Author: Jiang Haibo, BlockingNews

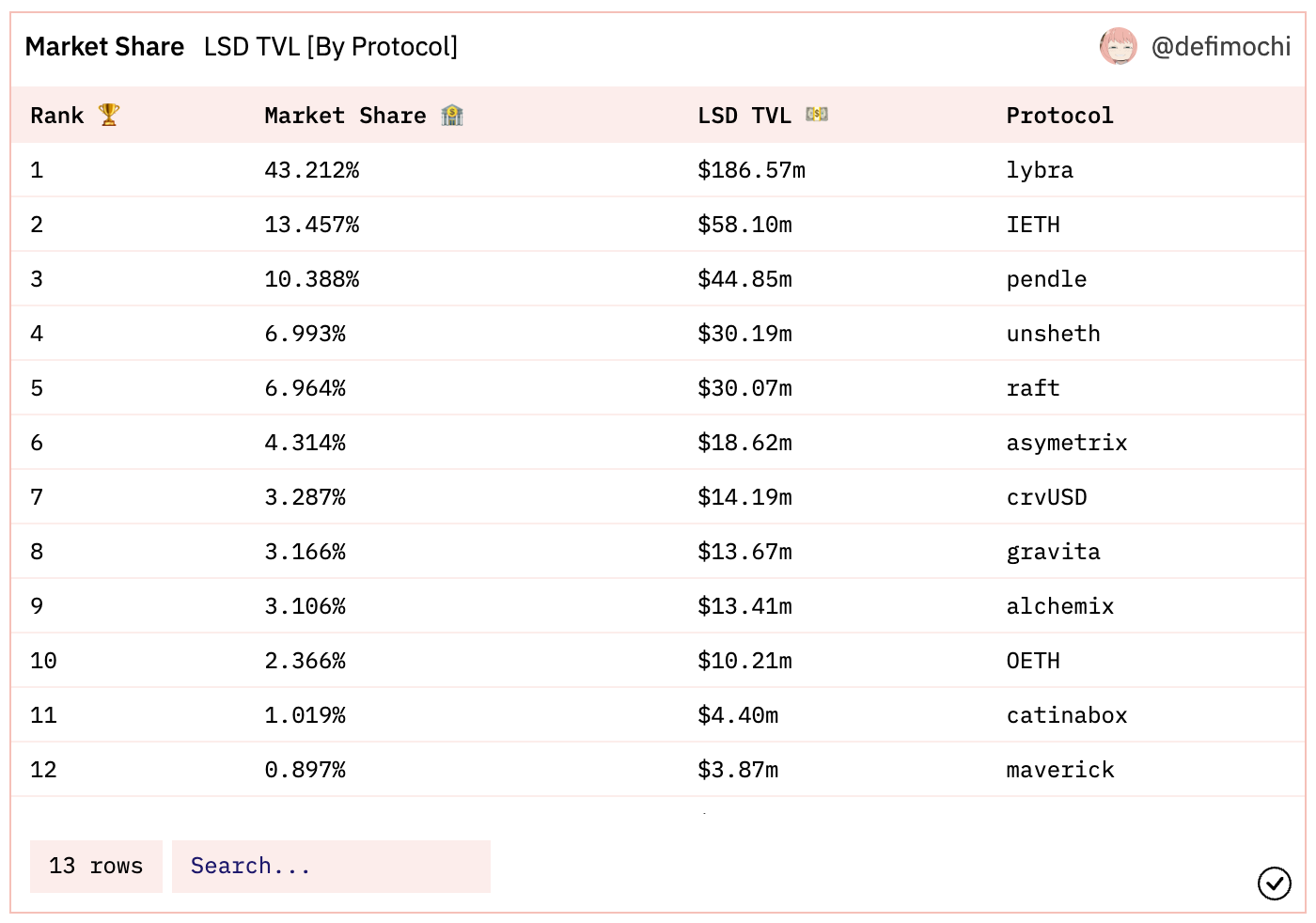

After the Shanghai upgrade of Ethereum, the amount of ETH pledged has hit a new high, and the unstable factor of LSD (liquidity staking derivatives) being unable to redeem has also been eliminated. LSDFi has seen rapid development, and existing DeFi projects are limited by factors such as code cannot be upgraded or project updates are slow. New LSDFi projects have emerged, bringing LSDFi Summer. In this article, BlockingNews will take stock of the LSDFi projects worth paying attention to in recent categories. The data in this article were all as of June 9.

