1. The digital encryption ecology and traditional finance need each other. Although the combination is not completely compatible under the condition of incomplete infrastructure, the combination of the two can still solve practical problems.

2. The introduction of pure blockchain technology cannot solve the fragmentation of judicial power. In RWA lending business, the advantages of non-trust are currently not brought into traditional finance, but instead let the default risk of traditional finance spread into the blockchain. Under the background of being unable to achieve non-trust, some projects try to break through industry difficulties from the way of multi-party trust. This is a rare business innovation.

3. The participation qualifications are inherited from the traditional world. Non-permission is not a feature of RWA business. Permission is an important governance power. Some projects attribute the power to the team, while others land on token governance. Whether the governance power is decentralized is a rare breakthrough in RWA lending business.

4. Although RWA is not beautiful, the cake is big enough.

- Which cryptocurrencies are likely to face a sell-off as Celsius debtors plan to sell all their altcoins?

- FTX founder caught up in legal whirlpool, US prosecutors add new charges and propose separate trial

- Uniswap Foundation releases cross-chain bridge assessment report, approves Wormhole and Axelar for use in its protocol governance

01, Background

One of the emerging trends in the world of blockchain and cryptocurrency is to use real-world assets to expand on-chain credit. This involves using blockchain technology to create digital representations of real-world assets, such as real estate, commodities, or artwork, and using these digital assets as collateral to issue on-chain credit. By doing so, borrowers can obtain credit more easily and cheaply than with traditional loans, while lenders can earn interest from the assets they hold by providing liquidity to the market. This approach has the potential to democratize access to credit and make it more inclusive, particularly serving underserved or marginalized communities that have difficulty accessing traditional financial services. In addition, by using real-world assets as collateral, the on-chain credit market can be more stable and less susceptible to volatility and speculation that may plague other forms of cryptocurrency lending.

Overview of the traditional global bond market

The traditional bond market has a long and rich history, dating back to the 17th century when the Dutch East India Company issued bonds to finance its trading activities. Since then, financial markets have grown significantly, and bonds have gradually become an important financing tool for governments, corporations, and other institutions.

In modern times, the traditional bond market can be summarized as a decentralized global network of buyers and sellers, with trading taking place in debt securities or bonds issued by borrowers seeking to raise funds. The market is highly diverse, with bonds issued by governments, corporations, municipalities, and other entities, and can be further classified based on factors such as bond maturity, credit rating, and currency denomination.

Market Summary

According to data from the Bank for International Settlements, the traditional bond market is vast, with an estimated $123 trillion in outstanding bonds as of 2021. The market is also highly globalized, with bond issuance and trading taking place primarily in major financial centers such as New York, London, Tokyo, and Hong Kong, as well as in regional markets around the world.

BIS data shows that in 2020, the United States and Japan combined accounted for nearly half of global bond issuance, with Western Europe and China accounting for another quarter. This reflects the strong presence of developed countries in the market, which have well-developed financial systems, deep pools of capital, and stable political and economic environments that are attractive to borrowers.

By contrast, developing countries have traditionally had a smaller share of the traditional bond market, in part due to their relatively weaker financial infrastructure and less stable political and economic conditions. However, in recent years there has been a trend towards greater participation by emerging markets, with issuers from countries such as Brazil, Mexico, and Indonesia becoming more active in the market.

Despite this trend, there are still significant disparities in the distribution of the traditional bond market. For example, according to data from the International Monetary Fund, developing countries account for only around 20% of global bond issuance, despite representing roughly two-thirds of the world’s population and a significant share of global economic growth.

One factor contributing to these disparities is the so-called “interest rate gap,” which refers to the differences in interest rates between developed and developing countries. Developed countries typically have lower interest rates, reflecting their stronger financial systems and stable political and economic environments. This makes it harder for developing countries to compete in the traditional bond market, as they must offer higher interest rates to attract investors.

Bond Market Vertical Structure

The financial infrastructure of the traditional bond market includes a range of participants such as issuers, underwriters, traders, and investors. The process of issuing bonds typically involves several steps, such as selecting the type and structure of the bond, determining the interest rate or coupon, and finding buyers for the bond. Issuers can work with underwriters who help market and sell bonds to investors, or can issue bonds directly to the public through a public offering.

