NYDIG is an institution specializing in Bitcoin financial services, including savings accounts, brokerage trading, 401(k), and more. Its latest funding round has brought its valuation close to $7 billion.

At a glance

● Bitcoin prices have been relatively low since Q2. This article looks back at past cycles to see what might be ahead.

● Regulatory activity has been a hot topic, but not when it comes to Bitcoin. Recent case outcomes may take years to materialize.

- Explaining the response and impact of the cryptocurrency market under the high-pressure regulation of the US SEC

- Binance and Coinbase face SEC charges: Detailed analysis of market reaction and impact

- Foresight Ventures: Market liquidity retreats, altcoin index plummets

● When looking for catalysts to drive future prices, past cycles suggest the need for issues such as unresolved pressures in the banking system to calm down before the market can stabilize.

The road ahead

A lot has changed in the crypto asset space since Q1 ended. While Bitcoin enjoyed impressive returns due to falling confidence in the US banking system in Q1, the opposite was true in Q2. The main reason for the market’s poor performance was the actions taken by financial regulatory agencies against the crypto asset industry. Despite rising 53.6% from the beginning of the year to date, 2023 has been a mixed bag. What is frustrating some Bitcoin investors is that unlike Bitcoin’s outstanding performance in Q1, Bitcoin’s performance in Q2 has been worse than other risk assets such as stocks. Against this backdrop, we believe that a review of past cycles and how they influence our view of Bitcoin’s future performance may be helpful. Past performance is no guarantee of future results, but unlike other technological revolutions we have studied or experienced, this one seems to exhibit clearer repeating patterns.

Regulatory shadow

Undoubtedly, the most significant event of Q2 revolved around the actions taken by US financial regulatory agencies against some of the industry’s largest service providers. We believe that the SEC’s case against Coinbase and the CFTC and SEC’s cases against Binance are the most important, although these cases did not involve Bitcoin, nor did they question its regulatory status. And these cases underscore one fact: Bitcoin is the crypto asset with the greatest regulatory clarity, while many other crypto assets remain in doubt. These cases may take years to resolve, and we will not know their impact on the industry soon unless there is new legislation. For example, Ripple’s lawsuit with the SEC has been going on for two and a half years and is still unresolved. While there may be some announcements about this case, appeals could continue to prolong the final definitive outcome. We do not know what regulatory or law enforcement agencies may do next, so our suggestion is to watch how prices react to news to see which factors the market has already anticipated. For example, after news of the SEC’s lawsuit against Coinbase was released, Bitcoin initially fell slightly, then recovered all the losses and rose, which was a sign to us that investors’ positions had already taken this news into account. An old market adage may be very applicable here: “Climbing the wall of worry.”

The Shadow of 2019

The dual-sided performance of 2023 so far is reminiscent of 2019. For those who are just entering the industry, the performance of 2018 was very similar to that of 2022, with a significant pullback after the bull market peaks of 2017 and 2021. Prices hit bottom in December 2018, at around $3,200, and then rose rapidly in the first half of 2019, reaching nearly $14,000 by the end of June. From the low point to the high point in June, Bitcoin rose 328%. At first, Bitcoin’s rise had no fundamental reason, but then a theory emerged that revolved around the depreciation of the renminbi and the desire of Chinese investors to hedge against it with Bitcoin. However, the second half of 2019 was very different from the first half, with Bitcoin falling nearly 50% to $7,100. Although Bitcoin still rose 90.9% in 2019, the process of getting there was not smooth. However, the most important thing about 2019, and what we believe applies to Bitcoin today, is that it marked the first year of the new bull market that continued until 2021.