Stablecoin Class

Lybra Finance

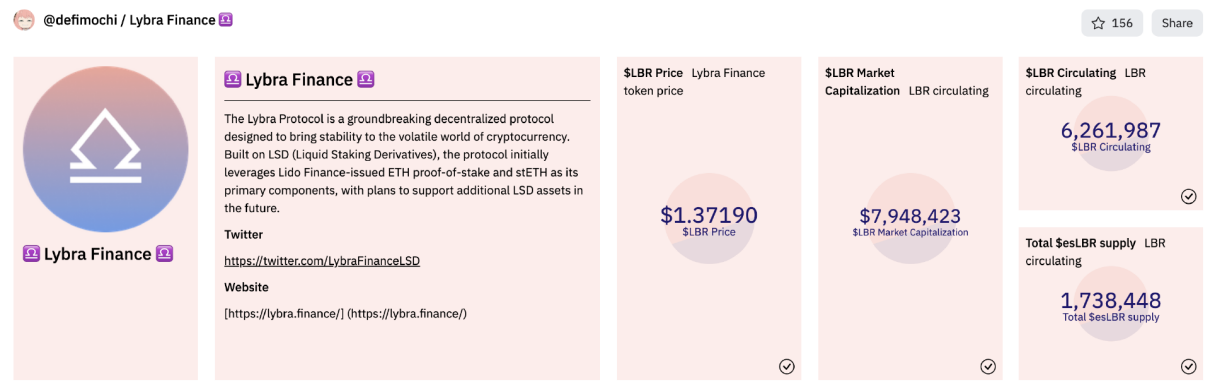

Lybra is currently a popular LSDFi project, and its native token has attracted a lot of attention with an increase of more than 40 times. In Lybra, stablecoins can be minted by collateralizing ETH and stETH (ETH will also be converted into stETH). eUSD is an interest-bearing asset, and the LSD income generated by ETH and stETH will be allocated to eUSD.

- What’s the story behind Taiko, the Type-1 zkEVM rising star who secured a $12 million funding from Sequoia Capital despite the market downturn?

- Viewpoint: ZK/L2 is not a narrative, but it can be a fertile ground for breeding new narratives.

- Tenet: A new public chain designed specifically for LSD

Lybra is also a project with high mining income in LSDFi. As of June 9, DeFiLlama shows that Lybra’s TVL is $186 million. The APR (calculated based on the minted eUSD) for minting eUSD on the official website is 31.39%, the APR for eUSD/USD LP is 13.68%, the APR for LBR/ETH LP is 147.07%, and the APR for staking LBR is 60.3%.

Since the intrinsic value of eUSD will continue to rise; it is relatively safe to mint by over-collateralization; and it can participate in liquidity mining. Therefore, the price of eUSD is more inclined to be higher than its intrinsic value, and there has been a premium of 3% in the past. The LSD income lost by eUSD minters is compensated by token issuance.

Another feature of Lybra is the token economy. In addition to the native token LBR, the mining output is esLBR, which takes one year to unlock 100% into LBR. If you choose the fastest unlocking speed (one month), you can only get 20% of LBR.

Prisma Finance

Link: https://www.prismafinance.com/

Prisma allows users to collateralize wstETH (Lido), cbETH (Coinbase), rETH (Rocket Pool), sfrxETH (Frax), and WBETH (Binance) to mint stablecoin acUSD, and its code library is based on Liquity.

