader, minting 484.4 million DAI out of deposited LST. The minting amount is significantly higher than that of eUSD (Lybra) by 5,730%, despite the highest collateral ratio and relatively high fees.

Lybra introduces a new concept of redistributing staking rewards to stablecoin holders. By simply holding interest-bearing eUSD, holders can earn up to 8% derived yield, paid by the underlying LST yield. Additionally, eUSD minting provides users with a chance to earn about 28.59% of esLBR. eUSD faces limited DeFi compatibility and often stays above $1 due to insufficient arbitrage incentives. The upcoming V2 may address these issues. Meanwhile, Lybra’s unique CDP stablecoin and liquidity mining opportunity propelled its TVL to soar 1,059.20% since mid-May.

CrvUSD provides the highest rate for borrowers, exceeding 7.5%, which is also driven by increasing demand. Users may not mind higher rates due to the underlying borrowing liquidation AMM algorithm (LLAMA). It allows for “soft liquidation,” where the collateral will be converted to a limited partner position to limit potential losses from price fluctuations. The competition for LSDfi CDP stablecoins is fierce, as emerging stablecoins such as GHO by Aave and stablecoins by Prisma Finance are striving to capture a piece of the market.

(3) DEXes

As of June 25, 2023, the total value locked (TVL) of LST on DEX is $1.03B, making it the third-largest category in LSDfi.

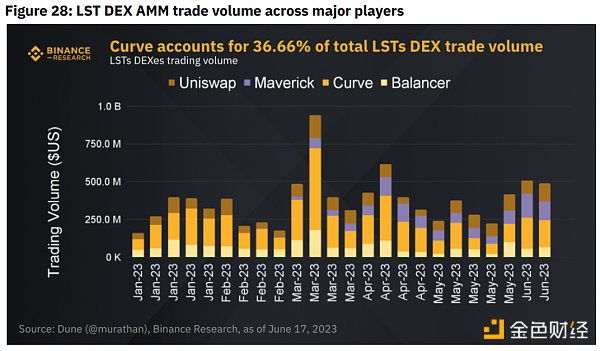

DEX is an important form of exit liquidity for users, especially if someone has invested a lot of money and cannot wait for a withdrawal due to network delays. Although Curve accounts for 36.66% of the total LST trading volume, Maverick is quickly closing the gap, with its daily trading volume increasing to $125 million.

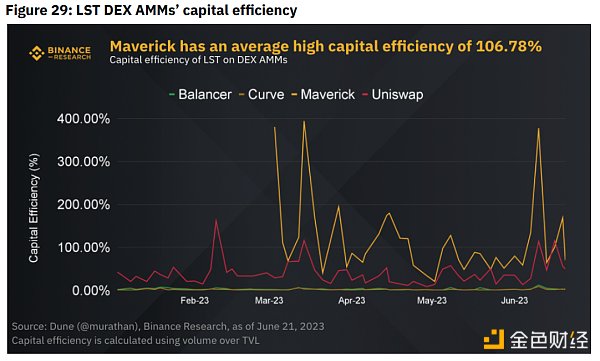

Capital efficiency refers to the effectiveness of using existing funds deposited by LPs in an AMM. Higher capital efficiency can bring better liquidity to LPs and generate more profits.

Maverick performs the best, with an average capital efficiency of 106.78%, followed by Uniswap, which averages 38.64%. Although Uniswap’s efficiency can skyrocket to 115%, it is mainly driven by occasional large trades by whales.

3. Where is the highest yield of LST?

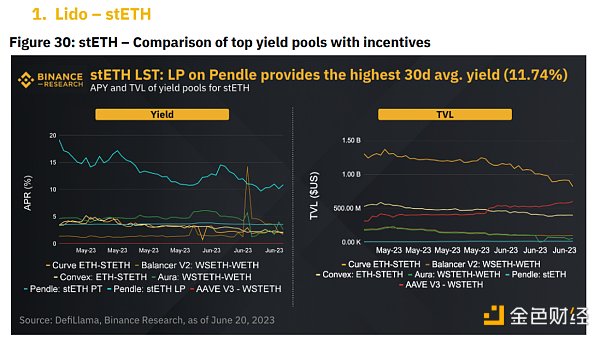

People may naturally question which LSDfi protocol will produce the highest return on their LST. To address this question, we compared the TVL and returns of several popular LST pools from three leading liquidity staking providers: Lido, RocketPool, and Frax. Typically, yields are highest on secondary or derivative protocols (such as Pendle, Convex, or Aura); TVL is usually larger on major DEXs such as Curve. Please note that the listed yields may fluctuate from time to time depending on market conditions at the time of writing.

