Editor | Bowen@Web3CN.Pro

Table of Contents

1. Project Overview

- Analysis: What are the common characteristics of cryptocurrencies listed by the US SEC as securities?

- Amidst internal and external challenges, can Binance’s “traffic effect” withstand risk based on multiple data analysis?

- Overview of the latest cohort of 6 projects from Outlier Ventures Base Camp accelerator:

2. Project Vision

3. Features and Advantages

- Cosmos SDK

- Tendermint Consensus Mechanism

- Canto Infrastructure

- Free Public Infrastructure (FPI)

- Contract Revenue Allocation (CSR)

4. Development History

5. Team Background

6. Financing Information

7. Development Achievements

8. Economic Model

9. Risks and Opportunities

1. Project Overview

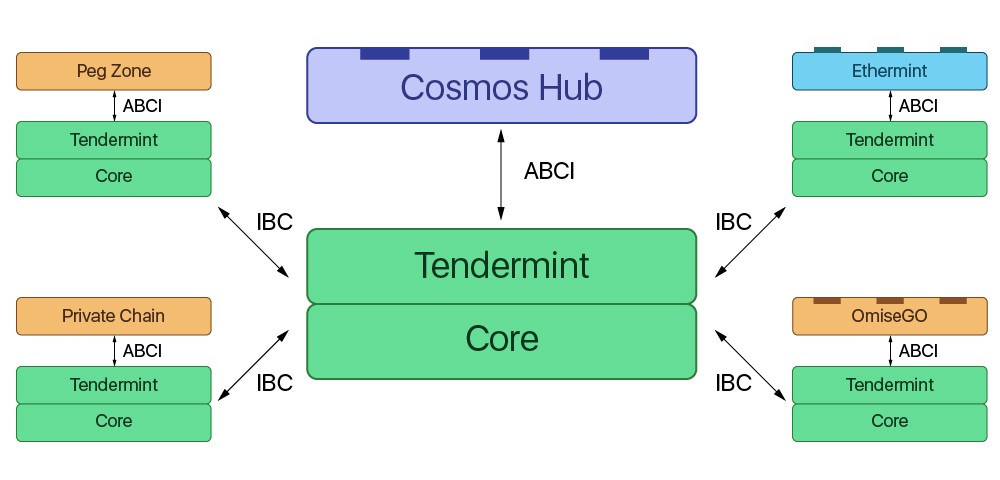

Canto is a Cosmos SDK-based Layer1 project designed for DeFi. It is a public chain that uses Cosmos’ Tendermint consensus mechanism and is compatible with EVM.

2. Project Vision

Compared with other emerging EVM chains, Canto pursues a highly decentralized approach, relying more on the community without investors or a foundation. It also provides free public infrastructure (FPI) and contract revenue allocation (CSR) to developers.

3. Features and Advantages

Cosmos SDK

The Cosmos SDK is an architecture that enables developers to easily create custom blockchains. Using open-source modules from the Cosmos SDK, developers can select the required modules to build the blockchain they need, according to the features they want their blockchain to have.

Tendermint Consensus Mechanism

The default consensus mechanism in Cosmos SDK is Tendermint.

Distributed consistency algorithms can generally be divided into two categories: Byzantine fault tolerance (BFT) and non-Byzantine fault tolerance. Non-Byzantine fault-tolerant algorithms such as Blockingxos and Raft are already widely used in current distributed systems, while the actual application scope of Byzantine fault-tolerant algorithms is relatively small (especially before the advent of blockchain). Tendermint belongs to the Byzantine fault-tolerant algorithm and has optimized the traditional PBFT algorithm. It only requires two rounds of voting to reach consensus, and the Tendermint algorithm is currently mainly used in blockchain systems.

Tendermint aims to provide the network and consensus layer for developers to build decentralized applications on, allowing them to focus on the blockchain application layer without having to simultaneously develop the consensus and network layers. More importantly, Tendermint is able to share block transactions between nodes and autonomously establish a standardized and immutable transaction order, facilitating the establishment of a PoS consensus network and greatly reducing development difficulty.

Imagine you are a chef and you’re making a pizza. First, you need to make the crust, and then you can add whatever different toppings you want on top of the crust, such as beef, chicken, or even tomato and cheese. In fact, Tendermint is like the crust of a pizza, and blockchain networks like Cosmos are the base under the crust. Developers play the role of the chef and can freely invent various blockchain applications on the base and the crust (Cosmos-Tendermint).