Although Prisma has not yet officially launched, it has gained support from the founders of Curve, Convex, Frax, Conic, CoinGecko, and other well-known exchanges, project parties, and KOLs, and may also develop into the “endgame” of “liquidity-staking tokens (LST)”. For stablecoin projects, liquidity is crucial, and after gaining support from teams such as Curve, Convex, and Frax, Prisma may have an advantage in this regard. If LST is used to mint stablecoins in Prisma and provide liquidity in Curve through Convex, CRV, CVX, PRISMA tokens, ETH collateral income, and stablecoin LP transaction fees will be obtained at the same time.

In addition, the project uses the veToken model. Holders of vePRISMA can vote to determine the emission of PRISMA to incentivize LP tokens for stablecoins.

Layer 1 blockchain

Tenet Protocol

Tenet is a Layer 1 blockchain that includes LSD and LSDFi functionalities, providing liquidity staking services and can mint stablecoin LSDC through various LSD. It introduces a diversified proof of stake mechanism (DiPoS), which allows various LSD to be used as collateral for Tenet network validators, eliminating the risk of network control by a single asset.

The Tenet mainnet has been launched, but no data is available yet. The project has also established a full-chain bridge dedicated to LSD with Layerzero, and its native token also adopts the veToken mechanism.

Leverage-type

Raft

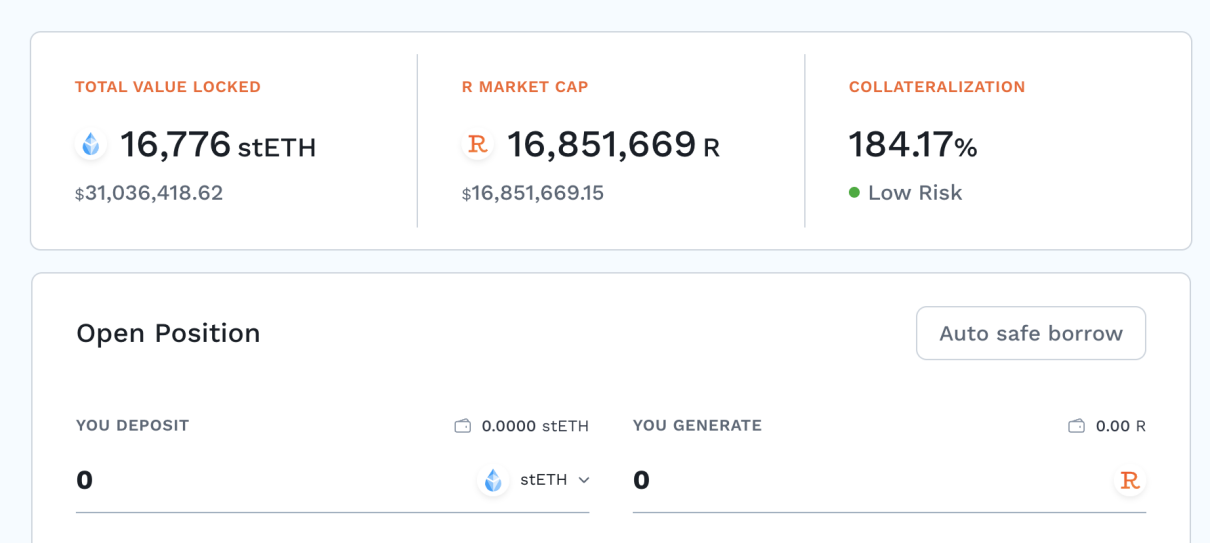

Raft allows users to over-collateralize stETH or wstETH to mint stablecoin R. R currently has three liquidity pools, namely Balancer R/wstETH pool, Balancer R/DAI pool, and Uniswap v3 R/USDC pool.