Once issued, bonds typically trade on the secondary market, where investors can buy and sell bonds based on their market value. The market value is determined by a range of factors such as the credit risk, liquidity, and prevailing interest rates of the bond. The market price of bonds is also influenced by the yield curve, which reflects the relationship between bond yields and their maturity dates, as well as other macroeconomic factors such as inflation and monetary policy.

The traditional bond market has long played a critical role in supporting economic growth and development, providing a reliable source of financing for a wide range of projects and initiatives. However, the market also faces a range of challenges and limitations, such as the risk of borrower defaults, the complexity of some bond structures, and the possibility of market volatility. As a result, people are increasingly interested in alternative financing models such as blockchain-based lending platforms that use real-world assets as collateral.

Challenges of Traditional Lending

Traditional financial lending faces many challenges, which has led to a growing demand for blockchain-based lending solutions. Some key challenges include:

1. High transaction costs: Traditional financial lending often involves a large number of intermediaries, each of which takes a cut from the transaction. This can lead to high transaction costs, making it harder for borrowers to access credit and for lenders to generate sufficient returns.

2. Lack of transparency: Traditional financial lending can also suffer from a lack of transparency, with borrowers often unaware of the terms and conditions of their loans or the fees and charges associated with borrowing. This can lead to a lack of trust between borrowers and lenders, making it harder to establish long-term relationships.

3. Slow and inefficient process: Traditional financial loans can also be slow and inefficient, with borrowers often having to provide extensive documentation and go through lengthy approval processes. This can be especially challenging for small businesses and individuals who may not have the resources to navigate these processes.

4. Limited access to credit opportunities: Finally, traditional financial loans may be impacted by limited access to credit opportunities, particularly in developing countries or for individuals and businesses with limited credit histories. This can make it difficult for these individuals and businesses to obtain the funding they need to grow and thrive.

These challenges have led to a growing demand for blockchain-based lending solutions, which offer a range of benefits including increased transparency, reduced transaction costs, and faster, more efficient processes. As blockchain technology continues to mature and evolve, we are likely to see continued innovation in this space as developers and entrepreneurs seek to leverage the unique advantages of blockchain technology to create new innovative lending products and services.

02, Blockchain Lending with Real-World Assets as Collateral

DeFi represents a major shift in the traditional financial system, offering greater accessibility, transparency, and efficiency. As technology continues to develop and mature, we can expect to see continued innovation in this space, with the launch of innovative products and services aimed at meeting the needs of users around the world.

A. Definition and Characteristics of Blockchain Lending with Real-World Assets

Blockchain lending with real-world assets (RWA) involves the use of blockchain technology to create digital representations of real-world assets such as real estate, commodities, or artwork, and using these assets as collateral to issue loans or other forms of credit. This type of loan is often referred to as an “asset-backed loan” and has several key features.

First, stability. The use of RWAs provides a more stable and reliable basis for valuing blockchain-based financial products and services, helping to reduce risk and increase the stability of the blockchain ecosystem. This is because RWAs are backed by tangible assets that have intrinsic value and are associated with real-world cash flows, making them less prone to volatility and speculation compared to purely cryptocurrency-based lending.

Second, democracy. Blockchain loans with RWA can democratize and make credit more inclusive, especially for underserved or marginalized communities who may have difficulty accessing traditional financial services. This is because RWA can be used as collateral to issue loans and other forms of credit that are easier to obtain and less costly than traditional loans.

Third, transparency. Using blockchain technology can increase the transparency and accessibility of the lending process, as all transactions are recorded on a public ledger accessible to all participants. This helps to lower fraud risk and increase trust between lenders and borrowers.

Overall, blockchain loans with real-world assets have the potential to make credit more accessible, stable, and transparent. The new mechanisms will reduce risks for all participants, thoroughly changing the lending industry.

B. Advantages of blockchain lending over traditional lending

Blockchain lending with real-world assets represents significant differences from traditional lending models in several key ways.

First, one of the most notable differences is international accessibility and global market integrity. Unlike traditional lending, which is often constrained by geographical and regulatory limitations, blockchain lending is available to borrowers and lenders anywhere in the world. This is because blockchain lending operates on a decentralized network that is not bound by any particular geographic location or jurisdiction. As a result, blockchain loans with real-world assets can offer borrowers and lenders greater flexibility and opportunities to access capital that may be unavailable to them through traditional lending channels.