Re-evaluating Bitcoin

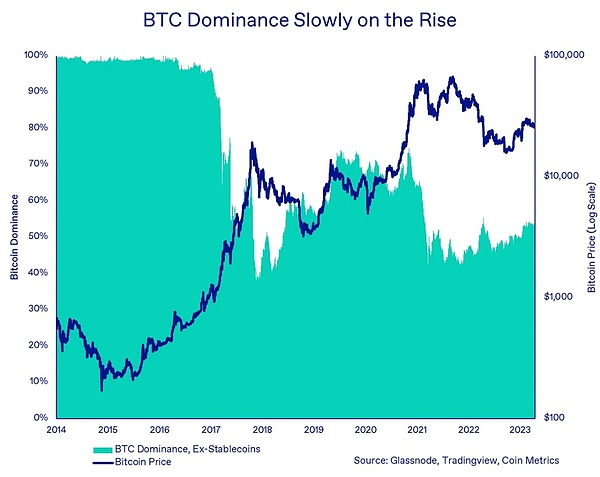

After experiencing pullbacks in 2014 and 2018, cryptocurrency investors began to rally around Bitcoin as the most fitting cryptocurrency for the market. Ethereum did not exist in 2014 and was still affected by the aftermath of ICOs in 2018, and many other altcoins were still questioned for their practicality in 2014 and 2018. Therefore, Bitcoin’s dominance, or its share in the entire industry’s market capitalization, rose during the pullback of the further altcoins and the early and middle stages of the subsequent bull market cycle. It was not until the later stage of the bull market, the most speculative part, that Bitcoin began to let go of its dominance to higher-beta altcoins. We are seeing this phenomenon again in this cycle, but the situation may be different. Due to regulatory uncertainty faced by many altcoins (which Bitcoin does not have), Bitcoin may occupy a larger share in the industry this time.

Search and social media are quiet

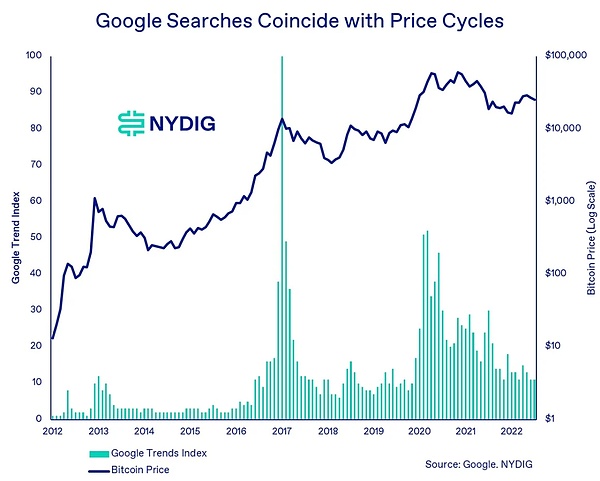

The cryptocurrency community is a highly social group, with much of the discussion taking place on social media platforms such as Twitter. Mentions of the word “Bitcoin” on these platforms are typically an indicator of market sentiment, with mentions correlating positively with price. Google searches are also reflective of this, with search volume correlating positively with price. Google Trends, which is not an absolute measure of search volume but rather an index where 100 represents the highest number in history, currently shows a significant drop in search volume for “Bitcoin”. The search volume has not yet dropped to the levels of the previous cycle, which could mean that things may need to calm down further, or we may have already reached a higher bottom than before. The high point of search volume has never reached the peak of the previous cycle, but this could only mean that the public has more general awareness of this asset. In any case, if we are to formulate a positive strategy based on this information, it would be to sell when Bitcoin becomes a hot topic of discussion and search, and to buy when it is not being talked about or searched for.

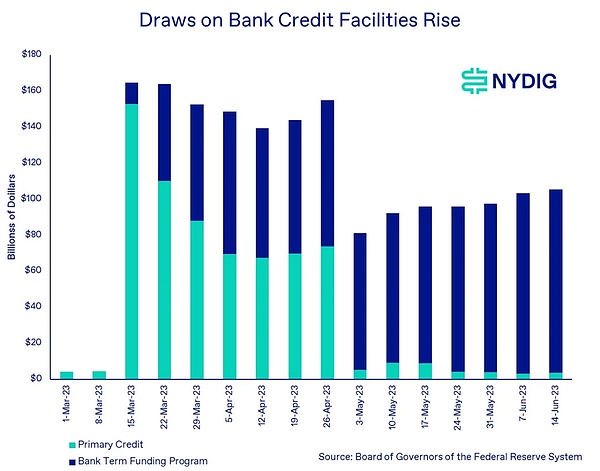

Bank crisis postponed, but may not be over

It has been a month and a half since the major event of the last regional bank crisis – the closure of First Republic Bank and its acquisition of assets by JPMorgan Chase on May 1. The event occurred at a time when the total amount of credit tools supported by the Federal Reserve System (Fed) saw a significant drop, primarily through credit at the discount window and new bank term financing facilities, but banks continued to increase their withdrawals of support measures provided by the Fed. Discussion of the health of regional banks now seems to have temporarily subsided, but Federal Reserve Chairman Powell’s comments this week suggest that we will still face future interest rate hikes, which have always been the root cause of regional bank crises.

Final thoughts

Before the market stabilizes, both regulatory and social aspects may need to calm down. The bottom of the market is often formed in indifference rather than aversion, and considering some of the indicators we have emphasized, the market seems to be moving in that direction. The situation in 2023 is becoming very similar to that of 2019, which was the first year of a three-year bull market that peaked in 2021. Although recent events in the cycle look very different from before, the shape and duration of the cycle continue to have amazing similarities. Again, it cannot be guaranteed that this will necessarily happen in the future.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!