Raft’s feature is its support for flash minting, which can increase leverage by up to 11 times at a time. It can mint stablecoin R far exceeding the collateral, exchange R for wstETH, then deposit wstETH into the protocol as collateral, and mint stablecoin R to repay the debt. Even if there is no high leverage demand, if it is necessary to repay the loan in a timely manner to avoid liquidation due to the decline of collateral prices, this feature is also very efficient.

Raft has investments from Lemniscap, Wintermute, Jump Crypto, GSR, and others. The project has only been launched for 4 days and has not yet issued governance tokens, but the TVL has reached $31.04 million, and the stablecoin minting volume is 16.85 million R.

Income

Instadapp Lite v2

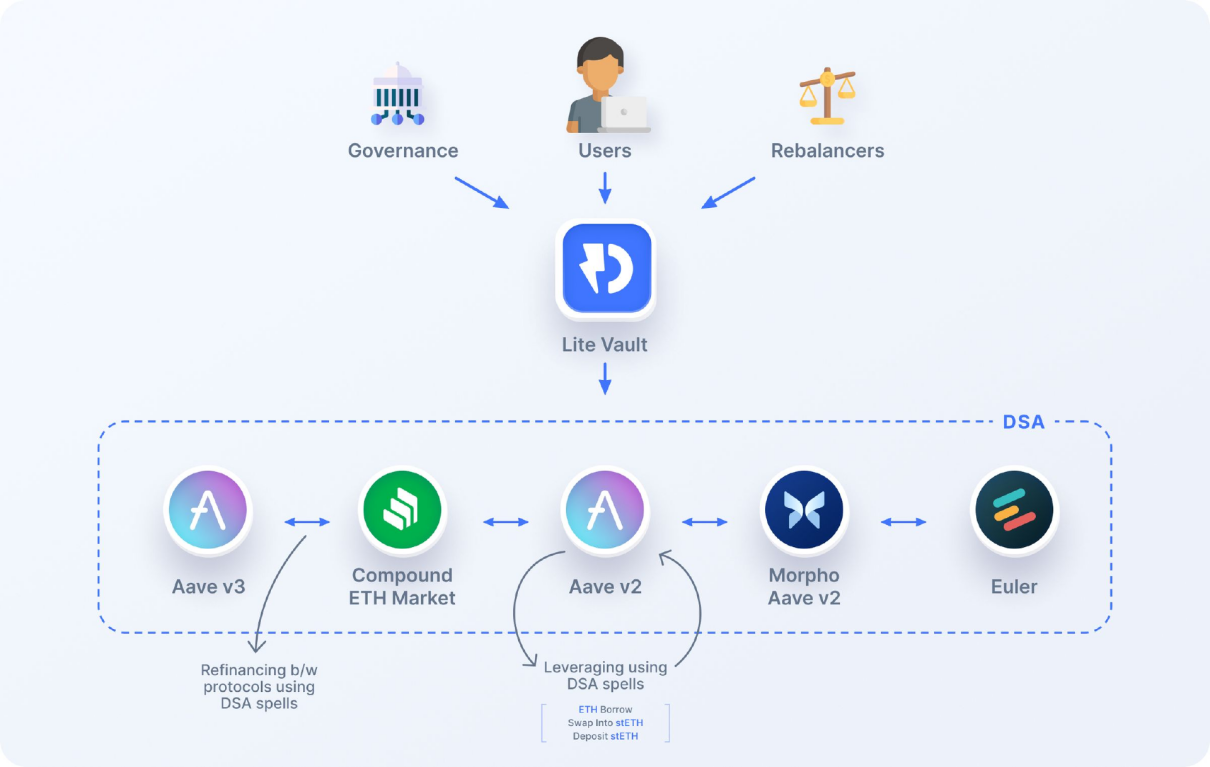

Instadapp is a project that promotes interoperability between DeFi. Instadapp Lite v1 was only focused on ETH for Aave v2, but after the upgrade in Shanghai, this strategy could not keep up with the development of LSDFi. Therefore, Instadapp released Lite v2, which is designed specifically for multiple stETH-related strategies and only allows ETH deposits. Lite v2 will use lending markets such as Aave v2, Aave v3, Morpho, Compound, and Euler to mortgage wstETH for borrowing ETH, exchange it for wstETH, and cycle it to enhance LSD income. Instadapp extracts 20% of the revenue, and depositors can also earn slightly higher returns than Lido stETH.