In addition to the international accessibility mentioned above, blockchain lending with real-world assets also provides more accessibility to crypto financial instruments. One example of this is the ability for certificates issued by RWA loan projects to be refinanced by other DeFi projects. This creates a more interconnected lending ecosystem, allowing borrowers to access funding from a wider range of sources. Furthermore, on-chain activity can serve as evidence for DeFi-based identity (DID) and reputation systems. This means that a borrower’s behavior and payment history can be tracked and used to establish trust and reputation within the DeFi ecosystem. Finally, blockchain loans can offer borrowers greater flexibility as they can choose different loan assets with different risk exposures based on their individual risk tolerance and investment objectives.

Finally, blockchain lending with real-world assets has the characteristics of consensus and democracy. The decentralization of blockchain lending means that all participants in the network have a voice in the decision-making process. This is in stark contrast to traditional lending, which is often controlled by a small number of institutions or individuals who decide who can borrow and at what interest rate. In the field of blockchain lending, decisions about who can borrow and at what interest rate are made through a consensus-driven process, which ensures that all participants have a voice in the lending process. This democratic lending approach helps to increase transparency and fairness, while also reducing the risk of bias and discrimination that may exist in traditional lending models.

In summary, compared to traditional lending, blockchain lending with real-world assets has several key advantages, including greater international accessibility, accessibility of cryptographic financial tools, and a more democratic decision-making process. These factors help to make lending more inclusive, transparent, and convenient for a wider range of borrowers and lenders, while also promoting the stability of the lending ecosystem and reducing risk.

C. Limitations of Blockchain Lending with Real-World Assets

While using blockchain lending with real-world assets has many advantages compared to traditional lending, there are also some limitations that must be considered.

Firstly, while blockchain technology provides a trustless and transparent platform, using real-world assets for blockchain lending introduces credit risk. Even if the assets are backed by real-world assets, borrowers may choose to default, exposing settlement and jurisdictional issues in real life. Of course, in this case, the consensus on the blockchain has failed, and the trustless halo cannot be sprinkled on the collateral assets in the real world. In addition, there may be challenges related to asset valuation, which may make it difficult to assess the appropriate collateral level required for the loan.

Secondly, there may be global compliance issues when lending across borders. Different countries have different regulatory frameworks and compliance requirements, which may present legal and operational challenges for blockchain lending platforms operating across multiple jurisdictions. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations may be especially challenging for blockchain lending platforms, which may need to work closely with regulatory bodies in various countries to ensure compliance.

Third, there are still technical risks in blockchain lending. Blockchain technology is still evolving, and there may be technical challenges related to security, scalability, and interoperability that could affect the stability and reliability of blockchain lending platforms. There may also be challenges related to programming and executing smart contracts, which could affect the performance and accuracy of loan contracts.

Overall, while blockchain lending has many advantages over traditional lending with real-world assets, it is important to consider the potential limitations and risks associated with this new form of lending. By carefully assessing risks and implementing appropriate risk management strategies, blockchain lending platforms can ensure the continued growth and development of this innovative emerging industry.

03, Case Study of Blockchain Lending Projects

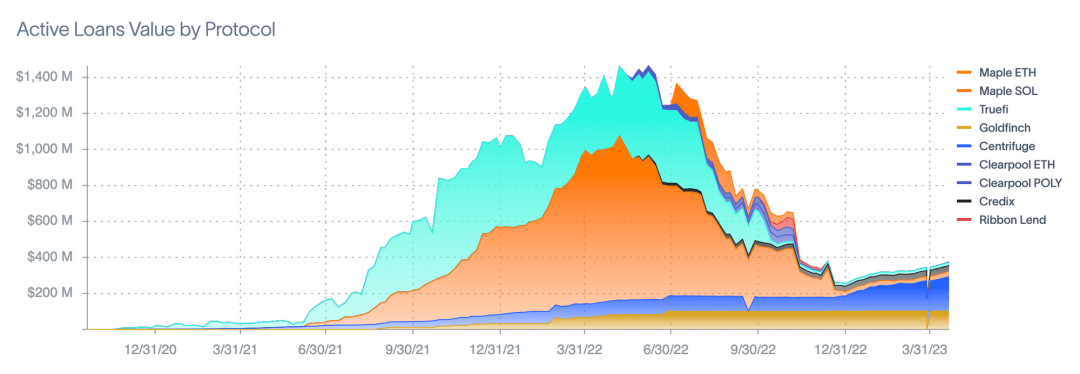

After the FTX crisis, the prosperity of DeFi and RWA-related DeFi has declined. The main participants in RWA during the last bull market have shrunk in scale, and survival has become the primary goal. But their strategies are still worth paying attention to. At least, they created an explosive business scale in the bull market.

