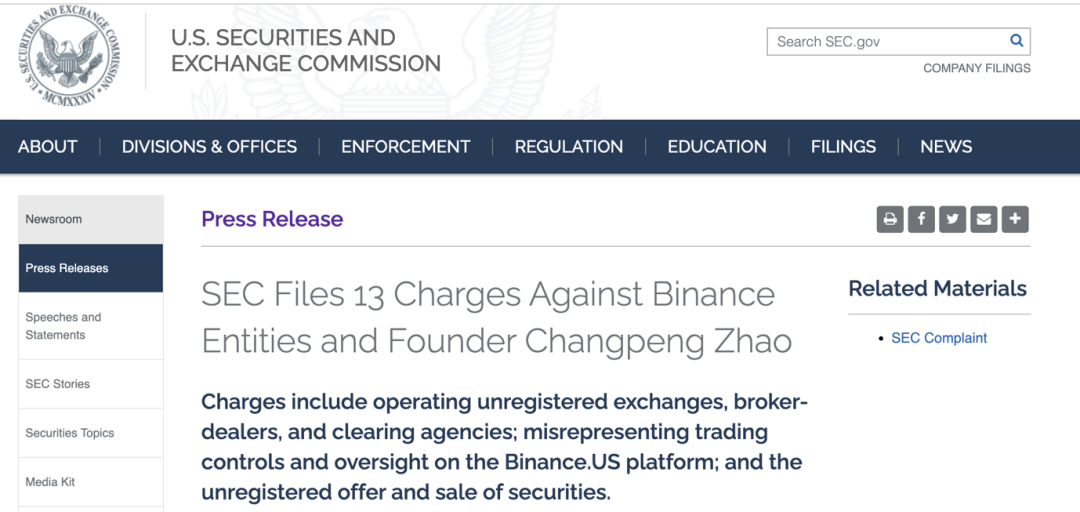

Last week, the SEC officially filed a lawsuit against Binance and Coinbase. Some have been waiting for regulatory intervention in various gray areas, while others believe that the relevant trading platforms can provide better investor protection, and still others believe that platforms and institutions should work together to maintain the ecological balance of the virtual asset market.

As for the future regulatory standards, let’s listen to the analysis of the Sa team.

Leaving aside the “personal interests” of the SEC or CFTC prosecution, let’s first take a look at the potential risks of unregulated virtual asset trading platforms:

- Inventory of LSDFi classification and 8 early projects worth paying attention to

- What’s the story behind Taiko, the Type-1 zkEVM rising star who secured a $12 million funding from Sequoia Capital despite the market downturn?

- Viewpoint: ZK/L2 is not a narrative, but it can be a fertile ground for breeding new narratives.

One-hand trading, one-hand market-making: exaggerated trading volume, false liquidity?

Last week, the SEC filed multiple charges against Binance and Coinbase, including its functions as a traditional financial service such as an exchange, broker, and clearing agency, but did not register these functions with the SEC as required by law. As the actual controller of Binance, CZ also violated the related regulations on function registration.

It can be imagined that under the premise of lack of legal regulation and unregulated by institutions, whether the virtual currency attribute is recognized as a commodity, security, or other, when the virtual asset trading platform interweaves trading, agency, clearing and other businesses, the opaque operating system can manipulate the market and plunder users.

Take the SEC’s allegations against Binance as an example:

Binance.US’s undisclosed main market maker, Sigma Chain (also owned by CZ), is likely to have conducted targeted wash trading:

CZ instructed BAM Trading (Binance.US’s parent company) to accept two market makers, Sigma Chain and Merit Peak, which he owns and controls. These two entities are operated by several Binance employees who work under the direction of Zhao Changpeng. Merit Peak traded on the platform at least from November 15, 2019 to June 10, 2021. Until April 2022, Sigma Chain was a frequent spot trader on Binance US platform, and it also continued to serve as a counterparty for some OTC trades and Convert and OCBS services on Binance US platform. The activities of Sigma Chain and Merit Peak on the Binance US platform and their undisclosed relationship with Zhao Changpeng and Binance involve conflicts between Zhao Changpeng’s financial interests and the interests of Binance US platform customers.