ETH depositors will receive deposit certificates iETH. According to Defi Mochi’s statistics, Lite v2’s TVL is $58.1 million, second only to Lybra in LSDFi.

Liquidity

unshETH

unshETH is an LSD liquidity center. In Curve and other projects, stETH and other LSDs are usually paired with ETH for trading, and there are no direct trading pairs between different LSDs (direct trading can also be achieved through routing).

These types of projects allow users to deposit different LSDs such as wstETH and sfrxETH to obtain deposit certificates, which in unshETH are used to mint unshETH. In addition to earning LSD income for ETH, holding unshETH can also earn transaction fees and mint/redemption fees.

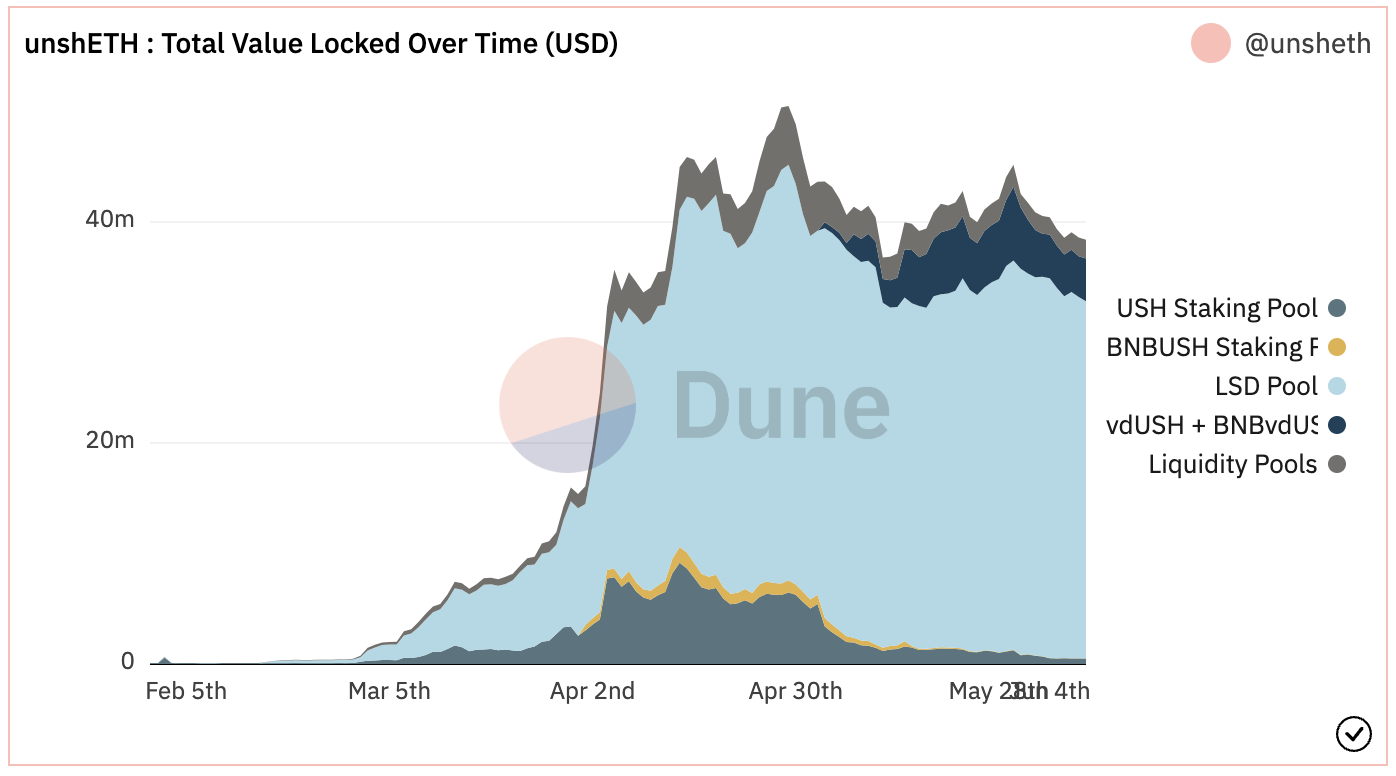