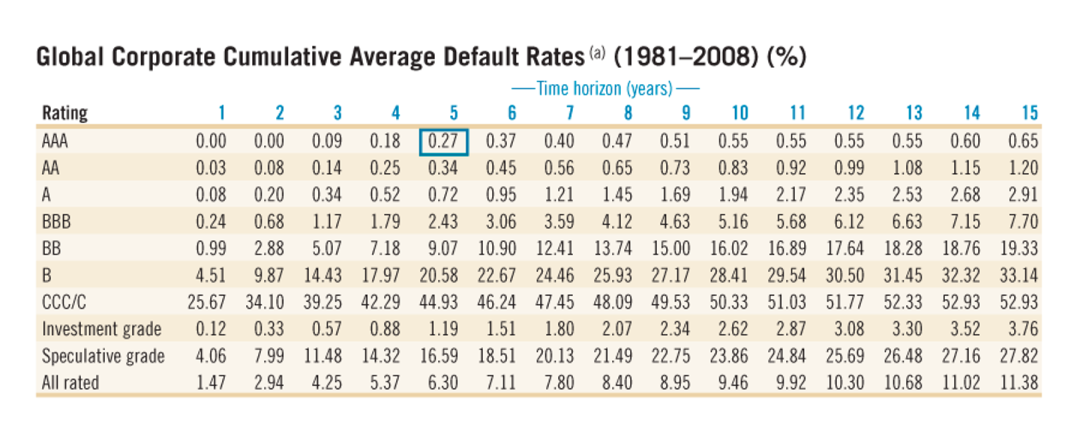

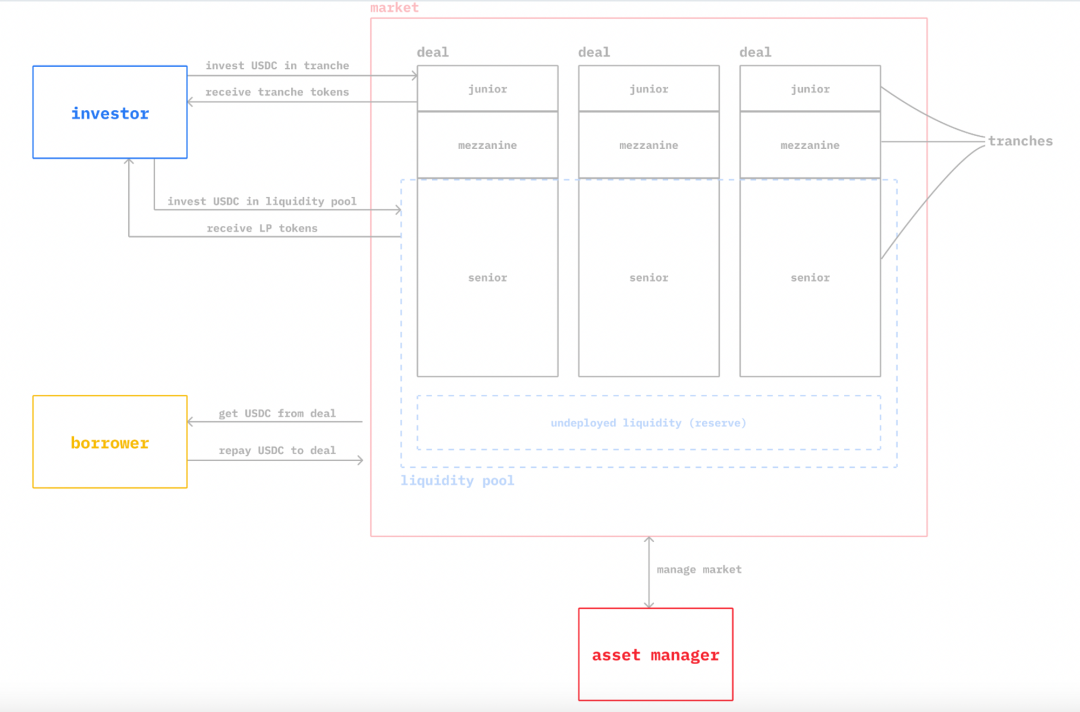

“Waterfall” Financial Structure

To mitigate the credit risk of real-world assets, most RWA lending introduces a waterfall structure. Now, it seems to have become mainstream in the RWA lending industry.