Highest 30-day average yield: Pendle stETH LP (30-day average APY of 11.74%)

Highest TVL: Curve ETH-STETH (30-day average APY of 2.56%)

Currently, Pendle’s stETH pool offers the highest yield for liquidity providers, although the APY is trending downward. Its TVL is the lowest at $16.37 million, possibly because its complex yield tokenization may deter most retail users. However, since May, TVL has increased by 72.70%. The Curve ETH-STETH pool dominates the largest market share with a TVL of $821.26 million, even though the reward APY is as low as 1.94%.

Recently, the locked value has dropped by 37.12%. Users seem to be turning to high-yield protocols like Lybra Finance or using stETH as collateral in currency markets like Aave. For Aave V3, stETH’s TVL has grown 90.69% in the past 7 weeks, reaching $603.78M.

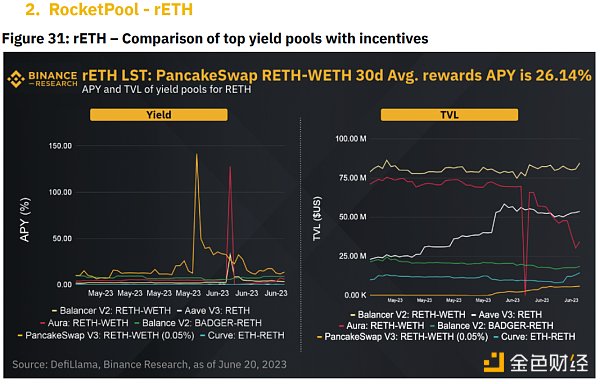

Highest 30-day average yield: PancakeSwap V3: RETH-WETH (30-day average APY of 26.13%)

Highest TVL: Balancer V2: RETH-WETH (30-day average APY of 7.19%)

PancakeSwap offers the highest total APY rewards, averaging 23.25% per month. The adoption rate of PancakeSwap’s RETH-WETH pool has increased, with its TVL growing 203.14% since early June.

Balancer V2 RETH-WETH is still the most popular pool, with a TVL of $84.63M in June and an average yield of 5.51%. RocketPool uses Balancer’s suboptimal pools to provide its users with lower slippage and fees. Since May, Aave V3 rETH pool’s TVL has grown 132.83%, despite an average reward APY of only 0.01%. This is consistent with our previous observation of the growing demand for using LST as collateral in currency markets.

Aura’s RETH-WETH TVL has been affected by the AIP-29 pool migration. Since the upgrade was announced on June 9, Aura’s RETH-WETH pool TVL has dropped by 47.56%. In addition, the popular LST protocol Pendle recently announced the removal of RETH-WETH from its vePENDLE voting options. The team also suggested selling or transferring liquidity to alternatives.

However, such announcements may not have a significant impact as the Pendle pool contributes only about 3.94% of Aura’s pool TVL.

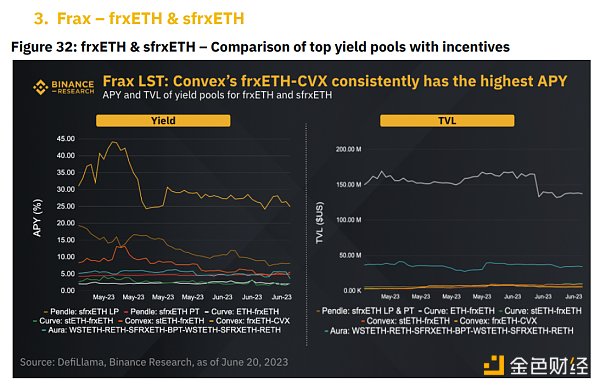

Highest 30-day average yield: Convex’s frxETH-CVX (30-day average APY of 27.75%)

Highest TVL: Curve’s ETH-frxETH (30-day average APY of 2.27%)

Although Convex’s frxETH-CVX always offers the highest APY rewards, it has not gained a large market share. This may be because of additional steps, such as providing liquidity on Curve first.