Another feature of unshETH is the introduction of Omnichain, which can be used on the Ethereum mainnet, BNB chain, and Arbitrum. Currently, unshETH’s TVL is $38.56 million, and the staking yield of unshETH is 11%, of which 6.78% is mining rewards for the native token USH.

There are many LSDFi projects in the liquidity category, such as the early LSDx, which have similar principles. UnshETH is currently the most widely used one, so we will not elaborate on other projects here.

Future Earnings

Pendle

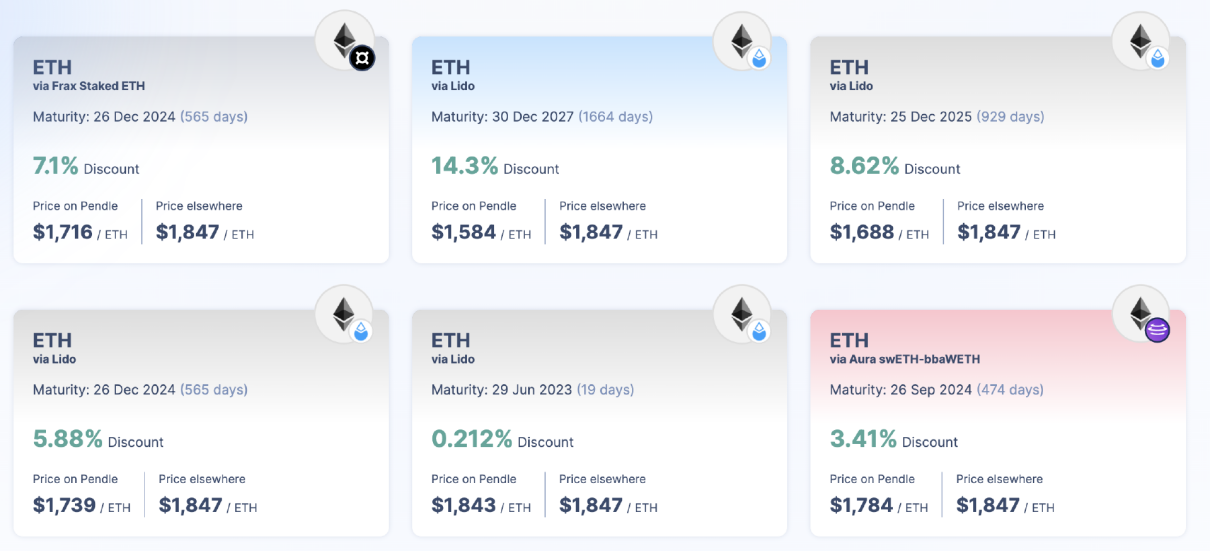

Pendle has gradually risen due to LSD in the near future. Users can use Pendle to divide yield assets such as stETH into two parts, one is the PT token representing the principal, and the other is the YT token representing the yield right. This method is similar to traditional finance, separating the principal and interest of bonds. After minting, exchanging YT tokens for PT tokens will result in more principal at maturity.