The waterfall structure in CLO (Collateralized Loan Obligation) refers to the priority of payments made by the parties involved in the CLO. This structure is called “waterfall” because payments flow down in a predetermined order, much like water flowing down a waterfall.

The waterfall structure is usually divided into several “parts,” which are different levels of debt issued by the CLO. Payments are arranged in order of priority, with the highest level of payments receiving payment first, followed by the next highest level of payments, and so on. The payment waterfall starts at the top of the structure and flows down through each part until all payments are completed.

This structure was originally invented in the 1980s but became prevalent after the 2000s. The main reasons for its prevalence are: 1. The development of financial technology enables institutions to measure risks more accurately; 2. Electronic trading systems reduce transaction costs; 3. In the case of low interest rates, this structure can provide additional returns as long as you have additional risk information.

There is a unique trend in RWA, led by the Ondo finance project, which uses high-quality assets such as US treasuries as collateral for lending. Due to the extremely low default risk (including US bank bonds), there is no need to adopt a “waterfall” structure to address default risk.

A. Centrifuge

Product:

Centrifuge has the largest RWA collateralized lending market. As it claims, “Centrifuge is an infrastructure for decentralized financing of physical assets on-chain, creating a completely transparent market that allows borrowers and lenders to transact without unnecessary intermediaries.”

- TVL: 192.1M

- FDV: 112.2M

Investors:

Mechanism:

Features:

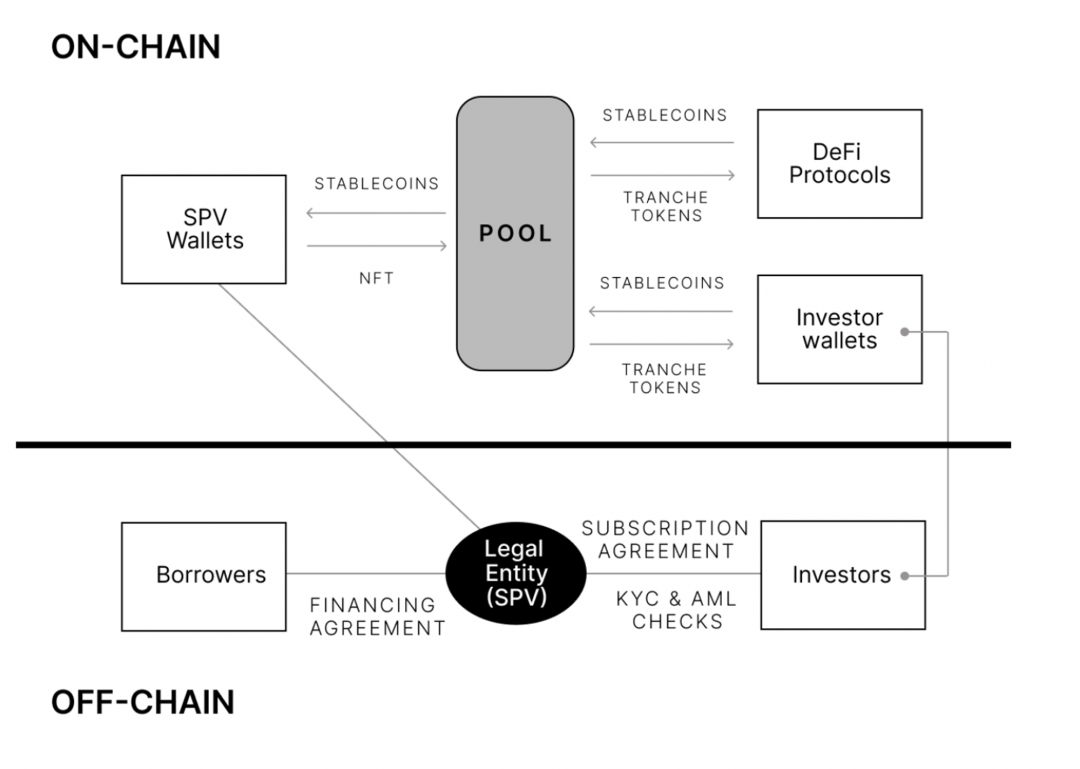

- On-chain/off-chain structure

As a pioneer in the RWA lending industry, Centrifuge uses an on-chain and off-chain structure to reduce credit risk. In the off-chain structure, it establishes an SPV structure, and when there is a default, the collateral will be easy to liquidate. It uses centralized KYC and AML services to comply with regulations in different countries.