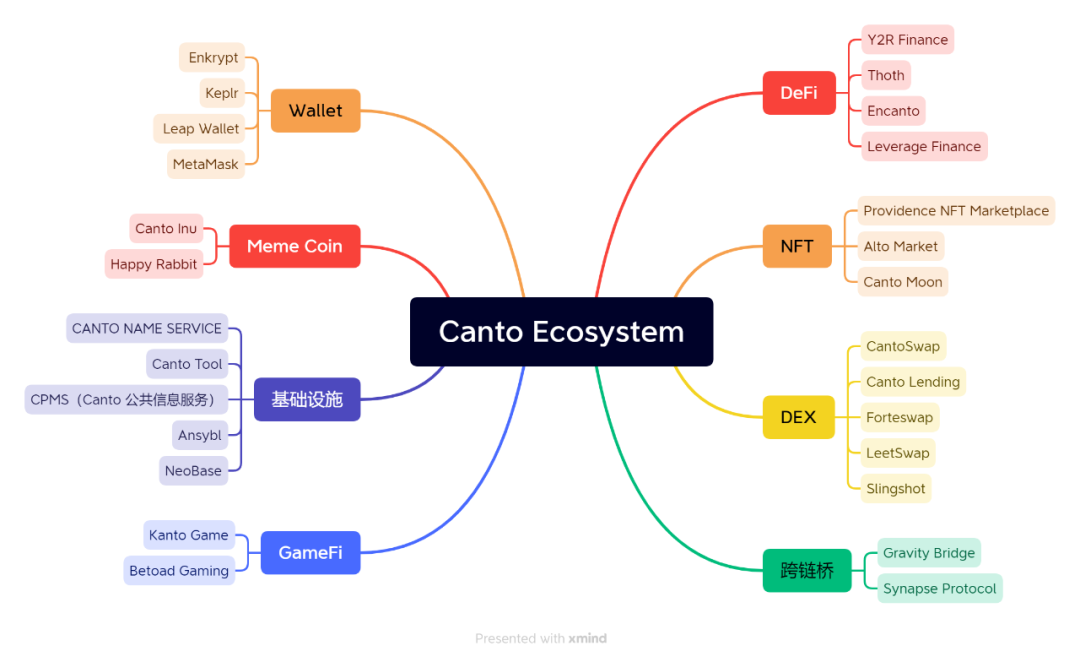

Canto Infrastructure

Canto focuses on DeFi, and its infrastructure mainly consists of three components:

① Canto DEX

Canto DEX is an AMM DEX developed by the Canto team, which uses constant-sum and constant-product formulas for stablecoins that require centralized liquidity and assets that require unlimited liquidity, respectively.

In addition, Canto DEX is also designed to be without transaction fees and permanently unable to upgrade. Liquidity providers can only receive native asset $CANTO rewards and cannot receive fee income.

② Canto Lending Market (CLM)

CLM is a lending market forked from Compound v2, with governance controlled by $CANTO stakers. LP tokens obtained by providing liquidity to Canto DEX can be used as collateral to deposit and borrow other assets. However, LP tokens themselves cannot be borrowed.

③ $NOTE

$NOTE is an over-collateralized “stablecoin” within the Canto ecosystem that can only be obtained by borrowing from CLM. $USDC and $USDT are currently supported as collateral assets. The price of $NOTE is controlled by a smart contract, and its interest rate is periodically adjusted according to an algorithm to stabilize its price at around $1. Therefore, it can be said that the price of $NOTE is cointegrated with the US dollar, but not pegged to it. $NOTE primarily serves as a “soft-pegged” stablecoin with the US dollar for the Canto ecosystem.

Free Public Infrastructure (FPI)

Canto has made some improvements at the application level: Canto developed these infrastructure-level protocols and made them public utility protocols, namely Free Public Infrastructure (FPI). Specifically, the Canto public chain comes with a fork of Compound’s lending market, a fork of Solidly’s DEX, and a stablecoin called NOTE.