Currently, the maturity time for the ETH LSD product displayed on the Pendle official website ranges from 19 days to 1664 days. Pendle’s LSD TVL is $44.85 million, ranking third.

Lottery-type

Asymetrix

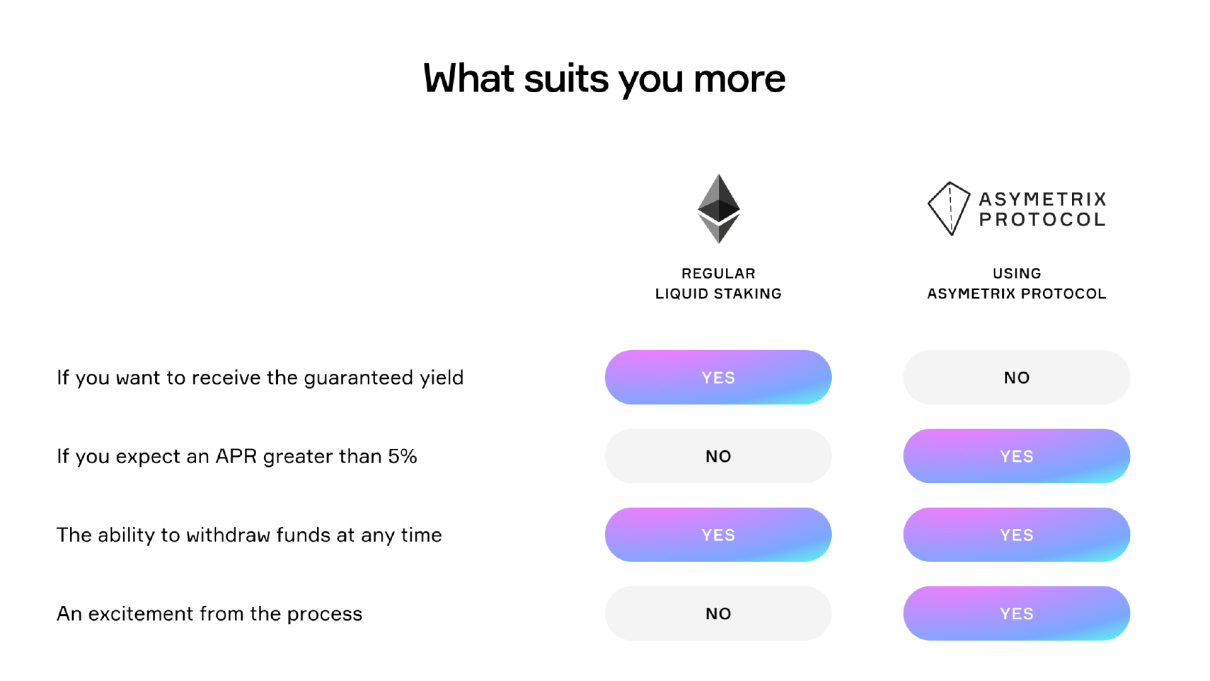

Asymetrix provides asymmetric pledge earnings. Users deposit stETH into the protocol, and the protocol earns pledge earnings, but does not distribute the earnings fairly to everyone. Instead, it randomly selects one lucky person to distribute all the earnings through Chainlink VRF. Everyone always retains their principal and can withdraw it at any time.

Currently, Asymetrix’s TVL is $18.62 million, with 346 users and an average deposit amount of 29.27 stETH.

Conclusion

The LSDFi track is currently developing rapidly, and various new projects are emerging, and Lybra and other projects have also brought about wealth effects. However, the functions of most projects seem to be only a subset of mainstream DeFi projects, such as the function of mortgaging LSD based on Liquidity code to borrow stablecoins, which can also be realized in MakerDAO and Aave. In the liquidity of LSDFi, Curve and Balancer are still more attractive.

Many things are homogeneous, and there were many opportunities to participate in early stages, but this has also led to competitive incentives, and many projects may fail in competition.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!