- Financial agreements

In addition to on-chain signatures and transaction records, investors can also sign subscription agreements with issuers.

- Diverse RWA collateral

The collateral is diverse, including emerging market consumer loans and structured credit, among others. Each project will have an independent SPV wallet to control its fundraising. Interest rates range from 3%+ to 10%+.

- High default rate

By size, its default rate for completed loans is 5.6%. A high default rate does not mean failure, but rather that it tends to adopt higher-risk financial strategies. Since it does not have a deliberate selection process for investment projects, it does not bear any responsibility when a project fails.

B. Maple

Product:

By combining industry-standard compliance and due diligence with the transparency and frictionless lending brought by smart contracts and blockchain technology, Maple is changing capital markets. Maple is the gateway for financial institutions, fund representatives, and companies seeking on-chain capital to achieve growth.

- TVL: 28.4M

- FDV: 78.7M

Supporters:

Mechanism:

Maple converts traditional Collateralized Loan Obligations (CLOs) into cryptocurrency form. Each project has a representative who is also the initial provider of lost capital. The representative is also responsible for executing write-downs in the event of a default. The representative must be verified by the Maple team.

Features:

Opaque and centralized:

- The power to determine who can become a representative is controlled by the Maple team. Currently, 62% of active loans are given to Maven 11.

- Has a recovery plan and legal agreements with borrowers in the event of default.

- Medium default rate

- Its default rate is 2.935%, but considering the risk exposure proportion to M11, I think it carries too much risk.