By 2021, at least $145 million had been transferred from BAM Trading to Sigma Chain accounts, and an additional $45 million had been transferred from BAM Trading’s Trust ComBlockingny B account to Sigma Chain accounts. From this account, Sigma Chain spent $11 million to purchase a yacht. The SEC has implied that the yacht was purchased using funds misappropriated from Binance.US users, although no substantial evidence has been provided. All of this supports the SEC’s allegations that Binance manipulated the market by artificially increasing trading volume, liquidity, and trading interest related to assets through wash trading.

Meanwhile, the SEC alleges that BAM Trading and BAM Management misled Binance.US customers and stock investors to believe that they had the ability to monitor the market and detect and prevent manipulative trades in the trading volumes of Binance.US’s cryptographic assets. CZ’s statement in 2019 that credit is the core competitiveness of the trading platform and that false trading volumes will bring down credit platforms provides a landing point for the SEC’s allegations of false statements and misleading investors, and also sounds the alarm that virtual assets are still outside the regulatory framework.

Liquidity of virtual platforms may be a problem

Last year’s collapse of FTX verified the high risk of asset liquidity under this business model.

FTX, as a virtual asset trading platform, claimed outwardly that it has complex and complete risk control measures to protect investor assets. However, FTX’s largest customer is Alameda, a hedge fund controlled by FTX CEO Sam Bankman-Fried. The fund was able to partially conceal this activity because the assets it traded never touched its own balance sheet. Alameda did not hold any funds, but instead held a large amount of overvalued illiquid assets (such as FTX’s affiliated token FTT). That is, Alameda borrowed billions of dollars from FTX users, made high-risk, high-leverage bets, and ultimately caused financial inflation, collapse, and bankruptcy without any disclosure or avoidance of risk reduction measures by FTX. In this case, FTX’s behavior of co-mingling client assets, illegally misappropriating, and conducting related-party transactions with Alameda early on put the platform in a liquidity trap.

However, Binance and Coinbase’s current situation may be much better than FTX’s, with no allegations of fraud or other financial crimes, and the virtual currency market is relatively stable: according to Fortune, Coinbase’s stock price fell about 13% this week, and Bitcoin traded at around $27,000 from Monday to Friday last week, with other major cryptocurrencies trading relatively stably.

Investors have difficulty declaring their rights in accordance with the law

FTX, Binance and other platforms that commingle company assets with customer funds to fabricate trading volume, make private investments, and engage in other behavior undoubtedly expose ordinary investors to high trading risks. However, when a platform misappropriates user assets due to fraud or negligence, or freezes user assets for platform-related reasons, the legal status of cross-border transactions and virtual currencies makes it difficult for investors to fight back and obtain compensation from virtual asset trading platforms with substantial funds and a global trading network, due to the unclear applicability of laws and the lack of regulation.

Possible future regulatory directions

When a US court rules on the crimes committed by Binance and Coinbase, the characterization of virtual currencies is an unavoidable issue. Only when it is determined whether virtual currencies are “commodities” or “securities”, or fall within other defined ranges, can relevant laws be applied.

According to CNBC, Coinbase’s CCO responded to the SEC’s lawsuit as follows: “SEC is harming America’s economic competitiveness and companies like Coinbase that have already publicly committed to compliance by relying solely on enforcement in the absence of clear rules for the digital asset industry…(Faced with regulatory challenges,) the solution is to legislate fair rules to make the industry more transparent and equal in its development, rather than litigation (to expand legal interpretation). At the same time, we will continue to operate our business as usual.”

According to its statement on the official website, Binance believes that the SEC is attempting to unilaterally define the structure of the cryptocurrency market by designating specific tokens and services as securities. On the contrary, the SEC’s move is to rush to compete with other regulatory agencies (such as the CFTC) for jurisdiction over virtual assets, rather than prioritizing the protection of investors.

According to the New York Times analysis, not all US lawmakers have a sense of urgency to legislate the virtual asset trading industry, and regulation will be a long and slow process. Enforcement actions may be taken before relevant bills are passed, and hot issues such as property characterization may be decided by federal courts first. However, from an industry perspective, this indirect path may ultimately succeed. The US Supreme Court has shown a willingness to limit institutional power, and cryptocurrency lobbyists are well aware of their impact. In the next term, the justices will reconsider the theory of requiring courts to defer to professional agencies, or further curb executive power.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!