These “public utilities” that have already been built naturally also need to play their public role. Canto’s DEX protocol cannot be upgraded and is not subject to control. It will run permanently on Canto without increasing costs in the future. The Canto lending market is governed by Canto stakers. Canto holders value the ecological value of the entire chain more and will naturally not capture additional profits on a single application. For the stablecoin $NOTE, the protocol will not charge any fees.

Most importantly, these core public infrastructures will not have governance tokens, eliminating the possibility of future rent-seeking from users. In addition, the core protocol will follow the “minimum user capture” principle and will not set a user interface. Users can only trade through third-party aggregators, which can minimize the impact of centralization.

Canto believes that existing DeFi protocols are more like pay-to-use private parking lots serving their own communities, while Canto’s FPI is more like free roadside parking open to everyone.

Contract Revenue Sharing (CSR)

Contract Revenue Sharing (CSR) is a fee-sharing model for the Canto network that allows contract developers to extract a certain percentage of transaction fees paid by users to the network when interacting with the contract in order to earn revenue.

Contract developers registered as CSR can receive some NFTs. As contract revenue accumulates, holders of CSR NFTs can claim that revenue at any time. The NFTs themselves can be traded and combined in DApps. This composability can provide multiple use cases, including trading, packaging, investment, loan collateral, etc.

Four, Development History

August 16, 2022, the public chain project Canto launched Genesis and announced detailed information about token distribution

August 19, 2022, over $12 million was bridged from Ethereum to Canto

On September 9, 2022, Canto announced the launch of its first hackathon, offering 300,000 $CANTO as a reward. On September 20, 2022, CantoDAO passed a proposal to reduce the network security release and liquidity mining incentive measures by about 54%. On October 18, 2022, the Canto mainnet was upgraded to version 3.0.0. On February 23, 2023, two proposals to reduce the $CANTO issuance and liquidity mining rewards by 30% were passed by votes. On March 17, 2023, the proposal to “continue liquidity mining incentives” was passed. On May 12, 2023, the Canto community voted in favor of a proposal to “reduce liquidity mining incentives and block reward issuance rate”.

Five, Team Background

Canto is a community project initiated by @scott_lew_is. According to Gitbook, any community member can freely create resources, channels, images, etc.

From the information on Twitter, the Canto team is composed of senior practitioners in the cryptocurrency industry. @scott_lew_is is the co-founder of DeFi Pulse and Slingshot; @RobinWhitney_ was a core member of Acala and Karura; and @0xzak is the co-founder of Slingshot and advisor to DeFi Pulse.

Six, Financing Information

Canto has no financing information yet. Previously, there was news that the cryptocurrency venture capital fund Variant invested in Canto, but specific information is not available.

Seven, Development Achievements

Canto was born in August 2022. From December 2022 to late January 2023, the number of Canto users increased by more than 100%, TVL doubled, from $66 million to $138 million, and trading activity also increased rapidly. However, as the Canto market cooled down, the current TVL has decreased to $76 million.

Eight, Economic Model

$NOTE is an over-collateralized “stablecoin” within the Canto ecosystem, serving the Canto ecosystem. It can only be obtained by borrowing from CLM and currently supports $USDC and $USDT as collateral assets. The price of $NOTE is controlled by smart contracts, and its interest rate will be periodically adjusted according to the algorithm to stabilize its price at around $1. Therefore, it can be said that the price of $NOTE is cointegrated with the US dollar, but it is not pegged to it.

$CANTO is the native token of the Canto network, designed to have a limited supply and used to pay for transaction gas fees, as well as staked with validators to help secure the network.