C. GoldFinch

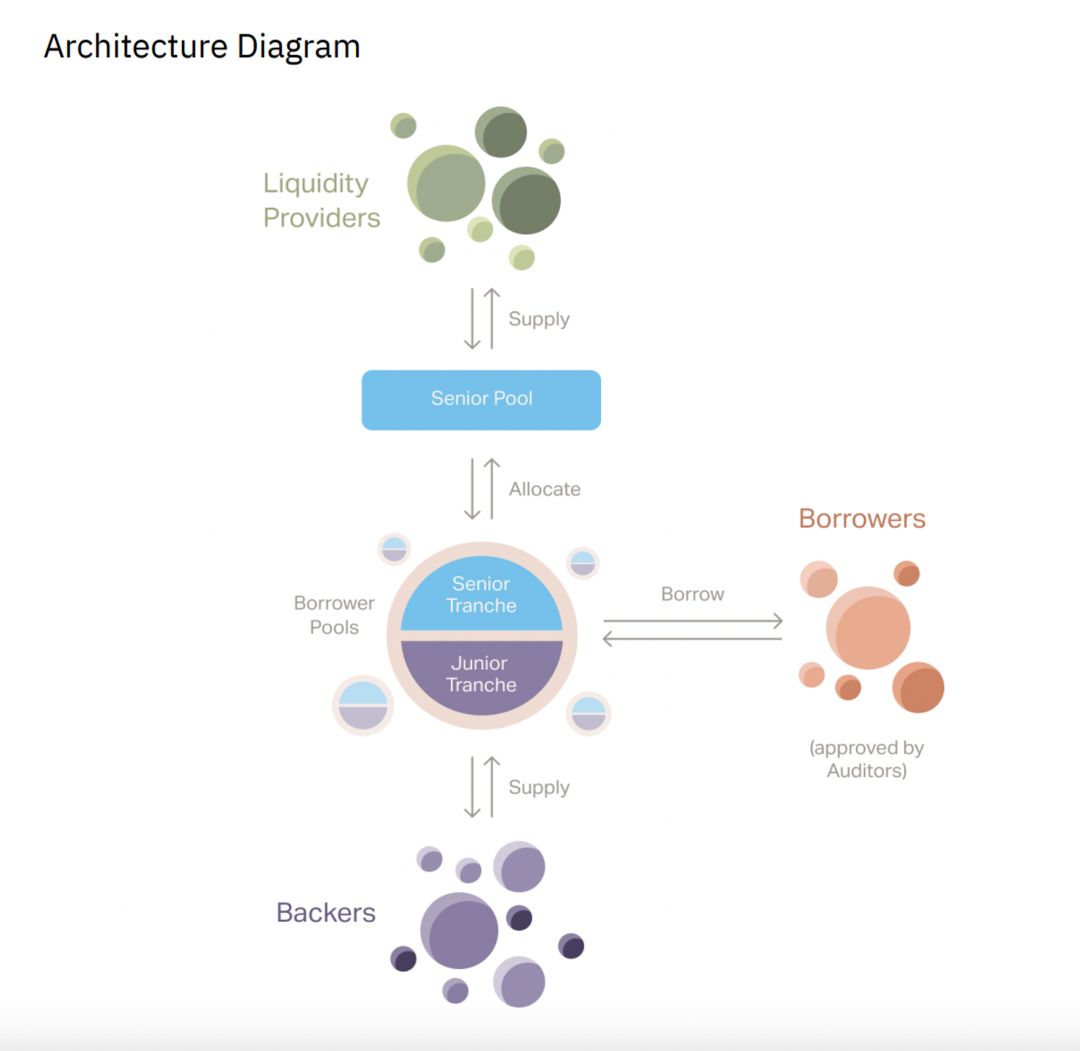

Goldfinch is a decentralized protocol for crypto lending without the need for crypto collateral. The Goldfinch protocol has four core participants: borrowers, supporters, liquidity providers, and auditors. Unlike other protocols, Goldfinch tries to establish a uniform risk-weighted asset (RWA) related to actual assets. All assets in the senior asset pool face the same risk.

- FDV: 101.6M

- TVL: 66M

Supporting Institutions:

Mechanism:

Features:

1. Decentralized:

The project has a decentralized decision-making process, and supporters decide whether the project can successfully raise funds and the scale of the project through collective decision-making.

2. Innovative credit model:

The project adopts a leverage model and a dynamic supporter incentive mechanism. The leverage model determines the amount of capital allocated to each borrower pool by the senior asset pool based on the trust level of each borrower pool. When more supporters invest in the borrower pool, the borrower pool appears more reliable and can obtain more leverage capital.

3. Diverse borrowers:

The project diversifies capital investment in different types of borrowers and lending situations, covering everything from fintech in emerging countries to consumer debt support loans in developed countries. The decentralization of borrowers also means that default risk is diversified.

4. Unified risk and liquidity:

The project has a unified senior asset pool, and responsibility and interest rate remain consistent throughout the range.

5. Low default risk:

So far, the default risk is zero, indicating that the project has a lower default risk.

D. Credix

Product

Credix is a next-generation credit ecosystem that enables institutional borrowers to access liquidity and creates attractive risk-adjusted investment opportunities for institutional investors, credit funds, and accredited investors.

Supporting institutions:

Mechanism:

Features:

Centralization:

The project has a centralized underwriting process, with one person responsible for screening, due diligence and investment structure. This is similar to the situation in traditional finance where one entity has control over the investment process.

Market specific:

When creating a new lending project, a unique LP token is generated to differentiate investments in different liquidity pools in different markets. However, this may lead to weak liquidity as liquidity demand and supply are separated.

Non-transferable:

The token used in this project is non-transferable and can only be traded in accounts that comply with regulatory requirements. While this design helps with compliance issues, it may make it difficult for individual investors to participate in the market. Therefore, due to the platform’s strict requirements, many investors may be excluded from participating.

Three-tier default protection:

Credix uses various methods to ensure that funds in senior collateral can be repaired. In addition to excess collateral assets and funds in junior collateral, it can also use the payment gap between the revenue of financial technology companies and the interest paid to Credix for repair.

E. TrueFi:

Product:

TrueFi is an unsecured lending protocol based on on-chain credit scoring controlled by TRU holders. It is part of the TrustToken ecosystem. There is no clear solution when default or default occurs. The quality of each loan project depends heavily on the portfolio manager’s decisions. It is also a centralized structure.

Supporting institutions:

Mechanism:

The portfolio manager provides detailed information for each transaction, and the borrower decides whether to accept it. Transactions can also be divided into three risk levels. Different levels have different default responsibilities and interest rates.

Features:

TureFi has chosen a gradual decentralization process. Currently, the solution is very centralized. Default recovery plans are not considered at the platform level. So far, its default rate is 0.258%, which is relatively low. But this is not the result of a systemic credit solution for TrueFi. Loans purely rely on the borrower’s credit or reputation without physical assets (RWA) as collateral.