Pendle’s sfrxETH LP offers the second highest yield, with sfrxETH currently offering the highest ETH staking yield at around 5.20%. When combined with protocols such as Pendle, users can further increase their yield. Pendle’s sfrxETH currently has a TVL of only $6.44M, accounting for approximately 1.63% of the entire sfrxETH TVL.

This presents an important opportunity to increase adoption of the sfrxETH LP pool. Curve’s ETH-frxETH currently has the highest TVL, although its reward APY is the lowest. Currently driven by Frac, the pool aims to encourage users to become LPs with an initial goal of providing an APY almost equivalent to sfrxETH’s staking APY.

Five, Related Protocols

LSDfi is a relatively young industry, with many new protocols emerging in recent months. In order to more comprehensively outline what some of these protocols are attempting to offer users, we focus on two projects that have recently seen turbulence in social metrics. We will briefly discuss the following protocols below. Please note that mentioning specific projects does not constitute an endorsement or recommendation by Binance, and users should conduct thorough due diligence.

1. Pendle

Pendle is a yield trading protocol that allows users to purchase assets at a discount or gain leveraged yield exposure without liquidation risk. It was launched in 2020 and raised $370 million from venture capital and institutional investors like Mechanism Capital and Spartan Group in 2021.

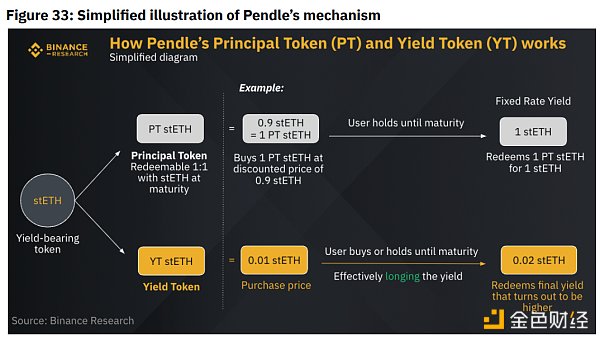

As of June 28, 2023, it currently has 43.9K Twitter followers. The protocol is popular in the crypto community as an early provider of LST liquidity mining and high APYs. This is achieved through yield tokenization, which involves splitting yield tokens into Principal Tokens (PTs) and Yield Tokens (YTs). Figure 33 below provides a simplified chart to illustrate how it works.

Principal Tokens (PTs): Holding a PT stETH, users won’t be able to earn the yield generated by stETH. Because it doesn’t include the yield part, the price of 1 PT stETH will always be lower than 1 stETH. As a tradable token, the price of PT stETH depends on various factors, including time before expiration and yield speculation. This data insight: Liquid Stake and LSDfi Heat Up 26 allows users to purchase stETH at a discount and effectively lock in a fixed yield if held until expiration.

Yield Token (YT): YT can also be traded on Pendle’s AMM, holding 1 YT stETH grants the user the right to receive 1 stETH in yield before expiry. Buying or holding YT stETH until maturity means that the user is betting on receiving a yield higher than the purchase price.

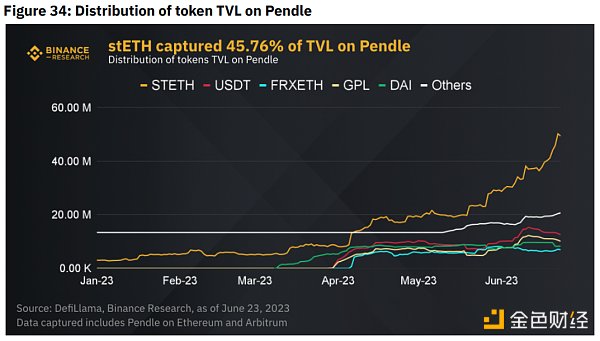

There are over 20 markets to choose from on both Ethereum and Arbitrum, including non-LST tokens such as $GLP and $APE. Pendle’s total TVL has reached $107.95M, with stETH accounting for 45.76% of deposited assets.