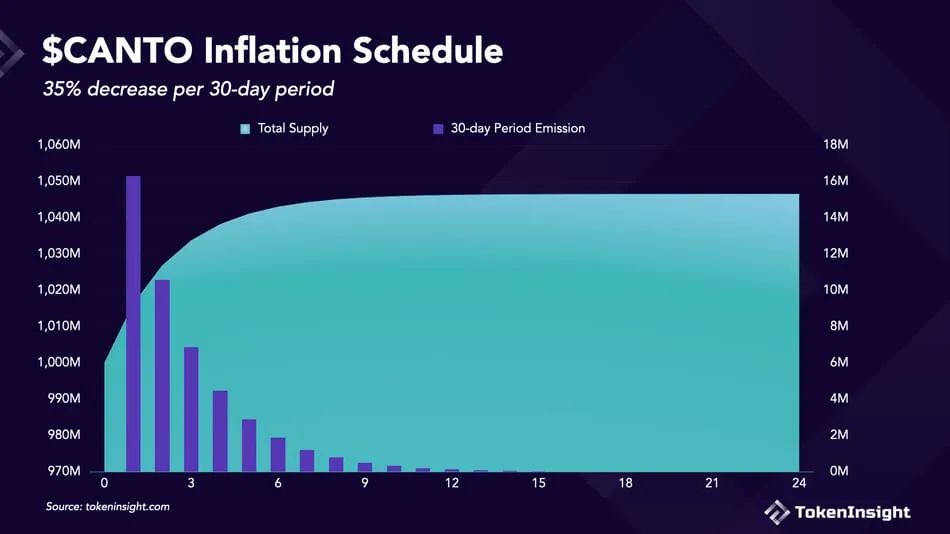

The token issuance schedule is as follows:

- $CANTO issuance will occur in 30-day cycles

- In cycle 1, approximately 16 million $CANTO will be minted with an annualized interest rate of 19.84%

- Issuance will decrease 35% per cycle until it reaches zero

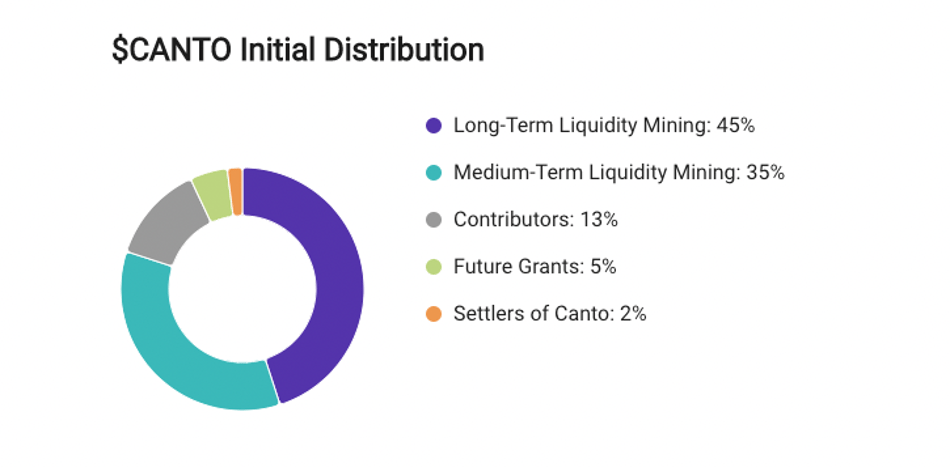

The initial total supply of $CANTO is 1 billion, distributed as follows:

- 13% allocated to contributors

- 2% allocated to an airdrop

- 5% allocated to future network grants

- 35% allocated to mid-term liquidity mining

- 45% allocated to long-term liquidity mining

- Undistributed tokens will be held in the community pool

To maintain the security of the Canto network, the total maximum supply of $CANTO will gradually inflate over time at a decreasing rate. All tokens from inflation are allocated to $CANTO stakeholders in proportion to their stake in the network. Over time, the inflation rate of $CANTO should approach zero.

IX. Risks and Opportunities

Canto is an interesting experiment in the blockchain ecosystem, bringing new ideas and points of interest including:

1. A strong commitment to decentralization, with no investors or foundation and more reliance on the community.

2. Provision of free public infrastructure (FPI), with core public infrastructure not having governance tokens to prevent future rent-seeking from users.

3. Smart contract revenue sharing (CSR) to incentivize the development of high-quality decentralized applications.

4. The current L1 public chain market is highly competitive, but there are few standout projects, and Canto is one of the better ones with a relatively large number of participants.

Of course, Canto is still relatively early, and compared to February of this year, its market heat has declined somewhat. Some people say that it has a bit of a Ponzi taste, so caution should be exercised in the hype of CANTO.

Reference:

https://canto.io

https://zhuanlan.zhihu.com/p/531637942

www.odaily.news/post/5184885

www.defidaonews.com/article/6802562

news.marsbit.co/20230214143735756098.html

www.theblockbeats.info/news/34585

www.theblockbeats.info/news/34379

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!