Comparative analysis:

1. KYC and Compliance:

Due to the involvement of real-world assets, cash flows, and settlement in case of default, local government support, KYC and compliance are crucial. All of these projects take these issues very seriously and introduce third parties relevant to this business. As we mentioned earlier, the biggest financial cost of loans is compliance costs, and these projects do not have more advantages in this regard than traditional finance. In order to meet compliance requirements, even the voucher tokens are designed to be non-transferable.

2. Credit:

On-chain credit is a good thing for open finance. However, none of these projects have attempted to incorporate on-chain credit into project credit assessment. On the one hand, the history of DeFi is short and on-chain activities are limited. On the other hand, the cost of creating an anonymous account is almost zero. On-chain data cannot represent personal reputation. Only GoldFinch attempts to allow each entity to have a unique account on the platform.

3. Solutions for credit defaults:

Maple Finance, GoldFinch, and Centrifuge provide solutions for credit defaults. For off-chain collateral, these projects prefer to use SPVs to control disposal rights. Credix tells users that they have a team to manage collateral. TrueFi does not specify what happens in case of default. Interestingly, when FTX crashed, Justin SUN transferred 6 million dollars from Alameda Research.

4. Transparency:

All on-chain activities are transparent. However, off-chain cash flows and debt credit-related off-chain information need to be disclosed regularly. Centrifuge claims to have a peer-to-peer network to share information. But since the crypto industry is brand new, there is still a discussion on whether information disclosure should comply with securities laws.

5. Liquidity:

Centrifuge provides margin for others. GoldFinch has unique credit risk assessment and unified senior asset pool liquidity. As the business grows, its liquidity will also increase. Credix’s liquidity is poor, especially when its loan pool is exhausted. Maple Finance does not specify how to establish liquidity.

04, Conclusion and Suggestions

This is not a good business, it is a huge business.

The actual world of finance is far larger than DeFi, and the decentralized world is still in its infancy compared to traditional industries. Even if a small fraction of traditional finance turns to blockchain, it will be a huge success for DeFi and its infrastructure.

The crypto world needs real-world assets (RWA) to enhance its credit value.

There are fewer stable businesses in the emerging decentralized world. Therefore, the discount rate of collateral is much higher than that of real-world assets. We can see that if USDC and USDT support a certain blockchain, the blockchain will have better liquidity and it will be easier to build DeFi. This is also true for other business areas. The crypto world needs real-world stable assets to enhance its credit. RWA is actually the largest category of on-chain assets for stablecoins. If we retrieve the authorized amount of centralized stablecoins in different ecosystems, we will find that the higher the authorization of the chain, the higher the valuation. This is why RWA is so important to the crypto industry.

The imbalance in the development of the global financial system provides survival space for RWA lending.

In the traditional world, especially in some developing countries, the financial infrastructure is limited. Many business opportunities are missed due to the lack of a credit system. The real world needs blockchain to help establish a credit system. There are huge differences in the financial level between countries and regions. For example, in Kenya, the financial network is not spread throughout the country, and many cities do not have a financial system. The accessibility of crypto finance is much higher than that of traditional finance.

Lack of infrastructure

Even if we know that using blockchain has many advantages, the process of handling each lending case involving the real world and different jurisdictions will affect lending risk. In the real world, the settlement of RWA and other financial and compliance services is very time-consuming and expensive.

In my opinion, GoldFinch is the most innovative and decentralized RWA lending project in my mind. However, even GoldFinch has not introduced the credit rating of endorsers to measure lending risk. All solutions to default risk rely on individual regulations in various jurisdictions in the traditional world. As long as these regulations are not blockchainized, most financial costs cannot be reduced.

KYC and compliance are only passive requirements for customers

When we read the documents of these projects, there are few lines showing the relationship between KYC and security. All compliance efforts seem to be only for legal compliance, not for the safety of customers’ funds.

All of these reasons have led to the existence of a large RWA mortgage lending market, but crypto projects are having a hard time expanding their business in the short term.

Reference Sources:

Financial Infrastructure and Access to Finance: A Global Perspective

Financial Infrastructure, Group Lending and Funding Costs in Developing Countries

https://uploads-ssl.webflow.com/62d551692d521b4de38892f5/631146fe9e4d2b0ecc6a3b97_goldfinch_whiteBlockingper.pdf

https://rockawayx.com/comms/centrifuge-analysi

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!