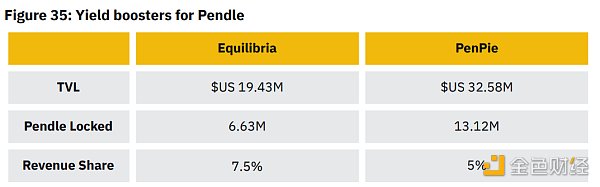

With more protocols building on top of Pendle, the TVL is expected to grow to maximize returns for $PENDLE holders and LPs. Equilibria and PenPie are two yield aggregators that offer yield boost for Pendle. Both account for 48.18% of Pendle’s TVL.

There are 92.7M $PENDLE units that have not been staked, of which only 21.76% of the unstaked $PENDLE are locked on Equilibria and PenPie. This provides them with an opportunity to tap into untapped markets and further expand. As they grow in success, it may also help increase Pendle’s TVL.

2. EigenLayer

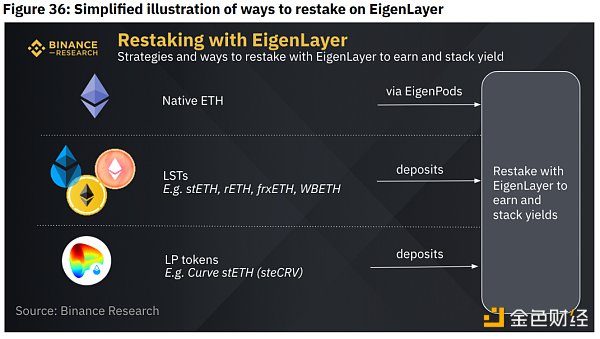

EigenLayer introduces the concept of restaking, allowing users to reclaim their LST or ETH for securing other applications through the extension of cryptographic security. They have raised a total of $64.5M, including a $50M Series A funding round in the past three months, and are now valued at $250M. As of June 28, 2023, they currently have 74.6K Twitter followers. The following Figure 36 is a simple illustration of the potential method of restaking using EigenLayer.

EigenLayer officially launched its mainnet on June 14, 2023. In the initial stage, people can choose to stake LST and/or ETH on the native beacon chain via EigenPods.

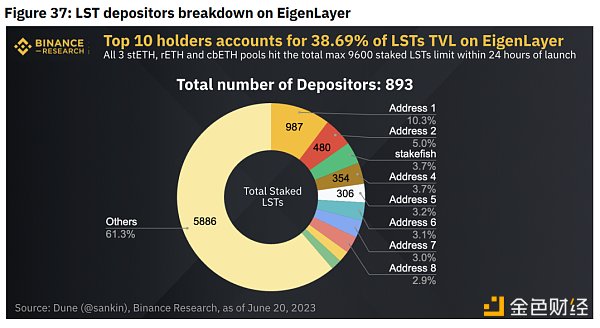

For LST, the protocol currently supports rETH, stETH, and cbETH with an initial cap of 3,200 LST per pool. All three pools quickly reached their limits with a total of 873 unique depositors, with the top ten holders accounting for 38.69% of the staked LST.

Interestingly, Stakefish is a SaaS and is the third-largest staker of Eigenlayer to date. As of June 20, 2023, only 51.12 LST has been withdrawn from the staking pool. For a deeper understanding of Eigenlayer, see this report.

VI. Conclusion

Liquidity staking and LSDfi are currently in the relatively early stages of development and adoption. Emerging staking service providers like Swell Network have been gaining attention, and many new LSDfi competitors continue to enter the market, vying for their share in the industry.

As LSDfi provides users with more incentives and opportunities, the number of staked tokens is expected to grow. It will be interesting to observe the growth and evolution of this emerging industry.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!