In the DeFi ecosystem, the development of on-chain options is currently in full bloom. Although it has been affected by the downturn in the crypto world in the past two years, on-chain Dex varieties have become very mature. Uniswap for spot trading and dydx for contract trading are both challenging the existence of Cex. However, the development of on-chain options is difficult, and the few attempts made have not achieved the expected results. The former on-chain options king, Opyn, has turned to develop Squeeth, abandoning the traditional Opyn V2 order book-style options trading platform.

Harsh Reality

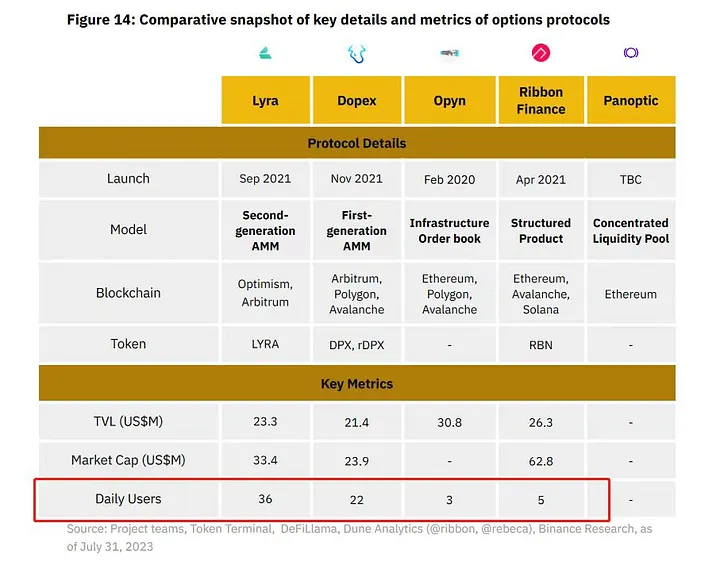

The remaining few are also in a pessimistic state of survival. The latest report from Binance Research Institute provides very intuitive data. Currently, the four main options Cex platforms have only tens of daily active users, and even single digits. The total number of daily active users for on-chain options is only: 36+22+3+5=66 people.

Such a low number of active users can partly be explained by the inactivity of trading in the bear market and low volatility environment. However, compared to the buzz in perpetual contracts and spot trading, the on-chain options track can be said to be very quiet.

- King of Crypto Trading Su Zhu Returns, OLAS Surges Over 10 Times in Half a Month

- Interpreting the two updates of THORChain Bullish or Bearish?

- Behind the sharp drop of Bitcoin in August Long pressure caused by leverage liquidation

Also worth noting is the stark contrast between the huge TVL and the very few participants. The main purpose of LPs in the AMM model is to provide liquidity for trades. If the number of traders is so low, LPs and TVL become meaningless, even a waste of resources. After all, money invested in TVL is still an investment and requires a return. In a market environment where the USD interest rate can reach 5%, the opportunity cost of participating in locking funds is extremely high.

The LP model originated from the DeFi Summer two years ago. For mainstream protocols like Uniswap, huge trading volumes can bring good capital turnover and transaction fee income, providing sufficient incentives for LPs. In low-volume protocols, the income for LPs is severely insufficient. Although some protocols can provide tokens as incentives, overall, they lack attractiveness. Some of the LPs are invested by VCs and related institutions. If some institutions gradually withdraw their investments, it is easy to fall into a death spiral of declining liquidity and TVL.

What is the problem?

It should be noted that as a major track in traditional finance, the options track should not be reduced to the point where there are only 66 users worldwide every day.

Firstly, the liquidity of options itself is scattered. In the order book model, the same BTC option with different time dimensions and strike price dimensions requires market makers to provide multiple liquidity. Due to the non-intuitive price calculation, it places high demands on the system settings and security mechanisms of market makers. In the current DeFi world, which is still dominated by retail investors, scattered liquidity leads to large spreads and poor trading experience. In comparison, centralized exchange Deribit has sufficient liquidity, small bid-ask spreads, and good depth, making it more appealing to use Cex. Going back to DeFi Summer, many people were attracted to use Uniswap because they could buy coins that centralized exchanges couldn’t offer, which led to the early accumulation of Uniswap’s user base. However, there is currently no significant difference in product output between Dex and Cex.

Secondly, as a tool, options have stronger combat effectiveness when used in combination, such as combined options, structured products generated by spot/contract. Among the current mainstream options protocols, only Ribbon Finance provides structured products such as covered calls. In the current centralized exchanges, the issuance volume of single-period structured products, such as shark fins and dual currency wealth management, can reach over 100 million USD. Compared to CEX, Dex has a natural advantage in reducing centralized risks, and there is great potential for market development in this area.

Thirdly, there is user education. The characteristics, risks, and returns of the product need to be clearly introduced and updated in real-time. Currently, user education is generally insufficient, and multilingual support is not perfect. Already, a large number of options terms, such as Greeks, are already sufficiently obscure and difficult to understand, and adding language barriers will further increase the user’s threshold. In addition, since it is DeFi, multilingual support should be essential.

Finally, it should also be noted that in the traditional financial market, due to risk control requirements and compliance considerations, the leverage ratio of contracts is limited. Options provide a unique exposure with high leverage ratios. In the blockchain world, the leverage ratio of contracts becomes extremely large, often reaching ten or even hundreds of times; moreover, the delta of the contract is almost 1, making the product simple and easy to understand, thus impacting the position of options with a certain entry threshold. How to provide user value different from contracts has become a question that all options products must answer.

Where is the way out

Innovation is needed to break the deadlock. In the current context where the overall on-chain options market is not active, the importance of innovation is even more pronounced.

The only new product mentioned in the Binance Research report is LianGuainoptic. LianGuainoptic provides a brand-new on-chain options solution and approach. Firstly, perpetual options are introduced, which is a major reform of traditional options. It effectively changes the scattered liquidity of traditional options and unifies options with different exercise prices and expiration dates into one, focusing on liquidity. This is very similar to the counterattack of perpetual contracts against traditional expiration contracts. Initially, all CEX contract markets were traditional weekly, monthly, and quarterly contracts, but today, almost all trading volumes are in perpetual contract trading pairs. Perpetual contracts are a disruptive force in contract trading and their value in the options field should not be underestimated. Secondly, LianGuainoptic is built on top of Uniswap’s LP, so it has excellent natural liquidity.

Let us wait and see the innovation and development of the options market on the blockchain in the future. As an important tool in traditional finance, it has tremendous potential and room for development. Just as Uniswap provides a completely new solution to the existing trading problems, the success of the on-chain options market is also likely to be achieved through disruptive innovation.

This article does not constitute investment advice.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!